NBA Star Giannis Antetokounmpo Makes History with Major Kalshi Investment

In a landmark move that blurs the lines between sports, finance, and technology, Milwaukee Bucks superstar Giannis Antetokounmpo has become a shareholder in Kalshi, a federally regulated prediction market platform.

This investment marks the first time an active NBA player has directly invested in the company, signaling a significant shift in how athletes engage with the burgeoning event-trading industry. The partnership arrives at a critical juncture for the NBA, which is currently navigating heightened scrutiny over gambling integrity following recent federal indictments of league figures. For the prediction market sector, Antetokounmpo’s endorsement provides monumental mainstream validation, potentially accelerating the adoption of event contracts as a novel financial and forecasting tool for millions of users.

Giannis Makes History as First Active NBA Investor

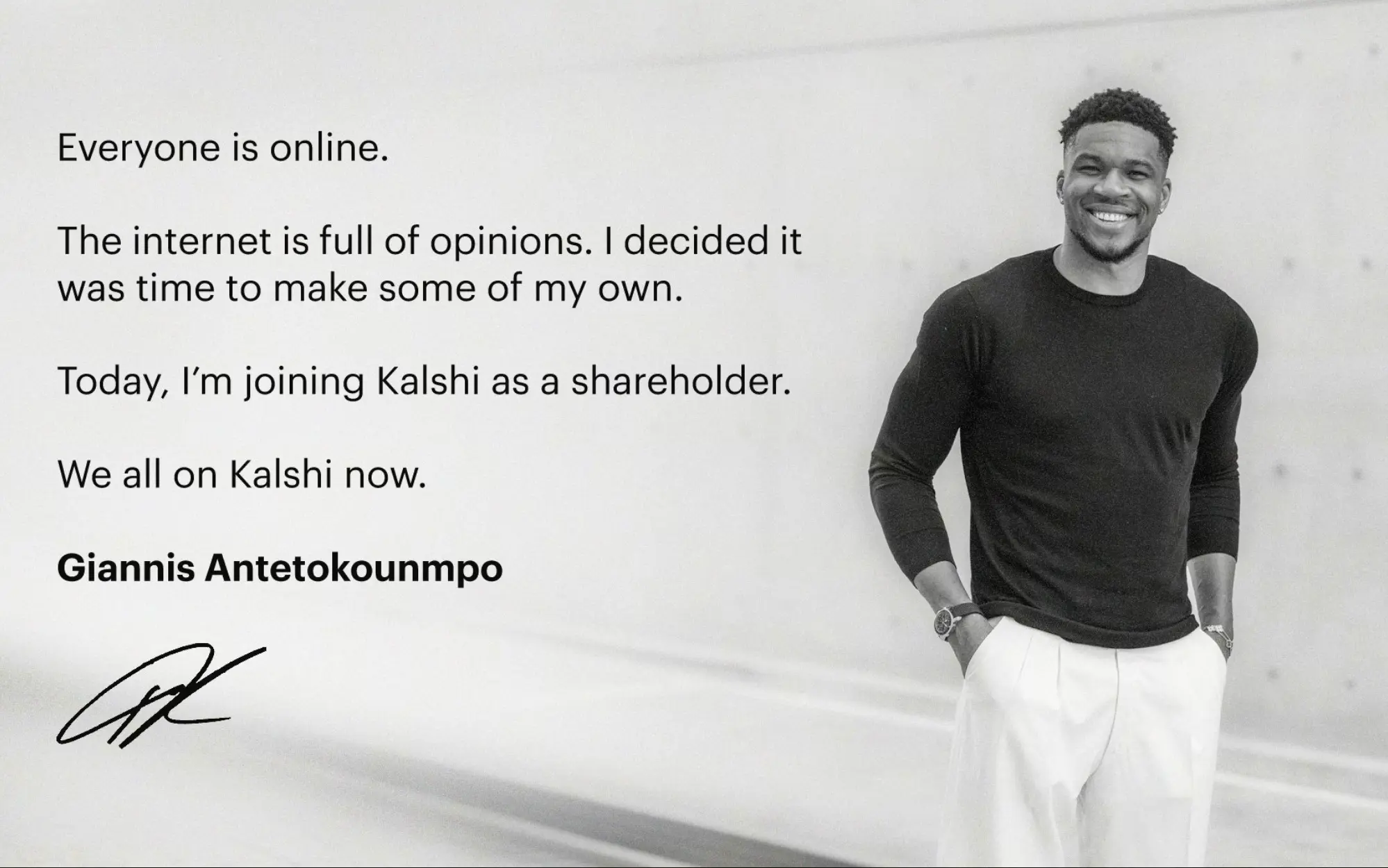

Milwaukee Bucks forward Giannis Antetokounmpo announced a groundbreaking partnership on Friday, February 6, 2026, revealing he has taken a stake in the prediction market platform Kalshi. Through a social media post, the two-time NBA MVP stated, “The internet is full of opinions. I decided it was time to make some of my own… Today, I’m joining Kalshi as a shareholder”. Kalshi confirmed that this makes the 31-year-old athlete the first active NBA player to become a direct investor in the company.

The partnership is structured to include collaboration on live events and marketing campaigns. Kalshi CEO Tarek Mansour welcomed Antetokounmpo, calling him a “legend” and “exactly the type of long-term partner we want to align our growing brand with”. For Antetokounmpo, whose business portfolio already includes ownership stakes in baseball’s Milwaukee Brewers and MLS’s Nashville SC, this investment is a strategic move into a rapidly growing fintech sector. He expressed his confidence in the platform, saying, “I like to win. It’s clear to me Kalshi is going to be a winner and I’m excited to be getting involved”.

Crucially, the investment complies with the NBA’s collective bargaining agreement. The current CBA permits players to advertise for sports betting companies and hold passive equity stakes of up to 1%, provided they do not promote wagers on NBA, WNBA, or G League games. Kalshi has explicitly stated that, in accordance with its strict terms of service that prohibit insider trading and market manipulation, Antetokounmpo will be forbidden from trading on any markets related to the NBA.

