# MyWeekendTradingPlan

38.91K

Pin

Gate广场_Official

Gate Plaza | 1/31–2/1 Weekend Exclusive Benefits Topic: #MyWeekendTradingPlan

🎁 Post with the topic, 100 lucky posters * each receive $50 position experience voucher weekend benefits

In a volatile market, some choose short-term trading, some wait patiently, and others plan ahead for next week's opportunities. This weekend, will you choose to attack or defend?

👉 Do you expect a rebound or continued decline in the weekend market?

👉 Which tokens are you currently watching or trading?

👉 Are there any industry news or sudden events worth noting this weekend?

Post and share your trading ideas

View Original🎁 Post with the topic, 100 lucky posters * each receive $50 position experience voucher weekend benefits

In a volatile market, some choose short-term trading, some wait patiently, and others plan ahead for next week's opportunities. This weekend, will you choose to attack or defend?

👉 Do you expect a rebound or continued decline in the weekend market?

👉 Which tokens are you currently watching or trading?

👉 Are there any industry news or sudden events worth noting this weekend?

Post and share your trading ideas

- Reward

- 20

- 21

- Repost

- Share

Luna_Star :

:

2026 GOGOGO 👊View More

Bitcoin (BTC) Technical Analysis: Fibonacci Supports, Channel Compression, and Breakout Scenarios

Bitcoin is currently trading around a critical Fibonacci-derived support zone, where price behavior is likely to define the next medium-term trend. The market is showing signs of compression within a descending and narrowing channel, increasing the probability of a directional breakout in the near term.

Key Fibonacci Support: 75,672 USD

According to Fibonacci retracement levels, 75,672 USD has been identified as a major support area.

This level was tested yesterday, confirming its technical releva

Bitcoin is currently trading around a critical Fibonacci-derived support zone, where price behavior is likely to define the next medium-term trend. The market is showing signs of compression within a descending and narrowing channel, increasing the probability of a directional breakout in the near term.

Key Fibonacci Support: 75,672 USD

According to Fibonacci retracement levels, 75,672 USD has been identified as a major support area.

This level was tested yesterday, confirming its technical releva

BTC-1,46%

- Reward

- 5

- 2

- Repost

- Share

Discovery :

:

Happy New Year! 🤑View More

#MyWeekendTradingPlan #MyWeekendTradingPlan

Most weekend trading plans are trash. Why? Because they’re built on hope, not structure. Liquidity dries up, volume thins, and amateurs confuse “quiet” with “safe.” If your weekend plan doesn’t start with risk control, you’re not trading — you’re donating.

Here’s how I’m approaching this weekend, step by step.

First, context matters more than entries. Weekend price action is not about trend continuation; it’s about range manipulation. Big players rarely initiate fresh positions — they probe liquidity, hunt stops, and reset positioning for Monday. If

Most weekend trading plans are trash. Why? Because they’re built on hope, not structure. Liquidity dries up, volume thins, and amateurs confuse “quiet” with “safe.” If your weekend plan doesn’t start with risk control, you’re not trading — you’re donating.

Here’s how I’m approaching this weekend, step by step.

First, context matters more than entries. Weekend price action is not about trend continuation; it’s about range manipulation. Big players rarely initiate fresh positions — they probe liquidity, hunt stops, and reset positioning for Monday. If

- Reward

- 3

- 1

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊$ETH has hit the final target and is forming a potential double bottom on the 4H.

Now we wait for the daily candle close above support for confirmation.

Bullish divergence printing on the Oscillator.

If confirmation comes, we may get a solid long opportunity from here

#MyWeekendTradingPlan #GateLiveMiningProgramPublicBeta #CryptoMarketPullback

Now we wait for the daily candle close above support for confirmation.

Bullish divergence printing on the Oscillator.

If confirmation comes, we may get a solid long opportunity from here

#MyWeekendTradingPlan #GateLiveMiningProgramPublicBeta #CryptoMarketPullback

ETH-4,32%

- Reward

- 1

- 2

- Repost

- Share

TheCaptainOfTheRetai :

:

Why are there still people shouting about a rise? Is there still someone calling for an increase?View More

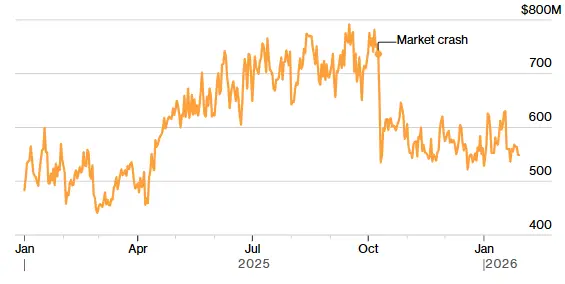

⚠️ BITCOIN LIQUIDITY IS DRYING UP

Bitcoin’s market depth, the capital available to absorb large orders, is still more than 30% below its October peak.

Last time this happened was after the FTX collapse.

Thin order books mean small flows can now move price fast.

