Search results for "TRUMP"

Binance Buys 4,225 BTC for SAFU Fund in $300M Asset Conversion

Binance has converted $300 million in stablecoins to 4,225 BTC for its Secure Asset Fund for Users (SAFU), raising its Bitcoin reserve to 10,455 BTC. The exchange's ties to the Trump-linked World Liberty Financial and the USD1 stablecoin, mostly held on Binance, have sparked political interest.

CryptoNewsFlash·11h ago

Bill Gates appears in Epstein files! Ex-wife responds: It's time for a societal purge.

Bill Gates has attracted attention for appearing in Epstein files. His ex-wife Melinda stated that this is a social reckoning for the crimes of the elite and called for those involved to respond personally to questions. Gates admitted to regretting his dealings with Epstein, but the concealment allegations in the files still caused a stir among the public. The Epstein files also involve other celebrities, including Musk and Trump.

CryptoCity·16h ago

Facing Aave liquidation risk! World Liberty Financial is urgently selling off Bitcoin to rescue the situation and prevent further losses.

Amidst the intense volatility in the cryptocurrency market, DeFi protocol World Liberty Financial (WLFI), supported by the family of U.S. President Donald Trump, has unexpectedly come under pressure due to liquidation risks faced by lending platforms. The protocol was forced to sell Bitcoin to repay debts, drawing significant market attention.

According to on-chain data platform Arkham Intelligence, the official wallet of World Liberty Financial sold over 170 Bitcoins on Wednesday at an approximate price of $67,000 each, cashing out about $11 million. The funds were immediately transferred to leading lending protocol Aave to repay loans and avoid liquidation.

Alongside the forced sale of assets to cover debts, WLFI tokens have also continued to experience downward pressure.

区块客·16h ago

Tencent "Periscope": $700 Million Lesson, the "Old Narrative" in the Crypto Market Is Dead

Tencent Finance "Periscope"

By Xie Zhaoqing

Edited by Liu Peng

The cryptocurrency market has retraced all the gains brought by Trump's rise to power, experiencing an epic crash that has once again turned the word "risk"—temporarily forgotten by greed—into its most ferocious form, glaring at all investors.

Last week, Bitcoin experienced its largest single-week decline in three years. February 5th became an unexpected day for crypto market investors: Bitcoin dropped 13% that day, marking the largest single-day decline since June 2022, and briefly fell below $61,000 in the early hours of February 6th.

During this intense correction, veteran crypto trader Yi Lihua liquidated 400,000 Ethereum within a week, suffering a loss of $700 million, making him the top "whale" ruthlessly hunted during this round of plummeting.

This sharp correction caught the market off guard, including long-term bullish "steadfast holders." Even more troubling, many long...

PANews·19h ago

The era of the Federal Reserve gradually printing money is here! Lyn Alden: Mildly stimulating assets without explosive growth

Economist and Bitcoin advocate Lyn Alden states that the Federal Reserve is entering gradual money printing, mildly stimulating without large-scale liquidity injections. She recommends holding scarce assets and balancing from optimistic sectors to underweighted ones. Trump nominates hawkish Waugh, with March rate cut expectations dropping to 19.9%. Alden says all policies will ultimately lead to currency depreciation.

MarketWhisper·23h ago

Schiff Warns 'Affordability Crisis Will Get Worse' as Trump Eyes Iran 25% Tariffs

Proposed U.S. tariffs tied to Iran-linked trade could ripple through global supply chains, lifting import costs and worsening household affordability as China’s central role magnifies indirect exposure under President Trump’s evolving sanctions strategy.

