2026 KLINK Price Prediction: Expert Analysis and Future Market Outlook for the Emerging Blockchain Token

Introduction: KLINK's Market Position and Investment Value

Klink Finance (KLINK), positioning itself as the affiliate and ad tech infrastructure for Web3, has been facilitating platform growth and monetization through a global network of partner offers and campaigns. As of February 2026, KLINK maintains a market capitalization of approximately $167,008, with a circulating supply of about 231.67 million tokens, and a current price around $0.0007209. This utility token, serving as the core of the Klink ecosystem, is playing an increasingly vital role in Web3 advertising technology and affiliate marketing sectors.

This article will comprehensively analyze KLINK's price trajectory from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. KLINK Price History Review and Market Status

KLINK Historical Price Evolution Trajectory

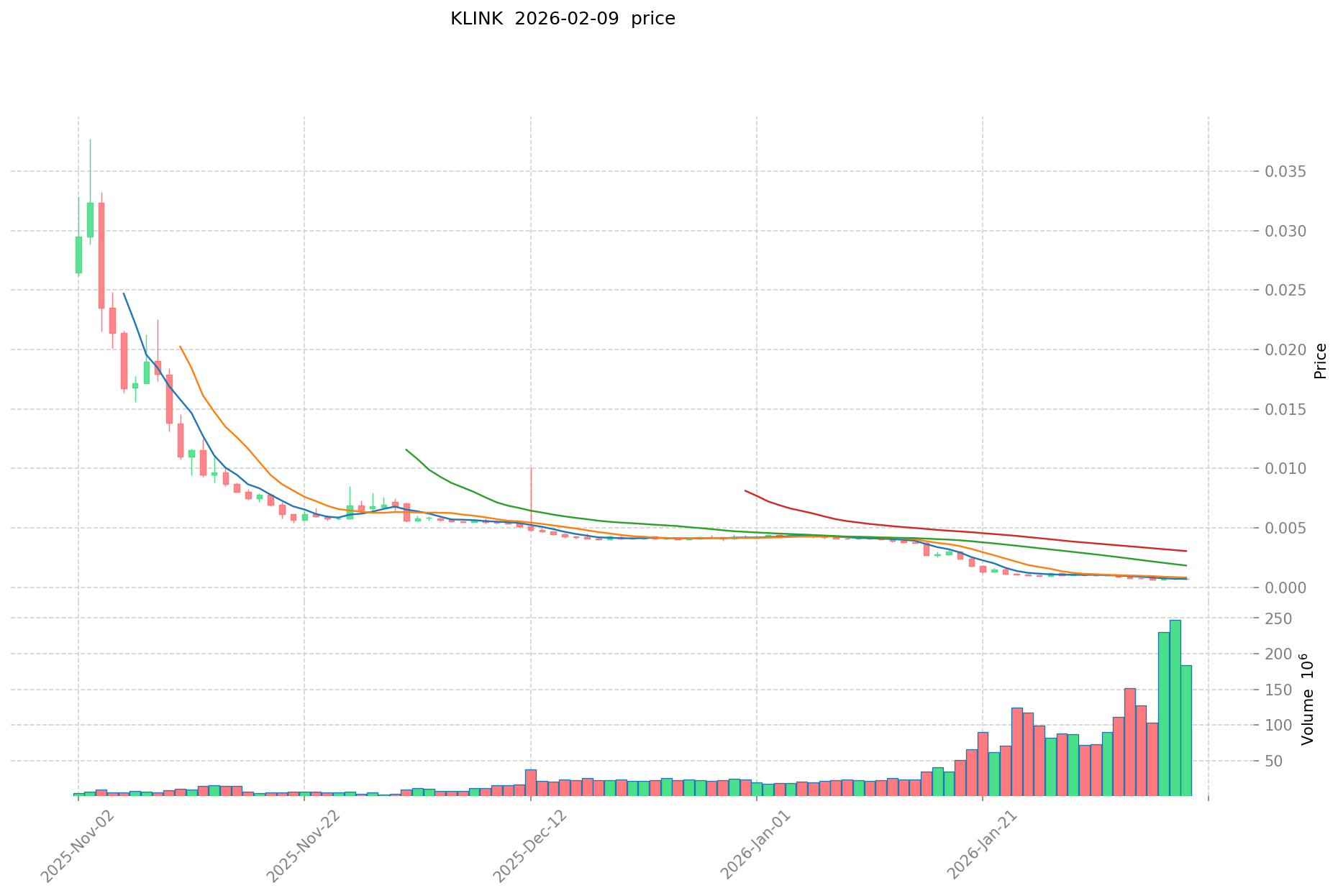

- 2025: KLINK reached a notable price level of $0.2232 on October 7, marking a significant milestone in its early trading period

- 2026: The token experienced substantial downward pressure, with the price declining to $0.0006274 on February 6, representing a considerable correction from previous levels

KLINK Current Market Situation

As of February 9, 2026, KLINK is trading at $0.0007209, showing a 24-hour increase of 5.67%. The token's 24-hour trading range has been between $0.0006816 and $0.0007308, with a total trading volume of $125,622.14.

