Is Almanak (ALMANAK) a good investment?: A Comprehensive Analysis of the Token's Potential, Market Position, and Risk Factors for 2024

Introduction: Almanak (ALMANAK)'s Investment Position and Market Outlook

Almanak (ALMANAK) is a digital asset in the cryptocurrency space, launched in 2025, focusing on democratizing quantitative trading through AI-powered multi-agent systems. As of February 04, 2026, ALMANAK holds a market capitalization of approximately $856,499.90, with a circulating supply of around 268,748,008 tokens, and the current price stands at approximately $0.003187. Positioned as an accessible no-code platform for hedge-fund-grade trading strategies, Almanak has attracted backing from notable investors including Delphi Labs, BanklessVC, Hashkey, AppWorks, Near, RockawayX, Sparkle VC, and Matrix Partners. As the project gains attention in the AI and decentralized finance sectors, investors are increasingly discussing "Is Almanak (ALMANAK) a good investment?" This article provides a comprehensive analysis of ALMANAK's investment value, historical price performance, future price projections, and associated investment risks to serve as a reference for potential investors.

I. ALMANAK Price History Review and Current Investment Value

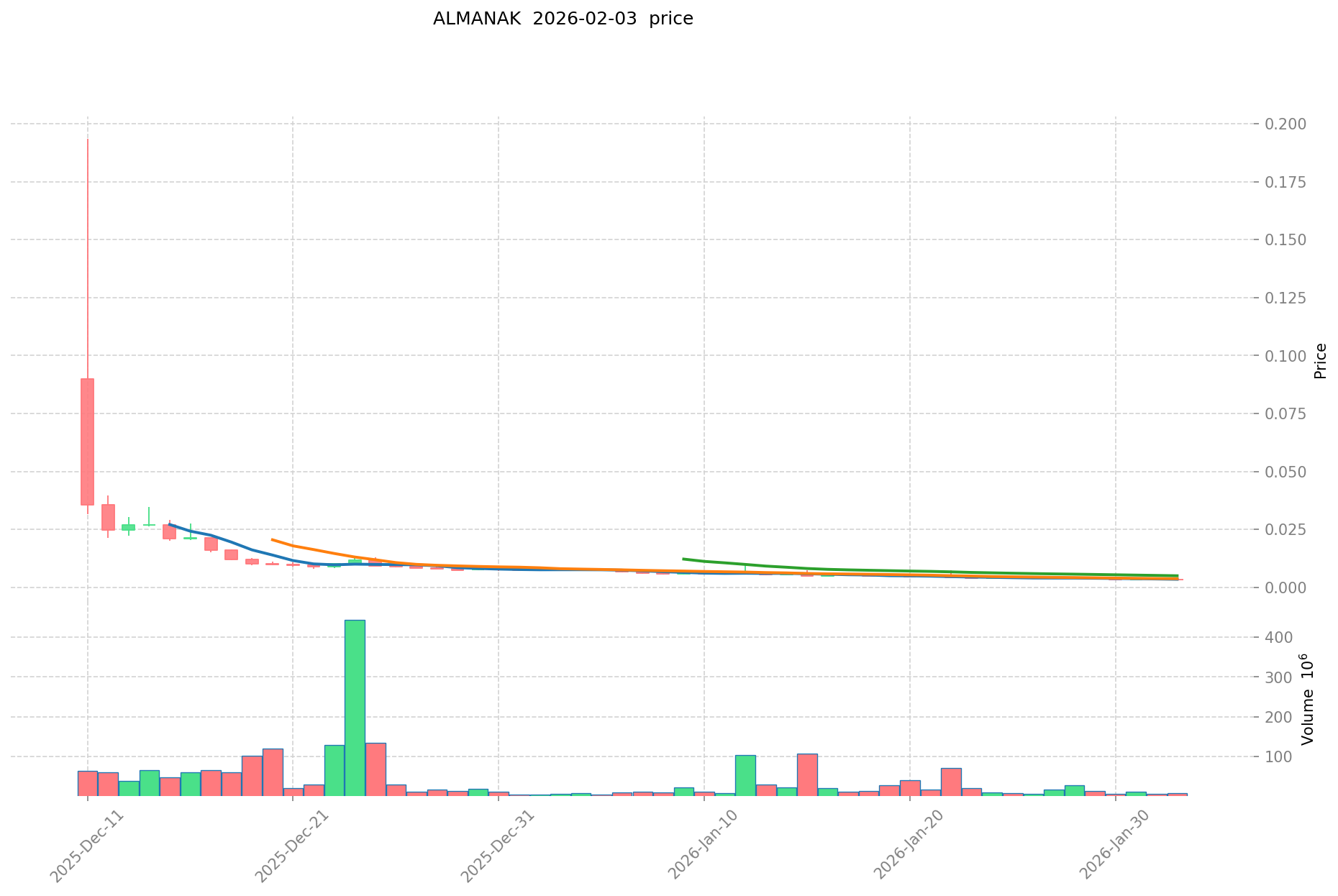

Almanak (ALMANAK) Investment Performance

- December 2025: Token launch period → Initial market enthusiasm drove prices to elevated levels

