2026 CORL Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: CORL's Market Position and Investment Value

Coral Finance (CORL), as a decentralized finance AI application layer enabling users to discover and engage in early alpha and yield-generating opportunities, has established its presence in the DeFAI ecosystem since its launch in 2025. As of February 2026, CORL maintains a market capitalization of approximately $246,535, with a circulating supply of about 232,361,670 tokens, and the price hovering around $0.001061. This asset, positioned at the intersection of artificial intelligence and decentralized finance, is playing an increasingly significant role in the emerging DeFAI sector.

This article will comprehensively analyze CORL's price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. CORL Price History Review and Market Status

CORL Historical Price Evolution Trajectory

- October 2025: CORL reached its all-time high of 0.28699 on October 12, 2025, marking a significant milestone since its launch

- February 2026: The token experienced substantial decline, dropping to its all-time low of 0.001005 on February 6, 2026, representing a decline of approximately 99.65% from its peak

- Recent Period: CORL has shown continued downward pressure, with the price declining 25.84% over the past 7 days and 46.61% over the past 30 days

CORL Current Market Status

As of February 8, 2026, CORL is trading at 0.001061, showing a modest recovery of 0.47% in the past hour but declining 2.49% over the past 24 hours. The 24-hour trading range spans from a low of 0.001051 to a high of 0.001149, indicating limited price volatility in the short term.

The token maintains a market capitalization of approximately 246,535, ranking 3,709 in the overall cryptocurrency market with a dominance of 0.000042%. The circulating supply stands at 232,361,670 CORL tokens, representing 23.24% of the maximum supply of 1,000,000,000 tokens. The fully diluted market cap is calculated at 1,061,000.

Coral Finance operates as a DeFAI application layer, combining AI-driven insights with decentralized finance mechanisms to enable users to discover, trade, and participate in early-stage opportunities and yield-generating activities. The token is deployed on the BSC (BNB Smart Chain) as a BEP-20 token and currently has 29,005 holders. Trading activity remains relatively modest, with 24-hour trading volume reaching approximately 24,422.

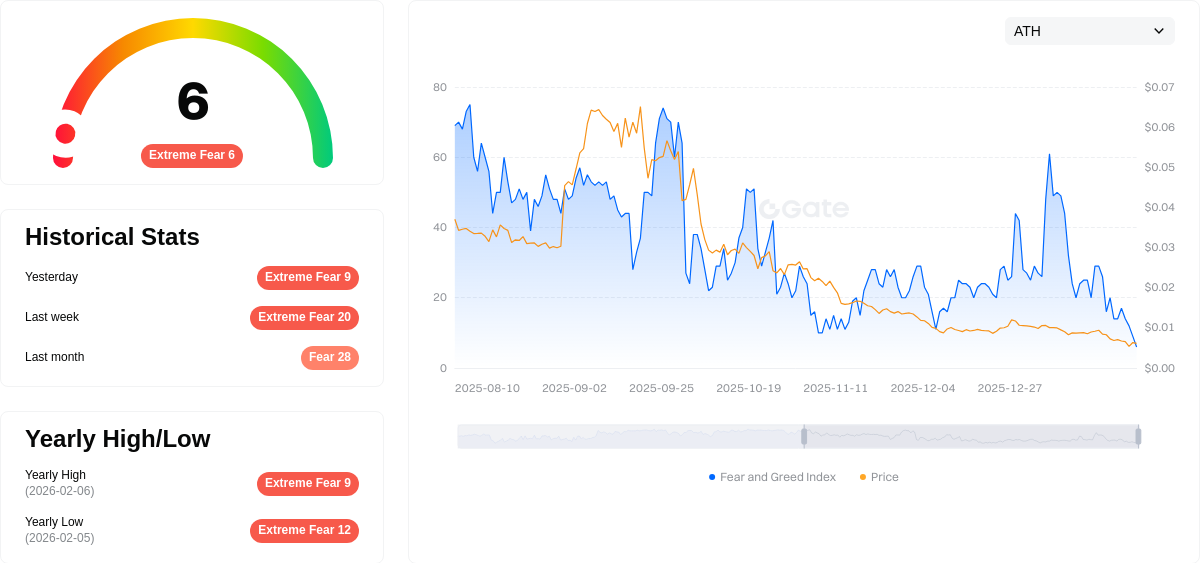

The current market sentiment index stands at 6, indicating an "Extreme Fear" state in the broader cryptocurrency market, which may contribute to the ongoing price pressure on CORL and similar assets.

