XRP Traders Brace for a Bottom: 3 Things to Watch This Week

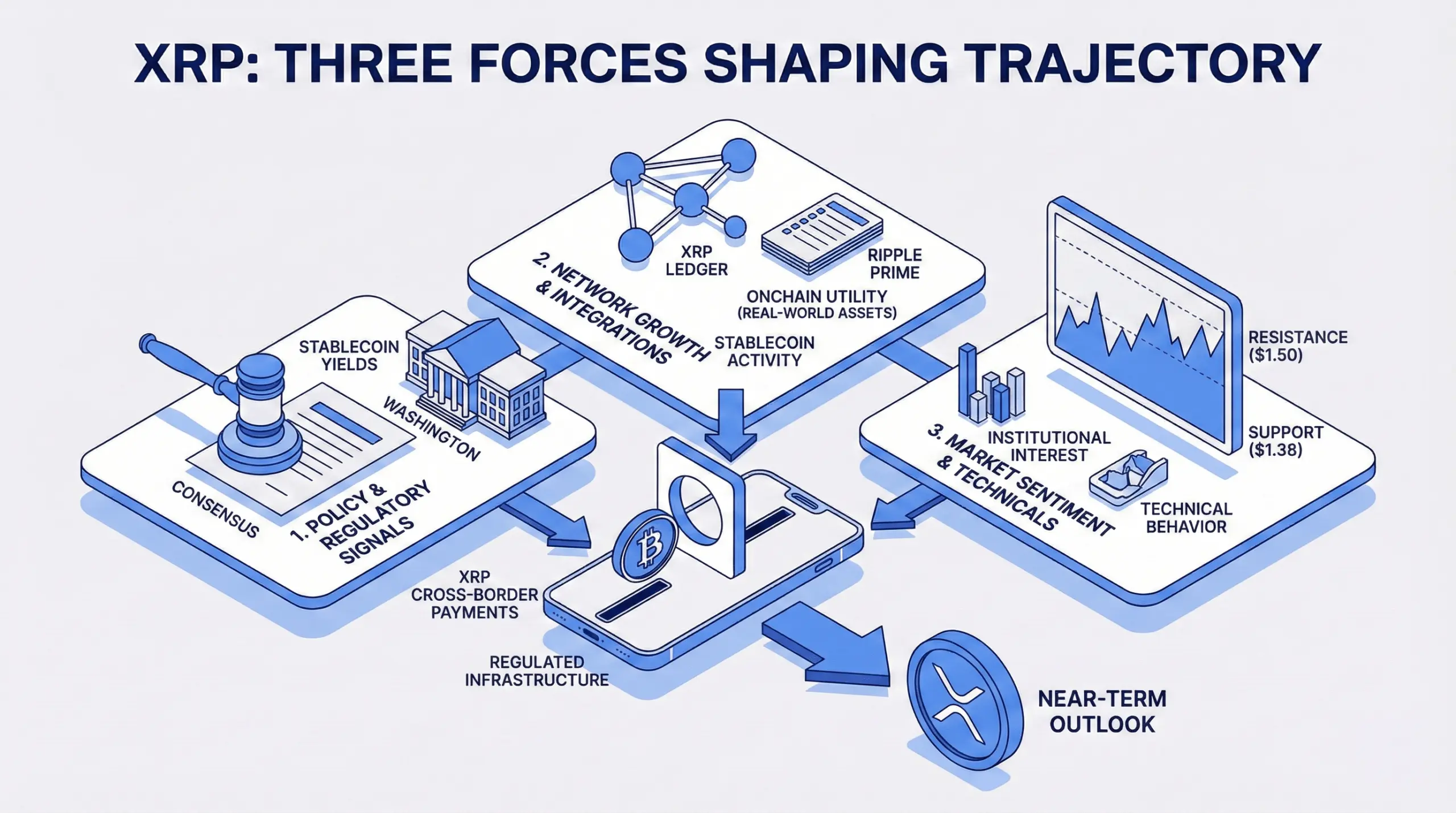

XRP entered the week under pressure as traders debated whether the recent pullback marks a temporary shakeout or the start of a deeper reset. With prices hovering near long-term support, attention is now locked on three forces shaping XRP’s near-term trajectory.

