Search results for "Q"

Ni28 Airdrop Week: Learn, participate, and earn OZNi through real-time interaction

Ni28 officially launches Airdrop Week, a community event centered around participation, aimed at rewarding genuine contributors. During the event, 10,000 OZNi will be distributed through public courses and live Q&A sessions. Participants need to actively attend the courses and answer questions to receive the airdrop. This activity emphasizes the combination of education and engagement, laying the foundation for the future community ecosystem.

TechubNews·01-19 08:58

$718 Billion Bitcoin Quantum Threat to Be Addressed by New Startup - U.Today

Project Eleven has secured $20 million to develop defenses against potential quantum computing threats to cryptocurrency, specifically targeting vulnerabilities in blockchain security. Their product, "Yellowpages," aims to create a post-quantum infrastructure that links vulnerable Bitcoin addresses to quantum-secure identities. While concerns about an imminent "Q-Day" are deemed overhyped, experts acknowledge the need for preparedness against future quantum threats.

UToday·01-14 16:14

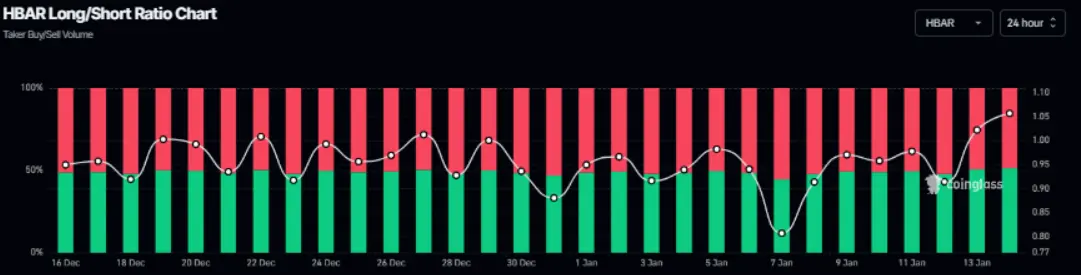

Hedera (HBAR) price maintains its upward trend thanks to ETF capital inflows strengthening market sentiment

Hedera (HBAR) is currently fluctuating around the 0.127 USD level during Wednesday's trading session, approaching a key resistance zone. If the price convincingly breaks through this level, the market could see a new upward momentum in the near future. Notably, demand from institutional entities continues to increase, as the q

HBAR3,11%

TapChiBitcoin·01-14 13:09

Crypto Liquidations Shake the Market in a Matter of Hours

The crypto market faced intense pressure as crypto liquidations surged to $156 million within just four hours. Traders witnessed sharp price movements across major digital assets. Sudden volatility forced leveraged positions to close rapidly. Many participants struggled to react as losses piled up q

Coinfomania·01-08 11:08

XRPL Adopts Quantum-Safe Signatures

The XRP Ledger has adopted CRYSTALS-Dilithium as its cryptography standard for digital signatures.

Unlike the previously used elliptic curve cryptography, the new standard is not vulnerable to attacks from quantum computers.

Q-Day, which is the day when a quantum computer will be capable

CryptoNewsFlash·2025-12-30 10:16

Coinbase 展望 2026:量子威脅未至,比特幣雙軌應對策略已成形

Coinbase in its 2026 Market Outlook report points out that quantum computing is expected to bring positive impacts to fields such as medical research and climate modeling, but it will also pose challenges to existing cryptographic systems. Recently, investors' concerns about related risks have significantly increased. BlackRock has identified quantum computing as a potential long-term risk factor, and regulatory agencies in the US and EU are also requiring critical infrastructure to complete the transition to post-quantum cryptography by 2035 at the latest. Overall, the quantum threat has not yet materialized, but proactive policy and market-level preparations have officially begun.

Risk Node Q-day, the critical point where quantum computers truly become a threat

Coinbase defines the true risk node, "Q-day," as the day when quantum computers with the ability to break encryption, (CRQCs), officially appear. In this scenario, quantum computers may operate two key algorithms

ChainNewsAbmedia·2025-12-30 04:46

XRPL Adopts Quantum-Safe Signatures

The XRP Ledger has adopted CRYSTALS-Dilithium as its cryptography standard for digital signatures.

Unlike the previously used elliptic curve cryptography, the new standard is not vulnerable to attacks from quantum computers.

Q-Day, which is the day when a quantum computer will be capable

CryptoNewsFlash·2025-12-29 10:15

Lighter TGE Countdown: 25% LIT tokens airdropped without lock-up, can the market catch up?

