CryptoSat

No content yet

Pin

CryptoSat

#TRADING STRATEGY ✍️

MARGIN MODE ✅

Using CROSS MARGIN

Leverage Capital per trade(not

per entry)

1x to 10x Upto 8%

11x to 25x Upto 5%

26x to 50x Upto 3%

Morethan 51x Upto 2%

⚠️ Hold 2 to 3 trades , when you're using cross margin and maintain risk ratio less than 5%

Using ISOLATED MARGIN

😀Use leverage 5x to 10x only and invest 5 to 8% funds

ENTRY STRATEGY ✅

Take 2 to 3 entries ( DCA STRATEGY )

RESTRICTING TAKING ENTRIES ✅

Existing users

If you took the trade at entry 1 then it achieved tp2

MARGIN MODE ✅

Using CROSS MARGIN

Leverage Capital per trade(not

per entry)

1x to 10x Upto 8%

11x to 25x Upto 5%

26x to 50x Upto 3%

Morethan 51x Upto 2%

⚠️ Hold 2 to 3 trades , when you're using cross margin and maintain risk ratio less than 5%

Using ISOLATED MARGIN

😀Use leverage 5x to 10x only and invest 5 to 8% funds

ENTRY STRATEGY ✅

Take 2 to 3 entries ( DCA STRATEGY )

RESTRICTING TAKING ENTRIES ✅

Existing users

If you took the trade at entry 1 then it achieved tp2

- Reward

- 3

- 1

- Repost

- Share

Ryakpanda :

:

👍🏻👍🏻👍🏻🇯🇵 Japan Looks Set to Break Its 11-Month Rate Pause — This Week Could Be Historic

All eyes are on the Bank of Japan’s policy meeting on December 18–19, 2025 — when markets are pricing in a strong chance of the first rate hike since January. Most economists expect the BOJ to lift its policy rate from 0.50% to 0.75% at that meeting, potentially marking the start of a broader tightening cycle.

These expectations aren’t just talk — surveys show around 90% of analysts now see a December hike as likely, and many think rates could climb to 1.0% or higher by late 2026 if inflation and wage trends

All eyes are on the Bank of Japan’s policy meeting on December 18–19, 2025 — when markets are pricing in a strong chance of the first rate hike since January. Most economists expect the BOJ to lift its policy rate from 0.50% to 0.75% at that meeting, potentially marking the start of a broader tightening cycle.

These expectations aren’t just talk — surveys show around 90% of analysts now see a December hike as likely, and many think rates could climb to 1.0% or higher by late 2026 if inflation and wage trends

- Reward

- like

- Comment

- Repost

- Share

🇺🇸Blue States Just Took Trump to Court Over a $100,000 H-1B Visa Fee

California AG Rob Bonta, backed by 19 other states, has launched a major lawsuit against the Trump administration after it moved to hike H-1B petition fees to $100,000 — a move critics say goes far beyond what Congress ever authorized. Bonta framed it bluntly: “No presidential administration can rewrite immigration law.”

Silicon Valley rely heavily on high-skilled foreign talent, but Bonta argues the impact runs deeper: physicians, researchers, teachers, nurses, and public-sector workers could all be harder to hire — worse

California AG Rob Bonta, backed by 19 other states, has launched a major lawsuit against the Trump administration after it moved to hike H-1B petition fees to $100,000 — a move critics say goes far beyond what Congress ever authorized. Bonta framed it bluntly: “No presidential administration can rewrite immigration law.”

Silicon Valley rely heavily on high-skilled foreign talent, but Bonta argues the impact runs deeper: physicians, researchers, teachers, nurses, and public-sector workers could all be harder to hire — worse