Schiff Warns Iran-Linked Tariffs Could

Coinpedia·23h ago

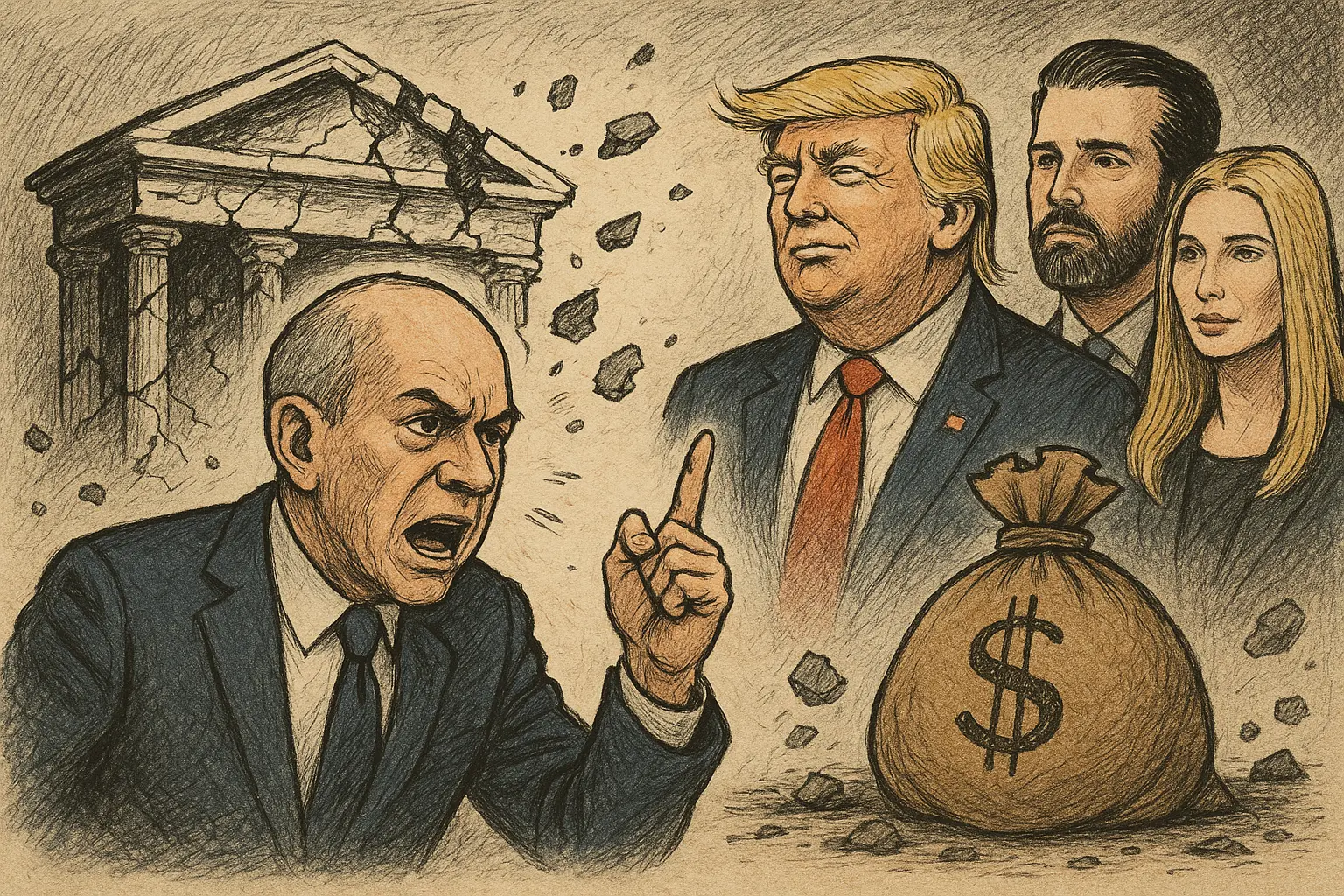

'Clueless and Venal': Economist Nouriel Roubini Blasts Trump’s Crypto Push as a Recipe for Financial Ruin

Economist Nouriel Roubini has sharply criticized the Trump administration’s second‑term embrace of digital assets, calling it a reckless experiment that undermines the U.S. financial system.

Legislative ‘Time Bombs’

Renowned economist Nouriel Roubini has issued a blistering critique of the Trump

BTC-0,05%

Coinpedia·02-08 15:02

Mysterious United Arab Emirates company invests 500 million USD in shares! U.S. House of Representatives intervenes in investigation of World Liberty Financial

The U.S. Congress is investigating Donald Trump's family cryptocurrency business, particularly whether World Liberty Financial (WLFI) is involved with foreign capital and U.S. technology policy issues. The investigation stems from a suspected acquisition of WLFI shares by an UAE company for $500 million on the eve of Trump's inauguration, focusing on potential conflicts of interest and national security risks. Congressman Ro Khanna has requested detailed equity and profit information and is examining the use and benefits of the stablecoin USD1 issued by WLFI.

区块客·02-08 13:15

Expectations of interest rate cuts in March surge after Kevin Warsh's nomination for Fed Chair

The market adjusts interest rate expectations after Trump's nomination of Kevin Warsh to succeed Jerome Powell. Probability of a rate cut in March by the FOMC has risen, indicating potential for looser monetary policy despite Warsh's hawkish stance.

BTC-0,05%

TapChiBitcoin·02-08 11:03

Facing Aave liquidation risk! World Liberty Financial is urgently selling off Bitcoin to rescue the situation and prevent further losses.

Amidst the intense volatility in the cryptocurrency market, DeFi protocol World Liberty Financial (WLFI), supported by the family of U.S. President Donald Trump, has unexpectedly come under pressure due to liquidation risks faced by lending platforms. The protocol was forced to sell Bitcoin to repay debts, drawing significant market attention.

According to on-chain data platform Arkham Intelligence, the official wallet of World Liberty Financial sold over 170 Bitcoins on Wednesday at an approximate price of $67,000 each, cashing out about $11 million. The funds were immediately transferred to leading lending protocol Aave to repay loans and avoid liquidation.

Alongside the forced sale of assets to cover debts, WLFI tokens have also continued to experience downward pressure.

区块客·02-08 09:39

Why are gold, US stocks, and Bitcoin all falling? What are the reasons behind the simultaneous decline in these major assets? Many investors are asking why these markets are dropping together and what factors are influencing this trend. In this article, we will analyze the key reasons and provide insights into the current financial environment.

