bitcoindata21

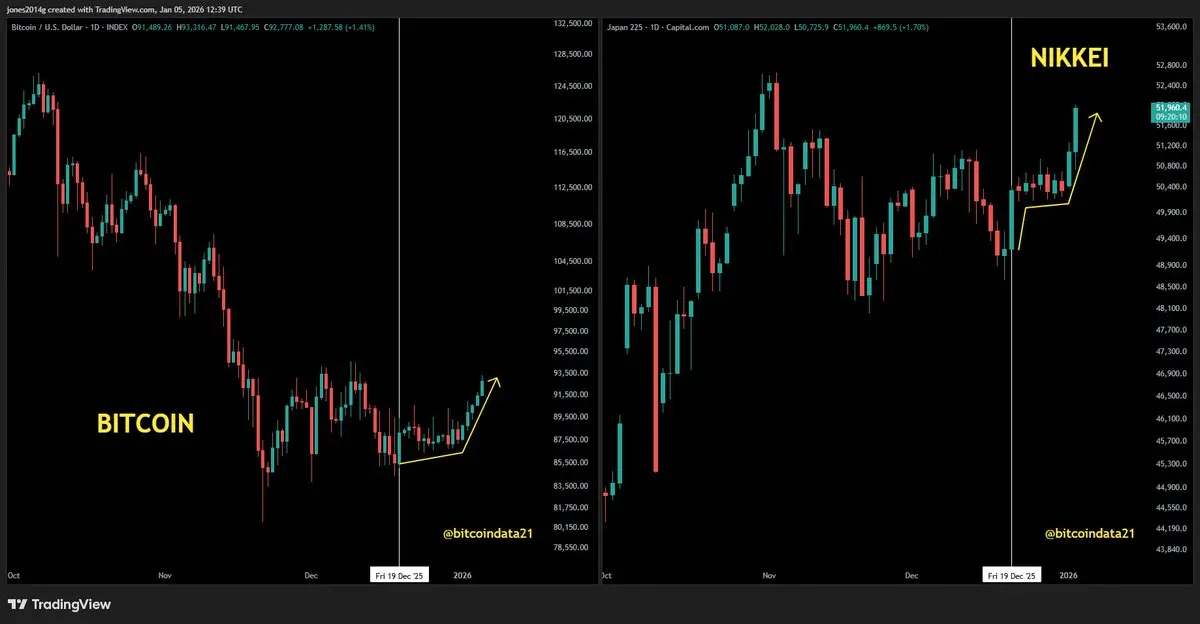

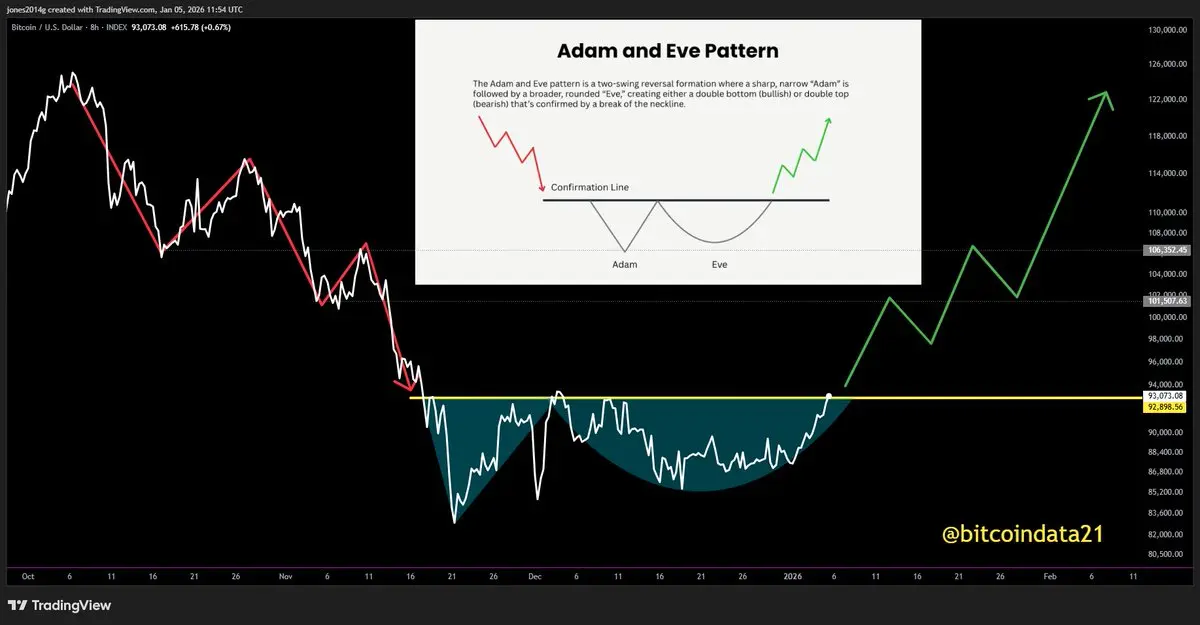

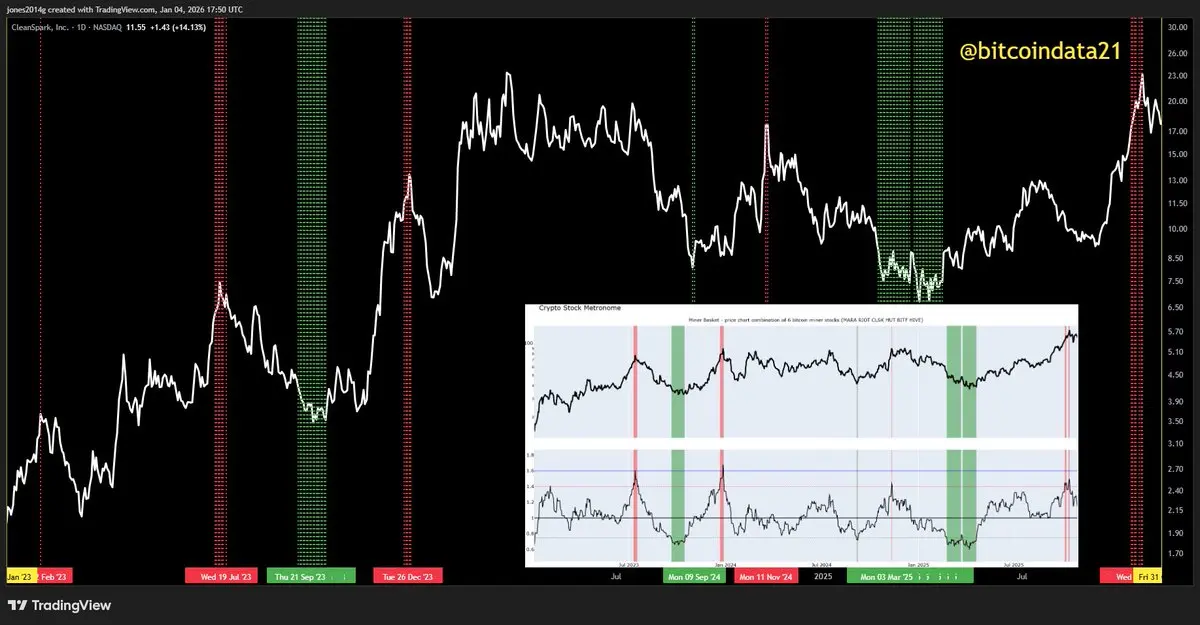

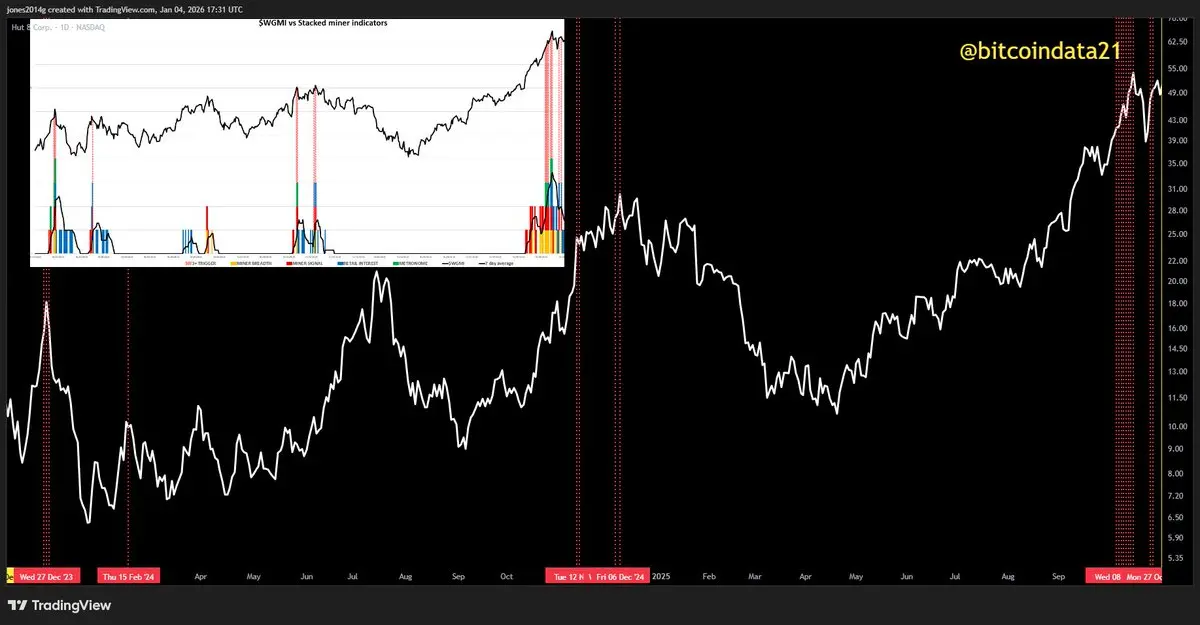

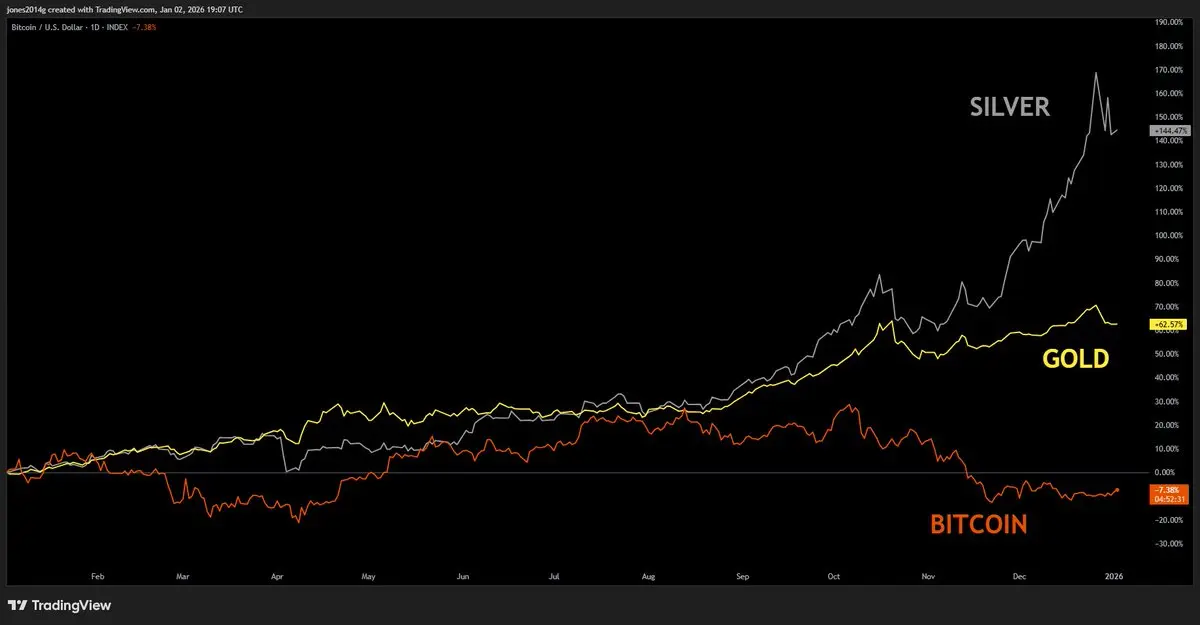

