GateUser-cc27e448

No content yet

GateUser-cc27e448

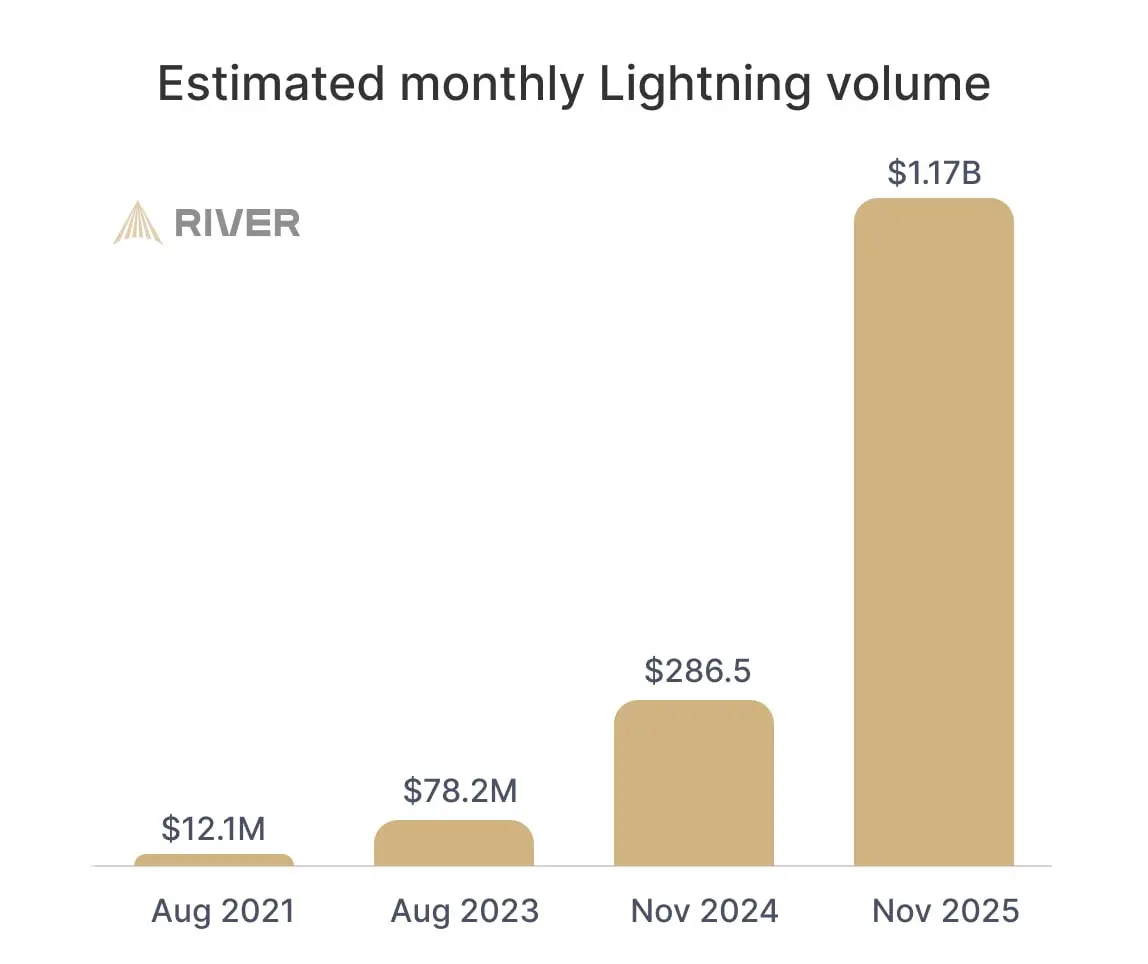

Bitcoin's Lightning Network surpassed $1 billion in monthly transaction volume according to data from last year👀

#CryptoObservers #CelebratingNewYearOnGateSquare

#CryptoObservers #CelebratingNewYearOnGateSquare

BTC1,69%

- Reward

- 1

- Comment

- Repost

- Share

US-listed Bitcoin miners' share of global Bitcoin hashrate stays near all-time high despite AI pivots and winter storms👀