Recent US economic data shows good performance, but all asset classes are experiencing a collective plunge. The underlying reasons include tense Middle East tensions, Trump's remarks, and declining confidence in tech stocks. Market liquidity is tight, with capital fleeing risk assets and shifting into the US dollar. This crisis is similar to the liquidity crisis during the pandemic and may prompt a reassessment of asset allocation.

区块客·02-08 06:20

Trump Says Powell Will Be “Gone Soon”: Why Bitcoin Traders Are Watching Closely

_Trump says Fed Chair Powell may exit soon, drawing attention from Bitcoin traders watching interest rate and dollar policy signals._

U.S. President Donald Trump said Federal Reserve Chair Jerome Powell would be “gone soon,” drawing attention from global markets.

The comment raised questions a

BTC-0,05%

LiveBTCNews·02-08 06:00

Trump-Linked Firm Dumps $11.75M in Bitcoin Amid Market Drop

World Liberty Finance sold 173 WBTC for USDC to mitigate risk amid Bitcoin volatility. The firm is under U.S. scrutiny for a $500M UAE-linked deal, raising concerns about foreign influence and potential conflicts of interest.

CryptoFrontNews·02-07 14:41

Morning Minute: Bitcoin Erases Trump Pump, Falls to $60k

_Morning Minute is a daily newsletter written by __Tyler Warner__. The analysis and opinions expressed are his own and do not necessarily reflect those of Decrypt. Subscribe to the Morning Minute __on Substack__._

GM!

Today’s top news:

Crypto majors crash on Thursday as BTC hits $60k before

Decrypt·02-07 13:26

Mysterious United Arab Emirates company invests 500 million USD in shares! U.S. House of Representatives intervenes in investigation of World Liberty Financial

The U.S. Congress is investigating Donald Trump's family cryptocurrency business, particularly whether World Liberty Financial (WLFI) is involved with foreign capital and U.S. technology policy issues. The investigation stems from a suspected acquisition of WLFI shares by an UAE company for $500 million on the eve of Trump's inauguration, focusing on potential conflicts of interest and national security risks. Congressman Ro Khanna has requested detailed equity and profit information and is examining the use and benefits of the stablecoin USD1 issued by WLFI.

区块客·02-07 13:10

Trump Administration Approves New Crypto-Friendly Bank

_Trump administration approves Erebor Bank, a crypto-friendly lender, signaling deeper U.S. integration of digital assets into the regulated banking system._

The United States has approved a new crypto-friendly national bank, marking a key milestone for digital asset finance. During the second t

LiveBTCNews·02-07 12:21

Trump: Dow 100K by 2029… This Coin Could 20× Sooner

President Trump's prediction of the Dow reaching 100,000 by January 2029, driven by tariffs and framed as a long-term strategy, sparks divided opinions. While supporters cite his business acumen, critics warn of potential inflation and mixed historical outcomes.

Coinfomania·02-07 09:26

Trump Signs Executive Order Authorizing New 25% Tariff on Iran-Linked Trade

President Trump's executive order allows a 25% tariff on imports from countries trading with Iran, aiming to disrupt Tehran's revenue sources. This policy targets indirect trade relationships and may reshape global supply chains, raising compliance risks for businesses.

CryptometerIo·02-07 05:01

Weekly Highlights | Gold, US stocks, and cryptocurrencies all decline; Wosh and Epstein are this week's celebrities

PANews Editor's Note: PANews has selected a week's worth of high-quality content to help everyone identify gaps and improve over the weekend. Click on the title to read.

Macro Perspective

Why haven't rate cuts and balance sheet reductions seen substantial changes since Warsh took office?

It is expected that Warsh will not immediately implement the policies of rate cuts and balance sheet reduction upon taking office. Tight interbank liquidity limits the space for balance sheet reduction, and the interest rate path is constrained by employment and inflation data. His policy framework may lack flexibility and needs to balance the FOMC's stance with relations to Trump.

Gold crash, dollar rally—Is Warsh an enemy or a friend?

Markets are highly volatile due to Kevin Warsh potentially taking the helm at the Federal Reserve. His contradictory stance of supporting rate cuts while insisting on balance sheet reduction has triggered a sharp decline in gold and silver prices and a strengthening dollar. Investors are worried about liquidity tightening, and Wall Street shows clear divisions over his independence and policy influence.

The U.S. Senate Agriculture Committee passes the CLARITY Act

PANews·02-07 01:37

Morning Minute: Bitcoin Erases Trump Pump, Falls to $60k

_Morning Minute is a daily newsletter written by __Tyler Warner__. The analysis and opinions expressed are his own and do not necessarily reflect those of Decrypt. Subscribe to the Morning Minute __on Substack__._

GM!

Today’s top news:

Crypto majors crash on Thursday as BTC hits $60k before

Decrypt·02-06 13:25

Facing Aave liquidation risk! World Liberty Financial is urgently selling off Bitcoin to rescue the situation and prevent further losses.

