SisterJMQi

No content yet

SisterJMQi

11.24 Ethereum Market Analysis and Strategy

After finding strong support around 2763, the price rebounded and is now stabilizing above 2850. In the short term, it faces resistance in the 2854-2865 range and is generally showing a consolidation pattern.

Key Indicators

MACD: Bearish momentum is weakening on the daily chart; 1-hour chart is oscillating.

RSI: Daily at 32.5, moving out of oversold territory; 1-hour at 59.2, running healthily.

Moving Averages: EMA7(2821.5) provides support, EMA120(2865.2) acts as resistance.

Trading Recommendations

Long: Light position near 2800, add at 2750, stop l

After finding strong support around 2763, the price rebounded and is now stabilizing above 2850. In the short term, it faces resistance in the 2854-2865 range and is generally showing a consolidation pattern.

Key Indicators

MACD: Bearish momentum is weakening on the daily chart; 1-hour chart is oscillating.

RSI: Daily at 32.5, moving out of oversold territory; 1-hour at 59.2, running healthily.

Moving Averages: EMA7(2821.5) provides support, EMA120(2865.2) acts as resistance.

Trading Recommendations

Long: Light position near 2800, add at 2750, stop l

ETH7,15%

- Reward

- like

- Comment

- Repost

- Share

Boom and bust, US Non-Farm Payrolls hit the scene!#美联储会议纪要将公布

This Thursday night, the market was once again turned upside down by the US September Non-Farm Payrolls data! Once the data was released, US stocks surged like they were on steroids, with the Dow, Nasdaq, and S&P 500 all running wild, and tech stocks especially turning red-hot. Meanwhile, gold and cryptocurrencies took a nosedive, especially in the crypto circle, plunging 5% overnight. This scene of ice and fire is even more exciting than a Hollywood blockbuster! 1. Impressive Non-Farm Data, but Is the Labor Market Still Soft? Sept

This Thursday night, the market was once again turned upside down by the US September Non-Farm Payrolls data! Once the data was released, US stocks surged like they were on steroids, with the Dow, Nasdaq, and S&P 500 all running wild, and tech stocks especially turning red-hot. Meanwhile, gold and cryptocurrencies took a nosedive, especially in the crypto circle, plunging 5% overnight. This scene of ice and fire is even more exciting than a Hollywood blockbuster! 1. Impressive Non-Farm Data, but Is the Labor Market Still Soft? Sept

BTC5,24%

- Reward

- like

- Comment

- Repost

- Share

ETH: The fluctuations are narrowing, approaching a direction choice.

Technical Overview: The 1-hour chart has formed a 3040-3060 consolidation platform, with significant selling pressure above 3050. The daily line is constrained by a descending trend line, and 3125 has become a critical moving average for the bulls and bears. The EMA30 (3028) has become the focus of contention for the day. If the critical point breaks above 3080: it opens up an upward space, targeting 3125-3160. If it breaks below 3028: it will test the support at 2950, and further decline aims for 2900. In extreme cases, a br

Technical Overview: The 1-hour chart has formed a 3040-3060 consolidation platform, with significant selling pressure above 3050. The daily line is constrained by a descending trend line, and 3125 has become a critical moving average for the bulls and bears. The EMA30 (3028) has become the focus of contention for the day. If the critical point breaks above 3080: it opens up an upward space, targeting 3125-3160. If it breaks below 3028: it will test the support at 2950, and further decline aims for 2900. In extreme cases, a br

ETH7,15%

- Reward

- like

- Comment

- Repost

- Share

After the rapid fall of BTC, can we buy the dip?

#比特币行情观察

When the market suddenly experiences a steep fall, investors' minds are often stirred by the thought of "buying the dip." Behind this temptation lies enormous opportunity, but also unfathomable risk. Why should one be cautious when buying the dip during a sharp decline? A sudden drop is often not an isolated event; it may be due to policy changes, major players unloading, or systemic risks. Attempting to catch a falling knife often results in bloody hands. The true bottom is not a specific point, but a range that requires time for

#比特币行情观察

When the market suddenly experiences a steep fall, investors' minds are often stirred by the thought of "buying the dip." Behind this temptation lies enormous opportunity, but also unfathomable risk. Why should one be cautious when buying the dip during a sharp decline? A sudden drop is often not an isolated event; it may be due to policy changes, major players unloading, or systemic risks. Attempting to catch a falling knife often results in bloody hands. The true bottom is not a specific point, but a range that requires time for

