WatchMeCrushTheMarketMaker

No content yet

WatchMeCrushTheMarketMaker

Regarding Long-Term Holding and Tactical Adjustments for ZK

In the trading layout of ZKUSDT, I have chosen to hold firmly and will dynamically adjust my strategy based on market changes.

From the current 15-minute K-line chart, we can see that the ZK price experienced a rapid surge, rising from a low point of 0.01974 to a high of 0.03228, followed by a retracement phase. The current price is oscillating around 0.02611. This upward movement released strong bullish momentum, and the subsequent pullback appears more like a shakeout by the main force rather than a trend reversal.

Long-Term Holding

In the trading layout of ZKUSDT, I have chosen to hold firmly and will dynamically adjust my strategy based on market changes.

From the current 15-minute K-line chart, we can see that the ZK price experienced a rapid surge, rising from a low point of 0.01974 to a high of 0.03228, followed by a retracement phase. The current price is oscillating around 0.02611. This upward movement released strong bullish momentum, and the subsequent pullback appears more like a shakeout by the main force rather than a trend reversal.

Long-Term Holding

ZK-12,47%

- Reward

- 2

- 2

- Repost

- Share

CaptainChenOfTheEncryptionTeam :

:

Sure! 😌 I mean, what was I even thinking about just now, you guys not having dinner there? Haha, I really want to laugh out loud now, haha, haha, I can't stop laughing!View More

The Surge of Past Gains and the Unquenchable Fire: SENT's Roller Coaster and My Trading Journey

Last night’s SENT was like a sudden flare shooting into the sky, completing a fierce rally during my hours of deep sleep. When I opened the market interface this morning, the glaring decline on the screen and the $1000 U that evaporated from my account instantly woke me up. Looking at the nearly vertical red line on the candlestick chart that surged and then retreated, I could almost see the frenzy and agitation in the market last night, and I also clearly felt the dual regret of “missing out on pro

Last night’s SENT was like a sudden flare shooting into the sky, completing a fierce rally during my hours of deep sleep. When I opened the market interface this morning, the glaring decline on the screen and the $1000 U that evaporated from my account instantly woke me up. Looking at the nearly vertical red line on the candlestick chart that surged and then retreated, I could almost see the frenzy and agitation in the market last night, and I also clearly felt the dual regret of “missing out on pro

SENT-2,93%

- Reward

- like

- 2

- Repost

- Share

WYnn :

:

Are you adding to your position? Are you still using the stop-loss here?View More

Recently, ETH and BTC experienced a sharp decline and entered a consolidation phase, with overall market movements oscillating and lacking a clear trend direction. This is not a good time to open positions. Currently, BTC is fluctuating around $78,000, while ETH is oscillating in the $2,400 range. Support and resistance levels have not yet been effectively confirmed, and the market remains under the continuous influence of the Federal Reserve policy shift expectations and rising geopolitical risks. Risk aversion sentiment is strong, and the continuous net outflows from spot ETFs also reflect c