The highly anticipated decentralized perpetual contract trading platform Lighter is about to reach a key milestone—Token Generation Event (TGE) and a large-scale airdrop. According to core information disclosed by the project team in the market Q&A, its native token LIT has a total supply of 1 billion tokens, of which up to 25%, or 250 million tokens, will be used for the initial airdrop, with no lock-up restrictions. This airdrop will be directly distributed based on the completed points system, and community speculation suggests that the timing window is very likely to be in the coming days. Against the backdrop of a generally sluggish market, Lighter’s TGE performance is regarded by the industry as a key indicator of current market risk appetite, supported by its ZK Rollup-based technical architecture, a total locked value of $1.392 billion, and a recent massive financing round of $68 million.

LIT-0,12%

MarketWhisper·2025-12-29 05:51

CZ Year-End Q&A: Besides Giggle Academy, what else is he planning?

Original author: Chain Research Society, Crypto KOL

Editor's note: On the evening of December 18, Binance founder CZ participated in the year-end Q&A hosted by BNB Chain. During the event, he shared his views on topics such as amnesty, investment philosophy, stablecoins, RWA, and more. This article is a summary compiled by the crypto KOL Chain Research Society, with the original text as follows:

Has CZ returned? Not entirely.

After resigning as Binance CEO, CZ made a rare appearance at the recent BNB Chain annual AMA. Without the title of CEO, he was able to speak more openly.

GIGGLE-2,6%

金色财经_·2025-12-19 14:22

Bitcoin faces ‘Q‑Day’ risk if quantum threat isn’t patched by 2026–2028

By 2028, Bitcoin could face serious security and price pressure if it fails to adopt quantum‑resistant cryptography, with Charles Edwards warning delays past 2026 risk a prolonged bear market and confidence shock.

Summary

Charles Edwards says quantum computers could crack Bitcoin's elliptic‑cu

BTC1,55%

Cryptonews·2025-12-17 10:30

CZ Dubai Q&A full text: I actually cried when I stepped down as Binance CEO

At the 2025 Binance Blockchain Week held in Dubai on December 3–4, Binance founder CZ participated in a group interview. The Q&A covered topics such as crypto payments, digital asset treasuries, US policies, Giggle Academy, life aspirations, and more. CZ believes that payments remain an unresolved core scenario, and that successful future Web3 founders should focus on products and users with a long-term mindset. The DAT model is feasible in itself, but its risks depend on the management team. The reopening of US regulations will bring great opportunities to the industry. Mainstream adoption of crypto technology depends on regulatory clarity, infrastructure, and enterprise-level integration. Crypto has significantly improved financial accessibility in developing countries, and education, philanthropy, and ecosystem development are his personal future focuses.

This content reflects the personal opinions of the guest and does not represent Wu Shuo's views. The audio transcript was generated by GPT and may contain errors.

Why is crypto industry

金色财经_·2025-12-10 10:12

The US is rushing to buy while Japan bans it! Crypto ETF spread contract trading faces a crackdown

The Financial Services Agency (FSA) of Japan has released a revised regulatory Q&A, confirming that contracts for difference (CFDs) linked to overseas crypto ETFs are "not acceptable." The ban takes immediate effect, with companies such as IG Securities ceasing to offer CFD products tracking US Bitcoin ETFs. Japan states that, under the Financial Instruments and Exchange Act, these products are considered high-risk crypto derivatives. Since Japan has not approved spot crypto ETFs, the investor protection framework remains incomplete.

MarketWhisper·2025-12-10 00:54

Japan Blocks Crypto ETF-Linked CFD Trading Without Local Approval

Japan’s Financial Services Agency has sent a firm message to the market. It says offering derivatives tied to overseas crypto ETFs is “not desirable.” The update came through a revised regulatory Q&A released this week. The reason is simple. Japan has not approved spot crypto ETFs yet. Because of th

BTC1,55%

Coinfomania·2025-12-09 05:48

Jensen Huang: Bitcoin converts excess energy into a form of currency, and AI follows the same concept but is even more universal.

Recently, several crypto media outlets published reports about "Nvidia CEO: Bitcoin stores excess energy as a form of money, allowing you to carry it anywhere." In fact, this is not "news"; it originated from a Latin American crypto industry professional, Julián Andrés, sharing the video on LinkedIn. The video itself comes from a segment of Jensen Huang participating in a 2024 discussion with the Washington think tank Bipartisan Policy Center.

