EleventhQuantification

No content yet

EleventhQuantification

【$LINK Signal】Hold Cash and Wait — Weak Rebound in Downtrend Lacks Reversal Momentum

$LINK In a prolonged downtrend, the market is weakly consolidating, with the 4H rebound suppressed by EMA20, indicating weak buying strength.

🎯Direction: Hold Cash (NoPosition)

Market Analysis: Price is trading below EMA20 (8.69). The 4H candlesticks have been repeatedly rejected at this level, showing it as a valid resistance. RSI (41.3) is in a weak zone, not oversold, with no rebound momentum.

Hardcore Logic: Key data points to a bearish dominance. Funding rate (0.0041%) is positive, but open interest (OI)

View Original$LINK In a prolonged downtrend, the market is weakly consolidating, with the 4H rebound suppressed by EMA20, indicating weak buying strength.

🎯Direction: Hold Cash (NoPosition)

Market Analysis: Price is trading below EMA20 (8.69). The 4H candlesticks have been repeatedly rejected at this level, showing it as a valid resistance. RSI (41.3) is in a weak zone, not oversold, with no rebound momentum.

Hardcore Logic: Key data points to a bearish dominance. Funding rate (0.0041%) is positive, but open interest (OI)

- Reward

- like

- Comment

- Repost

- Share

【$AKT Signal】Hold Cash and Wait — Weak Consolidation in a Downtrend

$AKT Presents weak consolidation within a long-term downtrend, with the price suppressed below EMA20 and showing no rebound strength.

🎯 Direction: Hold Cash

Market Analysis: The price remains consistently suppressed by EMA20 (0.3164) on the 4H timeframe, with multiple rebounds failing to break through effectively. The depth imbalance of -24.31% indicates that the ask wall is significantly thicker than the bid wall, suggesting heavy selling pressure above.

Logical Rationale: Despite the price decline, open interest (OI) rema

View Original$AKT Presents weak consolidation within a long-term downtrend, with the price suppressed below EMA20 and showing no rebound strength.

🎯 Direction: Hold Cash

Market Analysis: The price remains consistently suppressed by EMA20 (0.3164) on the 4H timeframe, with multiple rebounds failing to break through effectively. The depth imbalance of -24.31% indicates that the ask wall is significantly thicker than the bid wall, suggesting heavy selling pressure above.

Logical Rationale: Despite the price decline, open interest (OI) rema

- Reward

- like

- Comment

- Repost

- Share

【$STX Signal】Hold cash and wait for a weak rebound in a downtrend

$STX In a long-term downtrend, the price is weakly oscillating and firmly suppressed below the EMA20 (0.2609). Every rebound encounters selling pressure. The buy volume ratio on the 4H timeframe remains below 0.5, indicating active selling dominance. The deep imbalance (25.98%) points to weak liquidity below, which could trigger further declines.

🎯Direction: Hold cash (NoPosition)

The current structure does not support high-probability long setups: 1) The trend is downward, and the price is below EMA20; 2) Open interest (OI) is

View Original$STX In a long-term downtrend, the price is weakly oscillating and firmly suppressed below the EMA20 (0.2609). Every rebound encounters selling pressure. The buy volume ratio on the 4H timeframe remains below 0.5, indicating active selling dominance. The deep imbalance (25.98%) points to weak liquidity below, which could trigger further declines.

🎯Direction: Hold cash (NoPosition)

The current structure does not support high-probability long setups: 1) The trend is downward, and the price is below EMA20; 2) Open interest (OI) is

- Reward

- like

- Comment

- Repost

- Share

【$NEAR Signal】Empty Position Waiting for Key Support Confirmation

$NEAR Continuing to weaken and fluctuate below EMA20, deep imbalance indicates heavy selling pressure. Currently, it is only a consolidation pattern during a downtrend.

🎯Direction: No Position (NoPosition)

Market Analysis: Price is firmly suppressed by EMA20 (1.0215), with a clear downward channel on the daily chart. Multiple rebounds on the 4H level have been quickly suppressed by selling pressure. The latest candlestick shows a buy/sell ratio of 0.5, indicating a stalemate between bulls and bears without major buying interest

View Original$NEAR Continuing to weaken and fluctuate below EMA20, deep imbalance indicates heavy selling pressure. Currently, it is only a consolidation pattern during a downtrend.