View Original- Reward

- like

- Comment

- Repost

- Share

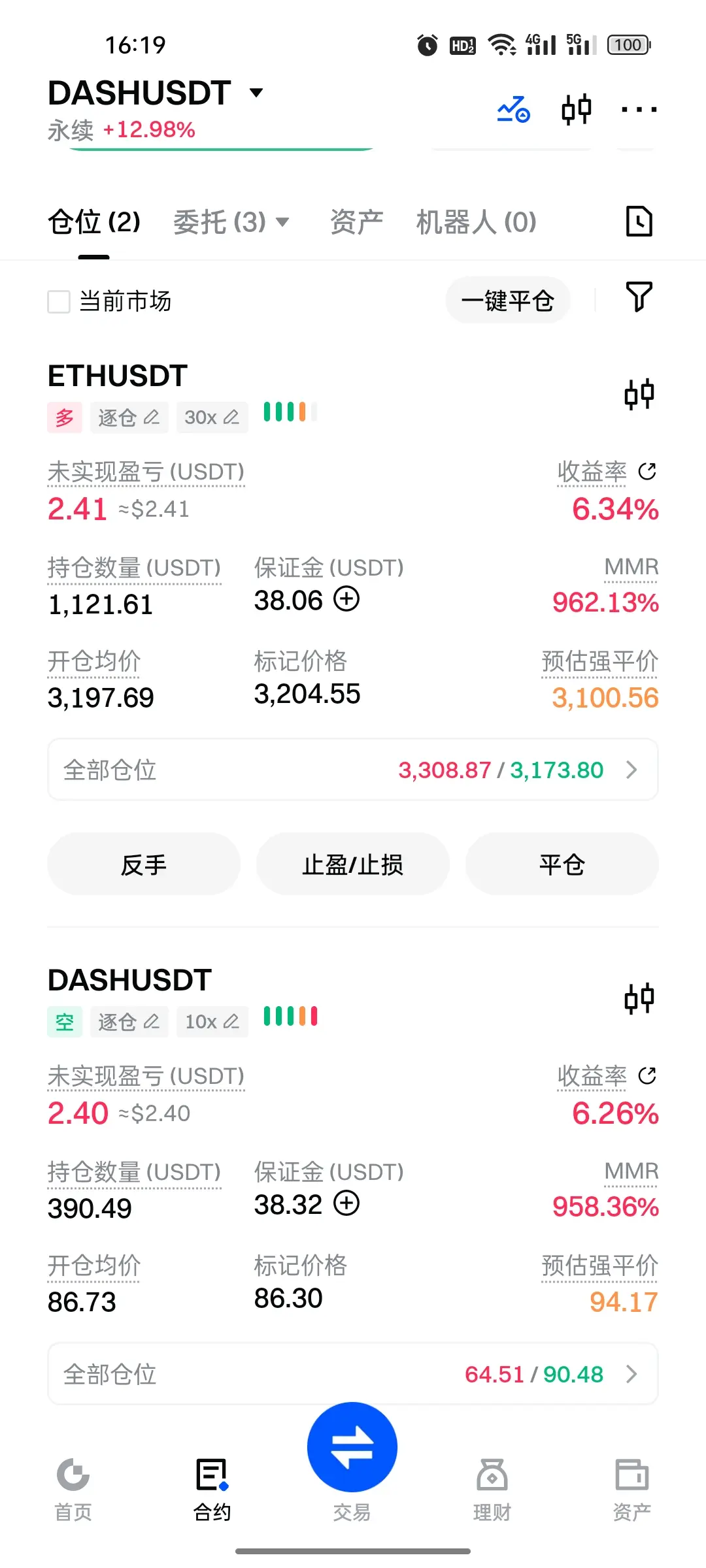

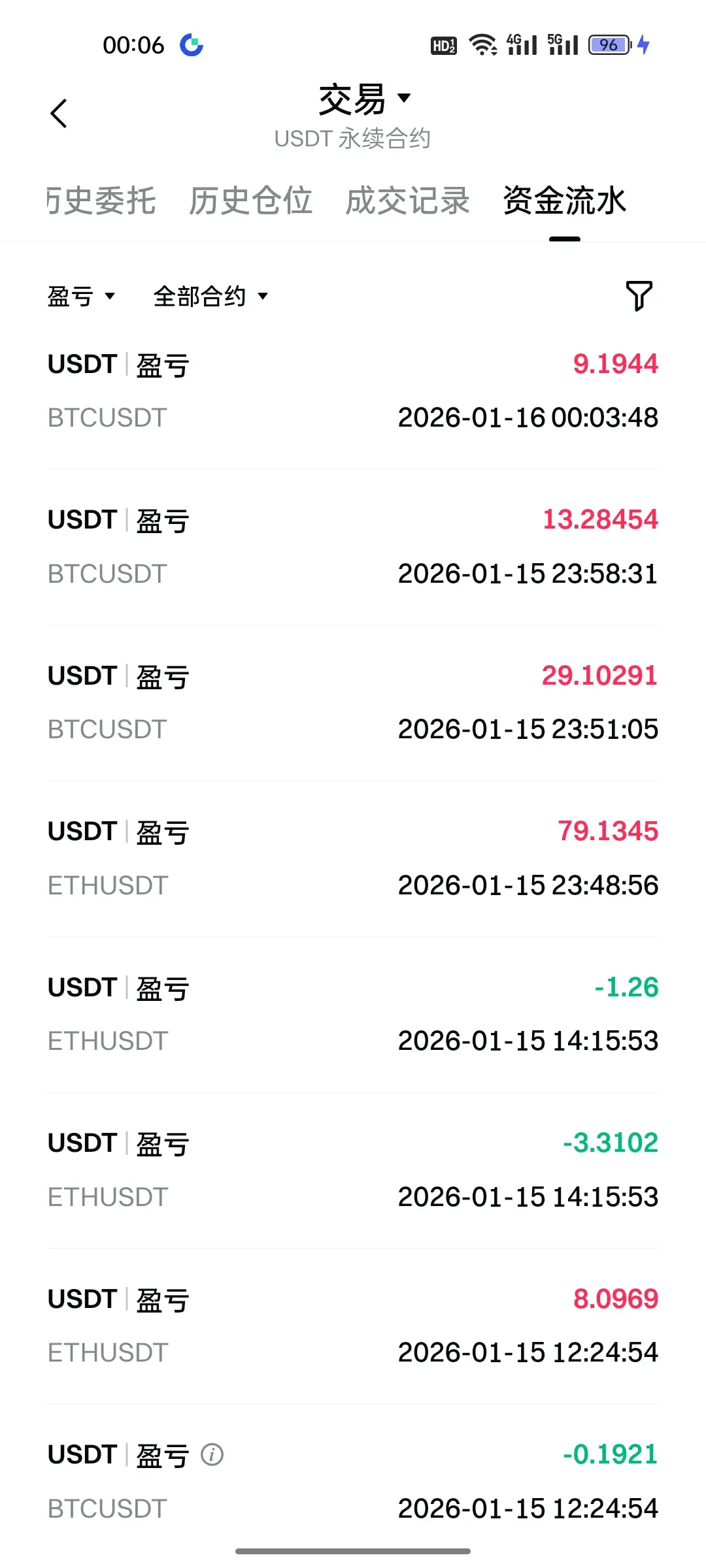

Today’s Trading Review

Today's overall trading maintained profitability, but several issues related to mindset and operation were exposed during the process, which are worth reviewing thoroughly:

1. Overall Results

Although some entries were not precisely timed and greed led to blindly adding positions during floating profits, resulting in some losses, the account ultimately remained profitable. This indicates that my overall market judgment framework is effective; however, the details of execution need optimization.

2. Core Issues

1. Mistakes Caused by Greed Leading to Over-Adding

In some pos

View OriginalToday's overall trading maintained profitability, but several issues related to mindset and operation were exposed during the process, which are worth reviewing thoroughly:

1. Overall Results

Although some entries were not precisely timed and greed led to blindly adding positions during floating profits, resulting in some losses, the account ultimately remained profitable. This indicates that my overall market judgment framework is effective; however, the details of execution need optimization.

