Lucaa

No content yet

Lucaa

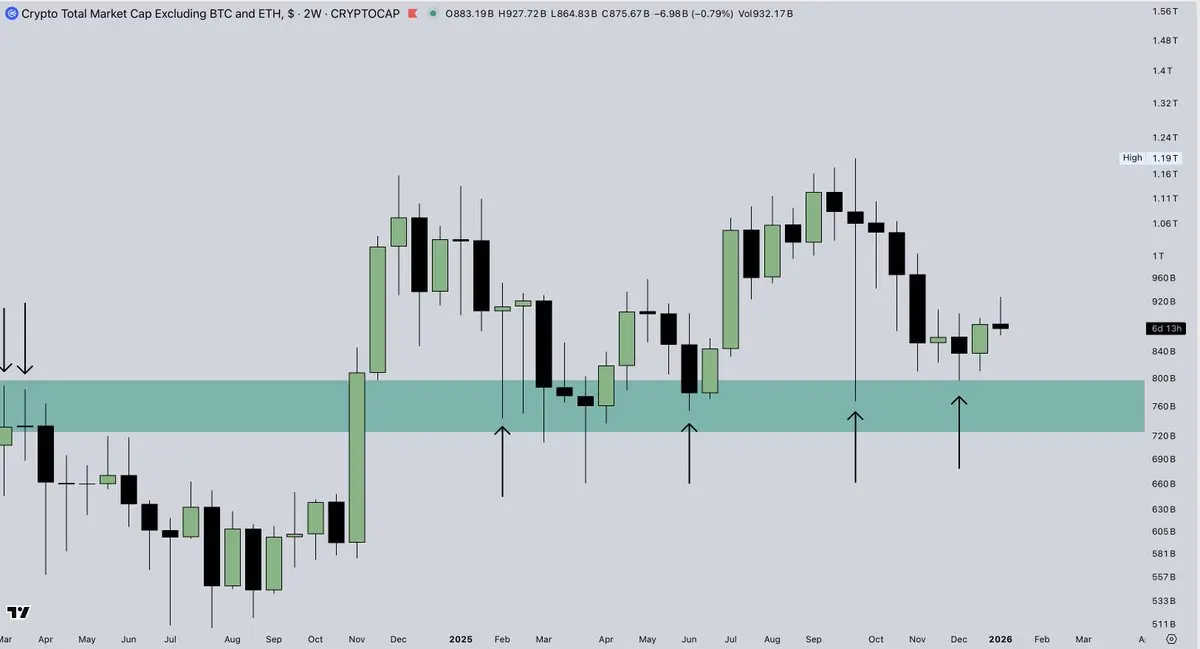

The TOTAL3 has been in a high-timeframe accumulation phase, backtesting the prior high from March 2024 for the past 12 months.

And you're bearish?

And you're bearish?

