2026 ZULU Price Prediction: Expert Analysis and Market Forecast for the Next Generation of Digital Assets

Introduction: ZULU's Market Position and Investment Value

Zulu Network (ZULU), positioned as the first Native Bitcoin DePIN Layer optimized for AI and DePIN implementations, has been building its ecosystem since its launch in November 2024. As of February 2026, ZULU maintains a market capitalization of approximately $1.45 million, with a circulating supply of 144.5 million tokens out of a maximum supply of 1 billion, and a price around $0.01. This innovative asset, which combines Bitcoin's security with EVM infrastructure flexibility, is playing an increasingly important role in decentralized physical infrastructure networks and AI protocol operations.

This article will comprehensively analyze ZULU's price trends from 2026 to 2031, examining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. ZULU Price History Review and Current Market Status

ZULU Historical Price Evolution Trajectory

- 2024: Zulu Network launched on November 11, with an initial listing price of $0.1, price experienced notable fluctuations throughout the year

- 2024-2025: The token reached its peak price of $0.27599 on November 11, 2024, representing a significant appreciation from its launch price

- 2025: The token underwent a correction period, declining from the high of $0.27599 to a low of $0.001313 recorded on July 10, 2025

ZULU Current Market Status

As of February 02, 2026, ZULU is trading at $0.01, with a 24-hour trading volume of $11,776.74. The current price level represents a recovery from the historical low, though it remains below the all-time high recorded in November 2024.

The token's 24-hour performance shows a decline of 1.74%, with the daily price range between $0.01 and $0.010179. In the short-term hourly timeframe, ZULU has experienced minimal movement with a 0.00068% change. Over the past seven days, the token has demonstrated modest positive momentum with a 0.024% increase.

In longer timeframes, ZULU faces pressure with a 10.01% decrease over the past 30 days and a 6.27% decline year-over-year. The current market capitalization stands at $1.45 million, with 144.5 million tokens in circulation, representing 14.45% of the total supply of 1 billion tokens. The fully diluted valuation is calculated at $10 million.

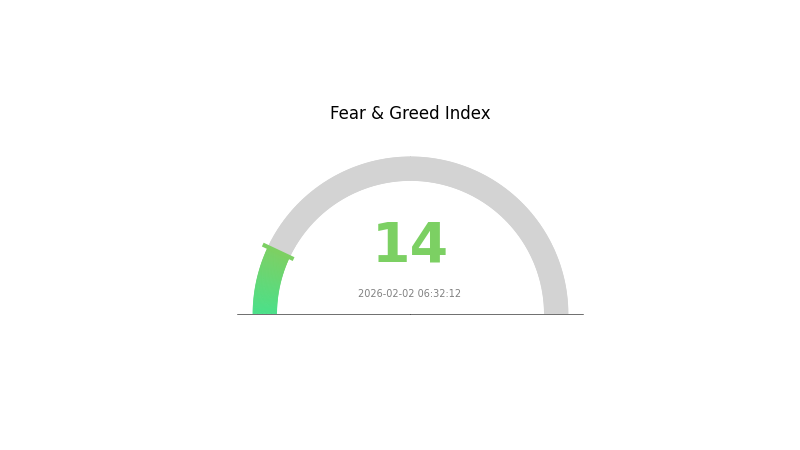

Zulu Network maintains a market dominance of 0.00037%, indicating its position as an emerging project within the broader cryptocurrency ecosystem. The token is held by approximately 375 addresses, suggesting a developing user base. Market sentiment as measured by the Fear and Greed Index currently registers at 14, indicating an "Extreme Fear" environment across the broader market.

Click to view current ZULU market price

ZULU Market Sentiment Indicator

02-02-2026 Fear and Greed Index: 14 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index dropping to 14. This exceptionally low reading indicates widespread market pessimism and investor anxiety. During such periods, panic selling often dominates trading activities, creating significant price volatility across digital assets. However, extreme fear historically presents contrarian opportunities for strategic investors. Gate.com provides comprehensive market sentiment analysis and real-time data to help traders navigate these turbulent conditions and make informed investment decisions.

