#CryptoSurvivalGuide

#CryptoSurvivalGuide: How to Survive & Thrive in the Crypto Market (2026 Edition)

Hey Gate.io family! Crypto market is a wild jungle – extreme volatility, scams, bear markets, FOMO, and rug pulls can wipe out portfolios overnight. But if you follow these proven survival rules, you don’t just survive… you come out stronger and richer when the next bull run hits.

I’ve compiled every major point from real experience, expert guides Investopedia, bear market strategies, and 2026 market reality.

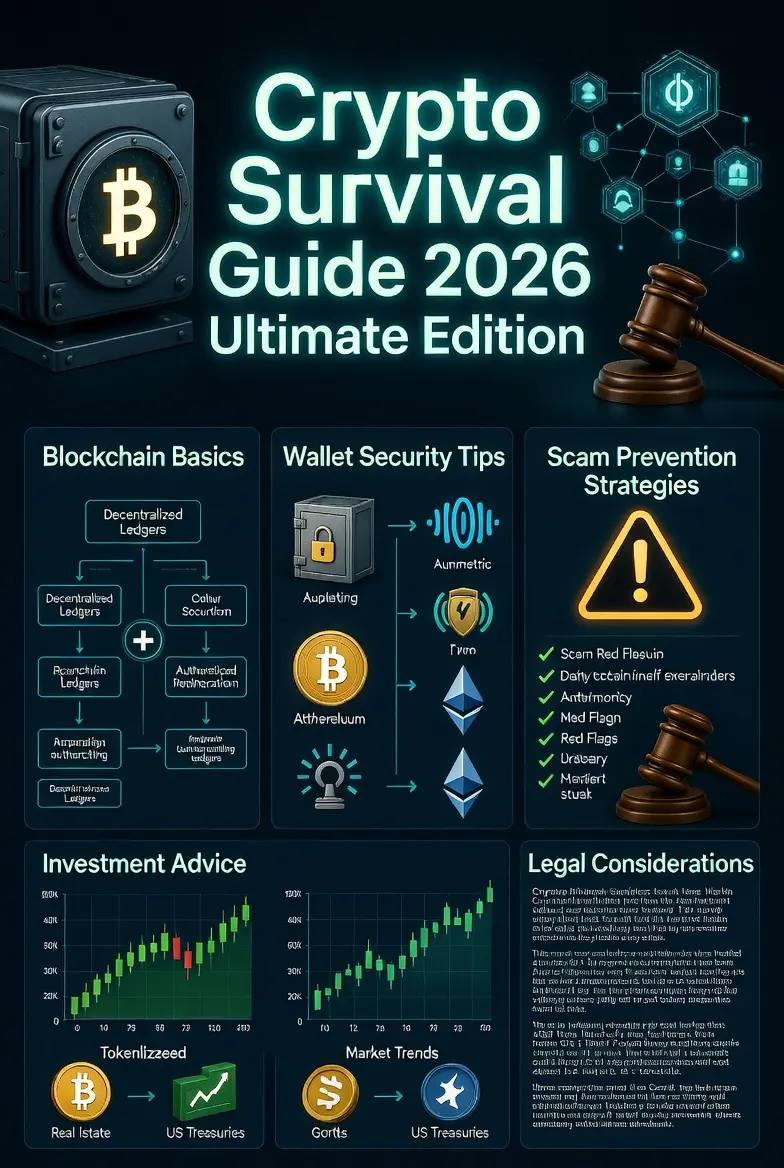

1. Only Invest What You Can Afford to Lose (Golden Rule #1)

Never use rent money, emergency funds, or borrowed cash. Crypto can drop 50-80% in weeks (we saw it in 2025-2026 corrections). Limit crypto to max 5-10% of your total portfolio after you have 6 months of fiat savings. Why? Because even the best traders lose sometimes. This keeps you emotionally stable and alive for the long game.