- Reward

- like

- Comment

- Repost

- Share

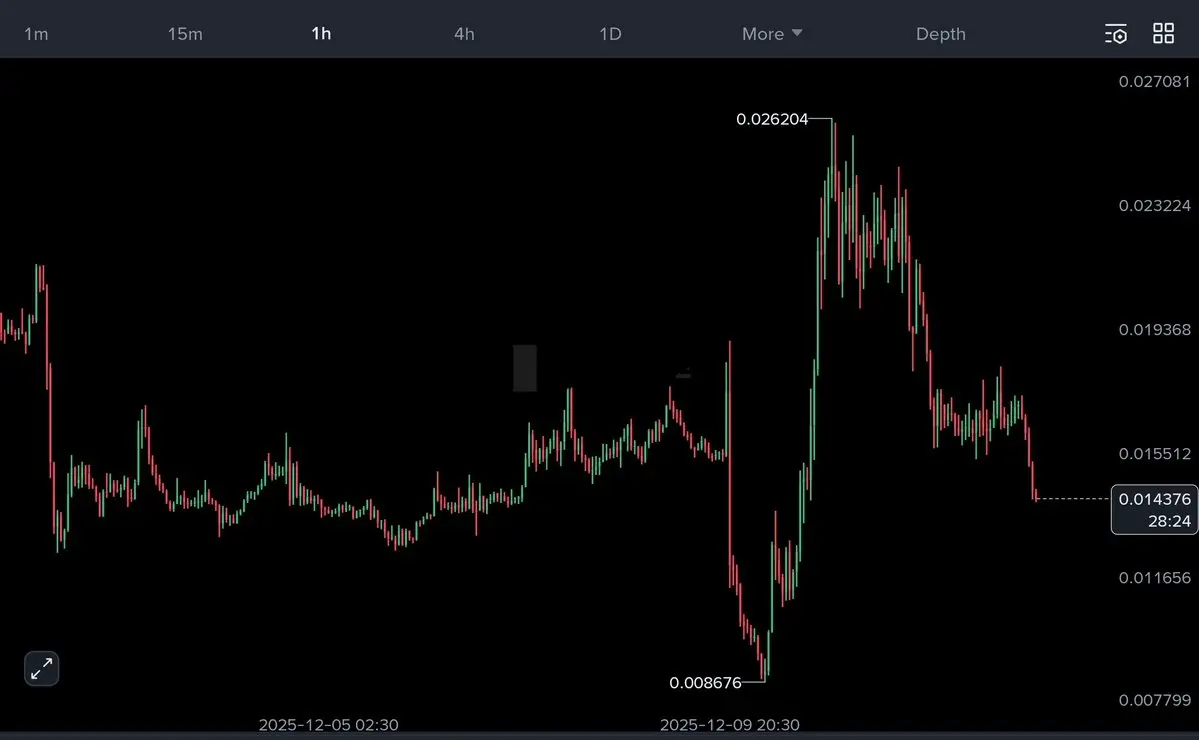

$TRUTH has officially lost its key 15,600 horizontal support, and the chart is now showing clear downside pressure.

This breakdown opens the door for a deeper slide, especially with momentum already shifting heavily to the sellers’ side. Once a level like this cracks, price usually seeks the next liquidity pockets below — and that’s exactly what we’re seeing on the 1h structure.

The smarter play here is a controlled short position, entering between 14,800 – 15,500, with mandatory DCA to balance the position. A clean stoploss at 15,700 keeps the setup disciplined and protects against sudden rec

This breakdown opens the door for a deeper slide, especially with momentum already shifting heavily to the sellers’ side. Once a level like this cracks, price usually seeks the next liquidity pockets below — and that’s exactly what we’re seeing on the 1h structure.

The smarter play here is a controlled short position, entering between 14,800 – 15,500, with mandatory DCA to balance the position. A clean stoploss at 15,700 keeps the setup disciplined and protects against sudden rec

- Reward

- like

- Comment

- Repost

- Share

$ZEC hit 476, just shy of our 480 target!

Structure remains bullish, momentum is intact, and the chart continues to hint at that $500 extension we’ve been eyeing.

If anyone missed the initial entries, there’s still opportunity — but the best re-entry zone sits around 460–450, where previous support and buyer reaction have been consistent. A pullback into that range with stabilizing volume would offer a cleaner, safer long setup toward the next upside levels.

Trend is healthy, higher targets remain open, and the move hasn’t finished its story yet.

$ZEC

Structure remains bullish, momentum is intact, and the chart continues to hint at that $500 extension we’ve been eyeing.

