What is ART: A Comprehensive Guide to Understanding Assisted Reproductive Technology and Its Impact on Modern Fertility Treatment

LiveArt's Positioning and Significance

In 2025, LiveArt emerged as ART, a project designed to address the illiquidity and inaccessibility of the $10 trillion investment-grade collectibles market, including art, watches, cars, wine, and other cultural assets.

As the first AI-powered RWAfi protocol transforming blue-chip real-world assets into programmable financial instruments, LiveArt plays a pivotal role in DeFi, RWA tokenization, and cultural asset financialization.

As of 2026, LiveArt has established itself as a rapidly growing protocol with over 13 million connected wallets and deployment across 17 blockchain networks, managing a pipeline of over $200 million in assets and maintaining an active development ecosystem.

This article provides an in-depth analysis of its technical architecture, market performance, and future potential.

Origin and Development Journey

Background of Creation

LiveArt was created in 2025 to solve the fundamental illiquidity challenge in high-value collectibles markets, where masterpieces and luxury assets remain inaccessible to average investors.

It emerged during the convergence of artificial intelligence innovation and real-world asset tokenization trends, aiming to democratize access to cultural wealth by converting physical assets into yield-generating, globally tradeable financial products.

LiveArt's launch brought transformative possibilities for collectors, investors, and DeFi participants seeking exposure to alternative asset classes.

Key Milestones

- 2025: Protocol deployment across multiple blockchain networks, establishing multi-chain infrastructure with 17 network integrations.

- 2025: Platform expansion reaching over 13 million connected wallet addresses.

- 2025: Asset pipeline development surpassing $200 million in curated collectibles.

- 2025: Token listing on 5 cryptocurrency exchanges including Gate.com.

With community and ecosystem partner support, LiveArt continues enhancing its AI-powered valuation systems, asset onboarding protocols, and DeFi integration capabilities.

How LiveArt Works?

Decentralized Infrastructure

LiveArt operates on a distributed blockchain network spanning 17 different chains, eliminating reliance on centralized custodians or traditional financial intermediaries.

These networks collaboratively validate asset tokenization transactions, ensuring transparency and system resilience while empowering users with direct ownership of tokenized real-world assets.

Blockchain Foundation

LiveArt utilizes blockchain technology as a transparent, immutable ledger recording all asset tokenization and trading activities.

Transactions are organized into blocks and cryptographically linked to form a secure, auditable chain.

Anyone can verify asset provenance and ownership history without intermediaries, establishing trust through code.

The protocol's multi-chain deployment architecture enhances accessibility and interoperability across diverse blockchain ecosystems.

Asset Verification Mechanism

LiveArt implements AI-powered validation systems combined with blockchain consensus mechanisms to authenticate real-world assets and prevent fraudulent tokenization.

Asset custodians and verification nodes maintain network integrity through rigorous due diligence, provenance verification, and quality assessment protocols, ensuring only investment-grade collectibles enter the ecosystem.

The innovation includes AI-driven valuation models providing real-time pricing for illiquid assets.

Secure Transactions

LiveArt employs public-private key cryptography to protect asset ownership and transactions:

- Private keys (functioning as secure access credentials) authorize asset transfers and yield claims

- Public keys (serving as verifiable addresses) enable transparent ownership verification

This architecture ensures asset security while maintaining pseudonymous transaction privacy.

Additional features include smart contract-based custody mechanisms and programmable asset management protocols.

LiveArt (ART) Market Performance

Circulation Overview

As of February 09, 2026, LiveArt (ART) has a circulating supply of 356,052,795.66 tokens, with a total supply of 1,000,000,000 tokens. The circulating supply represents approximately 31.83% of the total supply. The project is deployed across 17 blockchain networks and has connected over 13 million wallets. The token ecosystem supports the transformation of investment-grade real-world assets including art, watches, cars, wine, and collectibles into liquid, programmable financial instruments on-chain.