- December 11, 2025: Early trading milestone → ALMANAK reached $0.19366 during initial market activity

- January-February 2026: Market correction phase → Price declined from $0.19366 to approximately $0.003132

Current ALMANAK Investment Market Status (February 2026)

- Current ALMANAK price: $0.003187

- Market sentiment (Fear & Greed Index): Data shows neutral to cautious market conditions

- 24-hour trading volume: $25,421.89

- Token holders: 4,906 addresses

Click to view real-time ALMANAK market price

II. Core Factors Influencing Whether ALMANAK is a Good Investment (Is Almanak(ALMANAK) a Good Investment)

Supply Mechanism and Scarcity (ALMANAK investment scarcity)

- Total Supply and Circulation: Almanak has a maximum supply of 1,000,000,000 tokens, with a circulating supply of 268,748,008 tokens as of February 4, 2026, representing approximately 26.87% of the total supply.

- Supply Impact on Value: The current circulating supply relative to the maximum supply suggests that a significant portion of tokens remains to be released, which may influence future price dynamics.

- Investment Consideration: The token's scarcity level and future token release schedule are important factors for investors to consider when evaluating long-term holding potential.

Institutional Investment and Mainstream Adoption (Institutional investment in ALMANAK)

- Institutional Backing: Almanak has received support from notable investors including Delphi Labs, BanklessVC, Hashkey, AppWorks, Near, RockawayX, Sparkle VC, Matrix Partners, Shima Capital, and multiple key opinion leaders in the crypto space.

- Holder Distribution: As of February 4, 2026, Almanak has approximately 4,906 token holders, indicating an emerging community base.

- Platform Accessibility: The token is listed on 8 exchanges, providing multiple channels for market participation and liquidity.

Macroeconomic Environment Impact on ALMANAK Investment

- Market Performance Context: As of February 4, 2026, ALMANAK has experienced price fluctuations with a 24-hour decline of 5.25%, a 7-day decline of 18.59%, and a 30-day decline of 58.16%.

- Market Positioning: The token holds a market dominance of 0.00011%, with a market capitalization of approximately $856,499.90, ranking at position 2634 in the overall crypto market.

- Volatility Considerations: The token's price has ranged from $0.003132 (recorded on February 3, 2026) to $0.19366 (recorded on December 11, 2025), demonstrating significant price volatility that investors should factor into their risk assessment.

Technology and Ecosystem Development (Technology & Ecosystem for ALMANAK investment)

- Platform Functionality: Almanak enables users to build, optimize, and manage quantitative-grade financial strategies using AI agents in a no-code environment, democratizing access to sophisticated trading tools.

- Technology Accessibility: The platform eliminates the traditional need for developers and quantitative analysts by leveraging AI technology to provide hedge-fund-level strategy capabilities to a broader user base.

- Token Standard: ALMANAK operates as an ERC-20 token on the Ethereum blockchain, with the contract address 0xdefa1d21c5f1cbeac00eeb54b44c7d86467cc3a3.

- Application Scope: The project focuses on making advanced quantitative trading accessible through AI-powered multi-agent systems, positioning itself within the intersection of artificial intelligence and decentralized finance.

III. ALMANAK Future Investment Forecast and Price Outlook (Is Almanak(ALMANAK) worth investing in 2026-2031)

Short-term Investment Forecast (2026, short-term ALMANAK investment outlook)

- Conservative forecast: $0.0028 - $0.0032

- Neutral forecast: $0.0032 - $0.0037

- Optimistic forecast: $0.0037 - $0.0042

Mid-term Investment Outlook (2027-2029, mid-term Almanak(ALMANAK) investment forecast)

- Market stage expectation: During the 2027-2029 period, ALMANAK may enter a gradual growth phase, with price movements potentially influenced by the development of its AI-driven quantitative trading platform and broader market adoption trends.