If anyone missed the initial entries, there’s still opportunity — but the best re-entry zone sits around 460–450, where previous support and buyer reaction have been consistent. A pullback into that range with stabilizing volume would offer a cleaner, safer long setup toward the next upside levels.

Trend is healthy, higher targets remain open, and the move hasn’t finished its story yet.

$ZEC

ZEC-2.02%

Original content no longer visible

- Reward

- like

- Comment

- Repost

- Share

$JUV is setting up a clean long opportunity as it continues to respect the ascending trendline.

Each dip into this support has been bought aggressively, and today’s reaction shows the same story — trendline strength plus fresh momentum stepping in right on cue. This is the kind of structure where early entries pay off before the next push.

A good entry sits at 0.775 and 0.760, with a disciplined stoploss at 0.740 to keep the trade clean.

If the trend continues to hold, upside targets open smoothly toward 0.784 → 0.796 → 0.810 → 0.825 → 0.860, all aligning with previous intraday reaction zones.

Each dip into this support has been bought aggressively, and today’s reaction shows the same story — trendline strength plus fresh momentum stepping in right on cue. This is the kind of structure where early entries pay off before the next push.

A good entry sits at 0.775 and 0.760, with a disciplined stoploss at 0.740 to keep the trade clean.

If the trend continues to hold, upside targets open smoothly toward 0.784 → 0.796 → 0.810 → 0.825 → 0.860, all aligning with previous intraday reaction zones.

