AxelAdlerJr

No content yet

AxelAdlerJr

Got 60 seconds? 🧡 Share your feedback

- Reward

- like

- Comment

- Repost

- Share

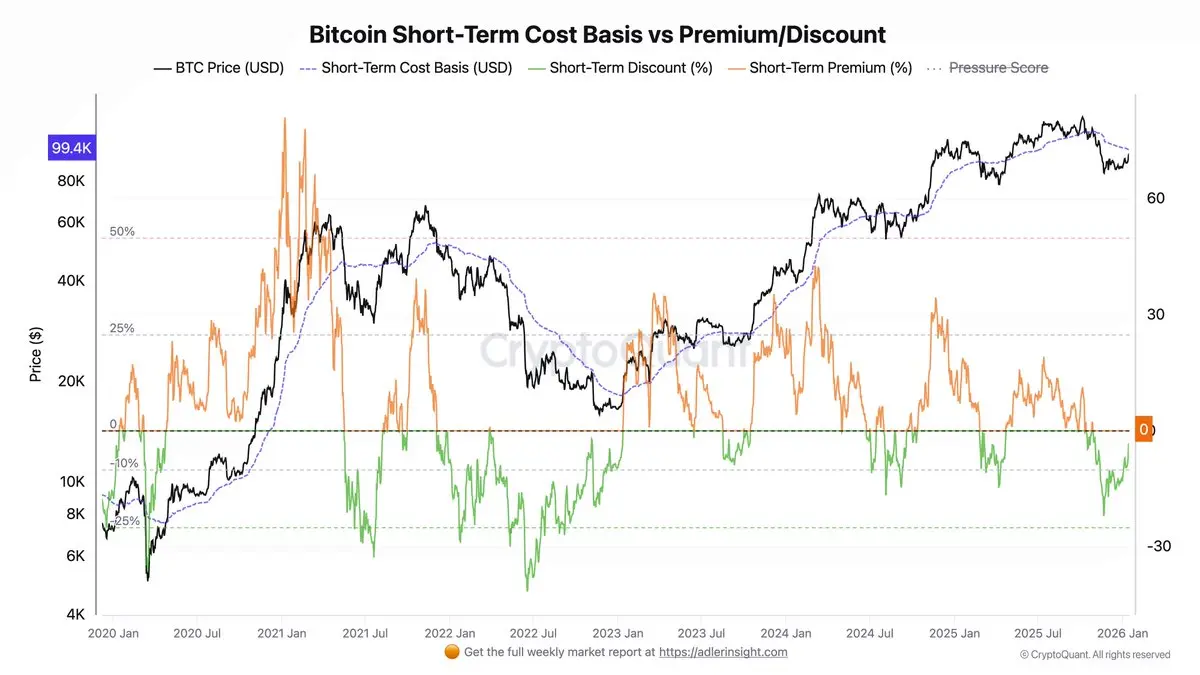

STH selling pressure to exchanges cooled, but the structure remains unchanged.