Price Volatility

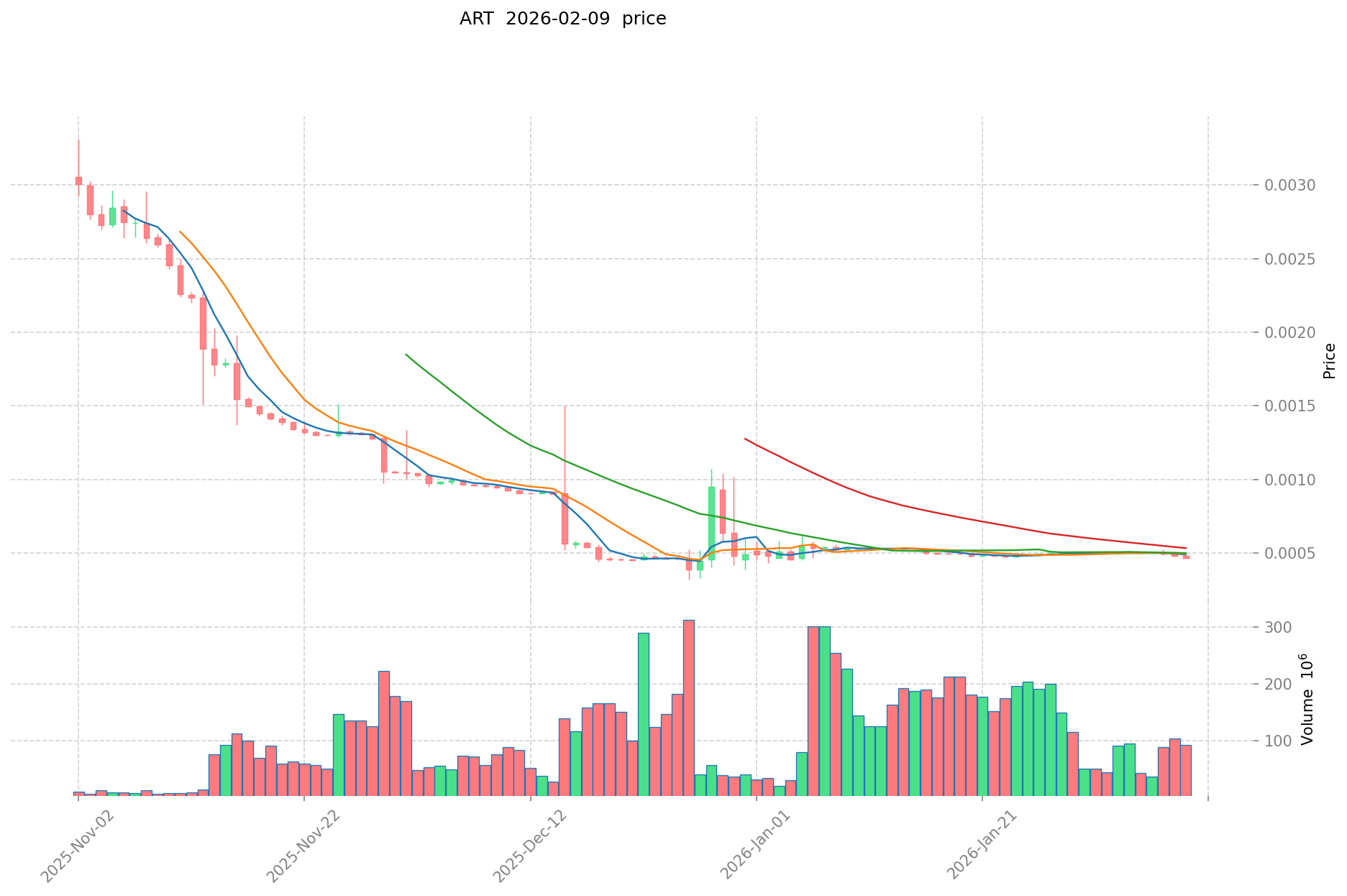

LiveArt (ART) reached an all-time high of $0.099 on September 09, 2025. The token experienced its lowest price point of $0.0003175 on December 26, 2025. As of the latest update, the token is trading at $0.0004668, showing short-term fluctuations with a 1-hour change of +0.13%, a 24-hour decline of -2.19%, a 7-day decrease of -6.36%, and a 30-day drop of -11.3%. The 24-hour trading range has been between $0.0004663 and $0.0004793. These price movements reflect the evolving dynamics of the RWAfi (Real World Asset Finance) sector and market sentiment toward asset tokenization platforms.

Click to view the current ART market price

On-Chain Metrics

- Market Capitalization: $166,205.45 (representing circulating supply value)

- Fully Diluted Valuation: $466,800.00 (based on total supply)

- 24-Hour Trading Volume: $45,618.80 (indicating market liquidity)

- Token Holders: 36,793 addresses (reflecting user adoption)

- Listed Exchanges: 5 platforms (providing trading accessibility)

- Market Dominance: 0.000018% (share of total cryptocurrency market capitalization)

LiveArt Ecosystem Applications and Partners

Core Use Cases

LiveArt's ecosystem supports multiple applications:

- RWAfi (Real-World Asset Finance): LiveArt protocol enables the tokenization of investment-grade art, watches, cars, wine, and collectibles, providing on-chain trading of cultural wealth.

- DeFi Integration: The platform combines AI intelligence with DeFi liquidity mechanisms, facilitating yield-generating financial products derived from blue-chip assets.

Strategic Collaborations

LiveArt has developed its technology infrastructure across 17 blockchain networks, enhancing its cross-chain capabilities and market reach. With over 13 million connected wallets and a pipeline exceeding $200 million in assets, these foundational elements support LiveArt's ecosystem expansion.

Challenges and Controversies

LiveArt faces several challenges:

- Market Volatility: The token experienced price fluctuations, with a 24-hour change of -2.19% and a 30-day decline of -11.3%

- Early-Stage Adoption: As a relatively new platform launched in January 2025, LiveArt is working to establish broader market recognition

- Competition Pressure: The RWA tokenization space features multiple emerging protocols competing for market share

These issues have sparked discussions within the community and continue to drive LiveArt's innovation efforts.

