NRN vs ETH: Which Blockchain Platform Offers Better Performance and Lower Costs for DeFi Users?

Introduction: Investment Comparison Between NRN and ETH

In the cryptocurrency market, the comparison between NRN vs ETH has consistently been a topic investors cannot avoid. The two differ significantly in market cap ranking, application scenarios, and price performance, representing distinct positioning within crypto assets. NRN (Neuron): Launched in 2024, it has gained market recognition through its positioning in AI-powered competitive gaming and PvP arena experiences. ETH (Ethereum): Since its inception in 2015, it has been regarded as a foundational smart contract platform and is among the cryptocurrencies with the highest global trading volume and market capitalization. This article will comprehensively analyze the investment value comparison between NRN vs ETH, focusing on historical price trends, supply mechanisms, institutional adoption, technological ecosystems, and future predictions, attempting to answer the question investors care about most:

"Which is the better buy right now?"

I. Historical Price Comparison and Current Market Status

Price Trends of NRN (Coin A) and ETH (Coin B)

- 2025: NRN experienced notable volatility following its listing on Gate.com in June 2024 at a launch price of $0.2. The token reached its historical high of $0.29916 in January 2025, driven by initial market interest in AI Arena's competitive gaming platform.

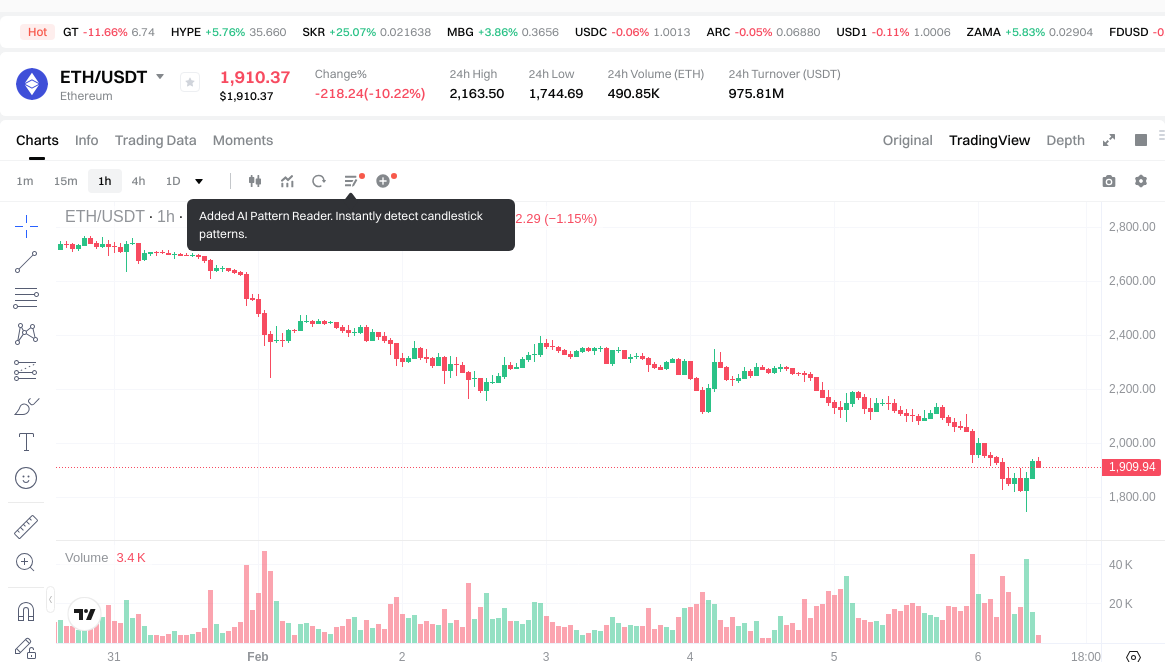

- 2025-2026: ETH showed significant price movements, reaching a historical peak of $4946.05 in August 2025. However, by early 2026, the token faced downward pressure alongside broader cryptocurrency market corrections.

- Comparative Analysis: During the recent market cycle, NRN declined from its peak of $0.29916 to a historical low of $0.003632 on February 6, 2026, representing substantial downward movement. In comparison, ETH experienced a considerable decline from its 2025 high of $4946.05 to approximately $1936.6 by February 2026.

Current Market Conditions (2026-02-06)

- NRN Current Price: $0.004014

- ETH Current Price: $1936.6

- 24-Hour Trading Volume: NRN recorded $20,563.52 versus ETH's $977,566,770.87, highlighting substantial differences in market liquidity and trading activity.

