2026 LOULOU Price Prediction: Expert Analysis and Market Forecast for the Emerging Digital Asset

Introduction: LOULOU's Market Position and Investment Value

Loulou (LOULOU), as a meme token inspired by a Dutch pug influencer with 3 million TikTok followers and 115.5 million likes, has been capturing attention in the cryptocurrency community since its launch in 2024. As of 2026, LOULOU maintains a market capitalization of approximately $1.39 million, with a circulating supply of 1 billion tokens and a current price hovering around $0.00139. This asset, recognized as representing the "cutest #PUG in the world," is operating within the meme cryptocurrency sector on the Solana blockchain.

This article will comprehensively analyze LOULOU's price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. LOULOU Price History Review and Current Market Status

LOULOU Historical Price Evolution Trajectory

- September 2024: LOULOU launched on Gate.com at an initial price of $0.00828, marking its entry into the cryptocurrency market

- October 2024: The token reached its all-time high of $0.0095 on October 3, 2024, representing a 14.7% increase from its launch price

- December 2025: LOULOU recorded its all-time low of $0.0011161 on December 1, 2025, reflecting an 86.5% decline from the launch price and an 88.3% drop from its historical peak

- 2026: The token shows signs of recovery, with the current price at $0.0013901 as of February 2, 2026, representing a 24.6% increase from the all-time low

LOULOU Current Market Status

As of February 2, 2026, LOULOU is trading at $0.0013901, showing a modest 24-hour gain of 0.96% with an increase of $0.000013218. The token has experienced notable volatility in recent periods, with a 7-day decline of 13.53% and a 30-day decrease of 15.34%. Over the past year, LOULOU has faced significant downward pressure, declining 61.050% from its previous year levels.

The token's 24-hour trading volume stands at $12,567.28, with intraday price movements ranging between a low of $0.001269 and a high of $0.0014459. LOULOU maintains a market capitalization of $1,390,100, ranking at position 2299 in the cryptocurrency market with a market dominance of 0.000050%.

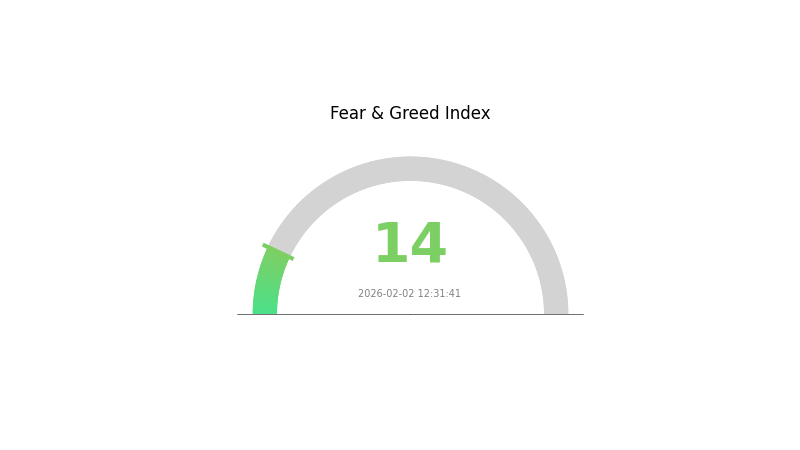

With a total supply of 1 billion tokens and 100% circulation, LOULOU's fully diluted valuation matches its current market cap at $1,390,100. The token has attracted 5,744 holders on the Solana blockchain. The current market sentiment indicator reflects a Fear & Greed Index of 14, indicating an "Extreme Fear" environment in the broader cryptocurrency market.

LOULOU's price remains 85.4% below its all-time high of $0.0095, while trading 24.6% above its historical low of $0.0011161. The token's recent hourly performance shows a slight uptick of 0.18%, suggesting potential short-term stabilization.

Click to view the current LOULOU market price

LOULOU Market Sentiment Indicator

2026-02-02 Fear & Greed Index: 14 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear with an index reading of just 14. This indicates that investors are highly pessimistic and risk-averse, suggesting potential panic selling in the market. Such extreme fear conditions historically present opportunities for long-term investors, as assets are often oversold during these periods. However, traders should exercise caution and conduct thorough research before making investment decisions. Market sentiment can shift rapidly, and maintaining a balanced portfolio strategy is essential during volatile periods.