BTC5,24%

- Reward

- like

- Comment

- Repost

- Share

10.28 Ether Market Analysis The market situation is a bit awkward now, it can't fall through, and it can't rise either, both bulls and bears are consuming here. In the current situation, the price just broke 4100 and was pulled back to 4113, indicating that there are buyers below, but there is also considerable pressure above. The daily chart is suppressed below 4137, and the weekly line at 4032 has become the last defense line. Key positions to remember: support levels are these two, with 4080 being the first test. If it can't hold here, we have to look at the next one around 4050

ETH7,15%

- Reward

- like

- Comment

- Repost

- Share

10.23 Bitcoin market analysis

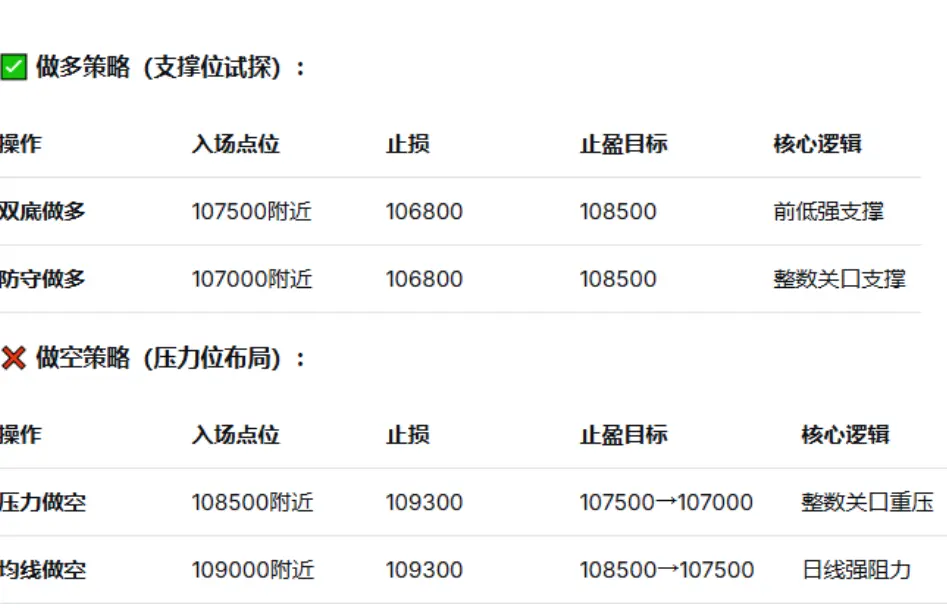

BTC is oscillating and it's exhausting! 108,500 is a huge pressure point, how can we break through, folks?

This market is really frustrating! BTC is swinging back and forth around 108,000, and every time it rushes to 108,500, it gets knocked down. The support at 107,500 is holding up, creating a double bottom structure, but the pressure above is just too heavy!

📊 Core Signal Interpretation

1. What the K-line tells you:

The double bottom formed at 107,500 in 1 hour, providing short-term support.

108.5k pressure is heavy, multiple tests have failed to pass.

The

BTC is oscillating and it's exhausting! 108,500 is a huge pressure point, how can we break through, folks?

This market is really frustrating! BTC is swinging back and forth around 108,000, and every time it rushes to 108,500, it gets knocked down. The support at 107,500 is holding up, creating a double bottom structure, but the pressure above is just too heavy!

📊 Core Signal Interpretation

1. What the K-line tells you:

The double bottom formed at 107,500 in 1 hour, providing short-term support.

108.5k pressure is heavy, multiple tests have failed to pass.

