# WarshLeadsFedChairRace

5.23K

Kevin Warsh’s odds of becoming Fed Chair have risen to 60%, with rates expected to stay unchanged in January. Would his leadership be bullish or bearish for crypto?

EagleEye

Warsh Leads Fed Chair Race Kevin Warsh’s Rising Odds and Potential Implications for Crypto Markets

Kevin Warsh has emerged as the frontrunner in the race for Federal Reserve Chair, with his odds now rising to 60%. Market analysts are closely watching this development, as the Fed Chair plays a crucial role in shaping monetary policy, interest rates, and overall market sentiment. January’s upcoming meeting is expected to leave rates unchanged, but the implications of Warsh’s potential leadership could influence crypto markets in both subtle and significant ways.

Why Warsh’s Leadership Matters

M

Kevin Warsh has emerged as the frontrunner in the race for Federal Reserve Chair, with his odds now rising to 60%. Market analysts are closely watching this development, as the Fed Chair plays a crucial role in shaping monetary policy, interest rates, and overall market sentiment. January’s upcoming meeting is expected to leave rates unchanged, but the implications of Warsh’s potential leadership could influence crypto markets in both subtle and significant ways.

Why Warsh’s Leadership Matters

M

- Reward

- 10

- 7

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊View More

#WarshLeadsFedChairRace

🏛️ The Race for the Fed: Why Kevin Warsh Leading the Pack Matters

The financial corridors of Washington and Wall Street are buzzing with a single name: Kevin Warsh. As the race to lead the Federal Reserve intensifies, Warsh has emerged as the frontrunner to succeed as the next Fed Chair.

This isn't just a change in leadership; it’s a potential shift in the global economic landscape. Here is a deep dive into why this development is grabbing headlines worldwide.

🔍 Who is Kevin Warsh?

A former member of the Federal Reserve Board of Governors and a key advisor during the

🏛️ The Race for the Fed: Why Kevin Warsh Leading the Pack Matters

The financial corridors of Washington and Wall Street are buzzing with a single name: Kevin Warsh. As the race to lead the Federal Reserve intensifies, Warsh has emerged as the frontrunner to succeed as the next Fed Chair.

This isn't just a change in leadership; it’s a potential shift in the global economic landscape. Here is a deep dive into why this development is grabbing headlines worldwide.

🔍 Who is Kevin Warsh?

A former member of the Federal Reserve Board of Governors and a key advisor during the

- Reward

- 7

- 13

- Repost

- Share

MissCrypto :

:

DYOR 🤓View More

#WarshLeadsFedChairRace

🏛️🚀 Would Kevin Warsh’s Leadership Usher in a “Golden Era” for Crypto?

