Mechanisms and Economic Models of Prediction Markets: AMM, Order Books, and Game Theory Design

In this lesson, we'll dive deep into the core mechanisms behind prediction markets, including AMMs, order books, and game theory design. You'll learn how prices reflect probabilities, how markets provide liquidity, and master the foundational economic models that drive prediction markets to operate efficiently.

I. Price as Probability: The Foundation of Prediction Market Economic Models

The most important economic principle in prediction markets is that contract prices can be viewed as estimates of an event’s probability.

Example:

- If the Yes contract for an event is priced at 0.62, the market believes there’s roughly a 62% chance the event will occur.

This is a strong assumption, but it’s been proven highly effective across numerous historical events (elections, policies, sports, on-chain events, and more).

Why can price represent probability?

There are three key reasons:

Participants are incentivized by real stakes:

Prices in prediction markets aren’t “votes”—they’re actual financial bets.

- Misjudging probabilities leads directly to losses.

- Market mechanisms continually calibrate prices through trading: When prices deviate from “market consensus probability,” automatic arbitrage occurs—buying undervalued and selling overvalued contracts.

- Information aggregation: Different individuals hold different information or views. Prediction markets aggregate this dispersed information into a single price, forming a public probability.

The core of prediction market mechanism design is focused on enabling prices to become faster, more accurate, and harder to manipulate.

II. Order Book Model: The Prediction Market Version of Traditional Financial Structures

Order books closely resemble traditional exchange market structures, forming prices through order placement and matching.

In prediction markets, order book operations are similar to spot/options trading:

- Buyers place bids for Yes/No contracts.

- Sellers place asks to sell contracts.

- Orders are matched when bid and ask prices cross.

- The latest transaction sets the market price.

Advantages

- Accurate price discovery: Prices emerge from real competition between traders, reflecting true market supply and demand.

- Large trades can achieve better pricing: Orders can be split rather than consuming an entire AMM curve at once.

- Familiar structure for professional traders: Strategies like high-frequency trading, arbitrage, and risk hedging can be directly reused.

Disadvantages

- Requires many market makers to maintain depth: Low trading activity leads to sparse order books and large price swings.

- Early-stage prediction markets often lack liquidity: Resulting in phenomena like “order sweeping” and wide bid-ask spreads.

- Price updates are discontinuous and not smooth: Less friendly for applications needing real-time probabilities (such as on-chain queries).

Best Use Cases for Order Book Model

- Major events, long timeframes, stable capital participation

- Markets dominated by professional traders

- Institutions providing ongoing market making (e.g., Kalshi)

Order books are more like mechanisms for “institutional prediction markets” than pure Web3-native designs.

III. AMM Model: The Core Innovation of Web3 Prediction Markets

On-chain, order books can’t rely on high-frequency matching or deep liquidity, so AMM (Automated Market Maker) models have become mainstream in prediction markets. The most significant model is LMSR (Logarithmic Market Scoring Rule), proposed by Robin Hanson—the mathematical foundation for on-chain prediction market development.

LMSR Core Formula

LMSR uses a cost function to determine market prices:

C(q) = b · ln(e^(q₁/b) + e^(q₂/b))

Where:

- q₁, q₂ = quantities of Yes/No contracts

- b = liquidity parameter (affects price slippage)

Prices are determined by partial derivatives:

P(Yes) = e^(q₁/b) / (e^(q₁/b) + e^(q₂/b))

This creates a smooth, continuous market-making model that guarantees liquidity.

Advantages of AMM Model

- Liquidity is always available (no “can’t buy/can’t sell” situations)

- Prices are continuous and usable as real-time probabilities

- On-chain computation is straightforward

- Market stability can be tuned by adjusting b

Disadvantages of AMM

- Large trades cause severe price slippage

- Early large capital can manipulate prices (though at high cost)

- LPs must be incentivized to provide liquidity; otherwise, curve costs are insufficient

Importance of b Parameter

- Smaller b → market prices are highly sensitive; small trades can shift probabilities significantly

- Larger b → market prices are more stable; suitable for major events

This is why Web3 prediction markets often adjust curve parameters based on event type.

