2025 ARG Price Prediction: Expert Analysis and Market Forecast for Algorand's Future Performance

Introduction: Market Position and Investment Value of ARG

Argentine Football Association Fan Token (ARG) serves as the official fan token of the Argentina Football Association Club, designed to strengthen the relationship between fans and the club. As of December 2025, ARG has achieved a market capitalization of approximately $12.15 million, with a circulating supply of about 10.9 million tokens and a price hovering around $0.6075. This digital asset empowers fans through unique advantages, such as participating in club decision-making processes and benefiting from exclusive discounts and rewards.

This article will provide a comprehensive analysis of ARG's price trends through 2025-2030, integrating historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors.

Argentine Football Association Fan Token (ARG) Market Analysis Report

I. ARG Price History Review and Market Status

ARG Historical Price Evolution

- May 2022: ATL (All-Time Low) recorded at $0.424316 on May 12, 2022, marking the lowest point in the token's trading history.

- November 2022: ATH (All-Time High) achieved at $9.19 on November 18, 2022, representing peak market valuation during the bull market period.

- 2022-2025: Extended bear market cycle, with price declining approximately 93.4% from ATH to current levels, reflecting broader market contraction in the fan token sector.

ARG Current Market Status

As of December 23, 2025, ARG is trading at $0.6075, showing a modest decline of -0.55% in the past 24 hours. The token's 24-hour trading range spans from $0.6021 to $0.6396, indicating relatively stable price action within a narrow band.

Key Market Metrics:

- Market Capitalization: $6,619,010.78 (based on circulating supply)

- Fully Diluted Valuation: $12,150,000.00

- Circulating Supply: 10,895,491 ARG (54.48% of total supply)

- Total Supply: 20,000,000 ARG

- 24-Hour Trading Volume: $40,509.95

- Market Cap to FDV Ratio: 54.48%

- Market Dominance: 0.00037%

- Total Token Holders: 4,929

Recent Price Performance:

- 1-Hour Change: -0.31%

- 7-Day Change: -4.14%

- 30-Day Change: -11.43%

- 1-Year Change: -21.8%

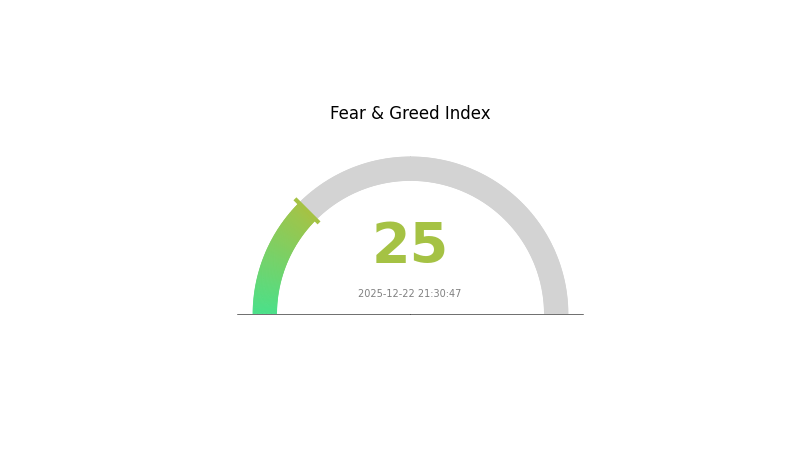

The token continues to trade significantly below its historical peak, with weakness persisting across multiple timeframes. Current market sentiment reflects extreme fear conditions (VIX reading of 25 as of December 22, 2025).

Click to view current ARG market price

ARG Market Sentiment Indicator

2025-12-22 Fear and Greed Index: 25 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index dropping to 25. This reading indicates significant market pessimism and investor anxiety. During periods of extreme fear, opportunities often emerge for contrarian investors. Market participants should exercise caution while monitoring for potential entry points. Such sentiment extremes typically precede market reversals. Consider your risk tolerance and investment strategy carefully before making trading decisions on Gate.com.

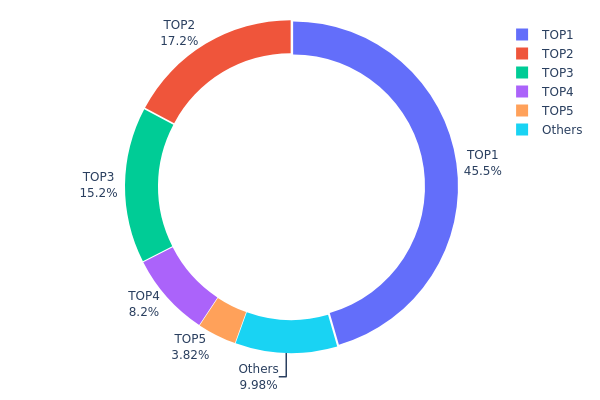

ARG Holdings Distribution

The address holdings distribution chart illustrates the concentration of ARG tokens across the blockchain network by tracking the top individual addresses and their respective token quantities. This metric serves as a critical indicator of token ownership structure, revealing the degree of decentralization and potential market concentration risks within the ARG ecosystem.

