Is Lamina1 (L1) a good investment?: A Comprehensive Analysis of Its Technology, Market Position, and Investment Potential in 2024

Introduction: Lamina1 (L1) Investment Position and Market Outlook

L1 is an emerging digital asset in the cryptocurrency sector, launched in November 2024 as a creator-owned platform designed for intellectual property incubation, distribution, and monetization. As of February 2026, L1 has a market capitalization of approximately 560,180 USD, with a circulating supply of around 235.77 million tokens, and a current price maintaining near 0.002376 USD. With its positioning as a platform dedicated to the future of IP economics, L1 has gradually become a focal point when investors discuss "Is Lamina1 (L1) a good investment?" This article will comprehensively analyze L1's investment value, historical trends, future price predictions, and investment risks to provide reference for investors.

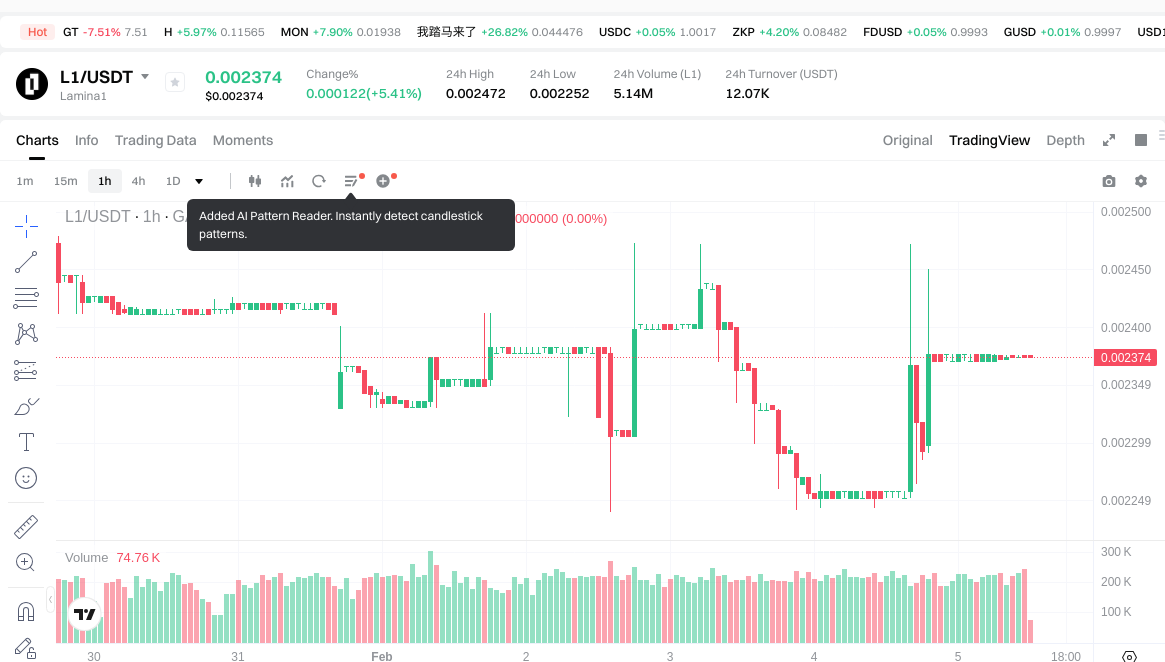

Since its listing at 0.3 USD in November 2024, L1 has experienced notable price volatility, with recent 24-hour data showing a 5.41% increase, though the token has declined 15.2% over the past 30 days and 97.03% over the past year. With a total supply of 1.5 billion tokens and a circulating ratio of approximately 15.72%, L1 currently ranks 2952 in the global cryptocurrency market with a market dominance of 0.00014%. The platform's focus on creator economy and IP monetization represents a niche sector within the blockchain ecosystem, attracting attention from investors interested in content creation and digital rights management solutions.