The

BTC5,24%

- Reward

- like

- Comment

- Repost

- Share

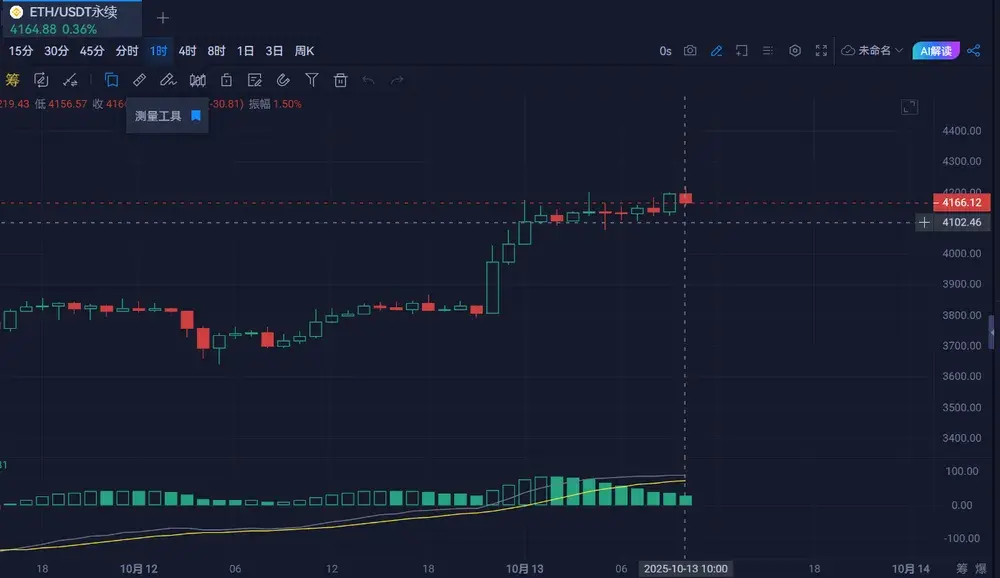

10.13 Current Market Dynamics and Trading Strategies for Ethereum

Market Status:

The market is quite tangled right now. After breaking through 4000, the 1-hour chart had a surge, but it was clearly knocked down around 4200. The daily chart has formed a long upper shadow, indicating significant selling pressure at this level. The 4-hour chart has formed an ascending wedge, which is a signal for a potential trend change.

Key positions are closely monitored.

Support below: The range of 4080-4030 is very critical; if it breaks, it may test 4000.

Resistance above: the 4200-4250 range, especially th

View OriginalMarket Status:

The market is quite tangled right now. After breaking through 4000, the 1-hour chart had a surge, but it was clearly knocked down around 4200. The daily chart has formed a long upper shadow, indicating significant selling pressure at this level. The 4-hour chart has formed an ascending wedge, which is a signal for a potential trend change.

Key positions are closely monitored.

Support below: The range of 4080-4030 is very critical; if it breaks, it may test 4000.

Resistance above: the 4200-4250 range, especially th

- Reward

- like

- Comment

- Repost

- Share

10.10 Ethereum Short-Term Price Trend Analysis and Trading Strategy

Looking for support in the pullback, watching for resistance in the rebound. Ether is currently at a critical stage of bullish and bearish competition. The 1-hour level has formed a descending channel with consecutive bearish candles, and the price has dropped from 4393.63 to 4369.28. The daily level shows a long lower shadow (4265.06-4368.09), indicating strong support near 4265. From a technical perspective, the narrowing MACD histogram on the 1-hour chart suggests a potential short-term rebound, but the price remains below

Looking for support in the pullback, watching for resistance in the rebound. Ether is currently at a critical stage of bullish and bearish competition. The 1-hour level has formed a descending channel with consecutive bearish candles, and the price has dropped from 4393.63 to 4369.28. The daily level shows a long lower shadow (4265.06-4368.09), indicating strong support near 4265. From a technical perspective, the narrowing MACD histogram on the 1-hour chart suggests a potential short-term rebound, but the price remains below

ETH7,15%

- Reward

- like

- Comment

- Repost

- Share

#行情震荡下的投资策略 10.9 The direction choice is imminent, will the Ethereum (ETH) market break above 4500 or below 4400?

First, let's look at the short term (1-hour chart): the price quickly dropped from the high point of 4539, reaching a low around 4441, and now it seems to be operating in a descending channel. The previously critical 4500 integer level has already been broken, and now it has turned into resistance.

Looking at the daily chart: On October 8th, a candlestick with a long lower shadow was formed (rising from 4410 to 4558), which looked like a rebound was coming, but the next day it

First, let's look at the short term (1-hour chart): the price quickly dropped from the high point of 4539, reaching a low around 4441, and now it seems to be operating in a descending channel. The previously critical 4500 integer level has already been broken, and now it has turned into resistance.