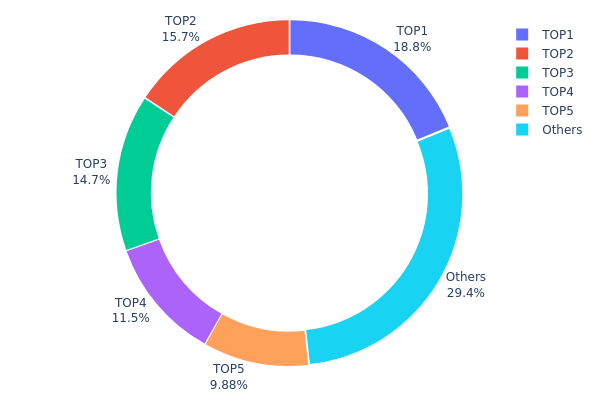

ZULU Holdings Distribution

The holdings distribution chart provides a comprehensive snapshot of token ownership concentration across different wallet addresses, serving as a critical indicator of decentralization and market structure stability. This metric reveals how ZULU tokens are allocated among major holders and smaller participants, offering insights into potential price manipulation risks and overall market health.

Based on the current on-chain data, ZULU exhibits a notably concentrated ownership structure. The top five addresses collectively control 508,061.61K tokens, representing approximately 70.54% of the total circulating supply. The largest single address holds 169,108.33K tokens (18.78%), followed by the second-largest with 141,666.67K tokens (15.74%) and the third with 132,000.00K tokens (14.66%). This concentration pattern suggests that a relatively small number of entities maintain significant influence over the token's market dynamics.

Such high concentration levels present both opportunities and risks for market participants. On one hand, the remaining 29.46% distributed among smaller holders indicates some degree of community participation and liquidity distribution. On the other hand, the substantial holdings in the top three addresses alone—totaling nearly 49.18% of supply—could potentially create vulnerability to coordinated selling pressure or price manipulation. The current distribution structure suggests that ZULU's market remains in a relatively centralized state, which may impact price stability and could introduce heightened volatility during periods of significant holder activity.

Click to view current ZULU Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xbc3a...a3ba67 | 169108.33K | 18.78% |

| 2 | 0xcc7f...f3d882 | 141666.67K | 15.74% |

| 3 | 0xf8f6...bd53ea | 132000.00K | 14.66% |

| 4 | 0x7005...594fe0 | 103333.34K | 11.48% |

| 5 | 0xc882...84f071 | 88953.27K | 9.88% |

| - | Others | 264938.40K | 29.46% |

II. Core Factors Influencing ZULU's Future Price

Supply and Demand Dynamics

- Market Supply-Demand Balance: ZULU's price formation fundamentally depends on the interplay between token supply and market demand. Changes in circulating supply, token release schedules, and adoption rates directly impact price levels.

- Historical Price Patterns: ZULU reached its all-time high of $0.27599 on November 11, 2024, while its all-time low of $0.001313 occurred on July 10, 2025. This substantial volatility reflects how supply-demand imbalances can drive significant price swings.

- Current Market Conditions: The cryptocurrency market continues to experience fluctuations driven by shifts in investor sentiment and adoption trends, which remain key determinants of ZULU's near-term price trajectory.

Market Sentiment and Adoption Trends

- Investor Sentiment: Market psychology plays a crucial role in ZULU's price movements. Positive sentiment driven by ecosystem developments or broader crypto market rallies can fuel upward momentum, while negative news or sector-wide corrections may trigger sell-offs.

- Adoption Indicators: The pace at which users, developers, and enterprises integrate ZULU into their operations serves as a leading indicator for long-term price sustainability. Growing adoption typically correlates with increased demand and price stability.

- Network Effects: As more participants join the ZULU ecosystem, network effects may amplify both price appreciation potential and resilience against market downturns.

Macroeconomic Environment

- Interest Rate Policies: Central bank monetary policies, particularly interest rate adjustments, significantly influence cryptocurrency valuations. Lower interest rates generally enhance risk asset appeal, potentially benefiting ZULU, while rate hikes may pressure prices downward.

- Inflation Dynamics: Cryptocurrencies are often viewed as hedges against currency devaluation. In periods of elevated inflation expectations, digital assets like ZULU may attract increased capital inflows as investors seek alternative stores of value.

- Regulatory Developments: Government policies regarding cryptocurrency regulation, taxation, and legal status can materially impact market confidence and price performance. Favorable regulatory clarity may support price growth, whereas restrictive measures could constrain upside potential.

Technological and Ecosystem Development

- Protocol Upgrades: Any technical improvements or protocol enhancements that increase transaction efficiency, security, or scalability could positively influence ZULU's competitive positioning and market valuation.

- Ecosystem Expansion: The development of decentralized applications, partnerships, and use cases within the ZULU ecosystem may drive organic demand growth and contribute to long-term price appreciation.

- Infrastructure Maturity: As the underlying infrastructure supporting ZULU matures, including wallet integrations, exchange listings, and developer tools, accessibility and liquidity improvements may reduce volatility and support more stable price discovery.