Jensen Huang: Bitcoin is about converting excess energy into a form of currency

During the Q&A session of the discussion, an investor from a crypto startup first thanked the rise of AI for sharing some of the negative PR pressure generated by Bitcoin mining on the blockchain industry. He went on to say that many electricity producers and energy suppliers allocate surplus electricity to Bitcoin mining because there is a very clear market for it—one-to-one and with immediate feedback.

ChainNewsAbmedia·2025-12-07 15:05

CZ responds to community questions: Asking God for 5 wishes is too much, but the meaning of life unfolds in the unknown.

During the Q&A session at Binance Blockchain Week, someone asked CZ:

“If you could make 5 wishes to God, what would you choose?”

CZ said that 5 wishes are too many, one is enough.

He admitted that he doesn’t have many wishes, because the excitement of life comes from uncertainty:

“If the game is destined for you to win from the very beginning, then it’s no fun.”

His only wish is:

“I hope everyone has good health, and I also hope that God doesn’t give me too many unfortunate situations.”

PANews·2025-12-05 08:39

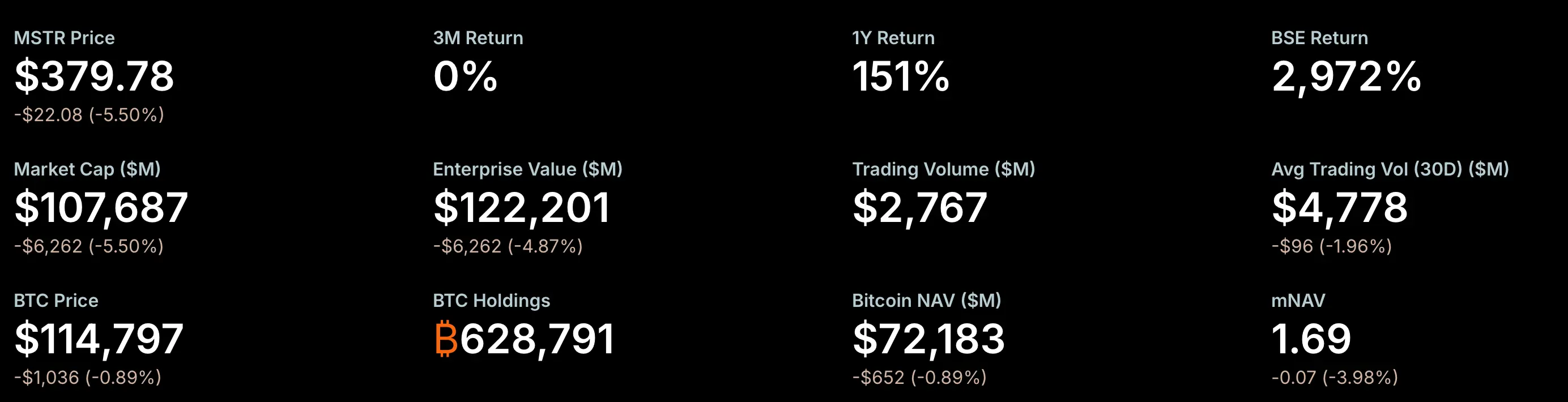

MicroStrategy strengthens capital structure, Mizuho maintains "Outperform" rating and target price of $484

Investment bank Mizuho Securities recently reiterated its "Outperform" rating on MicroStrategy (MSTR) and maintained its price target of $484 per share. This update came shortly after a Q&A session between the firm's analyst Dan Dolev and MicroStrategy CFO Andrew Kang. The meeting revealed several key insights into the company's capital management strategies and its approach to managing Bitcoin assets.

Successfully Raised $1.44 Billion to Cover 21 Months of Preferred Stock Dividends

MicroStrategy recently raised $1.44 billion in capital to bolster its US dollar reserves and ensure that it can pay 21 months of preferred stock dividends without needing to tap into its Bitcoin assets. This funding will also strengthen the company's overall financial stability, enabling it to

ChainNewsAbmedia·2025-12-03 14:53

Trump-linked ALT5 Sigma faces scrutiny for violation of SEC disclosure rules

Alt5 Sigma is facing fresh scrutiny after conflicting timelines in its SEC filings raised questions about how and when the company disclosed the resignation of its independent accountant.

