CryptoPatel

No content yet

CryptoPatel

🇮🇳 BIG: Indian Cyber Crime Coordination Centre going LIVE on Crypto Frauds

What to Expect:

→ Emerging crypto crime tactics

→ How scammers are targeting Indians

→ Protection tips from govt experts

📅 TODAY, Dec 31 | 4 PM IST

🔴 LIVE:

What to Expect:

→ Emerging crypto crime tactics

→ How scammers are targeting Indians

→ Protection tips from govt experts

📅 TODAY, Dec 31 | 4 PM IST

🔴 LIVE:

- Reward

- like

- Comment

- Repost

- Share

ADOPTION: Bank of America approves Bitcoin for clients.

Advisors can now Recommend 1-4% Allocation to Bitcoin ETFs from BlackRock, Fidelity, Bitwise & Grayscale.

One of America's Largest Banks is officially in.

Advisors can now Recommend 1-4% Allocation to Bitcoin ETFs from BlackRock, Fidelity, Bitwise & Grayscale.

One of America's Largest Banks is officially in.

BTC1,2%

- Reward

- like

- Comment

- Repost

- Share

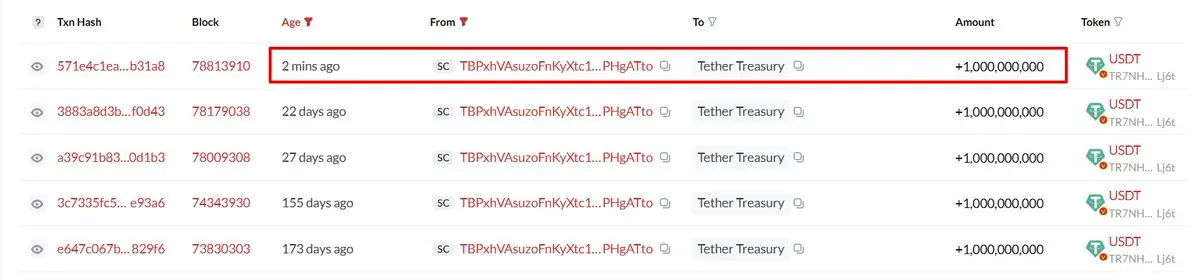

$Tether just minted $1B USDT on Tron.

In 2025, a Total of $26B USDT has been minted, Showing Growing Stablecoin supply and liquidity.

@trondao

In 2025, a Total of $26B USDT has been minted, Showing Growing Stablecoin supply and liquidity.

@trondao

TRX-0,15%

- Reward

- like

- 1

- Repost

- Share

GoldGeneratesWater :

:

Merry Christmas ⛄$PEOPLE LONG SETUP (4H):

✔ Expected sweep of last week’s low

✔ Price reacting from a clean bullish support zone

✔ Trend shift already forming

✔ Upside liquidity resting above recent highs

Entry: ~$0.0087 | SL: $0.00796 | TPs: $0.00992/$0.01063/$0.01134

Wait for confirmation, Let Liquidity Lead the Move.

#PEOPLE @ConstitutionDAO

✔ Expected sweep of last week’s low

✔ Price reacting from a clean bullish support zone

✔ Trend shift already forming

✔ Upside liquidity resting above recent highs

Entry: ~$0.0087 | SL: $0.00796 | TPs: $0.00992/$0.01063/$0.01134

Wait for confirmation, Let Liquidity Lead the Move.

#PEOPLE @ConstitutionDAO

PEOPLE-0,77%

- Reward

- like

- Comment

- Repost

- Share

Eric Trump Said "Q4 will be Unbelievable for Your Crypto Bags."