I. Lamina1 (L1) Price History Review and Investment Value Status

Lamina1 (L1) Investment Performance

- 2024: Token launch at $0.3 in November → Price reached $0.9 shortly after listing before experiencing significant volatility

- 2024-2026: Market correction phase → Price declined from early highs to current levels around $0.002376

- Current period (February 2026): Trading near recent lows → 24-hour price movement shows +5.41% recovery from $0.002252 to $0.002472 range

Current L1 Investment Market Status (February 2026)

- L1 current price: $0.002376

- 24-hour trading volume: $12,038.07

- Circulating supply: 235,766,048 L1 (15.72% of total supply)

- Market capitalization: $560,180.13

Click to view real-time L1 market price

II. Core Factors Influencing Whether L1 Is a Good Investment

Supply Mechanism and Scarcity (L1 Investment Scarcity)

- Total Supply: 1,500,000,000 L1 tokens with a circulating supply of 235,766,048 tokens, representing approximately 15.72% of the maximum supply

- Circulating supply represents a relatively low proportion of total supply, potentially creating scarcity dynamics as more tokens enter circulation

- Investment Significance: The controlled release of tokens and limited circulation ratio may support long-term value proposition

Institutional Investment and Mainstream Adoption (Institutional Investment in L1)

- L1 is currently listed on 1 exchange, indicating early-stage market presence

- The project focuses on creator-owned platform economics for IP incubation, distribution, and monetization, targeting a specific use case in the content creation sector

- Limited exchange availability may affect liquidity and institutional accessibility at present

Macroeconomic Environment Impact on L1 Investment

- Cryptocurrency markets remain sensitive to broader monetary policy shifts and interest rate changes, which influence risk appetite for digital assets

- Economic uncertainty and inflationary pressures may drive interest toward alternative digital assets, though L1's performance depends on project-specific adoption

- Market conditions as of February 2026 show L1 experiencing significant price fluctuations, with 1-year performance showing substantial decline

Technology and Ecosystem Development (Technology & Ecosystem for L1 Investment)

- L1 operates on a Mainnet infrastructure, providing an independent blockchain environment

- The platform is designed specifically for IP-related applications, creating a focused ecosystem around content creation and monetization

- Project documentation available through whitepaper outlines technical architecture and use cases for the creator economy

- The specialized focus on IP incubation and creator-owned platforms represents a targeted approach to blockchain application development

III. L1 Future Investment Forecast and Price Outlook (Is Lamina1(L1) worth investing in 2026-2031)

Short-term Investment Forecast (2026, short-term L1 investment outlook)

- Conservative Forecast: $0.00164 - $0.00237

- Neutral Forecast: $0.00237 - $0.00274

- Optimistic Forecast: $0.00274 - $0.00309

Mid-term Investment Outlook (2027-2028, mid-term Lamina1(L1) investment forecast)

-

Market Stage Expectation: The token may experience moderate growth as the platform develops its creator-focused IP infrastructure. Price movements could range from gradual accumulation phases to periods of heightened interest depending on ecosystem adoption and broader market conditions.

-

Investment Return Forecast:

- 2027: $0.00161 - $0.00390

- 2028: $0.00289 - $0.00415

-

Key Catalysts: Platform adoption by content creators, expansion of IP incubation services, strategic partnerships in the digital content space, and overall cryptocurrency market sentiment.

Long-term Investment Outlook (Is L1 a good long-term investment?)

- Base Scenario: $0.00282 - $0.00537 (assuming steady platform development and moderate ecosystem growth)

- Optimistic Scenario: $0.00455 - $0.00715 (assuming accelerated adoption, successful IP monetization features, and favorable market conditions)

- Risk Scenario: Below $0.00282 (in cases of development delays, limited creator adoption, or prolonged bear market conditions)

For more on L1 long-term investment and price forecasts, visit: Price Prediction

2026-2031 Long-term Outlook

- Base Scenario: $0.00164 - $0.00537 USD (corresponding to steady progress and gradual mainstream application growth)

- Optimistic Scenario: $0.00455 - $0.00715 USD (corresponding to large-scale adoption and favorable market environment)

- Transformative Scenario: Above $0.00715 USD (in cases of breakthrough ecosystem developments and mainstream adoption)

- December 31, 2031 Projected High: $0.00715 USD (based on optimistic development assumptions)

Disclaimer: These projections are based on historical data patterns and current market information. Cryptocurrency investments carry substantial risk, and actual results may differ significantly from these forecasts. This analysis does not constitute investment advice, and investors should conduct their own research before making any financial decisions.