2. Core Issues

1. Mistakes Caused by Greed Leading to Over-Adding

In some pos

- Reward

- 1

- Comment

- Repost

- Share

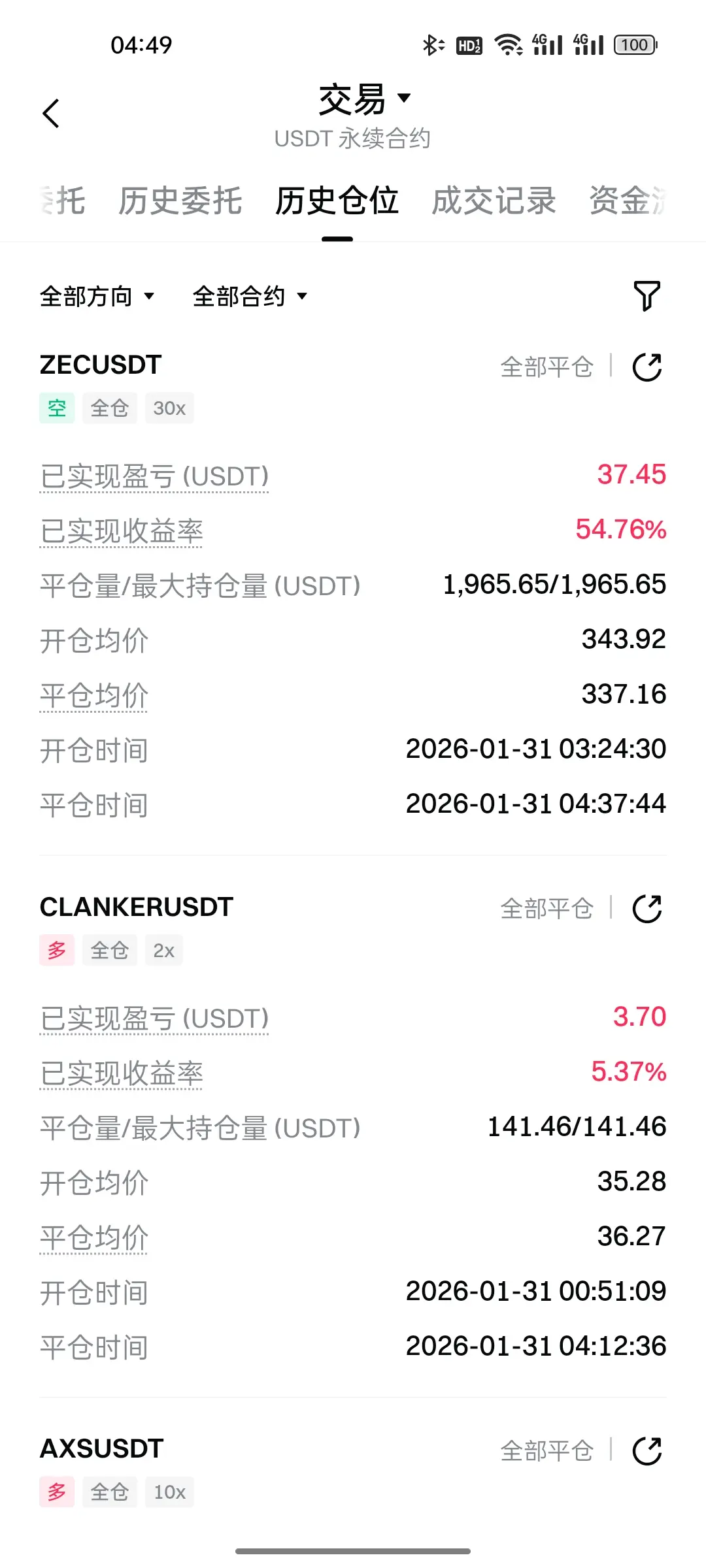

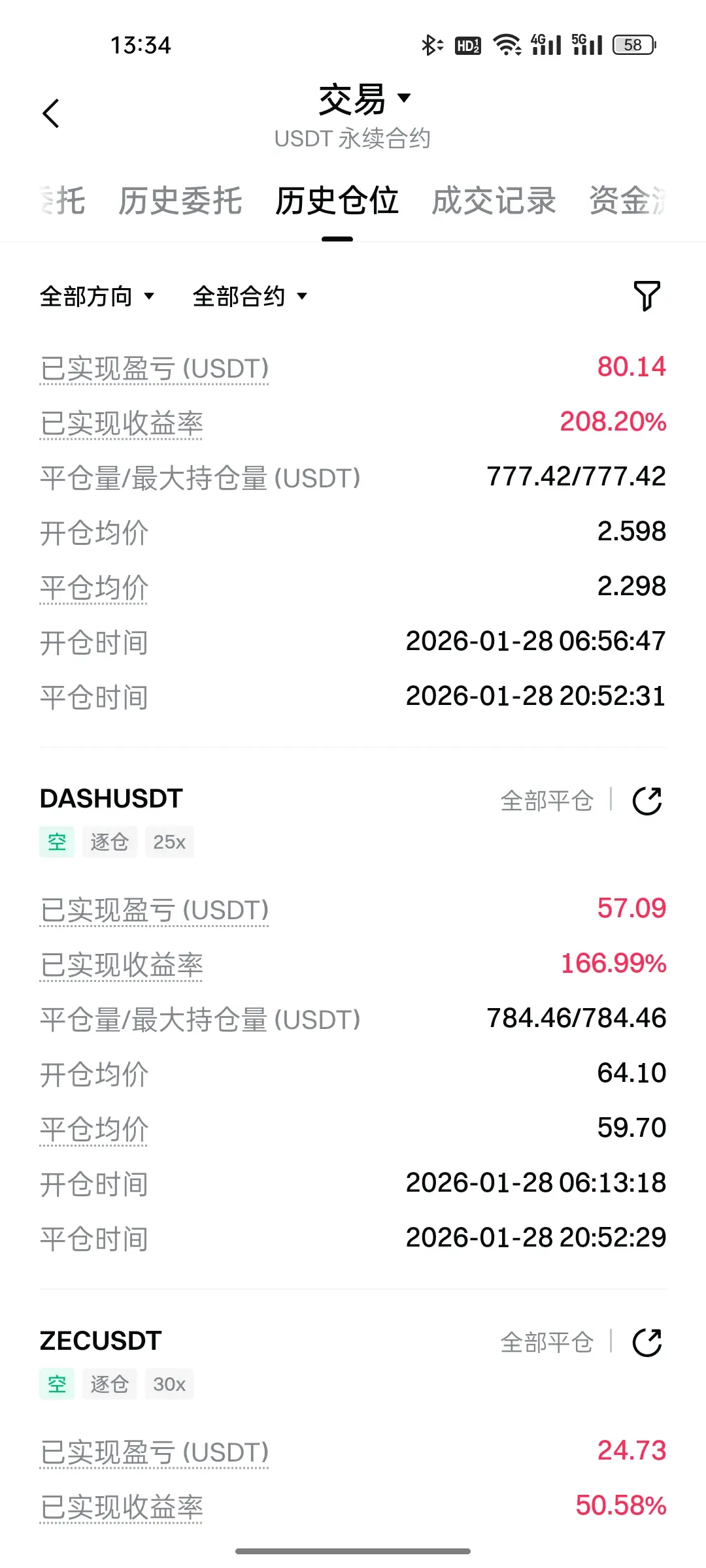

Recent Trading Profit and Loss Review Report

I. Core Trading Data Overview

- Reporting Period: January 28, 2026 – January 29, 2026

- Total Profit: approximately 242.84 USDT

- Key Profit Targets: DASH, ENS, HYPE, and other anonymous tokens

- Maximum Drawdown: Single account floating profit once retraced about 40%, due to violation of existing trading rules

II. Trading Process Review

1. Profit Highlights

- On January 28, short position on DASH achieved a 169.99% return within approximately 14 hours, accurately capturing the downward price trend.

- On January 29, long position on ENS, utilizing 1

View OriginalI. Core Trading Data Overview

- Reporting Period: January 28, 2026 – January 29, 2026

- Total Profit: approximately 242.84 USDT

- Key Profit Targets: DASH, ENS, HYPE, and other anonymous tokens

- Maximum Drawdown: Single account floating profit once retraced about 40%, due to violation of existing trading rules

II. Trading Process Review

1. Profit Highlights

- On January 28, short position on DASH achieved a 169.99% return within approximately 14 hours, accurately capturing the downward price trend.

- On January 29, long position on ENS, utilizing 1

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 1

- Comment

- Repost

- Share

Cryptocurrency Trading Profit Report (2026.01.19-2026.01.21)#Gate每10分钟送1克黄金

I. Trading Results Overview

1. Profitability

- Total profit during the period: +87.52 USDT (DASHUSDT +75.62 USDT, FHEUSDT +11.90 USDT)

- Core profitable trades: DASHUSDT short position achieved a 113.52% return with 10x leverage; FHEUSDT long position achieved an 86.19% return with 10x leverage.

