2026 ARCA Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: ARCA's Market Position and Investment Value

Legend of Arcadia (ARCA), a blockchain-powered card-based RPG gaming token, has been establishing its presence in the Web3 gaming ecosystem since its launch in November 2024. As of February 2026, ARCA maintains a market capitalization of approximately $537,000, with a circulating supply of around 109.9 million tokens, trading at $0.004889. This gaming-focused digital asset, recognized as a bridge between traditional mobile gaming and blockchain technology, is playing an increasingly significant role in the play-to-earn and NFT gaming sectors.

This article will comprehensively analyze ARCA's price trajectory from 2026 to 2031, combining historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. ARCA Price History Review and Market Status

ARCA Historical Price Evolution Trajectory

- November 2024: ARCA launched on Gate.com at $0.08, reaching a peak of $0.095 shortly after listing on November 4, 2024

- 2025: The token experienced significant downward pressure, declining from its early highs as market conditions evolved

- February 2026: ARCA recorded its lowest price point at $0.00485, representing a substantial decline from its all-time high

ARCA Current Market Status

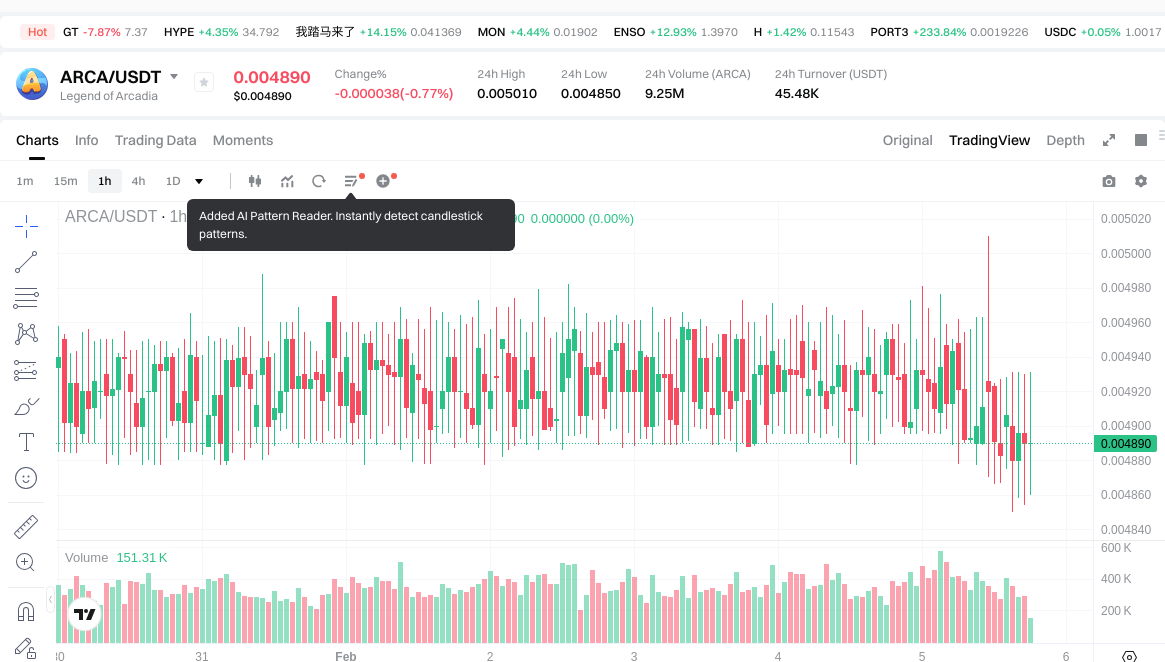

As of February 5, 2026, ARCA is trading at $0.004889, showing relatively stable short-term performance with a 0.44% increase over the past hour and a 0.82% gain over the past week. The 24-hour trading volume stands at $45,385.83, indicating moderate market activity. The token's market capitalization is positioned at $537,301, with 109.9 million tokens currently in circulation, representing approximately 10.99% of the total supply of 1 billion ARCA tokens.

The token's fully diluted valuation reaches $4.89 million, while maintaining a market dominance of 0.00019%. Over the past month, ARCA has declined by 9.21%, and the annual performance shows an 81.36% decrease from year-ago levels. The current price represents a 94.86% decline from its all-time high of $0.095 recorded in November 2024.