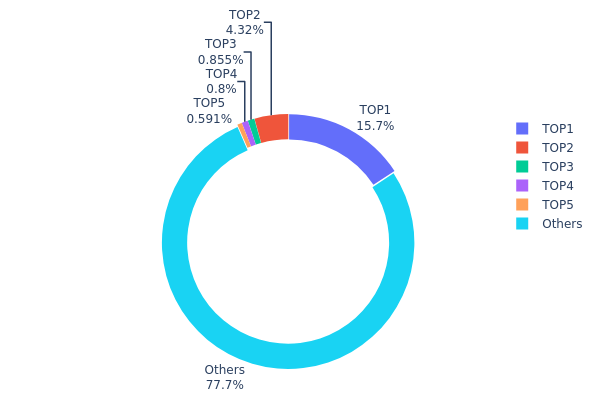

LOULOU Holding Distribution

The holding distribution chart visualizes how LOULOU tokens are allocated across different wallet addresses, providing crucial insights into the concentration of supply among major holders versus retail participants. This metric serves as a key indicator of decentralization and potential market manipulation risks.

Based on the current data, LOULOU exhibits a moderately concentrated holding structure. The top address controls 15.72% of the total supply (157,271.02K tokens), while the top five addresses collectively hold approximately 22.28% of tokens. The remaining 77.72% is distributed among other addresses, suggesting a relatively broad distribution pattern. This concentration level falls within a moderate range - not as decentralized as some community-driven projects, yet avoiding the extreme centralization seen in projects where top holders control over 50% of supply.

This distribution pattern presents both opportunities and risks for market dynamics. The 15.72% holding by the largest address could potentially influence price movements during significant buy or sell events, particularly in lower liquidity conditions. However, the fact that over three-quarters of supply remains distributed among smaller holders indicates a reasonably healthy community participation level. This structure suggests moderate price stability under normal market conditions, though investors should remain aware that concentrated holdings could amplify volatility during market stress or if major holders decide to liquidate positions. The current distribution reflects a developing ecosystem with growing decentralization as the project matures.

Click to view current LOULOU Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | u6PJ8D...ynXq2w | 157271.02K | 15.72% |

| 2 | 5Q544f...pge4j1 | 43214.05K | 4.32% |

| 3 | 74yZ3U...amsQZi | 8547.03K | 0.85% |

| 4 | 8j1rJZ...ayGS4y | 8000.00K | 0.80% |

| 5 | 31y4z8...BvSDns | 5911.64K | 0.59% |

| - | Others | 777045.39K | 77.72% |

II. Core Factors Influencing LOULOU's Future Price

Supply Mechanism

- Circulation Supply: LOULOU has a total circulation of 1,000,000,000 tokens with a 100% circulation rate. The circulating market cap stands at $1,805,000, representing a fully diluted market.

- Historical Pattern: With complete token circulation from launch, LOULOU eliminates future supply-side pressure that typically affects price discovery in phased-release token models.

- Current Impact: The absence of locked tokens or vesting schedules means price movements are primarily driven by demand-side factors rather than systematic supply increases.

Institutional and Major Holder Dynamics

- Trading Volume: The 24-hour trading volume of $48,738.13 indicates moderate market activity, with a turnover rate of 2.70%, suggesting relatively stable holder behavior without significant institutional accumulation signals.

- Market Positioning: As a micro-cap asset with less than 0.01% of global cryptocurrency market capitalization, LOULOU operates in the speculative segment where retail participation dominates over institutional involvement.

Macroeconomic Environment

- Monetary Policy Influence: Cryptocurrency markets remain sensitive to central bank policies, particularly the Federal Reserve's stance on interest rates. Tightening monetary conditions generally create headwinds for risk assets including digital currencies.

- Market Correlation: Price movements in micro-cap tokens like LOULOU often amplify broader cryptocurrency market trends, with heightened volatility during periods of macroeconomic uncertainty.

Technical Development and Ecosystem Building

- Market Liquidity: The current 2.70% turnover rate suggests developing liquidity conditions. Enhanced trading infrastructure and exchange listings could improve price discovery mechanisms.

- Volatility Characteristics: Micro-cap cryptocurrencies typically experience pronounced price swings driven by relatively small transaction volumes, requiring careful risk assessment for potential participants.

