2026 EDGEN Price Prediction: Expert Analysis, Market Trends, and Potential Growth Opportunities

Introduction: EDGEN's Market Position and Investment Value

LayerEdge (EDGEN), positioned as the world's first people-powered zero-knowledge verification layer, has been developing its unique approach to blockchain verification since its launch. As of February 2026, EDGEN maintains a market capitalization of approximately $672,355, with a circulating supply of around 260.3 million tokens, and the price stabilizing around $0.002583. This asset, recognized as a "democratizing force in blockchain verification," is playing an increasingly vital role in the Web3 security infrastructure.

This article will comprehensively analyze EDGEN's price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. EDGEN Price History Review and Market Status

EDGEN Historical Price Evolution Trajectory

- 2025: Initial market entry with listing on Gate.com in June, price established early trading patterns

- 2025: Price reached a peak level of $0.08 in early June, reflecting initial market enthusiasm

- 2025-2026: Market adjustment phase, price declined from historical high of $0.08 to current levels around $0.002583

EDGEN Current Market Situation

As of February 4, 2026, EDGEN is trading at $0.002583, showing a decline of 0.87% over the past 24 hours. The token has experienced notable volatility recently, with a 7-day decrease of 26.029% and a 30-day decline of 38.76%. Over the past year, the token has decreased by 93.53% from its higher levels.

The 24-hour trading volume stands at $14,749.71, with the token ranking approximately 2800th in the cryptocurrency market. The current price represents a significant adjustment from the historical high of $0.08, which was recorded in early June 2025. The recent low of $0.002496 was observed on February 3, 2026.

EDGEN's market capitalization is approximately $672,354.90, with a circulating supply of 260.3 million tokens out of a total supply of 1 billion tokens, representing a circulation ratio of 26.03%. The fully diluted market cap stands at $2.583 million. The token is held by 4,312 addresses and is listed on 9 exchanges. The market share represents approximately 0.000097% of the total cryptocurrency market.

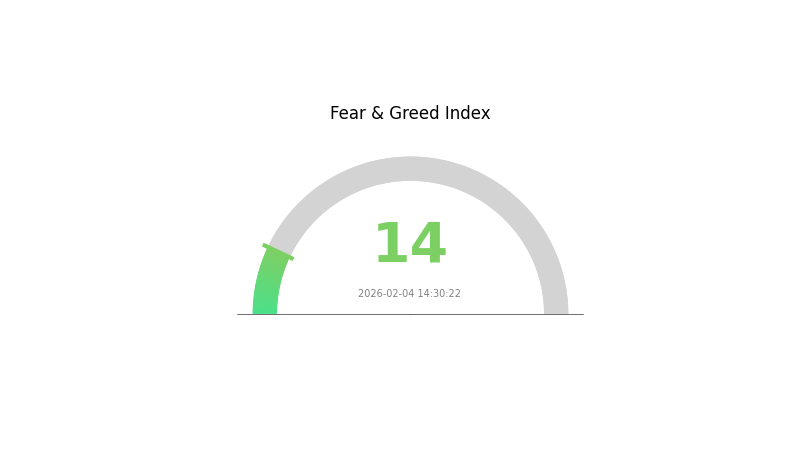

The current market sentiment indicator shows a reading of 14, corresponding to an "Extreme Fear" classification, suggesting heightened caution among market participants.

Click to view current EDGEN market price

EDGEN Market Sentiment Index

2026-02-04 Fear and Greed Index: 14 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear, with the index hitting 14. This indicates significant market pessimism and investor anxiety. Such levels typically present contrarian opportunities, as extreme fear often precedes market reversals. Investors should exercise caution while remaining alert to potential entry points. Market conditions suggest heightened volatility and uncertainty. Monitor key support levels and consider dollar-cost averaging strategies during prolonged fear periods. Professional traders often view extreme fear as a potential accumulation phase before recovery.