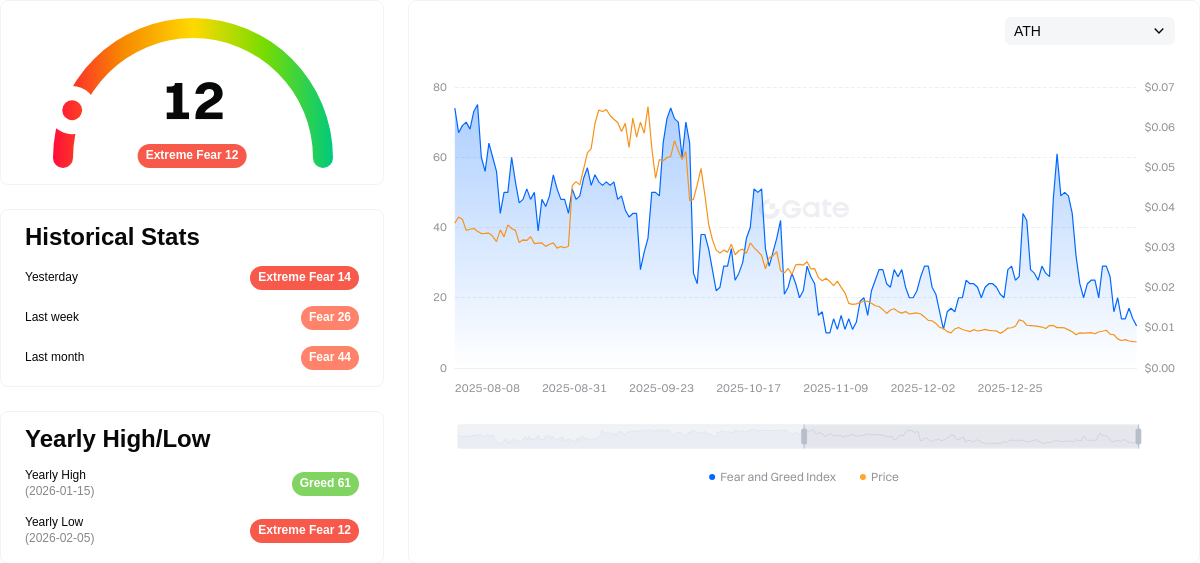

The 24-hour price range fluctuated between $0.00485 and $0.00501, demonstrating limited intraday volatility. The market sentiment index currently stands at 12, indicating extreme fear conditions in the broader crypto market environment.

Click to view current ARCA market price

ARCA Market Sentiment Index

2026-02-05 Fear and Greed Index: 12 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the ARCA Fear and Greed Index reading just 12 points. This historically low level indicates severe market pessimism and panic selling pressure among investors. During such extreme fear conditions, the market often presents contrarian opportunities for long-term investors who maintain conviction. However, heightened volatility and downside risks remain significant concerns. Traders should exercise strict risk management and avoid emotional decision-making. Market sentiment can shift rapidly, so monitoring the index continuously helps traders adjust strategies accordingly. Extreme fear periods typically precede substantial recoveries, making this a critical juncture for portfolio positioning and risk assessment.

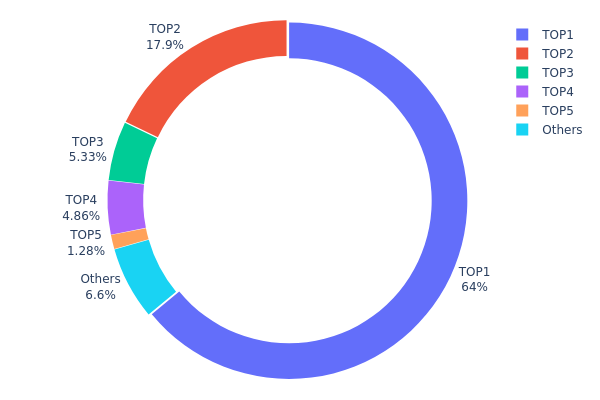

ARCA Holdings Distribution

The holdings distribution chart illustrates the allocation of ARCA tokens across different wallet addresses, reflecting the token's decentralization level and concentration risk. According to the latest on-chain data, ARCA exhibits a highly concentrated holdings structure. The top address holds 640,026.67K tokens, representing 64.00% of the total supply, while the second-largest address controls 179,204.73K tokens (17.92%). The top two addresses alone account for 81.92% of the circulating supply, indicating significant centralization that could pose structural risks to the market.

