Aadvark

No content yet

Aadvark

remember when FOGO was trying to do an ICO at 1 Billion FDV and people were calling it the next MegaETH

FOGO-0,55%

- Reward

- like

- Comment

- Repost

- Share

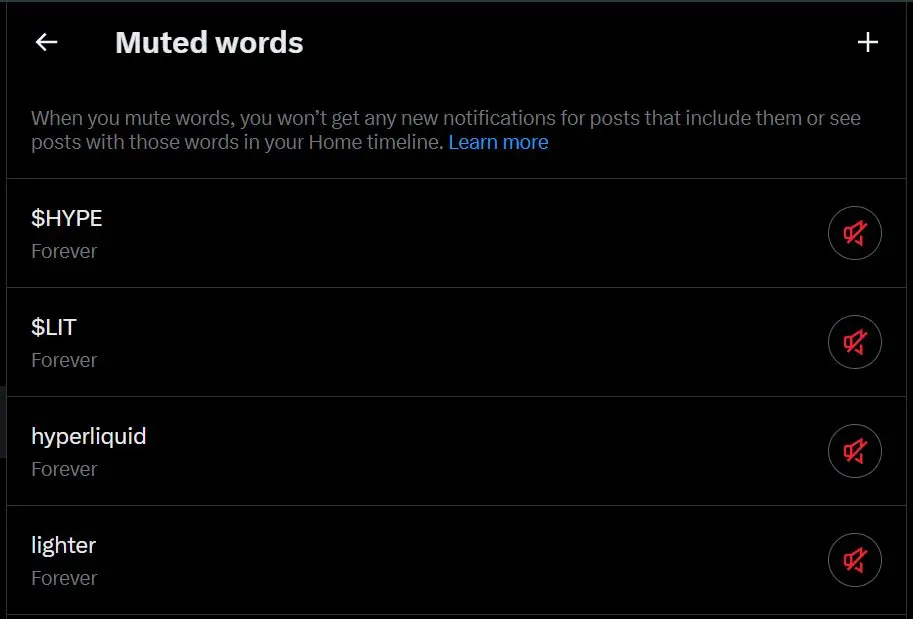

this one simple trick will improve your mental health by 10x

- Reward

- like

- Comment

- Repost

- Share

$LIT is currently valued at ~$650m circulating mcap ($2.7) and $2.6b FDV, with revenues annualising around $60m and declining.

$HYPE, by comparison, trades at roughly $6b circulating mcap ($25.5) and $25b FDV, while annualised revenue sits near $700m.

On a multiples basis, HYPE trades at ~8x P/E (circulating) and ~28x FDV P/E, whereas LIT trades at ~10.5x circulating P/E and ~43x on an FDV basis.

Given this, LIT is currently more expensive than HYPE on both circulating and fully diluted metrics, despite weaker fundamentals. Additionally, 100% of Hyperliquid revenue is directed toward buybacks,

$HYPE, by comparison, trades at roughly $6b circulating mcap ($25.5) and $25b FDV, while annualised revenue sits near $700m.

On a multiples basis, HYPE trades at ~8x P/E (circulating) and ~28x FDV P/E, whereas LIT trades at ~10.5x circulating P/E and ~43x on an FDV basis.

Given this, LIT is currently more expensive than HYPE on both circulating and fully diluted metrics, despite weaker fundamentals. Additionally, 100% of Hyperliquid revenue is directed toward buybacks,

