Lesson 1

What Are Prediction Markets? From Concept and History to On-Chain Evolution

This lesson provides a comprehensive introduction to the foundational concepts, operational logic, and historical development of prediction markets. It also explores why Web3 prediction markets are set to experience rapid growth again in 2025—laying the groundwork for future lessons on mechanisms, economic design, and on-chain infrastructure.

I. Basic Definition of Prediction Markets: Why Are They Called “Price Oracles for the Real World”?

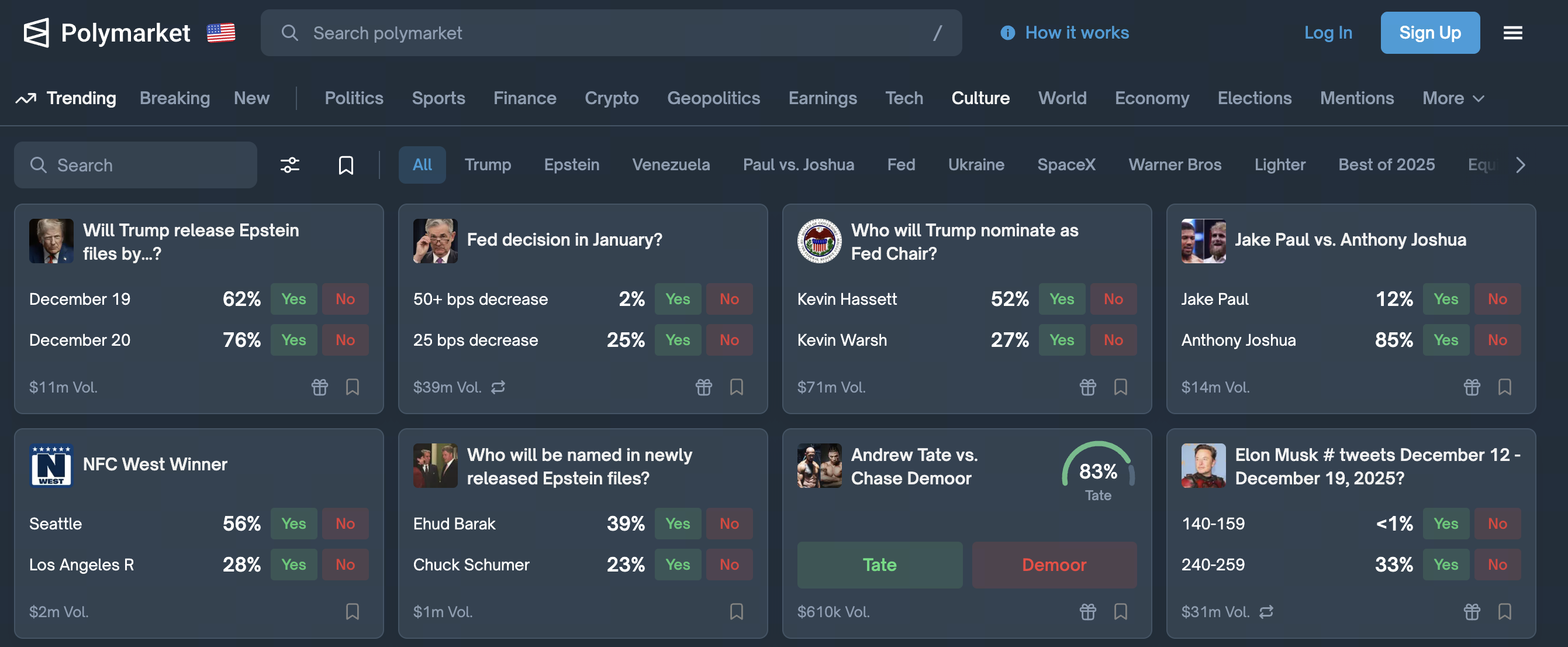

Soure: https://polymarket.com/

A prediction market is a probability aggregation tool built on market mechanisms, where participants place bets on future events. The market price ultimately reflects the probability of those events occurring.

Simply put: Prediction markets = Using trading to obtain real-time probabilities for future events.

Examples

- If a contract for a U.S. election candidate winning rises from 0.45 to 0.62, it means the market believes their odds of winning increased from 45% to 62%.

- If a contract for an ETF being approved by a certain date is priced at 0.30, the market estimates a 30% probability.

Why are prediction markets more effective than surveys or polls?

- Participants “put their money where their mouth is”—information carries real cost.

- The market continuously updates prices—an endogenous forecasting mechanism.

- Continuous trading—dynamically reflects the latest information.

Therefore, prediction markets are known as:

- Sentiment barometers

- Market-based pricing tools for future event probabilities

- The best information aggregators (“wisdom of crowds”)

Disclaimer

* Crypto investment involves significant risks. Please proceed with caution. The course is not intended as investment advice.

* The course is created by the author who has joined Gate Learn. Any opinion shared by the author does not represent Gate Learn.

Catalog

Lesson 1:What Are Prediction Markets? From Concept and History to On-Chain Evolution

4 enrolled

Lesson 2:Mechanisms and Economic Models of Prediction Markets: AMM, Order Books, and Game Theory Design

3 enrolled

Lesson 3:Technical Architecture of On-Chain Prediction Markets and Oracle Systems

0 enrolled

Lesson 4:The Expanding Applications of Prediction Markets—From Macro Events to On-Chain Behavior

0 enrolled

Lesson 5:Future Trends and Ecosystem Competition in Prediction Markets

1 enrolled