Summary

Conflicting timelines in Alt5 Sigma's SEC filings raise concerns over its auditor resignation and q

TRUMP2,1%

Cryptonews·2025-12-02 03:42

From the perspective of interest-bearing assets, Bitcoin and Ethereum

On November 19, an online publication featured Dan Bin's recent public speech.

In this speech, Dan Bin specifically mentioned gold, Bitcoin, and Tesla.

Regarding gold, but Bin mentioned (the gist is):

If we look at the long historical perspective, gold, as a non-yielding asset, cannot outperform yielding assets (such as stocks), and a time return chart compares the return comparison curves of the two.

Seeing this statement, I am reminded of something Buffett said in his shareholder Q&A (the gist is):

He used a famous European painting as an example, mentioning that if an investor had purchased this painting in 19XX and held it until today, what the price of the painting would be; meanwhile, another investor used that money to invest in a US stock index fund at that time, and what that fund would be worth today. In comparison, the returns of the latter were far higher than those of the former.

So Buffett's conclusion is also: from an investment perspective, for non-yielding

金色财经_·2025-12-02 00:19

Drift v3 Townhall Set to Reveal Major Upgrade for On-Chain Trading

Drift co-founders are hosting a townhall to launch Drift v3, the biggest upgrade yet, enhancing performance for traders. The event includes a 2025 progress overview, a roadmap reveal, and a live Q&A. Join in Abu Dhabi for Liquid Hours following the event.

DRIFT-0,09%

ICOHOIDER·2025-12-01 12:43

Nic Carter Raises Concerns on Bitcoin's Quantum Vulnerability: Q-Day to Arrive by 2035

A new article by Nic Carter, partner at Castle Island Ventures, raises alarms about the vulnerability of bitcoin before the emergence of a cryptographically relevant quantum computer (CRQC). Carter believes that such an event will happen circa 2035, sooner than expected.

Nic Carter Awakens

BTC1,55%

Coinpedia·2025-11-29 00:11

Countdown to Q Day begins? Analyzing how Quantum Computing threatens the foundations of Bitcoin

Original source: decrypt

Original Author: Jason Nelson

Compiled by: Deloris

Saudi Arabia has joined the global quantum computing race.

The government-controlled energy and chemical company Saudi Aramco announced on Monday that it has installed its first quantum computer in Saudi Arabia, a move that further exacerbates the growing security risks facing Bitcoin and other blockchain networks.

Saudi Aramco stated that the 200-qubit computer, manufactured by the French neutral atom quantum computing company Pasqal, has been installed at its own Dammam data center, which is specifically designed for industrial applications such as energy modeling and materials research.

Pasqal stated that this is the most powerful system the company has delivered to date. Quantum bits (qubits) are the fundamental units of quantum computers.

Pasqal CEO Loïc Henry said in a statement: "Deploying our most powerful yet.

PANews·2025-11-27 05:02

What else can you buy after selling Bitcoin?

In the interview, Duan Yongping talked about Moutai again.

He said that in 2021, when Moutai's stock price was around 2,600 or 2,700, he really wanted to sell Moutai because he felt the price was too high.

But when he truly wanted to sell, he struggled with it for a long time because:

After selling Moutai, he really didn’t know what else to buy.

When I heard this, I thought it was just the same old story, because I had already seen similar statements in his Q&A records before.

But his next words answered a question that had lingered in my mind for a long time.

He said (to paraphrase):

If he sold, holding cash would make him very uncomfortable, because he has always been fully invested in stocks. So if he held cash, he would most likely still buy other stocks, but if he ended up buying other stocks, there’s a good chance those stocks wouldn’t perform as well as Moutai in the future. He believes Moutai will continue to go up, but if he buys other stocks then...

金色财经_·2025-11-22 01:48

Quantum threat countdown? Vitalik and venture capitalists warn: encryption technology could be breached as early as 2028.

Metaculus' latest forecast indicates that quantum computers capable of running Shor's Algorithm may appear by 2034, a full 20 years earlier than the expectations from 3 years ago. Meanwhile, Ethereum founder Vitalik Buterin and Dragonfly partner Haseeb Qureshi, among others, have warned that the real Q-Day, when quantum computers will be able to break encryption technology, could arrive between 2028 and 2033.

( "Understanding Quantum Computers in One Hour": Take you deep into the quantum revolution, capable of breaking network encryption in just a few seconds )

Vitalik Sounds the Alarm: Ethereum and Bitcoin's ECC Encryption Will Be Cracked

In yesterday's speech at Devconnect, Ethereum co-founder Vitalik Buterin.