III. 2026-2031 ZULU Price Prediction

2026 Outlook

- Conservative Prediction: $0.0065 - $0.01

- Neutral Prediction: Around $0.01

- Optimistic Prediction: Up to $0.0132 (requires favorable market conditions and increased adoption)

2027-2029 Outlook

- Market Stage Expectation: The token may enter a gradual growth phase, with price fluctuations reflecting broader crypto market cycles and project development milestones

- Price Range Prediction:

- 2027: $0.01067 - $0.01218

- 2028: $0.00809 - $0.01498

- 2029: $0.00887 - $0.01693

- Key Catalysts: Sustained community engagement, potential partnerships, and overall cryptocurrency market sentiment could drive price movements during this period

2030-2031 Long-term Outlook

- Baseline Scenario: $0.00941 - $0.01579 (assuming steady project development and stable market conditions)

- Optimistic Scenario: $0.01518 - $0.01688 (requires strong ecosystem growth and favorable regulatory environment)

- Transformative Scenario: Potential to reach $0.01688 by 2031 (contingent on breakthrough developments and widespread adoption)

- February 2, 2026: ZULU trading within the predicted range of $0.0065 - $0.0132 (reflecting current market conditions)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.0132 | 0.01 | 0.0065 | 0 |

| 2027 | 0.01218 | 0.0116 | 0.01067 | 16 |

| 2028 | 0.01498 | 0.01189 | 0.00809 | 18 |

| 2029 | 0.01693 | 0.01344 | 0.00887 | 34 |

| 2030 | 0.01579 | 0.01518 | 0.00941 | 51 |

| 2031 | 0.01688 | 0.01549 | 0.00929 | 54 |

IV. ZULU Professional Investment Strategy and Risk Management

ZULU Investment Methodology

(1) Long-Term Holding Strategy

- Target Investors: Investors who believe in the long-term potential of Bitcoin DePIN infrastructure and AI-driven decentralized applications

- Operational Recommendations:

- Consider accumulating ZULU tokens during market corrections, as the current price of $0.01 represents a significant discount from historical levels

- Monitor the development progress of Zulu Network's DePIN and AI protocol integrations to assess long-term value proposition

- Implement a dollar-cost averaging approach to mitigate timing risk in volatile market conditions

- Storage Solution: Use Gate Web3 Wallet for secure storage with multi-signature functionality and hardware wallet integration options

(2) Active Trading Strategy

- Technical Analysis Tools:

- Moving Averages: Track 50-day and 200-day moving averages to identify trend reversals and momentum shifts

- Volume Analysis: Monitor the 24-hour trading volume ($11,776.74) relative to market cap to gauge liquidity and market interest

- Swing Trading Key Points:

- Set stop-loss orders below key support levels to protect capital during downward movements

- Take partial profits during rallies toward resistance levels to secure gains while maintaining position exposure

ZULU Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of cryptocurrency portfolio allocation

- Aggressive Investors: 3-5% of cryptocurrency portfolio allocation

- Professional Investors: Up to 10% with active risk management protocols

(2) Risk Hedging Solutions

- Portfolio Diversification: Balance ZULU exposure with established cryptocurrencies and stablecoins to reduce concentration risk

- Position Sizing: Limit single-position exposure based on individual risk tolerance and market volatility conditions

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for active trading and staking participation

- Cold Storage Solution: Transfer long-term holdings to hardware wallets with offline key storage for maximum security

- Security Precautions: Enable two-factor authentication, regularly update security settings, and never share private keys or seed phrases

V. ZULU Potential Risks and Challenges

ZULU Market Risks

- High Volatility: ZULU has experienced significant price fluctuations, with historical high of $0.27599 and low of $0.001313, indicating substantial volatility

- Limited Liquidity: With a 24-hour trading volume of $11,776.74 and market cap of $1.445 million, liquidity constraints may impact execution during large transactions

- Low Market Dominance: ZULU represents only 0.00037% of total cryptocurrency market capitalization, suggesting limited market recognition and adoption

ZULU Regulatory Risks

- DeFi Regulatory Uncertainty: Evolving regulatory frameworks for decentralized finance and staking services may impact Zulu Network's operational model

- Cross-Chain Compliance: As a protocol bridging Bitcoin security with EVM infrastructure, regulatory treatment across different blockchain ecosystems remains unclear

- Token Classification: Regulatory authorities may classify ZULU differently across jurisdictions, affecting trading and usage rights

ZULU Technical Risks

- Smart Contract Vulnerabilities: As an ERC-20 token integrating with Bitcoin security and DePIN protocols, complex smart contract architecture may contain undiscovered vulnerabilities