JUV42.38%

- Reward

- like

- Comment

- Repost

- Share

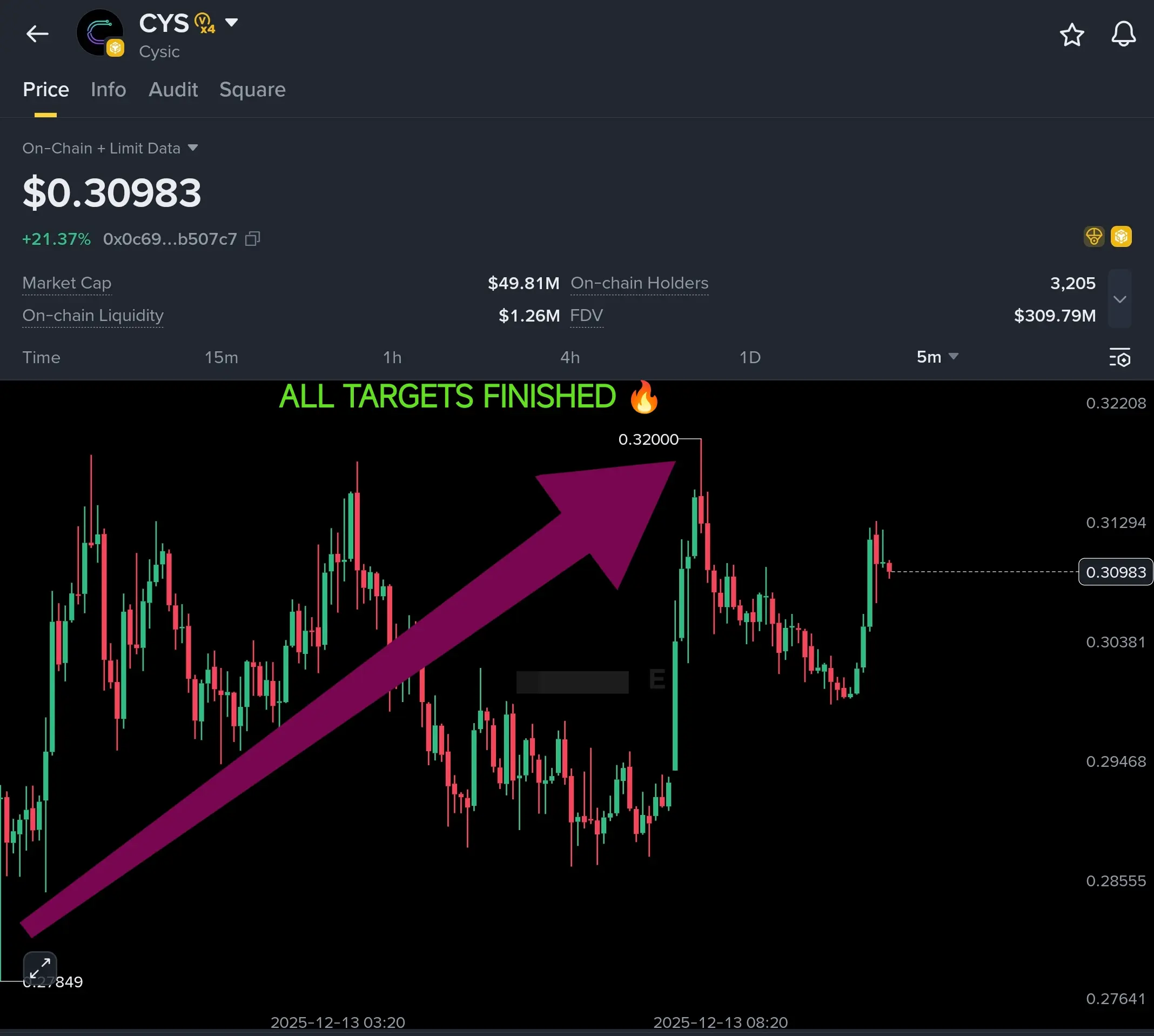

$CYS delivered all targets flawlessly, and I hope every one of you stacked profits on this beautiful breakout. The move tapped 0.3200 before cooling off, and now price is reacting to the minor resistance band at 0.313–0.318 — nothing unusual after a strong rally.

This zone is the key. If buyers step in with strong volume and we see a clean breakout above 0.318, the chart opens up instantly toward the next expansion levels: 0.35 → 0.40. Momentum is still healthy, but confirmation is everything at this stage.

On the downside, immediate support sits at 0.30, with a secondary support zone at 0.

This zone is the key. If buyers step in with strong volume and we see a clean breakout above 0.318, the chart opens up instantly toward the next expansion levels: 0.35 → 0.40. Momentum is still healthy, but confirmation is everything at this stage.

On the downside, immediate support sits at 0.30, with a secondary support zone at 0.

CYS-3.53%

CryptoSat

- Reward

- 2

- Comment

- Repost

- Share

$AXL hit its 4th target just like we thought! Once it lost steam at 0.1440, things really picked up speed towards 0.1332.

This entire sequence has followed the structure perfectly: weakening at resistance, momentum shift, and clean continuation into the next downside target. At this stage, anyone riding the trade should already be in deep profit, with stoploss secured at entry or better.

This entire sequence has followed the structure perfectly: weakening at resistance, momentum shift, and clean continuation into the next downside target. At this stage, anyone riding the trade should already be in deep profit, with stoploss secured at entry or better.