- Reward

- like

- Comment

- Repost

- Share

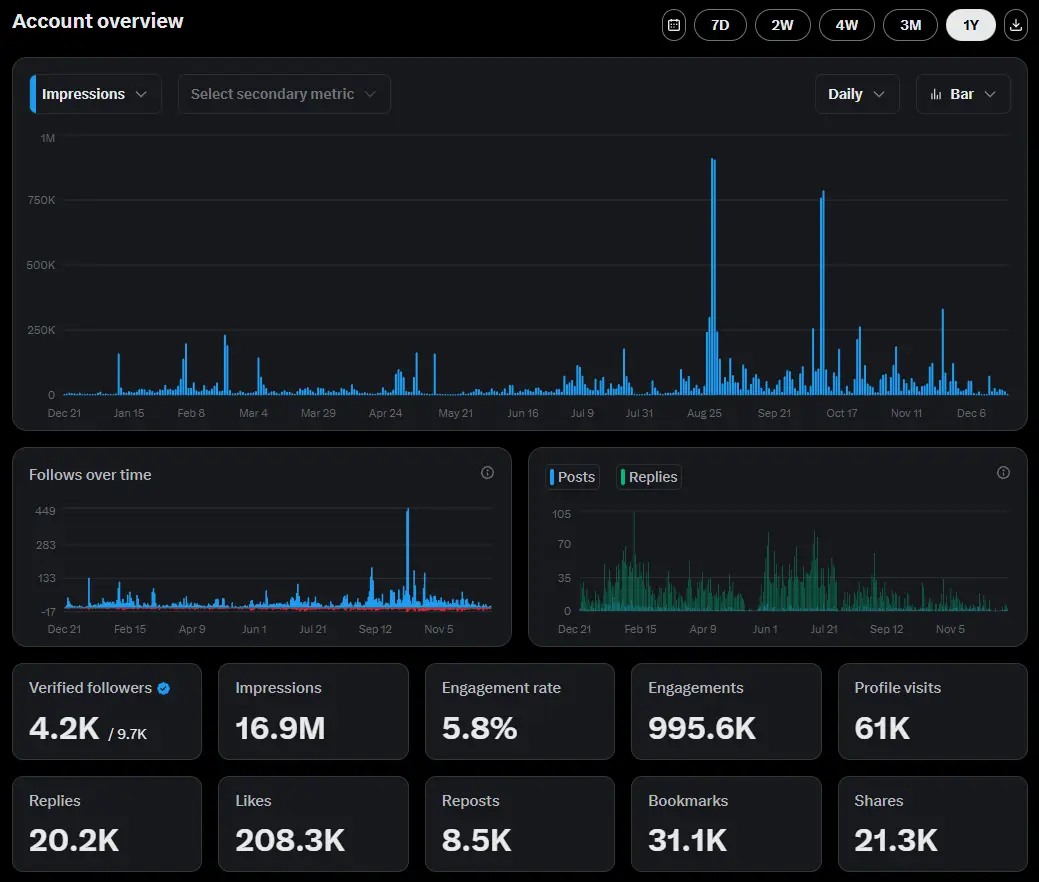

hate @KaitoAI all you want for filling the timeline with slop, but they helped me kickstart my content journey on twitter, thankful to them.

