2026 GO4 Price Prediction: Expert Analysis and Market Forecast for the Next Generation Gaming Console

Introduction: GO4's Market Position and Investment Value

GameonForge (GO4), as a dynamic Web3 gaming onboarding solution, has established itself in the blockchain gaming ecosystem since its launch in 2024. As of February 2026, GO4 maintains a market capitalization of approximately $541,211, with a circulating supply of around 4.62 million tokens, and the price hovering near $0.117. This asset, known as a bridge between traditional gaming and Web3 ecosystems, is playing an increasingly important role in facilitating user adoption through its network of over 300 traditional game streams.

This article will comprehensively analyze GO4's price trajectory from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide professional price forecasts and practical investment strategies for investors.

I. GO4 Price History Review and Current Market Status

GO4 Historical Price Evolution Trajectory

- 2025: GO4 reached a price peak of $1.1877 on June 20, experiencing substantial volatility throughout the year

- 2025: The token encountered a significant downturn in March, dropping to its recorded low of $0.0362 on March 16

- 2025-2026: Following the launch price of $0.2 in November 2025, GO4 has shown mixed performance, with the current price settling at $0.11714

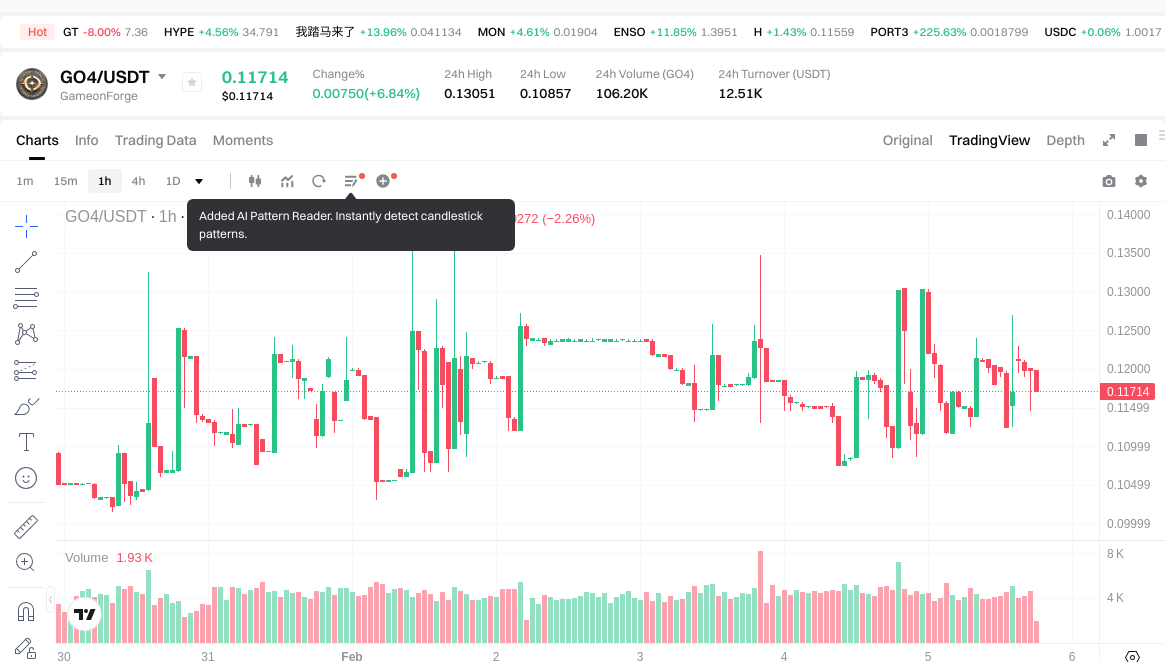

GO4 Current Market Dynamics

As of February 5, 2026, GO4 is trading at $0.11714, reflecting a 24-hour increase of 6.84%. The token has demonstrated moderate price movement within a daily range between $0.10857 and $0.13051. Over the past seven days, GO4 has gained 6.76%, while the 30-day performance shows a 5.94% increase. However, the annual perspective reveals a decline of 26.63% from its peak levels.

The current market capitalization stands at approximately $541,211, with a 24-hour trading volume of $12,565. GO4 maintains a circulating supply of 4,620,207 tokens out of a maximum supply of 100,000,000 tokens, representing a circulation ratio of 4.62%. The fully diluted market cap is calculated at $11,714,000, with the token holding a 0.00045% share of the broader market.