LiveArt Community and Social Media Atmosphere

Community Engagement

LiveArt's community demonstrates growing activity, with 36,793 token holders participating in the ecosystem. On X platform, the project maintains an active presence through @LiveArtX, engaging users with updates about protocol developments and asset tokenization milestones. The platform's deployment across 17 chains and connection with over 13 million wallets reflects expanding community interest.

Social Media Sentiment

X platform discussions about LiveArt show varied perspectives:

- Supporters highlight LiveArt's innovative approach to RWA tokenization and AI-powered asset management, viewing it as a bridge between traditional collectibles markets and blockchain finance.

- Observers monitor price performance and market adoption rates as indicators of the protocol's long-term viability.

Recent trends indicate interest in how LiveArt integrates AI technology with real-world asset management.

Trending Topics

X users discuss LiveArt's approach to unlocking liquidity in the $10 trillion investment-grade collectibles market, exploring both its potential to democratize access to cultural assets and the challenges of scaling RWA protocols.

LiveArt Information Resources

- Official Website: Visit LiveArt's official site for features, use cases, and latest developments.

- Documentation: LiveArt Documentation provides detailed information about the protocol's architecture, objectives, and vision.

- X Updates: On X platform, LiveArt uses @LiveArtX to share updates, covering protocol enhancements, asset tokenization announcements, and community activities.

LiveArt Future Roadmap

- Ongoing Development: Expansion of the asset pipeline and enhancement of AI-powered asset evaluation systems

- Ecosystem Goals: Scaling tokenization infrastructure across additional blockchain networks and asset categories

- Long-term Vision: Establishing LiveArt as a comprehensive platform for transforming cultural and collectible assets into accessible financial instruments

How to Participate in LiveArt?

- Purchase Options: ART token is available on Gate.com and other supporting platforms

- Storage Solutions: Use compatible wallets supporting BASE network for secure storage

- Ecosystem Engagement: Explore the LiveArt platform to understand RWA tokenization opportunities

- Developer Contribution: Visit the documentation portal to learn about building on LiveArt's infrastructure

Summary

LiveArt leverages blockchain technology and AI to redefine real-world asset tokenization, offering programmable financial instruments derived from investment-grade collectibles. With its multi-chain deployment, substantial asset pipeline, and growing wallet connections, LiveArt positions itself within the expanding RWA sector. While facing market volatility and early-stage adoption challenges, LiveArt's innovative approach to combining cultural assets with DeFi mechanisms presents a distinctive value proposition in decentralized finance. Whether you are new to RWA protocols or an experienced participant, LiveArt represents an interesting development in on-chain asset management worth monitoring.

FAQ

What is crypto art and how does it differ from traditional digital art?

Crypto art is digital art with verified ownership secured by blockchain technology. Unlike traditional digital art, it offers provable authenticity, ownership rights, and scarcity, preventing unauthorized copying and enabling true digital ownership.

How do NFTs relate to crypto art and why are they important?

NFTs serve as digital certificates of authenticity and ownership for crypto art. They enable artists to tokenize their work, establish provenance, and receive direct compensation. NFTs democratize art ownership by making digital art tradeable and collectible on blockchain, creating new revenue streams for creators and establishing verifiable scarcity in the digital realm.

Where can I buy and sell crypto art?

You can buy and sell crypto art on specialized NFT platforms and digital marketplaces that support cryptocurrency payments. These platforms allow you to browse, purchase, and auction digital artworks directly using crypto assets.

What are the risks and benefits of investing in crypto art?

Benefits include ownership of unique digital assets and potential appreciation as the market grows. Risks involve market volatility, security vulnerabilities, and uncertain long-term value. Only invest funds you can afford to lose in this emerging asset class.

How does blockchain technology ensure authenticity and ownership of crypto art?

Blockchain creates immutable digital records for each crypto art piece, recording ownership and transaction history permanently. Smart contracts verify authenticity, while decentralized ledgers ensure transparent provenance tracking. This prevents counterfeiting and guarantees true ownership rights.

Detailed Analysis of the Top 10 RWA Cryptocurrencies in 2025

Benefits of RWAs in Crypto

How to Earn with The RWA DePin Protocol in 2025

Detailed Analysis of RWA in Crypto Assets

Rexas Finance: A Blockchain-Powered Real-World Asset Tokenization Ecosystem

SIX Token (SIX): Core Logic, Use Cases and 2025 Roadmap Analysis

What is AIX9: A Comprehensive Guide to the Next Generation of Enterprise Computing Solutions

What is KLINK: A Comprehensive Guide to Understanding the Revolutionary Communication Platform

What is KAR: A Comprehensive Guide to Knowledge and Reasoning Systems in Modern Technology

What is MART: A Comprehensive Guide to Multi-Agent Reinforcement Learning Through Time

2026 BSCS Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year