Gate Square | 1/31–2/1 Weekend Topic: #MyWeekendTradingPlan

🎁 Post with the topic, 100 lucky users * $50 position Voucher.

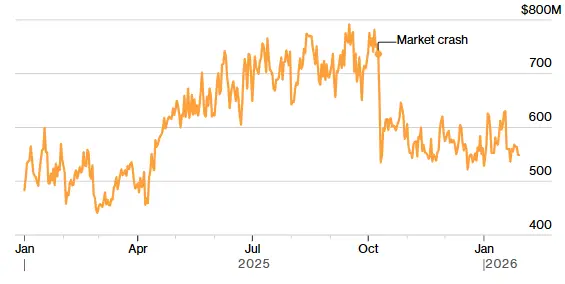

In a volatile market, some stay on the sidelines, while others position early for next week. This weekend, are you going offensive or defensive?

👉 Bullish bounce or further downside?

👉 Which tokens are you watching or trading?

👉 Any key crypto news or events to watch this weekend?

Share your trading plan or market news to win weekend rewards!

📅 Jan 31, 10:00 – Feb 2, 18:00 (UTC+8)

🎁 Post with the topic, 100 lucky users * $50 position Voucher.

In a volatile market, some stay on the sidelines, while others position early for next week. This weekend, are you going offensive or defensive?

👉 Bullish bounce or further downside?

👉 Which tokens are you watching or trading?

👉 Any key crypto news or events to watch this weekend?

Share your trading plan or market news to win weekend rewards!

📅 Jan 31, 10:00 – Feb 2, 18:00 (UTC+8)