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.0030862 | 0.002374 | 0.00163806 | 0 |

| 2027 | 0.003904043 | 0.0027301 | 0.001610759 | 14 |

| 2028 | 0.004146339375 | 0.0033170715 | 0.002885852205 | 39 |

| 2029 | 0.00537365583 | 0.0037317054375 | 0.0028360961325 | 57 |

| 2030 | 0.005372163147825 | 0.00455268063375 | 0.002822661992925 | 91 |

| 2031 | 0.007145887522734 | 0.004962421890787 | 0.004515803920616 | 108 |

IV. Lamina1 Investment Strategy and Risk Management (How to invest in Lamina1)

Investment Methodology (Lamina1 investment strategy)

Long-term Holding (HODL Lamina1): This approach suits conservative investors who believe in the long-term vision of creator-owned platforms and the evolution of IP monetization infrastructure. Given Lamina1's focus on intellectual property incubation and distribution, investors with a multi-year horizon may consider accumulating positions during market corrections.

Active Trading: Traders can leverage technical analysis and price action strategies to capitalize on L1's price movements. With a 24-hour trading volume of approximately $12,038 and recent volatility showing a 5.41% increase in 24 hours alongside a -7.66% decline over 7 days, swing trading opportunities may emerge. However, the relatively limited exchange availability (currently listed on 1 exchange) may affect liquidity and execution quality.

Risk Management (Risk management for Lamina1 investment)

Asset Allocation Ratios:

- Conservative investors: Consider allocating no more than 1-3% of crypto portfolio to L1 due to its early-stage nature and significant price volatility

- Aggressive investors: May allocate 5-10% with clear stop-loss parameters, acknowledging the project's developmental phase

- Professional investors: Could incorporate L1 as part of a diversified metaverse and creator economy thesis with appropriate hedging strategies

Risk Hedging Solutions: Implement a multi-asset portfolio approach by balancing L1 exposure with established cryptocurrencies and stablecoins. Consider using position sizing techniques and establishing predetermined exit points to manage downside exposure.

Secure Storage: For long-term holdings, utilize hardware wallets that support Avalanche subnet tokens. For active trading positions, employ reputable exchanges with robust security measures and two-factor authentication. Consider splitting holdings between hot wallets (for trading) and cold storage solutions (for long-term positions).

V. Lamina1 Investment Risks and Challenges (Risks of investing in Lamina1)

Market Risks: L1 exhibits substantial price volatility, with a 97.03% decline over one year from its historical high of $0.9 (reached on November 14, 2024) to current levels around $0.002376. The 24-hour price range demonstrates continued volatility between $0.002252 and $0.002472. The relatively small market capitalization of approximately $560,180 and limited circulating supply (235.77 million tokens, representing 15.72% of total supply) may contribute to price sensitivity and potential manipulation risks.

Regulatory Risks: As a platform focused on intellectual property rights and creator economies, Lamina1 operates in a regulatory landscape that varies significantly across jurisdictions. Changes in securities laws, digital asset regulations, or IP rights frameworks in different countries could impact the platform's operational model and token utility. Investors should monitor regulatory developments in their respective jurisdictions.

Technical Risks: Built on the Avalanche network infrastructure, L1 faces inherent blockchain technology risks including potential smart contract vulnerabilities, network congestion, or consensus mechanism challenges. The project's success depends on continued technical development and the ability to attract creators and users to its platform. Limited exchange availability (currently 1 exchange) may present liquidity challenges during market stress periods.

