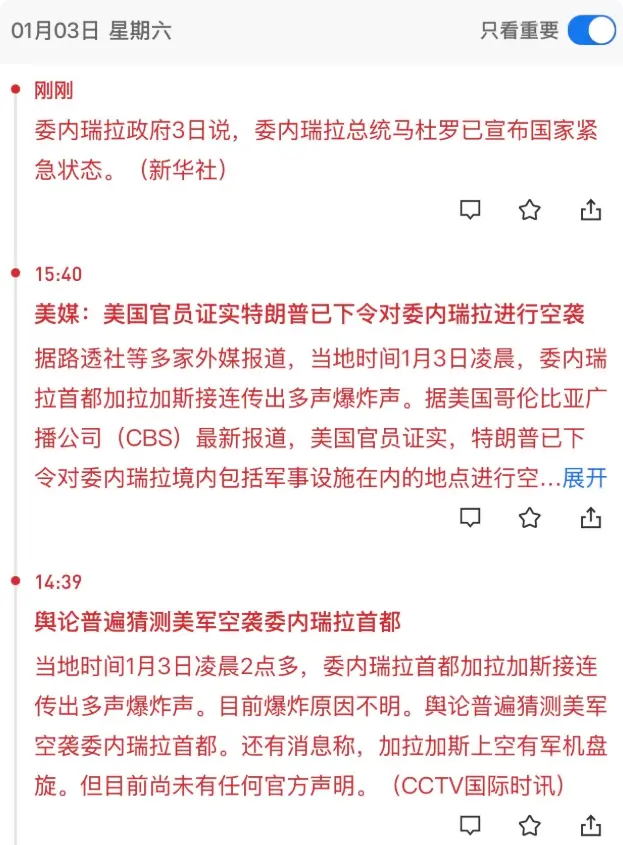

The impact of this matter in Venezuela, in the medium to long term, will be the starting point of a commodities bull market.

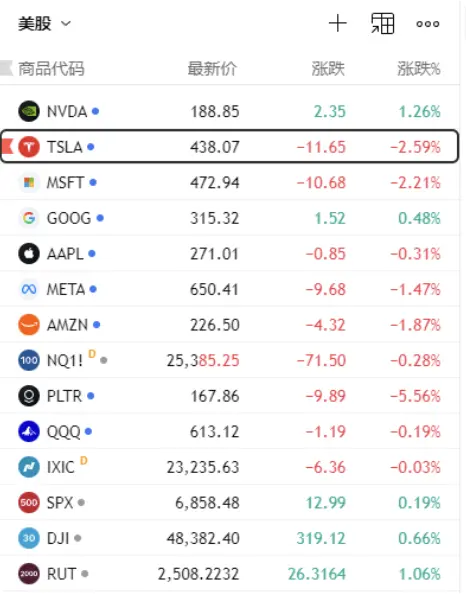

Venezuela's oil, Chile's copper, Argentina's lithium, and Bolivia's silver—these resources will be firmly "controlled" by the United States.

On a deeper level, this is another event accelerating the decoupling of China and the US. At least in terms of energy resources, China and the US will build core resource supply circles that cannot be disturbed by the other.

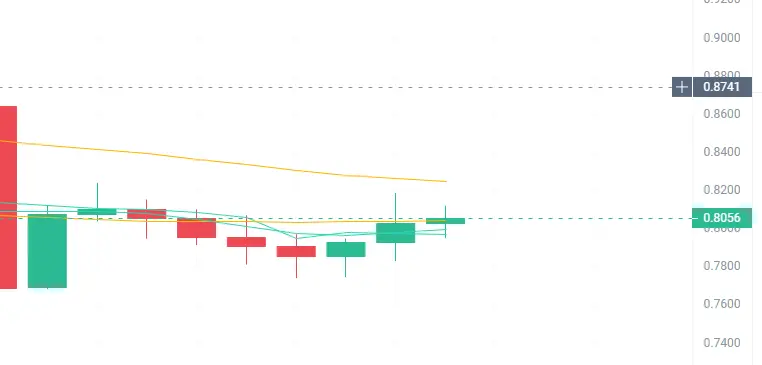

In the future, oil, gold, silver, and industrial metals will each have their own buying cycles......

View OriginalVenezuela's oil, Chile's copper, Argentina's lithium, and Bolivia's silver—these resources will be firmly "controlled" by the United States.

On a deeper level, this is another event accelerating the decoupling of China and the US. At least in terms of energy resources, China and the US will build core resource supply circles that cannot be disturbed by the other.

In the future, oil, gold, silver, and industrial metals will each have their own buying cycles......