from 1k followers a year ago to almost 10k now

keep yapping

from 1k followers a year ago to almost 10k now

keep yapping

- Reward

- like

- Comment

- Repost

- Share

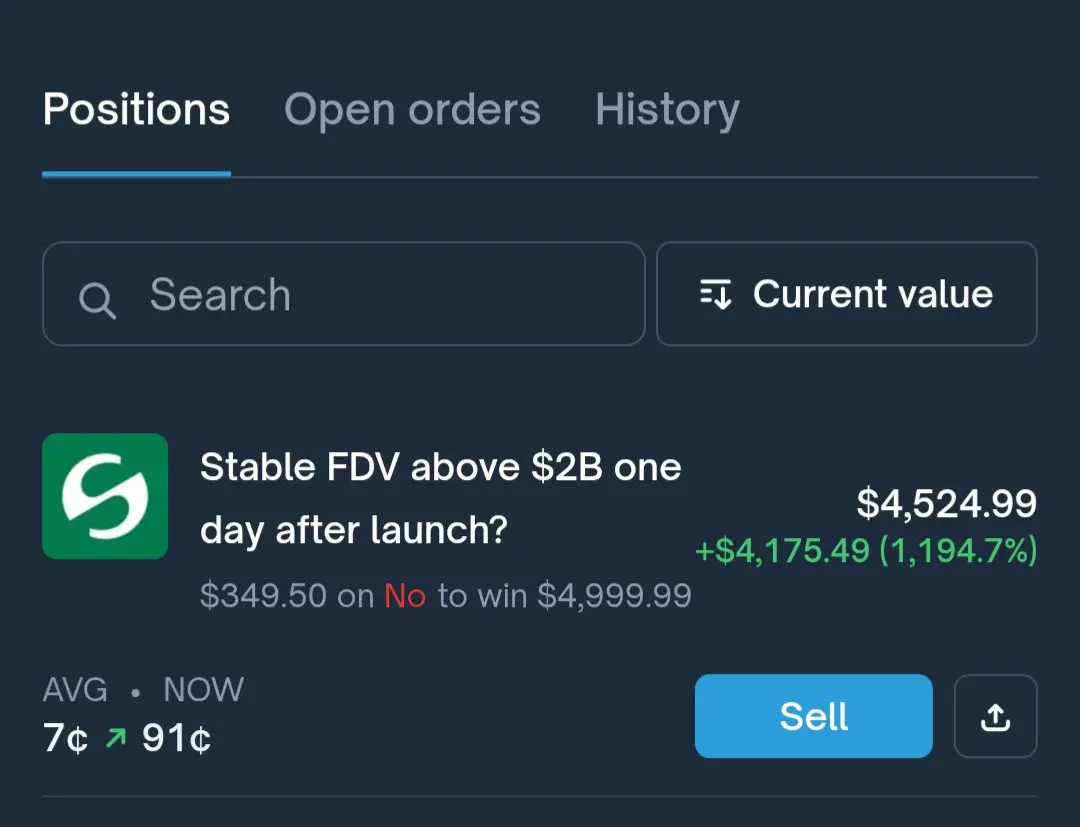

always place some stink bids at absurd prices on Polymarket incase prediction gods decide to bless you

- Reward

- like

- Comment

- Repost

- Share

you're hustling for a mere 2x on your ICO. i'm making an easy 400x on mine

we're not the same

we're not the same

- Reward

- like

- Comment

- Repost

- Share

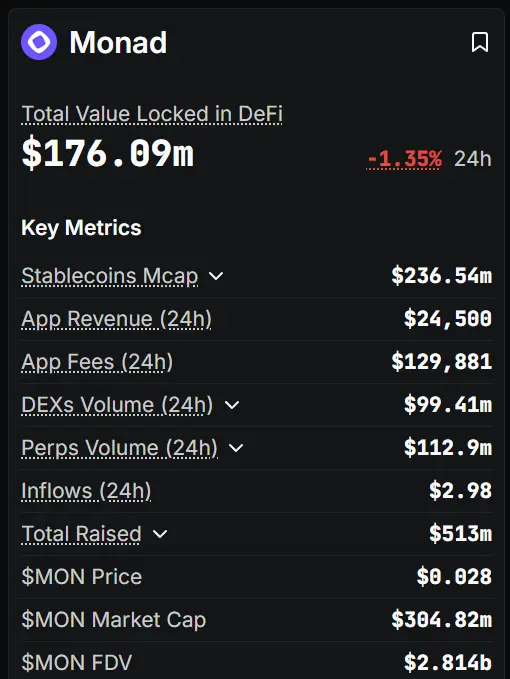

monad is a perfect example of why you need a fck ton of apps in your ecosystem, not just the generic defi and shitcoin launchpads but diverse, innovative new shit to try out

the 100th iteration of memecoins and nfts isn't going to cut it (pretty obvious from the fact that even the main meme couldn't cross 10M mcap)

there's literally nothing to do on there even if i bridge my money, and the TVL reflects that clearly

the 100th iteration of memecoins and nfts isn't going to cut it (pretty obvious from the fact that even the main meme couldn't cross 10M mcap)

there's literally nothing to do on there even if i bridge my money, and the TVL reflects that clearly

MON3,65%

- Reward

- like

- Comment

- Repost

- Share

some of you might have noticed me tweeting over the past weeks about a certain project which was not of the highest quality

that was my first ever paid tweet collab, and will be my last ever.

