Is oooo (OOOO) a good investment?: A Comprehensive Analysis of Market Potential, Risk Factors, and Long-term Growth Prospects

Introduction: AI Omninet (OOOO)'s Investment Position and Market Prospects

OOOO is a digital asset in the cryptocurrency field. As of February 2026, OOOO has a market capitalization of approximately $173,984.2, with a circulating supply of around 158,600,000 tokens, and the current price maintains at approximately $0.001097. With its positioning as "AI-driven full-spectrum collaboration that breaks down the barriers between multi-chain, multi-protocol, and multi-application environments," OOOO has gradually become a focal point for investors discussing "Is OOOO a good investment?" This article will comprehensively analyze OOOO's investment value, historical trends, future price predictions, and investment risks, providing reference for investors.

I. Coin (OOOO) Price History Review and Current Investment Value Status

OOOO Historical Price Trends and Investment Performance (oooo(OOOO) investment performance)

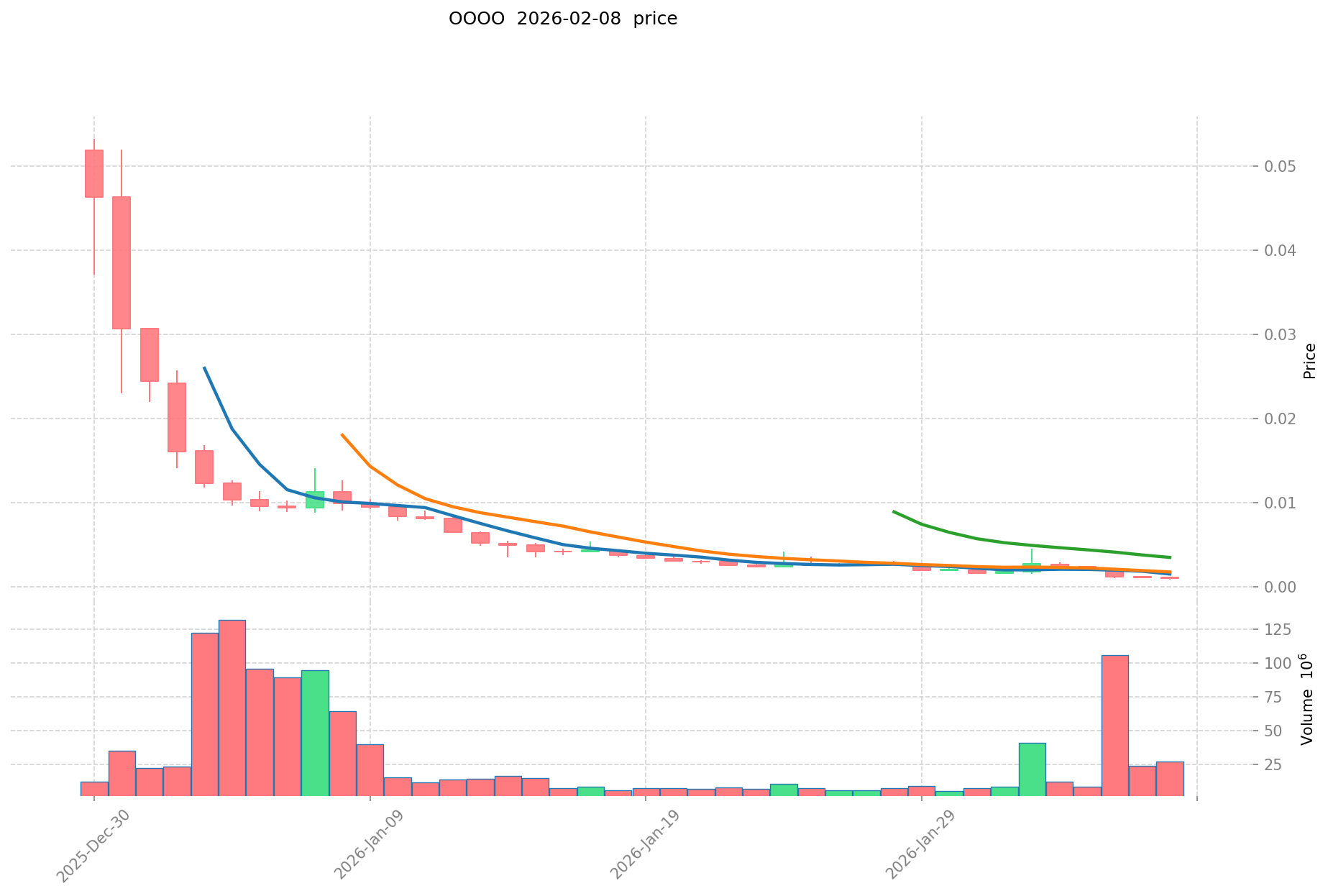

- December 2025: The token reached a price level near 0.05331 USD during a period of market activity, reflecting heightened trading interest and speculative momentum.

- February 2026: Market conditions shifted, with the price adjusting to approximately 0.00084 USD, illustrating the volatility characteristic of emerging digital assets.

- Recent Period: Trading activity has shown fluctuations, with the price moving between lower ranges and modest recovery phases, influenced by broader market dynamics and on-chain developments.

Current OOOO Investment Market Status (February 2026)

- OOOO current price: 0.001097 USD

- Market sentiment indicators suggest ongoing consolidation and cautious optimism among participants.

- 24-hour trading volume: 10,062.144274 USD

- The token circulates on BSC, with a total supply of 1,000,000,000 tokens, of which approximately 158,600,000 are currently in circulation.

Click to view real-time OOOO market price

II. Core Factors Influencing Whether OOOO is a Good Investment

Supply Mechanism and Scarcity (OOOO Investment Scarcity)

- Fixed Maximum Supply → OOOO has a maximum supply of 1,000,000,000 tokens, with 158,600,000 currently in circulation (15.86% circulating ratio), creating potential scarcity dynamics that may influence long-term valuation.

