Is EARNM (EARNM) a good investment?: A Comprehensive Analysis of Risk, Potential Returns, and Market Outlook for 2024

Introduction: EARNM's Investment Position and Market Outlook

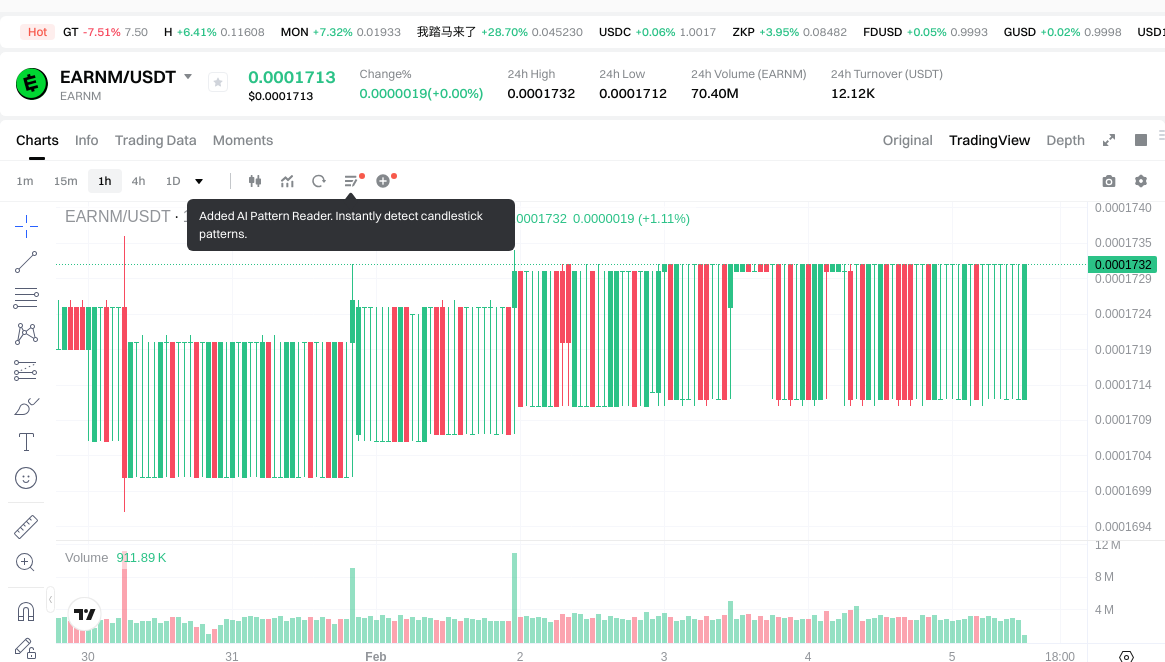

EARNM represents a notable asset within the cryptocurrency sector, operating as a DePIN (Decentralized Physical Infrastructure Network) rewards ecosystem with a community exceeding 45 million users. As of February 2026, EARNM maintains a market capitalization of approximately $562,900, with a circulating supply of 3.25 billion tokens and a current trading price around $0.0001732. The project positions itself as a platform that converts everyday mobile activity into rewards by leveraging data and user attention as currency, utilizing innovations such as the Fractal Box Protocol, EARN'M SmartWallet, and EarnOS. With its ranking at position 2947 in the cryptocurrency market and a fully diluted market cap of $866,000, EARNM has emerged as a subject of discussion among investors evaluating "Is EARNM a good investment?" This analysis examines EARNM's investment characteristics, historical price performance, future price outlook, and associated investment considerations to provide reference information for market participants.

I. EARNM Price Historical Review and Current Investment Value

EARNM Historical Price Trends and Investment Returns (EARNM(EARNM) investment performance)

- 2024: Token launch on December 19, 2024 with initial price of $0.01 → Price reached $0.0666 on the same day

- 2026: Price declined significantly → From early highs to $0.0001105 recorded on January 14, 2026

- Recent period: Market activity remained limited → 24-hour trading volume at $12,123.95 as of February 5, 2026

Current EARNM Investment Market Status (February 2026)

- EARNM current price: $0.0001732

- 24-hour trading volume: $12,123.95

- Circulating supply: 3,250,000,000 EARNM (65% of maximum supply)

- Market capitalization: $562,900

- Token holders: 129,741 addresses

- Contract address on Polygon: 0xaeb3dd897ade187b9f9e4c491bc7a81f69f7093e

Click to view real-time EARNM market price

II. Core Factors Influencing Whether EARNM Is a Good Investment

Supply Mechanism and Scarcity (EARNM Investment Scarcity)

- Supply Structure → Influences Price and Investment Value

- EARNM has a maximum supply of 5,000,000,000 tokens, with a current circulating supply of 3,250,000,000 tokens, representing a circulation rate of 65%. This fixed supply cap creates a baseline scarcity mechanism that could support long-term value retention.

