2026 AIR Price Prediction: Expert Analysis and Market Forecast for Airline Industry Recovery

Introduction: AIR's Market Position and Investment Value

AIRian (AIR), as a Web3 community project based on DePIN and Sport AI infrastructure, has been developing its health-focused ecosystem since its launch in 2024. As of 2026, AIR maintains a market capitalization of approximately $1.40 million, with a circulating supply of around 157.33 million tokens, and the price hovers around $0.008876. This asset, positioned as a "health data-driven community token," is playing an increasingly notable role in the intersection of decentralized physical infrastructure and fitness technology.

This article will comprehensively analyze AIR's price trajectory from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. AIR Price History Review and Market Status

AIR Historical Price Evolution Trajectory

- 2024: AIR reached a notable price level of $0.15 in July, marking a significant milestone in its early trading period

- 2025: The token experienced substantial volatility, with the price declining to $0.00022 in November, representing a considerable correction from previous levels

- 2026: As of early February, AIR is trading at $0.008876, showing a recovery from its previous low point

AIR Current Market Status

AIRian (AIR) is currently priced at $0.008876 as of February 02, 2026. The token has experienced mixed short-term performance, with a decline of 4.096% over the past hour and 8.97% over the past 24 hours. The 7-day performance shows a decrease of 13.96%, indicating recent downward pressure.

However, the 30-day trend presents a contrasting picture, with AIR recording gains of 24.79%, suggesting some recovery momentum in the medium term. The yearly performance shows a decline of 71.25%, reflecting the broader market correction that occurred throughout 2025.

The token's 24-hour trading range has been between $0.00887 and $0.010175, with a daily trading volume of $12,873.23. AIR currently holds a market ranking of 2296, with a circulating supply of 157,326,692 tokens out of a maximum supply of 1,000,000,000 tokens. This represents approximately 15.73% of the total supply in circulation.

The market capitalization stands at $1,396,431.72, while the fully diluted valuation reaches $8,876,000. The market cap to FDV ratio of 15.73% indicates a relatively low circulating supply compared to the total token allocation. AIR holds a market dominance of 0.00032% and is supported by 557 token holders.

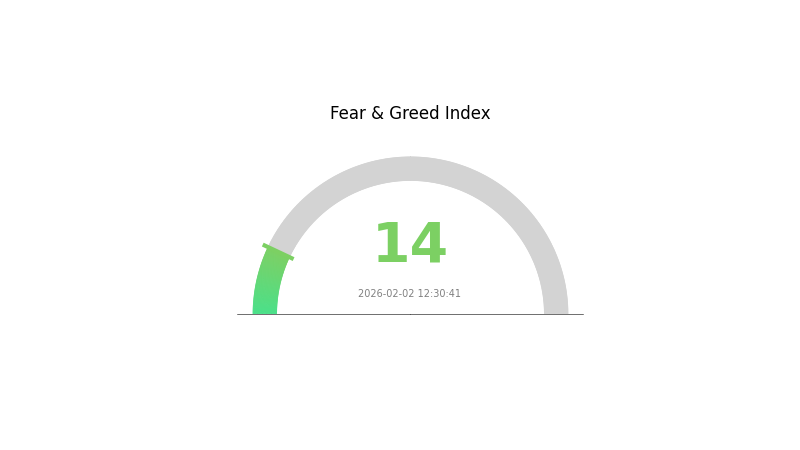

The current market sentiment index indicates a reading of 14, classified as "Extreme Fear," reflecting cautious investor sentiment in the broader cryptocurrency market.

Click to view current AIR market price

AIR Market Sentiment Indicator

2026-02-02 Fear & Greed Index: 14 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear & Greed Index at 14. This indicates significant pessimism among investors and heightened risk aversion. When the index reaches such low levels, it typically signals oversold market conditions, presenting potential contrarian opportunities for long-term investors. However, caution remains warranted as negative sentiment can persist. Monitor market fundamentals closely and consider dollar-cost averaging strategies during prolonged fear phases. Stay informed through Gate.com's market analysis tools for comprehensive insights.