$BTC #MyWeekendTradingPlan #GateLiveMiningProgramPublicBeta

Bitcoin’s market depth, the capital available to absorb large orders, is still more than 30% below its October peak.

Last time this happened was after the FTX collapse.

Thin order books mean small flows can now move price fast.

$BTC #MyWeekendTradingPlan #GateLiveMiningProgramPublicBeta

BTC-1,46%

- Reward

- like

- Comment

- Repost

- Share

#MyWeekendTradingPlan

#MyWeekendTradingPlan | Real & Deep Market Analysis

🧠 Weekend Market Psychology

Weekend markets operate without institutional dominance. Banks, funds, and major trading desks are largely inactive, leaving price action driven mostly by retail flow and low-volume participants.

As a result, price behavior becomes:

More emotional than logical

Highly sensitive to small orders

Prone to manipulation and false signals

This is why many weekend moves fail or reverse once institutional liquidity returns on Monday.

📉 Liquidity Reality & Market Structure

Weekends mean thin order bo

#MyWeekendTradingPlan | Real & Deep Market Analysis

🧠 Weekend Market Psychology

Weekend markets operate without institutional dominance. Banks, funds, and major trading desks are largely inactive, leaving price action driven mostly by retail flow and low-volume participants.

As a result, price behavior becomes:

More emotional than logical

Highly sensitive to small orders

Prone to manipulation and false signals

This is why many weekend moves fail or reverse once institutional liquidity returns on Monday.

📉 Liquidity Reality & Market Structure

Weekends mean thin order bo

- Reward

- 4

- 3

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

#MyWeekendTradingPlan

#MyWeekendTradingPlan

Weekend trading is all about preparation, patience, and discipline. With traditional markets closed, liquidity shifts mainly toward crypto, making weekends both an opportunity and a risk. My weekend trading plan is designed to protect capital first, then look for high-probability setups rather than chasing random price moves.

The first step in my plan is market review. Before the weekend starts, I analyze the weekly and daily charts to understand the broader trend. Is the market trending, ranging, or showing signs of exhaustion? I focus on key suppo

#MyWeekendTradingPlan

Weekend trading is all about preparation, patience, and discipline. With traditional markets closed, liquidity shifts mainly toward crypto, making weekends both an opportunity and a risk. My weekend trading plan is designed to protect capital first, then look for high-probability setups rather than chasing random price moves.

The first step in my plan is market review. Before the weekend starts, I analyze the weekly and daily charts to understand the broader trend. Is the market trending, ranging, or showing signs of exhaustion? I focus on key suppo

- Reward

- 9

- 15

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

#MyWeekendTradingPlan 1. The Rise of "Permitted" Assets

The ambiguity of "is it a security or a commodity?" is being resolved through structured frameworks like the GENIUS Act in the US and the full activation of MiCA in the EU.

Tokenized RWAs: Real-world assets (bonds, real estate, and private credit) now have clear legal pathways. This allows institutions to move these assets on-chain with the same legal protections as traditional certificates.

Stablecoins as "Tokenized Cash": Major jurisdictions (US, EU, UK, Singapore, Japan) now treat stablecoins as regulated payment instruments. Rules now

The ambiguity of "is it a security or a commodity?" is being resolved through structured frameworks like the GENIUS Act in the US and the full activation of MiCA in the EU.

Tokenized RWAs: Real-world assets (bonds, real estate, and private credit) now have clear legal pathways. This allows institutions to move these assets on-chain with the same legal protections as traditional certificates.

Stablecoins as "Tokenized Cash": Major jurisdictions (US, EU, UK, Singapore, Japan) now treat stablecoins as regulated payment instruments. Rules now

- Reward

- 14

- 16

- Repost

- Share

ybaser :

:

Watching Closely 🔍️View More

#MyWeekendTradingPlan

$ETH Weekly Update

Ethereum is trading around $2,600 after a clean rejection from the 1W 50 EMA. As mentioned earlier, this level was expected to act as strong resistance, and price reacted exactly as anticipated. I added more short exposure on the rejection, as this was not a reclaim attempt but a confirmed failure.

On the weekly timeframe, there is no structure supporting a sustained recovery. The market continues to print lower highs and lower closes, keeping the higher timeframe trend firmly bearish. More importantly, price is now pressuring the 1W 99 EMA (red line).

$ETH Weekly Update

Ethereum is trading around $2,600 after a clean rejection from the 1W 50 EMA. As mentioned earlier, this level was expected to act as strong resistance, and price reacted exactly as anticipated. I added more short exposure on the rejection, as this was not a reclaim attempt but a confirmed failure.

On the weekly timeframe, there is no structure supporting a sustained recovery. The market continues to print lower highs and lower closes, keeping the higher timeframe trend firmly bearish. More importantly, price is now pressuring the 1W 99 EMA (red line).