- Historical Context: EARNM's price has experienced significant volatility since its launch in December 2024, with notable price movements from $0.0666 to lower levels, demonstrating the impact of supply dynamics on market valuation.

- Investment Significance: The controlled supply mechanism, with 35% of tokens yet to enter circulation, presents both opportunities and risks. The gradual release of remaining tokens could create selling pressure, while the fixed maximum supply establishes scarcity as a foundational element for potential long-term investment value.

Institutional Investment and Mainstream Adoption (Institutional Investment in EARNM)

- Institutional Positioning: EARNM's ecosystem currently serves over 45 million users, indicating substantial community adoption. The project has generated over $70 million in Web2 and Web3 revenue and delivered $350 million in value earned and saved by users, demonstrating operational traction.

- Corporate Recognition: The team behind EARNM was ranked first by Deloitte as North America's fastest-growing company in 2023, with a growth rate of 32,481%. This recognition reflects strong business execution, though it primarily relates to the team's historical performance rather than direct institutional investment in the token.

- Market Integration: EARNM is currently listed on one exchange platform (Gate.com), which represents limited mainstream exchange adoption compared to more established digital assets. Broader exchange integration would be necessary to attract significant institutional participation.

Macroeconomic Environment's Impact on EARNM Investment

- Market Context: As a relatively new token launched in December 2024, EARNM's performance reflects broader cryptocurrency market conditions. The token's current market capitalization of approximately $562,900 positions it as a micro-cap asset, making it more susceptible to macroeconomic volatility and market sentiment shifts.

- Positioning Characteristics: Unlike established digital assets, EARNM operates within the DePIN (Decentralized Physical Infrastructure Network) rewards sector, representing a specific utility-focused niche rather than a store-of-value positioning. This fundamental difference means macroeconomic factors such as inflation hedging considerations may have less direct relevance to EARNM's investment thesis.

- Risk Considerations: The project's focus on converting daily mobile activity into rewards creates revenue dependency on user engagement and platform sustainability, factors that may be influenced by broader economic conditions affecting consumer behavior and technology adoption patterns.

Technology and Ecosystem Development (Technology & Ecosystem for EARNM Investment)

- Core Infrastructure: EARNM operates on the Polygon network, leveraging its scalability and lower transaction costs. The project has developed proprietary technologies including the Fractal Box Protocol, EARN'M SmartWallet, and EarnOS, which form the foundation for converting user attention and data into sustainable on-chain revenue.

- Ecosystem Scale: With over 45 million users and 129,741 token holders, EARNM has established a significant user base for a recently launched project. The platform's ability to generate revenue while distributing rewards demonstrates an operational ecosystem, though long-term sustainability requires continued user growth and engagement.

- Application Framework: The DePIN rewards model represents an emerging sector within blockchain applications, focusing on monetizing everyday mobile activities. This positions EARNM within the broader trends of user-data monetization and attention economy tokenization, areas that could see expanded adoption as Web3 infrastructure matures.

III. EARNM Future Investment Outlook and Price Forecast (Is EARNM worth investing in 2026-2031)

Short-term Investment Outlook (2026, short-term EARNM investment outlook)

- Conservative forecast: $0.000115 - $0.000171

- Neutral forecast: $0.000171 - $0.000200

- Optimistic forecast: $0.000200 - $0.000235

Mid-term Investment Outlook (2027-2029, mid-term EARNM investment forecast)

-

Market stage expectation: The token may experience gradual development as the DePIN rewards ecosystem continues to expand its user base and platform integrations. Growth potential exists if the project successfully converts its large user community into active on-chain participants.