- Investment return forecast:

- 2027: $0.0025 - $0.0046

- 2028: $0.0028 - $0.0053

- 2029: $0.0031 - $0.0054

- Key catalysts: Platform feature enhancements, expansion of the user base in quantitative trading, partnerships within the DeFi ecosystem, and overall crypto market sentiment.

Long-term Investment Outlook (Is ALMANAK a good long-term investment?)

- Base scenario: $0.0044 - $0.0075 (assuming steady platform development and moderate market growth)

- Optimistic scenario: $0.0060 - $0.0092 (assuming accelerated adoption of AI-driven trading solutions and favorable market conditions)

- Risk scenario: Below $0.0028 (under adverse market conditions or significant competitive pressures)

View ALMANAK long-term investment and price forecast: Price Prediction

2026-02-04 - 2031 Long-term Outlook

- Base scenario: $0.0045 - $0.0063 (corresponding to steady progress and gradual mainstream application growth)

- Optimistic scenario: $0.0060 - $0.0092 (corresponding to large-scale adoption and favorable market environment)

- Transformative scenario: Above $0.0092 (in case of breakthrough ecosystem developments and mainstream adoption)

- 2031-12-31 projected high: $0.0092 (based on optimistic development assumptions)

Disclaimer: The forecasts presented are for informational purposes only and do not constitute investment advice. Cryptocurrency markets are highly volatile and unpredictable. Past performance does not guarantee future results. Investors should conduct independent research and assess their risk tolerance before making any investment decisions.

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00424536 | 0.003192 | 0.00284088 | 0 |

| 2027 | 0.00464835 | 0.00371868 | 0.0025287024 | 16 |

| 2028 | 0.00531306405 | 0.004183515 | 0.0027611199 | 31 |

| 2029 | 0.00536556716325 | 0.004748289525 | 0.00308638819125 | 48 |

| 2030 | 0.007534823232746 | 0.005056928344125 | 0.00445009694283 | 58 |

| 2031 | 0.009191978651115 | 0.006295875788435 | 0.005981081999013 | 97 |

IV. Almanak Investment Strategy and Risk Management (How to invest in Almanak)

Investment Methodology (Almanak investment strategy)

Long-term Holding (HODL Almanak)

For conservative investors seeking steady exposure to AI-driven quantitative trading infrastructure, a long-term holding strategy may be considered. This approach involves accumulating ALMANAK tokens during market corrections and maintaining positions through multiple market cycles. Given the project's backing from established venture capital firms including Delphi Labs, BanklessVC, and Hashkey, investors adopting this strategy typically focus on the protocol's long-term adoption potential rather than short-term price movements.

Active Trading

Active traders may utilize technical analysis and wave operation strategies when engaging with ALMANAK. Recent price data shows the token experienced an hourly change of -0.13%, a 24-hour change of -5.25%, and a 7-day decline of -18.59%. The 24-hour trading range between $0.003132 and $0.003372 suggests opportunities for short-term trading, though substantial volatility should be expected. Technical indicators, support and resistance levels, and volume analysis become essential tools for traders attempting to capitalize on price fluctuations.

Risk Management (Risk management for Almanak investment)

Asset Allocation Ratios

- Conservative Investors: May consider allocating 1-3% of their crypto portfolio to ALMANAK, prioritizing capital preservation while maintaining limited exposure to AI-driven DeFi infrastructure projects.

- Aggressive Investors: Could allocate 5-10% of their crypto holdings to ALMANAK, accepting elevated volatility in exchange for potential upside from early-stage adoption of no-code quantitative trading solutions.

- Professional Investors: Might incorporate ALMANAK into diversified thematic portfolios focused on AI and DeFi convergence, with allocation decisions informed by risk-adjusted return models and correlation analysis with other portfolio holdings.

Risk Hedging Solutions

- Multi-asset Portfolio Construction: Combining ALMANAK holdings with established cryptocurrencies, stablecoins, and potentially inverse correlation assets to reduce portfolio-level volatility.

- Hedging Instruments: Utilizing derivatives such as put options or perpetual futures (where available) to protect against downside risk during periods of elevated market uncertainty.

Secure Storage

- Cold Wallets: Hardware wallets supporting ERC-20 tokens (such as Ledger or Trezor devices) provide enhanced security for long-term ALMANAK storage by keeping private keys offline.

- Hot Wallets: For active traders requiring frequent access, reputable software wallets with multi-signature capabilities and two-factor authentication offer a balance between accessibility and security.