Full breakdown in yesterday’s brief: 👇

Full breakdown in yesterday’s brief: 👇

- Reward

- like

- Comment

- Repost

- Share

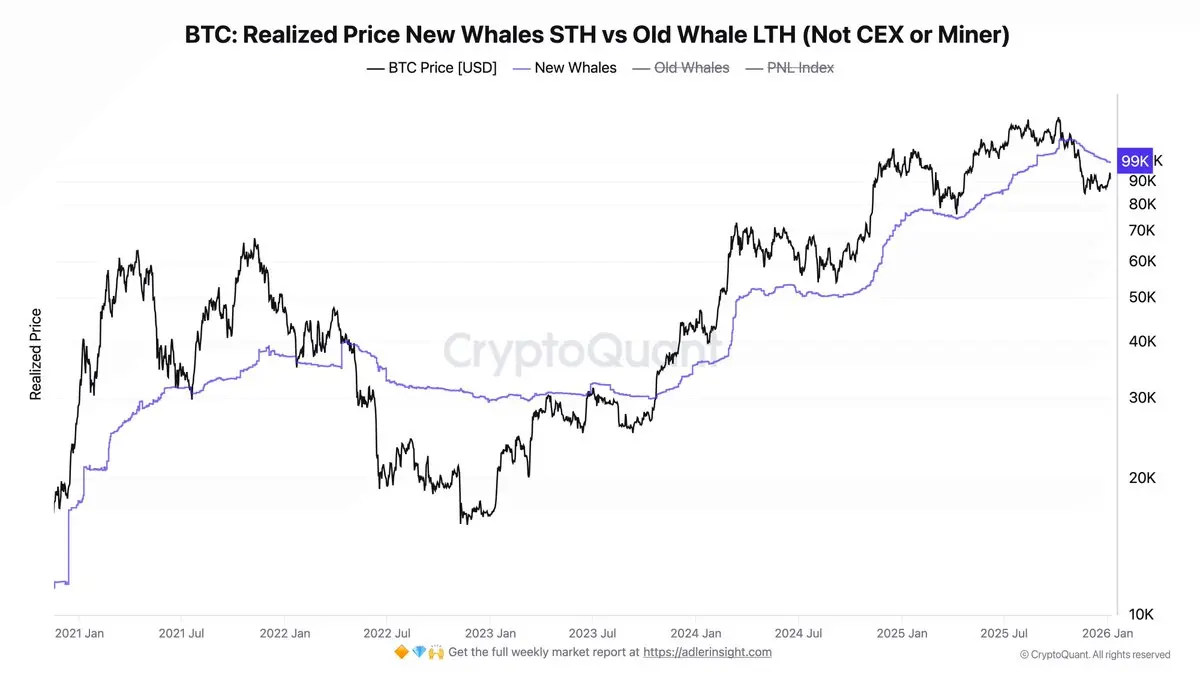

STH discount compressed from -22% to -4% in two months. Price is now testing STH cost basis. 35K BTC in profit hit exchanges yesterday. Profit vs loss: 7.5:1.

New ☕ Adler AM 👇

New ☕ Adler AM 👇

BTC0,25%

- Reward

- like

- Comment

- Repost

- Share

STH vs LTH cost basis - who's underwater right now. % Supply in Profit/Loss, sell pressure from underwater holders.

On-Chain Fundamentals for Humans | Part 4 👇

On-Chain Fundamentals for Humans | Part 4 👇

- Reward

- like

- Comment

- Repost

- Share

Guys, quick update - I’ve upgraded the dashboard to v2.1. Removed outdated models and added new ones.

Please take a look and share your feedback:

Please take a look and share your feedback:

- Reward

- like

- Comment

- Repost

- Share

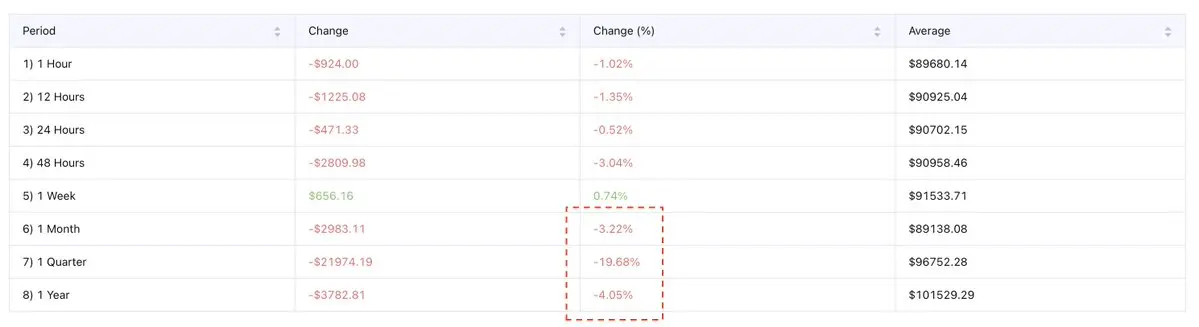

$100K Level to Become a Wall of Resistance

☕️Morning Brief #83 👇

☕️Morning Brief #83 👇

- Reward

- 1

- 1

- Repost

- Share

湘江河畔重相逢 :