#CryptoObservers #CelebratingNewYearOnGateSquare

#CryptoObservers #CelebratingNewYearOnGateSquare

BTC1,69%

- Reward

- like

- Comment

- Repost

- Share

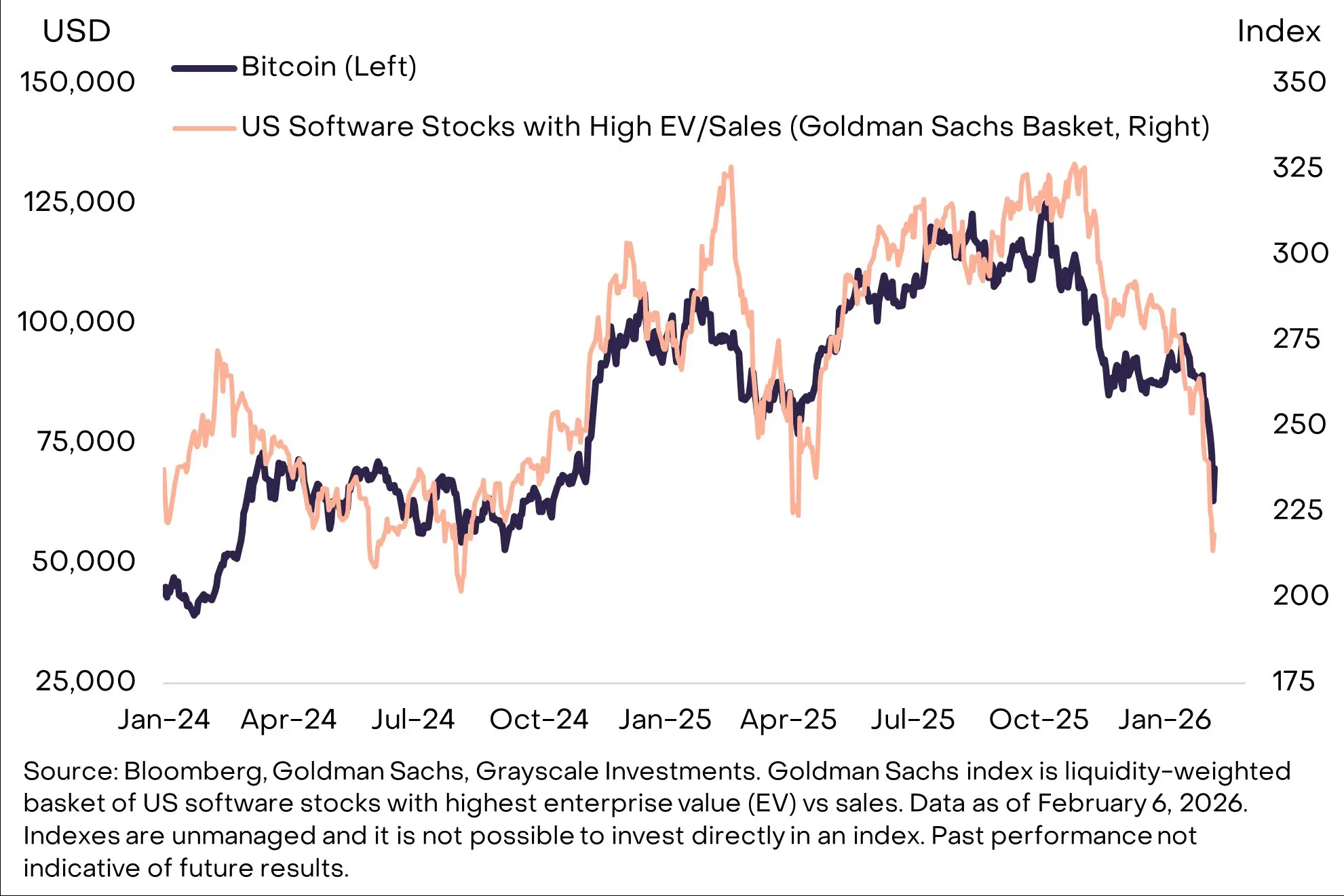

For at least the last 12 months, changes in the price of Bitcoin have been tightly correlated to U.S. software stocks with relatively high enterprise values (EV) compared to sales.