The third through fifth largest addresses hold 53,346.40K (5.33%), 48,622.99K (4.86%), and 12,811.16K (1.28%) respectively, with the remaining addresses collectively holding only 65,988.05K tokens (6.61%). This distribution pattern suggests that ARCA's market structure is dominated by a small number of large holders, potentially creating vulnerabilities to price manipulation and increased volatility. Such concentration may amplify market reactions to large-scale transfers or liquidations from top addresses, while limiting liquidity depth during periods of heightened trading activity.

From a market structure perspective, this holdings concentration reflects relatively weak decentralization characteristics, which could constrain ARCA's long-term ecosystem development. The dominance of whale addresses may result in unstable price discovery mechanisms and reduced market efficiency, as price movements could be disproportionately influenced by the actions of a few major holders rather than broader market consensus.

View current ARCA Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x8709...3a7a36 | 640026.67K | 64.00% |

| 2 | 0xf729...547ebf | 179204.73K | 17.92% |

| 3 | 0x5252...ee64a6 | 53346.40K | 5.33% |

| 4 | 0x3154...0f2c35 | 48622.99K | 4.86% |

| 5 | 0x58ed...a36a51 | 12811.16K | 1.28% |

| - | Others | 65988.05K | 6.61% |

II. Core Factors Influencing ARCA's Future Price

Supply Mechanisms

- Token Distribution Structure: ARCA has a circulating supply of 109,900,000 tokens with a current market capitalization of approximately $1.05 million. The supply mechanism directly impacts token scarcity and potential price appreciation.

- Historical Patterns: In November 2024, ARCA reached a historical high of $0.095, but by November 2025, the price had declined over 89% to $0.009553, demonstrating significant volatility in response to market conditions and supply dynamics.

- Current Impact: The current supply level and distribution pattern suggest that future price movements will largely depend on demand growth from blockchain gaming adoption and broader market recovery.

Institutional and Major Holder Dynamics

- Institutional Holdings: While specific institutional holding data is not extensively documented in available materials, ARCA's value proposition centers on blockchain gaming infrastructure, which may attract specialized gaming-focused investment funds.

- Corporate Adoption: ARCA's ecosystem is closely tied to blockchain gaming development, with its success dependent on adoption by gaming developers and platforms within the Legend of Arcadia ecosystem.

- Regulatory Landscape: The blockchain gaming sector continues to evolve within various regulatory frameworks globally, with policy developments in major markets potentially impacting ARCA's adoption trajectory.

Macroeconomic Environment

- Monetary Policy Impact: Cryptocurrency markets, including gaming tokens like ARCA, remain sensitive to global monetary policy shifts. Interest rate decisions by major central banks influence overall risk appetite in digital asset markets.

- Market Liquidity Conditions: ARCA's 24-hour trading volume of approximately $34,446 reflects relatively modest liquidity, making it susceptible to broader market sentiment shifts and capital flow patterns.

- Economic Uncertainty Factors: Global economic conditions, including concerns about traditional financial markets, can influence investor allocation toward or away from speculative crypto gaming assets.

Technological Development and Ecosystem Building

- Blockchain Gaming Infrastructure: ARCA's value is fundamentally linked to the development and adoption of blockchain gaming technology. Advances in scalability, user experience, and integration capabilities within the Legend of Arcadia platform directly impact token utility.

- Ecosystem Expansion: The growth of decentralized applications and gaming experiences within the ARCA ecosystem represents a critical factor for long-term value creation. Successful ecosystem development could drive increased token demand.

- Technological Upgrades: Continuous improvements in underlying blockchain technology, gaming mechanics, and tokenomics structure will influence ARCA's competitive position within the blockchain gaming sector and its ability to attract and retain users.