- Historical Price Movement → The token experienced notable price fluctuations, with documented price levels of $0.05331 on December 30, 2025, and $0.00084 on February 7, 2026, demonstrating significant volatility patterns.

- Investment Consideration → The limited maximum supply combined with the current low circulation ratio presents a scarcity framework that may factor into long-term investment analysis, though market dynamics remain subject to multiple variables.

Institutional Investment and Mainstream Adoption (Institutional Investment in OOOO)

- Holder Base → OOOO currently has 59,432 token holders, representing the current level of user adoption and distribution across the network.

- Exchange Presence → The token is listed on 6 exchanges, including Gate.com, providing various trading venues and liquidity access points for market participants.

- Adoption Indicators → Available data shows limited information regarding institutional investment patterns or major enterprise adoption at this stage of the project's development.

Macroeconomic Environment Impact on OOOO Investment

- Market Volatility Context → OOOO has demonstrated substantial price movements, with a 24-hour change of 1.76%, a 7-day decline of 40.62%, a 30-day decrease of 88.26%, and a 1-year drop of 98.62%, reflecting sensitivity to broader market conditions.

- Market Position → With a market dominance of 0.000043% and a fully diluted valuation of $1,097,000, OOOO represents a smaller market cap position within the cryptocurrency sector, which may correlate with different risk-return characteristics compared to larger assets.

- Liquidity Metrics → The 24-hour trading volume of $10,062.14 and a market cap to fully diluted valuation ratio of 15.86% provide context for current market activity levels.

Technology and Ecosystem Development (Technology & Ecosystem for OOOO Investment)

- Core Technology Framework → AI Omninet is described as AI-driven full-spectrum collaboration designed to facilitate interoperability across multi-chain, multi-protocol, and multi-application environments.

- Technical Implementation → The token operates using the BEP-20 standard, with the contract address 0xf0a28bddac9d3045c95bf57df033e80685d881c0 deployed on the BSC (Binance Smart Chain) network.

- Development Resources → Documentation is available at docs.oooo.money, with an official website at oooo.money and social media presence on X (formerly Twitter) at @oooo_money, providing channels for project updates and community engagement.