Click to view the current CORL market price

CORL Market Sentiment Index

2026-02-07 Fear and Greed Index: 6 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear with an index reading of just 6. This exceptionally low sentiment indicates significant market pessimism and panic selling pressure. When fear reaches such extreme levels, contrarian investors often view it as a potential buying opportunity, as markets tend to overreact to negative sentiment. However, cautious risk management remains essential during periods of extreme fear, as downward momentum may continue. Monitor key support levels and market fundamentals closely before making investment decisions during such volatile periods.

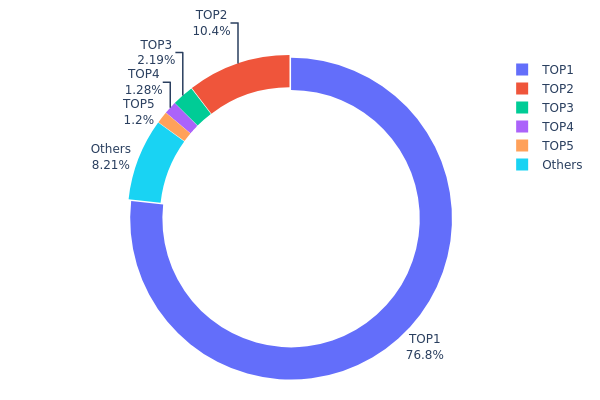

CORL Holdings Distribution

The holdings distribution chart illustrates the concentration of token ownership across different wallet addresses, providing insights into the decentralization level and potential market control dynamics. By analyzing the proportion of total supply held by top addresses versus smaller holders, this metric reveals the structural health and vulnerability of the token's ecosystem.

Based on the current data, CORL exhibits an extremely high concentration pattern. The top address alone controls 767,638.33K tokens, representing 76.76% of the total supply—a dominant position that significantly impacts market dynamics. The second-largest holder possesses 103,729.08K tokens (10.37%), while the top five addresses collectively control approximately 91.77% of the circulating supply. This leaves only 8.23% distributed among remaining addresses, indicating a severely centralized ownership structure.

Such extreme concentration poses considerable risks to market stability and price discovery mechanisms. The dominance of a single address creates substantial potential for price manipulation, as large-scale transactions from this holder could trigger dramatic market movements. Additionally, this centralization contradicts the fundamental principles of decentralization inherent to blockchain technology, potentially undermining investor confidence. The limited distribution among smaller holders suggests weak community participation and reduced liquidity depth, which may amplify volatility during market stress periods. This distribution pattern reflects a market structure that remains highly vulnerable to single-entity influence, with limited organic growth and participation from diverse stakeholders.

Click to view current CORL Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x6f0b...9e6018 | 767638.33K | 76.76% |

| 2 | 0x73d8...4946db | 103729.08K | 10.37% |

| 3 | 0xd17c...acedcd | 21864.29K | 2.18% |

| 4 | 0x4982...6e89cb | 12763.89K | 1.27% |

| 5 | 0x8fcf...99852c | 11950.00K | 1.19% |

| - | Others | 82054.41K | 8.23% |

II. Core Factors Influencing CORL's Future Price

Supply Mechanism

- Fixed Supply Model: CORL token has a maximum supply of 1 billion tokens, with current circulation at approximately 232 million tokens (23.24% of total supply). This fixed supply structure represents a deflationary model that may create upward price pressure over time as demand increases relative to the limited token availability.

- Historical Pattern: The controlled token release schedule has maintained relative supply stability in the market, potentially reducing excessive volatility caused by sudden supply shocks.

- Current Impact: With approximately 77% of tokens yet to be unlocked, the gradual release schedule will continue to influence price dynamics. Market participants should monitor unlock events as they may temporarily increase selling pressure.

Market Sentiment and Investor Confidence

- Investor Psychology: Market sentiment plays a direct role in CORL price movements. Positive news regarding widespread adoption or significant technological breakthroughs typically triggers optimistic market sentiment and drives price appreciation.