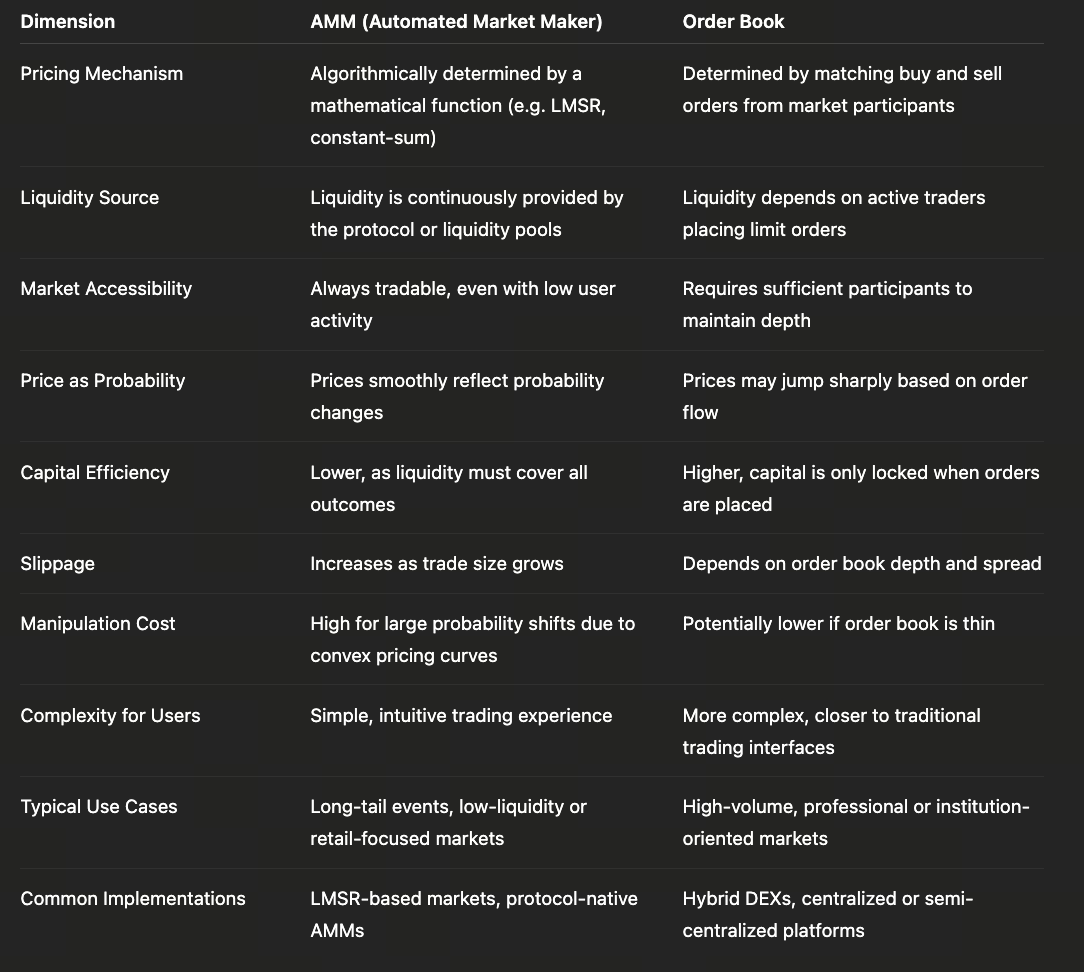

IV. AMM vs. Order Book: Comparing Two Models

AMMs and order books aren’t simply technical alternatives—they’re economic choices for prediction markets at different stages of development and user composition. The core advantage of AMMs is “continuous tradability”—even with few participants or limited event attention, the system can algorithmically generate prices, allowing prediction markets to cover a wide range of long-tail events. This design makes AMMs key tools for early market expansion and lowering participation barriers, but comes at the cost of requiring upfront capital for all possible outcomes—leading to lower capital efficiency and amplified nonlinear price effects during large trades.

By contrast, the order book model closely follows traditional financial logic for price discovery. Prices are set entirely by buy/sell intentions, and capital is only tied up in active orders—yielding higher capital efficiency and clearer supply-demand signals for highly participated events. However, this model is extremely sensitive to liquidity: as participant numbers drop, order book depth shrinks and risks of price volatility or manipulation rise sharply—limiting order books’ viability for long-tail prediction events.

In the long run, AMMs and order books aren’t opposing systems—they’re complementary components throughout the lifecycle of prediction markets. AMMs serve as “bootstrapping mechanisms,” ensuring smooth operation in early stages; order books become the “mature form,” handling primary price discovery as consensus concentrates and trading demand grows. Increasingly, prediction markets are exploring hybrid models: using AMMs for base liquidity and continuous quoting, while order books handle high-frequency trades and large capital flows. This evolutionary path essentially reflects a natural shift from usability-first to efficiency-and-depth-first priorities in prediction markets.

V. Game Theory Design in Prediction Markets: Manipulation Costs, Arbitrage, and Price Correction

Prediction markets differ from traditional assets—they have unique “game-theoretic economic designs.” For a healthy prediction market, the following must hold:

1. High cost of manipulation

For example:

- Pushing Yes probability from 60% to 90% requires buying large amounts of Yes contracts

- If the event fails, all capital is lost

Thus, manipulation carries very high costs—unlike “pumping” in other assets where one can later sell back. This gives prediction markets exceptional credibility in political events.

2. Arbitrage mechanisms automatically correct prices

Common forms of arbitrage in prediction markets include:

- Cross-platform arbitrage (same event priced differently across two markets)

- Cross-contract arbitrage (e.g., Yes/No arbitrage)

- Structural arbitrage (e.g., inconsistencies between probabilities of sub-events and parent events)

Arbitrage participants continually correct mispriced contracts, bringing market prices closer to true probabilities.

3. Information updates immediately reflect in prices

News reports, leaks, social media sentiment—all drive instant price changes. Prediction markets are highly sensitive to new information.

For example:

- Remarks during regulatory hearings

- Crypto project mainnet launch delays

- Changes in candidate health during elections

All these trigger “price jumps” that instantly reflect market consensus.

VI. Impact of Mechanism Design on Platform Ecosystem

Different prediction market platforms choose different combinations of mechanisms, each shaping their own advantages:

- AMM-based: Best for large numbers of small events; strongest in long-tail scenarios

- Order book-based: Best for major events with high participation and strong public attention

- Hybrid (adopted by some projects): “AMM as base + order book for depth” solves capability boundaries between models

Mechanism choices determine:

- Which events can be traded

- User experience

- Platform scalability

- Types of investor strategies available (arbitrage, hedging, long-term strategies)

Understanding these mechanisms helps you judge which platforms are most likely to succeed in the future.