2. Shortcomings and Regrets

- Profit did not meet expectations: Some trades were closed early, failing to fully capture subsequent market movements, resulting in unrealized maximum gains.

- Impulsive opening of positions: A

View OriginalI. Trading Results Overview

1. Profitability

- Total profit during the period: +87.52 USDT (DASHUSDT +75.62 USDT, FHEUSDT +11.90 USDT)

- Core profitable trades: DASHUSDT short position achieved a 113.52% return with 10x leverage; FHEUSDT long position achieved an 86.19% return with 10x leverage.

2. Shortcomings and Regrets

- Profit did not meet expectations: Some trades were closed early, failing to fully capture subsequent market movements, resulting in unrealized maximum gains.

- Impulsive opening of positions: A

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 1

- Comment

- Repost

- Share

DASH Short-term Downtrend Confirmed, Technical Collapse Approaching

From a technical perspective, DASH's upward momentum has been completely exhausted. After an initial rally, the price faced resistance at 96.50, forming a double top pattern. The subsequent correction directly broke the key neckline, confirming a reversal signal.

Currently, the MACD indicator has formed a death cross at a high level, with the red histogram continuously shrinking and the green histogram rapidly expanding, indicating that the bearish force is dominating the market. Although the KDJ indicator has temporarily rebo

From a technical perspective, DASH's upward momentum has been completely exhausted. After an initial rally, the price faced resistance at 96.50, forming a double top pattern. The subsequent correction directly broke the key neckline, confirming a reversal signal.