- Wallet Recommendations: Given ALMANAK's ERC-20 standard implementation on the Ethereum network, investors should ensure their chosen wallet solution fully supports Ethereum-based tokens and maintains regular security updates.

V. Almanak Investment Risks and Challenges (Risks of investing in Almanak)

Market Risks

- High Volatility: ALMANAK has demonstrated significant price fluctuations, with a 30-day decline of -58.16% indicating substantial downside risk potential. The token's market capitalization of approximately $856,500 and relatively limited exchange listings (8 platforms) suggest lower liquidity compared to established cryptocurrencies, potentially amplifying price swings.

- Price Manipulation Concerns: With a circulating supply of 268,748,008 tokens (26.87% of total supply) and a modest holder count of 4,906 addresses, concentrated holdings could create vulnerability to coordinated selling pressure or artificial price movements.

Regulatory Risks

- Policy Uncertainty Across Jurisdictions: The regulatory landscape for AI-powered trading platforms and associated tokens remains undefined in many regions. Potential classification as securities, restrictions on automated trading systems, or requirements for financial licensing could impact ALMANAK's operational model and token utility.

- Compliance Requirements: As regulatory frameworks evolve, the project may face obligations regarding user identification, transaction reporting, or geographic restrictions that could affect adoption rates and operational costs.

Technical Risks

- Network Security Vulnerabilities: As an ERC-20 token on the Ethereum network, ALMANAK inherits both the benefits and potential risks of Ethereum's infrastructure. Smart contract vulnerabilities, whether in the token contract or related protocol components, could expose holders to exploitation risks.

- Upgrade Failures: The implementation of protocol upgrades, new AI agent functionalities, or integration with additional blockchain networks carries execution risk. Technical difficulties during development or deployment could impact user confidence and token value.

- Dependency on External Infrastructure: The platform's reliance on oracle services for price data, external liquidity sources, and cross-chain bridges introduces third-party risk factors that could affect the protocol's reliability and user experience.

VI. Conclusion: Is Almanak a Good Investment?

Investment Value Summary

Almanak presents an investment thesis centered on democratizing quantitative trading through AI-driven, no-code solutions, potentially addressing a significant market need for accessible algorithmic trading infrastructure. The project has secured backing from recognized venture capital entities, suggesting institutional validation of its value proposition. However, the token has experienced substantial short-term price volatility, with a 30-day decline of -58.16% and trading well below its December 2025 peak. The market capitalization to fully diluted valuation ratio of 26.87% indicates significant future token supply entering circulation, which may create ongoing selling pressure.

Investor Recommendations

✅ Beginners: Consider dollar-cost averaging strategies with modest allocation sizes, combined with secure hardware wallet storage. New investors should prioritize education about AI-driven DeFi protocols and maintain risk exposure within their overall risk tolerance parameters.

✅ Experienced Investors: May explore wave operation strategies during periods of defined technical patterns, while maintaining diversified portfolio allocation across multiple crypto asset categories. Position sizing should account for ALMANAK's volatility characteristics and liquidity profile.

✅ Institutional Investors: Could evaluate strategic long-term positioning within thematic portfolios focused on AI-blockchain convergence, subject to thorough due diligence on the protocol's technical architecture, token economics, and competitive positioning within the quantitative trading infrastructure landscape.

⚠️ Notice: Cryptocurrency investments carry substantial risk, including the possibility of complete capital loss. This analysis is provided for informational purposes only and does not constitute investment advice. Prospective investors should conduct independent research and consult qualified financial advisors before making investment decisions.

VII. FAQ

Q1: What makes Almanak different from traditional quantitative trading platforms?

Almanak distinguishes itself by providing a no-code, AI-powered multi-agent system that democratizes hedge-fund-grade trading strategies. Unlike traditional platforms requiring developers and quantitative analysts, Almanak enables users to build, optimize, and manage sophisticated financial strategies through accessible AI agents. This eliminates technical barriers that historically restricted quantitative trading to institutional participants, making advanced algorithmic trading accessible to a broader user base while operating on blockchain infrastructure as an ERC-20 token.

Q2: How does ALMANAK's circulating supply affect its investment potential?

ALMANAK currently has 268,748,008 tokens in circulation, representing only 26.87% of its maximum supply of 1,000,000,000 tokens. This means approximately 73% of tokens remain unreleased, which creates potential selling pressure as additional tokens enter circulation over time. Investors should consider this supply schedule in their analysis, as significant future token releases may impact price dynamics. The gradual release of remaining tokens could dilute existing holder positions unless offset by corresponding growth in demand and platform adoption.