- Technology Development: Progress in AI-driven DeFi innovations and platform advancements serve as key confidence indicators for both retail and institutional investors.

- Adoption Momentum: Growing user adoption and expanding use cases within the DeFi ecosystem contribute to sustained investor interest and price support.

Macroeconomic Environment

- Cryptocurrency Market Conditions: CORL's price trajectory remains correlated with broader cryptocurrency market trends. Favorable conditions in the digital asset sector, including increased institutional participation and regulatory clarity, may provide tailwinds for CORL appreciation.

- Risk Appetite: Market risk sentiment influences capital flows into speculative assets like CORL. During periods of heightened risk appetite, cryptocurrency projects with innovative value propositions may attract increased investment.

- Economic Uncertainty: In environments characterized by traditional financial market volatility, some investors may seek alternative assets, potentially benefiting tokens positioned within emerging DeFi sectors.

III. 2026-2031 CORL Price Prediction

2026 Outlook

- Conservative prediction: $0.00087

- Neutral prediction: $0.00106

- Optimistic prediction: $0.00136

2027-2029 Mid-term Outlook

- Market stage expectation: The token may experience gradual growth with moderate volatility as adoption and market conditions evolve

- Price range predictions:

- 2027: $0.00116 - $0.00169, representing approximately 14% increase from 2026 levels

- 2028: $0.00103 - $0.00149, with potential 36% growth trajectory

- 2029: $0.00125 - $0.00172, showing continued upward momentum with projected 38% change

- Key catalysts: Market maturity, potential ecosystem developments, and broader crypto market trends

2030-2031 Long-term Outlook

- Baseline scenario: $0.0009 - $0.00209 (assuming stable market conditions and continued project development)

- Optimistic scenario: $0.00102 - $0.00238 (with favorable regulatory environment and increased adoption)

- Transformative scenario: Potential to reach upper ranges if significant technological breakthroughs or partnerships materialize

- 2026-02-08: CORL trading within established support levels as market participants assess long-term fundamentals

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00136 | 0.00106 | 0.00087 | 0 |

| 2027 | 0.00169 | 0.00121 | 0.00116 | 14 |

| 2028 | 0.00149 | 0.00145 | 0.00103 | 36 |

| 2029 | 0.00172 | 0.00147 | 0.00125 | 38 |

| 2030 | 0.00209 | 0.0016 | 0.0009 | 50 |

| 2031 | 0.00238 | 0.00185 | 0.00102 | 74 |

IV. CORL Professional Investment Strategy and Risk Management

CORL Investment Methodology

(1) Long-Term Holding Strategy

- Suitable for: Investors seeking exposure to DeFi AI innovation with moderate to high risk tolerance

- Operational Recommendations:

- Consider accumulating positions during market consolidation phases when volatility decreases

- Monitor project development milestones and ecosystem growth metrics

- Utilize secure storage solutions such as Gate Web3 Wallet for long-term holdings

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Current 24-hour range shows support near $0.001051 and resistance at $0.001149

- Volume Analysis: Monitor the 24-hour trading volume of approximately $24,423 to gauge market interest and liquidity

- Band Trading Points:

- Consider the token's significant price volatility, with 7-day decline of 25.84% and 30-day decline of 46.61%

- Set appropriate stop-loss levels to manage downside risk in volatile market conditions

CORL Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of crypto portfolio allocation

- Aggressive Investors: 5-8% of crypto portfolio allocation

- Professional Investors: 8-12% of crypto portfolio allocation with active risk monitoring

(2) Risk Hedging Solutions

- Position Sizing: Limit exposure based on the token's relatively low market capitalization of approximately $246,536

- Dollar-Cost Averaging: Implement systematic investment to mitigate timing risk given recent price volatility

(3) Secure Storage Solutions

- Software Wallet Recommendation: Gate Web3 Wallet for convenient access and trading flexibility

- Multi-Signature Solution: Consider multi-signature wallets for larger holdings

- Security Considerations: Enable two-factor authentication, regularly update security protocols, and never share private keys