ETH-4,32%

- Reward

- 12

- 17

- Repost

- Share

MrFlower_ :

:

2026 GOGOGO 👊View More

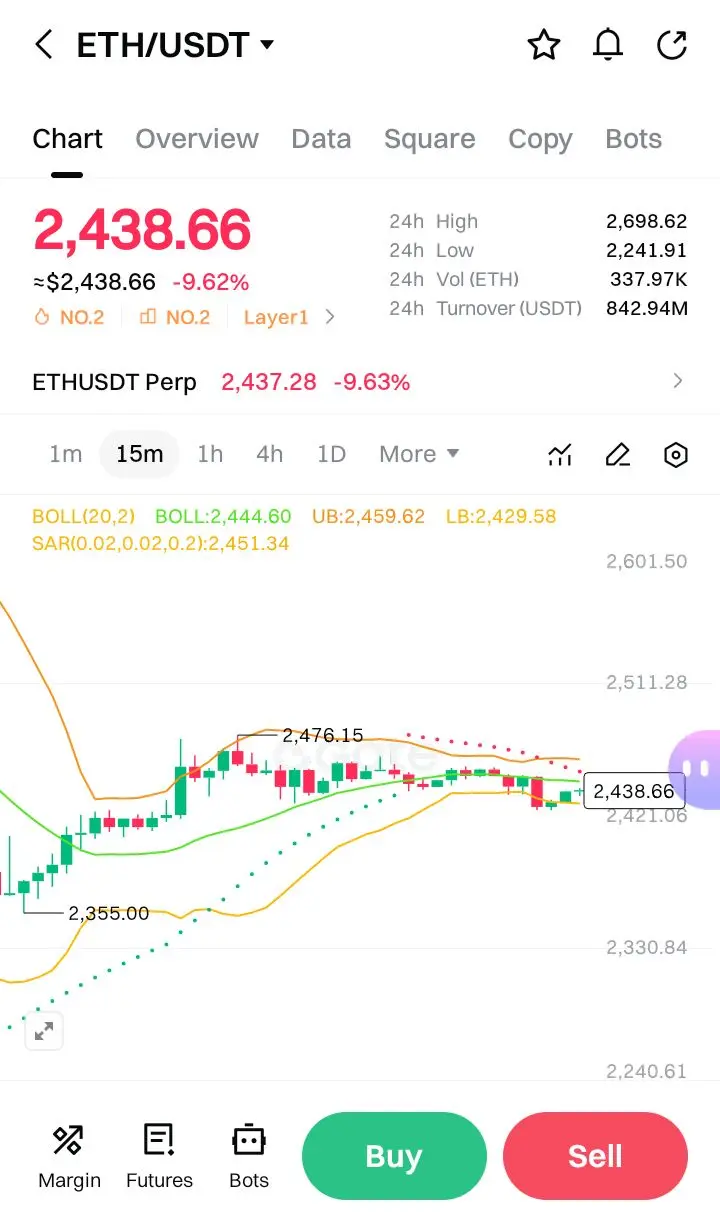

$ETH #MyWeekendTradingPlan Based on the Multi-timeframe charts, Here is the professional analysis and trade plan.

4H Chart - Identify Direction (Trend)

· Primary Trend: Bearish. Price has made a significant lower high (LH) and lower low (LL) structure from the ~$3,045 high. The sharp -9.5% move is a clear downtrend.

· Key Observation: Price is trading below the 4H Bollinger Band basis line (BOLL: ~2,470.50), confirming bearish momentum. The 24h Low ($2,241.91) is a critical macro level.

· Directional Bias: DOWN. Until price reclaims and holds above a significant 4H structure high (e.g., $2,630

4H Chart - Identify Direction (Trend)

· Primary Trend: Bearish. Price has made a significant lower high (LH) and lower low (LL) structure from the ~$3,045 high. The sharp -9.5% move is a clear downtrend.

· Key Observation: Price is trading below the 4H Bollinger Band basis line (BOLL: ~2,470.50), confirming bearish momentum. The 24h Low ($2,241.91) is a critical macro level.

· Directional Bias: DOWN. Until price reclaims and holds above a significant 4H structure high (e.g., $2,630

ETH-4,32%

- Reward

- 5

- 3

- Repost

- Share

MrFlower_ :

:

2026 GOGOGO 👊View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

38.91K Popularity

73.28K Popularity

370.87K Popularity

50.7K Popularity

69.55K Popularity

23.16K Popularity

27.92K Popularity

22.45K Popularity

94.33K Popularity

40.69K Popularity

35.55K Popularity

29.23K Popularity

19.26K Popularity

25.54K Popularity

216.91K Popularity

News

View MoreData: 139.02 BTC transferred from an anonymous address, with an estimated value of approximately $10.72 million USD.

6 m

Data: 89,100 SOL transferred from an anonymous address, valued at approximately $8,988,800.

26 m

The probability that the Federal Reserve will keep interest rates unchanged in March is 84.7%, and the probability of a rate cut is 15.3%.

31 m

Data: 20,800 SOL transferred out from Revolut, worth approximately $209,000,000 USD

56 m

ETH drops below 2300 USDT

2 h

Pin