2026 NERO Price Prediction: Expert Analysis and Market Forecast for the Next Generation Digital Asset

Introduction: NERO's Market Position and Investment Value

NERO (NERO) serves as a modular, EVM-compatible Layer 1 blockchain built specifically for developers and businesses, launched in 2025 with backing from institutional players like NTT Digital and CoinTrade. As of February 2026, NERO holds a market capitalization of approximately $539,607, with a circulating supply of 267 million tokens and a current price around $0.002021. This asset, characterized as an "app-centric blockchain with native account abstraction," is playing an increasingly important role in enabling seamless Web2-style user experiences and flexible gas payment mechanisms.

This article will comprehensively analyze NERO's price trajectory from 2026 to 2031, combining historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. NERO Price History Review and Current Market Status

Historical Price Evolution of NERO

NERO Chain's trading history shows a relatively brief but notable price trajectory since its market debut in January 2025.

- 2025: NERO experienced significant price appreciation following its testnet launch and institutional backing from NTT Digital and CoinTrade, reaching a peak of $0.02391 on July 28, 2025.

- 2026: The token entered a consolidation phase, with prices declining to a low of $0.001456 on January 19, 2026, representing approximately a 93.9% correction from its historical high.

Current Market Dynamics of NERO

As of February 5, 2026, NERO is trading at $0.002021, showing a modest recovery from its recent low. The token has demonstrated positive short-term momentum with a 1.91% increase over the past 24 hours and a more substantial 22.84% gain over the past 7 days. The 30-day performance indicates a 5.16% increase, suggesting gradual stabilization after the earlier decline.

The current market capitalization stands at approximately $539,607, with a 24-hour trading volume of $16,630.39. With 267 million tokens in circulation out of a maximum supply of 10 billion, the circulating supply ratio remains at 2.67%. The fully diluted market cap is approximately $20.21 million, and NERO maintains a market dominance of 0.00079%.

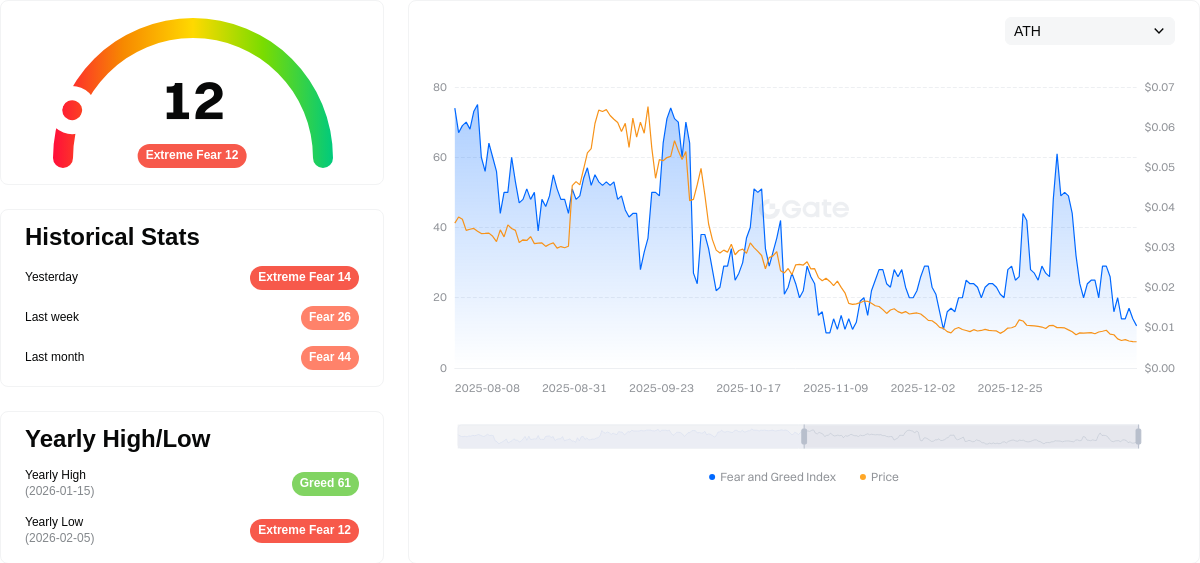

The Fear and Greed Index currently registers at 12, indicating "Extreme Fear" sentiment in the broader crypto market, which may be influencing NERO's price action alongside its technical fundamentals and development progress.