III. 2026-2031 LOULOU Price Prediction

2026 Outlook

- Conservative prediction: $0.00101-$0.00139

- Neutral prediction: $0.00139 (average expected price)

- Optimistic prediction: $0.00161 (requires favorable market conditions)

2027-2029 Outlook

- Market stage expectation: LOULOU may experience a gradual growth phase during this period, with price fluctuations potentially influenced by broader crypto market sentiment and project development progress

- Price range prediction:

- 2027: $0.00127-$0.00168

- 2028: $0.00113-$0.00175

- 2029: $0.00147-$0.00247

- Key catalysts: Market adoption trends, technological developments, and overall cryptocurrency market performance

2030-2031 Long-term Outlook

- Baseline scenario: $0.00178-$0.00234 (assuming steady market conditions and continued project development)

- Optimistic scenario: $0.00203-$0.00251 (assuming enhanced market adoption and positive regulatory environment)

- Transformative scenario: Potential for higher valuations if breakthrough developments occur in the project ecosystem

- 2026-02-02: LOULOU price predictions suggest potential growth trajectory over the next five years, with projected increases ranging from modest gains in near-term to approximately 58% growth potential by 2031

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00161 | 0.00139 | 0.00101 | 0 |

| 2027 | 0.00168 | 0.0015 | 0.00127 | 7 |

| 2028 | 0.00175 | 0.00159 | 0.00113 | 14 |

| 2029 | 0.00247 | 0.00167 | 0.00147 | 19 |

| 2030 | 0.00234 | 0.00207 | 0.00178 | 48 |

| 2031 | 0.00251 | 0.0022 | 0.00203 | 58 |

IV. LOULOU Professional Investment Strategy and Risk Management

LOULOU Investment Methodology

(1) Long-Term Holding Strategy

- Suitable for: Investors interested in meme token communities and social media-driven crypto assets

- Operational Recommendations:

- Consider LOULOU's community engagement on TikTok (3 million followers) as a sentiment indicator

- Monitor social media activity and holder growth (currently 5,744 holders) as metrics for community strength

- Storage Solution: Use Gate Web3 Wallet for secure SOL-based token storage with multi-signature protection

(2) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor the 24-hour trading volume ($12,567.28) relative to market cap ($1.39M) to assess liquidity conditions

- Price Range Indicators: Track the 24-hour range ($0.001269 - $0.0014459) to identify potential entry and exit points

- Swing Trading Considerations:

- Be aware of high volatility: the token has experienced a -13.53% decline over 7 days and -61.05% decline over 1 year

- Set strict stop-loss orders given the token's historical price range (ATL: $0.0011161, ATH: $0.0095)

LOULOU Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio allocation

- Aggressive Investors: 3-5% of crypto portfolio allocation

- Professional Investors: Up to 5-8% with active monitoring strategies

(2) Risk Hedging Approaches

- Diversification: Balance LOULOU holdings with established cryptocurrencies to offset meme token volatility

- Position Sizing: Limit exposure to no more than 5% of total portfolio given the token's high-risk nature

(3) Secure Storage Solutions

- Software Wallet Recommendation: Gate Web3 Wallet for SOL-based tokens with user-friendly interface and security features

- Cold Storage Option: For larger holdings, consider hardware wallet solutions compatible with Solana network

- Security Precautions: Never share private keys, enable two-factor authentication, and verify contract addresses (7BMb4jNt2tQG81jX7W22H2h2UyL4SW9QJgz25HRhpump) before transactions

V. LOULOU Potential Risks and Challenges

LOULOU Market Risks

- High Volatility: The token has demonstrated significant price fluctuations, with a 1-year decline of -61.05%, indicating substantial downside potential

- Limited Liquidity: With a relatively small market cap of $1.39M and dominance of only 0.000050%, the token may experience slippage during large transactions

- Meme Token Dynamics: As a social media-inspired token, price movements may be heavily influenced by sentiment shifts rather than fundamental value

LOULOU Regulatory Risks

- Meme Token Classification: Regulatory bodies may scrutinize tokens without clear utility, potentially affecting trading accessibility

- Platform Dependency: The token's value proposition relies heavily on TikTok's platform, which could face regulatory challenges in various jurisdictions

- Compliance Uncertainty: Evolving cryptocurrency regulations may impact the token's legal status and exchange availability

LOULOU Technical Risks

- Smart Contract Dependency: As a Solana-based token, it's subject to the security and performance of the underlying blockchain infrastructure