2. Do Your Own Research (DYOR) – Never Blindly Follow Hype

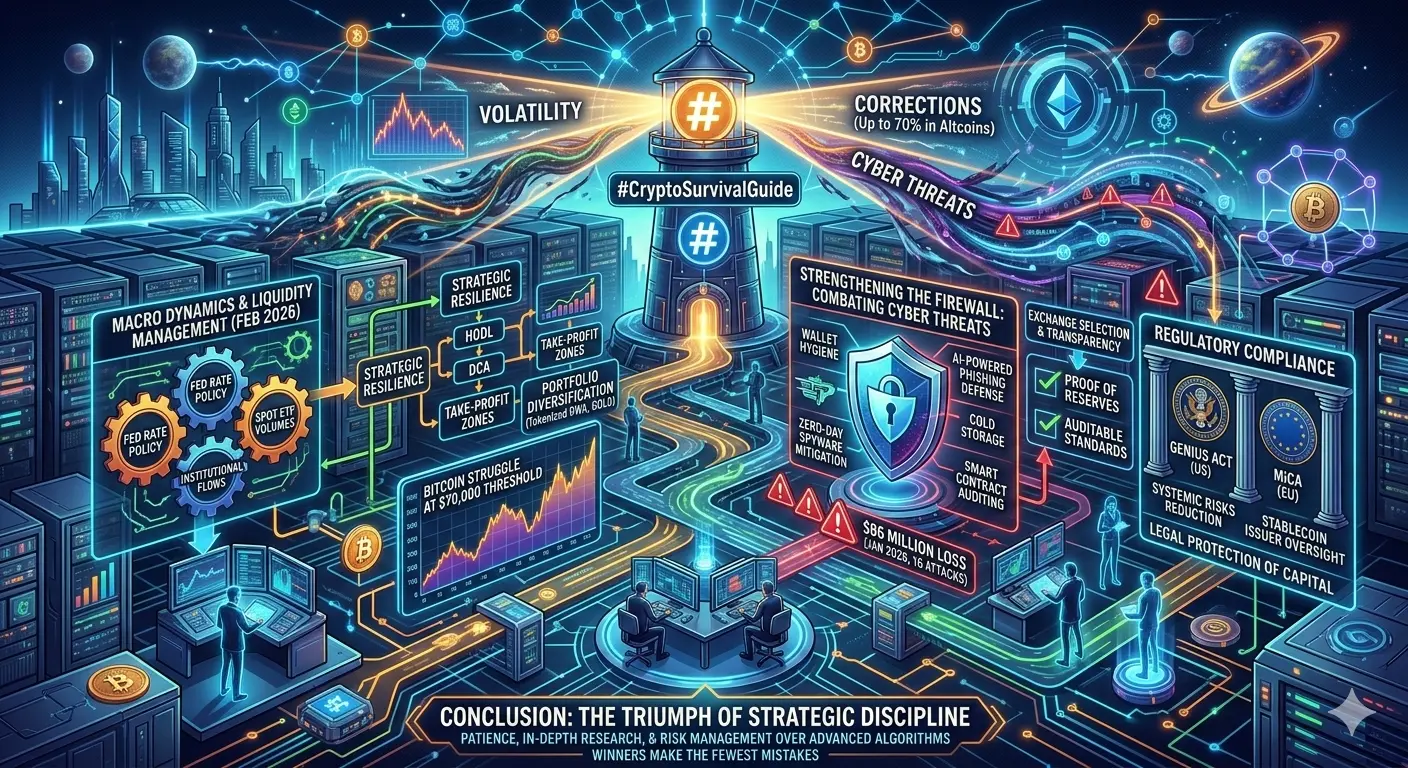

Read whitepapers, check team (doxxed or anonymous?), tokenomics (supply, vesting, utility), liquidity locks, audits, and on-chain data. Use Gate.io’s research tools, CoinMarketCap, DefiLlama, and Dune Analytics. Shills on Twitter/X and Telegram want your money. Real projects have real use cases (Bitcoin as digital gold, Ethereum for DeFi, Solana for speed). Skipping DYOR = guaranteed regret.

3. Use Dollar-Cost Averaging (DCA) – Buy the Dip Automatically

Instead of trying to catch the exact bottom (impossible), invest fixed amount every week/month (e.g., $100 BTC + $50 ETH). In bear markets like now (early 2026), you buy more coins when prices are low. Historical data shows DCA beats lump-sum timing 70%+ of the time. Set recurring buys on Gate.io – set it and forget it.

4. Diversify Smartly – Don’t Put All Eggs in One Basket

Mix: 40-60% Bitcoin/Ethereum (blue chips), 20-30% solid altcoins (SOL, BNB, etc.), 10-20% high-conviction new projects, and 10% stablecoins (USDT/USDC) for opportunities. In 2026, Bitcoin dominance is high – alts bleed more. Rebalance every 3-6 months. Diversification saved many in 2022 & 2025 crashes.

5. Secure Your Assets Like Your Life Depends On It (Gate.io Special)

Enable 2FA, fund password, and anti-phishing code on Gate.io (go to Security Settings).

Never keep large amounts on any exchange long-term → "Not your keys, not your coins."

Use hardware wallet (Ledger/Trezor) for holdings >3-6 months.

Never click suspicious links, never share seed phrase. Phishing scams stole billions in 2025. Gate.io has great security – use it fully.