This suggests that the drawdown likely had more to do with broad de-risking of growth-oriented portfolios rather than problems unique to crypto👀 #CryptoObservers #CelebratingNewYearOnGateSquare

This suggests that the drawdown likely had more to do with broad de-risking of growth-oriented portfolios rather than problems unique to crypto👀 #CryptoObservers #CelebratingNewYearOnGateSquare

BTC1,69%

- Reward

- 1

- Comment

- Repost

- Share

Strategy buys another 2,486 BTC for ~$168.4 million at ~$67,710 per Bitcoin👀

#CryptoObservers #CelebratingNewYearOnGateSquare

#CryptoObservers #CelebratingNewYearOnGateSquare

BTC1,69%

- Reward

- 1

- Comment

- Repost

- Share

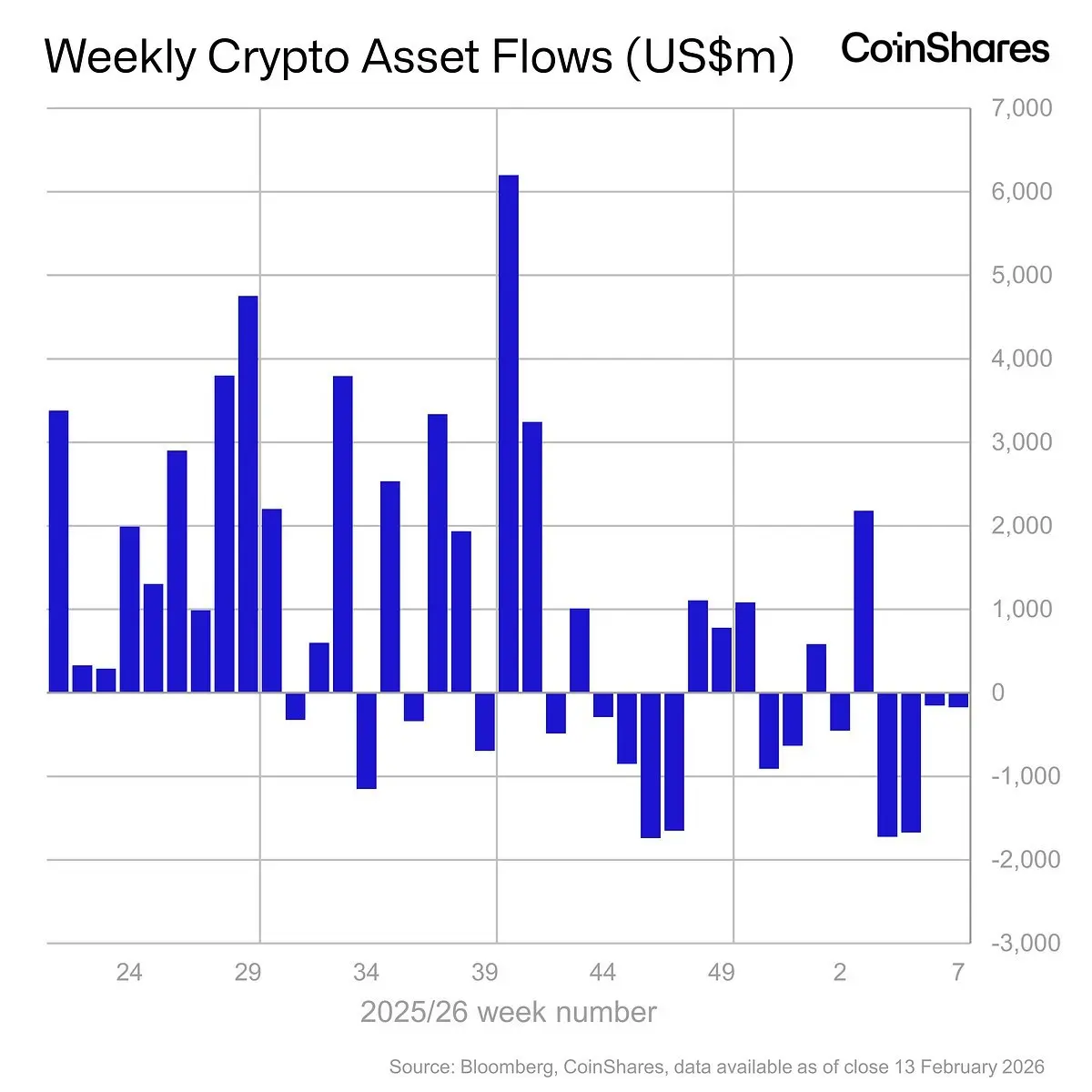

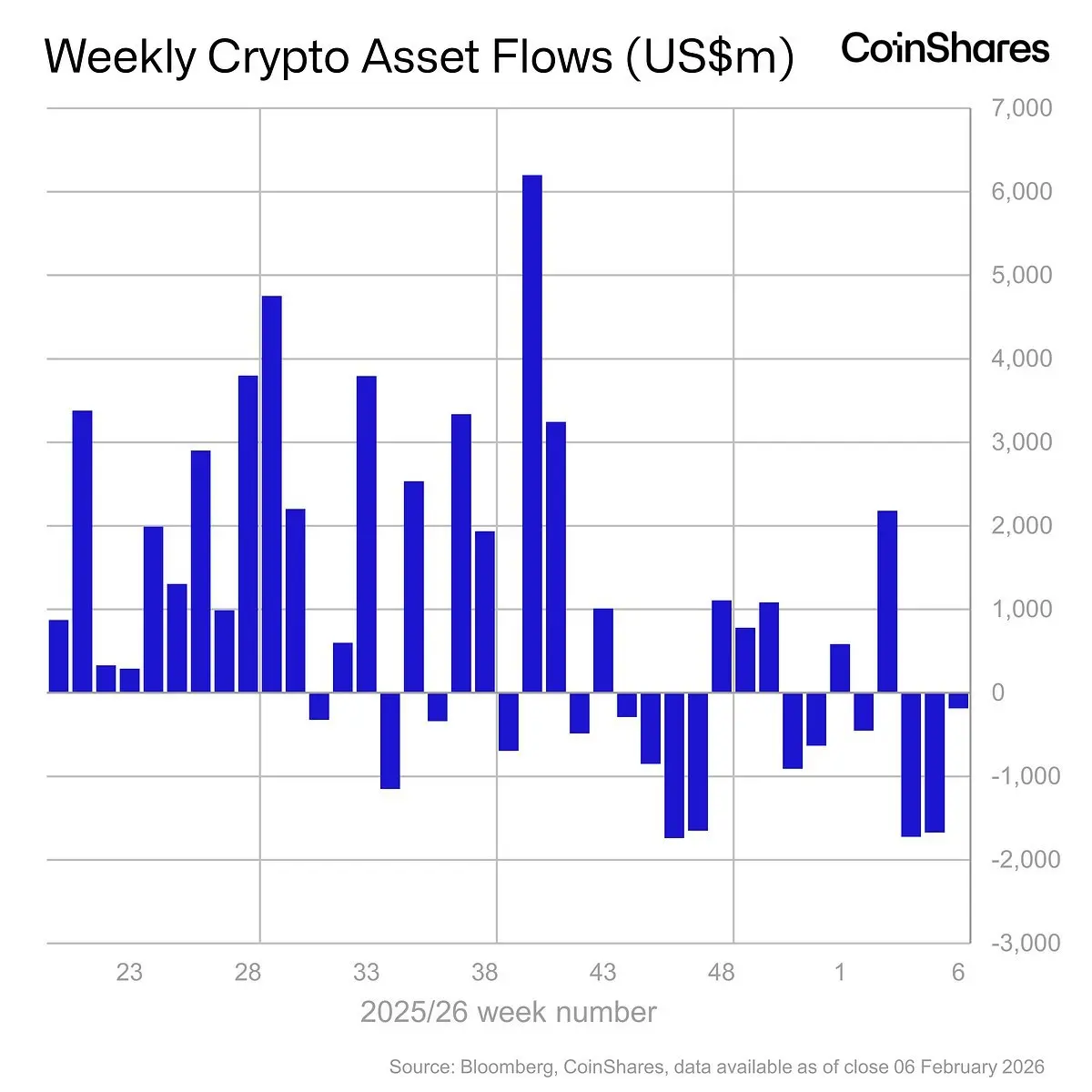

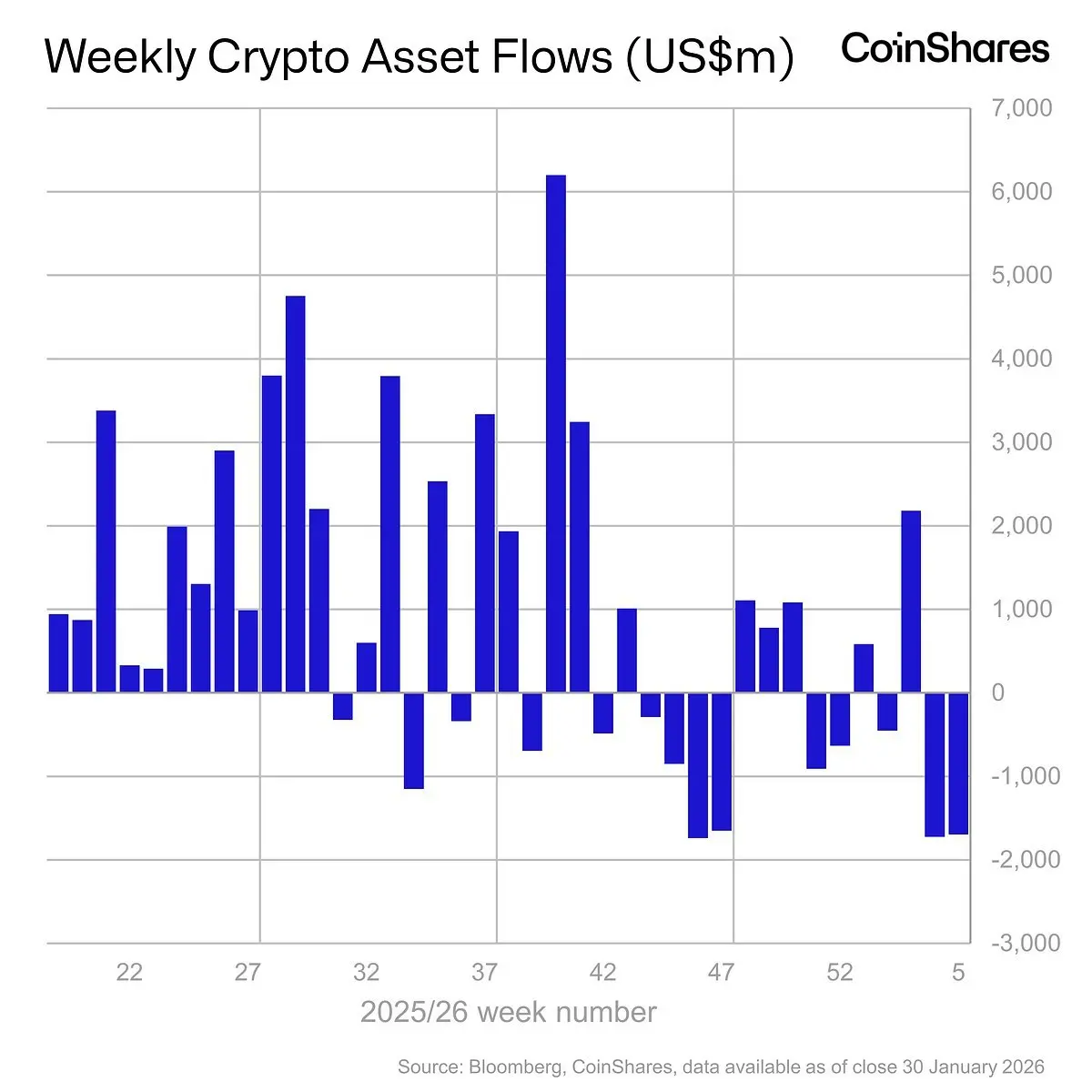

Digital asset investment products saw a fourth consecutive week of outflows totalling $173m, bringing the cumulative four-week run of outflows to $3.74bn👀