Click to view current NERO market price

NERO Market Sentiment Index

2026-02-05 Fear & Greed Index: 12 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear & Greed Index plummeting to 12. This indicates heightened market anxiety and pessimistic investor sentiment. When the index reaches such low levels, it often signals capitulation and panic selling among market participants. However, extreme fear can also present opportunities for contrarian investors who believe in long-term market recovery. Traders should exercise caution, manage risk prudently, and avoid making emotional decisions during this volatile period. Consider dollar-cost averaging or waiting for more stable market conditions before increasing exposure.

NERO Holding Distribution

The holding distribution chart reveals the concentration of token ownership across different wallet addresses, serving as a critical indicator of market structure and potential price manipulation risks. By analyzing the distribution pattern among top holders, we can assess the degree of decentralization and evaluate whether the token's ownership is sufficiently dispersed to support healthy market dynamics.

Based on the current holding distribution data, NERO demonstrates a relatively concentrated ownership structure. The top addresses collectively control a significant proportion of the total token supply, which suggests that a small group of holders maintains substantial influence over market liquidity and price movements. This concentration pattern typically indicates that the token is still in its early distribution phase, with limited circulation among retail participants. Such a structure increases the risk of coordinated selling pressure or price manipulation, as major holders possess the capacity to significantly impact market conditions through large-scale transactions.

From a market structure perspective, this concentrated distribution presents both challenges and considerations for potential investors. The current ownership pattern suggests reduced decentralization, which may affect the token's resilience against sudden market shocks or whale-driven volatility. However, it's worth noting that many successful projects begin with concentrated distributions that gradually disperse over time through natural market activity and ecosystem development. The key concern lies in monitoring whether this distribution evolves toward greater decentralization as the project matures, which would indicate healthier long-term market stability and reduced manipulation risks.

Click to view current NERO Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Core Factors Influencing NERO's Future Price

Market Demand and Adoption Trends

- Market Sentiment: Investor sentiment and market psychology play significant roles in NERO's price movements. Shifts in confidence levels can trigger notable volatility in token valuation.

- Adoption Patterns: The broader acceptance and integration of NERO within various platforms and use cases directly impacts its market positioning and price trajectory.

- Growth Projections: Market analyses suggest a projected annual growth rate of approximately 5%, reflecting steady but measured expansion expectations.

Macroeconomic Environment

- Regulatory Framework: Policy developments and regulatory oversight across different jurisdictions influence NERO's operational landscape and market accessibility.

- Economic Trends: Broader macroeconomic conditions, including inflation dynamics and monetary policy directions, contribute to the overall environment in which NERO operates.

- External Factors: Various external elements, including geopolitical developments and financial market conditions, continue to shape the cryptocurrency space and affect token valuations.

Technical Innovation

- Technological Advancement: Ongoing innovations and technical improvements within the NERO ecosystem may support long-term value proposition and competitive positioning.

- System Development: The evolution of neural network optimization capabilities represents a core aspect of NERO's technological foundation.

Historical Price Performance

- Price Range Observations: Historical data indicates that NERO experienced price levels around $0.02391 in July 2025, while recording lower levels near $0.002728 in October 2025.

- Volatility Patterns: Price fluctuations reflect the interplay between market sentiment, application developments, and various external influences that characterize the cryptocurrency market.