Looking at the daily chart: On October 8th, a candlestick with a long lower shadow was formed (rising from 4410 to 4558), which looked like a rebound was coming, but the next day it

ETH7,15%

- Reward

- 1

- 1

- Repost

- Share

MoneyIsWhatYouWishF :

:

Fluctuation is an opportunity 📊Ethereum (ETH) market encounters resistance at 4245 on September 30, what should be the next steps?

Currently, the 1-hour level has formed a clear "M top" pattern around 4245, and this position has become an important resistance area in the short term. The 4190-4200 range below currently provides support, but the two consecutive candlesticks in the early session have both closed with long upper shadows, indicating that the selling pressure above cannot be ignored. On the daily level, after the large bullish candlestick on September 29, the next day immediately saw a decrease in volume and form

Currently, the 1-hour level has formed a clear "M top" pattern around 4245, and this position has become an important resistance area in the short term. The 4190-4200 range below currently provides support, but the two consecutive candlesticks in the early session have both closed with long upper shadows, indicating that the selling pressure above cannot be ignored. On the daily level, after the large bullish candlestick on September 29, the next day immediately saw a decrease in volume and form

ETH7,15%

- Reward

- like

- Comment

- Repost

- Share

9.23 Bitcoin (BTC) Ethereum (ETH) latest market analysis and trading strategy

Bitcoin saw a drop of over ten thousand points last night, with the price falling from a high of around 115400 to around 111400. Currently, the price has rebounded to around 112500, and there is significant short-term price volatility. Previously, Mr. Coin also advised a cautious wait-and-see approach. There isn't much analysis to be done on the market at the moment. Recently, Mr. Coin has been reminding everyone to maintain good risk control and to pay attention to capturing profits in a timely manner. Despite t

View OriginalBitcoin saw a drop of over ten thousand points last night, with the price falling from a high of around 115400 to around 111400. Currently, the price has rebounded to around 112500, and there is significant short-term price volatility. Previously, Mr. Coin also advised a cautious wait-and-see approach. There isn't much analysis to be done on the market at the moment. Recently, Mr. Coin has been reminding everyone to maintain good risk control and to pay attention to capturing profits in a timely manner. Despite t

- Reward

- like

- Comment

- Repost

- Share

SOL short-term trading strategy: Key position layout and operation suggestions

The market fluctuates like ocean waves, while technical analysis acts like a surfer's board, helping traders seize opportunities and manage risks amid the fluctuations of SOL. As of September 19, 2025, the price of SOL is approximately $247.05, showing a strong oscillating trend overall. The technical indicators show that SOL has successively broken through key resistance levels of $240 and $250, with bullish strength prevailing, but there is also a possibility of short-term corrective adjustments.

1. Technical

The market fluctuates like ocean waves, while technical analysis acts like a surfer's board, helping traders seize opportunities and manage risks amid the fluctuations of SOL. As of September 19, 2025, the price of SOL is approximately $247.05, showing a strong oscillating trend overall. The technical indicators show that SOL has successively broken through key resistance levels of $240 and $250, with bullish strength prevailing, but there is also a possibility of short-term corrective adjustments.

1. Technical

SOL10,15%

- Reward

- like

- Comment

- Repost

- Share

9.19 Ethereum (ETH) latest market analysis

Ethereum has faced resistance near the 4645 level during the intraday uptrend, and is currently trading around 4595 following a pullback. The hourly chart has tested the upper key resistance multiple times without breaking through, so although there is a strong rebound and bullish sentiment warming up, it is still advisable to wait for a pullback to enter the market. Additionally, the upper gap has not been significantly breached, so we do not recommend blindly chasing long positions until the 4650 level is broken.

4-hour level: Recently, a long upper

Ethereum has faced resistance near the 4645 level during the intraday uptrend, and is currently trading around 4595 following a pullback. The hourly chart has tested the upper key resistance multiple times without breaking through, so although there is a strong rebound and bullish sentiment warming up, it is still advisable to wait for a pullback to enter the market. Additionally, the upper gap has not been significantly breached, so we do not recommend blindly chasing long positions until the 4650 level is broken.