VI. Conclusion: Is Lamina1 a Good Investment?

Investment Value Summary: Lamina1 presents an innovative approach to creator-owned platforms and IP monetization infrastructure. The project addresses emerging needs in the digital content economy, with potential long-term value accrual tied to platform adoption and creator ecosystem growth. However, the token has experienced significant price volatility, with substantial drawdowns from its historical peak, reflecting both broader market conditions and project-specific challenges.

Investor Recommendations:

✅ Beginners: Consider dollar-cost averaging with small, regular investments if interested in the creator economy thesis. Prioritize secure storage solutions using hardware wallets compatible with Avalanche subnet tokens. Limit exposure to risk capital you can afford to lose entirely.

✅ Experienced Investors: May explore swing trading opportunities given the token's volatility patterns, while maintaining strict risk management protocols. Consider L1 as part of a diversified portfolio approach to the metaverse and creator economy sectors.

✅ Institutional Investors: Could evaluate strategic positioning based on comprehensive due diligence of the platform's roadmap, partnership developments, and creator adoption metrics. Any allocation should align with broader Web3 and digital content infrastructure investment theses.

⚠️ Disclaimer: Cryptocurrency investments carry substantial risk, including the potential loss of principal. This content is provided for informational purposes only and does not constitute investment advice. Conduct thorough independent research and consider consulting with qualified financial advisors before making investment decisions.

VII. FAQ

Q1: What is Lamina1 (L1) and what makes it unique in the cryptocurrency market?

Lamina1 (L1) is a creator-owned blockchain platform launched in November 2024, specifically designed for intellectual property incubation, distribution, and monetization. The platform distinguishes itself by focusing exclusively on the creator economy, providing infrastructure for content creators to manage digital rights and monetize their IP assets. Built on Avalanche network infrastructure, L1 operates with a total supply of 1.5 billion tokens, of which approximately 15.72% (235.77 million tokens) is currently in circulation. As of February 2026, the token trades at around $0.002376 with a market capitalization of approximately $560,180, making it a niche player in the blockchain ecosystem that targets a specific use case rather than competing as a general-purpose cryptocurrency.

Q2: How has L1 performed since its launch and what is its current market position?

Since launching at $0.3 in November 2024, L1 has experienced significant volatility, initially surging to $0.9 shortly after listing before undergoing substantial correction. As of February 2026, the token has declined approximately 97.03% from its all-time high, currently trading near $0.002376. Recent short-term performance shows a 5.41% increase over 24 hours but a 7.66% decline over 7 days and a 15.2% decrease over 30 days. The token currently ranks 2952 globally with a market dominance of 0.00014% and maintains a 24-hour trading volume of approximately $12,038. The limited exchange availability (currently listed on 1 exchange) and relatively low circulating supply ratio suggest L1 remains in an early development phase with significant growth potential but also considerable risk exposure.

Q3: What are the projected price ranges for L1 over the next five years?

Price projections for L1 vary significantly based on adoption scenarios and market conditions. For 2026, conservative forecasts range from $0.00164 to $0.00237, neutral estimates suggest $0.00237 to $0.00274, and optimistic scenarios project $0.00274 to $0.00309. Looking toward 2027-2028, mid-term forecasts anticipate ranges of $0.00161 to $0.00390 for 2027 and $0.00289 to $0.00415 for 2028, assuming steady platform development and creator ecosystem growth. By 2031, base scenarios project $0.00282 to $0.00537, optimistic scenarios suggest $0.00455 to $0.00715, with a projected high of $0.00715 on December 31, 2031. These projections assume various degrees of platform adoption, successful implementation of IP monetization features, and favorable market conditions, though actual results may differ substantially due to market volatility and project-specific developments.

Q4: What investment strategies are most appropriate for L1 investors?

Investment strategies for L1 should align with individual risk tolerance and investment objectives. Long-term holding (HODL) suits conservative investors who believe in the creator economy thesis and are willing to weather short-term volatility, with recommended allocations of 1-3% of crypto portfolios. Active traders may capitalize on price movements using technical analysis, though limited exchange availability and relatively low liquidity require careful position sizing and execution strategies. Conservative investors should limit exposure to 1-3% of their crypto portfolio, while aggressive investors might allocate 5-10% with strict stop-loss parameters. Risk management should include diversification across multiple assets, predetermined exit points, and secure storage solutions such as hardware wallets compatible with Avalanche subnet tokens for long-term holdings and reputable exchanges with robust security measures for active trading positions.