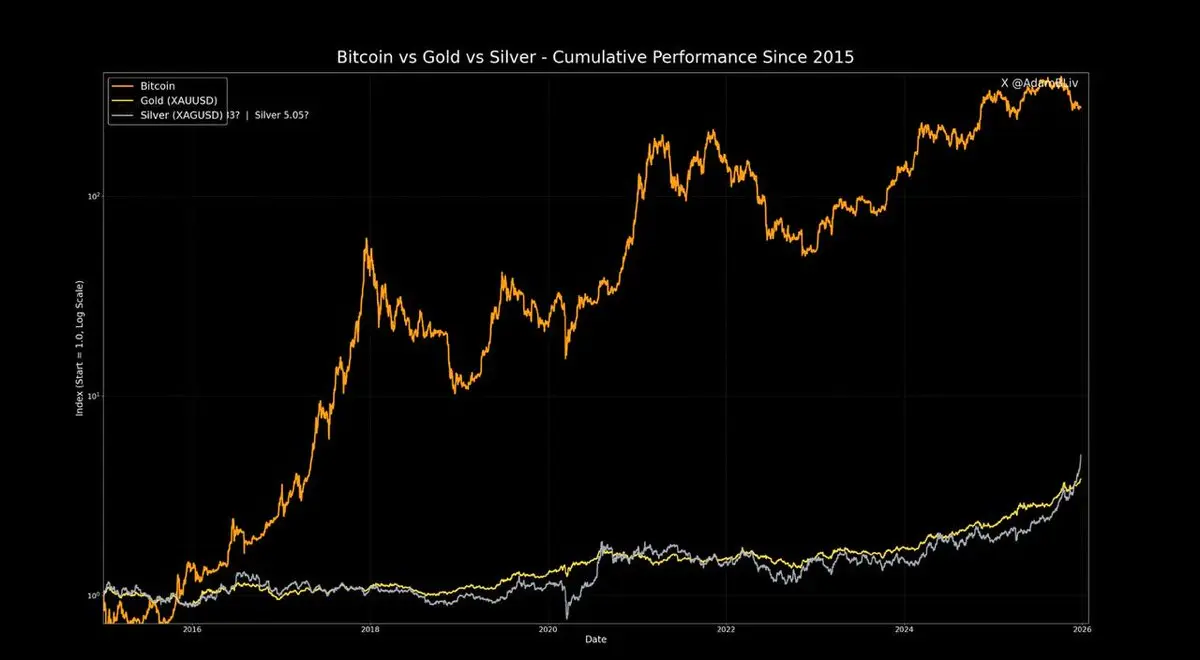

Well, He Wasn't Wrong...

#Bitcoin dropped 36% from Its Q4 High to Its Low.

With Just 1 Day left in Q4, that's Definitely "Unbelievable", Just not the Way he Meant it. 😅

Moral of the Story: Don't take Investment Advice from Politicians.

Well, He Wasn't Wrong...

#Bitcoin dropped 36% from Its Q4 High to Its Low.

With Just 1 Day left in Q4, that's Definitely "Unbelievable", Just not the Way he Meant it. 😅

Moral of the Story: Don't take Investment Advice from Politicians.