6. Master Your Emotions – Kill FOMO & FUD

FOMO (buying at ATH because “this is the next 100x”) and FUD (panic selling at bottom) destroy more portfolios than crashes. Have a written trading plan: entry price, target, stop-loss. When market screams, step away. Journal your trades. In 2026 bear phase, the strongest survive by staying calm.

7. Understand Market Cycles – Bears Are Normal & Temporary

Crypto has 4-year cycles (halving-driven). 2025 was volatile, early 2026 feels like accumulation/bear. History: every bear ends with new highs (BTC from $69k → $100k+ cycle before). Prepare cash/stablecoins during euphoria, accumulate during fear. Play dead if your thesis is intact – don’t fight the market.

8. Have Clear Exit Strategy & Take Profits

Set targets: e.g., sell 20% at 2x, 30% at 5x, let rest ride. Use trailing stop-loss on Gate.io Futures/Spot. Never greedily hold forever. Many made millions in 2021 but lost it all in 2022 because they never sold. Profit-taking is survival, not selling out.

9. Learn Technical + Fundamental Analysis Basics

TA: Moving averages, RSI (avoid buying when overbought >70), support/resistance. FA: Real adoption, revenue, partnerships. Gate.io charts are excellent – practice on demo/futures testnet first. Start with majors before memes.

10. Avoid Scams, High Leverage & Rug Pulls

No “guaranteed 100x”, no private groups promising signals.

Check liquidity, locked tokens, dev wallets.

Leverage max 3-5x (or avoid in beginning) – 20x+ wipes accounts in minutes.

Meme coins = high risk lottery. Only gamble what you can lose 100%.

11. Build a Small Trusted Community (Gate.io Square Advantage)

Join ethical groups (not 1000-member spam chats). Share ideas, get quick feedback. Gate.io Community Square is perfect – follow real traders, ignore paid shills. Best players have “home base” chats with guides, partners, and experts.

12. Stay Updated on Regulations & News – But Filter Noise

Follow official sources (SEC, White House crypto news, Gate.io announcements). 2026 has pro-crypto tailwinds but sudden rules can crash prices. Use alerts on Gate.io app. Don’t chase every tweet.

13. Keep Learning & Adapt – Crypto Never Sleeps

Read Gate.io Academy daily. Learn DeFi, staking, RWAs, tokenization (big 2026 trend). Update your edge every 6 months. The players who survive 5+ years are constant learners.

14. Have Emergency Fiat Fund + Tax Discipline

3-6 months expenses in bank/stablecoins. Track every trade for taxes (use Koinly or similar). In many countries 2026 rules are stricter – ignorance costs extra.

15. Long-Term Mindset Wins – HODL Smart, Not Blindly

Most millionaires in crypto held through 2-3 cycles. Spot trading on Gate.io for long-term, futures only for small % with strict rules. Patience > perfection.

#CryptoSurvivalGuide 2026

Risk only what you can lose

DYOR always

DCA every week

Diversify (BTC+ETH heavy)

Hardware wallet + Gate.io 2FA

Kill FOMO/FUD – stick to plan

Bears are buying seasons

Take profits on the way up

Learn charts & fundamentals

Avoid leverage & scams

Join trusted Gate.io Square chats

Stay regulated & informed

Never stop learning

Emergency fund first

Long-term vision = wealth

Crypto is not gambling when you have rules. Apply these and you’ll survive any market.

What’s YOUR #1 survival rule? Drop in comments 👇

#CryptoSurvivalGuide: How to Survive & Thrive in the Crypto Market (2026 Edition)

Hey Gate.io family! Crypto market is a wild jungle – extreme volatility, scams, bear markets, FOMO, and rug pulls can wipe out portfolios overnight. But if you follow these proven survival rules, you don’t just survive… you come out stronger and richer when the next bull run hits.

I’ve compiled every major point from real experience, expert guides Investopedia, bear market strategies, and 2026 market reality.

1. Only Invest What You Can Afford to Lose (Golden Rule #1)

Never use rent money, emergency funds, or borrowed cash. Crypto can drop 50-80% in weeks (we saw it in 2025-2026 corrections). Limit crypto to max 5-10% of your total portfolio after you have 6 months of fiat savings. Why? Because even the best traders lose sometimes. This keeps you emotionally stable and alive for the long game.

2. Do Your Own Research (DYOR) – Never Blindly Follow Hype

Read whitepapers, check team (doxxed or anonymous?), tokenomics (supply, vesting, utility), liquidity locks, audits, and on-chain data. Use Gate.io’s research tools, CoinMarketCap, DefiLlama, and Dune Analytics. Shills on Twitter/X and Telegram want your money. Real projects have real use cases (Bitcoin as digital gold, Ethereum for DeFi, Solana for speed). Skipping DYOR = guaranteed regret.