ChainNewsAbmedia·2025-11-20 03:54

Abu Dhabi Investment Council triples its stake in Bitcoin ETF in Q3

The Abu Dhabi Investment Council (ADIC) has nearly tripled its exposure to Bitcoin in Q3 through BlackRock's spot Bitcoin fund IBIT, increasing its holdings from 2.4 million to nearly 8 million shares, worth approximately 520 million USD. This move is seen as a sign that institutions in the UAE continue to q

BTC1,55%

TapChiBitcoin·2025-11-20 02:28

Will Bitcoin be broken by Quantum Computers in 2030?

Written by: Tiger Research

Compiled by: AididiaoJP, Foresight News

The advancements in quantum computing are bringing new security risks to blockchain networks. This section aims to explore technologies designed to address quantum threats and examine how Bitcoin and Ethereum are preparing for this transition.

Key Points

Q-Day scenario, which refers to the situation where quantum computers can break blockchain cryptography, is expected to arrive within 5 to 7 years. BlackRock has also pointed out this risk in its Bitcoin ETF application documents.

Post-quantum cryptography provides protection against quantum attacks on three security levels: communication encryption, transaction signing, and data persistence.

Companies like Google and AWS have begun adopting post-quantum cryptography, but Bitcoin and Ethereum are still in the early discussion stage.

A new technology raises unfamiliar questions.

If a quantum computer

DeepFlowTech·2025-11-17 10:06

Bitcoin Q-Day on the Horizon? New IBM Quantum Chip Expected to Hit Another Milestone

In brief

IBM introduced Nighthawk and Loon quantum processors on Wednesday.

Nighthawk's 120 qubits and 218 couplers support circuits up to 5,000 two-qubit gates.

IBM aims for community-verified quantum advantage by 2026 and milestones toward fault tolerance by 2029.

Decrypt's Art,

BTC1,55%

Decrypt·2025-11-12 22:33

Glassnode: The four-year cycle for BTC has become invalid; Ethereum's TPS reaches a new all-time high

Bitcoin

Schwab CEO: Will begin offering Bitcoin trading services in 2026

The CEO of Schwab stated that they will start providing Bitcoin trading services in 2026.

Jack Dorsey's Block Q3 Bitcoin Revenue Nears $2 Billion, Accounting for Nearly One-Third of Total Revenue

According to a 10-Q filing submitted to the U.S. Securities and Exchange Commission (SEC), the fintech and digital payments giant Block (stock ticker XYZ) founded by Jack Dorsey achieved revenue of $6.11 billion in the third quarter, with a net profit of $461.5 million.

In a letter to shareholders, Dorsey stated, "Block's gross profit increased by 18% year-over-year in the third quarter, with Cash App growing by 24% and Square's business growing by 9%."

According to The Wall Street Journal and The Bl

金色财经_·2025-11-08 02:51

Universal cash distribution of 10,000 yuan, a comprehensive Airdrop guide for everyone: eligibility, five methods, Q&A all in one go!

The Executive Yuan passed the "Special Regulations for Strengthening Economic, Social, and Civil National Security Resilience in Response to International Situations." All citizens can receive cash of 10,000. Eligibility includes nationals with household registration and foreign spouses under specific conditions. The distribution methods include direct deposit, registered deposit, ATM, and postal office collection. Registration can be made starting November 5, with deposits on November 11, and collection is available until April 30, 115, with cash being tax-free.

ChainNewsAbmedia·2025-10-29 10:46

FTX, Synthetix, PAX Gold Heat Up Despite Crypto Sell-Off

As cryptocurrency markets face another week of broad declines, blockchain analytics firm Santiment has identified several altcoin networks showing unusually strong on-chain activity, a potential early signal for buy-the-dip opportunities..

In a new analysis, Santiment analyst Brian Q used the firm’

DailyCoin·2025-10-17 09:27

Xenea Wallet Daily Q&A Complete Guide: A Web3 Beginner's Guide to Learn and Earn ( with Answers for October 16 )

In the world of Crypto Assets, acquiring your first digital asset is often the most challenging and exciting step. The Xenea Wallet makes this step simple and fun with its innovative daily Q&A feature. Just open the app, answer questions, and earn rewards; three steps to kickstart your encryption journey.

GEMS0,64%

MarketWhisper·2025-10-16 01:49

Smart money buys the dip against the trend: How did Trump's tariffs trigger a dumping wave and become a retail investor's "FUD trap"?