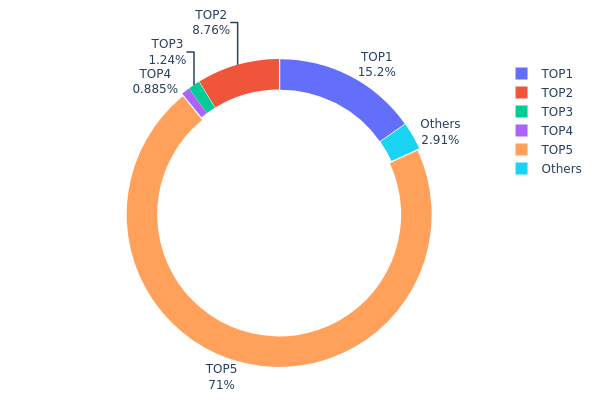

EDGEN Token Distribution

The token distribution chart visualizes the allocation of EDGEN tokens across different wallet addresses, serving as a critical indicator of decentralization and potential market manipulation risks. According to the current data, EDGEN exhibits a highly concentrated holding structure, with the top 5 addresses collectively controlling approximately 97.07% of the total supply.

The most striking feature is the dominance of address 0xe1ff...62d1a6, which alone holds 710,000K tokens, representing 71.00% of the entire circulating supply. This extreme concentration poses significant concerns regarding centralized control. Additionally, addresses ranked 1st and 2nd hold 15.20% and 8.75% respectively, further reinforcing the top-heavy distribution pattern. The remaining addresses, including those ranked 3rd through 5th and all others combined, account for merely 2.93% of holdings.

Such a centralized structure creates substantial systemic risks for EDGEN's market dynamics. The disproportionate control by a single entity could lead to heightened price volatility, as large-scale transactions from major holders may trigger dramatic price swings. Furthermore, this concentration raises questions about governance decentralization and potential vulnerability to coordinated sell-offs. From an on-chain structural perspective, EDGEN currently demonstrates weak distribution characteristics, indicating that the project is either in its early distribution phase or intentionally maintains a centralized token allocation model, which may impact long-term community trust and market stability.

Click to view current EDGEN Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xb8bb...1d6f4a | 152087.88K | 15.20% |

| 2 | 0x4b2c...3dd03e | 87576.02K | 8.75% |

| 3 | 0x58ed...a36a51 | 12430.07K | 1.24% |

| 4 | 0x0d07...b492fe | 8849.08K | 0.88% |

| 5 | 0xe1ff...62d1a6 | 710000.00K | 71.00% |

| - | Others | 29056.95K | 2.93% |

II. Core Factors Influencing EDGEN's Future Price

Supply Mechanism

- Community-Driven Token Distribution: A significant portion of EDGEN tokens is allocated through community programs, encouraging broad ownership and active participation among users.

- Historical Pattern: Token distribution strategies that prioritize community engagement have historically contributed to more stable holder bases and reduced concentration risk.

- Current Impact: The ongoing community allocation approach may support sustained interest and potentially influence price stability as more users become stakeholders in the ecosystem.

Institutional and Whale Dynamics

Insufficient information is currently available regarding institutional holdings, major corporate adoption, or specific national policies directly related to EDGEN.

Macroeconomic Environment

- Monetary Policy Impact: LayerEdge's price movement, like many digital assets, can be influenced by broader macroeconomic trends, including central bank policies and interest rate environments.

- Regulatory Environment: Government regulations and legal clarity in major cryptocurrency markets play a significant role in shaping investor confidence and market dynamics.

- Geopolitical Factors: International regulatory developments and policy shifts may create uncertainty or opportunity depending on their nature and scope.

Technology Development and Ecosystem Building

- Technology Adoption: LayerEdge's price trajectory is influenced by the rate and breadth of its technology adoption within the blockchain ecosystem.

- Market Sentiment: Investor confidence responds directly to news of widespread adoption or significant technological breakthroughs related to EDGEN.

- Technical Innovation: Progress in LayerEdge's technical capabilities and the expansion of its utility may contribute to long-term value perception among market participants.