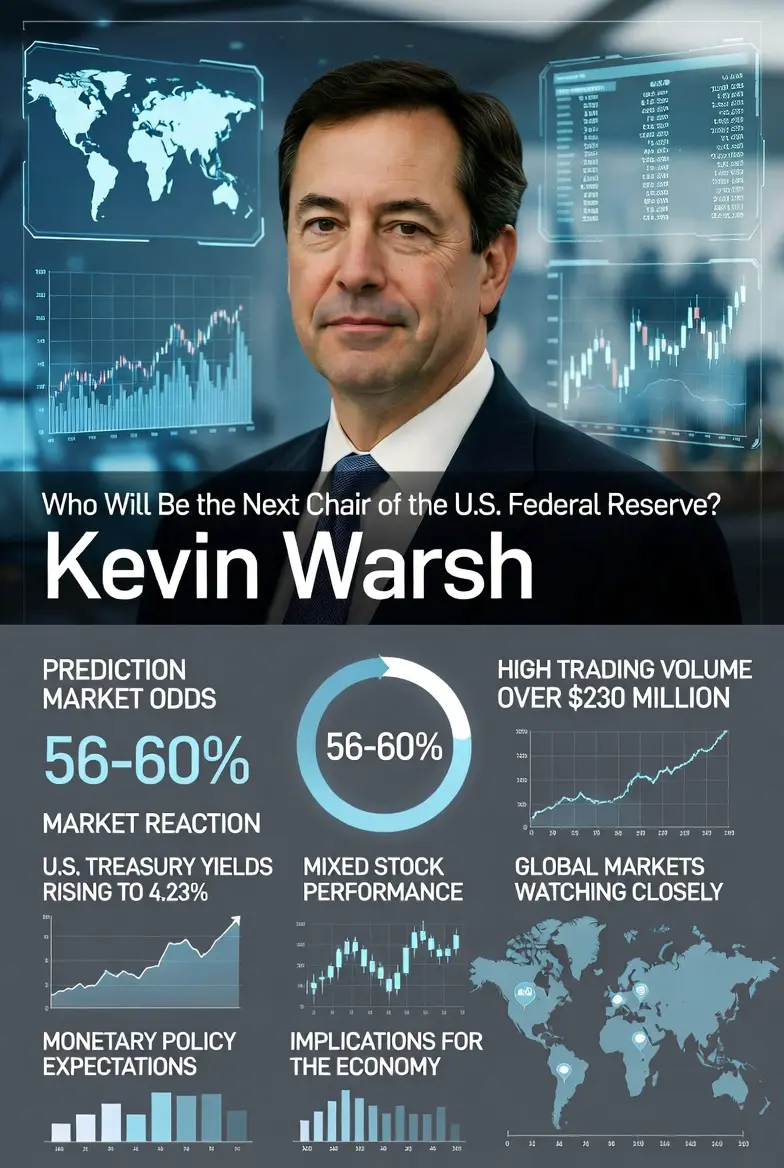

The financial world is buzzing. According to prediction markets like Polymarket and Kalshi, the odds of Kevin Warsh becoming the next Federal Reserve Chair have surged to 60%.

With interest rates expected to remain unchanged in January, the narrative has shifted:

👉 It’s no longer just what the Fed does — it’s who leads the Fed.

Let’s break down what a Kevin Warsh-led Fed could really mean for crypto.

1️⃣ Monetary Policy Outlook: Hawk or Dove? 🦅🕊️

Kevin Warsh is traditionally seen as a “hawk” —

🏛️🚀 Would Kevin Warsh’s Leadership Usher in a “Golden Era” for Crypto?

The financial world is buzzing. According to prediction markets like Polymarket and Kalshi, the odds of Kevin Warsh becoming the next Federal Reserve Chair have surged to 60%.

With interest rates expected to remain unchanged in January, the narrative has shifted:

👉 It’s no longer just what the Fed does — it’s who leads the Fed.

Let’s break down what a Kevin Warsh-led Fed could really mean for crypto.

1️⃣ Monetary Policy Outlook: Hawk or Dove? 🦅🕊️

Kevin Warsh is traditionally seen as a “hawk” —

- Reward

- 3

- 2

- Repost

- Share

NaeteeINDY :

:

HODL Tight 💪View More

#WarshLeadsFedChairRace

🏛️🚀 Would Kevin Warsh’s Leadership Usher in a “Golden Era” for Crypto?

The financial world is buzzing. According to prediction markets like Polymarket and Kalshi, the odds of Kevin Warsh becoming the next Federal Reserve Chair have surged to 60%.

With interest rates expected to remain unchanged in January, the narrative has shifted:

👉 It’s no longer just what the Fed does — it’s who leads the Fed.

Let’s break down what a Kevin Warsh-led Fed could really mean for crypto.

1️⃣ Monetary Policy Outlook: Hawk or Dove? 🦅🕊️

Kevin Warsh is traditionally seen as a “hawk” —

🏛️🚀 Would Kevin Warsh’s Leadership Usher in a “Golden Era” for Crypto?

The financial world is buzzing. According to prediction markets like Polymarket and Kalshi, the odds of Kevin Warsh becoming the next Federal Reserve Chair have surged to 60%.

With interest rates expected to remain unchanged in January, the narrative has shifted:

👉 It’s no longer just what the Fed does — it’s who leads the Fed.

Let’s break down what a Kevin Warsh-led Fed could really mean for crypto.

1️⃣ Monetary Policy Outlook: Hawk or Dove? 🦅🕊️

Kevin Warsh is traditionally seen as a “hawk” —

- Reward

- 6

- 5

- Repost

- Share

Crypto_Buzz_with_Alex :

:

Happy New Year! 🤑View More

#WarshLeadsFedChairRace

There is growing belief in financial markets that Kevin Warsh is now the leading candidate to become the next Chairman of the U.S. Federal Reserve (Fed). This is very important news because the Fed Chair plays a major role in controlling the U.S. economy, and U.S. decisions affect global markets.