🎯Direction: No Position (NoPosition)

Market Analysis: Price is firmly suppressed by EMA20 (1.0215), with a clear downward channel on the daily chart. Multiple rebounds on the 4H level have been quickly suppressed by selling pressure. The latest candlestick shows a buy/sell ratio of 0.5, indicating a stalemate between bulls and bears without major buying interest

- Reward

- like

- Comment

- Repost

- Share

【$OP Signal】Hold cash and wait for key support confirmation

$OP is weakly oscillating below EMA20, with deep imbalance indicating buy orders piling up but the price unable to push higher. This is a typical pattern of incomplete accumulation.

🎯 Direction: Hold cash

Market analysis: The price continues to trade below 0.1879 (EMA20), with a medium-term downtrend. On the 4H timeframe, it has tested the 0.1800-0.1820 support zone multiple times, but the rebound highs are gradually decreasing (0.1875 -> 0.1856 -> 0.1855), forming an early descending triangle.

Core logic: The key contradiction lie

View Original$OP is weakly oscillating below EMA20, with deep imbalance indicating buy orders piling up but the price unable to push higher. This is a typical pattern of incomplete accumulation.

🎯 Direction: Hold cash

Market analysis: The price continues to trade below 0.1879 (EMA20), with a medium-term downtrend. On the 4H timeframe, it has tested the 0.1800-0.1820 support zone multiple times, but the rebound highs are gradually decreasing (0.1875 -> 0.1856 -> 0.1855), forming an early descending triangle.

Core logic: The key contradiction lie

- Reward

- like

- Comment

- Repost

- Share

【$BCH Signal】No Position + Oscillation and Observation Under Deep Imbalance

$BCH Is oscillating narrowly around the key EMA area (EMA20: 522.6, EMA50: 525.0), with price action showing intense battle between bulls and bears but lacking a clear direction.

🎯Direction: No Position (NoPosition)

Market Analysis: The 4H candlestick chart shows disorderly oscillation, with the latest candle closing near EMA20, volume shrinking, and the buy/sell ratio (0.48) indicating a slight advantage for sellers. The price has failed to effectively stabilize above EMA50, indicating insufficient medium-term trend

View Original$BCH Is oscillating narrowly around the key EMA area (EMA20: 522.6, EMA50: 525.0), with price action showing intense battle between bulls and bears but lacking a clear direction.

🎯Direction: No Position (NoPosition)

Market Analysis: The 4H candlestick chart shows disorderly oscillation, with the latest candle closing near EMA20, volume shrinking, and the buy/sell ratio (0.48) indicating a slight advantage for sellers. The price has failed to effectively stabilize above EMA50, indicating insufficient medium-term trend

- Reward

- like

- Comment

- Repost

- Share

【$RENDER Signal】Hold Cash and Wait: Observing Accumulation During Deep Imbalance

$RENDER Entering a low-range consolidation during a long-term downtrend, with the price suppressed below EMA20 (1.338). The overall structure remains weak.

🎯 Direction: Hold Cash (NoPosition)

The current market shows conflicting signals: on one hand, order book depth indicates that buy orders (Bids) are significantly thicker than sell orders (Asks), with an imbalance rate of 27.85%, suggesting institutional support and accumulation around 1.30. On the other hand, the price is declining with a negative funding r

View Original$RENDER Entering a low-range consolidation during a long-term downtrend, with the price suppressed below EMA20 (1.338). The overall structure remains weak.

🎯 Direction: Hold Cash (NoPosition)

The current market shows conflicting signals: on one hand, order book depth indicates that buy orders (Bids) are significantly thicker than sell orders (Asks), with an imbalance rate of 27.85%, suggesting institutional support and accumulation around 1.30. On the other hand, the price is declining with a negative funding r

- Reward

- like

- Comment

- Repost

- Share

【$DOT Signal】Hold cash and wait for valid reversal signals in a downtrend

$DOT In a prolonged downtrend, the market is weakly consolidating, with the price firmly suppressed by EMA20. The deep imbalance indicates heavy selling pressure above, currently only a continuation of the decline, with no effective reversal structure observed.