-

Investment return forecast:

- 2027: $0.000193 - $0.000282 (approximately 17% growth from 2026)

- 2028: $0.000199 - $0.000318 (approximately 40% growth from 2026)

- 2029: $0.000241 - $0.000392 (approximately 61% growth from 2026)

-

Key catalysts: Platform adoption rate, effectiveness of the Fractal Box Protocol in generating sustainable on-chain revenue, expansion of SmartWallet and EarnOS features, market reception of MobileFi and DePIN concepts, and overall cryptocurrency market conditions.

Long-term Investment Outlook (Is EARNM a good long-term investment?)

- Base scenario: $0.000212 - $0.000336 (corresponding to steady progress in platform development and moderate user engagement growth through 2030)

- Optimistic scenario: $0.000383 - $0.000487 (corresponding to broader adoption of the rewards ecosystem and favorable market environment through 2031)

- Risk scenario: Below $0.000115 (under conditions of significant market downturns, limited platform adoption, or increased competition in the DePIN sector)

For detailed EARNM long-term investment analysis and price predictions: Price Prediction

2026-2031 Long-term Outlook

- Base scenario: $0.000211 - $0.000336 USD (corresponding to steady progress and gradual mainstream application growth)

- Optimistic scenario: $0.000383 - $0.000487 USD (corresponding to large-scale adoption and favorable market conditions)

- Transformative scenario: Above $0.000487 USD (if the ecosystem achieves breakthrough developments and mainstream penetration)

- December 31, 2031 predicted high: $0.000445 USD (based on optimistic development assumptions)

Disclaimer: Price predictions are speculative estimates based on historical data patterns and available information. Cryptocurrency markets are highly volatile and unpredictable. These forecasts should not be considered as financial advice or investment recommendations. Past performance does not guarantee future results. Investors should conduct their own research and consider their risk tolerance before making any investment decisions.

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.000234681 | 0.0001713 | 0.000114771 | -1 |

| 2027 | 0.000282156795 | 0.0002029905 | 0.000192840975 | 17 |

| 2028 | 0.000317771478225 | 0.0002425736475 | 0.00019891039095 | 40 |

| 2029 | 0.000392241588007 | 0.000280172562862 | 0.000240948404061 | 61 |

| 2030 | 0.00048750025938 | 0.000336207075435 | 0.000211810457524 | 94 |

| 2031 | 0.0004448019608 | 0.000411853667407 | 0.000383023910689 | 137 |

IV. EARNM Investment Strategy and Risk Management (How to invest in EARNM)

Investment Methodology (EARNM investment strategy)

-

Long-term Holding (HODL EARNM): This approach is suitable for conservative investors who believe in the long-term vision of the EARN'M ecosystem. Given the project's established user base of over 45 million users and the team's track record of generating over $70 million in Web2 and Web3 revenue, long-term holders may benefit from the platform's continued development and adoption of its DePIN rewards infrastructure.

-

Active Trading: Traders utilizing technical analysis and swing trading strategies should be aware of EARNM's price volatility. Recent data shows the token has experienced significant fluctuations, with a 24-hour high of $0.0001732 and low of $0.0001712. The 30-day decline of approximately 11.95% and the substantial annual decline of around 97.43% from its historical high suggest that active traders need to employ careful entry and exit strategies when engaging with this asset.

Risk Management (Risk management for EARNM investment)

-

Asset Allocation Ratio:

- Conservative investors may consider allocating a small percentage (1-3%) of their crypto portfolio to EARNM, treating it as a high-risk, speculative position.

- Aggressive investors comfortable with higher volatility might allocate 5-10% of their crypto holdings to EARNM.

- Professional investors should conduct thorough due diligence and may consider EARNM as part of a diversified DePIN sector allocation.

-

Risk Hedging Solutions: Investors should consider diversifying across multiple asset classes and crypto categories to mitigate concentration risk. Portfolio diversification across established cryptocurrencies, stablecoins, and emerging DePIN projects can help balance exposure to EARNM's volatility. Additionally, implementing stop-loss orders and position sizing strategies can help manage downside risk.

-

Secure Storage:

- Cold wallets provide the highest level of security for long-term EARNM holdings, keeping private keys completely offline.

- Hot wallets may be suitable for traders requiring frequent access, though security considerations should be prioritized.

- Hardware wallet solutions offer a balanced approach, combining security with accessibility for EARNM storage.