- Market Sentiment Index (Fear & Greed Index): 9 (Extreme Fear)

View real-time prices:

- Check NRN current price Market Price

- Check ETH current price Market Price

II. Core Factors Influencing NRN vs ETH Investment Value

Supply Mechanism Comparison (Tokenomics)

-

NRN: The native token of AI Arena (ARC) has transitioned from a single-game economy to a platform economy model. NRN supply dynamics are influenced by its utility within the AI Arena ecosystem, including staking mechanisms, marketplace fees, and participation in ARC RL activities. Players can stake NRN in ranking matches, purchase batteries for NFT charging, and stake NRN in fusion pools to increase NFT acquisition probability. Researchers also need to stake NRN to participate in research competitions involving AI algorithm models.

-

ETH: Ethereum's supply mechanism has evolved significantly, particularly following network upgrades. The protocol discussions in early 2025 have focused on maintaining ETH's monetary dominance and ensuring Ethereum L1's economic value. ETH's tokenomics are influenced by its deflationary mechanisms, staking requirements for network security, and burn mechanisms that reduce circulating supply during network activity.

-

📌 Historical Pattern: Supply mechanisms play a role in driving price cycle variations. NRN's value is tied to its consumption scenarios and staking requirements within the gaming ecosystem, while ETH's value is influenced by its broader network utility and deflationary dynamics.

Institutional Adoption and Market Application

-

Institutional Holdings: ETH tends to receive more attention from institutional investors due to its established position in decentralized finance and smart contract infrastructure. Historical data suggests that ETH accumulation by certain entities has shown correlation with subsequent price movements, with an approximate success rate of 75% across multiple accumulation periods, including instances in late 2023 and February 2024 where average gains reached approximately 15%.

-

Enterprise Adoption: ETH has broader enterprise adoption in areas including decentralized finance, smart contracts, and blockchain infrastructure. NRN's application is more focused within the AI Arena gaming ecosystem and its expanding platform economy. ETH's role spans across various sectors including DeFi protocols, NFT marketplaces, and Layer 2 solutions.

-

National Policies: Regulatory attitudes toward these assets vary across jurisdictions, with ETH generally receiving more regulatory attention due to its larger market presence and broader application scope.

Technological Development and Ecosystem Building

-

NRN Technical Evolution: NRN has evolved from supporting a single gaming economy (AI Arena) to enabling a platform economy. New demand drivers include integrated revenue streams, Trainer Marketplace fees, and ARC RL participation staking mechanisms. The ecosystem centers on AI-driven gameplay, NFT economics, and players earning revenue through training AI fighters in competitive environments.

-

ETH Technical Development: Ethereum's strategic priorities in early 2025 have focused heavily on ensuring long-term economic value. Current protocol discussions have shifted toward maintaining ETH's monetary dominance and protecting Ethereum L1 as core infrastructure. Technological upgrades continue to shape the network's scalability and efficiency.

-

Ecosystem Comparison: ETH maintains a more extensive ecosystem across DeFi, NFT, payment systems, and smart contract implementations. NRN's ecosystem is more specialized, focusing on AI Arena gaming applications, AI technology advancement, and platform-specific utilities. ETH's broader ecosystem encompasses decentralized applications, financial protocols, and cross-chain interoperability solutions.

Macroeconomic Environment and Market Cycles

-

Performance in Inflationary Environments: The relationship between these assets and inflation protection varies based on their respective use cases and market positioning. ETH's broader adoption and larger market capitalization may provide different characteristics compared to NRN's more specialized gaming-focused utility.

-

Macroeconomic Monetary Policy: Interest rates, dollar index movements, and broader monetary policy decisions influence cryptocurrency markets. Both assets are subject to these macro factors, though their sensitivities may differ based on their respective market positions and adoption levels.

-

Geopolitical Factors: Cross-border transaction demand and international dynamics affect cryptocurrency adoption patterns. ETH's more established position in global financial infrastructure may result in different exposure to geopolitical developments compared to NRN's gaming-centric ecosystem. Market uncertainties remain due to geopolitical tensions, global demand fluctuations, and energy price volatility.