🎯Direction: Hold cash (NoPosition)

Market analysis: The price is fluctuating narrowly between 1.26 and 1.29, but EMA20 (1.312) forms a clear dynamic resistance. The daily trend is clearly downward, falling from 2.28 to 1.28, a decline of nearly 44%, with no signs

View Original$DOT In a prolonged downtrend, the market is weakly consolidating, with the price firmly suppressed by EMA20. The deep imbalance indicates heavy selling pressure above, currently only a continuation of the decline, with no effective reversal structure observed.

🎯Direction: Hold cash (NoPosition)

Market analysis: The price is fluctuating narrowly between 1.26 and 1.29, but EMA20 (1.312) forms a clear dynamic resistance. The daily trend is clearly downward, falling from 2.28 to 1.28, a decline of nearly 44%, with no signs

- Reward

- like

- Comment

- Repost

- Share

【$TRX Signal】Empty position + Weak consolidation awaiting direction

$TRX is consolidating weakly below EMA20, with a deep imbalance of -20.02% indicating heavy selling pressure and weak buying support.

🎯 Direction: Empty position

Market analysis: Price is being suppressed by EMA20 (0.2776) and EMA50 (0.2795). The 4H-level candlestick highs are gradually declining, indicating a bearish structure. Depth data shows sell orders (Asks) accumulating 67,566 contracts at 0.27712, far exceeding buy order volume, forming a clear resistance wall.

Logical core: Funding rate is -0.0082%, negative, but o

View Original$TRX is consolidating weakly below EMA20, with a deep imbalance of -20.02% indicating heavy selling pressure and weak buying support.

🎯 Direction: Empty position

Market analysis: Price is being suppressed by EMA20 (0.2776) and EMA50 (0.2795). The 4H-level candlestick highs are gradually declining, indicating a bearish structure. Depth data shows sell orders (Asks) accumulating 67,566 contracts at 0.27712, far exceeding buy order volume, forming a clear resistance wall.

Logical core: Funding rate is -0.0082%, negative, but o

- Reward

- like

- Comment

- Repost

- Share

【$AAVE Signal】Hold Cash and Wait—Downtrend Continuation, Lack of Reversal Momentum

$AAVE In the daily chart downtrend, a narrow range consolidation has formed on the 4H chart. The price is suppressed below the EMA20 (111.33), and EMA20/50 are in a bearish alignment. Depth imbalance is at -2.37%, with a clear accumulation of sell orders (Asks), indicating heavy resistance above. The 4H RSI hovers around 42, not entering the oversold zone, lacking rebound momentum. The buy/sell ratio is between 0.39-0.55, showing weak buying pressure, only a weak rebound. Open interest remains stable, and the fu

View Original$AAVE In the daily chart downtrend, a narrow range consolidation has formed on the 4H chart. The price is suppressed below the EMA20 (111.33), and EMA20/50 are in a bearish alignment. Depth imbalance is at -2.37%, with a clear accumulation of sell orders (Asks), indicating heavy resistance above. The 4H RSI hovers around 42, not entering the oversold zone, lacking rebound momentum. The buy/sell ratio is between 0.39-0.55, showing weak buying pressure, only a weak rebound. Open interest remains stable, and the fu

- Reward

- like

- Comment

- Repost

- Share

【$LYN Signal】Long | Short squeeze continues, deep imbalance support

$LYN After a volume breakout, the price consolidates strongly at high levels. This is a healthy reset in a short squeeze market, not a top.

🎯Direction: Long

🎯Entry: 0.1740 - 0.1760

🛑Stop Loss: 0.1694 (Break below the previous 4H K-line low, rigid stop loss)

🚀Target 1: 0.1850

🚀Target 2: 0.1950

Market analysis: After a volume-driven long bullish breakout on the 4H timeframe, the price remains strongly range-bound above the EMA20(0.1550). This is a strong signal of trend continuation. Although RSI(77.84) is in overbought ter

View Original$LYN After a volume breakout, the price consolidates strongly at high levels. This is a healthy reset in a short squeeze market, not a top.