The current market capitalization stands at $167,008.50, with 231,666,666 tokens in circulation out of a maximum supply of 1,000,000,000 tokens, representing a circulation ratio of 23.17%. The fully diluted market cap is calculated at $720,900.

From a broader perspective, KLINK has faced notable price movements across different timeframes. The 1-hour change shows a decline of 0.74%, while the 7-day performance indicates a decrease of 27.96%. The 30-day trend reflects a downturn of 82.28%, and the 1-year performance shows a decline of 99.27%.

The token currently ranks #4,160 in the overall cryptocurrency market with a dominance of 0.000028%. KLINK is traded across 6 exchanges and has attracted 85,288 holders. The token operates on the BSC chain using the BEP-20 standard, with its contract address at 0x76e9b54b49739837be8ad10c3687fc6b543de852.

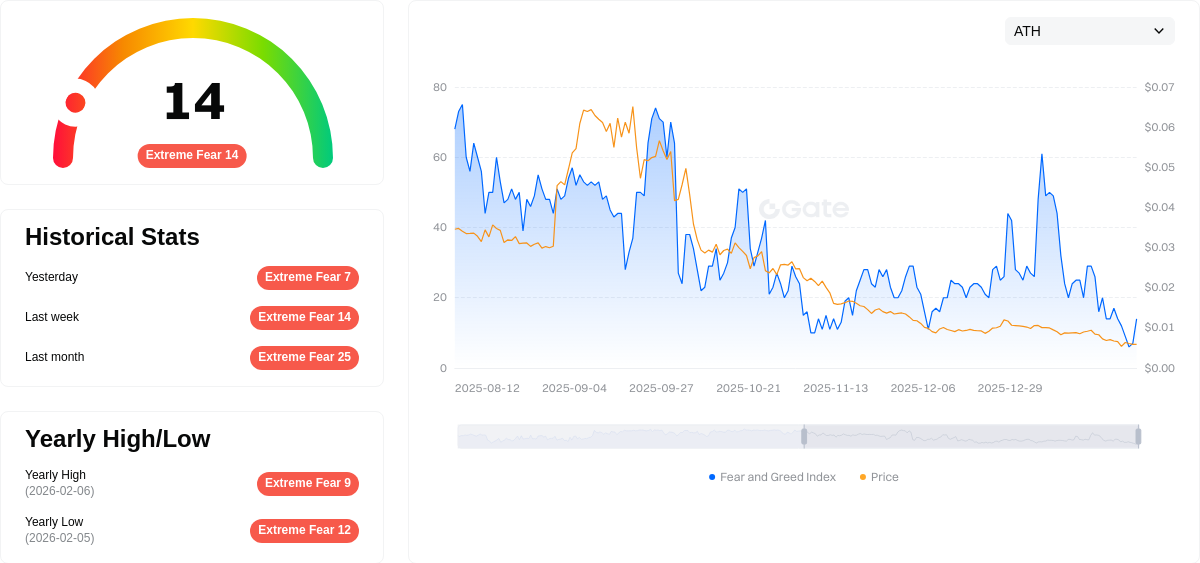

The market sentiment index stands at 14, indicating an extreme fear level in the current market environment.

Click to view current KLINK market price

KLINK Market Sentiment Indicator

2026-02-09 Fear and Greed Index: 14 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index standing at 14. This exceptionally low reading indicates that market participants are highly pessimistic and risk-averse. During such periods, investors typically withdraw from risky assets and seek safe havens. However, extreme fear often presents contrarian opportunities for long-term investors. Historical data suggests that markets typically recover from such sentiment extremes. Traders should exercise caution and avoid panic selling while remaining alert for potential entry points. Risk management remains paramount in volatile market conditions.

