2026 DRAC Price Prediction: Expert Analysis and Market Forecast for Draconis Token

Introduction: DRAC's Market Position and Investment Value

DRAC (DRAC), as a BRC-20 based crypto inscription, has been developing in the market since its launch in May 2023. As of February 2026, DRAC's market capitalization stands at approximately $522,369, with a circulating supply of around 106.82 million tokens, and its price maintains around $0.00489. This asset, characterized as a BRC-20 meme token, is exploring its role within the Bitcoin ecosystem's inscription and token space.

This article will comprehensively analyze DRAC's price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem developments, and macroeconomic conditions to provide professional price forecasts and practical investment strategies for investors.

I. DRAC Price History Review and Market Status

DRAC Historical Price Evolution Trajectory

- 2023: DRAC was published on May 9, 2023, with an initial price of $0.000046, beginning its market circulation as a BRC-20 meme token

- 2022: Price reached a historical peak of $0.091844 on November 1, 2022, representing a significant milestone in the token's early trading period

- 2025: Market experienced substantial correction, with price declining to an all-time low of $0.00005608 on February 16, 2025, reflecting broader market pressures

- 2026: As of February 5, 2026, the token has demonstrated recovery momentum, trading at $0.00489, representing an annual gain of 184.35% compared to the previous year

DRAC Current Market Status

As of February 5, 2026, DRAC is trading at $0.00489, exhibiting mixed short-term performance dynamics. The token has experienced a 3.02% decline over the past hour and an 8.01% decrease over the past 24 hours, with the 24-hour trading range spanning between $0.004841 and $0.005343. This recent downward pressure extends across longer timeframes, with the token recording a 16.68% decline over the past week and a 21.93% decrease over the past 30 days.

The market structure reveals a circulating supply of 106,824,000 DRAC tokens from a total supply of 72,001,378.83 tokens and a maximum supply of 100,000,000 tokens. The current market capitalization stands at $522,369.36, with a fully diluted market capitalization of $352,086.74. The market cap to FDV ratio of 100% indicates that the circulating supply represents the entirety of the evaluated market valuation. The token maintains a market dominance of 0.000013% within the broader cryptocurrency ecosystem.

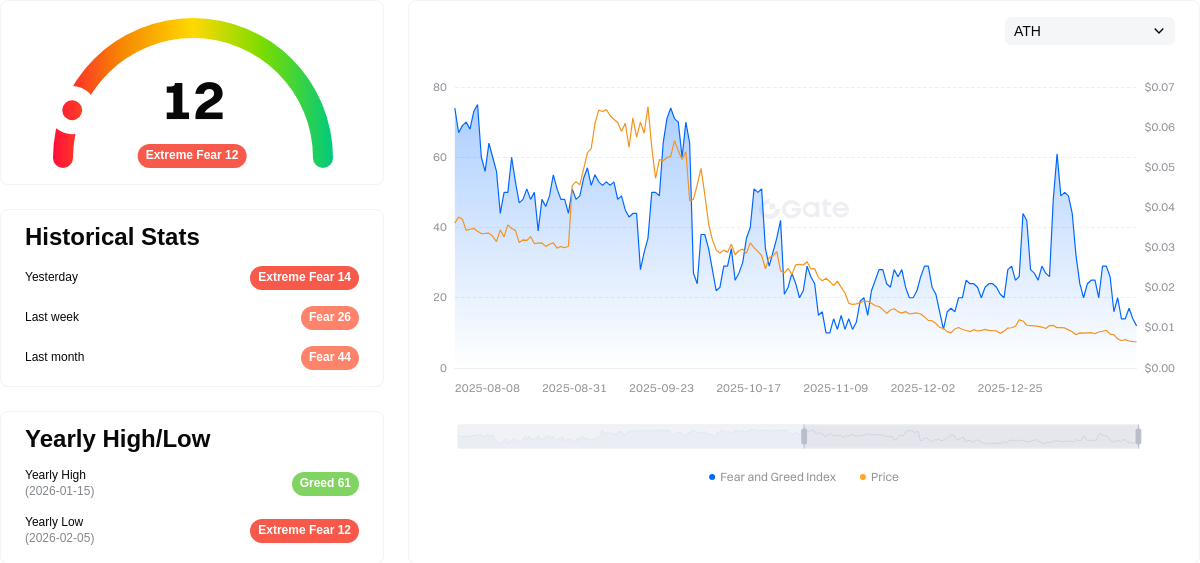

The 24-hour trading volume reaches $16,152.73, reflecting active market participation despite recent price corrections. The token holder base comprises 2,541 addresses, indicating a distributed ownership structure. Since its launch price of $0.000046, DRAC has demonstrated a cumulative gain of 105.30% as of the current assessment date. The cryptocurrency market sentiment index currently registers at 12, indicating an environment of extreme fear among market participants.