III. 2026-2031 ARCA Price Prediction

2026 Outlook

- Conservative prediction: $0.00445 - $0.00489

- Neutral prediction: Around $0.00489

- Optimistic prediction: Up to $0.00626 (requires favorable market conditions and increased adoption)

2027-2029 Outlook

- Market stage expectation: Progressive growth phase with gradual market maturity and expanding ecosystem development

- Price range prediction:

- 2027: $0.00385 - $0.00747 (14% potential increase)

- 2028: $0.00633 - $0.00815 (33% potential increase)

- 2029: $0.00646 - $0.00917 (50% potential increase)

- Key catalysts: Enhanced platform utility, broader market acceptance, technological improvements, and growing user base participation

2030-2031 Long-term Outlook

- Baseline scenario: $0.00801 - $0.00991 (assuming steady ecosystem development and maintained market interest)

- Optimistic scenario: $0.00825 - $0.01053 (with accelerated adoption and positive regulatory environment)

- Transformative scenario: Potential to reach $0.01053 or higher (under exceptional market conditions with breakthrough partnerships and significant ecosystem expansion)

- February 5, 2026: ARCA trading within early-stage price discovery range, establishing foundation for potential multi-year growth trajectory

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00626 | 0.00489 | 0.00445 | 0 |

| 2027 | 0.00747 | 0.00557 | 0.00385 | 14 |

| 2028 | 0.00815 | 0.00652 | 0.00633 | 33 |

| 2029 | 0.00917 | 0.00734 | 0.00646 | 50 |

| 2030 | 0.00991 | 0.00825 | 0.00801 | 68 |

| 2031 | 0.01053 | 0.00908 | 0.00735 | 85 |

IV. ARCA Professional Investment Strategies and Risk Management

ARCA Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Players and enthusiasts of blockchain-based card RPG games, long-term believers in the GameFi sector

- Operational Recommendations:

- Accumulate positions during market corrections when ARCA trades near historical support levels

- Monitor the development progress of Legend of Arcadia's PvP game modes and NFT marketplace activity

- Consider a storage solution that balances security and accessibility for potential NFT trading

(2) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor the current 24-hour trading volume of approximately $45,385 to identify liquidity patterns and potential breakout signals

- Support/Resistance Levels: Track key price levels, with recent lows around $0.00485 serving as potential support zones

- Swing Trading Essentials:

- Consider the token's limited exchange availability (listed on 3 exchanges) when planning entry and exit points

- Account for the relatively low circulating supply of 109.9 million tokens (10.99% of max supply) which may contribute to price volatility

ARCA Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio allocation

- Aggressive Investors: 3-5% of crypto portfolio allocation

- Professional Investors: Up to 10% of crypto portfolio allocation with active monitoring

(2) Risk Hedging Solutions

- Diversification Strategy: Balance ARCA holdings with established gaming tokens and mainnet assets to reduce sector-specific risks

- Position Sizing: Given the token's lower market ranking (2988) and limited market capitalization, maintain smaller position sizes relative to more established assets

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for convenient access to trading and potential NFT interactions within the Legend of Arcadia ecosystem

- Cold Storage Option: For long-term holdings exceeding active trading needs, consider hardware wallet solutions supporting ERC-20 tokens

- Security Precautions: Never share private keys or seed phrases, enable two-factor authentication on exchange accounts, and verify contract addresses (0x1c00c3e03c3a10a0c1d9b6d1a42e797d7cb4147a on Ethereum) before transactions

V. ARCA Potential Risks and Challenges

ARCA Market Risks

- High Volatility: The token has experienced an 81.36% decline over the past year, demonstrating significant downside volatility potential

- Limited Liquidity: With trading availability on only 3 exchanges and moderate 24-hour volume, large orders may face slippage challenges

- Low Market Dominance: Market share of 0.00019% indicates limited mainstream adoption and vulnerability to broader market downturns

ARCA Regulatory Risks

- Gaming Token Classification: Evolving regulatory frameworks for blockchain gaming assets may impact the token's utility and tradability

- NFT Regulation Uncertainty: As the project involves trading of NFT assets, changing regulatory approaches to digital collectibles could affect platform operations

- Cross-border Gaming Compliance: Mobile gaming regulations vary significantly across jurisdictions, potentially limiting the project's geographic expansion