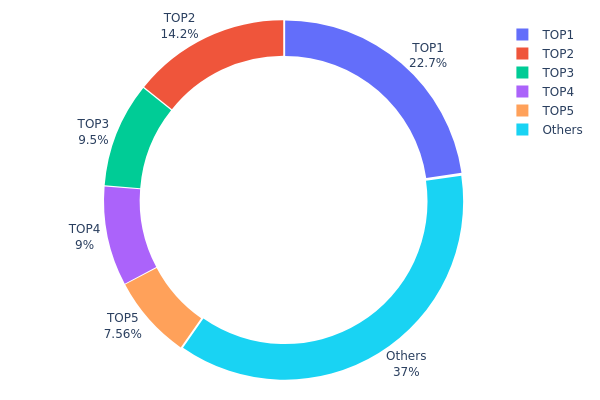

AIR Holding Distribution

The holding distribution chart reveals the concentration of token ownership across different addresses on the blockchain, serving as a critical indicator of market structure and decentralization level. For AIR, the current data shows a moderately concentrated distribution pattern. The top 5 addresses collectively hold approximately 62.99% of the total supply, with the largest holder controlling 22.68% (226.8M tokens), followed by the second-largest at 14.25% (142.5M tokens). The remaining addresses outside the top 5 account for 37.01% of the supply, suggesting a relatively diverse ownership base beyond the major holders.

This concentration level indicates a semi-centralized structure that warrants attention. While not reaching extreme concentration thresholds, the dominance of top holders creates potential risks for price manipulation and increased volatility during large-scale sell-offs. The presence of multiple large holders rather than a single dominant entity provides some balance, reducing the likelihood of unilateral market control. However, coordinated actions among top addresses could still significantly impact price dynamics.

From a market stability perspective, the current distribution reflects a maturing token ecosystem with established whale positions alongside growing retail participation. The 37.01% held by smaller addresses demonstrates healthy community engagement and broader accessibility. This structure suggests moderate liquidity concentration, where major movements by top holders could trigger cascading effects, but the diversified secondary tier offers some cushioning against single-point failures in market confidence.

Click to view current AIR Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xd3ae...73367e | 226800.00K | 22.68% |

| 2 | 0x822c...52c380 | 142500.00K | 14.25% |

| 3 | 0x7593...617a48 | 95000.00K | 9.50% |

| 4 | 0xe118...839acc | 90000.00K | 9.00% |

| 5 | 0x0a04...7752d5 | 75600.00K | 7.56% |

| - | Others | 370100.00K | 37.01% |

II. Core Factors Influencing AIR's Future Price

Supply Mechanism

- AI-Driven Supply Optimization: AIR's supply mechanism is increasingly influenced by AI-enhanced production systems. As referenced in materials, AI integration is driving demand growth while supply constraints persist, particularly in semiconductor and memory sectors that underpin AI infrastructure.

- Historical Patterns: Historical data shows that periods of rapid AI infrastructure expansion have coincided with supply bottlenecks in critical components. Memory price increases of approximately 100% have occurred during previous demand surges, creating cost pressures that influence pricing dynamics.

- Current Impact: Current supply limitations in advanced process chips (particularly 3nm technology) are constraining production flexibility. Combined with strong demand growth of 23% in key sectors, supply chains face reduced agility, potentially supporting price stability or increases in AIR-related assets.

Institutional and Major Holder Dynamics

- Institutional Holdings: Major technology companies are significantly expanding AI investments. Research and development expenditures have increased 31% year-over-year, with substantial capital flowing into AI infrastructure and capabilities.

- Corporate Adoption: Leading enterprises across sectors are integrating AI technologies at scale. One major technology firm has deployed AI across over 900 internal scenarios, while AI coding assistance is now utilized by over 90% of engineers at another leading company.

- National Policies: China's "Artificial Intelligence+" initiative and the "AI+Manufacturing" specialized action plan aim to promote AI application across industries. The "15th Five-Year Plan" emphasizes integrating AI with industrial development, cultural construction, and social governance, with targets to establish 500 typical application scenarios by 2027.

Macroeconomic Environment

- Monetary Policy Impact: Global memory pricing pressures and component cost increases are creating margin compression concerns. While current gross margins remain stable at 48-49%, forward guidance suggests increasing cost pressures may affect profitability in coming quarters.

- Inflation Hedge Attributes: AI infrastructure investments are accelerating despite cost pressures, suggesting strong underlying demand. Daily token consumption in China increased from 100 billion to over 30 trillion within 18 months, reflecting 300x growth in AI application deployment.

- Geopolitical Factors: International technology competition is intensifying, with differentiated AI development paths emerging. China's focus on open-source innovation and efficiency-optimized architectures (exemplified by DeepSeek) contrasts with closed-source approaches, potentially creating distinct value propositions.

Technology Development and Ecosystem Building

- Sparse Attention Mechanisms: Advanced algorithms like NSA (Next-generation Sparse Attention) and MoBA are improving inference efficiency by focusing computational resources on critical information rather than processing all data uniformly. This "intelligent density" approach enables more capable models with lower resource requirements.

- Intelligent Agent Evolution: AI is transitioning from conversational interfaces toward autonomous agents capable of task planning, execution, and iterative learning. These agents exhibit autonomy, generalization ability, and long-term memory, expanding AI's practical utility across industries.