The Fed Chair influences:

Interest rates

Inflation

Bond yields

Stock markets

Gold and commodities

The U.S. dollar

Crypto and global liquidity

Why Kevin Warsh Is Leading

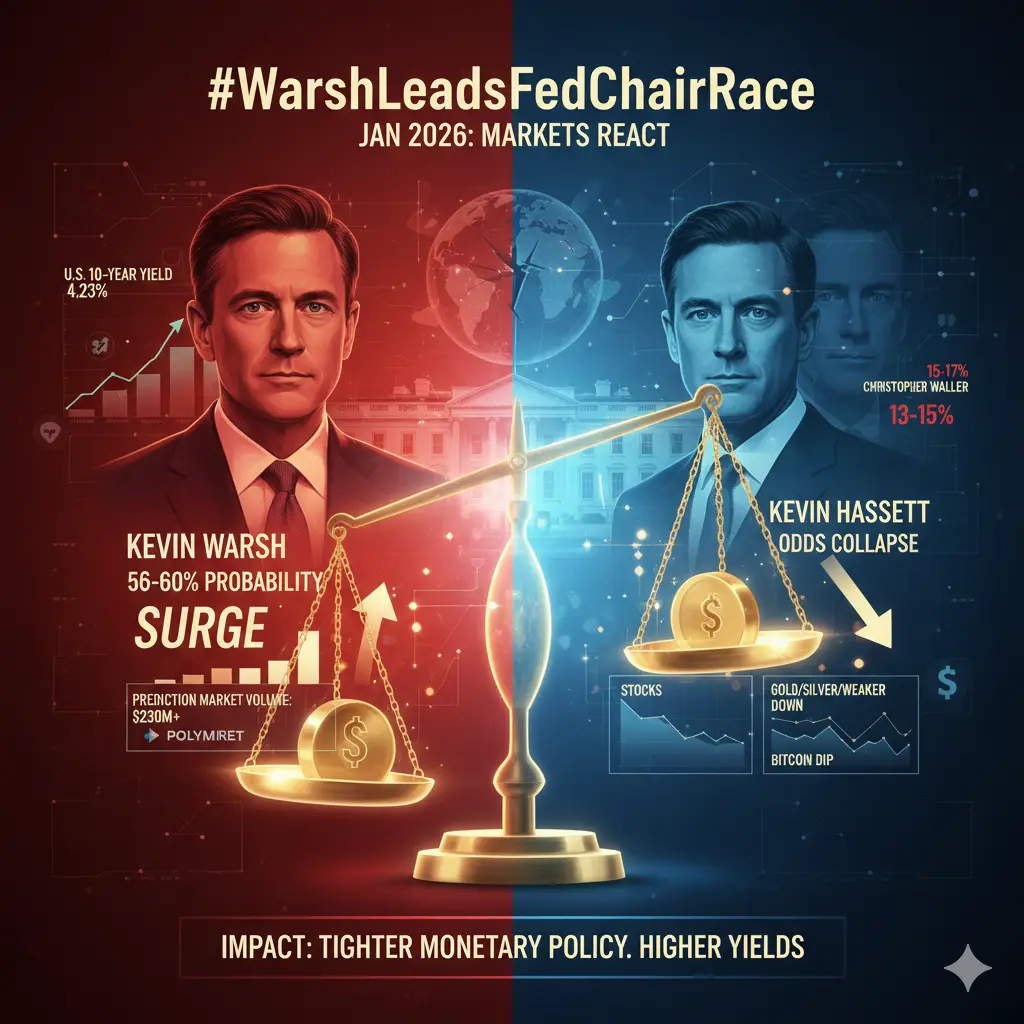

In mid-January 2026, President Donald Trump said that he prefers Kevin Hassett to remain in his current Whit

There is growing belief in financial markets that Kevin Warsh is now the leading candidate to become the next Chairman of the U.S. Federal Reserve (Fed). This is very important news because the Fed Chair plays a major role in controlling the U.S. economy, and U.S. decisions affect global markets.

The Fed Chair influences:

Interest rates

Inflation

Bond yields

Stock markets

Gold and commodities

The U.S. dollar

Crypto and global liquidity

Why Kevin Warsh Is Leading

In mid-January 2026, President Donald Trump said that he prefers Kevin Hassett to remain in his current Whit

BTC-2,3%

- Reward

- 14

- 18

- Repost

- Share

Crypto_Buzz_with_Alex :

:

Happy New Year! 🤑View More

#WarshLeadsFedChairRace

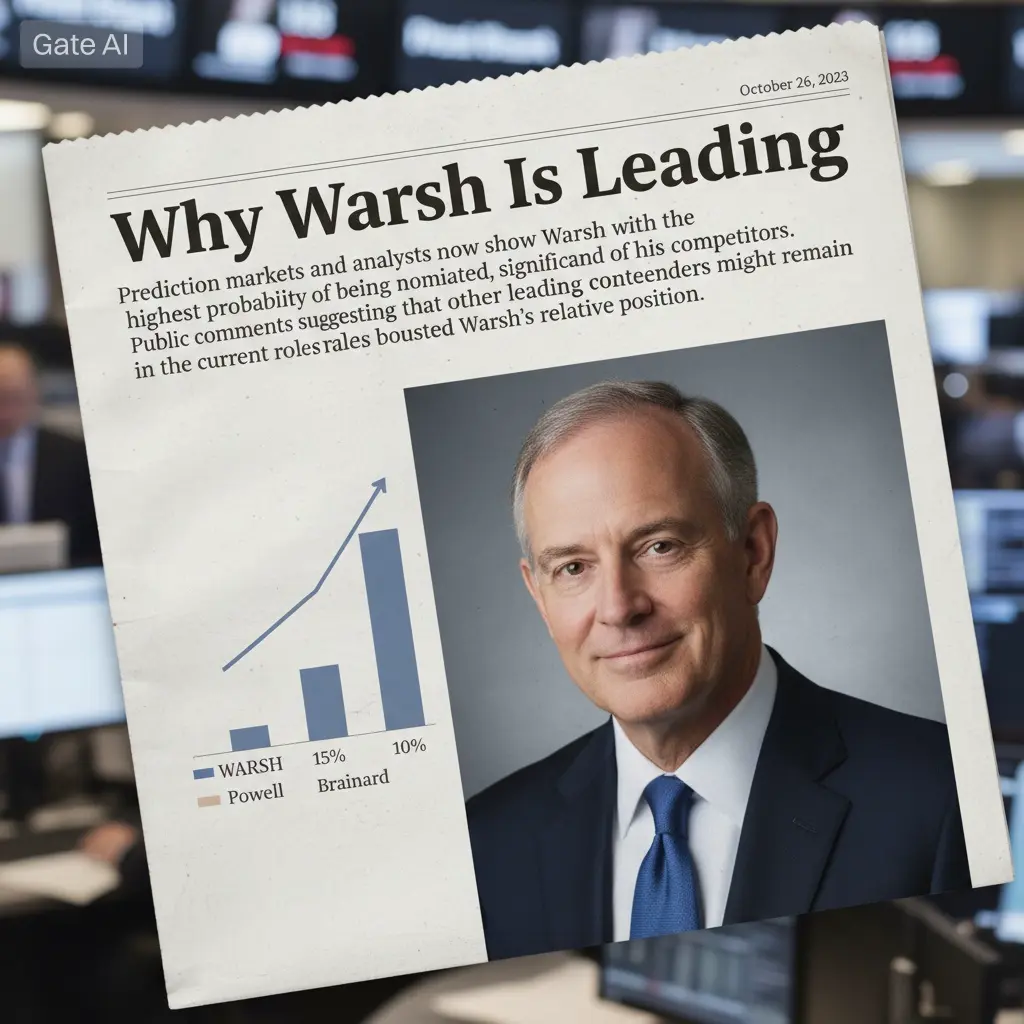

Recently, Kevin Warsh has emerged as the leading candidate to become the next Chair of the U.S. Federal Reserve, taking the front position in the race to replace Jerome Powell, whose term ends in May 2026. This shift is due to political signals and market expectations surrounding the upcoming Fed leadership decision.

1. Why Warsh Is Leading

Prediction markets and analysts now show Warsh with the highest probability of being nominated, significantly ahead of his competitors. Public comments suggesting that other leading contenders might remain in their current roles boo

Recently, Kevin Warsh has emerged as the leading candidate to become the next Chair of the U.S. Federal Reserve, taking the front position in the race to replace Jerome Powell, whose term ends in May 2026. This shift is due to political signals and market expectations surrounding the upcoming Fed leadership decision.

1. Why Warsh Is Leading

Prediction markets and analysts now show Warsh with the highest probability of being nominated, significantly ahead of his competitors. Public comments suggesting that other leading contenders might remain in their current roles boo

- Reward

- 3

- 5

- Repost

- Share

Crypto_Buzz_with_Alex :

:

Happy New Year! 🤑View More

What does it mean for the US dollar, gold, and crypto assets?

If Waller becomes Federal Reserve Chair, the impact will not be limited to US Treasuries and the stock market but will quickly spread to the US dollar, precious metals, and crypto assets.

First is the US dollar. Waller's policy style naturally provides medium-term support for the dollar because:

* Emphasizes inflation control

* More sensitive to monetary discipline

* Reduces long-term depreciation expectations

Next is gold. In the short term, hawkish expectations may cause fluctuations in gold prices, but in the medium to long term,

If Waller becomes Federal Reserve Chair, the impact will not be limited to US Treasuries and the stock market but will quickly spread to the US dollar, precious metals, and crypto assets.