- Reward

- like

- Comment

- Repost

- Share

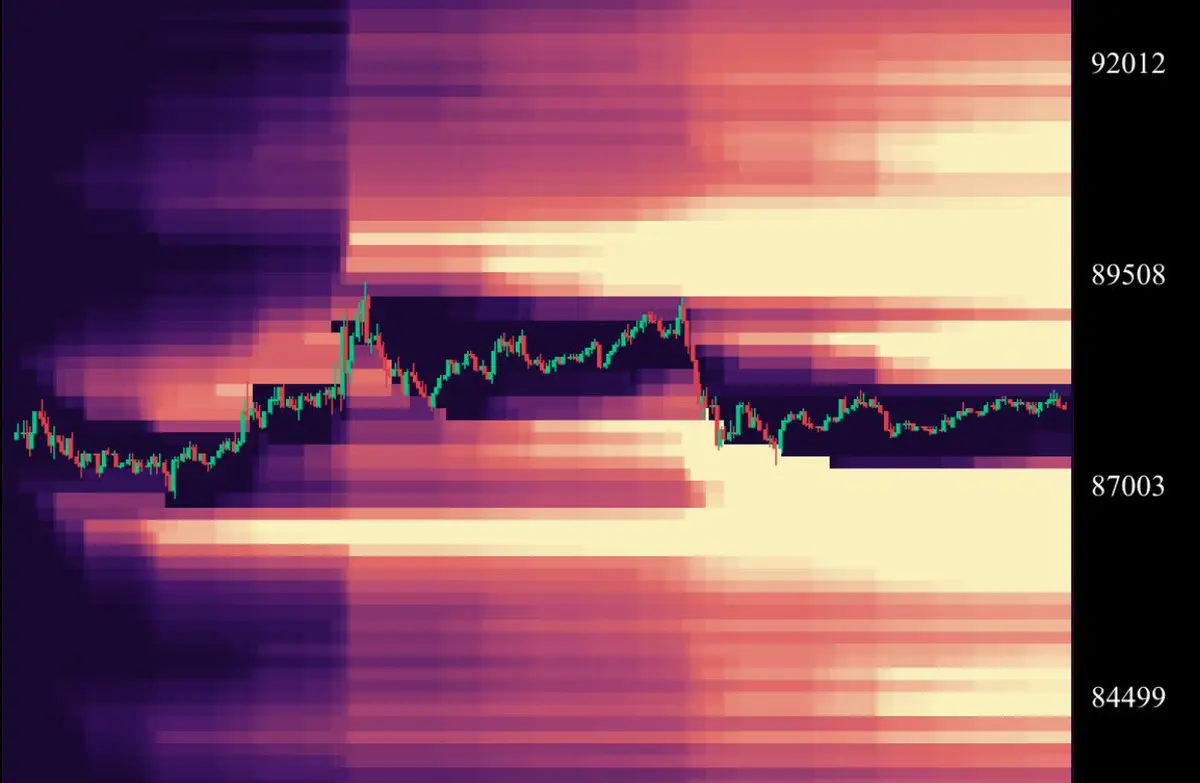

When I look at the $USDT.D chart, all I see is a high-timeframe distributive phase at a high-timeframe resistance that precedes a large reversal to the downside.

Yet so many are currently fearful, exactly like the last times this range got tested in this bull market.

Yet so many are currently fearful, exactly like the last times this range got tested in this bull market.

