Shenron1226

No content yet

Shenron1226

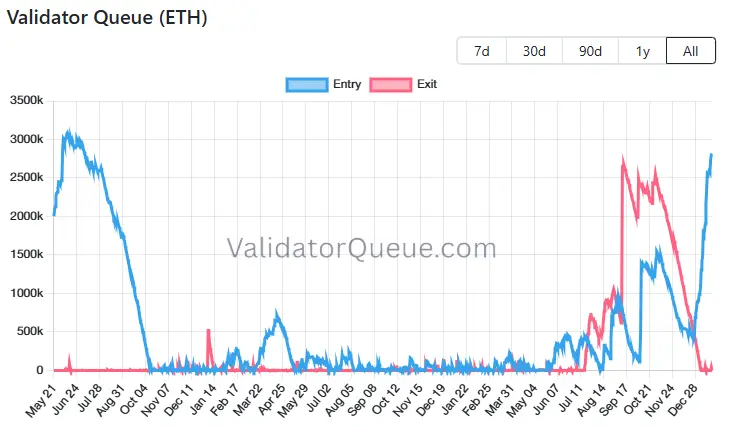

🚨$8.49B WORTH OF ETH QUEUED FOR STAKING AS EXIT QUEUE CLEARS

Roughly 2.82 million ETH, valued at $8.49BILLION, is currently waiting to enter Ethereum’s PoS network.

The sharp rise in validator demand follows BitMine staking a large portion of its ETH holdings.

Roughly 2.82 million ETH, valued at $8.49BILLION, is currently waiting to enter Ethereum’s PoS network.

The sharp rise in validator demand follows BitMine staking a large portion of its ETH holdings.