ARG exhibits a notably concentrated holdings pattern, with significant centralization evident at the top tier. The leading address (0x6F45...41a33D) commands 45.52% of total holdings, while the top three addresses collectively control 78.00% of the circulating supply. This extreme concentration in the hands of a limited number of stakeholders raises concerns regarding the token's decentralization status. The fourth and fifth largest addresses hold 8.20% and 3.82% respectively, with the remaining distributed addresses accounting for only 9.98% of total holdings. Such distribution dynamics indicate that decision-making power and market influence are heavily skewed toward a small cohort of major token holders.

The pronounced concentration observed in ARG's holder distribution carries meaningful implications for market dynamics and price stability. With nearly 80% of tokens controlled by the top three addresses, the potential for coordinated selling pressure or market manipulation remains considerable. This structural imbalance suggests limited liquidity dispersion in secondary markets and heightened vulnerability to volatile price swings driven by large holder actions. The decentralization deficit reflected in these metrics underscores the importance of monitoring whale activity and tracking any significant position shifts that could materially impact market sentiment and token valuation trajectories.

Click to view the current ARG Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x6F45...41a33D | 9104.51K | 45.52% |

| 2 | 0xc368...816880 | 3446.50K | 17.23% |

| 3 | 0x611f...dFB09d | 3049.99K | 15.25% |

| 4 | 0x0213...F3cF97 | 1640.34K | 8.20% |

| 5 | 0xc80A...e92416 | 763.65K | 3.82% |

| - | Others | 1995.01K | 9.98% |

II. Core Factors Influencing ARG's Future Price

Supply Mechanism

- Fixed Total Supply: ARG has a total supply of only 20,000,000 tokens, which directly impacts its price and investment value.

- Historical Pattern: Supply changes have historically driven ARG price fluctuations directly. The scarcity of the token is a core support for its long-term value.

- Current Impact: The fixed supply mechanism establishes a foundational constraint that supports price stability and long-term value appreciation potential.

Macroeconomic Environment

- Monetary Policy Impact: Interest rate fluctuations and monetary policy shifts affect investment attractiveness. As an asset related to the overall cryptocurrency market, ARG is sensitive to changes in interest rates and U.S. dollar movements.

- Inflation Hedge Attributes: ARG possesses potential "digital gold" characteristics in high-inflation environments, offering investors a hedge against currency devaluation.

- Geopolitical Factors: Geopolitical uncertainty can drive increased demand for ARG as investors seek alternative assets and diversification opportunities in unstable global conditions.

Three、2025-2030 ARG Price Forecast

2025 Outlook

- Conservative Forecast: $0.35-0.61

- Neutral Forecast: $0.60-0.69

- Optimistic Forecast: $0.69+ (Requires sustained market momentum and positive ecosystem developments)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Gradual recovery phase with increasing adoption and network expansion, showing steady appreciation with periodic volatility.

- Price Range Forecast:

- 2026: $0.62-0.76 (7% potential increase)

- 2027: $0.42-1.02 (16% potential increase)

- 2028: $0.79-1.17 (42% potential increase)

- Key Catalysts: Enhanced protocol functionality, institutional adoption, market sentiment improvement, and broader cryptocurrency market recovery trends.

2029-2030 Long-term Outlook

- Base Case: $0.70-1.14 (Market consolidation with moderate growth, assuming stable regulatory environment and steady user adoption)

- Optimistic Case: $0.87-1.60 (Strong ecosystem growth driven by successful product launches, strategic partnerships, and expanding use cases)

- Transformative Case: $1.60+ (Extreme favorable conditions including mainstream adoption, breakthrough technological advancement, and transformative market dynamics)

- 2030-12-31: ARG Trading at premium levels (Reflecting cumulative network effects and sustained development momentum)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.69771 | 0.6067 | 0.35189 | 0 |

| 2026 | 0.76308 | 0.6522 | 0.61959 | 7 |

| 2027 | 1.019 | 0.70764 | 0.42458 | 16 |

| 2028 | 1.16548 | 0.86332 | 0.78562 | 42 |

| 2029 | 1.13613 | 1.0144 | 0.69994 | 66 |

| 2030 | 1.60215 | 1.07527 | 0.87097 | 76 |

Argentine Football Association Fan Token (ARG) Professional Investment Analysis Report

I. Executive Summary

The Argentine Football Association Fan Token (ARG) is an official fan token designed to strengthen the relationship between fans and the Argentina Football Association Club. As a digital asset, ARG enables fans to participate in club decision-making processes and benefit from exclusive discounts and rewards.

