2026 MLP Price Prediction: Expert Analysis and Market Outlook for Magellan Midstream Partners

Introduction: MLP's Market Position and Investment Value

Matrix Layer Protocol (MLP), as an AI-driven communication and infrastructure protocol designed for decentralized network ecosystems, has been developing its position in the Web3 infrastructure space since its launch in 2024. As of February 2026, MLP has a market capitalization of approximately $252,762, with a circulating supply of around 618 million tokens, and its price is maintained at approximately $0.000409. This asset, recognized as an innovative multi-dimensional data transmission solution, is playing an increasingly important role in emerging fields such as the Internet of Things (IoT), Web3, and Metaverse applications.

This article will comprehensively analyze MLP's price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. MLP Price History Review and Current Market Status

MLP Historical Price Evolution Trajectory

- 2024: MLP launched on Gate.com in November 2024 with an initial offering price of $0.01, experiencing significant price movement in its early trading period

- December 2024: The token reached a notable price level of $0.077 on December 31, 2024, marking a substantial appreciation from its launch price

- 2025: The market entered a correction phase, with MLP experiencing significant downward pressure and reaching a low of $0.00024 in October 2025

MLP Current Market Status

As of February 8, 2026, MLP is trading at $0.000409, representing a decline of 16.39% over the past 24 hours. The token has experienced notable volatility, with the 24-hour trading range spanning from $0.0004039 to $0.0005267.

The current market capitalization stands at approximately $252,762, with a circulating supply of 618 million tokens out of a maximum supply of 5 billion tokens, resulting in a circulation ratio of 12.36%. The fully diluted market cap is estimated at $2.045 million. Over the past week, MLP has declined by 15.58%, while the 30-day performance shows a decrease of 40.12%.

The 24-hour trading volume is recorded at $34,379, and the token maintains a market share of 0.000081%. MLP currently ranks at position 3,687 in the overall cryptocurrency market. The token holder count has reached 15,621 addresses, indicating a growing community base.

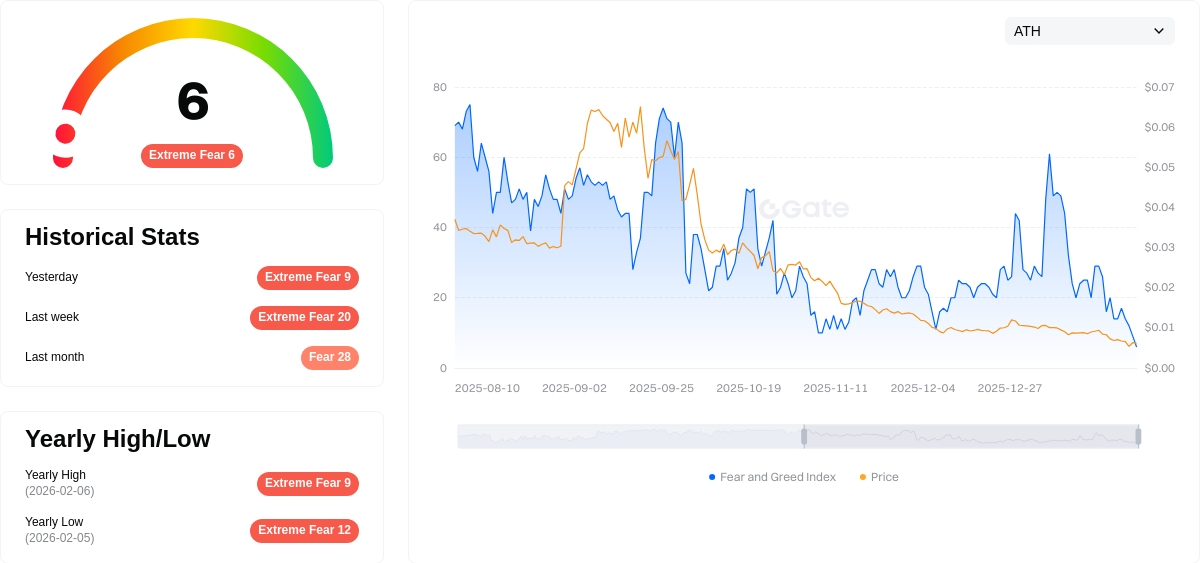

The broader market sentiment, as reflected by the cryptocurrency fear and greed index, stands at 6, signaling an "Extreme Fear" environment in the market. This cautious market sentiment may be contributing to the current price dynamics of MLP and other digital assets.

