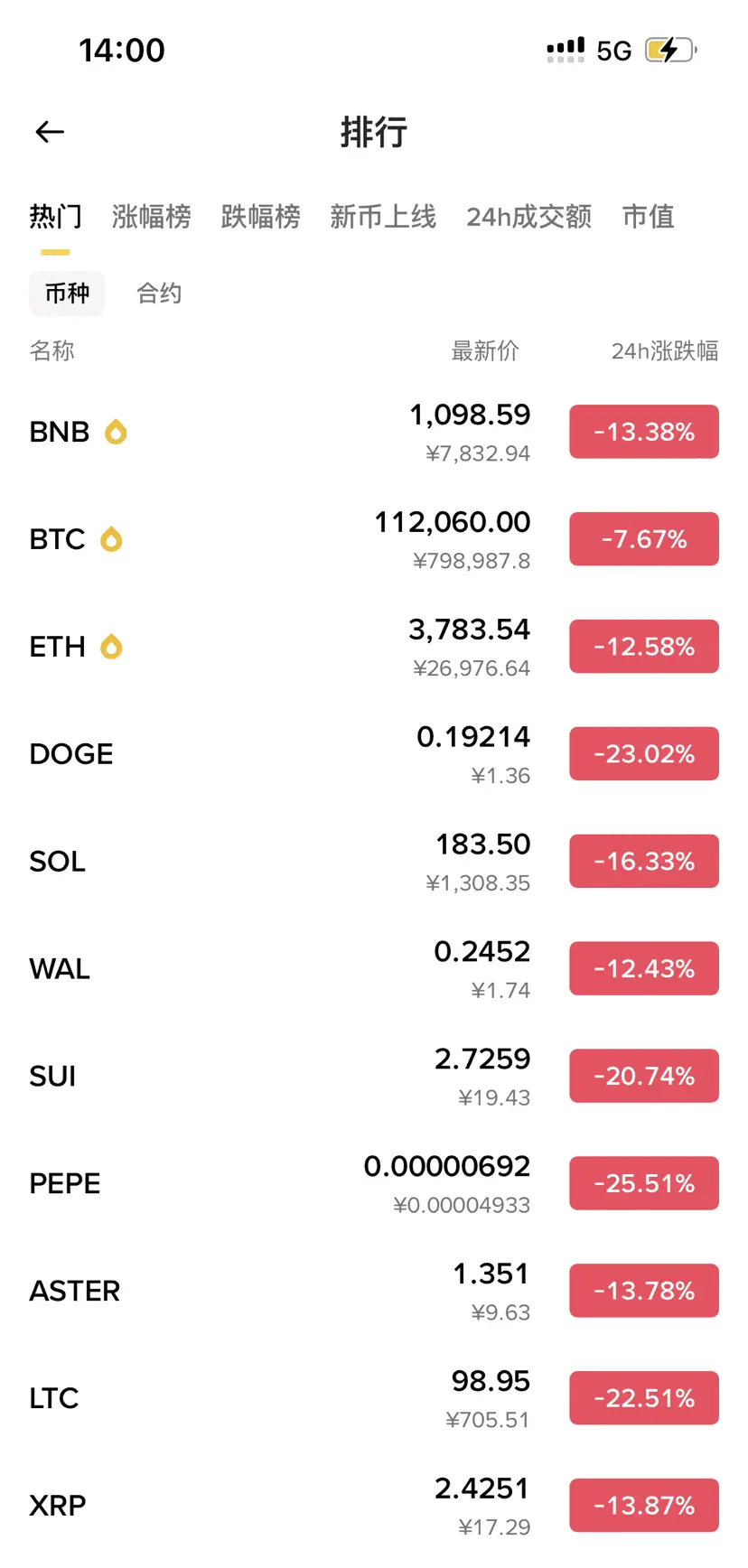

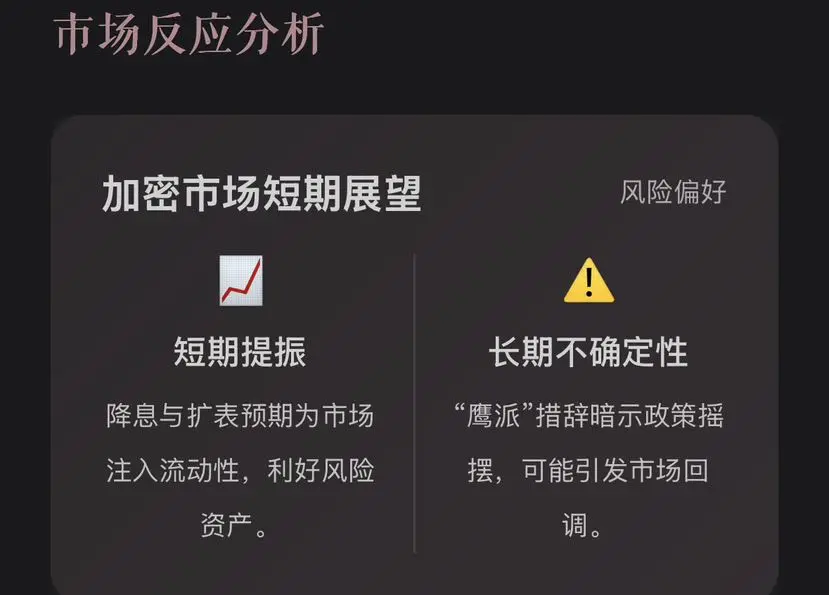

Many people remember March 12, 2020, when the entire market collapsed like a landslide, Bitcoin and Ethereum experienced a big dump, and altcoins were even worse, generally falling by 80%. After two consecutive days of bloodshed, the market was in utter despair. At that time, everyone was stuck at home, afraid to even check the prices.

But I know very well that this is not the end, but a turning point in destiny. The rules of the crypto world have always been this way—every big dump is the beginning of a major trend. At that time, I seized the opportunity and made a profit of 15 times. Looking

View OriginalBut I know very well that this is not the end, but a turning point in destiny. The rules of the crypto world have always been this way—every big dump is the beginning of a major trend. At that time, I seized the opportunity and made a profit of 15 times. Looking