Click to view the current DRAC market price

DRAC Market Sentiment Index

2026-02-05 Fear and Greed Index: 12 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the index at 12. This historically low reading suggests significant market pessimism and potential capitulation among investors. During extreme fear periods, risk assets typically face selling pressure, and volatility often increases. However, contrarian investors view such conditions as potential buying opportunities, as extreme fear often precedes market recoveries. Monitor key support levels and institutional accumulation signals for potential trend reversals. Trading activity on Gate.com shows mixed sentiment across major crypto assets.

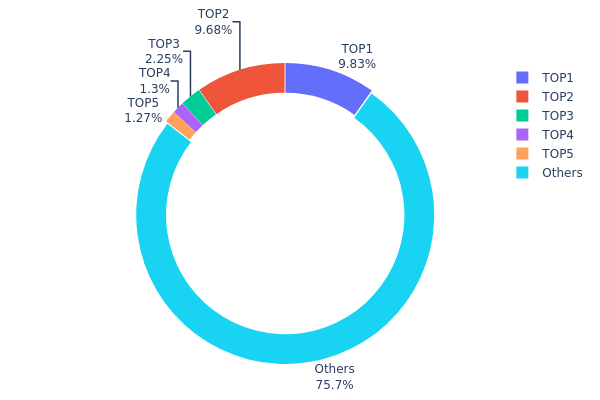

DRAC Holding Distribution

The holding distribution chart reveals the concentration level of token ownership across different wallet addresses, serving as a critical metric for assessing decentralization and potential market manipulation risks. By examining the proportion of tokens held by top addresses versus smaller holders, analysts can gauge the health of token distribution and its implications for price stability.

Current data indicates a moderate concentration pattern in DRAC's holding structure. The top two addresses collectively control approximately 19.50% of the total supply, with the largest holder possessing 10,500.66K tokens (9.82%) and the second-largest holding 10,344.88K tokens (9.68%). The top five addresses combined account for roughly 24.32% of circulating tokens, while the remaining 75.68% is distributed among other participants. This distribution suggests that while whale addresses maintain significant influence, the majority of tokens remain dispersed across a broader holder base.

From a market structure perspective, this concentration level presents both opportunities and risks. The substantial holdings by top addresses could potentially lead to increased volatility during large-scale sell-offs or coordinated movements. However, the fact that over three-quarters of the supply remains with other holders provides a cushion against extreme manipulation scenarios. The relatively balanced distribution between major holders and the broader community indicates a developing ecosystem with reasonable decentralization characteristics, though continued monitoring of whale activity remains essential for understanding potential price impact dynamics.

Click to view current DRAC Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 16G1xY...Vp9Wxh | 10500.66K | 9.82% |

| 2 | 1FJdZH...B9HgSf | 10344.88K | 9.68% |

| 3 | 14LEqn...F2UWYj | 2405.71K | 2.25% |

| 4 | 1CPu7W...dn92XA | 1393.26K | 1.30% |

| 5 | 1KMLqL...BvJHno | 1359.18K | 1.27% |

| - | Others | 80820.31K | 75.68% |

II. Core Factors Influencing DRAC's Future Price

Supply Mechanism

- Market Dynamics: The supply of DRAC tokens is influenced by user adoption levels and external market factors. The token's circulation and availability in the market play a crucial role in determining its value.

- Historical Patterns: Price volatility has historically reflected shifts in market sentiment and adoption rates. The token reached its lowest price of $0.000046 on May 10, 2023, indicating how supply-demand imbalances can impact valuation.

- Current Impact: Future supply dynamics will continue to be shaped by market demand, regulatory developments, and the pace of user adoption in the data compliance sector.

Institutional and Major Holder Dynamics

- Market Sentiment: Investor sentiment remains a key driver of DRAC's price movements. The token's performance is closely tied to overall confidence in data regulation and compliance solutions within the cryptocurrency ecosystem.

- Adoption Trends: The growing emphasis on data governance and regulatory compliance across industries may influence institutional interest in tokens positioned in this sector.

Macroeconomic Environment

- Regulatory Changes: Evolving data privacy regulations and compliance requirements globally could significantly impact DRAC's utility and adoption. Regulatory clarity in key markets may enhance investor confidence.

- Market Conditions: Broader cryptocurrency market trends continue to influence DRAC's price trajectory. Market-wide sentiment, liquidity conditions, and risk appetite affect token valuations across the sector.