4-hour level: Recently, a long upper

ETH7,15%

- Reward

- like

- Comment

- Repost

- Share

9.18 Ethereum (ETH) interest rate cut market analysis

Ethereum (ETH) is currently priced around $4610, experiencing a dramatic V reversal last night! After the Federal Reserve's interest rate decision, ETH briefly plummeted to the 4H EMA160 moving average, but then the bulls surged strongly, with a long lower shadow supporting the rebound. The price rose from the lower Bollinger Band all the way to the current upper resistance area (4610-4630). Currently, the market is slightly retracing to test the strength of the upper band, and the Bollinger Bands have not opened up significantly. The u

Ethereum (ETH) is currently priced around $4610, experiencing a dramatic V reversal last night! After the Federal Reserve's interest rate decision, ETH briefly plummeted to the 4H EMA160 moving average, but then the bulls surged strongly, with a long lower shadow supporting the rebound. The price rose from the lower Bollinger Band all the way to the current upper resistance area (4610-4630). Currently, the market is slightly retracing to test the strength of the upper band, and the Bollinger Bands have not opened up significantly. The u

ETH7,15%

- Reward

- like

- Comment

- Repost

- Share

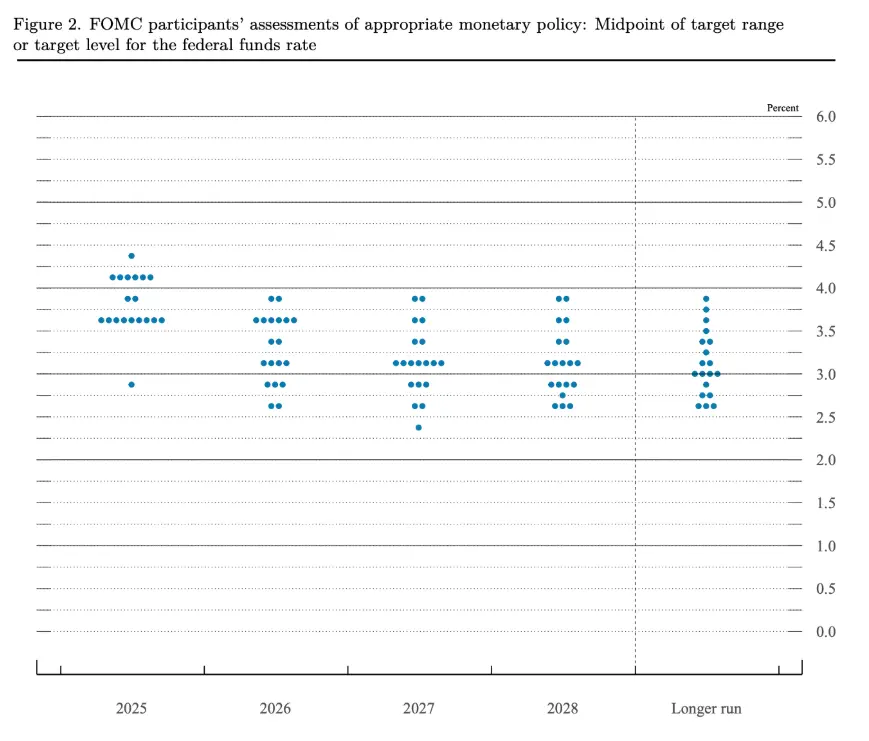

Interest rate cuts are in effect, coin prices are linked: how will the market move forward?

On Thursday, September 18, the Federal Reserve announced a 25 basis point rate cut, lowering the target range for the federal funds rate to 4%-4.25%, resuming the rate-cutting pace that had been paused since December of last year. New Federal Reserve Governor Milan cast a dissenting vote, supporting a 50 basis point cut.

The dot plot shows that among the 19 officials, 9 expect two rate cuts in 2025, two expect one rate cut, and six expect no further cuts. Additionally, one official believes there will b

On Thursday, September 18, the Federal Reserve announced a 25 basis point rate cut, lowering the target range for the federal funds rate to 4%-4.25%, resuming the rate-cutting pace that had been paused since December of last year. New Federal Reserve Governor Milan cast a dissenting vote, supporting a 50 basis point cut.