III. 2026-2031 Price Forecast: NRN vs ETH

Short-term Forecast (2026)

- NRN: Conservative $0.00264 - $0.004 | Optimistic $0.004 - $0.00596

- ETH: Conservative $1,062.64 - $1,932.07 | Optimistic $1,932.07 - $2,704.90

Mid-term Forecast (2028-2029)

- NRN may enter a consolidation phase, with projected price range of $0.00356 - $0.00652

- ETH may enter an expansion phase, with projected price range of $2,673.68 - $4,668.87

- Key drivers: institutional capital inflows, ETF adoption, ecosystem development

Long-term Forecast (2030-2031)

- NRN: Base scenario $0.00439 - $0.00627 | Optimistic scenario $0.00627 - $0.00746

- ETH: Base scenario $3,589.40 - $4,752.99 | Optimistic scenario $4,752.99 - $5,561.59

Disclaimer

NRN:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00596 | 0.004 | 0.00264 | 0 |

| 2027 | 0.0053286 | 0.00498 | 0.003735 | 24 |

| 2028 | 0.005360472 | 0.0051543 | 0.003556467 | 28 |

| 2029 | 0.00651915864 | 0.005257386 | 0.00299671002 | 30 |

| 2030 | 0.0066537477216 | 0.00588827232 | 0.0055349759808 | 46 |

| 2031 | 0.007462501924752 | 0.0062710100208 | 0.00438970701456 | 56 |

ETH:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 2704.898 | 1932.07 | 1062.6385 | 0 |

| 2027 | 3431.35632 | 2318.484 | 1924.34172 | 20 |

| 2028 | 3564.9009984 | 2874.92016 | 2673.6757488 | 48 |

| 2029 | 4668.87033984 | 3219.9105792 | 2382.733828608 | 66 |

| 2030 | 5561.5905479232 | 3944.39045952 | 3589.3953181632 | 104 |

| 2031 | 5180.759649056544 | 4752.9905037216 | 4562.870883572736 | 146 |

IV. Investment Strategy Comparison: NRN vs ETH

Long-term vs Short-term Investment Strategies

-

NRN: May be suitable for investors focused on emerging gaming ecosystems and AI-driven competitive platforms. The token's utility is closely tied to AI Arena's platform economy, including staking mechanisms, marketplace participation, and NFT integration. Given its specialized application scope and recent price volatility, NRN presents characteristics that differ from broader market assets.

-

ETH: May be suitable for investors seeking exposure to established smart contract infrastructure and decentralized finance ecosystems. ETH's broader adoption across DeFi protocols, NFT marketplaces, and Layer 2 solutions provides diversified utility beyond single-sector applications. The asset's role in blockchain infrastructure and its deflationary mechanisms following network upgrades represent distinct characteristics in the cryptocurrency landscape.

Risk Management and Asset Allocation

-

Conservative Investors: Portfolio construction approaches vary based on individual risk tolerance and investment objectives. Conservative strategies typically emphasize assets with established track records and broader market adoption. Considerations include liquidity profiles, historical volatility patterns, and ecosystem maturity levels.

-

Aggressive Investors: Risk-tolerant portfolios may incorporate exposure to emerging protocols alongside established assets. Allocation decisions should account for volatility characteristics, ecosystem development stages, and correlation patterns between different asset classes.

-

Hedging Tools: Risk management approaches may include stablecoin allocations for liquidity preservation, derivatives instruments for downside protection, and cross-asset portfolio construction to address correlation dynamics. Implementation depends on individual investment goals, market conditions, and available instruments across different platforms.

V. Potential Risk Comparison

Market Risks

-

NRN: The token has experienced substantial price movements, declining from its peak of $0.29916 in January 2025 to $0.003632 by February 2026. Trading volume of $20,563.52 reflects more limited market liquidity compared to larger-cap assets. Price dynamics are influenced by adoption patterns within the AI Arena gaming ecosystem and broader sentiment toward gaming-focused tokens. The current market sentiment index of 9 (Extreme Fear) reflects prevailing risk-off conditions across cryptocurrency markets.

-

ETH: The asset experienced a decline from its August 2025 peak of $4946.05 to approximately $1936.6 by February 2026. Despite this correction, ETH maintains substantially higher trading volume at $977,566,770.87, reflecting greater market liquidity. Price movements are influenced by broader cryptocurrency market cycles, DeFi adoption trends, regulatory developments, and macroeconomic conditions affecting risk assets.

Technical Risks

-

NRN: Technical considerations include the evolution from single-game to platform economy infrastructure, integration of new demand drivers such as Trainer Marketplace and ARC RL mechanisms, and the operational stability of AI-driven competitive gaming systems. The specialized nature of the ecosystem means technical developments are concentrated within gaming and AI-focused applications.

-

ETH: Technical considerations include network scalability developments, Layer 2 integration complexities, smart contract security across the ecosystem, and the ongoing evolution of Ethereum's infrastructure. Protocol discussions in early 2025 have centered on maintaining network economic value and monetary characteristics. The broader ecosystem scope means technical developments span multiple application areas and integration points.