Click to view the current MLP market price

MLP Market Sentiment Index

2026-02-07 Fear and Greed Index: 6(Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index plummeting to 6. This exceptionally low reading suggests investors are in panic mode, with widespread selling pressure and negative market sentiment dominating. Such extreme fear levels often present contrarian opportunities for long-term investors, as historical data shows markets typically recover from these conditions. However, caution is warranted as further downside risks may persist. Monitor key support levels and consider dollar-cost averaging strategies during extended fear periods.

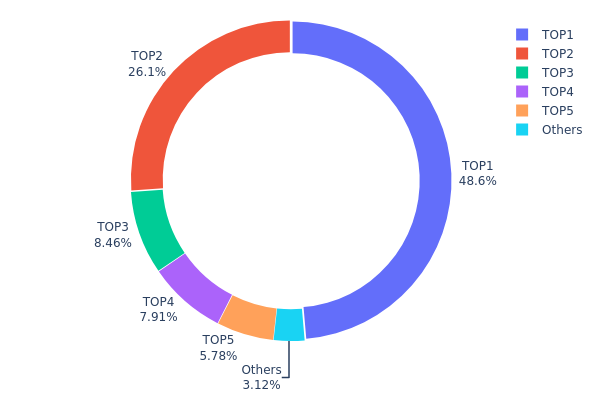

MLP Holding Distribution

The holding distribution chart reveals how MLP tokens are allocated across different wallet addresses, serving as a crucial indicator of token concentration and decentralization within the ecosystem. By analyzing the proportion of tokens held by top addresses versus smaller holders, investors can assess the potential risks associated with centralized control and market manipulation.

As of February 8, 2026, MLP exhibits a highly concentrated holding structure. The top address controls approximately 48.62% of the total supply (2.43 million tokens), while the second-largest holder possesses 26.10% (1.31 million tokens). Combined, the top two addresses account for 74.72% of all MLP tokens, indicating significant centralization. The top five addresses collectively hold 96.85% of the circulating supply, leaving only 3.15% distributed among other market participants. This extreme concentration pattern suggests that a small number of entities exercise substantial control over the token's market dynamics.

Such concentrated holdings present considerable implications for market stability and price volatility. The dominant position of top holders creates substantial risks, as large-scale token movements from these addresses could trigger significant price fluctuations or sudden liquidity shifts. The minimal distribution among smaller holders (merely 3.15%) indicates limited retail participation and raises concerns about potential market manipulation. This structure also reflects a relatively centralized governance model, which may deter investors seeking more decentralized projects. However, it's worth noting that some concentration may be attributed to protocol-owned liquidity, treasury reserves, or locked tokens serving specific ecosystem functions.

Click to view current MLP Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x1434...79475c | 2431382.71K | 48.62% |

| 2 | 0x0d07...b492fe | 1305262.34K | 26.10% |

| 3 | 0x3c5d...f59647 | 422917.96K | 8.45% |

| 4 | 0x456f...5ccf09 | 395467.63K | 7.90% |

| 5 | 0x782d...7d7128 | 289115.61K | 5.78% |

| - | Others | 155853.75K | 3.15% |

II. Core Factors Influencing MLP's Future Price

Macroeconomic Environment

-

Monetary Policy Impact: Central bank policies directly influence MLP price movements. Changes in interest rates and liquidity conditions set by major central banks can affect investor sentiment and capital flows into digital assets, potentially impacting MLP's valuation.

-

Inflation Hedge Characteristics: MLP's performance during inflationary periods remains a critical consideration for market participants. The asset's behavior in response to rising price levels may influence its appeal as a potential inflation hedge instrument.

-

Geopolitical Factors: International developments and regional tensions may affect MLP's price trajectory. Global political events and cross-border policy changes can create market uncertainty that influences trading patterns.

Market News and Events

-

Short-term Price Drivers: Daily market developments, including announcements and news releases, tend to generate noticeable price movements. Both positive and negative information flows can produce meaningful impacts on short-term price trends.