- Ecosystem Applications: AI applications are penetrating manufacturing (25.9% of deployments, up from 19.9%), with particular strength in automotive, robotics, and consumer electronics sectors. Over 100 enterprise clients now consume over 1 trillion tokens, indicating deep integration into business operations. The active device base supporting AI capabilities continues expanding, creating network effects that enhance ecosystem value.

III. 2026-2031 AIR Price Forecast

2026 Outlook

- Conservative Forecast: $0.00506 - $0.00888

- Neutral Forecast: $0.00888 (average market scenario)

- Optimistic Forecast: $0.01181 (requires favorable market conditions and increased adoption)

2027-2029 Mid-term Outlook

- Market Phase Expectation: AIR is anticipated to enter a gradual growth phase, with potential ecosystem expansion and wider recognition in the cryptocurrency market.

- Price Range Forecast:

- 2027: $0.00838 - $0.01406 (approximately 16% average price increase)

- 2028: $0.00622 - $0.01428 (approximately 37% average price increase from 2026)

- 2029: $0.00675 - $0.01522 (approximately 49% average price increase from 2026)

- Key Catalysts: Potential drivers include technological developments within the AIR ecosystem, broader market acceptance, strategic partnerships, and overall cryptocurrency market sentiment during this period.

2030-2031 Long-term Outlook

- Baseline Scenario: $0.00811 - $0.01423 by 2030 (approximately 60% average price increase from 2026, assuming steady market development)

- Optimistic Scenario: $0.01568 - $0.01838 by 2031 (approximately 90% average price increase from 2026, contingent upon significant ecosystem growth and favorable regulatory environment)

- Transformative Scenario: Potential to reach upper bounds of $0.01950 in 2030 under exceptionally favorable conditions including mass adoption, major technological breakthroughs, and strong institutional interest

- 2026-02-02: AIR trading within initial forecast range, positioned for potential long-term growth trajectory

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.01181 | 0.00888 | 0.00506 | 0 |

| 2027 | 0.01406 | 0.01034 | 0.00838 | 16 |

| 2028 | 0.01428 | 0.0122 | 0.00622 | 37 |

| 2029 | 0.01522 | 0.01324 | 0.00675 | 49 |

| 2030 | 0.0195 | 0.01423 | 0.00811 | 60 |

| 2031 | 0.01838 | 0.01686 | 0.01568 | 90 |

IV. AIR Professional Investment Strategies and Risk Management

AIR Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors seeking exposure to DePIN and Sport AI sectors with moderate risk tolerance

- Operational Recommendations:

- Consider gradual accumulation during market pullbacks, particularly when price approaches recent support levels around $0.0089

- Monitor ecosystem development milestones and community growth metrics (current holder count: 557)

- Secure Storage Solution: Gate Web3 Wallet offers multi-layer security features for ERC-20 tokens like AIR

(2) Active Trading Strategy

- Technical Analysis Tools:

- Moving Averages: Monitor 7-day and 30-day trends; current data shows -13.96% (7D) versus +24.79% (30D), indicating potential volatility

- Volume Analysis: Track 24-hour trading volume ($12,873) relative to market cap ($1.4M) to identify liquidity conditions

- Swing Trading Considerations:

- Set stop-loss orders below recent low of $0.00887 to manage downside risk

- Consider profit-taking near resistance levels, particularly the 24-hour high of $0.010175

AIR Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio allocation

- Aggressive Investors: 3-5% of crypto portfolio allocation

- Professional Investors: Up to 5-8% with active monitoring and hedging strategies

(2) Risk Hedging Solutions

- Portfolio Diversification: Balance AIR exposure with established large-cap cryptocurrencies to reduce correlation risk

- Position Sizing: Limit single-position exposure given the token's market cap rank (#2296) and relatively low liquidity

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for convenient trading and ecosystem participation

- Cold Storage Option: Consider hardware wallet solutions for long-term holdings exceeding personal risk thresholds

- Security Precautions: Verify contract address (0x294b9da569c0d694870239813bbe7b5824fd2339) before any transactions; enable two-factor authentication on all accounts

V. AIR Potential Risks and Challenges

AIR Market Risks

- Volatility Risk: Recent 1-year performance shows -71.25% decline from launch, indicating significant price fluctuations

- Liquidity Risk: Limited exchange availability (2 exchanges) and relatively low 24-hour volume may impact order execution

- Market Cap Risk: With only 15.73% of tokens in circulation and $1.4M market cap, the project remains in early growth stages with associated uncertainties