Currently, the MACD indicator has formed a death cross at a high level, with the red histogram continuously shrinking and the green histogram rapidly expanding, indicating that the bearish force is dominating the market. Although the KDJ indicator has temporarily rebo

DASH1,85%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 1

- Comment

- Repost

- Share

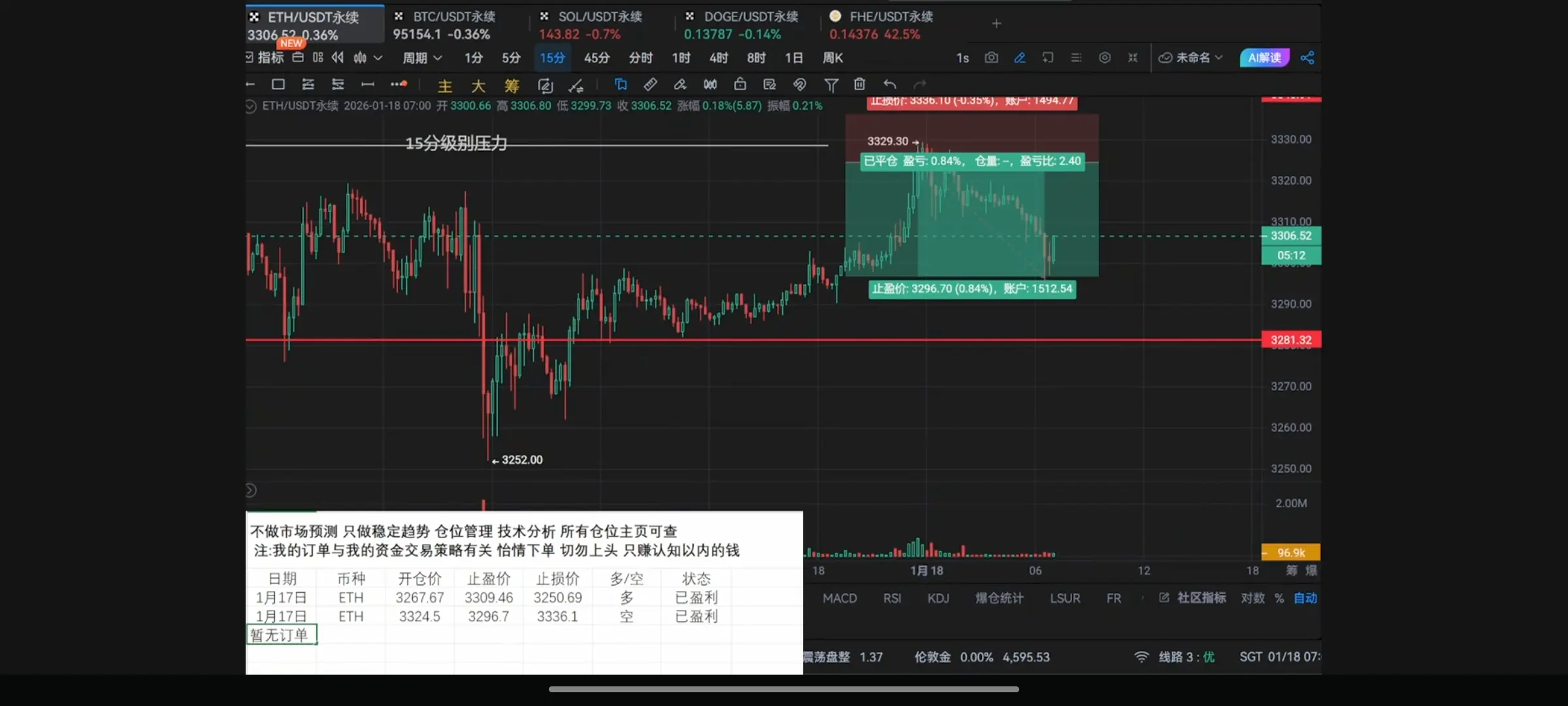

Profit Report on Signal Trading

This time, the ETH contract signal trading achieved two consecutive profits, both opened in real-time during the live broadcast, fully transparent throughout the process, accurately capturing swing opportunities.