III. OOOO Future Investment Forecast and Price Outlook (Is oooo(OOOO) worth investing in 2026-2031)

Short-term Investment Forecast (2026, short-term OOOO investment outlook)

- Conservative scenario: $0.00080 - $0.00095

- Neutral scenario: $0.00095 - $0.0011

- Optimistic scenario: $0.0011 - $0.00114

Mid-term Investment Outlook (2027-2029, mid-term oooo(OOOO) investment forecast)

- Market stage expectation: The project may enter a phase of gradual ecosystem development, with potential fluctuations tied to broader market sentiment and adoption progress

- Investment return forecast:

- 2027: $0.00059 - $0.0016

- 2028: $0.0011 - $0.0019

- 2029: $0.0011 - $0.0023

- Key catalysts: Multi-chain collaboration expansion, AI-driven protocol enhancements, and community engagement initiatives

Long-term Investment Outlook (Is OOOO a good long-term investment?)

- Base scenario: $0.0013 - $0.0022 (assuming steady ecosystem growth and moderate market conditions)

- Optimistic scenario: $0.0022 - $0.0030 (assuming accelerated adoption and favorable market environment)

- Risk scenario: Below $0.0010 (under adverse market conditions or slower-than-expected development)

View OOOO long-term investment and price forecast: Price Prediction

2026-2031 Long-term Outlook

- Base scenario: $0.0013 - $0.0022 (corresponding to steady progress and gradual mainstream application growth)

- Optimistic scenario: $0.0022 - $0.0030 (corresponding to large-scale adoption and supportive market environment)

- Transformative scenario: Above $0.0030 (in case of breakthrough ecosystem developments and mainstream integration)

- 2031-12-31 forecasted high: $0.0030 (based on optimistic development assumptions)

Disclaimer: Price forecasts are speculative and based on available data and market trends. Actual performance may vary significantly due to market volatility, regulatory changes, and unforeseen events. This analysis does not constitute investment advice.

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.0011388 | 0.001095 | 0.00079935 | 0 |

| 2027 | 0.001597167 | 0.0011169 | 0.000591957 | 1 |

| 2028 | 0.00187270623 | 0.0013570335 | 0.001099197135 | 23 |

| 2029 | 0.002260817811 | 0.001614869865 | 0.00111426020685 | 47 |

| 2030 | 0.00255795386616 | 0.001937843838 | 0.0017440594542 | 76 |

| 2031 | 0.003012184461787 | 0.00224789885208 | 0.001258823357164 | 104 |

IV. OOOO Investment Strategy and Risk Management (How to invest in OOOO)

Investment Strategy (OOOO investment strategy)

Long-term Holding (HODL OOOO): Suitable for conservative investors

For investors with a long-term perspective, holding OOOO may align with belief in the project's AI-driven multi-chain collaboration technology. This strategy typically involves:

- Accumulating tokens during market corrections

- Maintaining positions through price volatility

- Monitoring project development milestones and ecosystem expansion

Active Trading: Relies on technical analysis and swing trading

Active traders may capitalize on OOOO's price movements by:

- Utilizing technical indicators to identify entry and exit points

- Monitoring the 24-hour trading volume (approximately $10,062 as of February 9, 2026)

- Tracking price ranges (24H high: $0.001151, 24H low: $0.001046)

- Considering the token's high volatility, with 7-day changes showing significant fluctuations

Risk Management (Risk management for OOOO investment)

Asset Allocation Ratios: Conservative / Aggressive / Professional investors

- Conservative investors: Limit OOOO exposure to 1-3% of total crypto portfolio

- Aggressive investors: May allocate 5-10% depending on risk tolerance

- Professional investors: Consider strategic positions with comprehensive risk assessment

Risk Hedging Solutions: Multi-asset portfolio + hedging tools

- Diversification across different blockchain projects and traditional assets

- Consider stablecoin positions to manage volatility

- Use stop-loss orders to limit potential downside

- Monitor market dominance (currently 0.000043%) as a relative size indicator

Secure Storage: Hot/cold wallets + hardware wallet recommendations

- Cold storage (hardware wallets) for long-term holdings

- Hot wallets for active trading with minimal balances

- Verify contract address (BSC: 0xf0a28bddac9d3045c95bf57df033e80685d881c0) before transactions