XRP Nears a Crossroads

As of 8 a.m. Eastern on Feb. 10, XRP was trading near $1.41, down 12.5% over the past seven days and more than 33% over the last month. The token’s weekly range stretched from $1.16 to $1.62, while 24-hour trading volume stood at roughly $2.73 billion, signaling elevated participation even as prices sagged.

XRP’s recent slide unfolded during a turbulent stretch for digital asset markets, with the token briefly dipping as low as $1.12 on Feb. 6 before bouncing more than 30%. That rebound proved short-lived, however, as price action settled back into the low-$1.40 range, leaving traders split on whether the worst is already priced in.

Against that backdrop, XRP’s outlook this week hinges on three foundations: policy developments, fundamental network growth, and market sentiment reflected in technical behavior.

Policy and Regulatory Signals Remain a Looming Catalyst

Discussions in Washington around stablecoin yields are moving toward a late-February deadline, with banks and crypto representatives attempting to reach consensus. Any clarity emerging from those talks could influence XRP’s positioning in cross-border payments, particularly as policymakers weigh how digital assets fit into regulated financial infrastructure.

Regulatory momentum is being watched closely by institutional participants, many of whom remain sensitive to policy uncertainty. Even incremental guidance could shift risk appetite, especially after weeks of defensive positioning across crypto markets.

Network Growth and Integrations Are Adding Weight Beneath the Surface

Ripple’s recent integration of Ripple Prime with Hyperliquid introduced a new on-ramp for derivatives and tokenized assets tied to the XRP Ledger. At the same time, real-world assets on the ledger jumped 265% in the past 30 days to $1.4 billion, pointing to expanding onchain utility.

Stablecoin activity has also accelerated, with RLUSD‘s market capitalization rising to $1.52 billion and transfer volumes climbing 45%. Those figures suggest that while price action has cooled, usage across the ecosystem has not.

Institutional interest has surfaced as well. During the early-February dip, eight corporations led by Evernorth Holdings committed a combined $2 billion toward XRP reserves, viewing prices near $1.20 as an entry point rather than an exit ramp.

Market Sentiment and Technical Levels Are Doing the Talking

From a technical standpoint, XRP is clinging to the $1.40 area, which aligns closely with its 200-day exponential moving average. As long as daily closes hold above roughly $1.38, longer-term structure remains intact, though confidence is fragile.

Resistance near $1.50 has proven stubborn, capping rebound attempts and keeping momentum in check. A decisive move above that level could reopen the path toward $2, while failure risks another test of the $1.12 low.

Onchain data adds another wrinkle. Short- and medium-term holders shed a large portion of their holdings during the rebound, while larger participants appear to have accumulated near recent lows. That divergence hints at a market still sorting conviction from caution.

For now, XRP traders are left waiting. The token is no longer in free fall, but it has yet to reclaim enough ground to signal a clear shift in control. Whether this week delivers stabilization or another leg lower may depend less on headlines and more on how these three forces intersect in real time.

FAQ ⏱️

- **What price level are XRP traders watching most closely?**The $1.38 to $1.40 zone is key, as it aligns with long-term technical support.

- Why does policy news matter for XRP this week? Stablecoin and payment discussions in Washington could affect XRP’s regulatory positioning.

- **Is XRP network activity slowing down?**No, real-world assets and stablecoin usage on the XRP Ledger have grown sharply.

- **What would signal a stronger recovery?**A sustained move above $1.50 could shift short-term momentum in favor of buyers.

Related Articles

XRP and RLUSD Holders Gain Tokenized Treasury Yield Through Doppler Finance

Goldman Sachs reveals $2.3 billion in cryptocurrency investments! From skepticism to embracing BTC and XRP assets

Crypto Market Review: Is XRP Actually Capitulating? Bitcoin (BTC) Eyes $64,000 Already, Shiba Inu (SHIB) Needs One More Day - U.Today

XRP Trades Near $1.42 Support as $1.50 Level Tests Daily Megaphone Structure