III. 2026-2031 EDGEN Price Prediction

2026 Outlook

- Conservative Prediction: $0.0017 - $0.00258

- Neutral Prediction: $0.00258 average price level

- Optimistic Prediction: Up to $0.00333 (requiring favorable market conditions)

2027-2029 Outlook

- Market Stage Expectation: Progressive growth phase with gradual market expansion

- Price Range Predictions:

- 2027: $0.00183 - $0.0039

- 2028: $0.00178 - $0.00408

- 2029: $0.00316 - $0.0047

- Key Catalysts: Steady market adoption and ecosystem development driving price appreciation

2030-2031 Long-term Outlook

- Baseline Scenario: $0.00372 - $0.00545 (assuming sustained market interest)

- Optimistic Scenario: $0.00416 - $0.00668 (under favorable regulatory environment and increased adoption)

- Transformational Scenario: Potential to reach $0.00668 (with exceptional market conditions and widespread ecosystem integration)

- 2026-02-04: EDGEN trading within established range (current market positioning)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00333 | 0.00258 | 0.0017 | 0 |

| 2027 | 0.0039 | 0.00296 | 0.00183 | 14 |

| 2028 | 0.00408 | 0.00343 | 0.00178 | 32 |

| 2029 | 0.0047 | 0.00376 | 0.00316 | 45 |

| 2030 | 0.00545 | 0.00423 | 0.00372 | 63 |

| 2031 | 0.00668 | 0.00484 | 0.00416 | 87 |

IV. EDGEN Professional Investment Strategy and Risk Management

EDGEN Investment Methodology

(I) Long-term Holding Strategy

- Target Investors: Believers in decentralized verification infrastructure and Bitcoin-backed security models

- Operational Recommendations:

- Consider accumulating positions during market downturns, particularly when price retraces significantly from historical peaks

- Monitor LayerEdge ecosystem development milestones and user growth metrics as key holding indicators

- Storage Solution: Utilize Gate Web3 Wallet for secure asset custody with multi-signature protection

(II) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor the 24-hour trading volume trends to identify potential breakout or breakdown signals

- Support and Resistance Levels: Track price action around key psychological levels and historical price zones

- Swing Trading Essentials:

- Consider the high volatility characteristics reflected in significant percentage changes across different timeframes

- Implement strict stop-loss orders given the token's price fluctuation patterns

EDGEN Risk Management Framework

(I) Asset Allocation Principles

- Conservative Investors: 1-3% of crypto portfolio allocation

- Aggressive Investors: 5-8% of crypto portfolio allocation

- Professional Investors: Up to 10% with active position management

(II) Risk Hedging Solutions

- Portfolio Diversification: Balance EDGEN holdings with established cryptocurrencies and stablecoins

- Position Sizing: Scale investments gradually rather than entering full positions at once

(III) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for convenient trading and staking participation

- Cold Storage Option: Transfer long-term holdings to hardware wallet solutions for enhanced security

- Security Precautions: Never share private keys, enable two-factor authentication, and verify contract addresses before transactions

V. EDGEN Potential Risks and Challenges

EDGEN Market Risks

- High Volatility Exposure: The token has experienced substantial price fluctuations, with a 93.53% decline over one year

- Liquidity Concerns: Relatively modest 24-hour trading volume may result in slippage during larger transactions

- Market Cap Position: Current ranking and market dominance suggest limited institutional participation at this stage

EDGEN Regulatory Risks

- Decentralized Verification Oversight: Evolving regulatory frameworks for distributed validation networks may impact operational models

- Cross-jurisdictional Compliance: Global user base spanning multiple regulatory environments creates compliance complexity

- Token Classification Uncertainty: Regulatory treatment of utility tokens tied to verification services remains subject to interpretation

EDGEN Technical Risks

- Network Scalability Challenges: Achieving verification distribution across millions of users requires robust technical infrastructure

- Bitcoin Integration Dependencies: Reliance on Bitcoin's security foundation creates exposure to potential issues in the underlying network

- Competition from Established Solutions: Emerging market with potential competition from other verification and security protocols

VI. Conclusion and Action Recommendations

EDGEN Investment Value Assessment

LayerEdge presents an innovative approach to democratizing blockchain verification through its people-powered zero-knowledge verification layer. The project's emphasis on Bitcoin-backed security and user participation addresses genuine infrastructure needs in the Web3 ecosystem. However, investors should carefully weigh the long-term vision against current market realities, including significant price volatility, limited liquidity, and early-stage development status. The token's substantial decline from historical peaks reflects both broader market conditions and execution risks inherent in emerging infrastructure projects.