- Enable multi-factor authentication on exchange accounts

V. OOOO Investment Risks and Challenges (Risks of investing in OOOO)

Market Risks: High volatility and potential price manipulation

- Significant price fluctuations observed across different timeframes (1H: +1.19%, 24H: +1.76%, 7D: -40.62%, 30D: -88.26%, 1Y: -98.62%)

- Relatively low market capitalization ($173,984 as of February 9, 2026) may contribute to higher volatility

- Limited exchange listings (6 exchanges) may affect liquidity

- Trading volume fluctuations could impact order execution

Regulatory Risks: Policy uncertainties across different jurisdictions

- Evolving regulatory frameworks for AI-driven crypto projects

- Compliance requirements may vary by region

- Potential impact of regulatory changes on token accessibility and utility

- Cross-border transaction considerations for multi-chain protocols

Technical Risks: Network security vulnerabilities and upgrade failures

- Smart contract risks associated with BEP-20 token standard

- Dependencies on BSC network performance and security

- Multi-chain integration complexity may introduce technical challenges

- Project development and maintenance sustainability concerns

Additional Considerations:

- Current circulating supply represents 15.86% of maximum supply (158,600,000 / 1,000,000,000)

- Holder distribution (59,432 holders) may affect price stability

- Limited historical track record since launch

VI. Conclusion: Is OOOO a Good Investment?

Investment Value Summary: OOOO presents an innovative approach to AI-driven multi-chain collaboration, though it carries substantial short-term price volatility.

Key observations:

- The token's recent price performance shows significant declines across multiple timeframes

- Market capitalization and trading volume indicate early-stage market presence

- The project's focus on breaking down barriers between multi-chain, multi-protocol, and multi-application environments represents a technical value proposition

- Circulating supply ratio (15.86%) suggests potential future token releases may impact price dynamics

Investor Recommendations:

✅ Beginners: Dollar-cost averaging + secure wallet storage

- Start with minimal allocations to understand market behavior

- Use reputable hardware wallets for storage

- Educate yourself on BEP-20 token management

- Avoid investing more than you can afford to lose

✅ Experienced Investors: Swing trading + portfolio diversification

- Apply technical analysis to identify potential trading opportunities

- Maintain diversified exposure across multiple assets

- Set clear risk parameters and stop-loss levels

- Monitor project developments and community updates

✅ Institutional Investors: Strategic long-term allocation considerations

- Conduct comprehensive due diligence on project fundamentals

- Assess alignment with multi-chain infrastructure investment themes

- Implement professional risk management frameworks

- Consider position sizing relative to overall portfolio strategy

⚠️ Disclaimer: Cryptocurrency investments carry high risks. This content is for informational purposes only and does not constitute investment advice. Investors should conduct independent research and consult with qualified financial advisors before making investment decisions. Past performance does not guarantee future results.

VII. FAQ

Q1: What is the current price and market capitalization of OOOO?

As of February 9, 2026, OOOO is priced at approximately $0.001097 with a market capitalization of around $173,984.2. The token has a circulating supply of 158,600,000 tokens out of a maximum supply of 1,000,000,000 tokens (15.86% circulation ratio). The 24-hour trading volume stands at $10,062.14, with the token trading on 6 exchanges including Gate.com. The token operates on the BSC (Binance Smart Chain) network using the BEP-20 standard.

Q2: What has been OOOO's historical price performance?

OOOO has experienced significant price volatility since its launch. The token reached approximately $0.05331 in December 2025 during a period of heightened market activity, but adjusted to around $0.00084 by February 7, 2026. Recent performance data shows: 1-hour change of +1.19%, 24-hour change of +1.76%, 7-day decline of -40.62%, 30-day decrease of -88.26%, and 1-year drop of -98.62%. This substantial volatility reflects the characteristics of emerging digital assets with smaller market capitalizations.