KLINK Holding Distribution

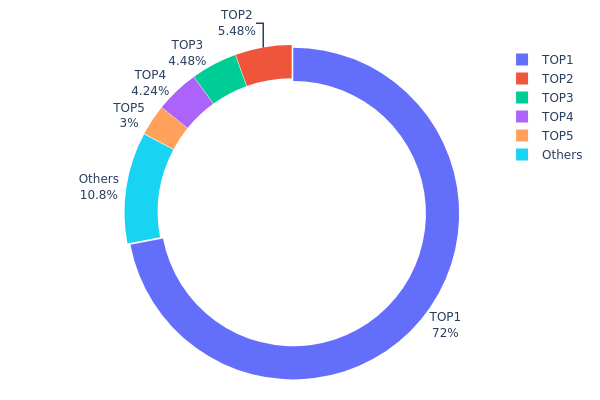

The holding distribution chart reflects the concentration of token holdings across different wallet addresses, serving as a crucial indicator of decentralization and market structure stability. By analyzing the distribution pattern of KLINK tokens among top holders and retail participants, we can assess potential risks related to price manipulation, liquidity concentration, and overall network health.

Based on the current data, KLINK exhibits a highly concentrated holding structure. The top address (0x700e...8de575) holds approximately 719.77 million tokens, accounting for 71.97% of the total supply. The top five addresses collectively control 85.15% of all KLINK tokens, while other addresses hold only 10.85%. This significant imbalance indicates that the vast majority of tokens are concentrated in the hands of a small number of entities, which could be project treasury wallets, early investors, or institutional holders.

Such extreme concentration poses notable risks to market stability and price dynamics. With over 70% of supply controlled by a single address, any large-scale selling activity could trigger substantial price volatility and liquidity crises. Additionally, this distribution pattern suggests limited token circulation in the open market, potentially making KLINK susceptible to price manipulation. The low percentage held by retail and smaller participants (10.85%) also reflects weak decentralization and may constrain organic market growth and community-driven development.

Click to view current KLINK Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x700e...8de575 | 719768.52K | 71.97% |

| 2 | 0x53f7...f3fa23 | 54835.98K | 5.48% |

| 3 | 0x73d8...4946db | 44781.18K | 4.47% |

| 4 | 0x468a...4833d2 | 42386.77K | 4.23% |

| 5 | 0x7a3d...6c667a | 30000.00K | 3.00% |

| - | Others | 108227.55K | 10.85% |

II. Core Factors Influencing KLINK's Future Price

Supply Mechanism

- Market Supply and Demand Dynamics: KLINK's price is significantly influenced by the balance between market supply and demand. Changes in token circulation and trading volume directly impact price volatility.

- Historical Patterns: Past observations show that KLINK's market price experiences notable fluctuations during periods of supply-demand imbalance, with investor sentiment playing a crucial role in these movements.

- Current Impact: The current market environment indicates that price volatility may intensify due to supply-demand factors and shifting market sentiment, particularly as the project continues to develop and expand its user base.

Institutional and Major Holder Dynamics

- Institutional Holdings: Specific institutional holding data for KLINK is not widely available in public materials. The token's price movement remains primarily influenced by retail investor sentiment and broader market trends.

- Enterprise Adoption: While concrete enterprise adoption details are limited in available resources, the project's focus on DeFi applications suggests potential for future institutional interest as the ecosystem matures.

- Regulatory Landscape: KLINK's price trajectory may be affected by evolving regulatory policies in the cryptocurrency sector, though specific national-level policy impacts on KLINK have not been documented in available materials.

Macroeconomic Environment

- Monetary Policy Impact: Global monetary policy shifts, particularly from major central banks, can indirectly influence cryptocurrency markets including KLINK through effects on risk appetite and liquidity conditions.

- Inflation Hedge Characteristics: As a digital asset, KLINK may exhibit correlation with broader crypto market trends during inflationary periods, though its specific hedge properties remain subject to market conditions and investor perception.

- Geopolitical Factors: International developments and geopolitical tensions can create volatility in cryptocurrency markets, potentially affecting KLINK's price through changes in overall market sentiment and capital flows.

Technical Development and Ecosystem Building

- Platform Development: KLINK Finance's ongoing development of its DeFi platform and related infrastructure represents a key factor in long-term value proposition, with technological improvements potentially enhancing user adoption.

- Ecosystem Applications: The project's growth depends on expanding its DeFi ecosystem, including development of decentralized applications and integration with broader blockchain networks, though specific major DApps have not been detailed in available materials.