Understanding Kalshi’s Unique Prediction Market Model

So, what exactly is Kalshi? Unlike traditional sportsbooks, Kalshi is a federally regulated exchange operating under the oversight of the U.S. Commodity Futures Trading Commission (CFTC). It is designated as a contract market, a status that places it in the same regulatory category as major financial futures exchanges. This key distinction allows it to operate across the United States under a federal framework, bypassing the complex patchwork of state-by-state gambling regulations.

The platform’s core product is the event contract. Users trade on the outcome of future real-world events, from political elections and award shows to sports championships. Each contract is a simple “yes-or-no” proposition, such as “Will Team X win the championship?” These contracts trade at a price between $0 and $1, which represents the market’s collective probability of that outcome occurring. If the event happens, the contract settles at $1; if not, it settles at $0.

This model is championed not just as a trading venue but as a tool for harnessing “collective intelligence.” Economists and supporters argue that by aggregating the knowledge and beliefs of a diverse crowd with real capital at stake, prediction markets can often generate more accurate forecasts than polls or individual experts. In an era of information overload and AI-generated content, Kalshi positions its price signals as a market-driven source of truth for future events.

Kalshi’s Market Traction and Competitive Landscape

Kalshi has experienced explosive growth, with weekly trading volumes now surpassing $1 billion, an increase of over 1000% since 2024. The platform lists over 3,500 markets and is accessed weekly by millions of users. Its rise is part of a broader sector boom; Web3 prediction markets alone have seen cumulative trading volume cross $13 billion.

The company has secured significant validation through high-profile partnerships. It is the official prediction markets partner for CNN and has a marketing partnership with the National Hockey League (NHL). It has also integrated with major financial platforms like Robinhood and Coinbase for distribution. This growth is backed by substantial capital, including a recent $1 billion Series E funding round led by Paradigm, with participation from top-tier firms like Sequoia Capital and Andreessen Horowitz.