Technology Development and Ecosystem Building

- Data Compliance Innovation: Technological advancements in data regulation and compliance systems represent a core driver for DRAC's long-term value proposition. Improvements in compliance automation and data governance tools could enhance the token's utility.

- Ecosystem Applications: The development of practical applications in data compliance, privacy protection, and regulatory technology may expand DRAC's use cases and drive adoption among enterprises requiring robust data management solutions.

III. 2026-2031 DRAC Price Prediction

2026 Outlook

- Conservative Prediction: $0.0029 - $0.00484

- Neutral Prediction: Around $0.00484

- Optimistic Prediction: Up to $0.00586 (requiring favorable market conditions and ecosystem development)

2027-2029 Mid-term Outlook

- Market Stage Expectation: DRAC may enter a gradual recovery and growth phase, with the market potentially transitioning from consolidation to expansion

- Price Range Predictions:

- 2027: $0.00465 - $0.00663, with an estimated 9% increase

- 2028: $0.00515 - $0.00833, with an estimated 22% increase

- 2029: $0.00551 - $0.01017, with an estimated 46% increase

- Key Catalysts: Continuous ecosystem development, increased user adoption, and potential technological upgrades or partnerships may drive price growth

2030-2031 Long-term Outlook

- Baseline Scenario: $0.0052 - $0.01092 (assuming steady market development and maintained project competitiveness)

- Optimistic Scenario: $0.00866 - $0.01092 in 2030 (assuming accelerated ecosystem expansion and significant user base growth), with potential to reach $0.00871 - $0.01184 by 2031

- Transformative Scenario: Approaching $0.01184 (requiring breakthrough technological innovations, major institutional adoption, or significant market expansion)

- 2026-02-05: DRAC is currently in an early development stage, with long-term price potential dependent on project execution and overall market environment

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00586 | 0.00484 | 0.0029 | -1 |

| 2027 | 0.00663 | 0.00535 | 0.00465 | 9 |

| 2028 | 0.00833 | 0.00599 | 0.00515 | 22 |

| 2029 | 0.01017 | 0.00716 | 0.00551 | 46 |

| 2030 | 0.01092 | 0.00866 | 0.0052 | 77 |

| 2031 | 0.01184 | 0.00979 | 0.00871 | 100 |

IV. DRAC Professional Investment Strategy and Risk Management

DRAC Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors with high risk tolerance who understand the BRC-20 ecosystem and are willing to hold through market volatility

- Operational Recommendations:

- Consider dollar-cost averaging to mitigate entry price risk given DRAC's historical volatility (ATH $0.091844 to ATL $0.00005608)

- Set clear profit-taking targets, noting that current price ($0.00489) remains significantly below historical highs

- Storage Solution: Gate Web3 Wallet offers secure storage options for BRC-20 tokens with user-friendly interface and enhanced security features

(2) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor 24-hour trading volume ($16,152.73) relative to market cap ($522,369) to identify liquidity patterns

- Price Action Analysis: Track support levels around $0.004841 (24H low) and resistance near $0.005343 (24H high)

- Key Trading Considerations:

- Be aware of limited exchange availability (currently trading on Gate.com)

- Consider the impact of low liquidity on order execution and slippage

DRAC Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5-1% of crypto portfolio allocation

- Aggressive Investors: 2-3% of crypto portfolio allocation

- Professional Investors: Up to 5% with active hedging strategies

(2) Risk Hedging Solutions

- Portfolio Diversification: Balance DRAC exposure with established cryptocurrencies and stablecoins

- Stop-Loss Implementation: Consider setting stops 15-20% below entry points given recent 30-day decline of 21.93%

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for active trading with convenient access

- Cold Storage Option: Hardware wallet solutions for long-term holdings

- Security Notes: Enable two-factor authentication, never share private keys, and regularly verify wallet addresses before transactions

V. DRAC Potential Risks and Challenges

DRAC Market Risks

- High Volatility: DRAC has experienced significant price swings, with 1-year performance showing +184.35% but recent 30-day decline of -21.93%

- Limited Liquidity: With only one exchange listing and $16,152 in 24-hour volume, large orders may face execution challenges

- Low Market Capitalization: At approximately $522,369 market cap, DRAC remains highly susceptible to market manipulation and sentiment shifts

DRAC Regulatory Risks

- Meme Token Classification: As a BRC-20 meme token, DRAC may face increased regulatory scrutiny in jurisdictions targeting speculative assets

- Exchange Delisting Risk: Limited exchange presence increases vulnerability to trading access disruption