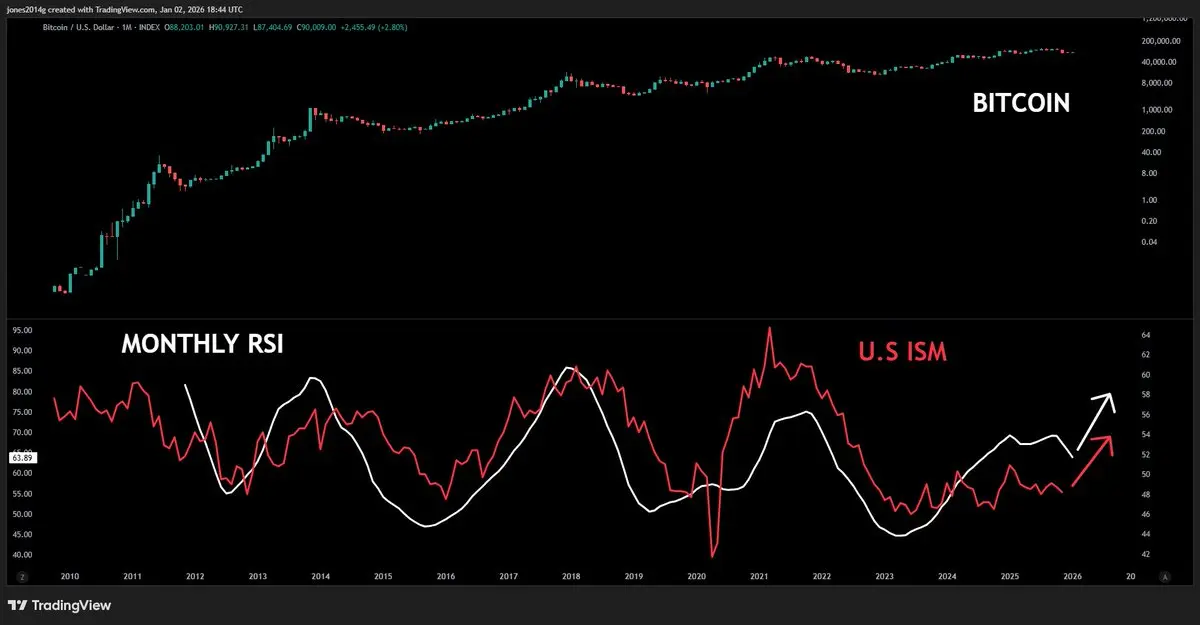

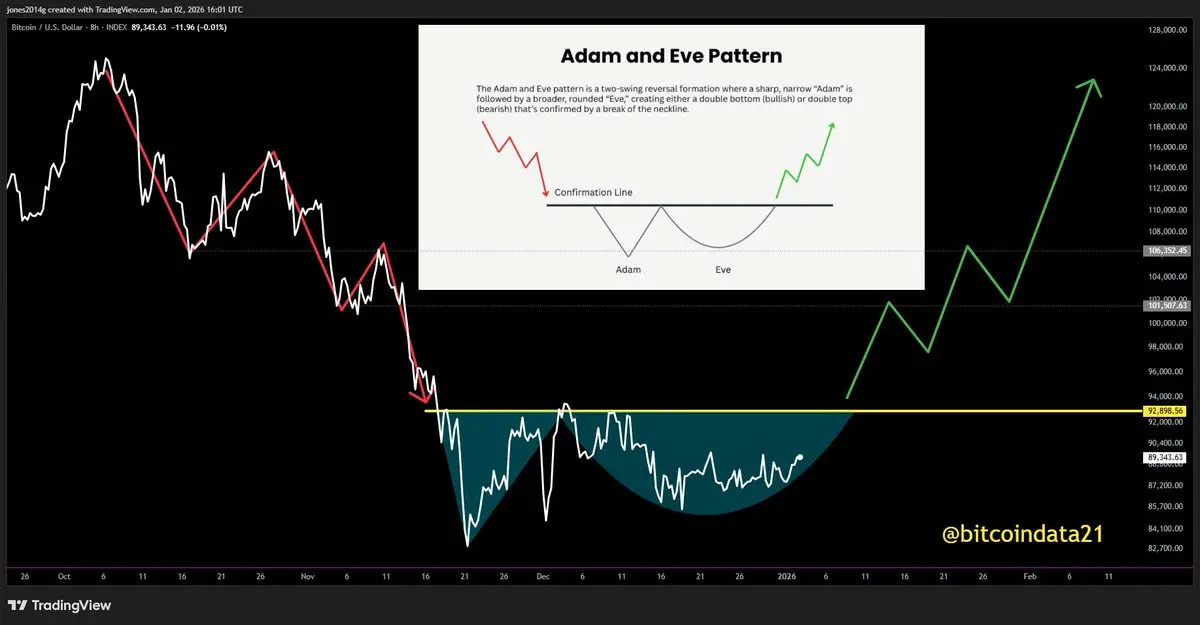

Q4 2025 will go down as the "final boss" capitulation. Making everyone sell the bottom is exactly what the big players wanted.

This could not have gone any better for them, and the KOLs spreading nonsense were just the middle-man puppets required.

Psychology 101, where the collective human minds are their own worst enemies.

This could not have gone any better for them, and the KOLs spreading nonsense were just the middle-man puppets required.

Psychology 101, where the collective human minds are their own worst enemies.