However, Kalshi operates in a competitive and legally nuanced space. It faces ongoing legal challenges from several state gaming regulators who argue its contracts constitute illegal gambling under state law, despite its federal status. Furthermore, it competes with other platforms like Polymarket, which, after a prior settlement with the CFTC, is poised to re-enter the U.S. market by acquiring a CFTC-licensed operation. This dynamic regulatory battleground centers on a fundamental question: are these event contracts legitimate financial instruments for hedging and forecasting, or are they merely sophisticated gambling wagers?.

A Controversial Timing: NBA’s Gambling Integrity Crisis

Antetokounmpo’s investment arrives at a moment of intense pressure on the NBA regarding gambling integrity. Notably, the announcement came just 100 days after a major NBA gambling scandal surfaced in October 2025. In that scandal, Miami Heat guard Terry Rozier and Portland Trail Blazers coach Chauncey Billups were among nearly three dozen individuals arrested on federal gambling-related charges.

The allegations against Rozier are particularly striking. Federal prosecutors claim he conspired with professional gamblers tied to organized crime to manipulate “prop bets” based on his own statistical performance in a March 2023 game. He allegedly informed conspirators he would exit a game early, allowing them to successfully bet the “under” on his performance props. Following his arrest, the NBA placed Rozier on leave, and the Heat withheld his $26.6 million salary. Although an arbitrator recently ruled the NBA must pay Rozier while his case proceeds, the incident has triggered a league-wide integrity review.

This context casts a sharp light on Antetokounmpo’s move. While his investment is legal and passive, it directly ties a top player’s finances to a platform where fans can trade on outcomes involving him and his peers. For instance, in the days leading up to the recent NBA trade deadline, Kalshi actively promoted a market titled “Giannis Antetokounmpo’s next team?” where over $23 million was wagered by users speculating on his future. At one point, the market probability of him staying in Milwaukee dipped below 30%. The partnership has sparked concern on social media and among fans, with some critics on platforms like Reddit calling it a “literal conflict of interest”.

The Ripple Effect: What This Means for Sports and Prediction Markets

The convergence of a superstar athlete and a leading prediction market is more than a celebrity endorsement deal; it is a catalyst with wide-ranging implications. For the NBA and professional sports leagues, this partnership tests the boundaries of existing rules. The league must now monitor a new gray area where players are not betting but are financially incentivized by the platforms facilitating bets on their own industry. It forces a re-examination of how “insider information”—from locker room dynamics to minor injuries—is protected in an era of real-time micro-trading on player performance.

For the prediction market industry, Antetokounmpo’s stamp of approval is a watershed moment for mainstream legitimacy. It signals to other athletes, institutions, and retail users that event trading is a credible, forward-looking financial activity, distinct from casual sports betting. This could unlock a wave of new partnerships and user adoption, pushing the sector closer to its ambition of becoming a foundational financial platform.

Ultimately, Giannis Antetokounmpo’s investment in Kalshi is a bold bet on the future of how we understand uncertainty. It highlights the ongoing transformation of prediction markets from niche curiosities into regulated financial venues with the potential to reshape forecasting, risk management, and even the relationship between sports stars and their fans. As both the sports and financial worlds watch closely, this partnership will undoubtedly influence the evolving dialogue on regulation, integrity, and innovation for years to come.

Related Articles

Rapper Preme's Super Bowl bet fails, losing $178,000 because "dance counts as a performance"

Kalshi CEO: Trading volume on Super Bowl Sunday surpasses $1 billion

CertiK: Prediction market to reach $63.5 billion in trading volume by 2025, with the industry facing security and regulatory challenges

Polymarket will collaborate with Kaito AI to launch the "Attention Market"

Logan Paul sparks controversy with a $1 million bet on Polymarket

Market maker Jump Trading provides liquidity in exchange for equity in Kalshi and Polymarket, establishing a presence in prediction markets.