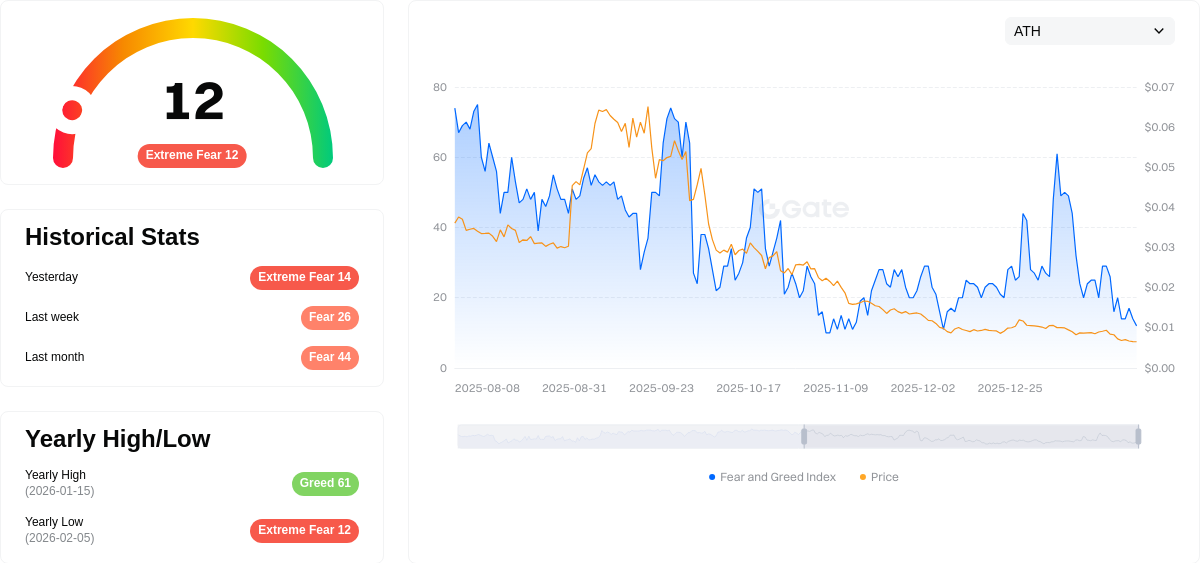

The token operates on the Arbitrum network and has attracted 1,586 holders since its launch. Current market sentiment indicators show an extreme fear reading of 12 on the volatility index, suggesting cautious investor positioning in the broader cryptocurrency environment.

Click to view the current GO4 market price

GO4 Market Sentiment Index

2026-02-05 Fear and Greed Index: 12 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear, with the Fear and Greed Index dropping to 12. This indicates investors are highly risk-averse, driven by pessimistic sentiment and market uncertainty. During such periods, assets typically trade at depressed valuations, creating potential opportunities for contrarian investors. However, extreme fear also signals heightened volatility and downside risks. Traders should exercise caution, maintain strict risk management, and avoid emotional decision-making. Long-term investors may view this as an accumulation opportunity, while short-term traders should wait for clearer market signals before taking positions.

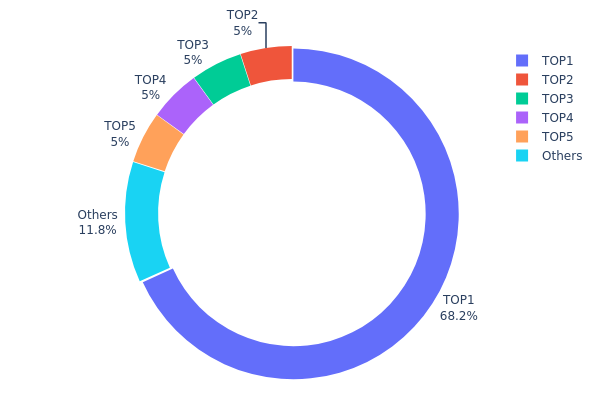

GO4 Holdings Distribution

The holdings distribution chart illustrates the percentage allocation of GO4 tokens across different wallet addresses, serving as a crucial indicator of token concentration and decentralization within the network. By examining the distribution pattern among top holders, this metric helps assess the potential risks of market manipulation and provides insights into the overall health of the token's ecosystem structure.