Regulatory Risks

- Global regulatory approaches toward digital assets continue to evolve across different jurisdictions. ETH's broader adoption and larger market presence result in greater regulatory attention across multiple application areas including DeFi, securities considerations, and financial infrastructure classifications. NRN's more specialized gaming ecosystem may face different regulatory considerations related to gaming tokens, virtual asset classifications, and platform-specific regulations. Regulatory developments vary significantly by jurisdiction and continue to evolve, creating uncertainties for both assets with differing characteristics based on their respective market positions and use cases.

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary

-

NRN Characteristics: The token operates within a specialized AI-powered gaming ecosystem with evolving platform economics. Its utility is tied to AI Arena applications including staking mechanisms, NFT integration, and marketplace participation. Recent price movements have shown substantial volatility with limited trading volume compared to larger-cap assets. The ecosystem focuses on AI-driven competitive gaming and platform-specific revenue streams.

-

ETH Characteristics: The asset serves as foundational infrastructure for smart contracts and decentralized applications. It maintains broader adoption across DeFi, NFT marketplaces, and Layer 2 solutions. Trading volume and market liquidity are substantially higher. The protocol continues to evolve with focus on maintaining network economic value and monetary characteristics. The ecosystem encompasses diverse application areas beyond single-sector focus.

✅ Investment Considerations

-

Beginner Investors: Consider starting with assets that have established track records, broader market adoption, and higher liquidity profiles. Understanding fundamental differences in use cases, ecosystem maturity, and risk characteristics is important before allocation decisions. Education on tokenomics, technological developments, and market dynamics should precede investment activities.

-

Experienced Investors: Portfolio construction may incorporate both established infrastructure assets and emerging sector-specific tokens based on individual risk tolerance and investment theses. Consideration of correlation patterns, liquidity requirements, and ecosystem development stages can inform allocation strategies. Ongoing monitoring of technical developments, adoption metrics, and market conditions remains relevant.

-

Institutional Investors: Asset selection typically emphasizes factors including market depth, regulatory clarity, custody solutions, and risk management frameworks. Established assets with broader adoption and clearer regulatory positioning may align with institutional requirements. Emerging assets require evaluation of specialized risks, liquidity constraints, and alignment with investment mandates.

⚠️ Risk Disclosure: Cryptocurrency markets exhibit substantial volatility. This content does not constitute investment advice. Market conditions, regulatory environments, and technological developments are subject to change. Individual circumstances, risk tolerance, and investment objectives vary. Consultation with qualified financial advisors and independent research should precede any investment decisions.

VII. FAQ

Q1: What are the main differences between NRN and ETH in terms of use cases and applications?

NRN is a specialized gaming token focused on AI Arena's competitive gaming ecosystem, while ETH serves as foundational infrastructure for smart contracts and decentralized applications across multiple sectors. NRN's utility centers around AI-driven competitive gaming, including staking in ranking matches, NFT charging through battery purchases, and participation in fusion pools and research competitions. In contrast, ETH powers a broader ecosystem encompassing DeFi protocols, NFT marketplaces, Layer 2 solutions, and general-purpose smart contract execution, making it significantly more versatile in application scope beyond gaming-specific scenarios.

Q2: How do the liquidity profiles of NRN and ETH compare for investors?

ETH demonstrates substantially higher market liquidity with 24-hour trading volume of $977,566,770.87 compared to NRN's $20,563.52 as of February 6, 2026. This significant difference reflects ETH's established market presence and broader adoption, enabling easier entry and exit positions with minimal price impact. NRN's limited trading volume indicates lower liquidity, which may result in wider bid-ask spreads and greater difficulty executing larger transactions without affecting market prices. For investors requiring flexible position management or institutional-scale operations, ETH's liquidity profile presents distinct advantages over NRN's more specialized market depth.

Q3: What are the key risk factors specific to investing in NRN versus ETH?

NRN faces concentration risk tied to AI Arena's platform adoption and gaming sector sentiment, having declined from $0.29916 in January 2025 to $0.003632 by February 2026. Its specialized ecosystem means success depends heavily on gaming platform development and user engagement within a narrower application scope. ETH, while experiencing correction from $4946.05 to approximately $1936.6 in the same period, faces risks related to broader cryptocurrency market cycles, regulatory developments affecting DeFi and smart contract platforms, and network scalability challenges. Additionally, ETH receives greater regulatory scrutiny due to its larger market presence across multiple application areas, while NRN may face gaming-specific regulatory considerations and platform-dependent technical risks.

Q4: How do the tokenomics and supply mechanisms differ between NRN and ETH?