:

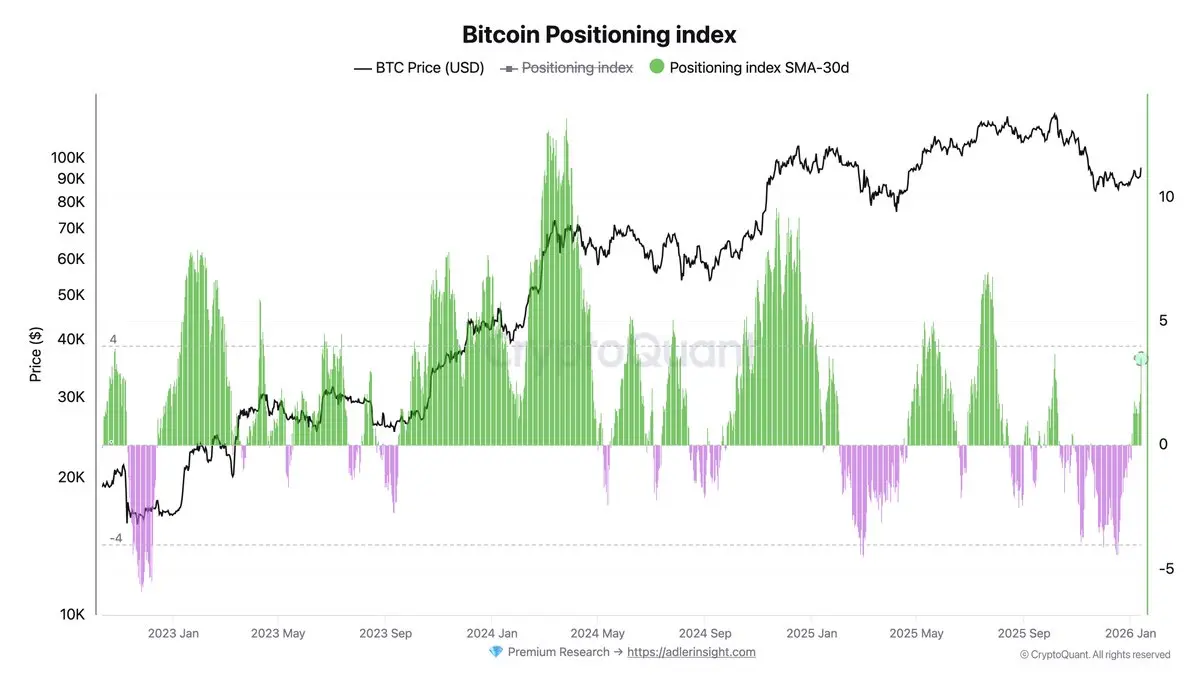

There is hope in washing and rinsing. Let's all make big money together this year and keep on prospering.Futures Bulls Are Back: Positioning Index Above 3 for the First Time Since October

Adler AM ☕️👇

Adler AM ☕️👇

- Reward

- like

- Comment

- Repost

- Share

Realized P/L Momentum Index tracks when realized profit and loss pressure meaningfully shifts.

SQL + full methodology included - 75% historical win rate 👇

SQL + full methodology included - 75% historical win rate 👇

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Bitcoin’s realized volatility has compressed to 23% - a level that statistically rarely persists for long. Historically, such compression regimes tend to end with sharp range expansion.