ETH-2,85%

- Reward

- 1

- Comment

- Repost

- Share

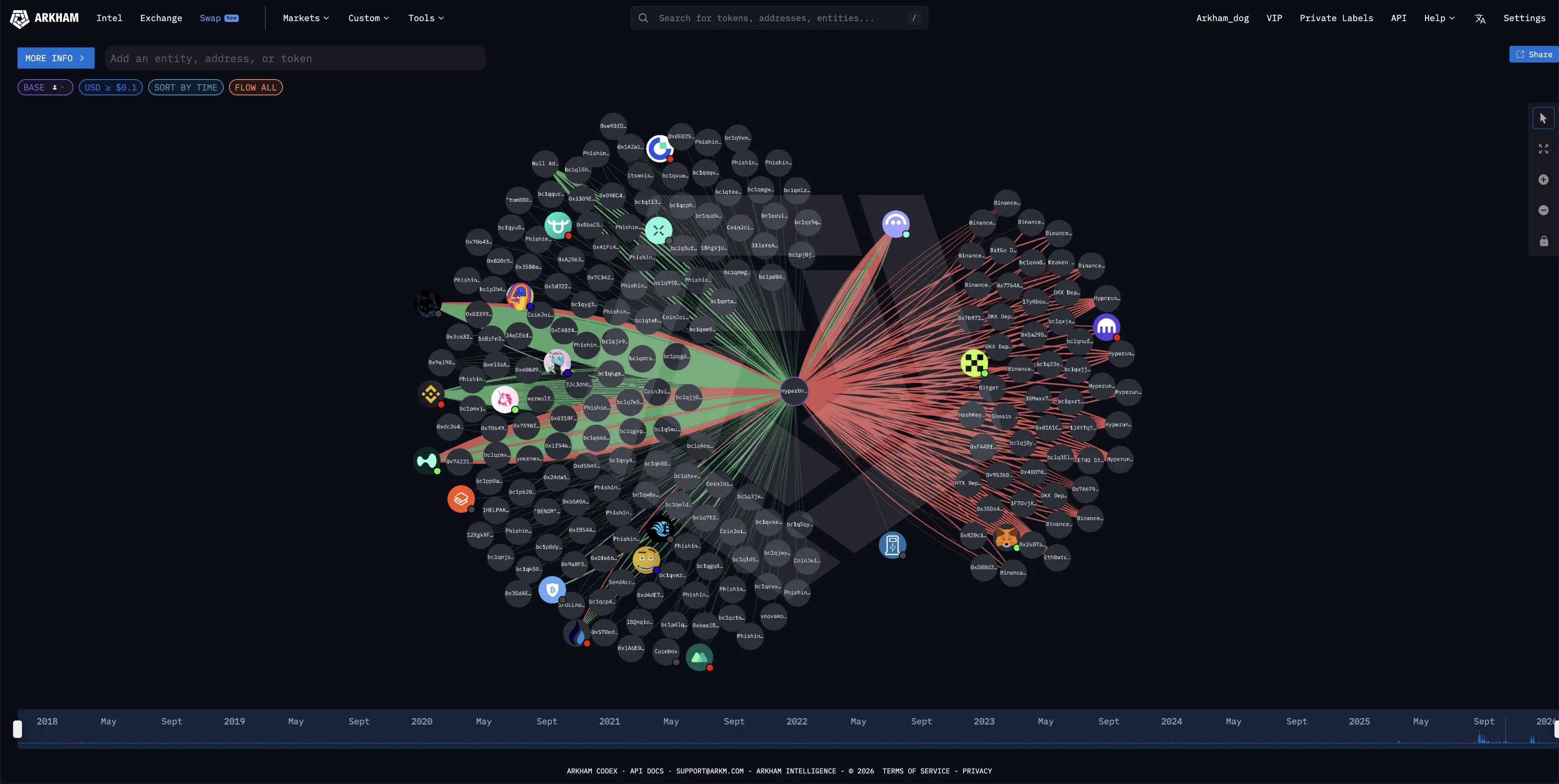

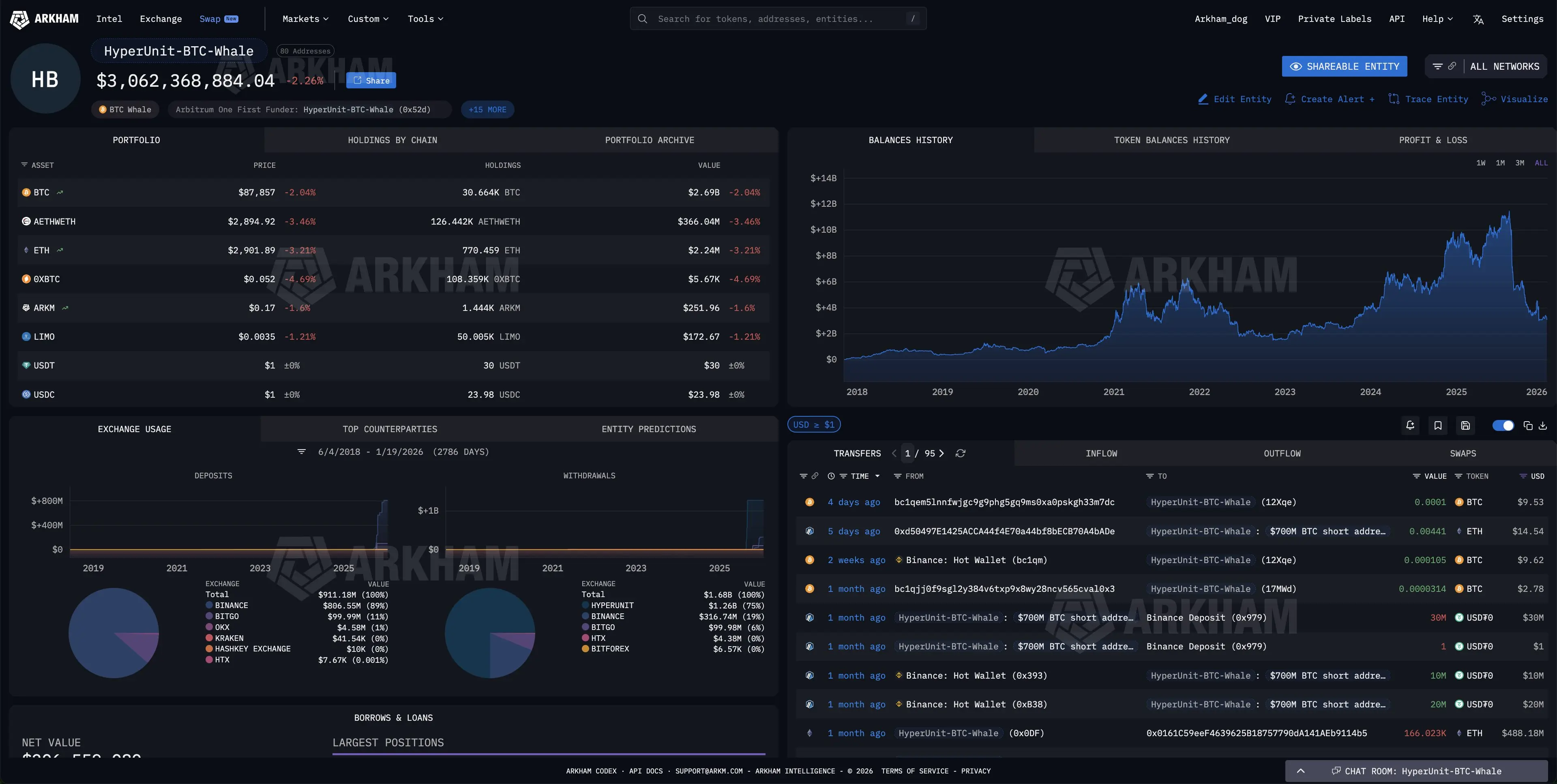

THE HYPERUNIT WHALE DOWN $100M IN A WEEK

The Hyperunit Whale, the $800 Million ETH bull tied to Garrett Jin, is currently down $124M in 7 day PnL.

Right now, he has $153M to maintain margin and a liquidation price of $2270. Will he make it back?

The Hyperunit Whale, the $800 Million ETH bull tied to Garrett Jin, is currently down $124M in 7 day PnL.

Right now, he has $153M to maintain margin and a liquidation price of $2270. Will he make it back?

ETH-2,85%

- Reward

- 1

- 1

- Repost

- Share

ybaser :

:

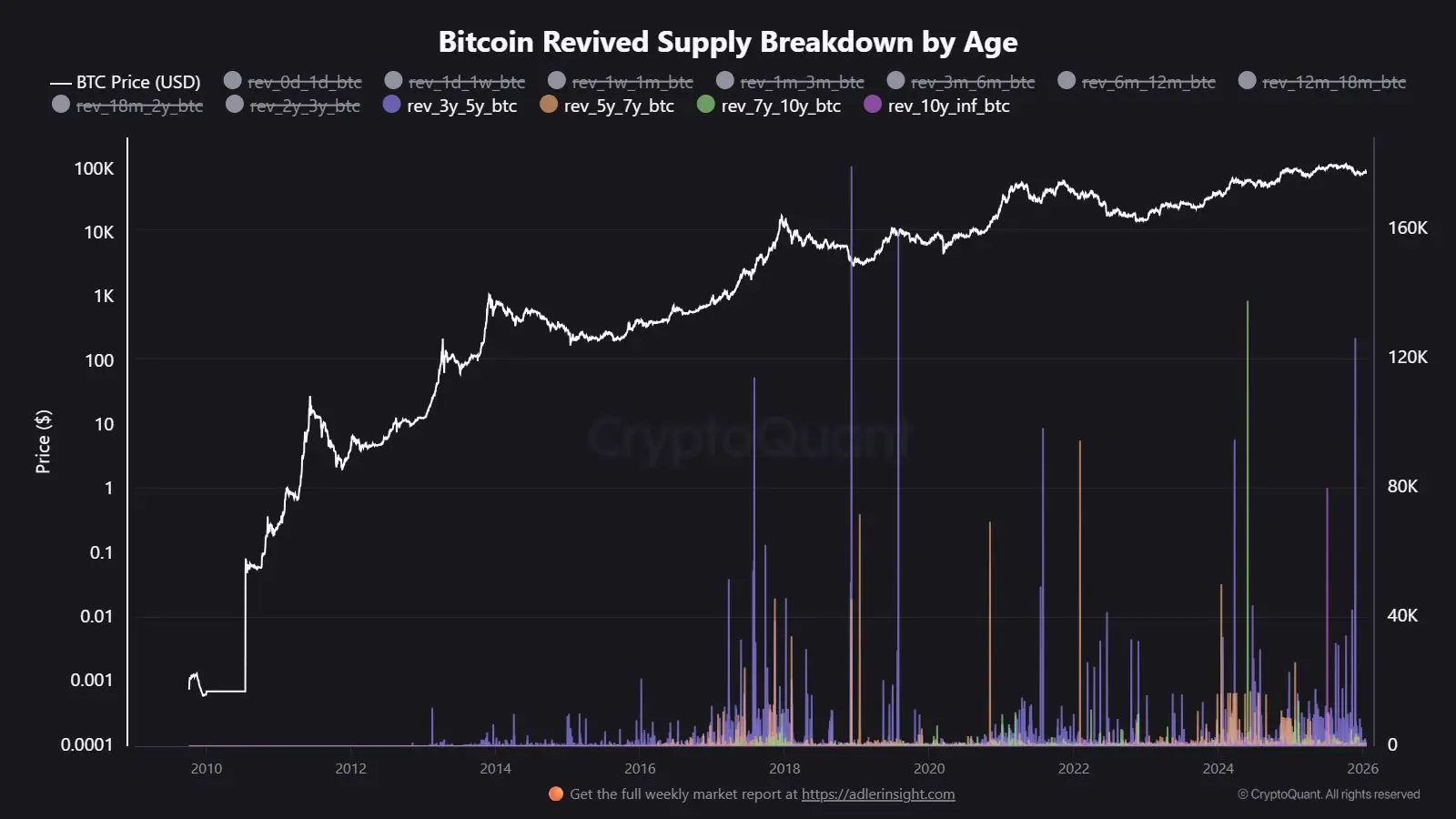

2026 GOGOGO 👊📊 INSIGHT: 2024–2025 saw the largest release of long-term Bitcoin supply ever, signaling a shift in ownership from early holders to new, per CryptoQuant.

BTC-0,88%

- Reward

- like

- 2

- Repost

- Share

MrKing :

:

2026 GOGOGO 👊View More

TODAY’S SCHEDULE IS EXTREMELY VOLATILE:

8:30 AM → INITIAL JOBLESS CLAIMS.

8:30 AM → US GDP RELEASE.

9:00 AM → FED INJECTS $6.9 BILLION.

10:00 AM → PCE PRICE INDEX.

4:30 PM → FED BALANCE SHEET.

6:30 PM → JAPAN INFLATION DATA.

10:00 PM → JAPAN INTEREST RATE DECISION.

8:30 AM → INITIAL JOBLESS CLAIMS.

8:30 AM → US GDP RELEASE.

9:00 AM → FED INJECTS $6.9 BILLION.

10:00 AM → PCE PRICE INDEX.

4:30 PM → FED BALANCE SHEET.

6:30 PM → JAPAN INFLATION DATA.

10:00 PM → JAPAN INTEREST RATE DECISION.

- Reward

- like

- Comment

- Repost

- Share

THAILAND MOVES TO SUPPORT CRYPTO INVESTMENTS

Thailand’s 'SEC' says new rules are coming for crypto ETFs, crypto futures, and tokenized investments, formally recognizing digital assets as an official asset class under the law.

Thailand’s 'SEC' says new rules are coming for crypto ETFs, crypto futures, and tokenized investments, formally recognizing digital assets as an official asset class under the law.

- Reward

- 1

- 3

- Repost

- Share

AYATTAC :

:

Buy To Earn 💎View More

🚨 BREAKING:

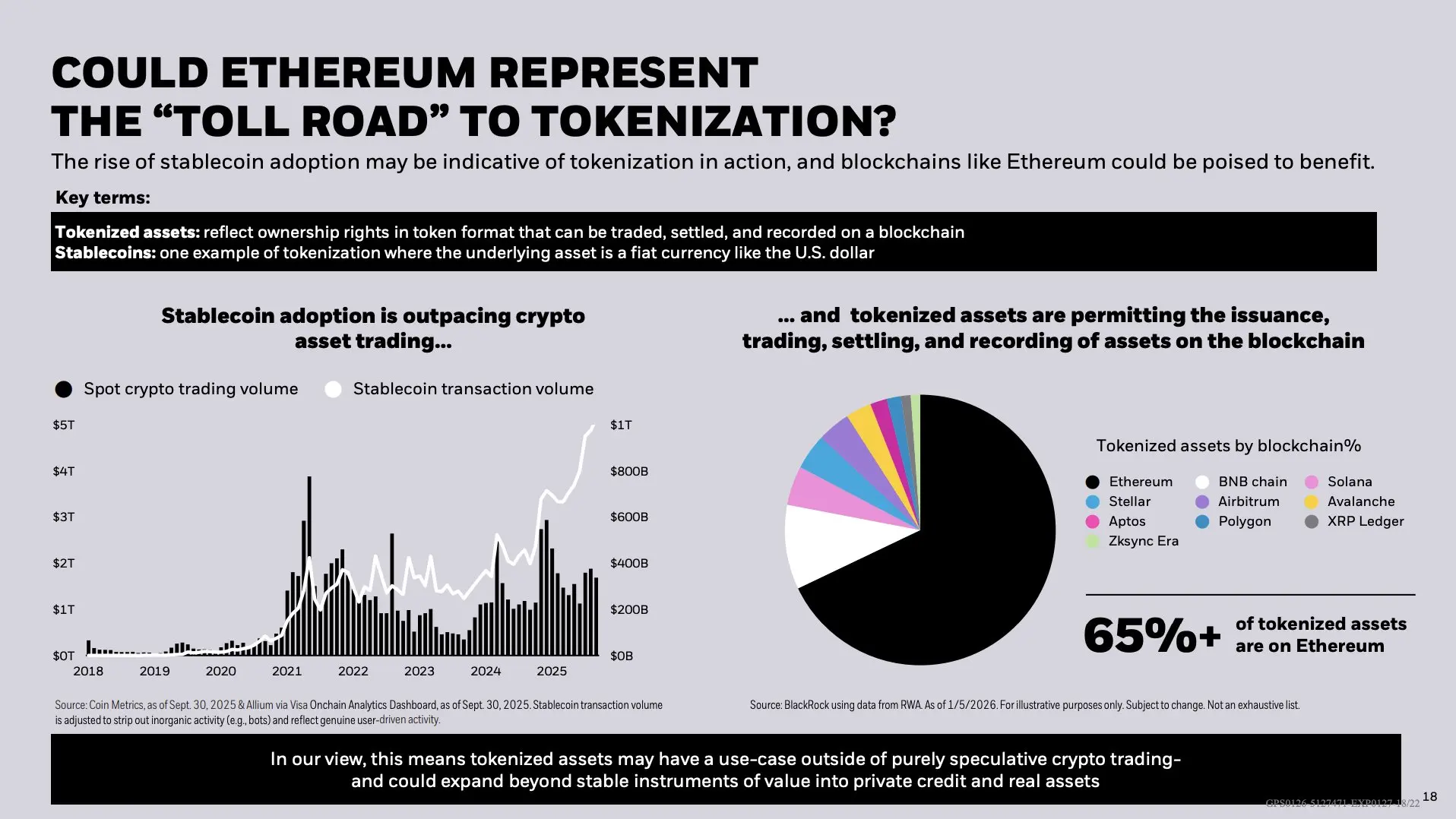

J.P. Morgan, the world’s largest bank, is now live on Ethereum.

The official RWA product is My OnChain Net Yield Fund (“MONY”), powered by JPM Kinexys.

Tokenization isn’t theory anymore.

It’s bank-grade financial infrastructure

J.P. Morgan, the world’s largest bank, is now live on Ethereum.

The official RWA product is My OnChain Net Yield Fund (“MONY”), powered by JPM Kinexys.

Tokenization isn’t theory anymore.

It’s bank-grade financial infrastructure

ETH-2,85%

- Reward

- like

- 2

- Repost

- Share

GateUser-a7228b5a :

:

2026 GOGOGO 👊View More

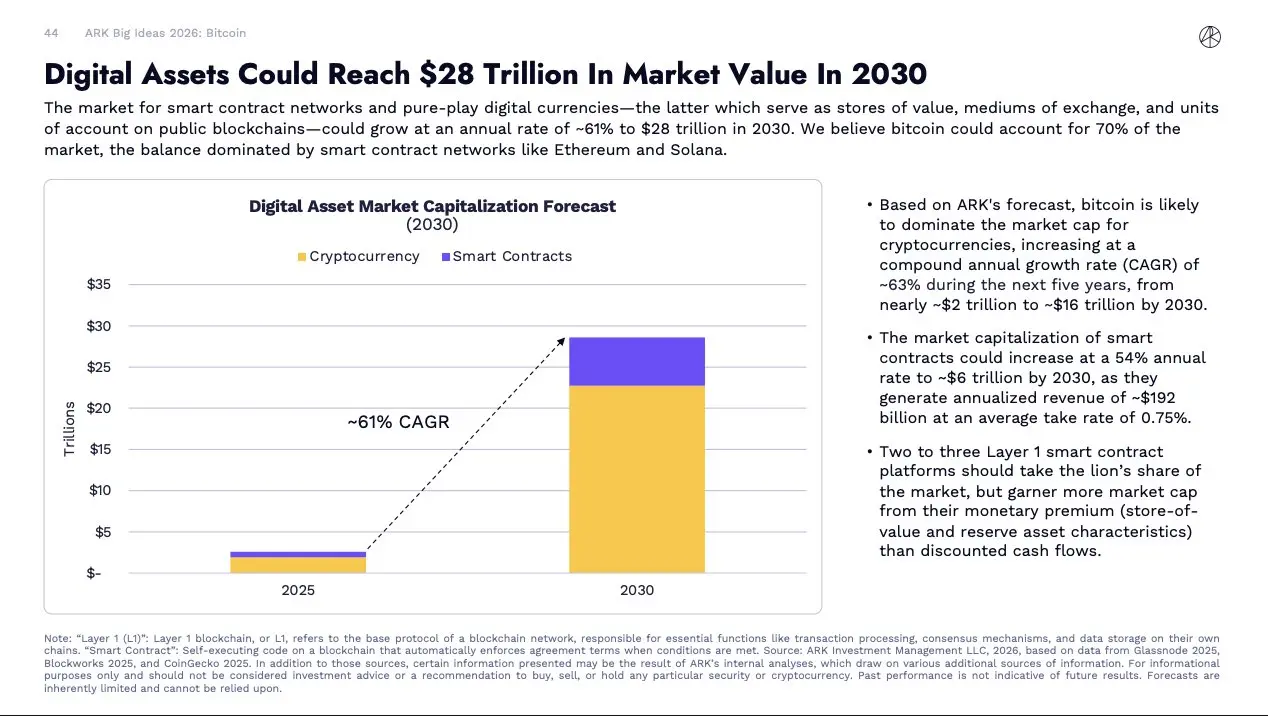

BULLISH: Cathie Wood's Ark Invest predicts digital assets could reach $28 trillion by 2030, with Bitcoin dominating at $16 trillion by 2030.

BTC-0,88%

- Reward

- 1

- 2

- Repost

- Share

Juse :

:

HODL Tight 💪View More

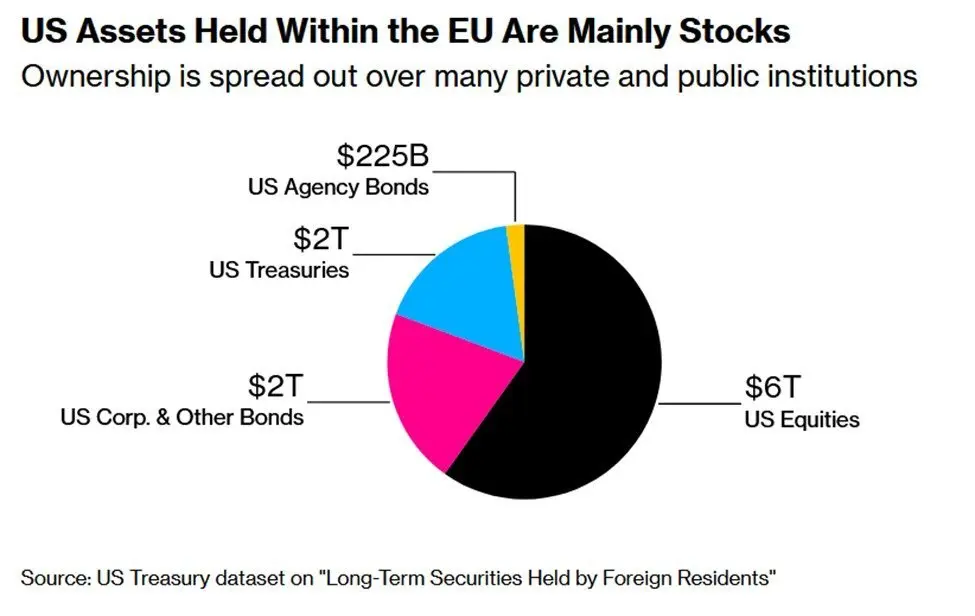

🚨EU INVESTORS HOLD RECORD $10T IN U.S. ASSETS

European investors now own an unprecedented $10TRILLION in U.S. assets, dominated by $6T in equities and nearly $2T in Treasuries.

European investors now own an unprecedented $10TRILLION in U.S. assets, dominated by $6T in equities and nearly $2T in Treasuries.

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

🔥 LATEST: NASDAQ-listed AVAX One rolls out an institutional-grade Avalanche validator, supporting public delegation.

AVAX-3,41%

- Reward

- like

- Comment

- Repost

- Share

🚨 NEW: XRP hits "Extreme Fear" after a 19% drop since January 5th.

Historically this high retail pessimism signals potential rallies as prices move opposite to expectations, per Santiment.

Historically this high retail pessimism signals potential rallies as prices move opposite to expectations, per Santiment.

XRP-2,62%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- 1

- Repost

- Share

Crypto24pro :

:

thank for good informationTHE BIGGEST BITCOIN SUPPLY SHIFT YOU’VE NEVER SEEN

This isn’t weak hands selling -- it’s some of the oldest $BTC finally moving.

2024 to 2025 saw more long-term holders (2+ years) move coins than any period in #Bitcoin’s history. Not panic. Not forced selling. Just veterans rebalancing after a massive run.

And here’s the key part: price didn’t collapse massively.

That tells you demand is real. New buyers are absorbing supply that used to be untouchable.

This doesn’t look like an ending, but it looks like a handoff -- from early holders to a new wave that cares about liquidity, macro, and size.

This isn’t weak hands selling -- it’s some of the oldest $BTC finally moving.

2024 to 2025 saw more long-term holders (2+ years) move coins than any period in #Bitcoin’s history. Not panic. Not forced selling. Just veterans rebalancing after a massive run.

And here’s the key part: price didn’t collapse massively.

That tells you demand is real. New buyers are absorbing supply that used to be untouchable.

This doesn’t look like an ending, but it looks like a handoff -- from early holders to a new wave that cares about liquidity, macro, and size.

BTC-0,88%

- Reward

- 1

- 2

- Repost

- Share

Shenron1226 :

:

Thank you 🙏View More

HUGE: $13 trillion BlackRock highlights Ethereum could be poised to benefit from tokenization, with 65% of tokenized assets on the network, in its 2026 Thematic Outlook.