- Reward

- like

- Comment

- Repost

- Share

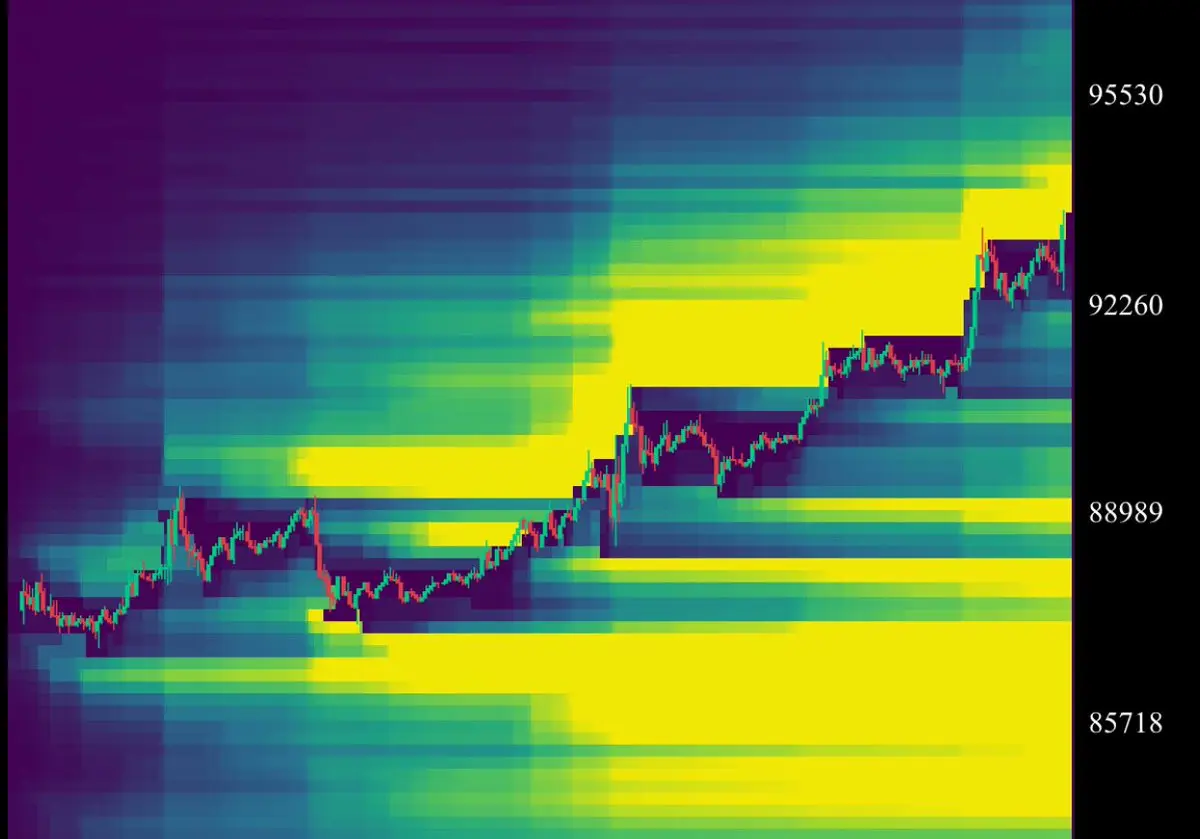

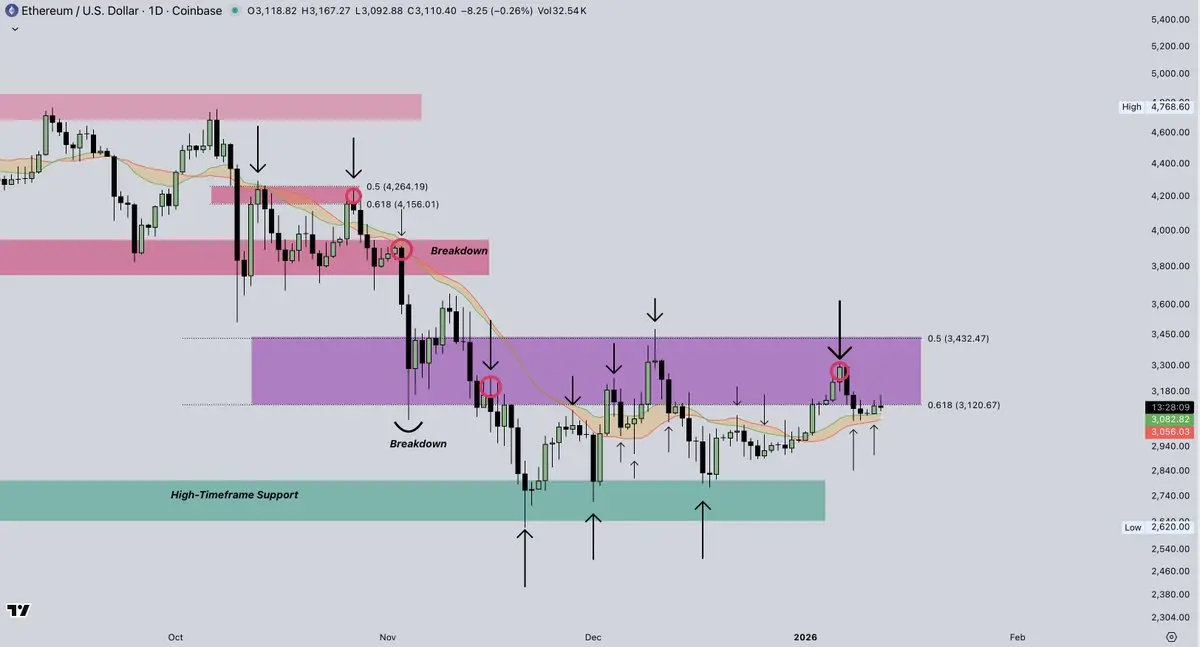

$ETH - I’m still not a big fan of the market structure on the low-timeframes, but it is improving.

A couple of days ago, the price rejected at the lost high-timeframe support range marked in purple, aligning with the golden pocket between the 0.5 and 0.618 Fibonacci POIs, which I covered in some of my prior updates.

That said, the price tapped into the 1D Bull Market Support Band, a strong reversal spot over the last couple of months, and has since bounced off of it.

As long as the price continues to hold above this range, I believe the most likely outcome remains further upside from here, eve

A couple of days ago, the price rejected at the lost high-timeframe support range marked in purple, aligning with the golden pocket between the 0.5 and 0.618 Fibonacci POIs, which I covered in some of my prior updates.

That said, the price tapped into the 1D Bull Market Support Band, a strong reversal spot over the last couple of months, and has since bounced off of it.

As long as the price continues to hold above this range, I believe the most likely outcome remains further upside from here, eve

ETH0,03%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

$IWM - As I’ve mentioned in some of my prior PAT Updates, I believe our main focus should be on the 1D Bull Market Support Band, which has been a strong reversal spot over the last couple of months, and on Fibonacci extension levels, specifically the 1.414 and 1.618 POIs at $275–$290, where I’ll be looking to de-risk part of my spot holdings in small-caps and rotate capital into other asset classes, as we’re currently in price discovery.