Realized Volatility 23.6%: Compression Has Reached a Critical Threshold

Morning Brief ☕️👇

Realized Volatility 23.6%: Compression Has Reached a Critical Threshold

Morning Brief ☕️👇

BTC0,25%

- Reward

- like

- Comment

- Repost

- Share

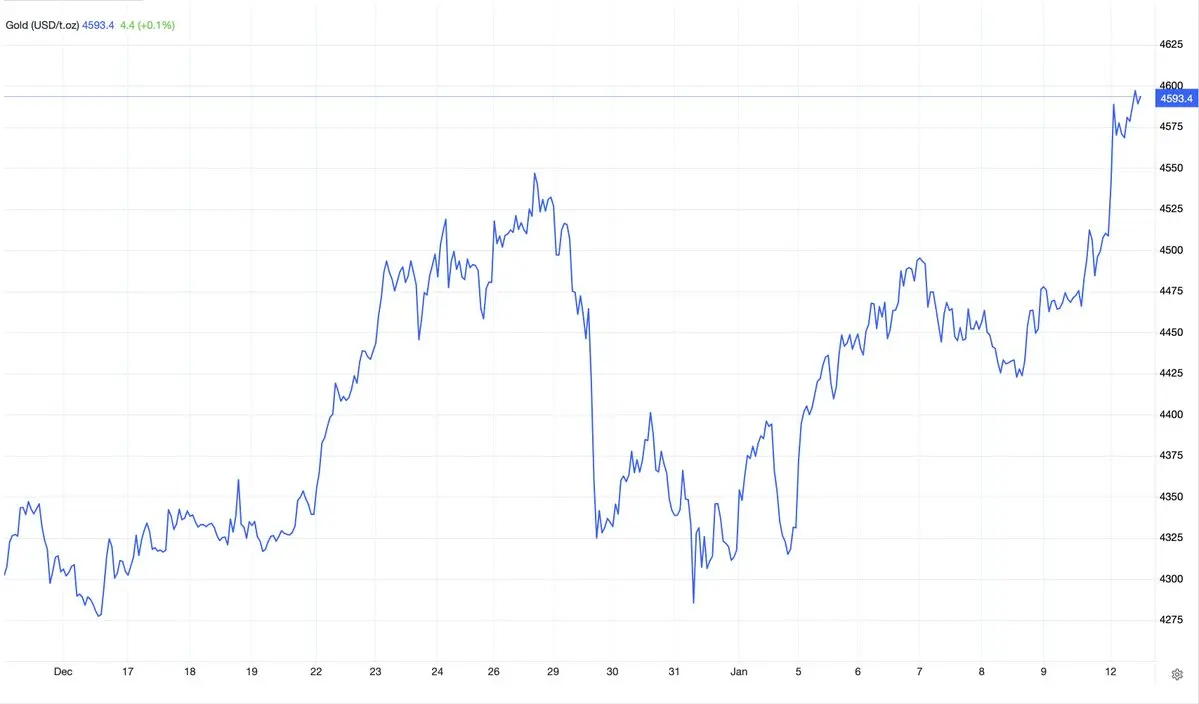

Gold hits a new record above $4,593/oz as demand for safe havens surges. Markets are reacting to concerns over Fed independence, rising geopolitical risks around Iran and growing expectations of US rate cuts. Focus now shifts to this week’s US inflation data.

