#BTCMarketAnalysis | 18 Dec 2025 📊

💰 Bitcoin Price Update:

Bitcoin is currently trading in a weak and choppy market structure. Buyers are trying to defend key support levels, but strong bullish momentum is still missing.

📉 Market Structure

BTC continues to form lower highs

Price remains in a consolidation phase

Low volatility suggests a major move is approaching

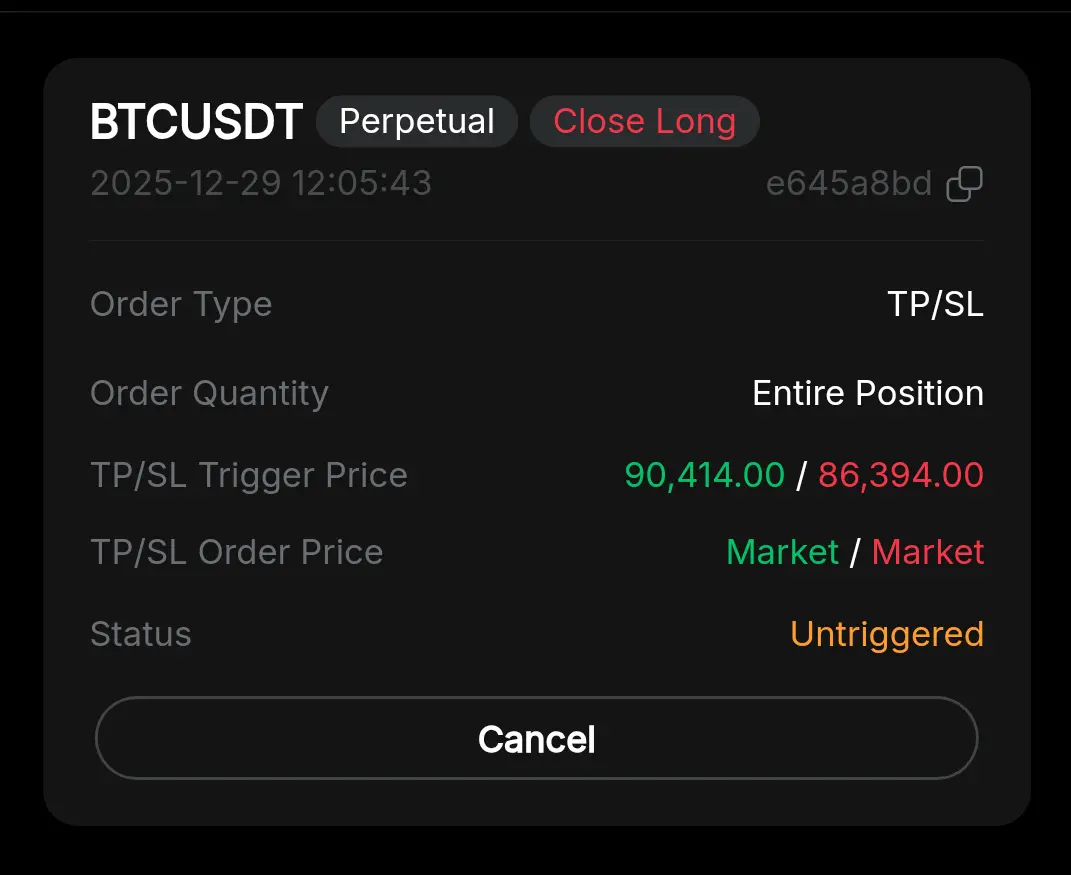

🔑 Key Levels to Watch

🟢 Support Zone:

$85,000 – $86,000 (critical demand area)

A daily close below this zone may increase downside pressure

🔴 Resistance Zone:

$89,500 – $90,500

A confirmed break above $91,000 is needed for bullis

💰 Bitcoin Price Update:

Bitcoin is currently trading in a weak and choppy market structure. Buyers are trying to defend key support levels, but strong bullish momentum is still missing.

📉 Market Structure

BTC continues to form lower highs

Price remains in a consolidation phase

Low volatility suggests a major move is approaching

🔑 Key Levels to Watch

🟢 Support Zone:

$85,000 – $86,000 (critical demand area)

A daily close below this zone may increase downside pressure

🔴 Resistance Zone:

$89,500 – $90,500

A confirmed break above $91,000 is needed for bullis