- Compliance Evolution: Changing regulations around inscription-based tokens could impact trading and accessibility

DRAC Technical Risks

- BRC-20 Protocol Dependency: Token functionality relies entirely on Bitcoin blockchain and BRC-20 standard stability

- Limited Development Activity: Available information suggests minimal ongoing technical development or ecosystem expansion

- Network Congestion: Bitcoin network fees and transaction times may affect token transfer efficiency during high-demand periods

VI. Conclusion and Action Recommendations

DRAC Investment Value Assessment

DRAC presents as a highly speculative BRC-20 meme token with significant risk-reward characteristics. While showing strong 1-year performance (+184.35%), recent negative trends across 1H (-3.02%), 24H (-8.01%), 7D (-16.68%), and 30D (-21.93%) timeframes indicate weakening momentum. The token's extremely low market cap ($522,369) and limited exchange availability suggest considerable volatility potential. Long-term value depends heavily on community engagement and broader BRC-20 ecosystem adoption. Current price ($0.00489) remains 94.67% below all-time high, presenting both recovery opportunity and downside risk.

DRAC Investment Recommendations

✅ Beginners: Avoid or allocate only minimal speculative capital (<0.5% of portfolio) after thorough research and understanding of BRC-20 tokens ✅ Experienced Investors: Consider small tactical positions (1-2% allocation) with strict stop-losses, monitoring community activity and volume trends ✅ Institutional Investors: Generally unsuitable for institutional allocation due to low liquidity, limited regulatory clarity, and lack of fundamental value drivers

DRAC Trading Participation Methods

- Spot Trading: Trade DRAC directly on Gate.com with various order types including limit and market orders

- Dollar-Cost Averaging: Reduce timing risk by making regular small purchases over extended periods

- Gate Web3 Wallet Integration: Utilize Gate Web3 Wallet for seamless on-chain storage and potential future DeFi integration

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make cautious decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is DRAC? What is its purpose?

DRAC is a remote management component for Dell PowerEdge servers, enabling administrators to monitor and control servers anytime, anywhere. It enhances operational efficiency and reduces downtime risks through centralized server management and real-time monitoring capabilities.

What is DRAC's historical price performance?

DRAC has shown upward momentum recently, with a 1.84% increase over the past 30 days. The token demonstrates volatility typical of emerging cryptocurrencies, with price fluctuations reflecting market sentiment and adoption trends. Historical performance indicates growth potential in the crypto market.

What are the main factors affecting DRAC price?

DRAC price is primarily driven by supply and demand dynamics, market sentiment, investor confidence, project development progress, trading volume, and overall crypto market conditions.

What is the DRAC price prediction for 2024?

DRAC price predictions for 2024 are uncertain. Current price stands at $0.004945. Market conditions remain volatile with unpredictable fluctuations. For accurate forecasts, consult latest market analysis and financial data sources.

What are the risks of investing in DRAC?

DRAC investment risks include market volatility, technical vulnerabilities, and regulatory uncertainty. Crypto prices fluctuate significantly, technical failures may cause losses, and regulatory changes could impact legality. Invest cautiously.

What are the advantages of DRAC compared to other mainstream cryptocurrencies?

DRAC offers efficient decentralized networks with lower transaction fees, enhanced privacy protection, and faster transaction speeds, making it more competitive than other mainstream cryptocurrencies.

How to buy and store DRAC?

Purchase DRAC on Gate.com platform. Store tokens securely in BRC20-compatible wallets. Keep your private keys confidential and backup your seed phrase for safety.

How is DRAC's market liquidity and trading volume?

DRAC maintains a 24-hour trading volume of $15,047.04 with a market cap of $533,531. The token demonstrates moderate liquidity suitable for active trading, supported by a circulating supply of 106.82 million DRAC at current price levels.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Top 5 Meme Coins to Invest in 2025: Risks and Rewards

Solana (SOL) : Low Fees, Memecoins, and the way to moon

Meme Coin Price Predictions for 2025:Factors Influencing Meme Coin Prices

Pepe Unchained: Pepe Meme Coin evolves into a Layer-2 ecosystem

MemeBox Price and Airdrop Guide 2025: What You Need to Know

LIY vs RUNE: A Comprehensive Comparison of Two Emerging Blockchain Tokens in the Crypto Market

Comprehensive Guide to Token Generation Events

What Are the Differences Between Web2 and Web3? Analyzing Future Trends in Web3

What is Grayscale, the cryptocurrency asset management firm?

A Comprehensive Guide to Decentralized Exchanges (DEXs): Leading Platforms and Selection Criteria