Amid the volatility in the crypto market, the DeFi protocol World Liberty Financial (WLFI), supported by the Trump family, was forced to sell 170 Bitcoins for $67,000 to repay debt through Aave due to liquidation pressure. WLFI token prices continue to decline, with a total drop of over 65%. Additionally, the protocol is facing political and regulatory controversies, with lawmakers investigating its $250 million equity transaction.

区块客·02-06 09:46

Are aliens really real? A UK director reveals that Trump will disclose the UFO truth in July. Do you believe it?

British documentary director claims that Trump is prepared to officially acknowledge the existence of aliens in a speech on July 8, 2026, which coincides with the 79th anniversary of the Roswell incident. However, the credibility of this news is highly questionable, and the White House has not responded. Past similar predictions have often not come true. If the news is true, it could have a significant impact on science, religion, and geopolitics. People should remain cautious and wait for future developments.

BTC-0,05%

動區BlockTempo·02-06 04:45

Bitcoin plunges to $60,000! The "Trump rally" has completely retraced, with the 200-day moving average acting as a potential support

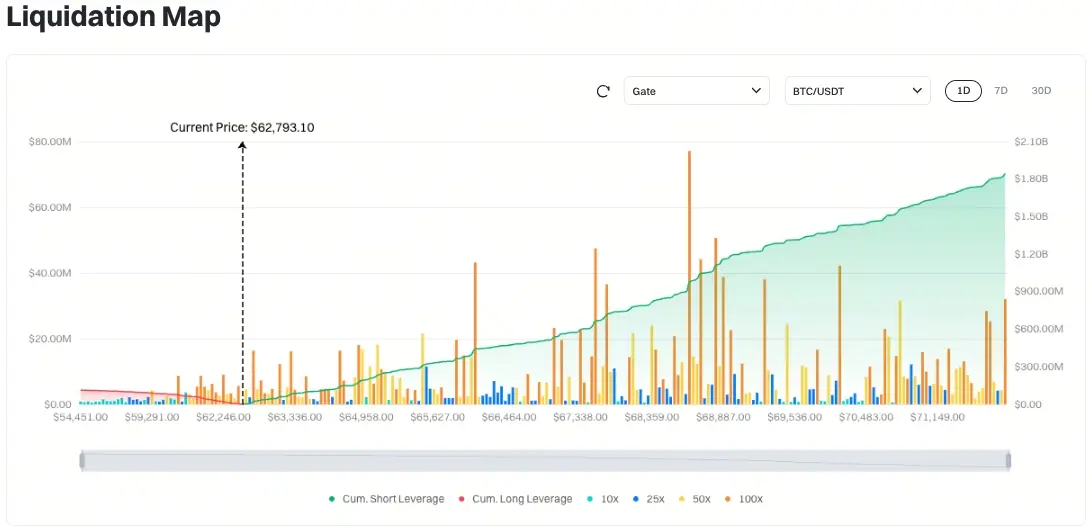

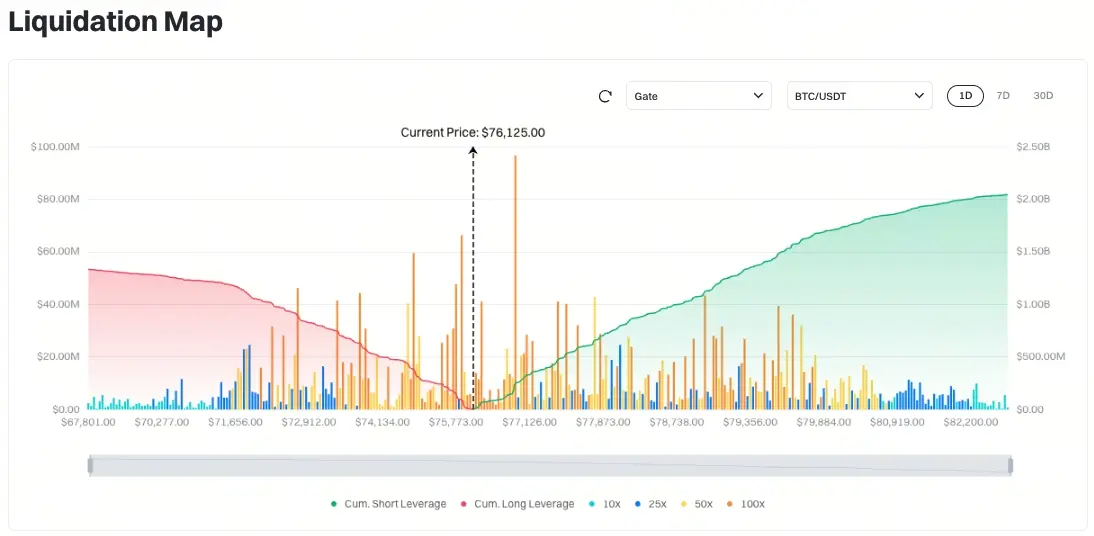

Bitcoin price accelerates downward to $60,000, with nearly $2.7 billion in liquidations across the network, marking the worst single-day decline since 2022. Although capital outflows are only 6.6%, analysts point out that the 200-day moving average is a key support level. Market liquidity is weak, and there are no signs of a bottom yet, with a potential risk of further decline to $38,000.