NRN's tokenomics revolve around consumption scenarios within the AI Arena ecosystem, including staking requirements for ranking matches, marketplace fee mechanisms, and NFT-related utilities such as battery purchases and fusion pool participation. The supply dynamics are directly influenced by platform activity and gaming engagement levels. ETH's tokenomics have evolved significantly following network upgrades, implementing deflationary mechanisms through burn protocols that reduce circulating supply during network activity, alongside staking requirements for network security. Protocol discussions in early 2025 have emphasized maintaining ETH's monetary dominance and long-term economic value, representing a broader monetary policy approach compared to NRN's gaming-focused utility model.

Q5: What factors should investors consider when choosing between NRN and ETH for portfolio allocation?

Investors should evaluate several critical factors including risk tolerance, investment timeline, and exposure objectives. NRN may suit those seeking specialized exposure to AI-powered gaming ecosystems with higher risk tolerance for volatility and limited liquidity, suitable for smaller allocation percentages within diversified portfolios. ETH may align with investors seeking established infrastructure exposure across DeFi, smart contracts, and broader blockchain applications, offering higher liquidity for position management and more diversified use case adoption. Additional considerations include correlation with existing portfolio holdings, regulatory positioning in relevant jurisdictions, technical development trajectories, and alignment with individual investment theses regarding gaming-specific tokens versus general-purpose blockchain infrastructure.

Q6: What are the projected price trajectories for NRN and ETH through 2031?

Short-term forecasts for 2026 project NRN in a conservative range of $0.00264 - $0.004 and optimistic range of $0.004 - $0.00596, while ETH shows conservative estimates of $1,062.64 - $1,932.07 and optimistic projections of $1,932.07 - $2,704.90. Mid-term projections for 2028-2029 suggest NRN consolidation around $0.00356 - $0.00652, whereas ETH may enter expansion phase with estimates of $2,673.68 - $4,668.87. Long-term forecasts for 2030-2031 indicate NRN base scenario of $0.00439 - $0.00627 and ETH base scenario of $3,589.40 - $4,752.99. These projections incorporate factors including institutional adoption, ecosystem development, and macroeconomic conditions, though actual outcomes depend on numerous variables including regulatory developments, technological advancements, and market sentiment shifts.

Q7: How does institutional adoption differ between NRN and ETH?

ETH receives substantially greater institutional attention due to its established position in decentralized finance and smart contract infrastructure, with historical accumulation patterns by certain entities showing correlation with subsequent price movements and approximate success rates of 75% across multiple periods. Enterprise adoption spans DeFi protocols, NFT marketplaces, Layer 2 solutions, and blockchain infrastructure implementations. NRN's institutional profile is more limited, with adoption focused within the AI Arena gaming ecosystem and platform-specific applications. The broader regulatory clarity, custody solution availability, and market depth associated with ETH align more closely with institutional investment requirements, while NRN represents a more specialized, emerging-sector exposure with corresponding differences in institutional accessibility and risk assessment frameworks.

Q8: What role do macroeconomic factors play in the performance of NRN versus ETH?

Both assets are influenced by macroeconomic conditions including monetary policy decisions, interest rate movements, dollar index fluctuations, and broader risk sentiment affecting cryptocurrency markets, as evidenced by the current Fear & Greed Index of 9 (Extreme Fear). However, their sensitivities differ based on market positioning and adoption characteristics. ETH's larger market capitalization and broader adoption across financial infrastructure may result in greater correlation with traditional risk assets and institutional capital flows responding to macroeconomic conditions. NRN's more specialized gaming focus means its performance may be influenced more heavily by sector-specific developments, platform adoption metrics, and gaming industry trends, though still subject to broader cryptocurrency market cycles driven by macroeconomic factors and geopolitical developments affecting digital asset sentiment.

How to Mine Ethereum in 2025: A Complete Guide for Beginners

Ethereum 2.0 in 2025: Staking, Scalability, and Environmental Impact

What is Ethereum: A 2025 Guide for Crypto Enthusiasts and Investors

How does Ethereum's blockchain technology work?

What are smart contracts and how do they work on Ethereum?

Ethereum Price Analysis: 2025 Market Trends and Web3 Impact

2026 CLEAR Price Prediction: Expert Analysis and Market Forecast for Cryptocurrency Trading Success

2026 USTC Price Prediction: Expert Analysis and Market Forecast for the Coming Year

2026 MDUS Price Prediction: Expert Analysis and Market Outlook for the Next Five Years

2026 TANSSI Price Prediction: Expert Analysis and Market Forecast for the Next Generation Blockchain Network

What is Compound? An Overview of Its Features and Key Considerations