III. 2026-2031 NERO Price Forecast

2026 Outlook

- Conservative forecast: $0.00143 - $0.00202

- Neutral forecast: approximately $0.00202

- Optimistic forecast: up to $0.00208 (contingent on favorable market conditions and increased adoption)

2027-2029 Outlook

- Market stage expectation: NERO is anticipated to enter a gradual growth phase, with price volatility reflecting evolving market sentiment and broader crypto market trends

- Price range forecast:

- 2027: $0.00158 - $0.00305

- 2028: $0.00173 - $0.0035

- 2029: $0.00172 - $0.00369

- Key catalysts: potential ecosystem expansion, technological improvements, and broader crypto market recovery could drive sustained price appreciation during this period

2030-2031 Long-term Outlook

- Baseline scenario: $0.00218 - $0.00336 (assuming steady project development and stable market conditions)

- Optimistic scenario: $0.00386 - $0.00436 (contingent on significant adoption milestones and positive regulatory developments)

- Transformative scenario: reaching $0.00521 (requires exceptional market conditions, major partnerships, and substantial ecosystem growth)

- February 5, 2026: NERO trading within the predicted range of $0.00143 - $0.00208 (early stage of projected growth trajectory)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00208 | 0.00202 | 0.00143 | 0 |

| 2027 | 0.00305 | 0.00205 | 0.00158 | 1 |

| 2028 | 0.0035 | 0.00255 | 0.00173 | 26 |

| 2029 | 0.00369 | 0.00302 | 0.00172 | 49 |

| 2030 | 0.00436 | 0.00336 | 0.00218 | 66 |

| 2031 | 0.00521 | 0.00386 | 0.00205 | 90 |

IV. NERO Professional Investment Strategies and Risk Management

NERO Investment Methodology

(I) Long-Term Holding Strategy

- Suitable for: Investors seeking exposure to modular blockchain infrastructure and account abstraction technology

- Operational Recommendations:

- Consider gradual accumulation during market consolidation phases, given NERO's early-stage development

- Monitor adoption metrics of the Blockspace 2.0 architecture and ERC-4337 implementation

- Utilize Gate Web3 Wallet for secure storage with multi-signature capabilities

(II) Active Trading Strategy

- Technical Analysis Tools:

- Volume-Price Analysis: Track trading volume trends on Gate.com, noting the current 24-hour volume of approximately $16,630

- Moving Averages: Observe short-term momentum, considering the 7-day price increase of approximately 22.84%

- Swing Trading Key Points:

- Set position sizing limits given the token's relatively low market capitalization

- Establish clear exit criteria based on support and resistance levels

NERO Risk Management Framework

(I) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio allocation

- Aggressive Investors: 3-5% of crypto portfolio allocation

- Professional Investors: Up to 7% with active risk monitoring

(II) Risk Hedging Solutions

- Diversification Strategy: Balance NERO holdings with established Layer 1 tokens

- Position Sizing: Limit individual position exposure relative to total portfolio volatility

(III) Secure Storage Solutions

- Non-Custodial Wallet Recommendation: Gate Web3 Wallet for direct control of private keys

- Multi-Layer Security Approach: Implement two-factor authentication and regular security audits

- Security Precautions: Never share private keys, verify contract addresses before transactions, and be cautious of phishing attempts

V. NERO Potential Risks and Challenges

NERO Market Risks

- High Volatility: With a 24-hour price change of 1.91% and a historical range from $0.001456 to $0.02391, NERO exhibits significant price fluctuations

- Limited Liquidity: Current 24-hour trading volume of approximately $16,630 may result in wider bid-ask spreads

- Market Capitalization: With a market cap of approximately $539,607 and ranking at 2,986, NERO faces competition from more established projects

NERO Regulatory Risks

- Evolving Regulatory Landscape: Blockchain infrastructure projects may face varying regulatory requirements across jurisdictions

- Compliance Requirements: Account abstraction and gasless transaction features may attract regulatory scrutiny

- Institutional Partnership Dependencies: Reliance on institutional backers may be affected by regulatory changes impacting these entities