I believe that as long as the price holds above the support band, the most likely outcome remains further upside.

However, if the price were to break below it

I believe that as long as the price holds above the support band, the most likely outcome remains further upside.

However, if the price were to break below it

- Reward

- like

- Comment

- Repost

- Share

For me, trading just doesn’t make much sense.

The whole point of investing, at least the way I see it, is to buy yourself time first,the money follows later.

That’s why I think day-trading is one of the most overhyped and over-marketed ideas out there. It’s pushed hard by gurus because it sells the dream of fast money.

In reality, chasing quick gains usually underperforms simply holding positions with a plan.

What actually compounds over years isn’t staring at every tick on a screen, but having a strategy you can realistically stick to.

The whole point of investing, at least the way I see it, is to buy yourself time first,the money follows later.

That’s why I think day-trading is one of the most overhyped and over-marketed ideas out there. It’s pushed hard by gurus because it sells the dream of fast money.

In reality, chasing quick gains usually underperforms simply holding positions with a plan.

What actually compounds over years isn’t staring at every tick on a screen, but having a strategy you can realistically stick to.

- Reward

- like

- Comment

- Repost

- Share

GM

Tons of updates are on your way later today. Stay tuned! 😁🔥

Tons of updates are on your way later today. Stay tuned! 😁🔥

- Reward

- like

- Comment

- Repost

- Share

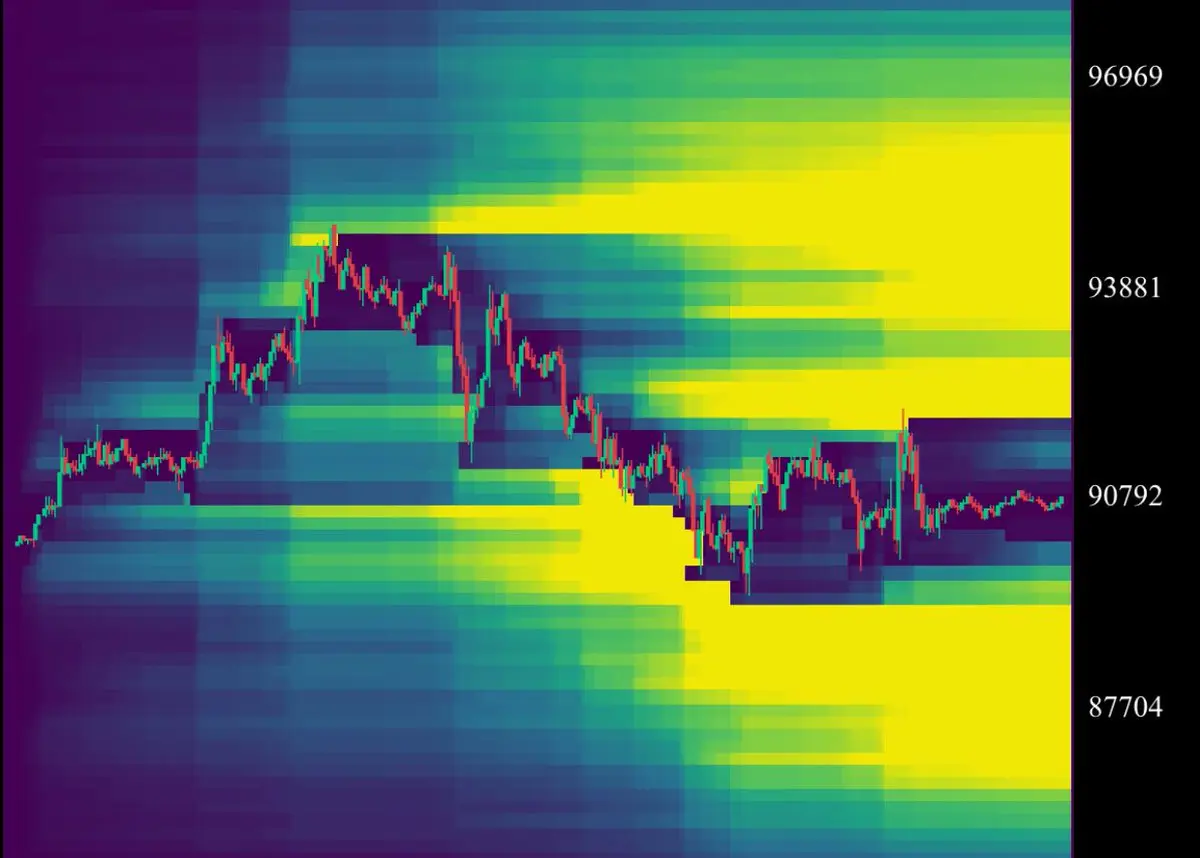

$BTC – For now, my overall standpoint hasn’t changed, as the price still hasn’t managed to break above the lost high-timeframe support range, marked in purple, which has been a strong reversal spot over the last couple of months.

