"Has the 'true bottom' not arrived yet? Experts warn: Bitcoin may face a 'surrender sell-off' in the final dip"

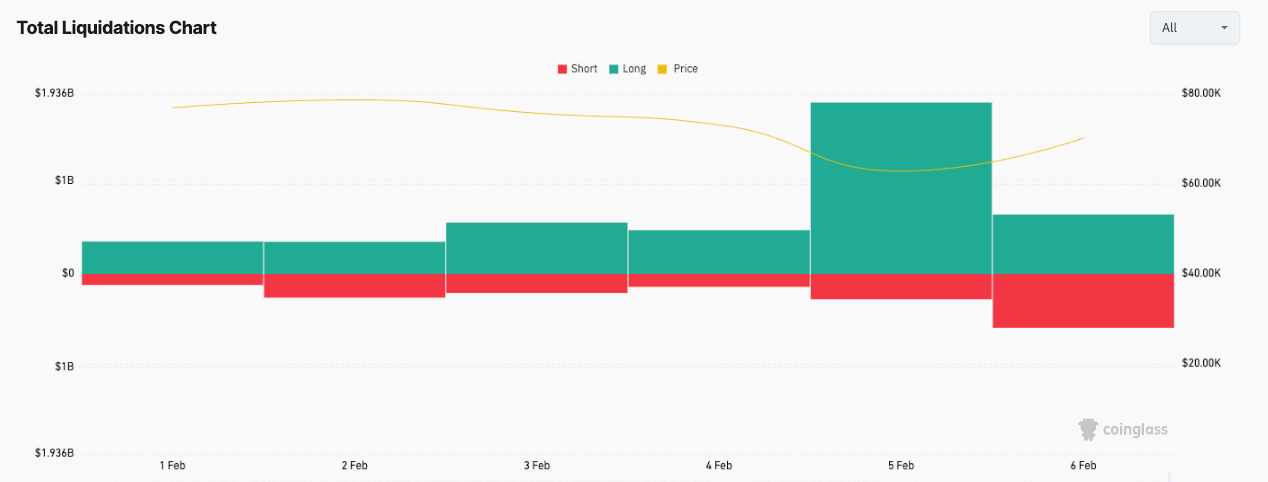

Last week, Bitcoin experienced significant volatility, with daily drops of over 10%, nearly falling below $60,000. Although it later rebounded to $70,000, analysts believe that a true "capitulation sell-off" has not yet occurred, as the futures basis spread remains unchanged and does not indicate extreme market pessimism, suggesting that Bitcoin may still have further downside potential.

区块客·2h ago