- Network Development Risk: The project's success depends on successful implementation of AI and DePIN protocol integrations, which face technical execution challenges

- Competition Risk: Zulu Network operates in a competitive space with numerous projects developing Bitcoin Layer 2 solutions and DePIN infrastructure

VI. Conclusion and Action Recommendations

ZULU Investment Value Assessment

Zulu Network presents an innovative approach by combining Bitcoin's security with EVM flexibility for AI and DePIN applications. The project's positioning in the emerging DePIN sector offers potential long-term value, particularly as decentralized physical infrastructure gains adoption. However, the current market metrics show limited liquidity and significant price volatility, with the token trading substantially below its historical high. The 14.45% circulation ratio indicates potential future supply pressure. Investors should weigh the project's technological innovation and strategic positioning against market risks, limited liquidity, and early-stage development challenges.

ZULU Investment Recommendations

✅ Beginners: Start with small allocations (less than 1% of portfolio) to understand token dynamics and project development before increasing exposure ✅ Experienced Investors: Consider strategic accumulation during market corrections while maintaining strict risk management protocols and diversified holdings ✅ Institutional Investors: Conduct thorough due diligence on technical architecture, team credentials, and partnership ecosystem before committing capital

ZULU Trading Participation Methods

- Spot Trading: Purchase ZULU tokens on Gate.com for direct ownership and participation in the Zulu Network ecosystem

- Staking Participation: Explore staking opportunities within the Zulu Network to earn yields while supporting DePIN and AI protocol operations

- Portfolio Integration: Incorporate ZULU as part of a diversified cryptocurrency portfolio focused on infrastructure and emerging technology sectors

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is ZULU token and what are its main use cases and applications?

ZULU token powers decentralized AI networks through model staking and data validation rewards. It incentivizes network participants, secures the protocol, and enables users to earn rewards for contributing to the AI ecosystem.

How has ZULU's historical price performance been? What was the price trend over the past year?

ZULU has maintained relative stability over the past year, trading around $0.011 levels as of late 2025. The token showed modest fluctuations but no dramatic swings, demonstrating steady consolidation in its price range through early 2026.

What are the main factors affecting ZULU price?

ZULU price is influenced by market sentiment, trading volume, project development progress, ecosystem activity, and overall crypto market conditions. Positive news and ecosystem expansion typically drive price increases.

What are the common analysis methods for ZULU price prediction? How to apply technical and fundamental analysis?

ZULU price prediction commonly uses technical analysis and fundamental analysis. Technical analysis examines charts and indicators like moving averages and RSI. Fundamental analysis evaluates project development, market demand, and adoption trends. Combining both methods helps identify price trends and support trading decisions.

What risks should I be aware of when investing in ZULU tokens?

ZULU token investments carry market volatility risk, regulatory uncertainty, and project execution risks. Price fluctuations can be significant. Conduct thorough due diligence on project fundamentals, team background, and tokenomics before investing. Consider your risk tolerance carefully.

What are the advantages and disadvantages of ZULU compared to similar tokens?

ZULU advantages: strong AI integration potential, pioneering Bitcoin DePIN sector, low historical price point. Disadvantages: limited project track record. Competitors like STX offer established infrastructure but lack DePIN innovation positioning.

What is the team background and development roadmap of the ZULU project?

ZULU is led by experienced technical experts focused on developing Bitcoin scalability solutions. The team plans to implement efficient scaling through innovative virtual machine architecture and advance blockchain technology development in the future.

How to buy and trade ZULU tokens on exchanges?

ZULU tokens are available on major cryptocurrency exchanges. The most active trading pair is ZULU/USDT. Simply create an account, complete verification, deposit funds, and place buy or sell orders directly on the platform.

Top 10 DePIN Crypto Projects to Invest in 2025

How to Participate in a DePIN Project

What is DePIN?How Does DePIN Work?

What Does Onyxcoin's DApp Ecosystem Look Like in 2025?

How to Earn with The RWA DePin Protocol in 2025

TrendX (XTTA): An Innovative Investment Platform Integrating AI and DePIN

SafeMoon Latest Updates and Price Analysis: What’s Happening with SafeMoon?

What is QuarkChain QKC price today with $25.39M market cap and $545K 24-hour trading volume

Jupiter Integrates Built-In Polymarket Predictions: Powering a New Era of Decentralized Prediction Markets

Is HashPack (PACK) a good investment?: A Comprehensive Analysis of Token Fundamentals, Market Potential, and Risk Factors for 2024

Is The Game Company (GMRT) a good investment?: A Comprehensive Analysis of Financial Performance, Market Position, and Future Growth Potential