ETH-2,85%

- Reward

- 2

- 1

- Repost

- Share

DragonFlyOfficial :

:

🌟 Amazing insight! 🙌 Really loved how you shared this — your perspective is super clear and helpful! 🚀 Keep it up, looking forward to learning more from you! 😊A real Bitcoin supply shock doesn’t happen “because price goes up.”

It happens when BTC quietly leaves the market.

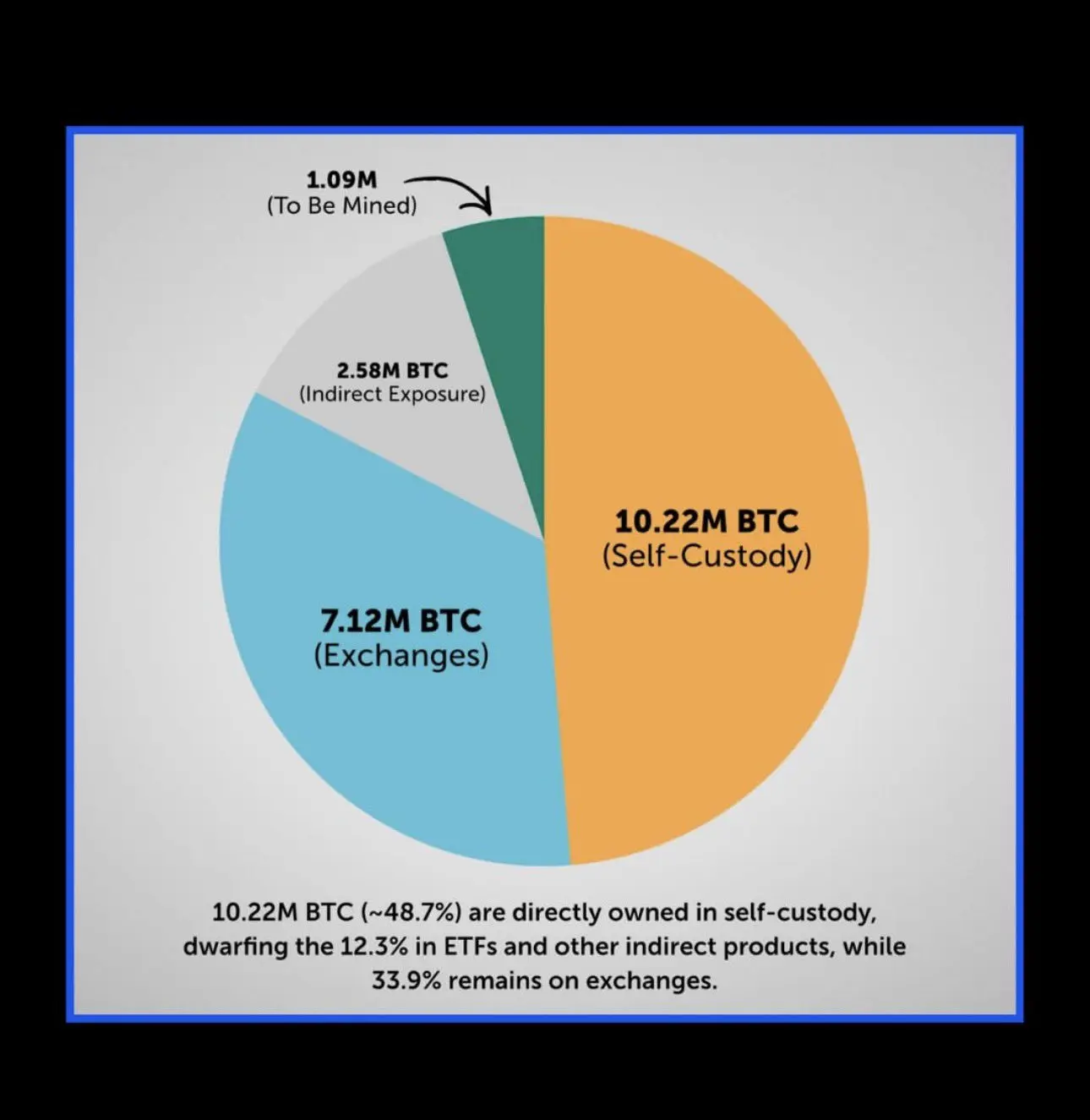

Based on this chart, ~10.2M BTC is already in self-custody.

That coin is effectively illiquid.

A true supply shock happens when:

• More BTC moves from exchanges → self-custody

• ETFs + institutions absorb new supply faster than miners can sell

• Long-term holders refuse to sell into demand

• New issuance (~450 BTC/day) gets completely soaked up

Price doesn’t cause the shock.

Illiquidity does.

When demand shows up and there’s nothing left on exchanges,

price adjusts violently — not

It happens when BTC quietly leaves the market.

Based on this chart, ~10.2M BTC is already in self-custody.

That coin is effectively illiquid.

A true supply shock happens when:

• More BTC moves from exchanges → self-custody

• ETFs + institutions absorb new supply faster than miners can sell

• Long-term holders refuse to sell into demand

• New issuance (~450 BTC/day) gets completely soaked up

Price doesn’t cause the shock.

Illiquidity does.

When demand shows up and there’s nothing left on exchanges,

price adjusts violently — not

BTC-0,88%

- Reward

- 1

- 1

- Repost

- Share

DragonFlyOfficial :

:

gogogoBTQ ISN'T WAITING FOR QUANTUM ATTACKS -- THEIR CHIP IS ALREADY IN VALIDATION

$BTQ just hit a major milestone: Their QCIM post-quantum crypto chip is now entering silicon validation with ITRI -- the world-class Taiwanese research powerhouse that helped birth $TSMC.