- Liquidity and Withdrawal Risks: The project faces challenges related to smart contract functionality and platform stability that may affect asset liquidity, representing an important consideration for price stability and investor confidence.

III. 2026-2031 KLINK Price Prediction

2026 Outlook

- Conservative Forecast: $0.00051

- Neutral Forecast: $0.00071

- Bullish Forecast: $0.00076 (contingent on favorable market conditions)

The initial forecast period suggests a modest correction with an expected decline of approximately 1% from current levels. The price range is anticipated to fluctuate between $0.00051 and $0.00076, with the average settling around $0.00071. This consolidation phase may reflect typical market adjustments as the token establishes its valuation baseline.

2027-2029 Mid-Term Outlook

- Market Stage Expectation: Recovery and gradual appreciation phase

- Price Range Predictions:

- 2027: $0.00063 - $0.00086

- 2028: $0.00074 - $0.00086

- 2029: $0.00042 - $0.00107

- Key Catalysts: Progressive market adoption and ecosystem development

The mid-term period shows a recovery trajectory with 2027 projecting a 2% increase, followed by a 10% gain in 2028. By 2029, the forecast indicates potential 14% growth with increased volatility reflected in the wider price range. The average price is expected to progress from $0.00074 in 2027 to $0.00083 in 2029, suggesting steady accumulation and interest despite periodic fluctuations.

2030-2031 Long-Term Outlook

- Baseline Scenario: $0.00086 - $0.00095 (assuming sustained ecosystem growth)

- Optimistic Scenario: $0.00108 - $0.00120 (with accelerated adoption)

- Transformative Scenario: $0.00125 (under highly favorable market conditions)

The long-term projections indicate substantial appreciation potential, with 2030 forecasting a 31% increase and average pricing around $0.00095. The trajectory extends into 2031 with a projected 49% cumulative gain, potentially reaching $0.00125 at the high end. The baseline range of $0.00086 to $0.00125 reflects growing maturity, though the wider spread between low ($0.00059) and high estimates suggests continued market volatility characteristic of emerging digital assets.

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00076 | 0.00071 | 0.00051 | -1 |

| 2027 | 0.00086 | 0.00074 | 0.00063 | 2 |

| 2028 | 0.00086 | 0.0008 | 0.00074 | 10 |

| 2029 | 0.00107 | 0.00083 | 0.00042 | 14 |

| 2030 | 0.0012 | 0.00095 | 0.00086 | 31 |

| 2031 | 0.00125 | 0.00108 | 0.00059 | 49 |

IV. KLINK Professional Investment Strategy and Risk Management

KLINK Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors who believe in the long-term potential of Web3 affiliate marketing infrastructure and are willing to accept high volatility

- Operational Recommendations:

- Consider accumulating positions during market downturns, given KLINK's significant price decline of 82.28% over the past 30 days

- Monitor ecosystem development milestones and partner network expansion as indicators of long-term value

- Storage Solution: Use Gate Web3 Wallet for secure storage with convenient access to staking features within the Klink ecosystem

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Current 24-hour range of $0.0006816 to $0.0007308 provides short-term trading boundaries

- Volume Analysis: Monitor the 24-hour trading volume of approximately $125,622 to identify potential momentum shifts

- Swing Trading Key Points:

- Given the high volatility (27.96% decline over 7 days), consider implementing tight stop-loss orders

- Track hourly price movements as KLINK showed -0.74% change in the past hour, indicating active intraday trading opportunities

KLINK Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5-1% of crypto portfolio

- Aggressive Investors: 2-3% of crypto portfolio

- Professional Investors: Up to 5% of crypto portfolio with active hedging strategies

(2) Risk Hedging Solutions

- Position Sizing: Limit exposure given KLINK's 99.27% decline over the past year

- Gradual Entry Strategy: Consider dollar-cost averaging to mitigate timing risk in this volatile asset

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for active trading and staking participation

- Cold Storage Option: Hardware wallet for long-term holdings exceeding trading needs

- Security Precautions: Never share private keys, enable two-factor authentication, and verify all contract addresses (BSC: 0x76e9b54b49739837be8ad10c3687fc6b543de852) before transactions

V. KLINK Potential Risks and Challenges

KLINK Market Risks

- Extreme Volatility: KLINK has experienced an 82.28% price decline in 30 days and 99.27% decline over one year, indicating substantial market instability

- Low Liquidity: With a market capitalization of approximately $167,008 and relatively low trading volume, large orders may significantly impact price

- Market Capitalization Risk: Ranked at position 4160 with only 0.000028% market dominance, KLINK faces substantial competition and limited market presence