On-chain analysis platform Santiment's data shows that during the big dump triggered by U.S. President Trump’s announcement of a 100% tariff on Chinese goods last week, "smart traders" took advantage of retail investors' excessive reaction to FUD (fear, uncertainty and doubt), significantly buying Bitcoin and alts. Santiment analyst Brian Q pointed out that retail sentiment often runs counter to price movement. This event is one of the four "panic peaks" since 2025 triggered by political and macroeconomic events, each creating a good opportunity for savvy buy the dip investors. Although Bitcoin has shown signs of recovery, the Crypto Fear & Greed Index currently remains in the "fear" range.

BTC1,55%

MarketWhisper·2025-10-14 03:10

Interview: WebX Founder Makoto Aok Shares His Connection with Taiwan and Insights on the Asian Blockchain Landscape

In the current context where Web3 is increasingly becoming the core of global innovation, Asia is playing a key role, showcasing unique and diverse characteristics in regulatory strategies, technological development, and the promotion of the creator economy across various markets. Chain News interviewed one of the important promoters of the Asian Web3 ecosystem, Makoto Aok(, the founder of WebX. He plays a critical role in the development of the cryptocurrency industry in Japan and connects regional cooperation dynamics through his international perspective and experience studying in Taiwan. This interview starts from his personal background and connections with Taiwan, delving into his insights on the evolution of WebX's vision, observations of the Asian market, trends in Japanese regulation, and future perspectives on blockchain security and regional cooperation.

The connection between Seiji Aoki and Taiwan

Q: First of all, could you briefly introduce your educational background and career? We are very interested to know you are

ChainNewsAbmedia·2025-09-25 03:54

Bitcoin Community Develops Post-Quantum Security Plans as Q-Day Approaches by 2030

|

Target audience |

Recommended actions |

|

Individual BTC holders | Migrate funds to new or quantum-resistant addresses immediately

Choose wallets or services implementing hybrid or PQC signatures

|

| Developers / Wallet providers / Exchanges | Deploy PQC signature support and new address

BTC1,55%

TheBitTimesCom·2025-09-24 15:09

DigiFinex Announces New Listings: MCH1, Q, and Etherex

DigiFinex is an international cryptocurrency exchange and has officially announced the launch of three new listings on its trading platform on September 5, 2025, at 04:06 UTC. Those include MCH1 (MCH), Q, and Etherex (REX), both combined with Tether (USDT). They claim that users can now trade in MCH

Coinfomania·2025-09-05 06:24

SEC warns of quantum risks, proposes framework to protect digital assets from "Q-Day"

The U.S. Securities and Exchange Commission (SEC) is reviewing a roadmap proposal to protect Bitcoin, Ether, and digital assets from the threat of quantum computers. This proposal, titled "Post-Quantum Financial Infrastructure Framework" (PQFIF) presented by Daniel Bruno Corvelo Costa, warns that

BTC1,55%

TapChiBitcoin·2025-09-04 09:23

Q is available for trading!

Quack AI (Q) is now trading on Kraken as of September 2, 2025. This AI-powered governance protocol enhances DAO decision-making and offers developer tools. However, trading features will activate once liquidity conditions are met.

BitcoinInsider·2025-09-02 15:03

Tonight's debut | 20 Q&A quick overview of the governance logic of the Trump family project WLFI

Last weekend, the proposal dispute between World Liberty Financial (WLFI) and Aave attracted market attention, as both sides fell into a confusion over the "7% sharing." A week later, WLFI will soon welcome the first token application and trading on September 1. So, what exactly is the governance model of this encryption project backed by the Trump family? Below, Odaily will guide you through 20 official questions and answers for an in-depth understanding:

General governance issues

1. How to participate in WLF protocol governance?

The sole purpose of WLFI is to participate in the governance of World Liberty Financial (referred to as "WLF Protocol"), therefore the community is encouraged to actively participate in proposals, discussions, and voting regarding WLF Protocol governance. If you do not intend to participate, please do not purchase this Token.

Proposal issue

GateUser-6bbdc2fc·2025-09-01 07:36

‘Crypto’s Flash Boys’: A Q&A With Austin Federa on DoubleZero

As blockchain ecosystems mature, the speed and efficiency of the infrastructure for nodes have become more than just technical considerations —they're strategic imperatives. Leading the charge in this space is Austin Federa, former Head of Strategy at the Solana Foundation, who is gearing up to

YahooFinance·2025-08-30 15:51

LAST MINUTE: Weekend Altcoin Listing from Binance! They Added Both Alpha and Perptual Futures

According to the latest information, Binance is listing the Quack AI (Q) token on Binance Alpha and in futures trading.