This isn’t hype -- it’s real hardware progress toward efficient, low-power quantum-resistant cryptography that’s actually deployable.

Post-quantum security fails without performance. QCIM’s compute-in-memory design tackles exactly that, and ITRI validation de-risks the architecture big time.

Huge step for BTQ_Tech. 🙌🚀

$BTQ just hit a major milestone: Their QCIM post-quantum crypto chip is now entering silicon validation with ITRI -- the world-class Taiwanese research powerhouse that helped birth $TSMC.

This isn’t hype -- it’s real hardware progress toward efficient, low-power quantum-resistant cryptography that’s actually deployable.

Post-quantum security fails without performance. QCIM’s compute-in-memory design tackles exactly that, and ITRI validation de-risks the architecture big time.

Huge step for BTQ_Tech. 🙌🚀

- Reward

- like

- Comment

- Repost

- Share

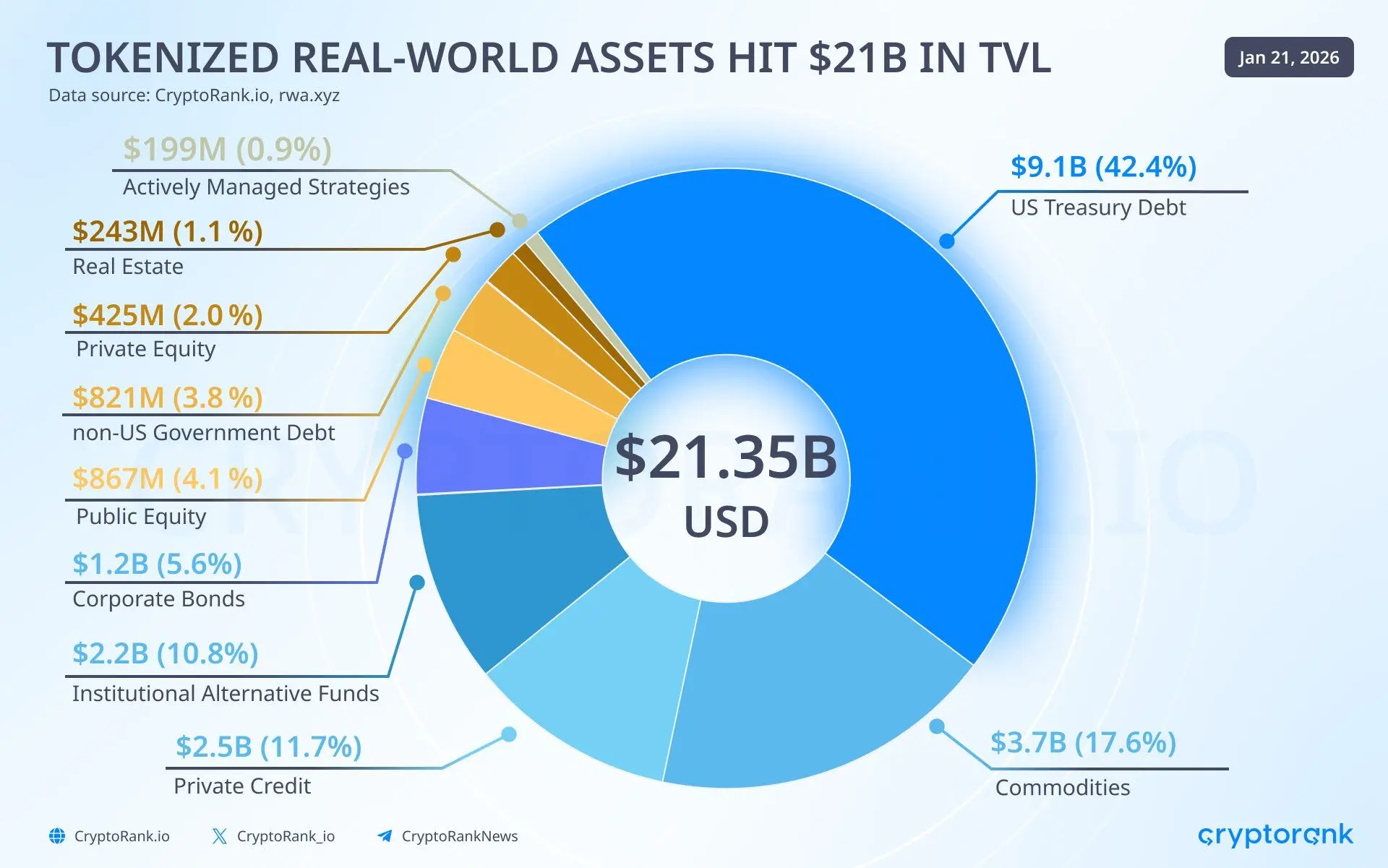

🔥 BIG: Tokenized RWAs hit $21B in TVL, with US Treasury Debt dominating at $9.1B (42.4%), according to CryptoRank.

- Reward

- 1

- 1

- Repost

- Share

DragonFlyOfficial :

:

🌟 Amazing insight! 🙌 Really loved how you shared this — your perspective is super clear and helpful! 🚀 Keep it up, looking forward to learning more from you! 😊BREAKING: The US government sold $654 billion in Treasuries last week across 9 auctions.

$500 billion were T-Bills with maturities from 4 to 26 weeks, mostly replacing maturing debt.

Furthermore, $154 billion in notes and bonds were issued, including $50 billion in 10-year notes.

Since 2020, T-Bills outstanding have now surged ~$4 trillion, or +160%.

As a % of marketable Treasury securities, T-Bills now reflect 22%, near the highest since 2021.

By comparison, T-Bills peaked at ~34% in the 2008 Financial Crisis.

