Ethereum Price Reclaims $2,000 as ETF Inflows Return: Is a V-Shaped Rebound Taking Shape? - BTC Hunts

The post Ethereum Price Reclaims $2,000 as ETF Inflows Return: Is a V-Shaped Rebound Taking Shape? appeared first on Coinpedia Fintech News

The post Ethereum Price Reclaims $2,000 as ETF Inflows Return: Is a V-Shaped Rebound Taking Shape? appeared first on Coinpedia Fintech News

Ethereum price has pushed decisively back above the $2,000 mark, trading between $2,060 and $2,080 after gaining more than 6% in the latest session. While the broader crypto market has turned positive, ETH’s rebound carries deeper structural implications as institutional flows stabilize and on-chain participation accelerates. The move follows weeks of pressure that saw Ethereum retest the lower boundary of its multi-month range. However, fresh ETF data, improving network activity, and historical volatility patterns now suggest the rebound may be evolving beyond a simple relief rally.

ETF Inflows Flip Positive After Heavy Outflows

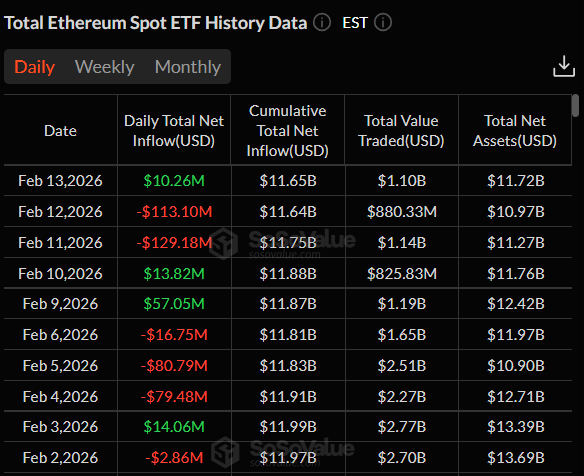

Data from U.S. spot Ethereum ETFs shows a meaningful shift in capital flows. On Feb. 13, ETFs recorded $10.26 million in daily net inflows, reversing back-to-back outflows of $129.18 million (Feb. 11) and $113.10 million (Feb. 12). Cumulative net inflows now stand at $11.65 billion, while total net assets hover around $11.72 billion. Daily total value traded reached $1.10 billion, highlighting that institutional participation remains active even amid volatility.

This shift is particularly notable given the aggressive withdrawals seen at the end of January, including a $252.87 million outflow on Jan. 30 and $155.61 million on Jan. 29. The stabilization and quick return of capital suggest repositioning rather than capitulation.

Tom Lee’s Historical V-Bottom Thesis Gains Traction

Market attention has also turned to Fundstrat’s Tom Lee, who argues that Ethereum may be setting up for another classic V-shaped rebound. His thesis is grounded in repeated historical behavior. Since 2018, Ethereum has endured eight separate drawdowns exceeding 50%, with declines ranging between -50% and -81%. In every instance, the correction eventually gave way to sharp V-bottom recoveries once leverage was flushed and macro pressures stabilized. The 2022 cycle serves as a prominent example. After collapsing more than 80% from its peak, ETH staged a powerful recovery as inflation peaked and monetary tightening expectations softened. Similar snapback rallies occurred in prior reset cycles when positioning became overly defensive.

JUST IN : Ethereum might be down, but Tom Lee says don’t get too comfortable being bearish.

He believes $ETH is setting up for a V-shaped rebound.

His reasoning is simple:

Since 2018, Ethereum has crashed over 50% eight different times… and every single time it eventually… pic.twitter.com/zTxeG2iuDT— Whale Degen (@hiwhaledegen) February 13, 2026

Lee’s perspective aligns with current conditions. Sentiment recently turned cautious, price retraced significantly from highs, ETF outflows peaked late January, and now flows are stabilizing while on-chain activity strengthens. This convergence of reset positioning and improving fundamentals mirrors the early stages of prior V-shaped recoveries.