QUACK0,42%

Bitcoinsistemi·2025-08-30 04:33

Ethereum Aiming for Strongest Q3 Since Its Inception, Forecast to Reach 7,500 USD

Ethereum is on track to reach its highest level in Q3 since the network launched in 2015, up 83% so far and driving forecasts that the price could reach $7,500 by the end of the year.

Ethereum Aiming for the Best Q3 Since Its Inception

Ethereum is on track to achieve its highest profit level in Q.

ETH1,77%

Blotienso·2025-08-25 14:29

How to Mine Litecoin? 3 Litecoin Cloud Mining Sites in 2025 Helping Crypto Enthusiasts Earn LTC Q...

SPONSORED POST\

Litecoin (LTC), often called the “silver to Bitcoin’s gold,” remains one of the most popular and widely used cryptocurrencies in 2025. With faster transaction speeds and lower fees compared to Bitcoin, Litecoin is frequently chosen for payments, remittances, and trading pairs

TheCryptonomist·2025-08-25 13:35

6.6 Million Bitcoin at Risk: Could Q-Day Bankrupt the Safest Crypto Exchanges Overnight? Prep For...

In crypto, people talk quietly about “Q-Day.” It’s the day quantum computers become strong enough to crack the encryption that keeps Bitcoin, banks, and much of the internet secure.

No one knows when it will happen. Some say decades from now. Others think it could come sooner. Earlier this year,

BTC1,55%

TheCryptonomist·2025-08-24 22:18

XRP red alert: Whale is dumping heavily, 3 consecutive "death cross" threaten the price to plummet

As of the time of writing, XRP has increased by less than 1% in the past 24 hours but has still fallen by 16.5% in the month. Despite a strong month of July, this altcoin continues to signal bearish in the short term.

Whale activity is increasing significantly, EMA lines are about to confirm another death cross, and price thresholds q

XRP0,12%

TapChiBitcoin·2025-08-21 15:11

Conflux (CFX) August 21 AMA Preview: Comprehensive Analysis of 3.0 Upgrade, AxCNH stablecoin, and Price Predictions

Conflux (CFX) will hold an AMA event on August 21 at 18:00 (UTC) on Discord, providing open Q&A support for participants of SummerHackfest 2025. With the 3.0 upgrade, AxCNH stablecoin pilot, and the intertwining of Chinese regulatory dynamics, CFX price movement has become the market focus. This article will delve into Conflux's technical upgrades, policy challenges, and potential price movement, and explore possible market reactions before and after the AMA.