US government borrowing is out of control.

$500 billion were T-Bills with maturities from 4 to 26 weeks, mostly replacing maturing debt.

Furthermore, $154 billion in notes and bonds were issued, including $50 billion in 10-year notes.

Since 2020, T-Bills outstanding have now surged ~$4 trillion, or +160%.

As a % of marketable Treasury securities, T-Bills now reflect 22%, near the highest since 2021.

By comparison, T-Bills peaked at ~34% in the 2008 Financial Crisis.

US government borrowing is out of control.

- Reward

- like

- Comment

- Repost

- Share

LATEST: ⚡ Solana Mobile has launched its SKR token with an airdrop for over 100,000 Seeker smartphone users and 188 developers, distributing nearly 2 billion tokens.

SKR106,35%

- Reward

- like

- Comment

- Repost

- Share

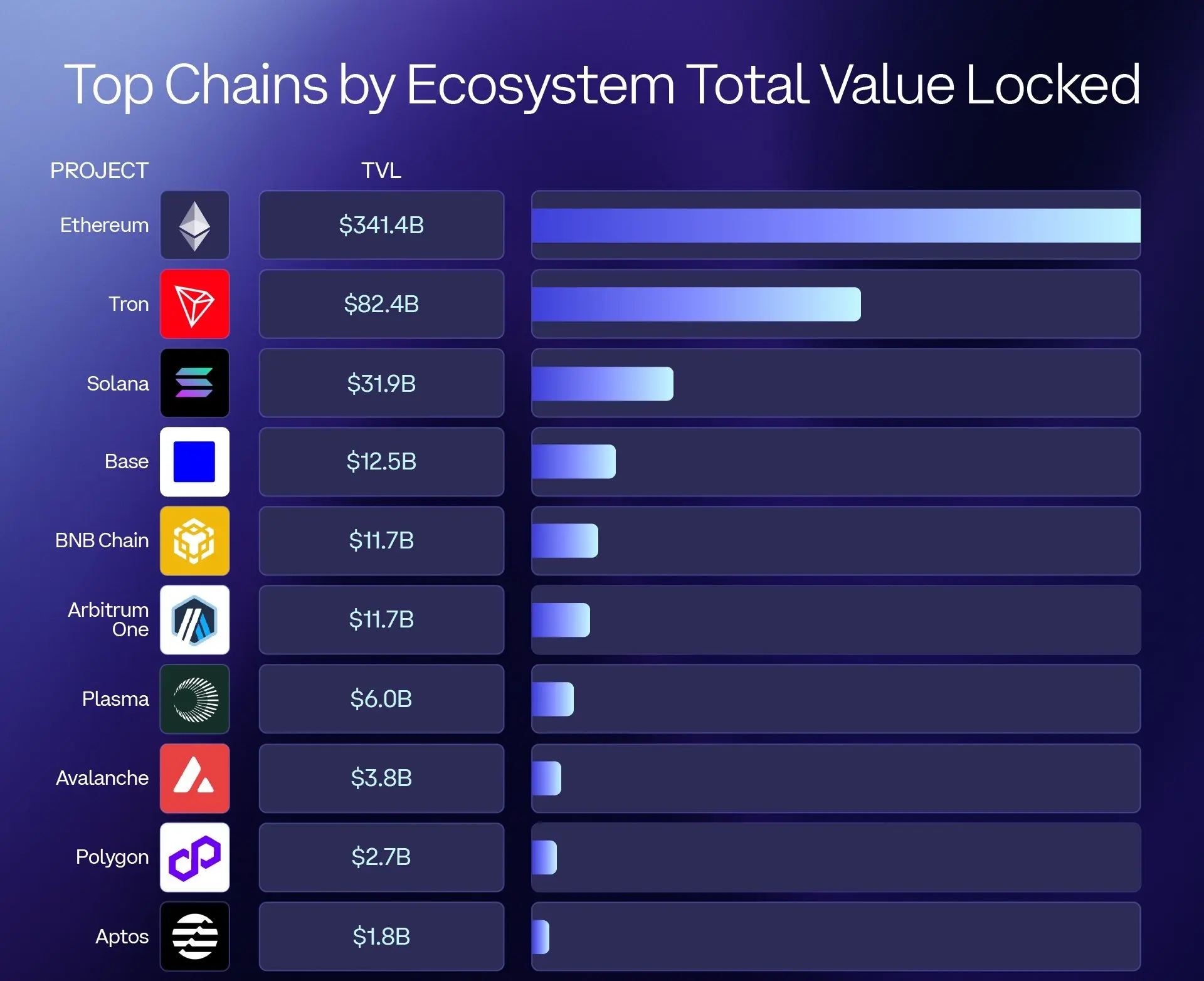

The total value locked in the ethereum ecosystem has hit $341.5 billion, nearly 11 times that of Solana, 29 times that of BSC, and a whopping 190 times that of Aptos.

The price and value of Ethereum are becoming disconnected, with the network's real intrinsic value—fueled by its unbeatable security, decentralization, and killer developer community—way outstripping its current market price.

This undervaluation is just a temporary blip, a prime chance for true believers to stack up before the unstoppable rally kicks in.

The price and value of Ethereum are becoming disconnected, with the network's real intrinsic value—fueled by its unbeatable security, decentralization, and killer developer community—way outstripping its current market price.

This undervaluation is just a temporary blip, a prime chance for true believers to stack up before the unstoppable rally kicks in.

- Reward

- 1

- Comment

- Repost

- Share

Trending Topics

View More61.97K Popularity

39.88K Popularity

24.27K Popularity

68.86K Popularity

347.86K Popularity

Pin