On January 17th during the live broadcast, ETH price dipped to the 3270-3280 support zone. Relying on the support effect formed by previous historical lows, a long position was initiated in real-time. When the price rebounded to the 3300 level, take-profit was triggered. The opening average price was 3,274.37 USDT, and the closing average price was 3,30

This time, the ETH contract signal trading achieved two consecutive profits, both opened in real-time during the live broadcast, fully transparent throughout the process, accurately capturing swing opportunities.

On January 17th during the live broadcast, ETH price dipped to the 3270-3280 support zone. Relying on the support effect formed by previous historical lows, a long position was initiated in real-time. When the price rebounded to the 3300 level, take-profit was triggered. The opening average price was 3,274.37 USDT, and the closing average price was 3,30

ETH0,08%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 1

- 2

- Repost

- Share

湘江河畔重相逢 :

:

Hold on tight, we're about to take off 🛫View More

Trade Review: Small Reversal Position, Unexpected Gains

This ETH trade was an "unplanned surprise." When the price dipped to a low of 3252, I broke my usual trend trading principles and chose to open a small long position in the opposite direction. Although it went against my trading system, considering the strong support zone between 3250-3270, I decided to try a small position for a test.

After opening the position, the price rebounded as expected, climbing to the 3300 level. When it reached the preset take-profit point, I decisively exited the trade, successfully locking in profits. The key

This ETH trade was an "unplanned surprise." When the price dipped to a low of 3252, I broke my usual trend trading principles and chose to open a small long position in the opposite direction. Although it went against my trading system, considering the strong support zone between 3250-3270, I decided to try a small position for a test.

After opening the position, the price rebounded as expected, climbing to the 3300 level. When it reached the preset take-profit point, I decisively exited the trade, successfully locking in profits. The key

ETH0,08%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 3

- 1

- Repost

- Share

Ukim :

:

Go full throttle 🚀ETH Market Analysis: 3252 indicates panic selling, with further upside potential

The current ETH low point at 3252 is essentially a short-term emotional release caused by market panic selling. Previously, the price faced resistance around 3380 and retreated, compounded by high leverage long liquidations, leading retail investors to flee en masse and creating a false appearance of a sharp decline. However, this is not a trend reversal signal.

From a technical perspective, the 3250-3270 range is a key support zone. Mild volume absorption here aligns with typical bottom-fishing behavior by funds.

The current ETH low point at 3252 is essentially a short-term emotional release caused by market panic selling. Previously, the price faced resistance around 3380 and retreated, compounded by high leverage long liquidations, leading retail investors to flee en masse and creating a false appearance of a sharp decline. However, this is not a trend reversal signal.

From a technical perspective, the 3250-3270 range is a key support zone. Mild volume absorption here aligns with typical bottom-fishing behavior by funds.

ETH0,08%

- Reward

- like

- Comment

- Repost

- Share

$ETH Trading Recap Report

This ETH and BTC contract trading has successfully taken profit, achieving the expected returns. The key points are summarized as follows:

In ETH contract trading, we based our decision on volume and price signals from the 15-minute K-line chart, identifying multiple instances of volume expansion at high levels with stagnation, followed by volume expansion and a breakdown of support levels. This operation precisely captured the downward wave from 3374 to 3343, with a single trade profit of 79.13 USDT, validating the effectiveness of the "high-volume stagnation + brea

This ETH and BTC contract trading has successfully taken profit, achieving the expected returns. The key points are summarized as follows:

In ETH contract trading, we based our decision on volume and price signals from the 15-minute K-line chart, identifying multiple instances of volume expansion at high levels with stagnation, followed by volume expansion and a breakdown of support levels. This operation precisely captured the downward wave from 3374 to 3343, with a single trade profit of 79.13 USDT, validating the effectiveness of the "high-volume stagnation + brea

ETH0,08%

- Reward

- 1

- 2

- Repost

- Share

GateUser-34ab1e70 :

:

Can you help me out?View More

I believe ETH is likely to decline further to around 3288 to seek support. Currently, ETH faces strong resistance at the 3400 level, with two attempts to break through unsuccessful, indicating significant selling pressure above. Additionally, a bearish divergence has appeared on the 4-hour chart, along with a KDJ death cross signal, suggesting that upward momentum is continuously converging. Considering the recent high-level consolidation and profit-taking trend, market sentiment is becoming more cautious. The probability of a pullback to test the key support level at 3288 is relatively high,

ETH0,08%

- Reward

- like

- Comment

- Repost

- Share