Q3: What is OOOO's core technology and value proposition?

OOOO positions itself as an AI-driven full-spectrum collaboration platform designed to break down barriers between multi-chain, multi-protocol, and multi-application environments. The project focuses on facilitating interoperability across different blockchain networks and protocols. The token is implemented using the BEP-20 standard on BSC, with the contract address 0xf0a28bddac9d3045c95bf57df033e80685d881c0. Project documentation is available at docs.oooo.money, with an official website at oooo.money and social media presence at @oooo_money on X (formerly Twitter).

Q4: What are the price predictions for OOOO from 2026 to 2031?

Short-term forecast for 2026 ranges from $0.00080 (conservative) to $0.00114 (optimistic). Mid-term projections show: 2027 ($0.00059-$0.0016), 2028 ($0.0011-$0.0019), and 2029 ($0.0011-$0.0023). Long-term outlook for 2030-2031 suggests a base scenario of $0.0013-$0.0022, an optimistic scenario of $0.0022-$0.0030, and a transformative scenario above $0.0030. The predicted high for December 31, 2031, is $0.0030. These forecasts are speculative and subject to significant market volatility, regulatory changes, and project development outcomes.

Q5: What are the main risks associated with investing in OOOO?

OOOO carries multiple risk categories: Market Risks include extreme volatility (evidenced by -98.62% one-year decline), low market capitalization ($173,984), and limited exchange listings (6 exchanges) affecting liquidity. Regulatory Risks involve evolving frameworks for AI-driven crypto projects and varying compliance requirements across jurisdictions. Technical Risks encompass smart contract vulnerabilities, BSC network dependencies, and multi-chain integration complexity. Additionally, the current 15.86% circulating supply ratio suggests potential future token releases may impact price dynamics, and the project has a relatively limited historical track record.

Q6: What investment strategies are recommended for different types of OOOO investors?

For Beginners: Implement dollar-cost averaging with minimal allocations (1-3% of crypto portfolio), use hardware wallets for secure storage, and avoid investing more than you can afford to lose. For Experienced Investors: Apply technical analysis for swing trading opportunities, maintain portfolio diversification, set clear stop-loss levels, and monitor the 24-hour trading range (recent high: $0.001151, low: $0.001046). For Institutional Investors: Conduct comprehensive due diligence, assess alignment with multi-chain infrastructure themes, implement professional risk management frameworks, and consider strategic long-term allocation (potentially 5-10% based on risk tolerance and investment objectives).

Q7: How does OOOO's tokenomics affect its investment potential?

OOOO has a fixed maximum supply of 1,000,000,000 tokens, creating a scarcity framework that may influence long-term valuation. Currently, only 158,600,000 tokens are in circulation (15.86% ratio), suggesting significant future supply could enter the market. The token has 59,432 holders, indicating early-stage adoption and distribution. The market dominance stands at 0.000043%, with a fully diluted valuation of $1,097,000 and a market cap to FDV ratio of 15.86%. This tokenomics structure presents both potential upside from scarcity and risks from future token releases impacting price stability.

Q8: Where can investors access reliable information and trade OOOO?

OOOO is available for trading on 6 exchanges, with Gate.com being a primary listing platform. Real-time market price data can be viewed at Gate.com's OOOO price page. For project information, investors can access documentation at docs.oooo.money and the official website at oooo.money. The project maintains social media presence at @oooo_money on X (formerly Twitter) for updates and community engagement. Always verify the official BSC contract address (0xf0a28bddac9d3045c95bf57df033e80685d881c0) before conducting transactions to avoid potential scams or phishing attempts.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

What is AIX9: A Comprehensive Guide to the Next Generation of Enterprise Computing Solutions

What is KLINK: A Comprehensive Guide to Understanding the Revolutionary Communication Platform

What is ART: A Comprehensive Guide to Understanding Assisted Reproductive Technology and Its Impact on Modern Fertility Treatment

What is KAR: A Comprehensive Guide to Knowledge and Reasoning Systems in Modern Technology

What is MART: A Comprehensive Guide to Multi-Agent Reinforcement Learning Through Time