Ethereum’s Network Growth Strengthen the Bullish Case

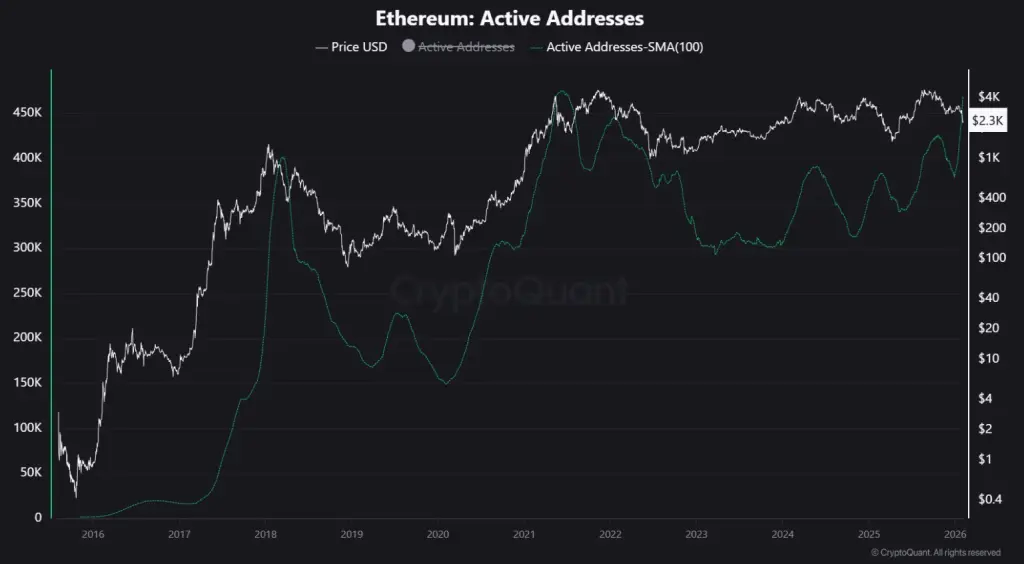

Network usage data adds another layer of confirmation. Ethereum’s active addresses have risen to cycle expansion levels, according to recent analytics. This increase in network participation has occurred even while price was correcting earlier this year. In prior cycles- notably 2017, 2020, and 2021, sustained expansions in active addresses either preceded or aligned with strong price appreciation phases.

The current divergence between rising participation and earlier price compression suggests that structural demand remained intact.

The current divergence between rising participation and earlier price compression suggests that structural demand remained intact.

Such behavior typically reflects accumulation rather than speculative exhaustion. When network growth accelerates while price stabilizes, it often marks the early stage of a broader recovery cycle rather than a short-lived bounce.

.article-inside-link { margin-left: 0 !important; border: 1px solid #0052CC4D; border-left: 0; border-right: 0; padding: 10px 0; text-align: left; }

.entry ul.article-inside-link li { font-size: 14px; line-height: 21px; font-weight: 600; list-style-type: none; margin-bottom: 0; display: inline-block; }

.entry ul.article-inside-link li:last-child { display: none; }

- Also Read :

- Chainlink Consolidates Below Key Resistance—Can the LINK Price Break Above $10 This Weekend?

- ,

Ethereum Price Structure Shows Early Signs Of Reversal

Following a severe decline, Ethereum price has rebounded from the demand zone of $1600 and reclaimed the $2000 mark. The latest recovery is technically significant because it follows a classic liquidity sweep beneath the $1800-$2000 demand zone before aggressively reclaiming lost territory.

By reclaiming the lower boundary and pushing decisively above $2k, ETH has shifted from distribution risk back toward re-accumulation structure. The short-term moving averages are beginning to flatten and curl upward, signaling improving momentum

In case of further upward movement, immediate resistance sits near $2200-$2450. A sustained close above the region would invalidate the lower-high structure and open the path toward $2500-$2800 where broader macro resistance aligns. On the downside, $1900 now acts as the first-line support, while $1800 remains the deeper structural defense level that must hold to preserve the bullish reset narrative

In case of further upward movement, immediate resistance sits near $2200-$2450. A sustained close above the region would invalidate the lower-high structure and open the path toward $2500-$2800 where broader macro resistance aligns. On the downside, $1900 now acts as the first-line support, while $1800 remains the deeper structural defense level that must hold to preserve the bullish reset narrative

FAQs

Why is Ethereum price going up today? Ethereum is rallying due to a rebound in institutional ETF inflows, rising on-chain network activity, and historical patterns suggesting a classic V-shaped recovery after a deep correction.

Is Ethereum a good investment right now? While no investment is guaranteed, recent data shows institutional flows stabilizing and network growth accelerating, which historically signals structural demand and potential for a broader recovery cycle.

What is the price prediction for Ethereum? If momentum continues, ETH faces immediate resistance at $2,200-$2,450. A break above that level could open a path toward the $2,500-$2,800 range. Key support sits at $1,900.

What support levels matter if Ethereum pulls back again? Immediate support is near $1,900, with $1,800 as critical structural support to maintain the current bullish recovery setup.

Related Articles

Bitcoin OG Garrett Jin Sells 5,000 BTC Worth $348.82M, Withdraws $53.12M USDT

The current mainstream CEX and DEX funding rates indicate that the market has once again shifted to a bearish outlook.

Data: If BTC drops below $65,939, the total long liquidation strength on mainstream CEXs will reach $1.686 billion.

"Long-term short BTC" whale cancels $55,125 "bottom-fishing" BTC limit buy order

Brazil Revives Bill 4501 to Accumulate 1 Million BTC for Strategic National Reserve

White House Says Trillions Await Bitcoin Market Rules