-

Event-driven Volatility: Specific occurrences in the broader cryptocurrency market or traditional financial sectors may create spillover effects that influence MLP's price behavior over multi-day periods.

III. 2026-2031 MLP Price Prediction

2026 Outlook

- Conservative forecast: $0.0003

- Neutral forecast: $0.00041

- Optimistic forecast: $0.00042 (requires favorable market conditions)

2027-2029 Outlook

- Market phase expectation: Gradual recovery and stabilization phase, with the market expected to enter a steady growth trajectory

- Price range forecast:

- 2027: $0.00035 - $0.00045

- 2028: $0.00036 - $0.00059

- 2029: $0.00038 - $0.00069

- Key catalysts: Market adoption expansion, technological development progress, and overall crypto market sentiment improvement

2030-2031 Long-term Outlook

- Baseline scenario: $0.00049 - $0.0006 (assuming steady market development and moderate adoption growth)

- Optimistic scenario: $0.00074 - $0.00089 (assuming accelerated ecosystem expansion and increased institutional participation)

- Transformative scenario: $0.00108 (under exceptionally favorable conditions including widespread mainstream adoption and significant technological breakthroughs)

- 2026-02-08: MLP trading within the range of $0.0003 - $0.00042 (early development stage)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00042 | 0.00041 | 0.0003 | 0 |

| 2027 | 0.00045 | 0.00042 | 0.00035 | 2 |

| 2028 | 0.00059 | 0.00043 | 0.00036 | 6 |

| 2029 | 0.00069 | 0.00051 | 0.00038 | 25 |

| 2030 | 0.00089 | 0.0006 | 0.00049 | 47 |

| 2031 | 0.00108 | 0.00074 | 0.00048 | 82 |

IV. MLP Professional Investment Strategies and Risk Management

MLP Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors who believe in the long-term potential of AI-driven decentralized communication infrastructure and can tolerate high volatility

- Operational Recommendations:

- Consider accumulating positions during periods of significant price declines, as MLP has experienced substantial corrections from its historical peak

- Monitor key development milestones in IoT, Web3, and Metaverse integration to evaluate project progress

- Utilize secure storage solutions such as Gate Web3 Wallet for long-term asset custody

(2) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor the 24-hour trading volume (currently $34,379) relative to market cap to identify potential accumulation or distribution phases

- Support and Resistance Levels: Track the 24-hour range ($0.0004039 - $0.0005267) to identify short-term trading opportunities

- Swing Trading Considerations:

- The token has shown considerable volatility with -16.39% change in 24 hours, presenting opportunities for experienced traders

- Set appropriate stop-loss levels given the token's historical range between $0.00024 and $0.077

MLP Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio allocation

- Aggressive Investors: 3-5% of crypto portfolio allocation

- Professional Investors: May consider up to 5-8% allocation with active monitoring

(2) Risk Hedging Solutions

- Position Sizing: Limit individual position size given the token's low market cap ($252,762) and high volatility characteristics

- Dollar-Cost Averaging: Consider systematic accumulation to mitigate timing risk, especially given the 30-day decline of -40.12%

(3) Secure Storage Solutions

- Software Wallet Recommendation: Gate Web3 Wallet provides convenient access for active traders while maintaining security

- Multi-signature Solution: For larger holdings, consider implementing additional security layers

- Security Precautions: Never share private keys, enable two-factor authentication, and verify contract addresses (0xdbe3ea3639077a837e767c5d82730254fc933e41 on BSC) before transactions

V. MLP Potential Risks and Challenges

MLP Market Risks

- High Volatility: The token has experienced a -99.11% decline over one year, indicating extreme price volatility and potential for significant losses

- Low Liquidity: With a circulating market cap of only $252,762 and limited exchange listings (currently on 1 exchange), large trades may experience substantial slippage

- Limited Trading History: The token was published in November 2024, providing limited historical data for comprehensive technical analysis

MLP Regulatory Risks

- Evolving Regulatory Landscape: AI and blockchain infrastructure projects may face increased regulatory scrutiny as global frameworks for digital assets continue to develop

- Cross-border Compliance: As a protocol serving IoT and Web3 ecosystems, regulatory requirements may vary significantly across jurisdictions