- Reward

- like

- Comment

- Repost

- Share

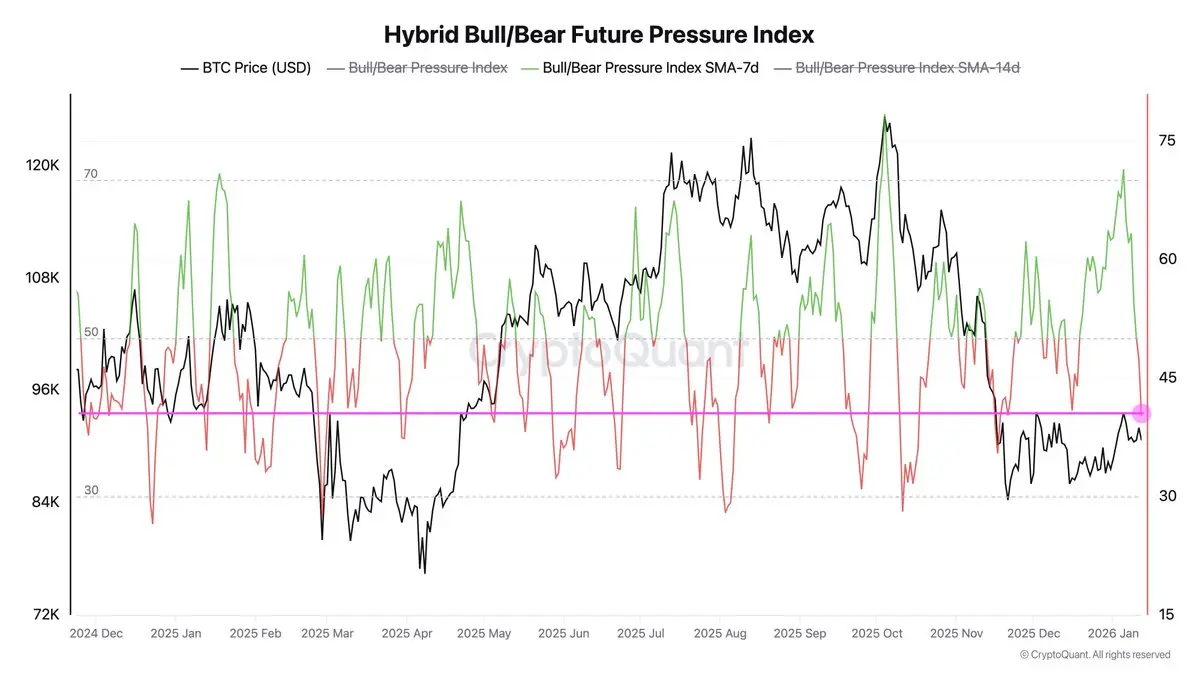

Bears are once again putting pressure on price in the futures market.

- Reward

- like

- Comment

- Repost

- Share

STH SOPR dropped to 0.98 - the lowest since January 1. Short-term holders have been selling at a loss for three months straight, with Z-Score at -0.58 confirming we're in a redistribution phase.

Are we near exhaustion, or is there more pain ahead?

☕️Adler AM 👇

Are we near exhaustion, or is there more pain ahead?

☕️Adler AM 👇

- Reward

- like

- Comment

- Repost

- Share

Weekly ML Snapshot #002

Current Market Regime Score = -3.0 (🟠 Elevated Risk). Elevated Risk indicates an unfavorable environment: more frequent corrections, chop, and false impulses.

Current Market Regime Score = -3.0 (🟠 Elevated Risk). Elevated Risk indicates an unfavorable environment: more frequent corrections, chop, and false impulses.