BTC1,2%

- Reward

- 1

- Comment

- Repost

- Share

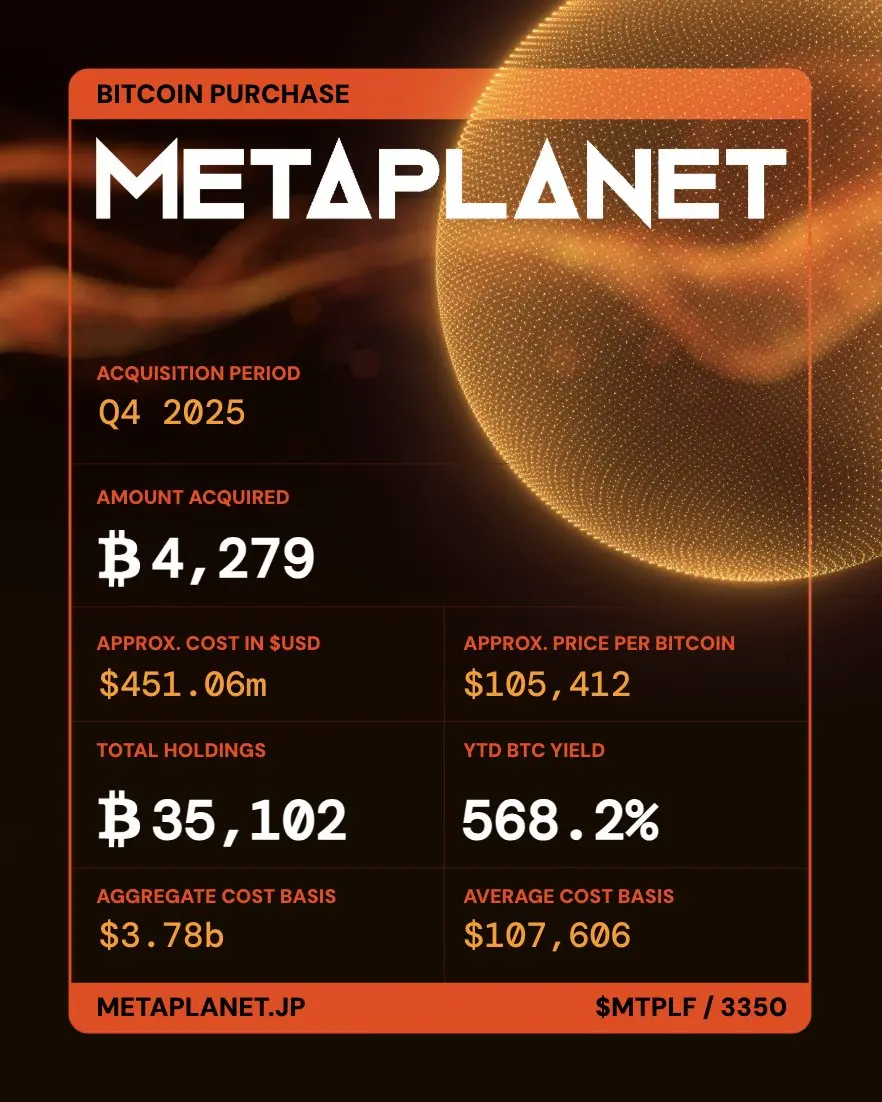

Metaplanet has Acquired 4,279 Bitcoin in Q4 for $451M, Paying about $105,412 Per coin.

Current position:

Total Holding: 35,102 $BTC Worth $3.09B

Total Acquisition Cost: $3.78B

Average Buy price: ~$107,606

Unrealized Loss: ~$690M

Despite this, They’re Planning to Buy much more:

2026 Goal: 100,000 BTC

2027 Goal: 220,000 BTC

This is a long-Term Bitcoin bet, not a Short-Term Trade.

@Metaplanet #Metaplanet

Current position:

Total Holding: 35,102 $BTC Worth $3.09B

Total Acquisition Cost: $3.78B

Average Buy price: ~$107,606

Unrealized Loss: ~$690M

Despite this, They’re Planning to Buy much more:

2026 Goal: 100,000 BTC

2027 Goal: 220,000 BTC

This is a long-Term Bitcoin bet, not a Short-Term Trade.

@Metaplanet #Metaplanet

BTC1,2%

- Reward

- like

- Comment

- Repost

- Share

FAKE NEWS SPREADING FAST: There Is NO Emergency FOMC Meeting Today

That Viral post about an "Emergency FOMC Meeting" today at 2 PM ET is FALSE.

What's actually happening: The Fed is releasing the minutes from the Dec 9-10 meeting. That's it. Routine stuff.

❌ No emergency meeting

❌ No crisis discussions

❌ No surprise rate cuts

The Next real FOMC Meeting is Jan 28, 2026.

Don't fall for fake news designed to create panic and manipulate the market. Always verify before you trade.

That Viral post about an "Emergency FOMC Meeting" today at 2 PM ET is FALSE.

What's actually happening: The Fed is releasing the minutes from the Dec 9-10 meeting. That's it. Routine stuff.

❌ No emergency meeting

❌ No crisis discussions

❌ No surprise rate cuts

The Next real FOMC Meeting is Jan 28, 2026.

Don't fall for fake news designed to create panic and manipulate the market. Always verify before you trade.

- Reward

- like

- Comment

- Repost

- Share

BREAKING: BlackRock's BUIDL becomes the first tokenized Treasury to pay $100M in dividends

Quick facts:

→ $1.7B assets Under Management

→ Launched March 2024 on Ethereum

→ Now live on 7 Chains (Solana, Aptos, Avalanche)

The world's Largest Asset Manager is Validating RWA with Real Yields.