#CryptoObservers #CelebratingNewYearOnGateSquare

#CryptoObservers #CelebratingNewYearOnGateSquare

- Reward

- 2

- 1

- Repost

- Share

EngrAliyu :

:

Thanks so much for sharing this vital informationTokenized asset market cap has grown from $1 billion in 2024 to $6 billion, meanwhile the NYSE plans to launch a 24/7 tokenized exchange in 2026👀

#CryptoObservers #CelebratingNewYearOnGateSquare

#CryptoObservers #CelebratingNewYearOnGateSquare

- Reward

- like

- Comment

- Repost

- Share

MARA CEO warns of “Energy War” as Bitcoin mining evolves beyond hashrate

To adapt, MARA and other large operators are expanding into High-Performance Computing (HPC), integrating GPU clusters alongside traditional ASIC fleets to capture AI-related compute demand👀

#CryptoObservers #CelebratingNewYearOnGateSquare

To adapt, MARA and other large operators are expanding into High-Performance Computing (HPC), integrating GPU clusters alongside traditional ASIC fleets to capture AI-related compute demand👀

#CryptoObservers #CelebratingNewYearOnGateSquare

BTC1,69%

- Reward

- like

- Comment

- Repost

- Share

A solo Bitcoin miner successfully mined block 936100, securing a significant reward of 3.153 BTC👀

#CryptoObservers #CelebratingNewYearOnGateSquare

#CryptoObservers #CelebratingNewYearOnGateSquare

BTC1,69%

- Reward

- like

- Comment

- Repost

- Share

CoinShares claims only 10,200 BTC face real quantum risk, pushing back on “overblown” estimates👀

#CryptoObservers #CelebratingNewYearOnGateSquare

#CryptoObservers #CelebratingNewYearOnGateSquare

BTC1,69%

- Reward

- like

- Comment

- Repost

- Share

Franklin Templeton and Swift say the future of banking is 24/7 and onchain👀

#CryptoObservers #CelebratingNewYearOnGateSquare

#CryptoObservers #CelebratingNewYearOnGateSquare

- Reward

- like

- Comment

- Repost

- Share

The hash price index, a measure of Bitcoin mining revenue, has fallen to a record low of approximately 3 cents per terahash; consequently, Bitcoin mining difficulty has dropped by 11%, marking its largest negative adjustment since the 2021 China ban👀

#CryptoObservers #CelebratingNewYearOnGateSquare

#CryptoObservers #CelebratingNewYearOnGateSquare

BTC1,69%

- Reward

- like

- Comment

- Repost

- Share

Digital asset investment products saw a marked slowdown in outflows last week, which totalled $187m👀

#CryptoObservers

#CelebratingNewYearOnGateSquare

#CryptoObservers

#CelebratingNewYearOnGateSquare

- Reward

- like

- Comment

- Repost

- Share

Alex Thorn, Head of Firmwide Research, found that venture capitalists deployed $8.5 billion across 425 deals in Q4 last year - an 84% increase in capital invested and a 2.6% rise in deal count compared to Q3👀