- Reward

- like

- Comment

- Repost

- Share

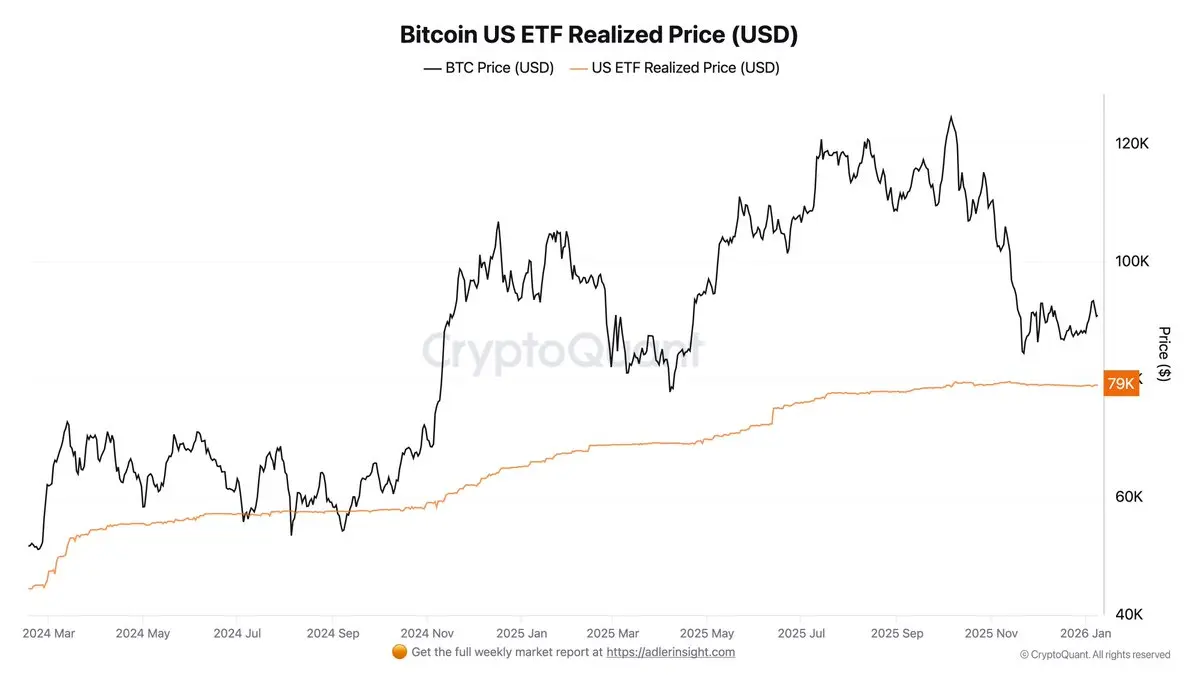

Since October last year, 64,100 BTC have been withdrawn from U.S. spot ETFs. At the same time, the $100K level remains a breakeven zone for large players. Holding a losing position throughout an entire bear cycle is economically irrational - Grayscale proved this in the previous cycle.

So what narrative actually justifies buying at $100K right now?

The full on-chain breakdown is available in this Sunday’s Bitcoin Deep Research, together with the latest Adler Strategy update. 👇

So what narrative actually justifies buying at $100K right now?

The full on-chain breakdown is available in this Sunday’s Bitcoin Deep Research, together with the latest Adler Strategy update. 👇

BTC0,25%

- Reward

- like

- Comment

- Repost

- Share

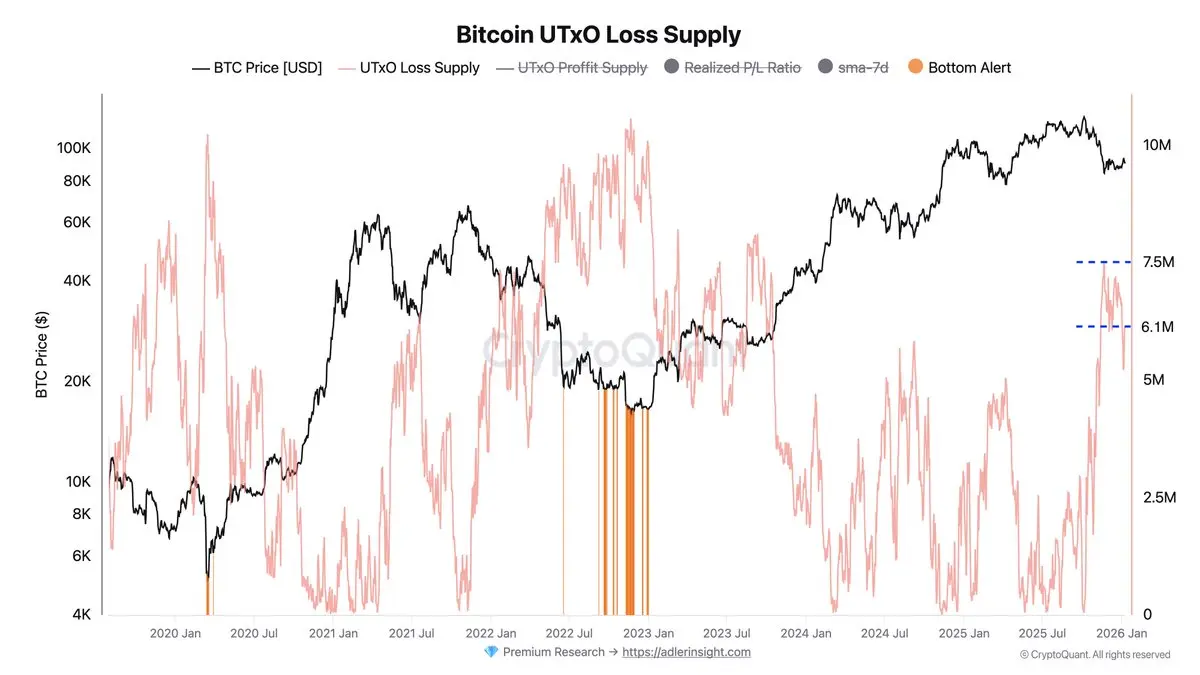

After BTC recovered from $80K to $90K, UTxO Loss Supply declined from 7.5M to 6.1M BTC.