V. EARNM Investment Risks and Challenges (Risks of investing in EARNM)

-

Market Risk: EARNM has demonstrated high price volatility, with the token experiencing significant price fluctuations since its launch. The historical high of $0.0666 recorded in December 2024 contrasts sharply with the historical low of $0.0001105 observed in January 2026. This substantial price range indicates considerable volatility potential. The relatively modest 24-hour trading volume of approximately $12,123 and market capitalization of around $562,900 suggest limited liquidity, which can amplify price swings and increase susceptibility to market manipulation risks.

-

Regulatory Risk: As with all cryptocurrency investments, EARNM faces uncertainties related to evolving regulatory frameworks across different jurisdictions. Changes in cryptocurrency regulations, data privacy laws, or DePIN-specific policies could impact the project's operations and token value. The project's focus on data and user attention as currency may attract additional regulatory scrutiny regarding data protection and user privacy compliance.

-

Technical Risk: The EARN'M ecosystem relies on multiple technological components including the Fractal Box Protocol, EARN'M SmartWallet, and EarnOS. Any technical vulnerabilities, security breaches, or implementation failures in these systems could negatively impact the platform's functionality and user trust. Smart contract vulnerabilities or network security issues could potentially expose users to risks or disrupt the platform's reward distribution mechanisms.

VI. Conclusion: Is EARNM a Good Investment?

-

Investment Value Summary: EARNM represents a project with an established user community and a team that has demonstrated operational success in both Web2 and Web3 environments. However, the token has experienced considerable price volatility, declining substantially from its historical peak. The project's focus on DePIN infrastructure and rewards mechanisms positions it within an emerging sector, though the long-term investment potential remains subject to market conditions, continued platform development, and user adoption trends.

-

Investor Recommendations:

✅ Beginners: Consider dollar-cost averaging strategies to mitigate timing risk, and prioritize secure storage solutions such as hardware wallets or established cold wallet providers. Start with modest allocations to understand the token's behavior before increasing exposure.

✅ Experienced Investors: May employ swing trading strategies based on technical analysis, while maintaining a diversified portfolio that includes EARNM as part of a broader DePIN sector allocation. Active monitoring of platform developments and user metrics can inform position adjustments.

✅ Institutional Investors: Should conduct comprehensive due diligence on the project's technical infrastructure, team credentials, and business model sustainability before considering strategic allocation. The project's established user base and revenue history may warrant consideration as part of a diversified blockchain infrastructure portfolio.

⚠️ Disclaimer: Cryptocurrency investments carry substantial risk, including the potential loss of principal. This content is provided for informational purposes only and does not constitute investment advice, financial guidance, or a recommendation to buy or sell any asset. Investors should conduct their own research and consult with qualified financial advisors before making investment decisions.

VII. FAQ

Q1: What is EARNM and how does it generate value for investors?

EARNM is a DePIN (Decentralized Physical Infrastructure Network) rewards ecosystem token that converts everyday mobile activity into cryptocurrency rewards. The project operates on the Polygon network and serves over 45 million users through its proprietary technologies including the Fractal Box Protocol, EARN'M SmartWallet, and EarnOS. The token generates value by monetizing user attention and data, having facilitated over $70 million in Web2 and Web3 revenue and delivered $350 million in value to users. For investors, EARNM represents exposure to the emerging MobileFi and DePIN sectors, though its current market capitalization of approximately $562,900 and significant price volatility since its December 2024 launch indicate high-risk characteristics typical of micro-cap cryptocurrencies.

Q2: How has EARNM performed since its launch and what is its current market position?

EARNM launched on December 19, 2024, with an initial price of $0.01 that reached a historical high of $0.0666 on the same day. Since then, the token has experienced substantial decline, reaching a historical low of $0.0001105 on January 14, 2026, and currently trading around $0.0001732 as of February 2026. This represents approximately a 97.43% decline from its peak. The token currently ranks at position 2947 in the cryptocurrency market with a circulating supply of 3.25 billion tokens (65% of maximum supply) and 129,741 token holders. The relatively low 24-hour trading volume of approximately $12,123 indicates limited liquidity and market activity compared to established cryptocurrencies.

Q3: What are the key technological advantages of the EARNM ecosystem?

EARNM's technological infrastructure consists of three core components: the Fractal Box Protocol, which converts user attention and data into sustainable on-chain revenue; the EARN'M SmartWallet, which facilitates rewards distribution and management; and EarnOS, the operating system powering the ecosystem's functionality. Built on Polygon, EARNM leverages scalability and lower transaction costs while maintaining compatibility with Ethereum-based applications. The project's ability to generate revenue while distributing rewards to 45 million users demonstrates operational proof-of-concept, though long-term sustainability depends on continued user engagement, platform development, and the broader adoption of DePIN infrastructure within the cryptocurrency ecosystem.

