U.S. January Non-Farm Payrolls "Better Than Expected"! The market increases bets on the Federal Reserve cutting interest rates in July, with Bitcoin briefly surpassing $67,500,000.

The latest U.S. non-farm payroll data exceeded expectations, adding 130,000 jobs far surpassing market forecasts, demonstrating the resilience of the labor market.

(Background: Barclays report interprets Federal Reserve Chair Powell’s “dovish” stance: not shrinking the balance sheet but shortening bond durations could trigger a rate cut storm)

(Additional context: U.S. ADP private employment data significantly below expectations! Market bets on no rate cuts before June, Bitcoin dips to $75,000, Ethereum falls below $2,200)

The U.S. Bureau of Labor Statistics (BLS) released the latest non-farm employment data on February 11, 2026 (Taipei time 21:30), covering employment in January 2026. The report shows the U.S. labor market is more resilient than market expectations, easing previous concerns about economic slowdown.

Specifically, non-farm payrolls increased by 130,000 in January, well above the consensus estimate of approximately 66,000 to 70,000. The unemployment rate remained around 4.3%, with limited change. The job growth was mainly driven by healthcare, social assistance, and construction sectors. Overall, this report indicates the employment market is more resilient than the soft data in recent months, alleviating fears of a hard landing for the U.S. economy.

Market Bets on Fed Rate Cuts in July

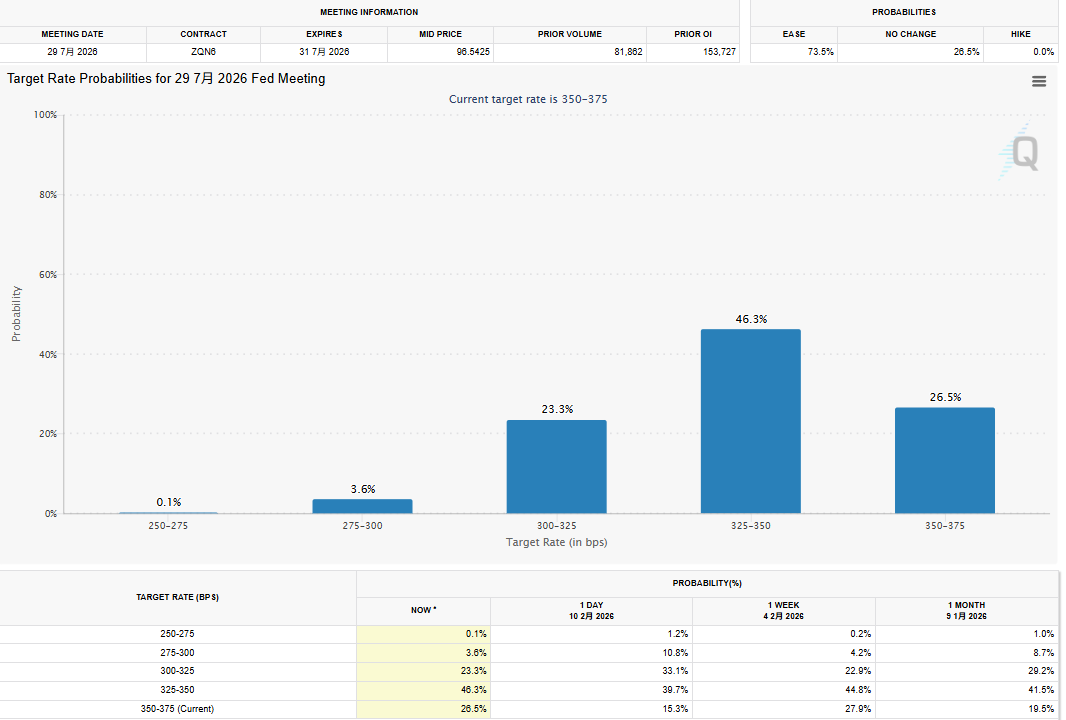

According to the latest CME FedWatch Tool data, after the non-farm payroll report, although the market still expects the Federal Reserve (Fed) to hold current interest rates in March and April this year, the probability of resuming rate cuts in June and lowering by one basis point has exceeded the chance of holding steady (41%), reaching 48.2%. In July, the market predicts a 46.3% chance of a 25 basis point cut, with the probability of no change dropping to 26.5%.

It is worth noting that the previous market consensus—especially before the non-farm data release—leaned toward June as the first rate cut. The shift now is mainly due to strong employment data reducing the urgency for the Fed to implement easing policies immediately.

Bitcoin Rises and Pulls Back

In the cryptocurrency market, driven by strong non-farm data, risk sentiment briefly stabilized, and Bitcoin (BTC) experienced a short-term rally, surpassing $67,000 to reach $67,670. However, as of writing, Bitcoin has quickly pulled back, currently around $66,960. Ethereum followed a similar trend, currently around $1,950.

Related Articles

Ethereum's market capitalization drops to the 86th position among global mainstream assets

Data: Today's top 100 cryptocurrencies by market capitalization gains and losses