🎯Direction: Long

🎯Entry: 0.1740 - 0.1760

🛑Stop Loss: 0.1694 (Break below the previous 4H K-line low, rigid stop loss)

🚀Target 1: 0.1850

🚀Target 2: 0.1950

Market analysis: After a volume-driven long bullish breakout on the 4H timeframe, the price remains strongly range-bound above the EMA20(0.1550). This is a strong signal of trend continuation. Although RSI(77.84) is in overbought ter

- Reward

- like

- Comment

- Repost

- Share

【$ZRO Signal】Long | Healthy Pullback After Short Squeeze Initiation

$ZRO After a nearly 20% surge in a single day, it is currently consolidating strongly above a key breakout level. The 4H timeframe shows typical short squeeze characteristics: funding rate -0.0332% (shorts paying), stable open interest, and continuous absorption by buyers. The depth imbalance of -10.08% indicates thicker sell walls, but the price remains firm, signaling main force control.

🎯 Direction: Long

🎯 Entry: 2.15 - 2.20 ( Previous high resistance turned support zone )

🛑 Stop loss: 2.05 ( Break below the start of t

View Original$ZRO After a nearly 20% surge in a single day, it is currently consolidating strongly above a key breakout level. The 4H timeframe shows typical short squeeze characteristics: funding rate -0.0332% (shorts paying), stable open interest, and continuous absorption by buyers. The depth imbalance of -10.08% indicates thicker sell walls, but the price remains firm, signaling main force control.

🎯 Direction: Long

🎯 Entry: 2.15 - 2.20 ( Previous high resistance turned support zone )

🛑 Stop loss: 2.05 ( Break below the start of t

- Reward

- like

- Comment

- Repost

- Share

【$STG Signal】Long Position - Short Squeeze Initiated, Deep Imbalance Support

$STG On the 4-hour chart, volume breakout of the previous consolidation zone, with a single candle surge of over 30%, currently in the acceleration phase of the short squeeze.

🎯Direction: Long

🎯Entry: 0.1880 - 0.1905

🛑Stop Loss: 0.1800 (Rigid stop loss, invalid if it breaks below previous high support and EMA20)

🚀Target 1: 0.2100

🚀Target 2: 0.2300

Hardcore logic: This is a classic short squeeze scenario. Core data resonance: 1) Funding rate at -0.5758%, extremely negative, indicating high cost for shorts; 2) Open

View Original$STG On the 4-hour chart, volume breakout of the previous consolidation zone, with a single candle surge of over 30%, currently in the acceleration phase of the short squeeze.

🎯Direction: Long

🎯Entry: 0.1880 - 0.1905

🛑Stop Loss: 0.1800 (Rigid stop loss, invalid if it breaks below previous high support and EMA20)

🚀Target 1: 0.2100

🚀Target 2: 0.2300

Hardcore logic: This is a classic short squeeze scenario. Core data resonance: 1) Funding rate at -0.5758%, extremely negative, indicating high cost for shorts; 2) Open

- Reward

- like

- Comment

- Repost

- Share

【$OG Signal】Short | RSI Bearish Divergence at the Top + Overheated Funding Rate

After a single-day surge of 21%, $OG formed a 4-hour RSI (85.28) serious overbought bearish divergence near 4.91, with the price approaching the 5.0 psychological level.

🎯 Direction: Short

🎯 Entry: 4.90 - 4.98

🛑 Stop Loss: 5.05 ( Rigid stop loss, breaking previous high and psychological level )

🚀 Target 1: 4.50

🚀 Target 2: 4.20

Market analysis: The 4-hour candlestick shows the last bullish candle with decreasing volume, indicating weakening buying power. The RSI reaching 85.28, along with a clear bearish div

View OriginalAfter a single-day surge of 21%, $OG formed a 4-hour RSI (85.28) serious overbought bearish divergence near 4.91, with the price approaching the 5.0 psychological level.

🎯 Direction: Short

🎯 Entry: 4.90 - 4.98

🛑 Stop Loss: 5.05 ( Rigid stop loss, breaking previous high and psychological level )

🚀 Target 1: 4.50

🚀 Target 2: 4.20

Market analysis: The 4-hour candlestick shows the last bullish candle with decreasing volume, indicating weakening buying power. The RSI reaching 85.28, along with a clear bearish div

- Reward

- like

- Comment

- Repost

- Share

【$ALLO Signal】Long | Healthy Pullback After Short Squeeze Initiation

After a 24% surge in 24 hours, $ALLO is consolidating strongly below the previous high resistance zone (0.0817). The 4H chart shows consecutive increasing bullish candles followed by a volume decrease and a pullback, which is a healthy reset after a short squeeze, not a top.