- Token Classification Uncertainty: The regulatory status of infrastructure tokens remains subject to interpretation by various regulatory bodies

MLP Technical Risks

- Smart Contract Vulnerability: As a protocol deployed on BSC, potential smart contract bugs or exploits could impact token security

- Network Dependence: The protocol's reliance on underlying blockchain infrastructure means any network issues or upgrades could affect functionality

- Competitive Landscape: The decentralized communication infrastructure sector faces competition from established protocols, potentially impacting adoption and value proposition

VI. Conclusion and Action Recommendations

MLP Investment Value Assessment

Matrix Layer Protocol represents an emerging infrastructure play in the AI-driven decentralized communication space, targeting growth areas including IoT, Web3, and Metaverse applications. However, the token currently faces significant challenges including a 12.36% circulation ratio, limited liquidity, and substantial price depreciation from its all-time high. While the long-term value proposition of decentralized communication infrastructure may be compelling, short-term risks remain elevated due to market conditions, low trading volume, and limited exchange availability.

MLP Investment Recommendations

✅ Beginners: Approach with extreme caution given high volatility and limited liquidity; allocate only a minimal portion of capital that you can afford to lose entirely, and prioritize education about the underlying technology ✅ Experienced Investors: Consider small speculative positions if aligned with broader infrastructure thesis; maintain strict risk management protocols and monitor development progress closely ✅ Institutional Investors: Conduct thorough due diligence on protocol architecture, team credentials, and competitive positioning; assess liquidity constraints before considering any significant allocation

MLP Trading Participation Methods

- Spot Trading: Available on Gate.com with MLP/USDT trading pairs for direct purchase and sale

- Dollar-Cost Averaging: Systematic accumulation strategy to mitigate entry timing risk in volatile market conditions

- Portfolio Rebalancing: Periodic adjustment of MLP allocation based on market performance and risk tolerance changes

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is MLP? What are the main factors affecting its price?

MLP is a master limited partnership structure in the energy sector. Its price is primarily influenced by revenue, operating costs, depreciation, amortization, and commodity price fluctuations.

How to conduct MLP price prediction? What are the common prediction methods?

Common MLP price prediction methods include technical analysis using trading volume, on-chain metrics, and historical price patterns. Machine learning models like neural networks and regression analysis are also widely used. Prediction accuracy depends on data quality and model selection.

MLP historical price trend and performance over the past year?

Over the past year, MLP experienced significant growth with a 870.59% increase, trading between $0.32 and $3.98. The cryptocurrency demonstrated strong upward momentum with notable market volatility during this period.

What are the main driving factors affecting MLP price fluctuations?

MLP price fluctuations are primarily driven by supply and demand dynamics, market sentiment, trading volume, regulatory developments, and broader cryptocurrency market trends. These factors collectively influence price movements and market behavior.

How accurate is MLP price prediction? What risks exist?

MLP prediction models achieve approximately 90% accuracy in historical data analysis. However, risks include market volatility, overfitting, and unpredictable external factors that may impact actual price movements. Past performance does not guarantee future results.

What are professional institutions' predictions for MLP's future price?

Professional institutions predict MLP will experience steady price appreciation with broad market prospects. Predictions are based on advanced multilayer perceptron algorithms. The outlook remains optimistic.

What are the distinctive price performance characteristics of MLP compared to similar assets?

MLP exhibits higher volatility than comparable assets, but demonstrates superior prediction accuracy with lower daily and monthly closing errors. Its price fluctuations are pronounced, yet predictability remains strong, offering distinct risk-return profile advantages.

Survey Note: Detailed Analysis of the Best AI in 2025

What Is the Best AI Crypto in 2025?

What is the Best AI Now?

Why ChatGPT is Likely the Best AI Now?

How Does Solidus Ai Tech's Market Cap Compare to Other AI Cryptocurrencies?

MomoAI: AI-Powered Social Gaming Revolution on Solana

Pepe: A Comprehensive Guide to What It Is and How It Works

The 7 Hottest Blockchain Stocks to Watch in the Coming Years

What is the Relative Strength Index? Application in Crypto Trading

Top Cryptocurrency Exchanges for Polish Traders

Master Japanese candlestick analysis like a professional and explore the most well-known patterns with real-world examples