Original content no longer visible

- Reward

- 1

- Comment

- Repost

- Share

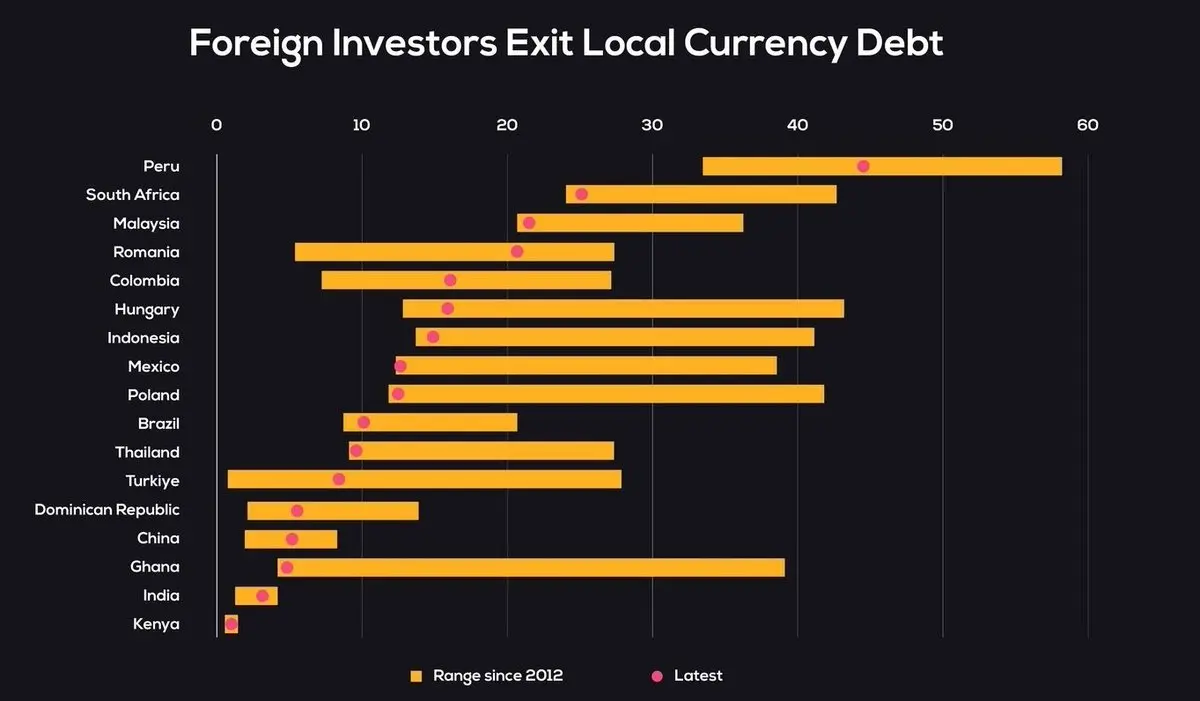

Foreign Investors Are Quietly Exiting Emerging-Market Debt… and the Ripple Effect Is Getting Loud 🌍

The latest data shows a clear trend: foreign investors are pulling capital out of local-currency bonds across emerging markets. From Peru and South Africa all the way to India and Kenya, the “latest” exposure (pink dots) is sitting near the bottom of its decade-long range — or even breaking new lows. And when global money steps back, someone has to step in. Right now, that burden is falling on local buyers, who are being forced to absorb the supply.

This shift matters because it amplifies vulne

The latest data shows a clear trend: foreign investors are pulling capital out of local-currency bonds across emerging markets. From Peru and South Africa all the way to India and Kenya, the “latest” exposure (pink dots) is sitting near the bottom of its decade-long range — or even breaking new lows. And when global money steps back, someone has to step in. Right now, that burden is falling on local buyers, who are being forced to absorb the supply.

This shift matters because it amplifies vulne

- Reward

- 2

- Comment

- Repost

- Share

Vanguard Throws Shade at BITCOIN… but Also Admits Its Hidden Power 👀

John Ameriks — Global Head of Quantitative Equity at Vanguard — just compared #Bitcoin to collectible toys, calling it a purely speculative asset. Harsh words from one of TradFi’s biggest players… but here’s where it gets interesting.

Even while criticizing it, Ameriks couldn’t ignore the truth: Bitcoin shines when fiat currencies don’t.

When things get crazy with inflation, politics, or money systems, #BTC isn't just a game – it's like, essential. It's a global, borderless, censorship-proof way to store value that actually

John Ameriks — Global Head of Quantitative Equity at Vanguard — just compared #Bitcoin to collectible toys, calling it a purely speculative asset. Harsh words from one of TradFi’s biggest players… but here’s where it gets interesting.

Even while criticizing it, Ameriks couldn’t ignore the truth: Bitcoin shines when fiat currencies don’t.

When things get crazy with inflation, politics, or money systems, #BTC isn't just a game – it's like, essential. It's a global, borderless, censorship-proof way to store value that actually

BTC-1.94%

- Reward

- 2

- Comment

- Repost

- Share

🇺🇸 Over 50% of adult Americans indicate that inflation is exceeding their income. - Yahoo Finance.

- Reward

- 2

- Comment

- Repost

- Share

$BTC just tapped the 89.8k support once again — the same level that has saved the structure multiple times over the past weeks.

This line has acted like a springboard every time price dipped into it, and today’s touch shows buyers trying to defend it again. As long as #BTC holds above this zone, the market can still stabilize and attempt another recovery push.