NERO Technical Risks

- Early-Stage Technology: As a relatively new mainnet launched in 2025, the Blockspace 2.0 architecture requires further testing under diverse network conditions

- EVM Compatibility Challenges: Maintaining compatibility while implementing novel features like native account abstraction may introduce technical complexities

- Competition: The Layer 1 blockchain space is highly competitive, with numerous projects offering similar modular architecture solutions

VI. Conclusion and Action Recommendations

NERO Investment Value Assessment

NERO presents an interesting opportunity in the modular blockchain sector with its focus on account abstraction and developer-centric features. The project has demonstrated positive momentum with a 22.84% increase over 7 days and backing from institutional players. However, investors should carefully weigh the early-stage nature of the project, limited liquidity, and competitive landscape. The token's low circulation ratio of 2.67% also warrants consideration regarding future supply dynamics.

NERO Investment Recommendations

✅ Beginners: Start with minimal allocation (under 1% of crypto portfolio), focus on education about Layer 1 technology, and use only funds you can afford to lose ✅ Experienced Investors: Consider modest allocation (2-4% of crypto portfolio), monitor project development milestones, and implement stop-loss mechanisms ✅ Institutional Investors: Conduct thorough due diligence on technical architecture, evaluate team credentials and partnerships, and establish clear governance frameworks for position management

NERO Trading Participation Methods

- Spot Trading: Purchase NERO directly on Gate.com with various trading pairs

- Dollar-Cost Averaging: Implement systematic purchase plans to mitigate timing risk

- Portfolio Rebalancing: Periodically adjust NERO allocation based on performance and risk parameters

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the historical price performance of NERO tokens?

NERO's all-time high reached $0.015 and all-time low was $0.00231. With a total supply of 2.85 billion tokens launched on July 30, 2025, NERO has shown significant volatility. Current pricing requires real-time data verification for the most accurate information.

What are the main factors affecting NERO price?

NERO price is primarily influenced by market sentiment, regulatory policies, and trading volume. The crypto market is highly sensitive to news and policy changes, while regulatory clarity and market demand directly impact price movements.

What are professional analysts' predictions for NERO's future price?

Professional analysts project NERO's price based on tokenomics and historical performance. While specific forecasts vary, market indicators suggest potential growth as adoption increases. Continuous monitoring of market dynamics is recommended for the most current insights.

NERO price prediction typically uses which technical analysis methods?

NERO price prediction commonly employs technical analysis tools including moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence). These indicators help analyze historical price trends and market momentum to forecast potential price movements.

How does NERO's price performance compare to similar tokens?

NERO has demonstrated resilience among comparable tokens. With a historical high of $0.01763 and current trading levels, NERO maintains competitive positioning. Its trading volume and market activity reflect solid investor interest, positioning it favorably within similar token categories for long-term growth potential.

What are the risks to pay attention to when investing in NERO for price prediction?

NERO price prediction involves market volatility, regulatory changes, and technical risks. Cryptocurrency prices fluctuate significantly. Only invest capital you can afford to lose and maintain rational decision-making throughout.

Top Layer 2 projects worth following in 2025: From Arbitrum to zkSync

Pepe Unchained: Pepe Meme Coin evolves into a Layer-2 ecosystem

2025 Layer-2 Solution: Ethereum Scalability and Web3 Performance Optimization Guide

What is Layer 2 in crypto assets? Understand the scaling solution for Ethereum

How Layer 2 Changes the Crypto Assets Experience: Speed, Cost, and Mass Adoption

Pepe Unchained (PEPU): Building the New Era of Meme Coins on Layer 2

LIY vs RUNE: A Comprehensive Comparison of Two Emerging Blockchain Tokens in the Crypto Market

Comprehensive Guide to Token Generation Events

What Are the Differences Between Web2 and Web3? Analyzing Future Trends in Web3

What is Grayscale, the cryptocurrency asset management firm?

A Comprehensive Guide to Decentralized Exchanges (DEXs): Leading Platforms and Selection Criteria