- Single Exchange Listing: Currently available on limited exchanges (exchange_num: 1), which concentrates trading risk and may affect price discovery

- Network Congestion: Solana network issues or congestion could impact transaction processing and token accessibility

VI. Conclusion and Action Recommendations

LOULOU Investment Value Assessment

LOULOU presents as a high-risk, community-driven meme token with a strong social media presence (3 million TikTok followers). While its current price of $0.0013901 represents a significant decline from its ATH of $0.0095, the token maintains an active holder base of 5,744 participants. The long-term value proposition depends heavily on sustained community engagement and social media momentum rather than fundamental utility. Short-term risks include high volatility (-13.53% over 7 days), limited liquidity, and dependency on social media platform dynamics.

LOULOU Investment Recommendations

✅ Beginners: Approach with extreme caution. If interested, allocate no more than 1% of your crypto portfolio and treat it as a high-risk, speculative position. Focus on learning about meme token dynamics before investing. ✅ Experienced Investors: Consider LOULOU only as a small speculative position (2-3% maximum) within a diversified portfolio. Monitor social media sentiment and holder metrics closely. Set strict stop-loss orders to manage downside risk. ✅ Institutional Investors: Given the token's small market cap ($1.39M), limited liquidity, and meme token characteristics, it may not meet institutional investment criteria. If participating, maintain minimal exposure and implement robust risk management protocols.

LOULOU Trading Participation Methods

- Spot Trading: Purchase LOULOU on Gate.com with SOL or stablecoin pairs, suitable for straightforward buy-and-hold strategies

- Active Trading: Utilize Gate.com's trading interface to capitalize on short-term price movements, recommended only for experienced traders

- Secure Storage: Transfer tokens to Gate Web3 Wallet for self-custody after purchase, ensuring control over your assets while maintaining security

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is LOULOU? What are its uses and value?

LOULOU is a Web3 utility token designed for decentralized applications and community governance. It enables transaction settlement, staking rewards, and ecosystem participation. The token derives value from network utility, adoption growth, and deflationary mechanisms within its protocol.

What is the current price of LOULOU? How has its historical price trend been?

LOULOU's all-time high was US$0.01142 and all-time low was US$0.001116. Currently, the price is significantly below its peak, down 86.70% from the highest point. The token remains above its historical minimum, showing volatility in the market.

What will be the LOULOU price prediction for 2024?

Based on historical data and investment returns, the 2024 LOULOU price prediction is $0.00708. This forecast is calculated from performance metrics as of February 2026.

What are the main factors affecting LOULOU price?

LOULOU price is primarily driven by community engagement, exchange listings, trading volume, and market demand. Social media trends, new platform listings, and overall market sentiment significantly impact price movements.

What are the advantages and disadvantages of LOULOU compared to similar projects?

LOULOU excels in innovative tokenomics and community-driven governance, offering superior transaction efficiency and lower fees. However, it faces challenges in brand recognition and trading volume compared to established competitors in the market.

What are the main risks to consider when investing in LOULOU?

LOULOU investment risks include market volatility, technical vulnerabilities, and security concerns. Investors should focus on proper asset allocation, risk management, and secure storage practices. Cryptocurrency markets are inherently unpredictable and require careful decision-making.

What is LOULOU's team background and project development prospects?

LOULOU's team brings strong expertise in the Web3 space with a focus on community-driven innovation. The project demonstrates solid fundamentals with active development, strategic partnerships, and clear tokenomics. Market prospects remain bullish with anticipated ecosystem expansion and increasing adoption potential in 2026.

What Is a Phantom Wallet: A Guide for Solana Users in 2025

Solana Price in 2025: SOL Token Analysis and Market Outlook

How Does Solana's Proof of History Work?

Solana (SOL) : Low Fees, Memecoins, and the way to moon

Is Solana a Good Investment?

Solana in 2025: Ecosystem Growth and DeFi Dominance

TEN vs ENJ: A Comprehensive Comparison of Two Leading Blockchain Gaming Tokens

GAI vs IMX: Which Layer 2 Scaling Solution Offers Better Returns for Crypto Investors in 2024?

ECHO vs HBAR: A Comprehensive Comparison of Two Emerging Blockchain Ecosystems

What is a cryptocurrency paper wallet and how do you create one

What is Cryptocurrency Futures Trading?