3. Use Dollar-Cost Averaging (DCA) – Buy the Dip Automatically

Instead of trying to catch the exact bottom (impossible), invest fixed amount every week/month (e.g., $100 BTC + $50 ETH). In bear markets like now (early 2026), you buy more coins when prices are low. Historical data shows DCA beats lump-sum timing 70%+ of the time. Set recurring buys on Gate.io – set it and forget it.

4. Diversify Smartly – Don’t Put All Eggs in One Basket

Mix: 40-60% Bitcoin/Ethereum (blue chips), 20-30% solid altcoins (SOL, BNB, etc.), 10-20% high-conviction new projects, and 10% stablecoins (USDT/USDC) for opportunities. In 2026, Bitcoin dominance is high – alts bleed more. Rebalance every 3-6 months. Diversification saved many in 2022 & 2025 crashes.

5. Secure Your Assets Like Your Life Depends On It (Gate.io Special)

Enable 2FA, fund password, and anti-phishing code on Gate.io (go to Security Settings).

Never keep large amounts on any exchange long-term → "Not your keys, not your coins."

Use hardware wallet (Ledger/Trezor) for holdings >3-6 months.

Never click suspicious links, never share seed phrase. Phishing scams stole billions in 2025. Gate.io has great security – use it fully.

6. Master Your Emotions – Kill FOMO & FUD

FOMO (buying at ATH because “this is the next 100x”) and FUD (panic selling at bottom) destroy more portfolios than crashes. Have a written trading plan: entry price, target, stop-loss. When market screams, step away. Journal your trades. In 2026 bear phase, the strongest survive by staying calm.

7. Understand Market Cycles – Bears Are Normal & Temporary

Crypto has 4-year cycles (halving-driven). 2025 was volatile, early 2026 feels like accumulation/bear. History: every bear ends with new highs (BTC from $69k → $100k+ cycle before). Prepare cash/stablecoins during euphoria, accumulate during fear. Play dead if your thesis is intact – don’t fight the market.

8. Have Clear Exit Strategy & Take Profits

Set targets: e.g., sell 20% at 2x, 30% at 5x, let rest ride. Use trailing stop-loss on Gate.io Futures/Spot. Never greedily hold forever. Many made millions in 2021 but lost it all in 2022 because they never sold. Profit-taking is survival, not selling out.

9. Learn Technical + Fundamental Analysis Basics

TA: Moving averages, RSI (avoid buying when overbought >70), support/resistance. FA: Real adoption, revenue, partnerships. Gate.io charts are excellent – practice on demo/futures testnet first. Start with majors before memes.

10. Avoid Scams, High Leverage & Rug Pulls

No “guaranteed 100x”, no private groups promising signals.

Check liquidity, locked tokens, dev wallets.

Leverage max 3-5x (or avoid in beginning) – 20x+ wipes accounts in minutes.

Meme coins = high risk lottery. Only gamble what you can lose 100%.

11. Build a Small Trusted Community (Gate.io Square Advantage)

Join ethical groups (not 1000-member spam chats). Share ideas, get quick feedback. Gate.io Community Square is perfect – follow real traders, ignore paid shills. Best players have “home base” chats with guides, partners, and experts.

12. Stay Updated on Regulations & News – But Filter Noise

Follow official sources (SEC, White House crypto news, Gate.io announcements). 2026 has pro-crypto tailwinds but sudden rules can crash prices. Use alerts on Gate.io app. Don’t chase every tweet.

13. Keep Learning & Adapt – Crypto Never Sleeps

Read Gate.io Academy daily. Learn DeFi, staking, RWAs, tokenization (big 2026 trend). Update your edge every 6 months. The players who survive 5+ years are constant learners.

14. Have Emergency Fiat Fund + Tax Discipline

3-6 months expenses in bank/stablecoins. Track every trade for taxes (use Koinly or similar). In many countries 2026 rules are stricter – ignorance costs extra.

15. Long-Term Mindset Wins – HODL Smart, Not Blindly

Most millionaires in crypto held through 2-3 cycles. Spot trading on Gate.io for long-term, futures only for small % with strict rules. Patience > perfection.

#CryptoSurvivalGuide 2026

Risk only what you can lose

DYOR always

DCA every week

Diversify (BTC+ETH heavy)

Hardware wallet + Gate.io 2FA

Kill FOMO/FUD – stick to plan

Bears are buying seasons

Take profits on the way up

Learn charts & fundamentals

Avoid leverage & scams

Join trusted Gate.io Square chats

Stay regulated & informed

Never stop learning

Emergency fund first

Long-term vision = wealth

Crypto is not gambling when you have rules. Apply these and you’ll survive any market.

What’s YOUR #1 survival rule? Drop in comments 👇