Q5: What are the primary risks associated with investing in L1?

L1 investment carries multiple risk categories that investors must carefully consider. Market risks include extreme price volatility, with the token experiencing a 97.03% decline from its $0.9 peak to current levels around $0.002376, and a small market capitalization of approximately $560,180 that may increase susceptibility to price manipulation. Regulatory risks stem from the platform's focus on IP rights and creator economies, which operate in a complex and evolving regulatory landscape across different jurisdictions that could impact the platform's operational model and token utility. Technical risks include potential smart contract vulnerabilities inherent to blockchain infrastructure, dependency on Avalanche network stability, and challenges related to attracting and retaining creators and users on the platform. Additionally, limited exchange availability (currently 1 exchange) presents liquidity constraints during market stress periods, potentially affecting investors' ability to enter or exit positions efficiently.

Q6: Is L1 suitable for different types of investors?

L1's suitability varies significantly across investor profiles and experience levels. For beginners, the token presents considerable challenges due to extreme volatility and early-stage development, though those interested in the creator economy thesis might consider dollar-cost averaging with small amounts of risk capital they can afford to lose entirely, prioritizing secure storage using hardware wallets. Experienced investors may find opportunities in swing trading given volatility patterns, but should maintain strict risk management protocols and position L1 as part of a diversified portfolio approach to metaverse and creator economy sectors. Institutional investors could evaluate strategic positioning based on comprehensive due diligence of the platform's roadmap, partnership developments, and creator adoption metrics, aligning any allocation with broader Web3 and digital content infrastructure investment theses. Regardless of experience level, all investors should recognize that L1 remains a highly speculative investment requiring thorough independent research and consideration of professional financial advice.

Q7: What key catalysts could drive L1's future price performance?

Several potential catalysts could influence L1's future price trajectory and overall market performance. Platform adoption by content creators represents a primary growth driver, as increased user engagement and active creator participation would validate the platform's value proposition and potentially drive token demand. Expansion of IP incubation services and successful implementation of monetization features could demonstrate the platform's utility and attract broader ecosystem participation. Strategic partnerships in the digital content space, collaborations with established content platforms, or integration with major creator economy platforms could significantly enhance visibility and adoption. Additionally, broader cryptocurrency market sentiment and conditions play crucial roles, as favorable market environments typically benefit smaller-cap tokens through increased risk appetite and capital inflows. Technical developments including mainnet upgrades, enhanced security features, and improved user experience could also serve as positive catalysts, while increased exchange listings would improve liquidity and accessibility for both retail and institutional investors.

Q8: How does L1's tokenomics structure affect its investment potential?

L1's tokenomics structure presents both opportunities and considerations for investors evaluating long-term potential. With a total supply capped at 1.5 billion tokens and a current circulating supply of approximately 235.77 million tokens (15.72% of maximum supply), the token maintains a controlled release schedule that could create scarcity dynamics as more tokens gradually enter circulation. This relatively low circulation ratio suggests significant token unlocks may occur over time, potentially creating selling pressure depending on release schedules and vesting terms. The limited circulating supply could support price appreciation if demand increases, though it also means future dilution as additional tokens are released. The platform's focus on creator-owned economics and IP monetization creates utility demand tied to platform adoption and transaction activity, meaning token value appreciation depends substantially on successful ecosystem development and creator engagement rather than speculative trading alone.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

Cryptocurrency Tax – How to File PIT-38 for Cryptocurrencies

Layer-1 vs Layer-2: What Sets Them Apart?

Smart Contracts: Definition and How They Work

What is EARNM: A Comprehensive Guide to Earnings Management and Financial Reporting

What is GARI: A Comprehensive Guide to Understanding the AI-Powered Social Platform and Its Revolutionary Features