ARCA Technical Risks

- Smart Contract Dependencies: As an ERC-20 token, ARCA relies on Ethereum network security and is subject to potential smart contract vulnerabilities

- Game Development Execution: The project's value proposition depends heavily on successful implementation of gameplay features and user adoption

- Competition from Established GameFi Projects: The blockchain gaming sector includes numerous competing projects with larger communities and more established ecosystems

VI. Conclusion and Action Recommendations

ARCA Investment Value Assessment

Legend of Arcadia (ARCA) represents a speculative opportunity within the blockchain gaming sector, targeting mobile gamers interested in card-based RPG experiences with NFT integration. The project's long-term value proposition centers on its free-to-play model and PvP social features inspired by popular franchises. However, investors should carefully weigh the significant short-term risks, including the token's substantial year-over-year decline, limited exchange listings, and low circulating supply ratio. The current market conditions suggest heightened volatility, and the project's success depends heavily on achieving meaningful user adoption and delivering on its gameplay development roadmap.

ARCA Investment Recommendations

✅ Beginners: Start with minimal exposure (under 1% of portfolio) and focus on understanding the project's gaming mechanics and community development before increasing positions ✅ Experienced Investors: Consider strategic accumulation during weakness if bullish on the GameFi sector recovery, while maintaining strict stop-loss protocols given historical volatility ✅ Institutional Investors: Conduct thorough due diligence on the development team's execution capabilities and evaluate the token's fit within a broader gaming sector allocation strategy

ARCA Trading Participation Methods

- Spot Trading on Gate.com: Access ARCA trading pairs with competitive liquidity and integrated wallet solutions

- Dollar-Cost Averaging: Implement systematic purchase plans to mitigate timing risk in this volatile asset

- Portfolio Rebalancing: Periodically adjust ARCA allocation based on project milestones, market conditions, and overall risk tolerance

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is ARCA? What are its uses and basic characteristics?

ARCA is a regulator manufacturer specializing in actuators for pneumatic, electric, and hydraulic valve control. Its product lines include 811, 812, 840, and MA series membrane actuators designed for industrial automation and fluid control applications.

2024年ARCA价格预测是多少?未来前景如何?

2024年ARCA预计价格为$0.005126,未来前景看好。预测显示2026年价格可能达到$0.005126,市场潜力持续释放。

What factors influence ARCA price? How to conduct technical analysis?

ARCA price is influenced by market demand, trading volume, whale holdings, and technical indicators. Technical analysis primarily relies on moving averages and RSI to identify trend reversals and momentum shifts.

What are the risks of investing in ARCA? How do they compare to other crypto assets?

ARCA carries moderate market volatility risk typical of emerging crypto assets. Price fluctuations may exceed traditional assets, though liquidity and adoption are improving. Risk levels align with comparable mid-cap cryptocurrencies, with potential for significant gains alongside downside exposure.

How has ARCA performed historically? What was the price change over the past year?

ARCA has shown strong performance over the past year with a 21.86% increase. The average price level was 1,139.14, reaching a high of 1,175.62 and a low of 1,103.67, demonstrating positive market momentum.

How to buy and trade ARCA? Which exchanges support it?

You can purchase ARCA on decentralized exchanges (DEX) by connecting your crypto wallet and selecting the ARCA trading pair. ARCA is also available on centralized platforms. Ensure you use a secure wallet and verify the contract address before trading.

2025 Vertus daily combo code: Web3 gamers rewards guide

Today's Vertus Daily Combo Code: Boost Your Web3 Gaming Rewards (April 29, 2025)

GALA Coin (GALA) – Web3 Gaming Token Overview, Price Prediction & Trading on Gate.com

What is Gaming Crypto?How Gaming Crypto Works?

Detailed analysis of the top ten encryption game coins to be launched in 2025

Top 6 Best Gaming Currencies

LIY vs RUNE: A Comprehensive Comparison of Two Emerging Blockchain Tokens in the Crypto Market

Comprehensive Guide to Token Generation Events

What Are the Differences Between Web2 and Web3? Analyzing Future Trends in Web3

What is Grayscale, the cryptocurrency asset management firm?

A Comprehensive Guide to Decentralized Exchanges (DEXs): Leading Platforms and Selection Criteria