Quick facts:

→ $1.7B assets Under Management

→ Launched March 2024 on Ethereum

→ Now live on 7 Chains (Solana, Aptos, Avalanche)

The world's Largest Asset Manager is Validating RWA with Real Yields.

- Reward

- like

- Comment

- Repost

- Share

🇨🇳 China's Digital Yuan to Pay Interest from 2026

Starting January 1, 2026, Chinese banks will pay interest on digital yuan (e-CNY) wallet balances, A major shift from "Digital Cash" to "Deposit Currency."

Why It Matters:

→ Competing with Alipay & WeChat Pay

→ Full deposit insurance protection

→ Cross-border pilots with Singapore, UAE, Saudi Arabia planned

This is NOT crypto, it's state-controlled digital money with full oversight. China leading the global CBDC race while banning crypto.

Starting January 1, 2026, Chinese banks will pay interest on digital yuan (e-CNY) wallet balances, A major shift from "Digital Cash" to "Deposit Currency."

Why It Matters:

→ Competing with Alipay & WeChat Pay

→ Full deposit insurance protection

→ Cross-border pilots with Singapore, UAE, Saudi Arabia planned

This is NOT crypto, it's state-controlled digital money with full oversight. China leading the global CBDC race while banning crypto.

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

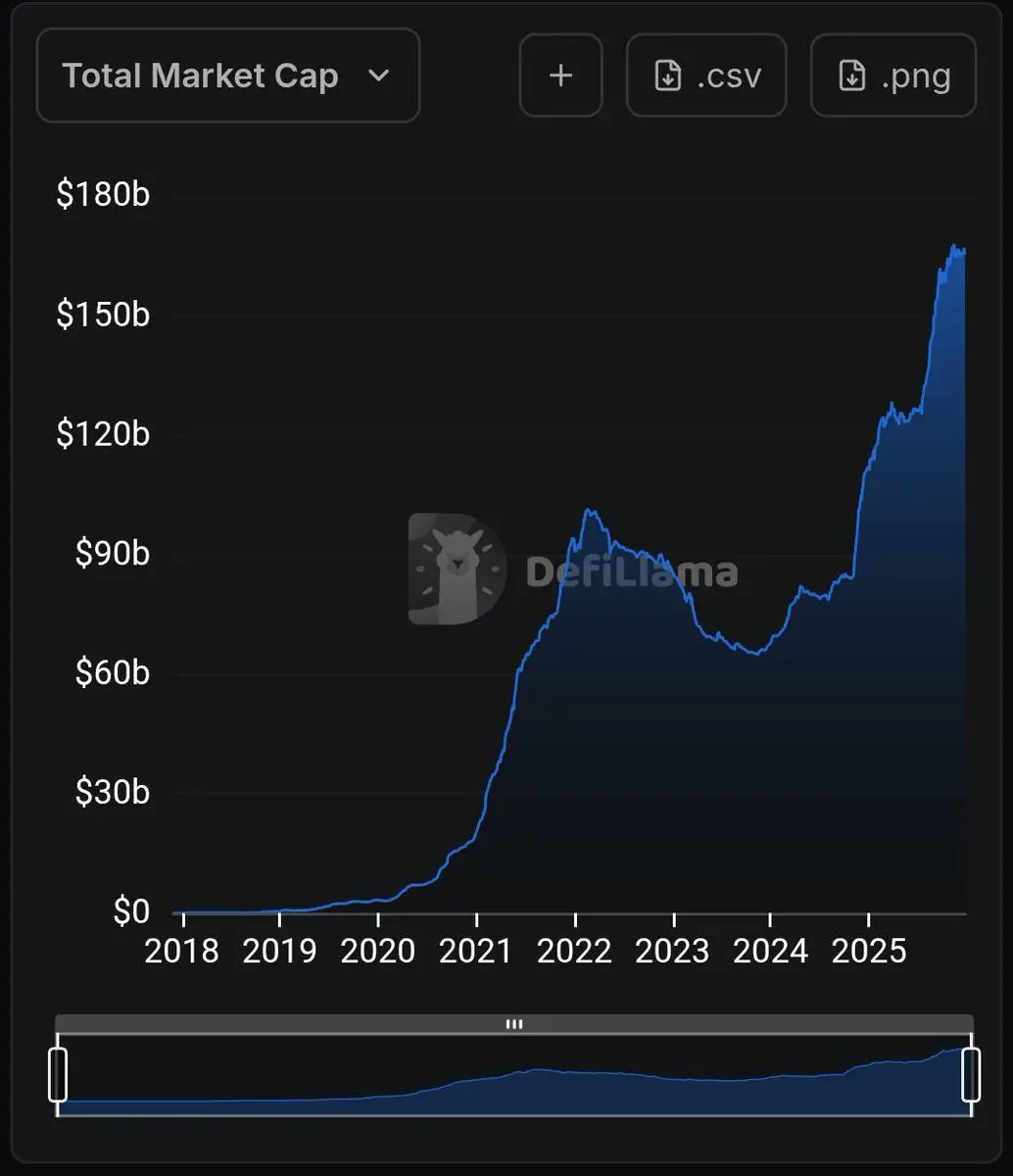

Real-world assets in DeFi have surged to $17B in TVL, overtaking DEXs to become the 5th-Largest Sector.

Tokenized U.S. Treasurys, Private Credit, and Commodities are moving on-chain, Led Mostly by Ethereum.

It’s Real Yield + Real Assets + Blockchain Rails.

Tokenized U.S. Treasurys, Private Credit, and Commodities are moving on-chain, Led Mostly by Ethereum.

It’s Real Yield + Real Assets + Blockchain Rails.

ETH0,92%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

🍔 Steak ’n Shake Says if every customer paid in Bitcoin for one year, its Strategic Bitcoin Reserve could reach ~$500M.

Why it Matters 👇

🔹 Accepting $BTC via Lightning Network since May 2025

🔹 ~50% Lower Fees vs Credit Cards