EDGEN Investment Recommendations

✅ Beginners: Limit exposure to small experimental allocations, focus on understanding the project's fundamentals before increasing position size, and utilize educational resources to learn about zero-knowledge verification technology

✅ Experienced Investors: Consider strategic accumulation during price weakness if aligned with portfolio thesis, actively monitor ecosystem development metrics and user growth indicators, and implement disciplined position sizing with clearly defined risk parameters

✅ Institutional Investors: Conduct comprehensive due diligence on technical architecture and team execution capabilities, assess regulatory implications across relevant jurisdictions, and consider pilot allocations with staged deployment tied to milestone achievements

EDGEN Trading Participation Methods

- Spot Trading: Purchase EDGEN directly on Gate.com with competitive trading pairs and deep liquidity access

- Dollar-Cost Averaging: Implement systematic purchase plans to mitigate timing risk and reduce volatility impact

- Ecosystem Participation: Explore opportunities to engage with the edgenOS verification layer as the network develops

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is EDGEN? What are its main uses and application scenarios?

EDGEN is a lightweight office and collaboration tool designed for note-taking, slide creation, storyboarding, code generation, web development, and data analysis. It serves teams and individuals seeking efficient productivity solutions across multiple work scenarios.

What are the main factors affecting EDGEN price?

EDGEN price is mainly influenced by token distribution through community programs that encourage user participation, and technology adoption driving market demand. Market sentiment, trading volume, and ecosystem development also play significant roles in price movements.

How to predict and analyze the future price of EDGEN?

Analyze EDGEN price trends by monitoring trading volume, market capitalization, adoption rates, and network fundamentals. Consider historical price patterns, investor sentiment, and blockchain ecosystem developments. Based on current growth trajectories, EDGEN could reach approximately 0.028355 by 2027 with 5% annual growth, potentially rising further by 2030.

Common technical analysis methods used in EDGEN price prediction?

Common EDGEN price prediction methods include moving averages, RSI (Relative Strength Index), and candlestick chart analysis. These tools help analyze historical price trends and market sentiment to forecast price movements.

What are the advantages and disadvantages of EDGEN compared to similar tokens?

EDGEN advantages: cross-chain verification, ZK technology integration, Bitcoin security backing. Disadvantages: technical complexity, intense market competition, adoption challenges. Positioned as emerging verification infrastructure with growth potential.

What risks should I consider when investing in EDGEN?

EDGEN investment risks include technology execution risk, market adoption uncertainty, and competition from other Layer2 solutions. Assess deployment scale, mainnet timeline, and actual builder adoption before investing.

Top Layer 2 projects worth following in 2025: From Arbitrum to zkSync

Pepe Unchained: Pepe Meme Coin evolves into a Layer-2 ecosystem

2025 Layer-2 Solution: Ethereum Scalability and Web3 Performance Optimization Guide

What is Layer 2 in crypto assets? Understand the scaling solution for Ethereum

How Layer 2 Changes the Crypto Assets Experience: Speed, Cost, and Mass Adoption

Pepe Unchained (PEPU): Building the New Era of Meme Coins on Layer 2

Is Taker Protocol (TAKER) a good investment?: A comprehensive analysis of tokenomics, use cases, and market potential

Is zkLink (ZKL) a good investment?: A comprehensive analysis of the zkEVM aggregation protocol's potential and risks in 2024

Is Aura Network (AURA) a good investment?: A Comprehensive Analysis of Technology, Market Potential, and Risk Factors for 2024

Is OPTIMUS (OPTIMUS) a good investment?: A Comprehensive Analysis of Potential Returns and Risk Factors

Is De.Fi (DEFI) a good investment?: A Comprehensive Analysis of Risks, Opportunities, and Market Potential in 2024