Satoshitalks

No content yet

Satoshitalks

Wild math check on Greenland:

If Trump’s offer was $100K per person, acquiring Greenland would cost the U.S. roughly $5.7B total.

For scale: that’s a rounding error in the federal budget.

Geopolitics isn’t expensive — indecision is.

If Trump’s offer was $100K per person, acquiring Greenland would cost the U.S. roughly $5.7B total.

For scale: that’s a rounding error in the federal budget.

Geopolitics isn’t expensive — indecision is.

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

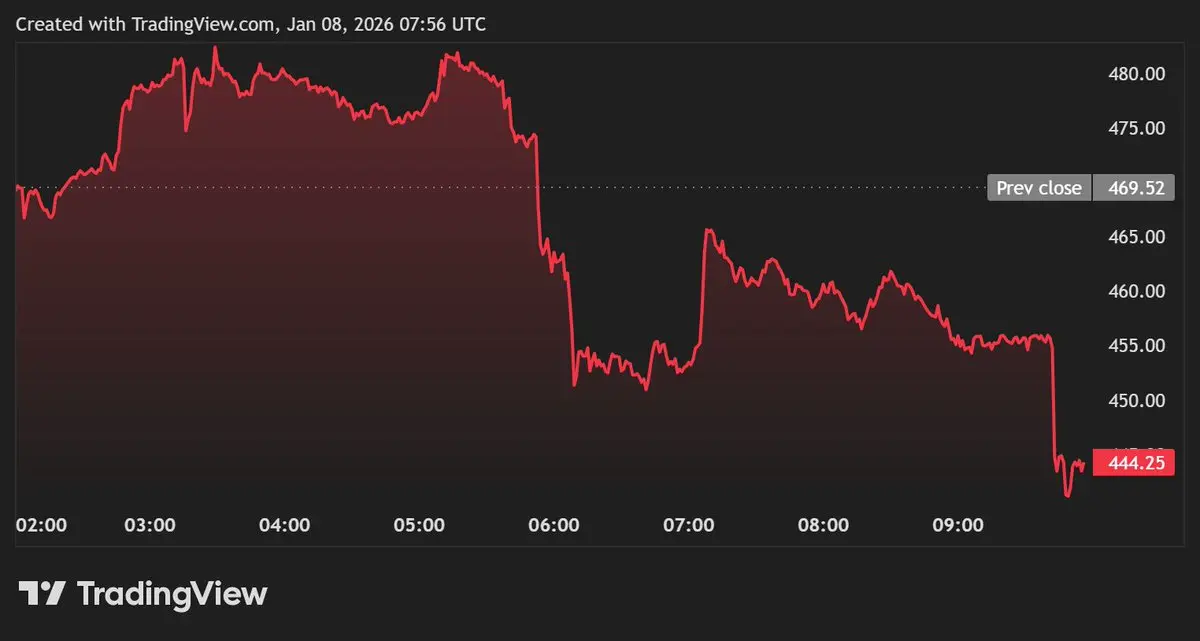

🚨 @ just expanded into TradFi perps.

What launched:

Gold perpetuals (XAUUSDT)

Silver perpetuals (XAGUSDT)

24/7 trading with crypto collateral

Crypto rails absorbing traditional markets.

What launched:

Gold perpetuals (XAUUSDT)

Silver perpetuals (XAGUSDT)

24/7 trading with crypto collateral

Crypto rails absorbing traditional markets.