KLINK Regulatory Risks

- Advertising Technology Compliance: Web3 affiliate marketing platforms may face scrutiny regarding user data handling and advertising standards across different jurisdictions

- Token Utility Classification: Regulatory bodies may examine whether KLINK's utility features constitute securities characteristics

- Cross-border Operations: Global partner network operations may encounter varying regulatory requirements in different markets

KLINK Technical Risks

- Smart Contract Vulnerabilities: As a BEP-20 token on BSC, KLINK depends on the underlying blockchain's security and potential smart contract bugs

- Ecosystem Dependency: The token's utility relies heavily on the adoption and growth of the Klink Finance platform and its partner network

- Competition Risk: Web3 advertising infrastructure faces intense competition from established players and emerging protocols

VI. Conclusion and Action Recommendations

KLINK Investment Value Assessment

KLINK Finance presents a high-risk, high-volatility investment opportunity in the emerging Web3 affiliate marketing infrastructure sector. While the project offers utility through staking, platform access, and ecosystem participation, investors must carefully weigh the substantial price depreciation (99.27% decline over one year) against potential future adoption. The token's low market capitalization of $167,008 and limited liquidity suggest this is a speculative asset suitable only for investors with high risk tolerance. Long-term value depends on the platform's ability to attract advertisers and expand its partner network, though current market performance indicates significant execution challenges.

KLINK Investment Recommendations

✅ Beginners: Avoid or allocate no more than 0.5% of your crypto portfolio, and only invest funds you can afford to lose entirely. Focus on understanding the Web3 advertising model before committing capital ✅ Experienced Investors: Consider small speculative positions (1-2% of crypto portfolio) with strict stop-loss orders. Monitor ecosystem development and partner announcements for potential catalysts ✅ Institutional Investors: Conduct thorough due diligence on platform metrics, advertiser adoption rates, and competitive positioning before considering allocation. Limit exposure to 0.5-1% of alternative asset allocation

KLINK Trading Participation Methods

- Spot Trading: Purchase KLINK on Gate.com and 5 other supporting exchanges with careful attention to order book depth

- Staking Participation: Utilize KLINK tokens for staking within the ecosystem to earn yields and access platform features

- Dollar-Cost Averaging: Implement gradual accumulation strategy over time to mitigate entry timing risk in this volatile asset

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is KLINK token and what is its use case?

KLINK is the utility token powering Klink's ad tech and affiliate infrastructure. Advertisers use KLINK to pay for campaigns and partner integrations. Fiat payments are automatically converted to KLINK, creating continuous token demand and driving ecosystem growth.

What is the current price of KLINK and its market capitalization?

The current price of KLINK is $0.0015033, with a market capitalization of $67,478.00. The 24-hour trading amount reaches $724,667.00.

What factors influence KLINK price movements?

KLINK price movements are influenced by supply and demand dynamics, protocol upgrades, macroeconomic conditions, market sentiment, trading volume, regulatory developments, and broader cryptocurrency market trends.

What is the price prediction for KLINK in 2024-2025?

For 2025, KLINK is expected to average $0.006421, with a potential high of $0.008925 and a low of $0.003724, based on current market analysis and trends.

What is the historical price performance of KLINK?

KLINK has shown volatility in recent weeks. On February 8, 2026, the price was $0.00405, with a high of $0.004074 and low of $0.003748 in the period. The token has fluctuated between $0.003748 and $0.004074 recently.

How does KLINK compare to similar tokens in the market?

KLINK ranks #7913 on CoinGecko with a market cap of BTC0.4121. It has declined 36.90% in the last week, underperforming both the global crypto market and similar BNB Chain tokens, indicating weaker comparative performance.

What are the risks associated with investing in KLINK?

KLINK investment carries market volatility risk, regulatory uncertainty, and project execution risk. As a cryptocurrency asset, it's subject to rapid price fluctuations and evolving regulatory landscapes. Conduct thorough research before investing.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

What is AIX9: A Comprehensive Guide to the Next Generation of Enterprise Computing Solutions

What is KLINK: A Comprehensive Guide to Understanding the Revolutionary Communication Platform

What is ART: A Comprehensive Guide to Understanding Assisted Reproductive Technology and Its Impact on Modern Fertility Treatment

What is KAR: A Comprehensive Guide to Knowledge and Reasoning Systems in Modern Technology

What is MART: A Comprehensive Guide to Multi-Agent Reinforcement Learning Through Time