The dot plot shows that among the 19 officials, 9 expect two rate cuts in 2025, two expect one rate cut, and six expect no further cuts. Additionally, one official believes there will b

BTC5,24%

- Reward

- like

- Comment

- Repost

- Share

As the rate cut day approaches, the world's attention is focused on the Fed, and the decision to cut rates will set off an explosion in the market.

1: Hawkish surprise, no interest rate cut trend for now: a sudden crash, Bitcoin may drop over 15% in 10 minutes, and altcoins may bleed heavily. However, after the panic clears, there is often a V-shaped rebound; a crash is essentially free money. Countermeasure: reduce positions in contracts in advance, prepare USDT for bottom hunting in spot trading. Remember: black swans are often opportunities, don't sell at the bottom!

Second: Cut int

View Original1: Hawkish surprise, no interest rate cut trend for now: a sudden crash, Bitcoin may drop over 15% in 10 minutes, and altcoins may bleed heavily. However, after the panic clears, there is often a V-shaped rebound; a crash is essentially free money. Countermeasure: reduce positions in contracts in advance, prepare USDT for bottom hunting in spot trading. Remember: black swans are often opportunities, don't sell at the bottom!

Second: Cut int

- Reward

- like

- Comment

- Repost

- Share

9.17 Ethereum (ETH) Market Analysis and Trading Recommendations

Ethereum's market continued to adjust yesterday, with the decline gradually easing as it approached the 4425 level, but unfortunately, it did not test the support strength at the 4400 level as expected. Currently, the price is rebounding around 4510, but the strength of the intraday rebound is still weakening. The Ethereum market is maintaining a downward oscillation, so the strategy should remain focused on short positions during rebounds, with resistance levels at 3900 and 4000.

On the short-term hourly chart, the Bollinger

Ethereum's market continued to adjust yesterday, with the decline gradually easing as it approached the 4425 level, but unfortunately, it did not test the support strength at the 4400 level as expected. Currently, the price is rebounding around 4510, but the strength of the intraday rebound is still weakening. The Ethereum market is maintaining a downward oscillation, so the strategy should remain focused on short positions during rebounds, with resistance levels at 3900 and 4000.

On the short-term hourly chart, the Bollinger

ETH7,15%

- Reward

- like

- Comment

- Repost

- Share

9.17 Bitcoin (BTC) Ethereum (ETH) latest market analysis

Bitcoin's price movement yesterday maintained a wide range of fluctuations, with both bulls and bears oscillating back and forth within the range throughout the day. It touched the support level near 114500 at the low point and rebounded. From evening to early morning, the price rebounded above 116000, and at the time of writing, it is running at 116800.

From the daily chart perspective, the price ended with a bullish candle yesterday, and during the day it broke through the previous high. In the short-term hourly chart, the price is

Bitcoin's price movement yesterday maintained a wide range of fluctuations, with both bulls and bears oscillating back and forth within the range throughout the day. It touched the support level near 114500 at the low point and rebounded. From evening to early morning, the price rebounded above 116000, and at the time of writing, it is running at 116800.

From the daily chart perspective, the price ended with a bullish candle yesterday, and during the day it broke through the previous high. In the short-term hourly chart, the price is

BTC5,24%

- Reward

- like

- Comment

- Repost

- Share

"Interest Rate Cut Night Preview: What History Tells Us and How the Crypto World Responds?"

At 2 a.m. Beijing time on Thursday, the Federal Reserve is set to announce its interest rate decision. A 25 basis point rate cut is almost a foregone conclusion, but the real focus of the market will be on Powell's comments regarding future policies—how many more rate cuts will there be this year?

Unlike in the past, this round of interest rate cuts is initiated in a complex environment of high asset valuations, no economic recession, and inflation not fully receding. Historical experience shows tha

At 2 a.m. Beijing time on Thursday, the Federal Reserve is set to announce its interest rate decision. A 25 basis point rate cut is almost a foregone conclusion, but the real focus of the market will be on Powell's comments regarding future policies—how many more rate cuts will there be this year?

Unlike in the past, this round of interest rate cuts is initiated in a complex environment of high asset valuations, no economic recession, and inflation not fully receding. Historical experience shows tha

BTC5,24%

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More54.34K Popularity

48.4K Popularity

19.03K Popularity

45.59K Popularity

257.41K Popularity

Pin