AIR Regulatory Risks

- DePIN Sector Regulation: Emerging regulatory frameworks for decentralized physical infrastructure networks may impact operational models

- Health Data Compliance: Projects handling health information may face evolving data privacy regulations across jurisdictions

- Token Classification: Regulatory clarity regarding utility tokens in health and fitness sectors continues to develop globally

AIR Technical Risks

- Smart Contract Risk: As an ERC-20 token, AIR depends on Ethereum network security, though individual contract vulnerabilities remain a consideration

- Ecosystem Dependency: Project success relies on continuous development of Sport AI integration and user adoption metrics

- Competition Risk: The web3 health and fitness sector faces competition from established players and emerging projects

VI. Conclusion and Action Recommendations

AIR Investment Value Assessment

AIRian represents an early-stage project combining DePIN infrastructure with Sport AI applications in the web3 health sector. The token's long-term value proposition centers on building a community-driven health data ecosystem. However, recent price performance (-71.25% over 1 year) and limited liquidity present near-term challenges. The 30-day recovery (+24.79%) suggests some market interest, but investors should approach with caution given the project's early development stage and market position.

AIR Investment Recommendations

✅ Beginners: Consider minimal allocation (under 1% of portfolio) only after thorough research; focus on understanding the DePIN and Sport AI sectors before investing ✅ Experienced Investors: May allocate 2-4% with active monitoring of ecosystem developments and community growth; implement strict stop-loss levels ✅ Institutional Investors: Conduct comprehensive due diligence on team, technology, and competitive positioning; consider pilot allocation with quarterly review cycles

AIR Trading Participation Methods

- Spot Trading: Available on Gate.com with AIR/USDT trading pairs for direct exposure

- Dollar-Cost Averaging: Implement systematic purchasing strategy to mitigate timing risk in volatile conditions

- Community Engagement: Participate in AIRian ecosystem activities to better understand project development and potential value drivers

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make cautious decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the historical price trend of AIR tokens? What are the major price fluctuation events?

AIR token launched with initial exchange listings marking market entry. The token has experienced volatility typical of emerging cryptocurrencies, with price movements influenced by market conditions and ecosystem developments. Key periods include early trading phases and subsequent market cycles reflecting broader crypto market trends and AIR adoption momentum.

What is the AIR price prediction for 2024-2025? What are the target prices predicted by major analysis institutions?

AIR price predictions for 2024-2025 show upward momentum driven by storage cost increases. Major analytical institutions project significant price appreciation as storage component costs surge, with supply chain pressures expected to support higher valuations throughout this period.

What are the main factors affecting AIR price? How do market sentiment, technical updates, and macroeconomic environment impact?

AIR price is influenced by market sentiment, technology updates, and macroeconomic factors. Positive sentiment and innovation drive adoption and demand, while economic policies and global conditions affect investor confidence and trading volume.

How to use technical analysis methods to predict AIR's price trend? Where are the support and resistance levels?

Identify AIR support and resistance using past price action, moving averages, and chart patterns. Confirm with trading volume. Prices typically reverse near these levels. Monitor 50-day and 200-day moving averages for dynamic support/resistance zones.

How is the price correlation between AIR and mainstream cryptocurrencies such as BTC and ETH?

AIR maintains high correlation with BTC and ETH long-term, but may temporarily decouple due to market events. In August 2025, ETF capital flows caused short-term divergence. Large-scale liquidations instantly restored correlation alignment between these assets.

What is AIR's fundamentals? How do project progress, team, and use cases impact its price?

AIR's fundamentals depend on ecosystem adoption and development progress. Strong team execution, real-world applications, and growing transaction volume drive long-term value. Successful partnerships and technical upgrades typically support price appreciation.

What are the risks of investing in AIR tokens? What are the limitations of price predictions?

AIR token investments carry liquidity and project risks. Price predictions have limitations due to market volatility and unpredictable factors. Historical data does not guarantee future performance, and market conditions change rapidly.

Top 10 DePIN Crypto Projects to Invest in 2025

How to Participate in a DePIN Project

What is DePIN?How Does DePIN Work?

What Does Onyxcoin's DApp Ecosystem Look Like in 2025?

How to Earn with The RWA DePin Protocol in 2025

TrendX (XTTA): An Innovative Investment Platform Integrating AI and DePIN

TEN vs ENJ: A Comprehensive Comparison of Two Leading Blockchain Gaming Tokens

GAI vs IMX: Which Layer 2 Scaling Solution Offers Better Returns for Crypto Investors in 2024?

ECHO vs HBAR: A Comprehensive Comparison of Two Emerging Blockchain Ecosystems

What is a cryptocurrency paper wallet and how do you create one

What is Cryptocurrency Futures Trading?