But if 89.8k fails, the chart has a clear air pocket below. #Bitcoin will naturally drift toward 87k–88k, where the next liquidity cluster sits. And if the selling pressure deepens, the major support at 85k becomes the ultimate landing z

This line has acted like a springboard every time price dipped into it, and today’s touch shows buyers trying to defend it again. As long as #BTC holds above this zone, the market can still stabilize and attempt another recovery push.

But if 89.8k fails, the chart has a clear air pocket below. #Bitcoin will naturally drift toward 87k–88k, where the next liquidity cluster sits. And if the selling pressure deepens, the major support at 85k becomes the ultimate landing z

BTC-1.94%

- Reward

- 2

- Comment

- Repost

- Share

🇺🇸 Larry Fink Just Fired a Warning Shot at the U.S. Crypto Scene

When the BlackRock CEO himself says the U.S. is moving too slow on crypto adoption… that’s not casual commentary — that’s a wake-up call. The world is accelerating into tokenization, digital assets, and real-time settlement while the biggest financial powerhouse is still tip-toeing around innovation. And Fink isn’t the type to make noise for nothing.

This is the same man who pushed $BTC ETFs into the mainstream. The same man who turned Wall Street’s skepticism into curiosity — and now urgency. When he says the U.S. needs to sp

When the BlackRock CEO himself says the U.S. is moving too slow on crypto adoption… that’s not casual commentary — that’s a wake-up call. The world is accelerating into tokenization, digital assets, and real-time settlement while the biggest financial powerhouse is still tip-toeing around innovation. And Fink isn’t the type to make noise for nothing.

This is the same man who pushed $BTC ETFs into the mainstream. The same man who turned Wall Street’s skepticism into curiosity — and now urgency. When he says the U.S. needs to sp

BTC-1.94%

- Reward

- 1

- Comment

- Repost

- Share

$RIVER's looking super bullish right now — huge green candles everywhere, a perfect staircase pattern, and no signs of slowing down yet. Breaking through 7.6 really showed its strength, and buyers are still totally in charge even after this massive vertical climb.

What we’re seeing now is a healthy pullback, nothing more. A drift toward 7.2–7.0 would actually be ideal — that’s where fresh volume can reload and push the next expansion. If the trend holds the way it’s shaping up, the next impulse should easily drive toward 8.0–8.5, with potential for even more if momentum stays hot.

Since we’re

What we’re seeing now is a healthy pullback, nothing more. A drift toward 7.2–7.0 would actually be ideal — that’s where fresh volume can reload and push the next expansion. If the trend holds the way it’s shaping up, the next impulse should easily drive toward 8.0–8.5, with potential for even more if momentum stays hot.

Since we’re

- Reward

- 1

- Comment

- Repost

- Share

$ENSO delivered exactly the reaction we mapped out — bouncing cleanly from 0.750 and pushing all the way to 0.812, confirming that the expected rally has already begun. The rejection near the second target zone (around 0.82) triggered a healthy pullback, and this phase is where traders should focus on support and confirmation levels before entering fresh positions.

The structure is intact: higher lows, strong impulse from the base, and controlled retracement. If price stabilizes on support with volume confirmation, the next leg continues smoothly.

And as always — once TP1 or TP2 hits, switch t

The structure is intact: higher lows, strong impulse from the base, and controlled retracement. If price stabilizes on support with volume confirmation, the next leg continues smoothly.

And as always — once TP1 or TP2 hits, switch t

ENSO-5.12%

CryptoSat

$ENSO just printed one of its strongest intraday shifts in weeks, and the structure finally looks ready to reverse the broader downtrend.

On the 1H, price has reclaimed MA7 and MA25 with a strong impulse candle, and more importantly — it has pushed directly into MA99 and MA200 without hesitation. That kind of vertical strength usually signals a change in momentum and early accumulation behaviour.

The sweep down to 0.678 was the liquidity grab this chart needed. Since then, candles have turned clean and controlled, forming higher lows and compressing under the moving averages. Once a chart starts attacking MA99 and MA200 from below with force, it’s usually preparing for a mid-term trend shift.

On the 4H, $ENSO is still fighting the MA99 zone around 0.75, but the reaction from the lows is undeniable. If buyers defend anything above 0.705–0.715, this structure has room to extend toward 0.77, 0.82, and even 0.90 later.