BTC-0,05%

CryptoCity·02-06 02:40

Gate Daily (February 6): Bitcoin, gold, silver, and US stocks crash simultaneously; Trump WLFI sells 100 WBTC tokens

Bitcoin (BTC) further deepened its correction, temporarily reporting around $64,300 on February 6, with a low of once dropping below the $60,000 mark. U.S. stocks, gold, and silver experienced a rare simultaneous plunge, and the market was extremely panicked. The World Liberty Financial team under the Trump family once again sold 100 WBTC to exchange for 6.71 million USDC.

MarketWhisper·02-06 01:17

Why did Bitcoin plummet today? The "Trump rally" has completely reversed, and miners are forced to shut down.

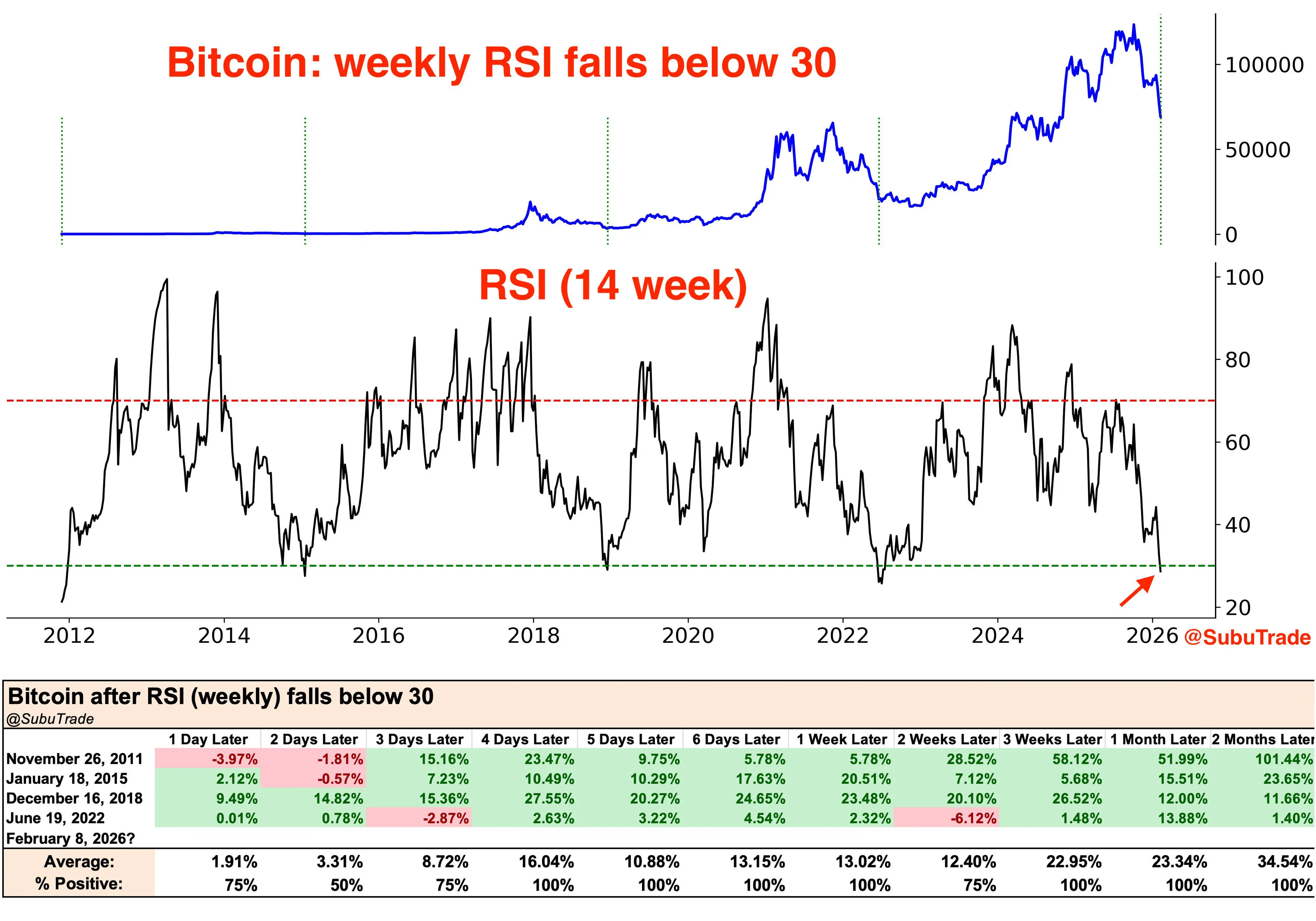

Bitcoin falls below $61,000, erasing the gains since Trump's election, down 51% from the all-time high. iShares IBIT, with a trading volume of $10 billion, drops 13%, and ETFs saw outflows of $5 billion in March. Mining costs at $87,000 are well above the market price, Luxor hash price hits a new low, and large-scale hash power is shutting down. The weekly RSI drops below 30 for the fifth time in history, and aNUPL turns negative, indicating holders are at a loss.