Key Metrics (as of December 23, 2025):

- Current Price: $0.6075

- 24H Change: -0.55%

- Market Cap: $6,619,010.78

- Fully Diluted Valuation: $12,150,000

- Circulating Supply: 10,895,491 ARG

- Total Supply: 20,000,000 ARG

- All-Time High: $9.19 (November 18, 2022)

- All-Time Low: $0.424316 (May 12, 2022)

- Holders: 4,929

II. Project Overview

Project Background

ARG is the official fan token of the Argentina Football Association Club, operating on the Chiliz 2.0 blockchain network. As a fan engagement token, it represents a new paradigm in sports-related digital assets, allowing supporters to actively participate in club governance and access exclusive benefits.

Core Value Proposition

- Governance Participation: Token holders can vote on club-related decisions and initiatives

- Exclusive Benefits: Access to special discounts, rewards, and member-only content

- Community Engagement: Strengthens the bond between fans and the organization

- Digital Ownership: Provides verifiable ownership of fan status through blockchain technology

Blockchain Infrastructure

- Chain: Chiliz 2.0 (CHZ2)

- Contract Address: 0xd34625c1c812439229EF53e06f22053249D011f5

- Scan URL: https://scan.chiliz.com/address/0xd34625c1c812439229EF53e06f22053249D011f5

III. Market Analysis

Price Performance Trends

| Time Period | Price Change | Change Amount |

|---|---|---|

| 1 Hour | -0.31% | -$0.0019 |

| 24 Hours | -0.55% | -$0.0034 |

| 7 Days | -4.14% | -$0.0262 |

| 30 Days | -11.43% | -$0.0784 |

| 1 Year | -21.8% | -$0.1694 |

Market Analysis: ARG exhibits consistent downward pressure across all timeframes, indicating sustained selling pressure. The token has declined significantly from its historical high, reflecting broader challenges in the fan token sector.

Market Capitalization and Dominance

- Market Cap Rank: #1,373

- Market Dominance: 0.00037%

- 24H Trading Volume: $40,509.95

- Circulating Supply Ratio: 54.48%

- Market Cap to FDV Ratio: 54.48%

The relatively low market dominance and trading volume suggest limited institutional interest and liquidity constraints in the current market environment.

IV. ARG Professional Investment Strategy and Risk Management

ARG Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Sports enthusiasts with strong affinity to Argentine football, long-term community members, and patient capital investors

- Operational Recommendations:

- Accumulate during periods of reduced market sentiment when prices are near support levels

- Participate actively in governance votes to maximize utility and community engagement

- Store holdings securely and maintain a diversified portfolio to mitigate concentration risk

(2) Active Trading Strategy

-

Technical Analysis Considerations:

- Support and Resistance Levels: Monitor the $0.424 support (all-time low) and $0.60 current price level for trading signals

- Volume Analysis: Track 24-hour trading volumes to identify potential breakout opportunities

-

Trading Considerations:

- Short-term traders should be cautious given the downward price trend over 30 days and 1 year

- Identify potential reversal patterns only after confirmation of trend stabilization

- Set strict stop-loss orders to limit downside exposure

ARG Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0-2% of total portfolio

- Aggressive Investors: 2-5% of total portfolio

- Professional Investors: 1-3% of total portfolio with specific use-case allocation

(2) Risk Hedging Strategies

- Portfolio Diversification: Combine ARG holdings with established cryptocurrencies and traditional assets to reduce volatility impact

- Position Sizing: Implement strict position limits to prevent catastrophic losses; no single position should exceed individual risk tolerance thresholds

(3) Secure Storage Solution

- Custody Options: Store ARG tokens on Gate.com for active trading, or transfer to personal wallets for long-term holdings

- Security Best Practices:

- Enable two-factor authentication on all trading accounts

- Use cold storage solutions for significant holdings

- Maintain multiple backup copies of private keys in secure locations

- Never share private keys or seed phrases with any third parties

V. Potential Risks and Challenges

ARG Market Risks

- Liquidity Risk: Limited 24-hour trading volume of approximately $40,509 creates potential slippage challenges for larger trades

- Price Volatility: Historical price swings from $9.19 to $0.42 demonstrate extreme volatility characteristic of speculative assets

- Sustained Downtrend: Negative performance across all measured timeframes (1H, 24H, 7D, 30D, 1Y) indicates structural selling pressure