According to the current data, GO4 exhibits a highly concentrated holdings structure. The top address controls an overwhelming 68.23% of the total supply (68,230,000 tokens), while the second through fifth largest holders each maintain exactly 5% (5,000,010 and 5,000,000 tokens respectively). The remaining 11.77% is distributed among other addresses. This distribution pattern suggests a centralized control mechanism, potentially indicating locked team allocations, treasury reserves, or strategic partnership holdings.

Such extreme concentration presents both opportunities and challenges for market participants. While the uniform 5% holdings among multiple top addresses may indicate a structured distribution strategy, the dominant 68.23% concentration in a single address significantly impacts market dynamics. This structure could lead to heightened volatility if large holders decide to move their positions, and it raises concerns about potential price manipulation risks. However, if these concentrated holdings represent locked or vested tokens with transparent release schedules, they may actually contribute to long-term price stability by limiting immediate circulating supply.

Click to view current GO4 Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x628c...2f2384 | 68230.00K | 68.23% |

| 2 | 0x9fc2...aba8f5 | 5000.01K | 5.00% |

| 3 | 0x4d37...c3bc8e | 5000.00K | 5.00% |

| 4 | 0xc9fe...73a71f | 5000.00K | 5.00% |

| 5 | 0x9f26...6cd83e | 5000.00K | 5.00% |

| - | Others | 11770.00K | 11.77% |

II. Core Factors Influencing GO4's Future Price

Supply Mechanism

- Customer-Centric Restructuring: GO4's strategic framework is built around customer demand integration, moving away from traditional production-based divisions. This transformation aims to enhance operational efficiency and responsiveness to market needs.

- Historical Pattern: Supply chain optimization and organizational restructuring have historically contributed to improved market positioning and value creation in similar business models.

- Current Impact: The shift towards customer-centric operations may enhance GO4's competitive advantage, potentially supporting price appreciation through improved service delivery and market penetration.

Institutional and Major Holder Dynamics

- Market Competition: GO4 operates in an environment influenced by high value-added products and technological advancements, including AI, edge computing, and integrated infrastructure solutions.

- Industry Adoption: The project demonstrates alignment with enterprise transformation strategies, focusing on integrated customer solutions rather than traditional segmentation.

- Economic Context: Global economic pressures, including economic downturns, geopolitical tensions, and weakened consumer confidence, create a challenging operating environment that affects valuation dynamics.

Macroeconomic Environment

- Economic Headwinds: The global economy faces multiple pressures including structural adjustments in key markets and policy uncertainties, which may influence investment appetite and risk tolerance.

- Market Sentiment: Consumer confidence fluctuations and economic uncertainties contribute to volatility in asset valuations across various sectors.

- Policy Variables: Regulatory frameworks and policy changes remain important considerations for future performance trajectories.

Technology Development and Ecosystem Building

- Strategic Integration: GO4's approach emphasizes customer demand integration and operational optimization, representing a shift toward more adaptive business models.

- Innovation Focus: The emphasis on high-value products and service transformation suggests ongoing development efforts aimed at market differentiation.

- Ecosystem Evolution: The restructuring from production-based to customer-centric models indicates efforts to build more resilient and responsive operational frameworks.

III. 2026-2031 GO4 Price Prediction

2026 Outlook

- Conservative prediction: $0.08903 - $0.11714

- Neutral prediction: $0.11714 (average market conditions)

- Optimistic prediction: $0.13588 (requires favorable market sentiment and increased adoption)

2027-2029 Outlook

- Market stage expectation: The token is projected to enter a gradual growth phase with moderate volatility, characterized by steady price appreciation and expanding market participation.

- Price range predictions:

- 2027: $0.11639 - $0.14169 (approximately 8% growth)

- 2028: $0.07107 - $0.13947 (14% cumulative growth with potential consolidation)

- 2029: $0.09985 - $0.17372 (16% cumulative growth)

- Key catalysts: Market expansion, potential ecosystem developments, and broader cryptocurrency market trends could serve as primary drivers for price movement during this period.