MarketWhisper·02-06 00:39

Mysterious United Arab Emirates company invests 500 million USD in shares! U.S. House of Representatives intervenes in investigation of World Liberty Financial

The U.S. Congress is investigating Donald Trump's family cryptocurrency business, particularly whether World Liberty Financial (WLFI) is involved with foreign capital and U.S. technology policy issues. The investigation stems from a suspected acquisition of WLFI shares by an UAE company for $500 million on the eve of Trump's inauguration, focusing on potential conflicts of interest and national security risks. Congressman Ro Khanna has requested detailed equity and profit information and is examining the use and benefits of the stablecoin USD1 issued by WLFI.

区块客·02-05 13:21

Glassnode: Bitcoin falls below the true average, market enters "bearish period"

Bitcoin falls below key support, spot trading volume remains sluggish, and investor losses lead to increased selling. The futures market is undergoing forced deleveraging, institutional capital inflows have significantly weakened, and the market has entered a defensive stance. This article is based on a piece by Glassnode, compiled, edited, and written by Foresight News.

(Previous summary: Bitcoin breaks below $70,000! Returns to November 2024 levels, fully retracing Trump-era gains)

(Additional background: Arthur Hayes warns of more black swan events for Bitcoin: today's BTC trend looks concerning)

Table of Contents

Core Insights

On-Chain Data Observations

Breaking below key support

Analysis of potential demand zones

Market pressure indicators

Comparison with historical cycles

Market Dynamics

Machine

動區BlockTempo·02-05 12:45

Bitcoin drops below $70,000! Returns to November 2024 levels, with all gains from Trump's term wiped out.

Bitcoin price drops below $70,000 again, returning to the level on the day of the 2024 U.S. presidential election, indicating that the market faces volatility risk. Investors should be cautious of technical selling pressure from leveraged funds. Analysts warn that in the worst-case scenario, it could fall to $25,000.

BTC-0,05%

動區BlockTempo·02-05 11:45

Trump Ready to Sign Crypto Market Structure Bill-Why This Is a Turning Point

_President Trump says he is ready to sign the Crypto Market Structure and Clarity Act, setting federal rules for crypto markets and exchanges._

President Donald Trump has said he is ready to sign the Crypto Market Structure and Clarity Act into law.

The statement has renewed attention on feder

BTC-0,05%

LiveBTCNews·02-05 10:45

Bessent in Heated Hearing: “Can’t Bail Out Bitcoin” Amid Scrutiny of Trump-Linked World Liberty

U.S. Treasury Secretary Scott Bessent faced intense Democratic scrutiny in a House hearing, firmly stating he lacks the authority to "bail out Bitcoin" or direct banks to buy crypto.

The hearing erupted into sharp exchanges over World Liberty Financial, a Trump-family-linked crypto venture that received a major investment from the UAE, raising conflict-of-interest and national security concerns. This contentious session underscores the deepening political divide over cryptocurrency regul

CryptopulseElite·02-05 05:33

Bitcoin keeps falling! An American congressman even asked if the government will step in to support the market? Treasury Secretary: We have no authority to rescue.

Bitcoin prices continue to decline. California State Assemblymember Sherman questions whether the Treasury Department has the authority to rescue Bitcoin. Treasury Secretary Bessent clearly states that they do not have the authority to proactively invest in Bitcoin. The government-held Bitcoin is solely obtained from law enforcement asset seizures. During the inquiry, Bessent and Congressman Micks had a heated exchange, with the focus involving the Trump family and related cryptocurrency companies.

CryptoCity·02-05 02:35

Why did Bitcoin plummet today? Trump, Greenland dispute, and four major hawkish bearish signals from the Federal Reserve

Bitcoin drops to $72,096, hitting a 16-month low, down 42% from the high of $126,000. Four major bearish factors: Trump-Greenland dispute causing US-Europe tensions, government shutdown delays, Warsh nomination sparking hawkish expectations, slow regulatory legislation. Bitcoin ETF saw a net outflow of $12 billion in March. MicroStrategy fell 5%, Riot and MARA dropped 11%.

MarketWhisper·02-05 00:43

Can the Government 'Bail Out' Bitcoin? Congressman Prompts Bizarre Exchange With Treasury Secretary

Treasury Secretary Scott Bessent defended the government's stance on Bitcoin during a tense hearing, stating he cannot direct banks to buy it and dodging questions about taxpayer funds for crypto investment. He clashed with Rep. Meeks over the Trump family’s crypto business.

Decrypt·02-04 18:36

The probability of Bitcoin falling below $65,000 exceeds 70%. What is the market worried about?

The weekend sell-off caused Bitcoin's price to briefly dip below the $75,000 psychological threshold, and market sentiment seems to have changed overnight. On the prediction platform Polymarket, an intriguing wager is heating up: the odds of Bitcoin falling below $65,000 in 2026 have surged to 72%, attracting nearly $1 million in bets. This is not just a numbers game; it acts as a mirror reflecting the deep currents surging within the current crypto market—from the frenzy following Trump's election victory to the widespread anxiety over "deep dips," with the rapid shift being astonishing.