🎯 Direction: Long

🎯 Entry: 0.0750 - 0.0765 ( Support at the upper part of the previous 4H bullish candle body and EMA20 )

🛑 Stop Loss: 0.0717 ( Break below the previous 4H candle low, rigid stop loss )

🚀 Target 1: 0.0817 ( Previous high resistance )

View OriginalAfter a 24% surge in 24 hours, $ALLO is consolidating strongly below the previous high resistance zone (0.0817). The 4H chart shows consecutive increasing bullish candles followed by a volume decrease and a pullback, which is a healthy reset after a short squeeze, not a top.

🎯 Direction: Long

🎯 Entry: 0.0750 - 0.0765 ( Support at the upper part of the previous 4H bullish candle body and EMA20 )

🛑 Stop Loss: 0.0717 ( Break below the previous 4H candle low, rigid stop loss )

🚀 Target 1: 0.0817 ( Previous high resistance )

- Reward

- like

- Comment

- Repost

- Share

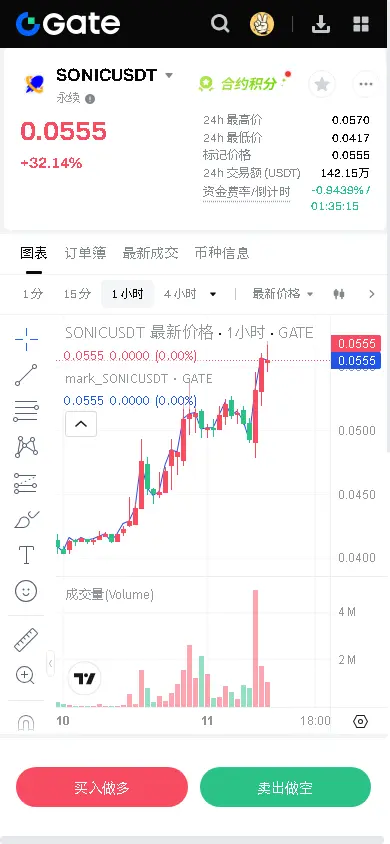

【$SONIC Signal】Long | Short Squeeze Pattern Confirmed, Deep Imbalance Supports Breakout

After a volume breakout above the previous high of 0.04996 on the 4-hour chart, a healthy pullback is underway. The price has stabilized above the EMA20 (0.0454), and open interest remains stable, indicating that funds have not exited.

🎯Direction: Long

🎯Entry: 0.0540 - 0.0550

🛑Stop Loss: 0.0480 $SONIC Rigid stop loss, below the previous breakout structure low(

🚀Target 1: 0.0620

🚀Target 2: 0.0680

The core logic is based on a short squeeze structure. The funding rate is as high as -0.7289%, indicating ex

View OriginalAfter a volume breakout above the previous high of 0.04996 on the 4-hour chart, a healthy pullback is underway. The price has stabilized above the EMA20 (0.0454), and open interest remains stable, indicating that funds have not exited.

🎯Direction: Long

🎯Entry: 0.0540 - 0.0550

🛑Stop Loss: 0.0480 $SONIC Rigid stop loss, below the previous breakout structure low(

🚀Target 1: 0.0620

🚀Target 2: 0.0680

The core logic is based on a short squeeze structure. The funding rate is as high as -0.7289%, indicating ex

- Reward

- like

- Comment

- Repost

- Share

【$RIVER Signal】Long | Healthy Pullback After Short Squeeze Initiation

$RIVER After a single-day surge of 26%, it is currently consolidating above a key breakout level. This is a healthy reset following a short squeeze, not a top.

🎯Direction: Long

🎯Entry: 16.80 - 17.10

🛑Stop Loss: 15.95 (Breaks below previous low and EMA20 support, rigid stop loss)

🚀Target 1: 18.60 (Previous high resistance)

🚀Target 2: 20.10 (Fibonacci 1.618 extension level)

Logic core: After a strong breakout above EMA20, open interest remains stable and funding rates are negative. This is a classic sign of a short squeez

View Original$RIVER After a single-day surge of 26%, it is currently consolidating above a key breakout level. This is a healthy reset following a short squeeze, not a top.