Q3: What are the primary risks associated with investing in ALMANAK?

ALMANAK carries several investment risks: market volatility (demonstrated by a 58.16% decline over 30 days), regulatory uncertainty surrounding AI-powered trading platforms, technical vulnerabilities inherent in smart contracts and blockchain dependencies, and liquidity constraints due to its relatively small market capitalization ($856,499.90) and limited exchange listings (8 platforms). Additionally, the concentrated token distribution among 4,906 holders creates potential manipulation risks. The project's early-stage status within the AI-DeFi convergence space adds execution risk regarding platform development and competitive positioning.

Q4: Which investment strategy is most appropriate for ALMANAK?

The optimal strategy depends on investor profile and risk tolerance. Conservative investors may consider 1-3% portfolio allocation with long-term holding (HODL) approaches, focusing on the protocol's institutional backing and adoption potential. Aggressive investors might allocate 5-10% for higher risk-reward exposure to AI-driven DeFi infrastructure. Active traders can utilize technical analysis given the token's volatility, with 24-hour trading ranges offering short-term opportunities. Regardless of strategy, proper risk management through diversification, secure storage in hardware wallets, and position sizing aligned with individual risk parameters remains essential.

Q5: What is ALMANAK's price outlook for 2026-2031?

Price forecasts suggest varied scenarios based on platform development and market conditions. Conservative projections for 2026 range from $0.0028 to $0.0042, while mid-term outlook (2027-2029) extends from $0.0025 to $0.0054 depending on adoption rates. Long-term forecasts through 2031 present a base scenario of $0.0045 to $0.0063, an optimistic scenario of $0.0060 to $0.0092, and a transformative scenario exceeding $0.0092 contingent upon breakthrough ecosystem developments. However, these projections carry substantial uncertainty given cryptocurrency market volatility and ALMANAK's early-stage status.

Q6: How does institutional backing influence ALMANAK's investment thesis?

ALMANAK has secured support from notable institutional investors including Delphi Labs, BanklessVC, Hashkey, AppWorks, Near, RockawayX, Sparkle VC, Matrix Partners, and Shima Capital. This backing provides several investment considerations: validation of the project's value proposition by experienced crypto venture capital firms, potential access to strategic resources and industry connections, and enhanced credibility within the cryptocurrency ecosystem. However, institutional backing alone does not guarantee investment success, and investors should evaluate the protocol's technical execution, market traction, and competitive positioning independently.

Q7: What storage solutions are recommended for ALMANAK tokens?

Given ALMANAK's implementation as an ERC-20 token on the Ethereum blockchain (contract address: 0xdefa1d21c5f1cbeac00eeb54b44c7d86467cc3a3), investors have multiple storage options. Long-term holders prioritizing security should utilize hardware wallets such as Ledger or Trezor devices, which keep private keys offline. Active traders requiring frequent access may opt for reputable software wallets with multi-signature capabilities and two-factor authentication. Regardless of chosen solution, investors must ensure their wallet fully supports Ethereum-based tokens and maintains regular security updates to protect holdings from potential vulnerabilities.

Q8: Is ALMANAK suitable for beginners entering the cryptocurrency market?

ALMANAK presents significant challenges for cryptocurrency beginners due to its early-stage status, high volatility (58.16% decline over 30 days), and relatively low market capitalization ($856,499.90). New investors considering ALMANAK should first establish foundational knowledge of blockchain technology, understand the risks inherent in low-cap cryptocurrencies, and implement proper risk management through modest allocation sizes (1-3% of crypto portfolio maximum). Dollar-cost averaging strategies combined with secure hardware wallet storage may help mitigate timing risks. Beginners should prioritize educational resources about AI-DeFi protocols and maintain diversification across established cryptocurrencies before allocating capital to speculative, early-stage projects like ALMANAK.

What will be the market capitalization of USDC in 2025? Analysis of the stablecoin market landscape.

How is DeFi different from Bitcoin?

What is DeFi: Understanding Decentralized Finance in 2025

USDC stablecoin 2025 Latest Analysis: Principles, Advantages, and Web3 Eco-Applications

Development of Decentralized Finance Ecosystem in 2025: Integration of Decentralized Finance Applications with Web3

2025 USDT USD Complete Guide: A Must-Read for Newbie Investors

What is CBDC, or Central Bank Digital Currency

Top 14 DeFi Investment Tools for Investors

What is liquidity mining and how can you profit from it

What is a cryptocurrency airdrop: where to find them and how to earn

What is EIP-4844? What Are Its Benefits?