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

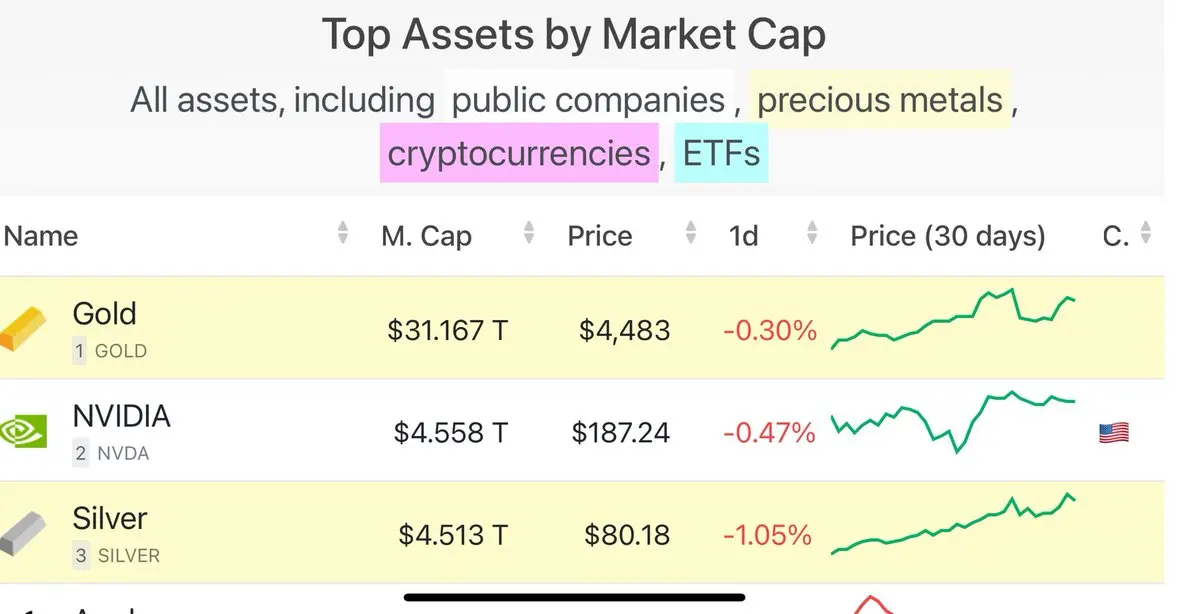

Gold & silver reclaim the top market-cap ranks.

Quick list update:

1. #Gold market cap: $31.1T

2. #Silver briefly > Nvidia

Back-and-forth since December

Precious metals flexing while tech cools.

Quick list update:

1. #Gold market cap: $31.1T

2. #Silver briefly > Nvidia

Back-and-forth since December

Precious metals flexing while tech cools.

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- 1

- Repost

- Share

Sanam_Chowdhury :

:

Happy New Year! 🤑- Reward

- like

- Comment

- Repost

- Share

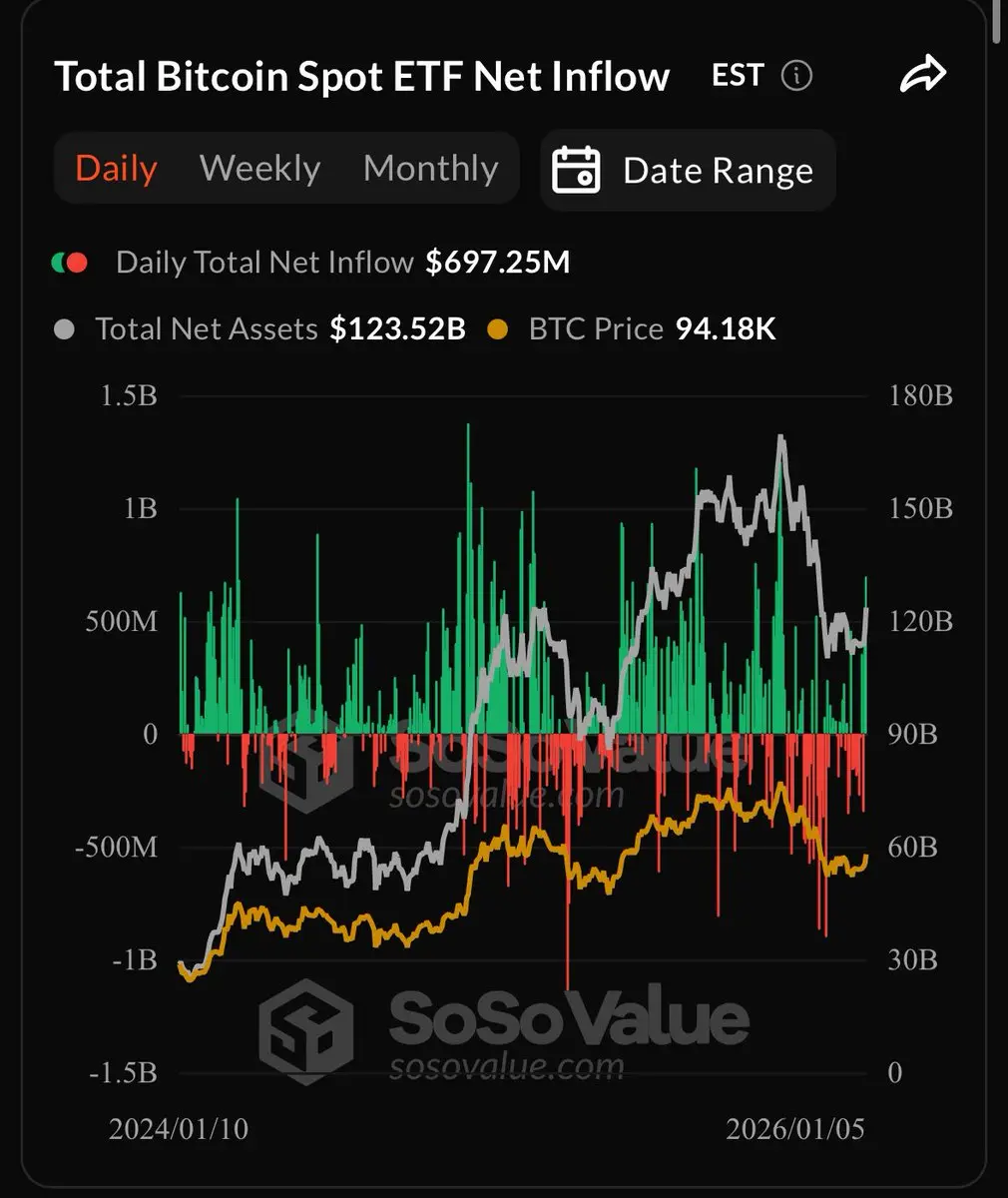

Bitcoin ETFs are starting 2026 strong.

What the data shows:

$697M net inflows Monday

Largest daily inflows since early October

2026 inflows already >$1.16B

Sentiment improving into the new year

Flows flip before price follows.

What the data shows:

$697M net inflows Monday

Largest daily inflows since early October

2026 inflows already >$1.16B

Sentiment improving into the new year

Flows flip before price follows.

BTC-0,01%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

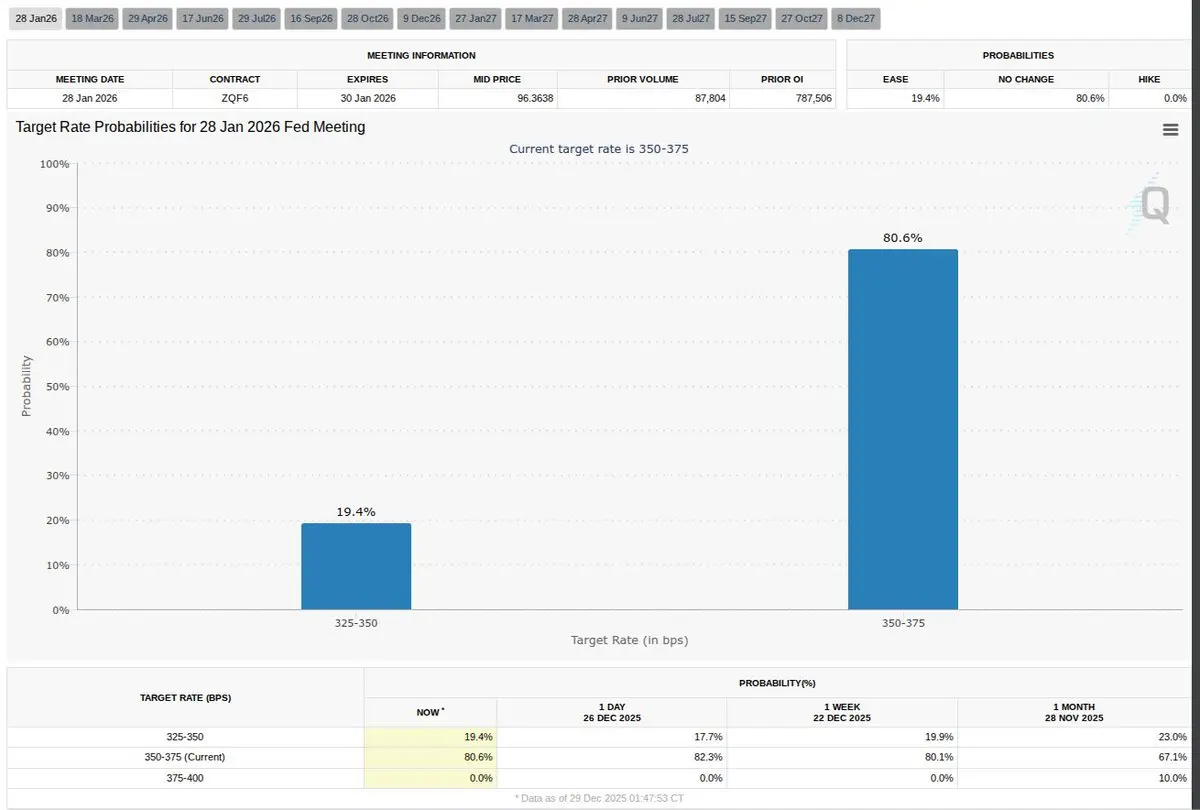

Crypto is starting 2026 on the sidelines.

Current setup:

Stocks & precious metals near ATHs

Bitcoin rejected ~$90K again

January rate cuts not priced in

Macro flows still favor TradFi

Liquidity moves last — but it moves hardest.