Because of this, I believe that the best approach is to remain somewhat cautious and ready for a potential rejection.

Going forward, if the price can manage to break above this range, that would be a clear sign of strength and in that case, I would flip fully bullish.

Until then, I’m keeping some cash on the side, ready to hedge part of my spot holdings in order to mi

Because of this, I believe that the best approach is to remain somewhat cautious and ready for a potential rejection.

Going forward, if the price can manage to break above this range, that would be a clear sign of strength and in that case, I would flip fully bullish.

Until then, I’m keeping some cash on the side, ready to hedge part of my spot holdings in order to mi

BTC-0,26%

- Reward

- like

- Comment

- Repost

- Share

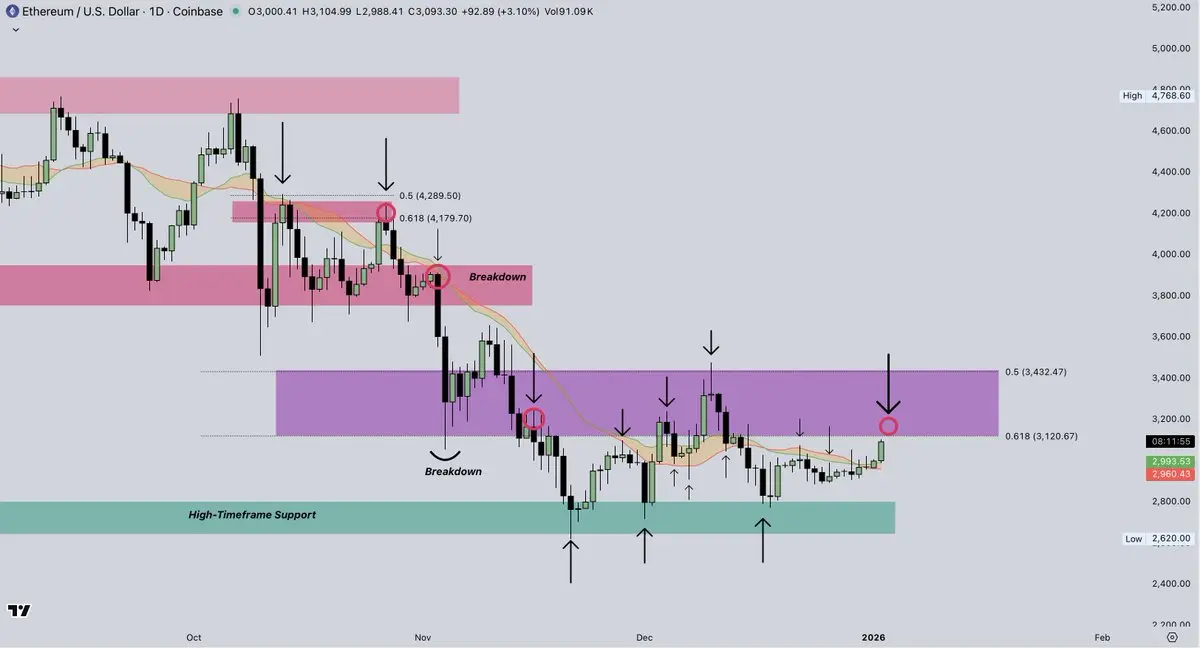

$ETH – I’m not liking the market structure here very much.

Even though the price has managed to break back above the 1D Bull Market Support Band, which has been a strong reversal spot over the last couple of months, the price still needs to durably reclaim the 0.618 Fibonacci POI, currently sitting at $3,120, in order to flip the low-timeframe outlook bullish again.

Until that happens, I believe that the best approach, just like with Bitcoin, is to remain somewhat cautious and ready for a potential rejection.