Q4: What is the investment outlook for EARNM through 2031?

Based on available data and market conditions, EARNM price forecasts vary by timeframe: For 2026, conservative estimates range from $0.000115 to $0.000235, with neutral scenarios around $0.000171 to $0.000200. Mid-term forecasts (2027-2029) project potential growth of 17% to 61% from 2026 levels, assuming continued platform development and user adoption. Long-term projections through 2031 suggest a base scenario range of $0.000212 to $0.000336, with optimistic scenarios reaching $0.000383 to $0.000487. However, these predictions remain highly speculative given the token's limited trading history, substantial historical volatility, and dependence on factors including DePIN sector adoption, platform execution, and overall cryptocurrency market conditions.

Q5: What are the primary risks associated with investing in EARNM?

EARNM investment carries several significant risk categories: Market risk includes extreme price volatility (97.43% decline from peak), low liquidity with approximately $12,123 in 24-hour trading volume, and limited exchange availability (currently listed on Gate.com). Regulatory risk involves potential changes in cryptocurrency regulations, data privacy laws, and DePIN-specific policies that could impact operations. Technical risk encompasses potential vulnerabilities in the Fractal Box Protocol, EARN'M SmartWallet, and EarnOS systems, as well as smart contract security concerns. Additionally, the project faces business execution risks related to sustaining user engagement across 45 million users, competing in the emerging DePIN sector, and converting its large user base into active on-chain participants.

Q6: What investment strategies are appropriate for different types of EARNM investors?

Investment approaches vary by experience level and risk tolerance: Beginners should consider dollar-cost averaging strategies to mitigate timing risk, starting with modest allocations (1-3% of crypto portfolio) and prioritizing secure storage solutions such as hardware wallets. Experienced investors may employ active trading strategies based on technical analysis, taking advantage of price volatility while maintaining diversification across the DePIN sector and broader cryptocurrency categories. Institutional investors should conduct comprehensive due diligence on the project's technical infrastructure, team credentials, and business model sustainability before considering strategic allocation (potentially 5-10% for aggressive profiles). All investors should implement risk management through position sizing, stop-loss orders, and portfolio diversification across multiple asset classes.

Q7: How does EARNM's token supply mechanism affect its investment potential?

EARNM has a maximum supply of 5 billion tokens, with 3.25 billion currently in circulation (65% circulation rate), creating a fixed scarcity mechanism that could support long-term value retention. The remaining 35% of tokens yet to enter circulation presents both opportunities and risks: gradual token releases could create selling pressure and dilution effects, while the controlled supply mechanism establishes fundamental scarcity. With 129,741 token holders and a contract address on Polygon (0xaeb3dd897ade187b9f9e4c491bc7a81f69f7093e), the distribution shows reasonable decentralization for a recently launched project. However, investors should monitor token unlock schedules and distribution patterns, as significant supply increases could impact price dynamics and investment returns over time.

Q8: What factors could catalyze EARNM price appreciation in the coming years?

Several potential catalysts could influence EARNM's price trajectory: Platform adoption metrics, including growth in active users beyond the current 45 million user base and increased on-chain transaction activity. Technical developments such as enhancements to the Fractal Box Protocol, expansion of EARN'M SmartWallet features, and EarnOS functionality improvements. Market factors including broader adoption of DePIN and MobileFi concepts, increased exchange listings beyond Gate.com, and favorable cryptocurrency market conditions. Business milestones such as strategic partnerships, institutional adoption, and sustainable revenue growth beyond the current $70 million generated. However, realization of these catalysts remains speculative, and investors should maintain realistic expectations given the project's early stage, limited market presence, and competitive landscape in the emerging DePIN sector.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

Cryptocurrency Tax – How to File PIT-38 for Cryptocurrencies

Layer-1 vs Layer-2: What Sets Them Apart?

Smart Contracts: Definition and How They Work

What is EARNM: A Comprehensive Guide to Earnings Management and Financial Reporting

What is GARI: A Comprehensive Guide to Understanding the AI-Powered Social Platform and Its Revolutionary Features