🔹 All #BTC Payments Flow Directly into its SBR

🔹 15% Same-Store Sales Growth, Beating Major Peers

🔹 BTC Rewards via Fold Partnership

They’re Now the First Major U.S. Restaurant Chain with a Strategic #Bitcoin Reserve.

Why it Matters 👇

🔹 Accepting $BTC via Lightning Network since May 2025

🔹 ~50% Lower Fees vs Credit Cards

🔹 All #BTC Payments Flow Directly into its SBR

🔹 15% Same-Store Sales Growth, Beating Major Peers

🔹 BTC Rewards via Fold Partnership

They’re Now the First Major U.S. Restaurant Chain with a Strategic #Bitcoin Reserve.

BTC1,2%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Top 10 Dapps by TVL: 2021 vs 2025

In 2021, TVL leaders were spread across DEXs, CDPs, and yield aggregators: Driven by active trading and yield farming.

By 2025, TVL is concentrated in lending, liquid staking, and restaking protocols.

The shift shows DeFi moving from activity-heavy apps to balance-sheet infrastructure, where capital stays parked and productive for longer periods.

DeFi is maturing.

In 2021, TVL leaders were spread across DEXs, CDPs, and yield aggregators: Driven by active trading and yield farming.

By 2025, TVL is concentrated in lending, liquid staking, and restaking protocols.

The shift shows DeFi moving from activity-heavy apps to balance-sheet infrastructure, where capital stays parked and productive for longer periods.

DeFi is maturing.

- Reward

- like

- Comment

- Repost

- Share

Wallet 0xa339 has sold 50,623 $ETH at an average of $2,921, realizing approximately $15M+ in profit through structured, leveraged positioning.

This is not emotional Selling, it’s Controlled Profit-taking, which can introduce Short-term Supply Pressure.

How Price Absorbs this Supply will Define the Next Move.

Watch the reaction, not the headline.

This is not emotional Selling, it’s Controlled Profit-taking, which can introduce Short-term Supply Pressure.

How Price Absorbs this Supply will Define the Next Move.

Watch the reaction, not the headline.

ETH0,92%

- Reward

- like

- Comment

- Repost

- Share