2030-2031 Long-term Outlook

- Baseline scenario: $0.1273 - $0.18319 (assuming steady market conditions and continued project development)

- Optimistic scenario: $0.15525 - $0.18319 (with enhanced utility and growing user base)

- Transformative scenario: Above $0.18319 (under exceptional favorable conditions including significant partnerships or technological breakthroughs)

- 2026-02-05: GO4 trading within projected range (early stage of 2026 forecast period)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.13588 | 0.11714 | 0.08903 | 0 |

| 2027 | 0.14169 | 0.12651 | 0.11639 | 8 |

| 2028 | 0.13947 | 0.1341 | 0.07107 | 14 |

| 2029 | 0.17372 | 0.13678 | 0.09985 | 16 |

| 2030 | 0.18319 | 0.15525 | 0.1273 | 32 |

| 2031 | 0.17938 | 0.16922 | 0.14045 | 44 |

IV. GO4 Professional Investment Strategies and Risk Management

GO4 Investment Methodology

(I) Long-term Holding Strategy

- Suitable for: Believers in Web3 gaming ecosystem development and patient investors seeking to participate in the gaming industry's blockchain transformation

- Operational Recommendations:

- Consider accumulating positions during market corrections when GO4 trades closer to support levels

- Monitor project development milestones including expansion of the 300+ gaming stream network and new game partnerships

- Utilize Gate Web3 Wallet for secure storage with proper backup of recovery phrases and private keys

(II) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor the 24-hour trading volume ($12,565.01) relative to market cap ($541,211.05) to identify liquidity patterns

- Price Range Indicators: Track the 24-hour range between $0.10857 and $0.13051 to identify potential entry and exit points

- Swing Trading Considerations:

- Observe short-term volatility patterns, noting the -2.26% 1-hour and +6.84% 24-hour price movements

- Set stop-loss orders to manage downside risk given the relatively low circulating supply (4.62% of total supply)

GO4 Risk Management Framework

(I) Asset Allocation Principles

- Conservative Investors: 1-3% portfolio allocation, focusing on established projects with GO4 as a minor speculative position

- Aggressive Investors: 5-10% allocation, appropriate for those comfortable with higher volatility in emerging gaming tokens

- Professional Investors: Up to 15% allocation with active position management and hedging strategies

(II) Risk Hedging Approaches

- Diversification Strategy: Balance GO4 holdings with other gaming sector tokens and established cryptocurrencies to reduce sector-specific risk

- Position Sizing: Scale positions based on market cap rank (#2983) and liquidity conditions to maintain portfolio stability

(III) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for active trading and convenient access to Gate.com trading pairs

- Cold Storage Approach: For long-term holdings, consider transferring tokens to hardware wallets after verifying the Arbitrum network contract address (0x85b7fa2a3cfe5ed48b619ec967750462a1fd9557)

- Security Precautions: Never share private keys, enable two-factor authentication, verify contract addresses through Arbiscan, and be cautious of phishing attempts targeting gaming token holders

V. GO4 Potential Risks and Challenges

GO4 Market Risks

- Low Liquidity Exposure: With a 24-hour trading volume of approximately $12,565 against a market cap of $541,211, significant price slippage may occur during larger transactions

- High Volatility Potential: The limited circulating supply (4.62% of total supply) may amplify price movements in response to trading activity or news events

- Market Cap Positioning: Ranked #2983 with 0.00045% market dominance indicates early-stage status with associated valuation uncertainty

GO4 Regulatory Risks

- Gaming Sector Scrutiny: Web3 gaming projects may face evolving regulatory frameworks regarding virtual asset classification and gaming regulations across jurisdictions

- Token Classification Uncertainty: Regulatory authorities in various regions may assess gaming utility tokens differently, potentially affecting trading availability

- Compliance Requirements: Future regulatory developments could impose additional compliance obligations on gaming platforms and their associated tokens

GO4 Technical Risks

- Smart Contract Dependencies: As an Arbitrum-based token, GO4 relies on the security and performance of the underlying Layer 2 infrastructure

- Platform Development Risk: The project's value proposition depends on successful execution of the Web3 gaming onboarding model and maintaining the network of traditional gaming streams

- Limited Exchange Availability: Currently available on 1 exchange, which may constrain liquidity and increase dependency on single platform operations