🎯Direction: Long

🎯Entry: 16.80 - 17.10

🛑Stop Loss: 15.95 (Breaks below previous low and EMA20 support, rigid stop loss)

🚀Target 1: 18.60 (Previous high resistance)

🚀Target 2: 20.10 (Fibonacci 1.618 extension level)

Logic core: After a strong breakout above EMA20, open interest remains stable and funding rates are negative. This is a classic sign of a short squeez

- Reward

- like

- Comment

- Repost

- Share

【$PIPPIN Signal】Hold off on trading — RSI is in extreme overbought territory, high risk of a short squeeze

After a violent 35% surge on the 4-hour chart, RSI has entered the extreme overbought zone (81), with the price far from the EMA20 moving average, indicating short-term momentum is severely overextended.

🎯 Direction: Hold off

Market analysis: The current price is at 0.3927. Depth imbalance data shows buy orders far exceed sell orders (Bid/Ask Ratio: 1.96), but this is a typical short squeeze structure rather than a healthy bullish trend. Funding rates are only 0.0175%, not reaching the

View OriginalAfter a violent 35% surge on the 4-hour chart, RSI has entered the extreme overbought zone (81), with the price far from the EMA20 moving average, indicating short-term momentum is severely overextended.

🎯 Direction: Hold off

Market analysis: The current price is at 0.3927. Depth imbalance data shows buy orders far exceed sell orders (Bid/Ask Ratio: 1.96), but this is a typical short squeeze structure rather than a healthy bullish trend. Funding rates are only 0.0175%, not reaching the

- Reward

- like

- Comment

- Repost

- Share

【$FHE Signal】Long | Short squeeze continues, deep imbalance support

$FHE After a volume breakout on the 4H timeframe, it consolidates strongly above the previous high resistance zone, forming a healthy reset.

🎯Direction: Long

🎯Entry: 0.1320 - 0.1340

🛑Stop Loss: 0.1258 (Breaks below the previous 4H candle body low, rigid stop loss)

🚀Target 1: 0.1450

🚀Target 2: 0.1540

Market analysis: Price has stabilized above the EMA20 (0.1074), trend structure intact. Three consecutive 4H candles with buy volume ratio >50%, indicating sustained demand.

Hardcore logic: This is a typical short squeeze scen

View Original$FHE After a volume breakout on the 4H timeframe, it consolidates strongly above the previous high resistance zone, forming a healthy reset.

🎯Direction: Long

🎯Entry: 0.1320 - 0.1340

🛑Stop Loss: 0.1258 (Breaks below the previous 4H candle body low, rigid stop loss)

🚀Target 1: 0.1450

🚀Target 2: 0.1540

Market analysis: Price has stabilized above the EMA20 (0.1074), trend structure intact. Three consecutive 4H candles with buy volume ratio >50%, indicating sustained demand.

Hardcore logic: This is a typical short squeeze scen

- Reward

- like

- Comment

- Repost

- Share

【$POWER Signal】Short Sell | Short Squeeze Failure + Triple Top Divergence Resonance

After a single-day surge of 48%, a clear supply zone has formed around 0.40, and the price is cooling off. RSI has reached 81.9, indicating severe overbought conditions, and on the 4H timeframe, a bearish divergence appears with new price highs but RSI not making new highs.

🎯Direction: Short Sell

🎯Entry: 0.380 - 0.395

🛑Stop Loss: 0.405 $POWER Rigid stop loss, invalidating the breakout above the previous high(

🚀Target 1: 0.345

🚀Target 2: 0.320

Hardcore logic: This is not a healthy trend continuation. 1) Fun

View OriginalAfter a single-day surge of 48%, a clear supply zone has formed around 0.40, and the price is cooling off. RSI has reached 81.9, indicating severe overbought conditions, and on the 4H timeframe, a bearish divergence appears with new price highs but RSI not making new highs.

🎯Direction: Short Sell

🎯Entry: 0.380 - 0.395

🛑Stop Loss: 0.405 $POWER Rigid stop loss, invalidating the breakout above the previous high(

🚀Target 1: 0.345

🚀Target 2: 0.320

Hardcore logic: This is not a healthy trend continuation. 1) Fun

- Reward

- like

- Comment

- Repost

- Share