It is important to understand: this does not mean new capital entered the market and bought the bottom. The decline in Loss Supply here is a mark-to-market effect, not the result of on-chain activity. Each UTxO has a creation price.

When the market price rises above that level, the UTxO is automatically reclassified from Loss to Profit - without a single on-chain transaction.

In other words, ~1.4M BTC simply moved out of loss on paper due to the price increase.

It is important to understand: this does not mean new capital entered the market and bought the bottom. The decline in Loss Supply here is a mark-to-market effect, not the result of on-chain activity. Each UTxO has a creation price.

When the market price rises above that level, the UTxO is automatically reclassified from Loss to Profit - without a single on-chain transaction.

In other words, ~1.4M BTC simply moved out of loss on paper due to the price increase.

BTC0,25%

- Reward

- 1

- Comment

- Repost

- Share

New whales have an entry price around $99K. If price reaches that level, they are likely to dump the market to exit at breakeven. Reminder: these are whales, not retail.

- Reward

- like

- Comment

- Repost

- Share

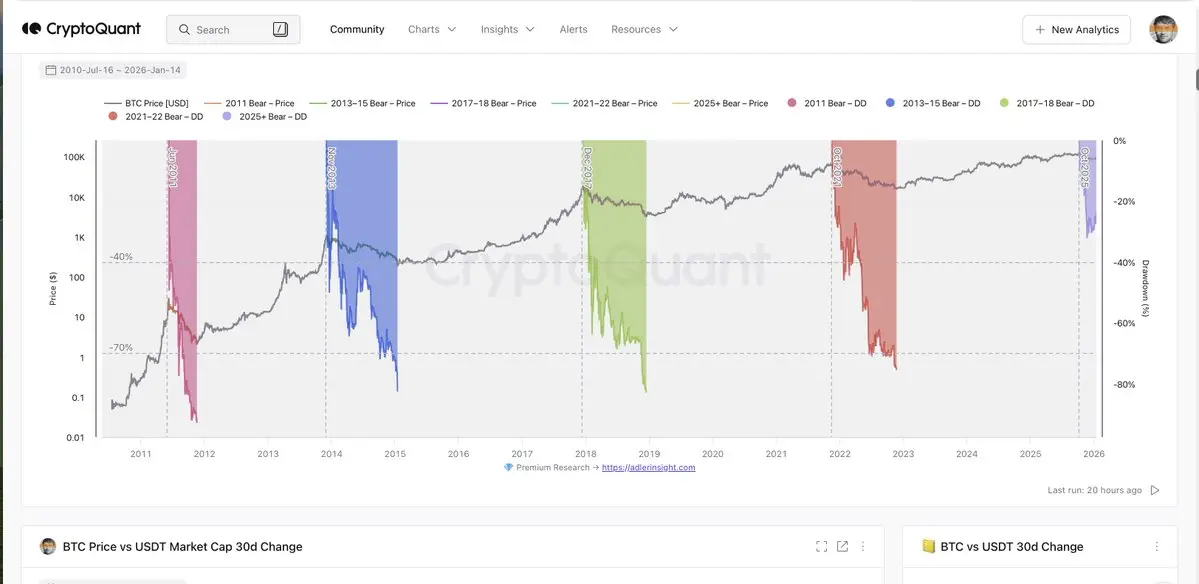

Since the start of the ETF era, drawdowns have been noticeably shallower.

- Reward

- like

- Comment

- Repost

- Share

At the $79K level, things will get heated - a real stress test for diamond hands.

- Reward

- like

- Comment

- Repost

- Share