VI. Conclusion and Action Recommendations

GO4 Investment Value Assessment

GO4 represents an early-stage opportunity in the Web3 gaming sector, positioned as a bridge between traditional gaming audiences and blockchain-based games through its network of over 300 gaming streams. The project's focus on consumer onboarding addresses a recognized challenge in Web3 gaming adoption. However, investors should carefully consider several factors: the limited circulating supply (4.62% of total) creates potential for both upside and volatility, the relatively low market cap ranking indicates early development stage, and the single-exchange availability constrains liquidity. The token has experienced price fluctuations, with a -26.63% annual performance, while showing recent positive momentum with a +6.84% 24-hour change. Long-term value will depend on the project's ability to successfully onboard users to Web3 gaming and expand its ecosystem partnerships.

GO4 Investment Recommendations

✅ Beginners: Start with minimal allocation (1-2% of crypto portfolio) to gain exposure while learning about Web3 gaming dynamics; utilize Gate.com's user-friendly interface for initial purchases and consider Gate Web3 Wallet for secure storage

✅ Experienced Investors: Consider a moderate position (3-7% allocation) with staged entry points; monitor development milestones and gaming partnerships; implement stop-loss strategies to manage the volatility associated with low liquidity conditions

✅ Institutional Investors: Conduct thorough due diligence on the gaming stream network claims and user onboarding metrics; assess position sizes carefully given limited liquidity ($12,565 daily volume); consider OTC arrangements for larger positions to minimize market impact

GO4 Trading Participation Methods

- Spot Trading on Gate.com: Access GO4/USDT trading pairs with competitive fees and established security infrastructure

- DeFi Integration: Interact with GO4's Arbitrum-based smart contract (verify address: 0x85b7fa2a3cfe5ed48b619ec967750462a1fd9557) through compatible decentralized applications

- Long-term Accumulation: Establish a dollar-cost averaging strategy through regular purchases on Gate.com to smooth out entry prices over time

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make cautious decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the current price of GO4 and how has its historical price trend been?

GO4 is currently trading at $0.18306, down 84.59% from its all-time high of $1.1877 reached on June 20, 2025. Over the past week, GO4 declined 2.65%, while the 30-day trend showed a slight gain of 0.37%.

What is the GO4 price prediction target for 2024?

Based on 2025 market trend analysis, the GO4 price prediction target for 2024 is $0.19. This projection reflects market momentum and value growth potential observed during that period.

What are the main factors affecting GO4 price?

GO4 price is primarily influenced by market demand, token supply, technical development, and regulatory policies. Investor sentiment and macroeconomic trends also play important roles in price movements.

What are the advantages of GO4 compared to similar projects?

GO4 stands out with superior transaction volume efficiency, faster confirmation speeds, and lower fees than comparable projects. Its advanced prediction algorithms and robust security features provide traders with reliable market insights and enhanced portfolio protection.

What are the main risks of GO4 investment and how to avoid them?

Main risks include regulatory uncertainty and market volatility. Mitigate by diversifying your portfolio and closely monitoring market dynamics and project developments.

What is GO4's technical foundation and team background?

GO4 is built on advanced machine learning and deep learning architecture. The development team comprises top AI experts with extensive research and commercial application experience, providing strong technical foundation and team capabilities.

What is the market liquidity and trading volume situation of GO4?

GO4 maintains a 24-hour trading volume of $12,621.16 with price range between $0.1095-$0.1301. The token demonstrates consistent market activity with data aggregated from multiple tracking platforms, reflecting steady participation and liquidity in the current market environment.

2025 Vertus daily combo code: Web3 gamers rewards guide

Today's Vertus Daily Combo Code: Boost Your Web3 Gaming Rewards (April 29, 2025)

GALA Coin (GALA) – Web3 Gaming Token Overview, Price Prediction & Trading on Gate.com

What is Gaming Crypto?How Gaming Crypto Works?

Detailed analysis of the top ten encryption game coins to be launched in 2025

Top 6 Best Gaming Currencies

LIY vs RUNE: A Comprehensive Comparison of Two Emerging Blockchain Tokens in the Crypto Market

Comprehensive Guide to Token Generation Events

What Are the Differences Between Web2 and Web3? Analyzing Future Trends in Web3

What is Grayscale, the cryptocurrency asset management firm?

A Comprehensive Guide to Decentralized Exchanges (DEXs): Leading Platforms and Selection Criteria