What also alarms some veteran players is that this decline has put Strategy, the publicly traded company with the largest Bitcoin holdings globally, to its first test since the end of 2023, where its average cost basis is being breached. It's like a marathon leader suddenly finding the track beneath them becoming slippery.

区块客·02-04 12:16

Meme coin marketing new tactic: investing $300,000 to create a gilded statue of Donald Trump

Cryptocurrency investors spent $300,000 to create a 15-foot-tall gilded Trump statue to promote PATRIOT Meme Coin. However, the token's price plummeted, internal disputes arose, and the gold rush project ultimately fell into chaos. This article is based on a report by David Yaffe-Bellany from The New York Times, compiled, translated, and written by Foresight News.

(Background recap: Trump stated he does not want the U.S. government to shut down: he will "work across party lines" to prevent a shutdown, but the market does not buy it)

(Additional background: The prediction market shows a "detonation signal": the probability of a U.S. government shutdown has plummeted to 47%)

This President Trump statue is called "Don Colossus." It stands 15 feet tall, placed on a base weighing 7,000 pounds, with an overall height comparable to a two-story building. The giant statue is made of blue

動區BlockTempo·02-04 07:50

Trump's Midterm Election Backers Revealed: From Crypto.com to OpenAI, Crypto and AI Giants Donor Generously

Trump raised $429 million in the midterm elections, with a broad range of funding sources, including significant contributions from the AI and cryptocurrency industries. At the same time, funds from industries such as energy, healthcare, and finance are also supporting his campaign, demonstrating a strong financial advantage.

PANews·02-04 05:56

Trump receives $30 million from crypto giants! OpenAI invests $12.5 million to lobby for regulatory easing

Trump and allies raise $429 million, setting a record, with Maga PAC holding $304 million. The biggest donor, Crypto.com, donates $30 million; OpenAI's Brockman contributes $12.5 million; A16Z founders each donate $3 million. The crypto industry and Silicon Valley are investing heavily to gain regulatory relief, especially in crypto legislation and opposition to state-level AI regulation. The funds may be used for midterm elections or to maintain influence after leaving office.

MarketWhisper·02-04 03:32

Wosh is about to succeed as Federal Reserve Chair! The probability of a rate cut in June skyrocketed to 46%, boosting risk assets.

Trump nominates Kevin Wash as Federal Reserve Chair. Wash criticizes long-term tightening policies, and market expectations shift towards easing. CME FedWatch shows a 46% chance of rate cuts at the first meeting. Market confidence rebounds, stocks rise first, followed by cryptocurrencies. Bitcoin reacts strongly to liquidity expectations, and altcoins respond even more quickly.

MarketWhisper·02-04 03:28

Trump signs bill ending the U.S. government shutdown after 4 days, but concerns remain in mid-February

On February 3rd, Trump signed the funding bill, ending a four-day partial government shutdown and ensuring funding for most departments until September 30th. However, Department of Homeland Security funding was only extended until February 13th, and subsequent immigration enforcement policies still carry risks. If the two parties cannot reach an agreement, a shutdown may occur again.

動區BlockTempo·02-04 02:30

From Trump to the UAE, decoding the "state capture" moment in cryptocurrency

In early 2026, a deal shocked the world: the UAE royal family invested $500 million in a cryptocurrency company owned by the Trump family, and a few months later, the U.S. government approved the export of 500,000 of the most advanced NVIDIA AI chips to this Gulf nation. On the surface, these are two separate business and political news stories. But on a deeper level, they together form a milestone declaration—a surprising "coming of age" ceremony for the nearly two-decade-long social and technological experiment of cryptocurrency. This coming of age celebration is not a tribute to its ideals of decentralization but marks its complete "capture" by traditional power structures, which have begun to serve them.

The story of cryptocurrency begins with an escape. It was born from the cypherpunk mailing list, growing out of a rebellion against central bank over-issuance, financial censorship, and outdated intermediary systems. Satoshi Nakamoto's genesis block is inscribed with a satire of the old system, becoming a symbol of this movement.

TechubNews·02-04 01:42

Gate Daily (February 4): Ondo Finance launches tokenization services on IPO debut; Aave shuts down Family wallet

Bitcoin (BTC) experienced a slight rebound after a deep decline, currently around $76,220 as of February 4. Donald Trump signed a funding bill, ending the partial government "shutdown." Ondo Finance launched a "Global Listing" service, allowing IPO stocks to be tokenized on their first day. Aave's founder announced the closure of the Family wallet and the deactivation of the Avara brand, fully returning to Aave.

MarketWhisper·02-04 01:20

Trump administration shutdown crisis temporarily averted! House passes $1.2 trillion bill, Bitcoin remains sluggish

The House of Representatives passed a $1.2 trillion funding bill with a vote of 217:214, ending the four-day crisis of the Trump administration shutdown. Trump is expected to sign the bill to reopen the government. Bitcoin was slightly boosted by the news, rising to around $76,000, but has not yet fully shaken off its sluggish trend. The Senate's Digital Asset Market Structure Act is stalled due to Coinbase withdrawing support.