That’s why I’m keeping some cash on the side, ready to hedge part of my spot holdings

Even though the price has managed to break back above the 1D Bull Market Support Band, which has been a strong reversal spot over the last couple of months, the price still needs to durably reclaim the 0.618 Fibonacci POI, currently sitting at $3,120, in order to flip the low-timeframe outlook bullish again.

Until that happens, I believe that the best approach, just like with Bitcoin, is to remain somewhat cautious and ready for a potential rejection.

That’s why I’m keeping some cash on the side, ready to hedge part of my spot holdings

- Reward

- like

- Comment

- Repost

- Share

Happy New Year everyone! 🎉🎉

As we close 2025, I hope I brought positivity and clarity to your timelines and helped with challenges of the markets.

My goal has always been to provide value, whether through personal perspectives, strategies, or helping you improve your own skills.

This year has been an incredible journey. I’ve made amazing friends, learned from brilliant people, and grown alongside all of you.

Together we managed to create something special, a platform we’re working on, a team that is all working together to bring out the most valuable analysis and managed to grow from 30,00

As we close 2025, I hope I brought positivity and clarity to your timelines and helped with challenges of the markets.

My goal has always been to provide value, whether through personal perspectives, strategies, or helping you improve your own skills.

This year has been an incredible journey. I’ve made amazing friends, learned from brilliant people, and grown alongside all of you.

Together we managed to create something special, a platform we’re working on, a team that is all working together to bring out the most valuable analysis and managed to grow from 30,00

- Reward

- like

- Comment

- Repost

- Share

80K might be the new 15K

- Reward

- like

- Comment

- Repost

- Share

You’re not an investor if you worry about the daily price action.

- Reward

- like

- Comment

- Repost

- Share

$COIN – I’m not liking the market structure here at all, as the price has broken below the high-timeframe support range I highlighted in some of my prior updates, aligning with the 0.618 Fibonacci POI at $241, which is a clear sign of weakness.

That said, I’m waiting on further signs before taking a more decisive stance, since this could still end up being just a deviation below support.

However, if the weakness continues, I would look to fully hedge my entire spot position, since a durable break below this range would open the door for a deeper pullback on the mid-term and would be a clear st

That said, I’m waiting on further signs before taking a more decisive stance, since this could still end up being just a deviation below support.

However, if the weakness continues, I would look to fully hedge my entire spot position, since a durable break below this range would open the door for a deeper pullback on the mid-term and would be a clear st

- Reward

- like

- Comment

- Repost

- Share

$TSLA - The base case seems to be playing out, with the price reaching the 1D Bull Market Support Band after rejecting at the high-timeframe resistance range between the 1.272 and 1.414 Fibonacci extension levels.

That said, the price seems to be breaking below it, so if the weakness continues in the coming days, I'll be looking to hedge part of my spot holdings in order to mitigate the short-term downside risk, since that would open the door for a deeper pullback toward the prior high-timeframe resistance range, marked in red, aligning with the 0.786 Fibonacci POI at $430, before a more durab

That said, the price seems to be breaking below it, so if the weakness continues in the coming days, I'll be looking to hedge part of my spot holdings in order to mitigate the short-term downside risk, since that would open the door for a deeper pullback toward the prior high-timeframe resistance range, marked in red, aligning with the 0.786 Fibonacci POI at $430, before a more durab

- Reward

- like

- Comment

- Repost

- Share

$TSLA - Looks like the price has rejected at the resistance range between the 1.272 and 1.414 Fibonacci extension levels, which I covered in some of my prior updates.

That said, I believe that the base case remains intact, a test of the 1D Bull Market Support Band, currently sitting at $461, in case of a rejection at this resistance range, before a more durable reversal to the upside.

If, however, the price were to break below the support band, I would look to hedge part of my spot holdings in order to mitigate the short-term downside risk, since that would open the door for a deeper pullback

That said, I believe that the base case remains intact, a test of the 1D Bull Market Support Band, currently sitting at $461, in case of a rejection at this resistance range, before a more durable reversal to the upside.

If, however, the price were to break below the support band, I would look to hedge part of my spot holdings in order to mitigate the short-term downside risk, since that would open the door for a deeper pullback

- Reward

- like

- Comment

- Repost

- Share

GM

My 2026 Outlook thread is dropping today. Stay tuned! 😁🔥

My 2026 Outlook thread is dropping today. Stay tuned! 😁🔥

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More6.46K Popularity

7.45K Popularity

51.36K Popularity

13.95K Popularity

87.55K Popularity

Pin