V. CORL Potential Risks and Challenges

CORL Market Risks

- High Volatility: Recent performance shows substantial price fluctuations with 30-day decline of 46.61%

- Liquidity Risk: Relatively low market capitalization and trading volume may result in price slippage during larger transactions

- Market Cap Concentration: Current circulating supply represents only 23.24% of total supply, potential for future dilution

CORL Regulatory Risks

- DeFi Regulatory Uncertainty: Evolving global regulatory frameworks for decentralized finance platforms may impact operations

- AI Integration Compliance: Regulatory scrutiny on AI-driven financial services could affect project development

- Cross-Border Compliance: Regulatory requirements may vary significantly across different jurisdictions

CORL Technical Risks

- Smart Contract Vulnerabilities: As with any blockchain-based project, potential security vulnerabilities in smart contract code

- Integration Complexity: AI-driven DeFi integration presents technical challenges that may affect platform stability

- Blockchain Dependency: Project operates on BSC (BEP-20 standard), exposing it to risks associated with the underlying blockchain infrastructure

VI. Conclusion and Action Recommendations

CORL Investment Value Assessment

Coral Finance presents an innovative approach to combining AI-driven insights with decentralized finance, targeting early-stage opportunities and yield generation. The project operates in the emerging DeFi AI sector with approximately 29,005 holders. However, investors should note the significant recent price decline of 46.61% over 30 days and the token's distance from its historical high of $0.28699. The project's long-term value proposition depends on successful execution of its AI-DeFi integration strategy, while short-term risks include high volatility and liquidity constraints.

CORL Investment Recommendations

✅ Beginners: Start with minimal allocation (1-2%) and prioritize learning about the project fundamentals and DeFi AI concepts before increasing exposure ✅ Experienced Investors: Consider strategic accumulation during market weakness with strict risk management protocols, limiting exposure to 5-8% of crypto portfolio ✅ Institutional Investors: Conduct thorough due diligence on project team, technology infrastructure, and competitive positioning before considering allocation

CORL Trading Participation Methods

- Spot Trading: Available on Gate.com with current liquidity supporting moderate trading volumes

- Progressive Accumulation: Implement dollar-cost averaging strategy to mitigate timing risk in volatile market conditions

- Portfolio Diversification: Include CORL as part of a broader DeFi AI sector allocation rather than concentrated exposure

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the historical price trend of CORL token?

CORL token has shown volatility in recent periods. Over the past 24 hours, prices fluctuated between US$0.001056 and US$0.001106. The 7-day range demonstrates broader price movements. Current market valuation is calculated based on existing price levels and available trading supply of approximately 232.36 million tokens.

What are the main factors affecting CORL price?

CORL price is influenced by market supply and demand, trading volume, investor sentiment, cryptocurrency market trends, regulatory changes, and macroeconomic conditions including interest rates and inflation.

How to conduct CORL price prediction? What are the analysis methods?

CORL price prediction can utilize technical analysis methods including moving averages, RSI, and MACD indicators. These tools help analyze market trends and price movements by examining historical data patterns and trading volume.

CORL投资有什么风险需要注意?

CORL is a high-risk investment requiring contract security verification. Monitor supply dynamics, liquidity structures, and market conditions before investing.

What are the advantages or disadvantages of CORL compared to similar tokens?

CORL offers transparent governance and real asset backing advantages, but faces regulatory challenges and market volatility risks compared to similar tokens in the ecosystem.

What will be the market capitalization of USDC in 2025? Analysis of the stablecoin market landscape.

How is DeFi different from Bitcoin?

What is DeFi: Understanding Decentralized Finance in 2025

USDC stablecoin 2025 Latest Analysis: Principles, Advantages, and Web3 Eco-Applications

Development of Decentralized Finance Ecosystem in 2025: Integration of Decentralized Finance Applications with Web3

2025 USDT USD Complete Guide: A Must-Read for Newbie Investors

Pepe: A Comprehensive Guide to What It Is and How It Works

The 7 Hottest Blockchain Stocks to Watch in the Coming Years

What is the Relative Strength Index? Application in Crypto Trading

Top Cryptocurrency Exchanges for Polish Traders

Master Japanese candlestick analysis like a professional and explore the most well-known patterns with real-world examples