Current setup:

Stocks & precious metals near ATHs

Bitcoin rejected ~$90K again

January rate cuts not priced in

Macro flows still favor TradFi

Liquidity moves last — but it moves hardest.

BTC-0,01%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

🚨 “Q1 2026 will be unbelievable for crypto.”

— Not Eric Trump.

But the setup is there:

Regulation finally clearing

Institutional flows building

Liquidity quietly improving

Markets move before headlines do.

— Not Eric Trump.

But the setup is there:

Regulation finally clearing

Institutional flows building

Liquidity quietly improving

Markets move before headlines do.

- Reward

- like

- Comment

- Repost

- Share

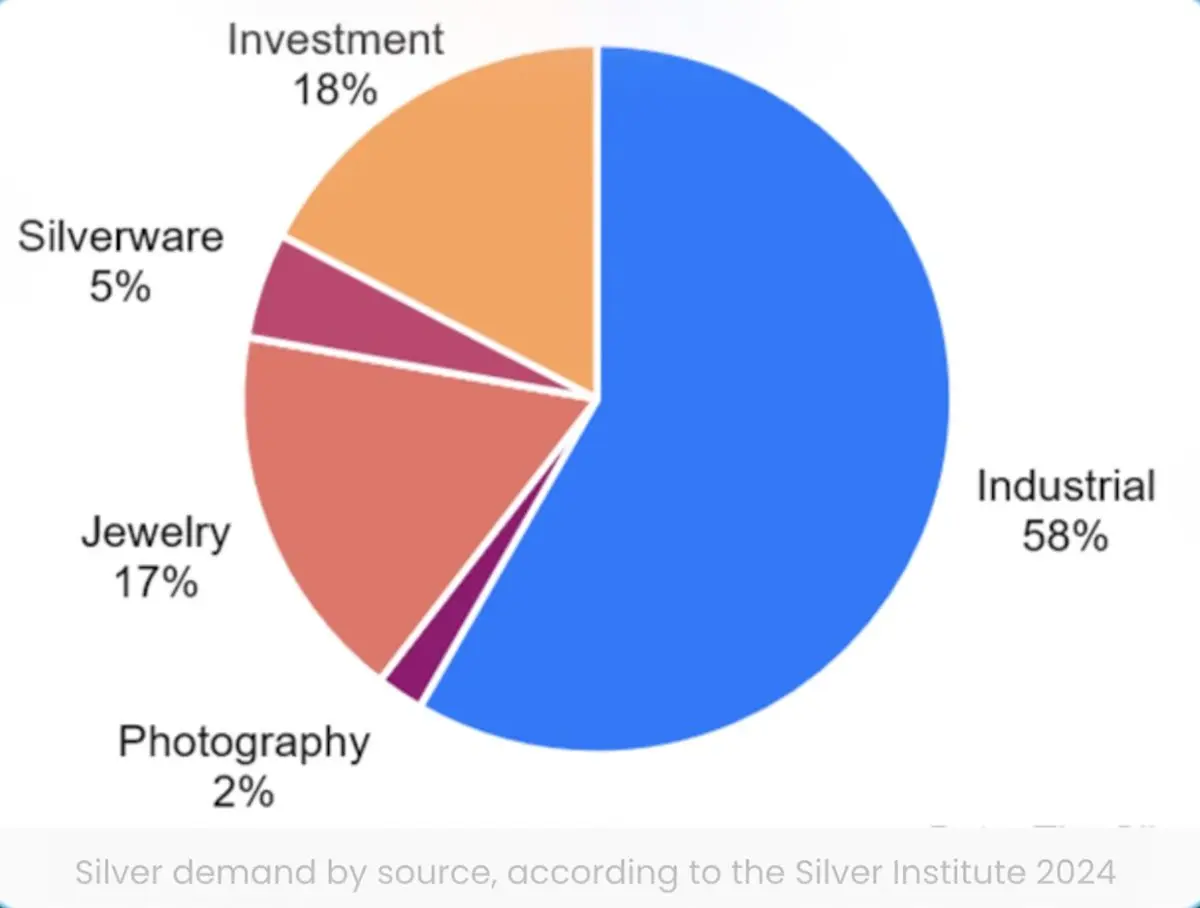

Most people miss this about silver.

~60% of global silver demand is industrial.

That means higher silver prices don’t just hit investors — they hit products.

If demand tightens, costs show up downstream.

2026 could make that very visible.

~60% of global silver demand is industrial.

That means higher silver prices don’t just hit investors — they hit products.

If demand tightens, costs show up downstream.

2026 could make that very visible.

- Reward

- like

- Comment

- Repost

- Share