First is the US dollar. Waller's policy style naturally provides medium-term support for the dollar because:

* Emphasizes inflation control

* More sensitive to monetary discipline

* Reduces long-term depreciation expectations

Next is gold. In the short term, hawkish expectations may cause fluctuations in gold prices, but in the medium to long term,

BTC-2,3%

- Reward

- 3

- 2

- Repost

- Share

CoinRelyOnUniversal :

:

Hold on tight, we're about to take off 🛫View More

#WarshLeadsFedChairRace

Market Implications and Policy Expectations

The narrative around the next U.S. Federal Reserve Chair is gaining momentum, and Kevin Warsh emerging as a leading contender is already influencing market expectations. While no official decision has been finalized, the growing perception that Warsh is leading the Fed Chair race matters because monetary policy is as much about credibility, philosophy, and signaling as it is about data. Markets move not only on decisions, but on who they believe will be making those decisions.

Kevin Warsh is widely viewed as a policy hawk wit

Market Implications and Policy Expectations

The narrative around the next U.S. Federal Reserve Chair is gaining momentum, and Kevin Warsh emerging as a leading contender is already influencing market expectations. While no official decision has been finalized, the growing perception that Warsh is leading the Fed Chair race matters because monetary policy is as much about credibility, philosophy, and signaling as it is about data. Markets move not only on decisions, but on who they believe will be making those decisions.

Kevin Warsh is widely viewed as a policy hawk wit

- Reward

- 7

- 8

- Repost

- Share

Crypto_Buzz_with_Alex :

:

Happy New Year! 🤑View More

#WarshLeadsFedChairRace

The conversation around the future of the Federal Reserve is gaining momentum, and the possibility of Kevin Warsh leading the race for Fed Chair is reshaping market expectations. Whenever leadership at the world’s most influential central bank comes into focus, investors across equities, bonds, commodities, and crypto start recalibrating their outlook—because the Fed doesn’t just set policy, it sets the tone for global liquidity.

Warsh is widely viewed as a policy-minded figure with a strong emphasis on credibility, inflation discipline, and the long-term consequences

The conversation around the future of the Federal Reserve is gaining momentum, and the possibility of Kevin Warsh leading the race for Fed Chair is reshaping market expectations. Whenever leadership at the world’s most influential central bank comes into focus, investors across equities, bonds, commodities, and crypto start recalibrating their outlook—because the Fed doesn’t just set policy, it sets the tone for global liquidity.

Warsh is widely viewed as a policy-minded figure with a strong emphasis on credibility, inflation discipline, and the long-term consequences

- Reward

- 5

- 5

- Repost

- Share

HighAmbition :

:

Happy New Year! 🤑View More

How should traders respond to this anticipated change?

In the face of the expectation that "Vosh will become the biggest favorite," the most taboo thing for traders is emotional judgments of black and white. What the market truly needs to do is not to bet on the candidate, but to adjust the strategic structure.

My core response ideas are threefold:

1️⃣ Reduce dependence on policy easing

2️⃣ Increase the weight of fundamentals and cash flow

3️⃣ Accept that volatility may remain higher than in recent years for a long time

Specifically, in terms of operations:

* Do not blindly liquidate due to ha

View OriginalIn the face of the expectation that "Vosh will become the biggest favorite," the most taboo thing for traders is emotional judgments of black and white. What the market truly needs to do is not to bet on the candidate, but to adjust the strategic structure.

My core response ideas are threefold:

1️⃣ Reduce dependence on policy easing

2️⃣ Increase the weight of fundamentals and cash flow

3️⃣ Accept that volatility may remain higher than in recent years for a long time

Specifically, in terms of operations:

* Do not blindly liquidate due to ha

- Reward

- 5

- 4

- Repost

- Share

CoinRelyOnUniversal :

:

Hold on tight, we're about to take off 🛫View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

15.15K Popularity

332.33K Popularity

43.57K Popularity

5.85K Popularity

5.23K Popularity

45.27K Popularity

1.94K Popularity

3.62K Popularity

105.14K Popularity

14.36K Popularity

169.94K Popularity

11.7K Popularity

6.54K Popularity

7.64K Popularity

148.48K Popularity

News

View More1. After launching Alpha, it increased by 154.96%, current price is 0.014903 USDT

45 m

Data: If BTC breaks through $97,499, the total liquidation strength of mainstream CEX short positions will reach $1.654 billion.

2 h

Data: If ETH breaks through $3,369, the total liquidation strength of short positions on mainstream CEXs will reach $1.402 billion.

2 h

Trump Announces 10% EU Tariffs; Hong Kong Group Seeks CARF Rule Changes

2 h

1. After launching Alpha, it increased by 52.18%, current price is 0.008487 USDT

2 h

Pin