#CryptoObservers

#CryptoObservers

- Reward

- like

- Comment

- Repost

- Share

Shiba Inu team warns of address poisoning scam targeting Safe Wallet users👀

#CryptoObservers

#CryptoObservers

SHIB3,57%

- Reward

- like

- Comment

- Repost

- Share

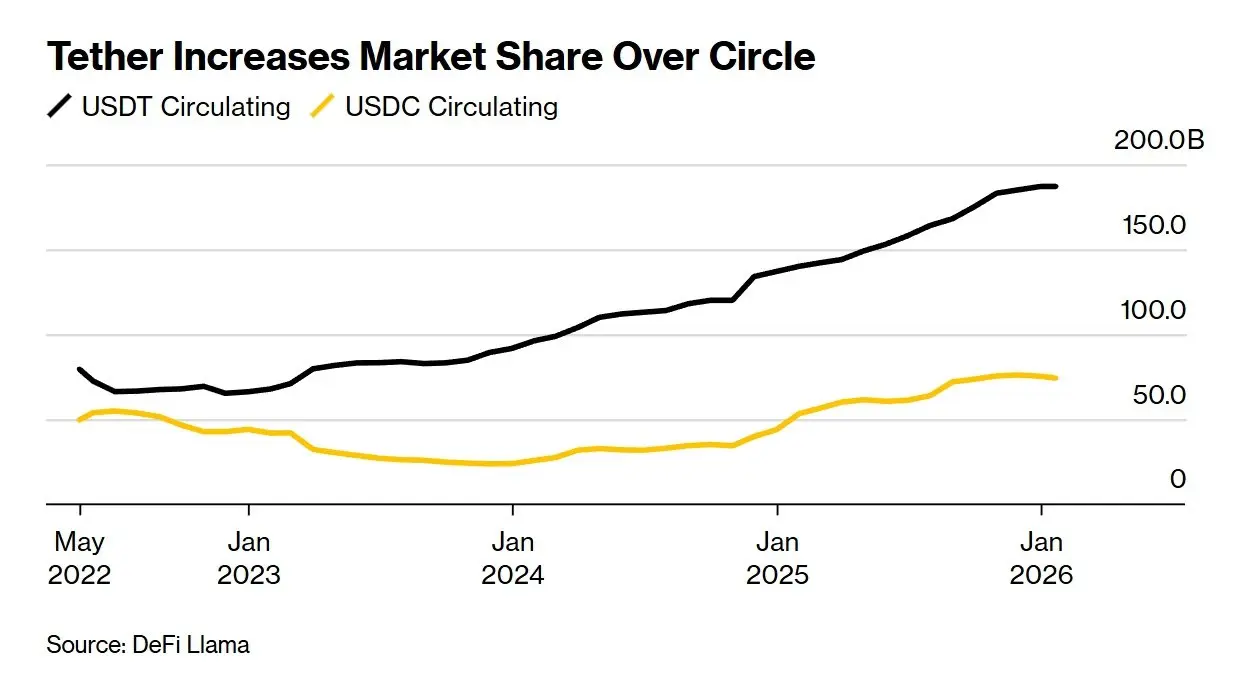

Between May 2022 and January 2026, Tether's USDT nearly tripled its circulating supply to reach a record high of $187 billion, significantly widening its lead over Circle's USDC, which remained relatively stagnant 👀