MarketWhisper·02-04 00:44

Why did Bitcoin drop today? The U.S. shot down an Iranian drone, and funds are fleeing to gold and silver.

Bitcoin fell below 73,000 on Tuesday, hitting a new low since Trump's election. The U.S. shooting down an Iranian drone triggered risk-off sentiment, with gold rising 6.7% and silver surging 10%. Glassnode shows that 44% of Bitcoin supply is in loss, with liquidations of 663 million. RSI hit 30, referencing a potential 20% drop in 2022 to test 60,000.

MarketWhisper·02-04 00:37

Crypto Market Structure Bill Moves Forward After Key Senate Committee Vote

Senate Agriculture Committee advances Digital Commodity Intermediaries Act 12–11, marking the first crypto market bill approval in the Senate.

President Trump signed the GENIUS Act in July 2025, regulating stablecoin issuers and reserve requirements in the U.S.

Full Senate v

BTC-0,05%

CryptoNewsLand·02-03 19:41

Trump Administration Reports Positive Outcome From White House Crypto Banking Meeting

White House officials said the crypto banking meeting stayed factually focused and aimed at practical solutions.

The Trump administration signaled progress on crypto policy talks as stablecoin yield remains the key open issue.

Officials want revised language soon to restart Senate

CryptoNewsLand·02-03 14:36

Did Epstein already meet Satoshi Nakamoto? The latest files reveal the darkest origins of cryptocurrency.

The latest Epstein files reveal: Did Bitcoin actually enter the sex offender radar as early as 2011? From Blockstream seed round investment, Ripple internal power struggles, to self-proclaimed contacts with "Bitcoin founders"—the dark origins of cryptocurrency are surfacing, a glimpse of which could rewrite the entire industry history.

(Previous background: Bitcoin becomes a battleground: the silent war between the White House and JPMorgan)

(Additional context: Musk taunts Trump again: Who will believe you if you don't release the Lolita Island files? "American Party" advocates prioritizing investigation)

Table of Contents

Is Epstein a "Crypto OG"?

Did Epstein meet Satoshi Nakamoto?

Conclusion

On January 30, the U.S. Department of Justice disclosed a large amount of "Epstein files" for the first time, immediately sparking widespread attention and discussion worldwide. When we see whether Musk "went to the island,"

動區BlockTempo·02-03 13:30

How will Federal Reserve Chair Jerome Powell's contradictory strategy of "interest rate cuts + balance sheet reduction" affect the stock and bond markets, the US dollar, and the crypto market?

Donald Trump nominates a hawkish candidate, Warsh, to lead the Federal Reserve. He advocates for "cutting interest rates but shrinking the balance sheet." This article analyzes what potential impacts this could have on the stock market, bond market, US dollar, and the crypto market.

(Background: Will Warsh promote capital flow into Bitcoin? After being nominated by Trump, gold prices fell below $5,000, and BTC briefly rebounded to $83,700.)

(Additional context: Trump-appointed Federal Reserve Chair Kevin Warsh on Bitcoin: It is not a substitute for the dollar but a "supervisor" of monetary policy.)

Table of Contents

- From Hawkish to "Pragmatic": A Shift in Monetary Policy Beliefs

- "Cutting Rates + Shrinking the Balance Sheet": A Dangerous Balancing Act

- "Good Cop" and "Software": Warsh's Bitcoin Paradox

- Era of Liquidity Tightening: The Survival Rules of Cryptocurrency

- The Ghost of CBDC: The Perspective of Warsh

動區BlockTempo·02-03 10:15

Trump Says He Was Not Involved in $500M Abu Dhabi WLFI Deal

Trump denied any involvement in the $500 million Abu Dhabi investment in World Liberty Financial.

The UAE-backed firm bought a 49% stake shortly before Trump’s 2025 inauguration.

US President Donald Trump has denied any knowledge of a $500 million investment by an Abu Dhabi company in WLFI. The W

TheNewsCrypto·02-03 08:58

Barclays warns: History shows that when the Federal Reserve Chair changes, the US stock market faces an average 16% correction

Barclays report shows that within six months of a Federal Reserve chair change, the S&P 500 typically declines by an average of 16%. The new chair, Waller, is known for his hawkish stance, which could lead to liquidity tightening and market uncertainty, affecting U.S. stocks and cryptocurrencies. Waller's push to reduce the balance sheet may conflict with Trump-era policies, and the market has not yet fully priced in this risk.

動區BlockTempo·02-03 07:55

CLARITY Act prospects bleak! Democrats criticize Trump family for earning billions and refusing to cooperate

The U.S. Senate Agriculture Committee passed the CLARITY Act at 12:11, with Democrats collectively opposing. Democratic lead negotiator Cory Booker criticized the Trump family for earning billions while refusing ethical regulations. The bill requires 60 votes; with only 53 Republican seats, they need to secure 7 Democratic senators. Three amendments were rejected, and the prospects for the midterm elections look bleak.

MarketWhisper·02-03 04:00

Load More