CFX-0,71%

MarketWhisper·2025-08-21 01:48

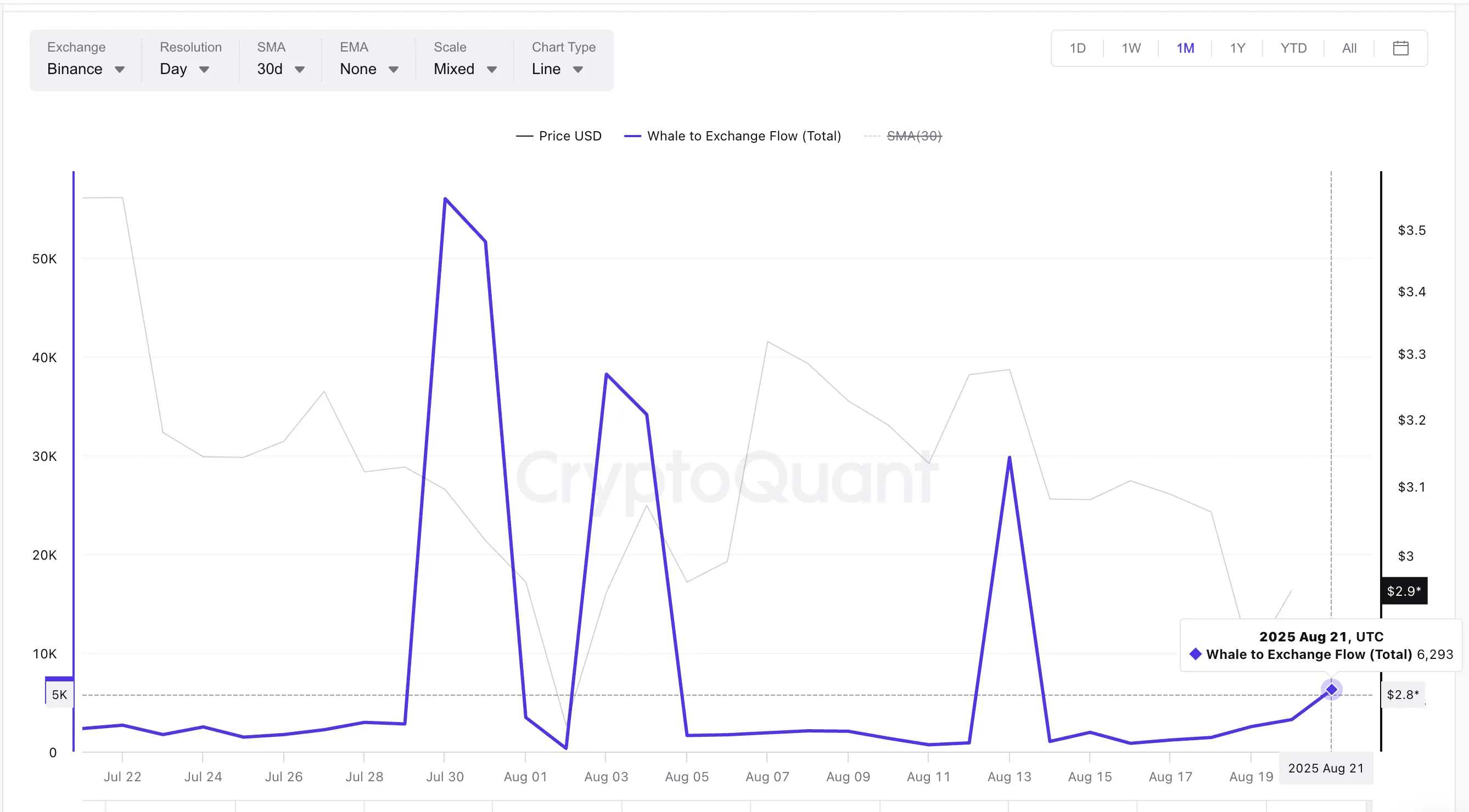

Strategy’s In-House Credit Products Key to Weathering Bitcoin Market Swings

Strategy executives fielded analyst questions on July 31, covering credit resilience, market positioning, and bitcoin accumulation during the firm’s Q2 2025 earnings call.

Strategy Execs Tout Resilience Amid Potential Bitcoin Slumps

The Q&A session during the Strategy earnings call included

Coinpedia·2025-08-01 16:36

Sharon, He Did What?! Ripple CTO Admits Faking Ozzy AMA

Trusted Editorial content, reviewed by leading industry experts and seasoned editors. Ad Disclosure

According to reports, Ripple’s chief technology officer, David Schwartz, has come clean about staging what was billed as a live fan Q&A with Ozzy Osbourne and the members of Black

Bitcoinistcom·2025-07-27 14:02

Ethereum Version of MicroStrategy Q&A: Analysis of the Logic and Holdings of Four Major US Companies Betting on ETH

This article revolves around ten key issues, systematically sorting out the core logic of four Ethereum reserve companies in terms of funding pathways, on-chain deployment, strategic motivations, and risk governance. (Previous summary: Interview with DeFi Report founder: 10 charts reveal the beginning of the Ethereum bull run, institutional funds may become the biggest driving force) (Background supplement: SharpLink Gaming increases the position with 4,904 Ethereum "unrealized gains of $260 million", SBET skyrocketed nearly 3 times this month) Starting from 2025, four US stock companies represented by SharpLink Gaming, Bitmine Immersion Tech, Bit Digital, and BTCS Inc. have built a system distinct from others by purchasing ETH on a large scale and investing it in on-chain staking.

ETH1,77%

動區BlockTempo·2025-07-22 04:42

Canaan, Avalon Q pioneering home BTC mining in 2025

As BTC surged past $110,000 in 2025, the block reward mining sector witnessed renewed interest, driven by profitability and technological innovation.

Canaan Inc. (NASDAQ: CAN), a Singapore-based manufacturer of ASIC (Application-Specific Integrated Circuit) mining hardware, is leading this

CoinGeek·2025-07-17 23:00

Load More