In short: momentum flipped, liquidity cleaned, and pressure is now upward. #ENSO is entering the “early breakout” phase — this is where conviction candles normally appear.

On the 1H, price has reclaimed MA7 and MA25 with a strong impulse candle, and more importantly — it has pushed directly into MA99 and MA200 without hesitation. That kind of vertical strength usually signals a change in momentum and early accumulation behaviour.

The sweep down to 0.678 was the liquidity grab this chart needed. Since then, candles have turned clean and controlled, forming higher lows and compressing under the moving averages. Once a chart starts attacking MA99 and MA200 from below with force, it’s usually preparing for a mid-term trend shift.

On the 4H, $ENSO is still fighting the MA99 zone around 0.75, but the reaction from the lows is undeniable. If buyers defend anything above 0.705–0.715, this structure has room to extend toward 0.77, 0.82, and even 0.90 later.

In short: momentum flipped, liquidity cleaned, and pressure is now upward. #ENSO is entering the “early breakout” phase — this is where conviction candles normally appear.

- Reward

- 1

- Comment

- Repost

- Share

$LUNA is showing a pure bullish recovery structure right now.

Price retested the major support at 15800 and bounced with real strength, pushing straight into the 21500 zone without hesitation. That type of vertical reaction usually signals smart money stepping back in after accumulation.

From here, the chart is shaping up for one more test toward the 24000–25000 resistance region. If #LUNA can hold that level and flip it into support, the next major expansion range opens cleanly toward 28000–30000. Volume is rising, moving averages are curling up, and the dips are getting bought almost instant

Price retested the major support at 15800 and bounced with real strength, pushing straight into the 21500 zone without hesitation. That type of vertical reaction usually signals smart money stepping back in after accumulation.

From here, the chart is shaping up for one more test toward the 24000–25000 resistance region. If #LUNA can hold that level and flip it into support, the next major expansion range opens cleanly toward 28000–30000. Volume is rising, moving averages are curling up, and the dips are getting bought almost instant

- Reward

- 1

- Comment

- Repost

- Share

Stop Overcomplicating ! One Indicator Solves the Entire Problem 💡

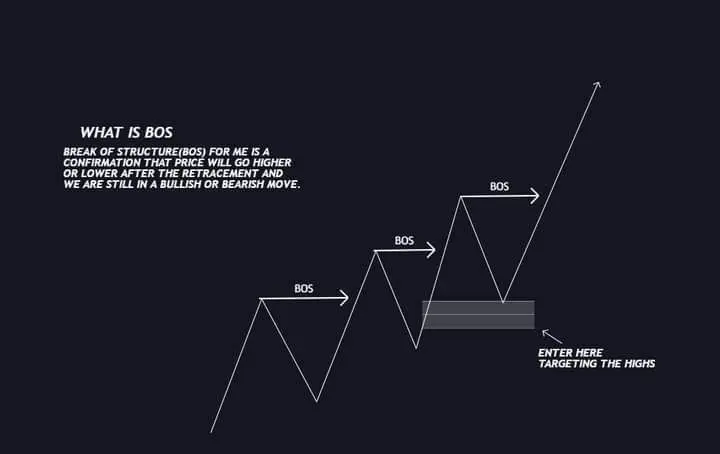

Every trader remembers the moment they first discovered “market structure.” For many, it felt like unlocking a hidden language — but the confusion usually started right after: BOS, CHoCH, SMC… what does any of this really mean?

So let’s break it down the way real traders learn it — through movement, context, and simple logic.

🔍 The Real Meaning of BOS (Break of Structure)

Forget the textbook definitions for a second.

A Break of Structure (BOS) is simply the market proving it wants to continue in the same direction.

Not predict

Every trader remembers the moment they first discovered “market structure.” For many, it felt like unlocking a hidden language — but the confusion usually started right after: BOS, CHoCH, SMC… what does any of this really mean?

So let’s break it down the way real traders learn it — through movement, context, and simple logic.

🔍 The Real Meaning of BOS (Break of Structure)

Forget the textbook definitions for a second.

A Break of Structure (BOS) is simply the market proving it wants to continue in the same direction.

Not predict

- Reward

- 3

- Comment

- Repost

- Share