#CryptoObservers

#CryptoObservers

- Reward

- like

- Comment

- Repost

- Share

Tether announces $100 million strategic equity investment in Anchorage Digital👀

#CryptoObservers

#CryptoObservers

- Reward

- like

- Comment

- Repost

- Share

Wall Street giant CME Group is eyeing its own 'CME Coin', says CEO👀

#CryptoObservers

#CryptoObservers

- Reward

- like

- Comment

- Repost

- Share

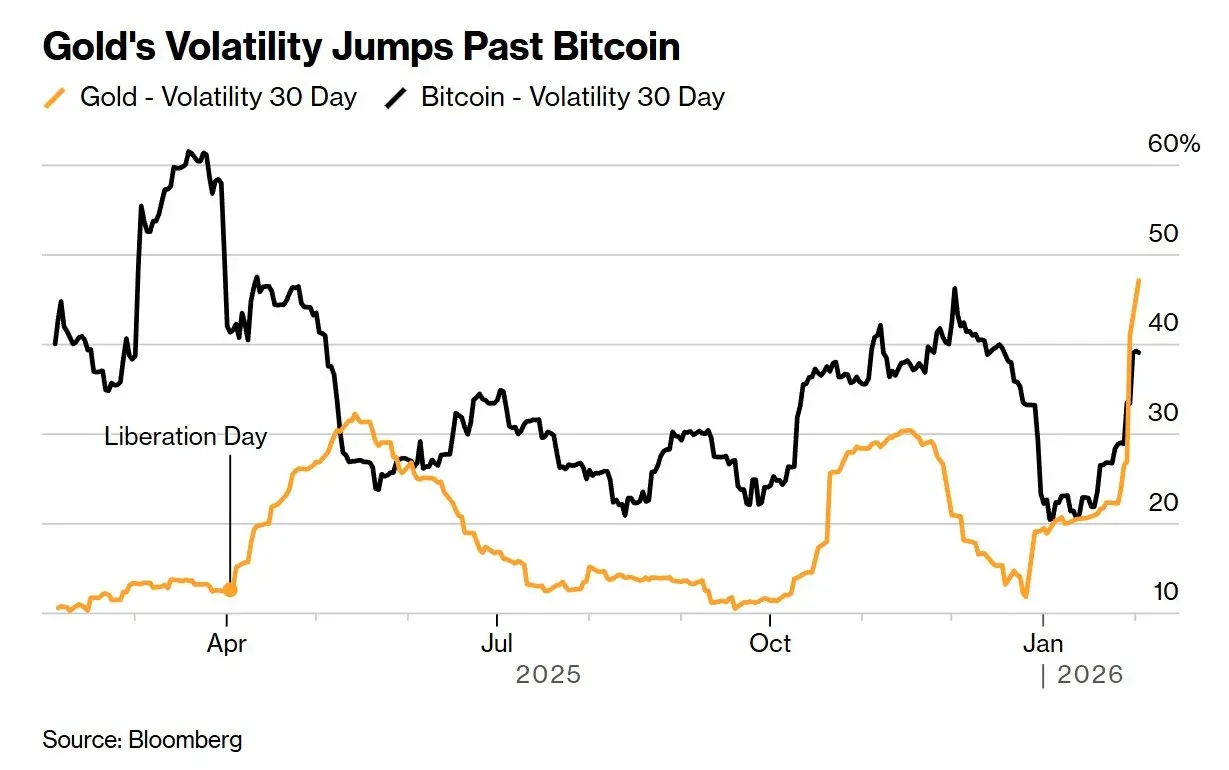

Thirty-day volatility in gold has climbed above 44%, the highest level since the 2008 financial crisis, surpassing the roughly 39% volatility of Bitcoin👀

#CryptoObservers

#CryptoObservers

BTC1,69%

- Reward

- like

- Comment

- Repost

- Share

Digital asset products saw $1.7bn of weekly outflows, flipping YTD flows to a net outflow of $1bn and driving a $73bn fall in AuM since October 2025 highs👀

#CryptoObservers #CryptoMarketPullback

#CryptoObservers #CryptoMarketPullback

- Reward

- like

- Comment

- Repost

- Share

Tether delivers $10b+ profits in 2025, $6.3B in excess reserves, and record $141 billion exposure in U.S. Treasury holdings: Q4 2025 attestation report👀

#CryptoObservers

#CryptoObservers

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More272.63K Popularity

882.86K Popularity

10.64M Popularity

104.62K Popularity

561.97K Popularity

Pin