didn't feel particularly great tweeting about something which i myself am not fully invested in or max farming, plus it's not my style to be told what to tweet about

that doesnt mean i'm not going to tweet about shit projects once in a while, just that i'll actually be invested in those shit projects

that was my first ever paid tweet collab, and will be my last ever.

didn't feel particularly great tweeting about something which i myself am not fully invested in or max farming, plus it's not my style to be told what to tweet about

that doesnt mean i'm not going to tweet about shit projects once in a while, just that i'll actually be invested in those shit projects

- Reward

- like

- Comment

- Repost

- Share

the Four Horsemen of gen wealth in the next few years:

- Prediction markets

- Perps

- Stablecoins

- Privacy (not really, just needed something to fill the fourth spot)

- Prediction markets

- Perps

- Stablecoins

- Privacy (not really, just needed something to fill the fourth spot)

- Reward

- like

- Comment

- Repost

- Share

i personally don’t sell airdrops

what i do is simply transfer my governance rights in exchange for stablecoins to the market, because I believe the market can make better governance decisions

what i do is simply transfer my governance rights in exchange for stablecoins to the market, because I believe the market can make better governance decisions

- Reward

- like

- Comment

- Repost

- Share

Locked in.

- Reward

- like

- Comment

- Repost

- Share

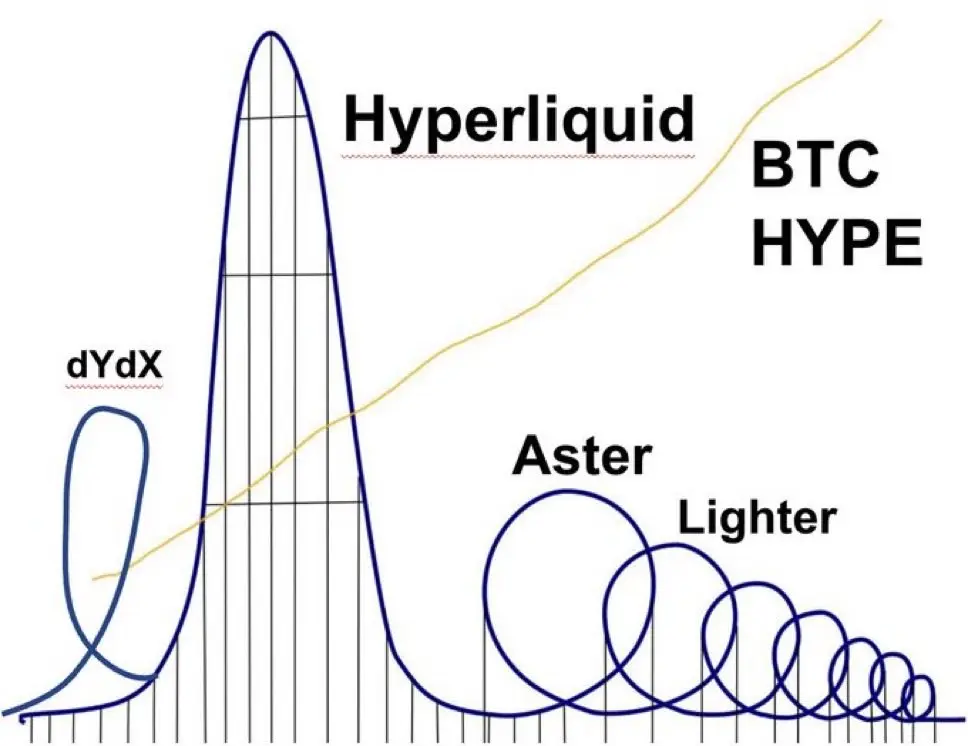

HL bros: “DEX good, CEX bad”

*another DEX appears on the scene*

HL bros: “Our DEX good, every other DEX or CEX bad”

*another DEX appears on the scene*

HL bros: “Our DEX good, every other DEX or CEX bad”

- Reward

- like

- Comment

- Repost

- Share