ARG Regulatory Risks

- Sports Licensing Uncertainty: Changes in licensing agreements with the Argentine Football Association could impact token utility and value

- Regulatory Classification: Fan tokens face evolving regulatory scrutiny across different jurisdictions regarding securities classification

- Geopolitical Factors: Restrictions on Argentine sports organizations or cryptocurrency usage in specific regions could limit market access

ARG Technical Risks

- Blockchain Dependency: Token viability depends on continued Chiliz 2.0 network functionality and security

- Smart Contract Risk: Potential vulnerabilities in the token contract could threaten user funds

- Adoption Risk: Low holder count (4,929 addresses) suggests limited market penetration and network effects

VI. Conclusions and Action Recommendations

ARG Investment Value Assessment

ARG operates in a specialized niche of sports-related digital assets, offering utility through fan engagement and governance participation. However, the token faces significant headwinds including sustained price depreciation, limited liquidity, and structural challenges in the fan token sector. The gap between fully diluted valuation ($12.15M) and current market cap ($6.62M) suggests moderate dilution risk as circulating supply expands. Long-term viability depends on sustained fan participation, successful club initiatives, and broader acceptance of fan tokens in the sports industry.

ARG Investment Recommendations

✅ Beginners: Limit exposure to 1-2% of speculative holdings; prioritize education about fan token mechanics before investing significant capital

✅ Experienced Traders: Consider small positions primarily for governance participation and community engagement rather than capital appreciation; implement strict risk management protocols

✅ Institutional Investors: Evaluate fan token exposure only within broader sports-tech diversification strategies; require thorough due diligence on licensing agreements and regulatory status

ARG Trading Participation Methods

- Exchange Trading: Access ARG through Gate.com platform for spot trading and price discovery

- Governance Participation: Acquire tokens specifically to participate in club decision-making processes and governance votes

- Community Engagement: Join fan communities to understand token utility, access exclusive benefits, and participate in club initiatives

Cryptocurrency investment carries extremely high risk. This report does not constitute investment advice. Investors should make decisions based on their individual risk tolerance and financial situation. It is strongly recommended to consult with qualified financial advisors before making investment decisions. Never invest capital you cannot afford to lose completely.

FAQ

Is arg a buy?

ARG is rated a Moderate Buy based on analyst consensus. Strong fundamental metrics and market sentiment support a positive outlook. Consider your investment strategy before trading.

What is ARG token and what is its use case?

ARG token is a digital asset enabling fans to participate in activities related to Argentina's national football team. It provides voting rights, exclusive content access, and community engagement opportunities within the fan ecosystem.

What factors could influence ARG price in the future?

ARG price could be influenced by project announcements, technological developments, market sentiment, trading volume, regulatory changes, and overall cryptocurrency market conditions.

What are the risks involved in investing in ARG?

ARG investments carry market volatility risk, liquidity risk, and regulatory uncertainty. Crypto markets are highly speculative, prices fluctuate rapidly, and past performance doesn't guarantee future results. Research thoroughly before investing.

How does ARG compare to similar projects in the same category?

ARG distinguishes itself through innovative tokenomics and robust community governance. With superior transaction volume and enhanced scalability compared to peers, ARG offers faster settlement times and lower fees. Its unique incentive mechanisms and strategic partnerships position it as a leading contender in the category.

What is the historical price performance of ARG?

ARG has demonstrated steady market performance with a 0.55% change over the past year. The token has shown resilience across market cycles, with a notable 52-week trading range reflecting moderate volatility. Historical data indicates consistent participation in market movements.

2025 BGSC Price Prediction: Expert Analysis and Market Forecast for the Coming Year

2025 KLV Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Aergo Price Analysis: 112% Surge in 90 Days - What's Next for 2025?

2025 XLM Price Prediction: Stellar Lumens' Potential Growth Trajectory in a Maturing Crypto Ecosystem

2025 1INCH Price Prediction: Analyzing Growth Potential and Market Trends for the DeFi Aggregator Token

2025 SUTPrice Prediction: Comprehensive Analysis and Forecast of Market Trends and Value Projections

Is MANEKI (MANEKI) a good investment?: A comprehensive analysis of potential returns, market risks, and future growth prospects for 2024 and beyond

Is Pixelmon (MONPRO) a good investment?: A comprehensive analysis of the blockchain gaming token's potential returns and market viability

Is Chain Games (CHAIN) a good investment?: A Comprehensive Analysis of Market Potential, Risk Factors, and Future Outlook

Is Enosys Global (HLN) a good investment?: A comprehensive analysis of the company's financial performance, market position, and growth prospects

TET vs DOT: Understanding the Key Differences Between Two Essential Testing Methodologies