2025 B2 Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: B2's Market Position and Investment Value

BSquared Network (B2) stands as a modular Bitcoin scaling solution that introduces innovative infrastructure including B² Rollup (the first Bitcoin rollup based on zero-knowledge proof verification), B² Hub (the first Bitcoin Data Availability layer achieving finality on the Bitcoin network), and MiningSquared (the first Bitcoin mining pool offering auto-subscribable BTC yield products). As of December 2025, B2 has established itself in the cryptocurrency market with a market capitalization of approximately $133.71 million USD and a circulating supply of around 46.89 million tokens, currently trading at $0.6367 per token. This pioneering Bitcoin scaling solution is playing an increasingly critical role in the modular blockchain infrastructure ecosystem.

This article will conduct a comprehensive analysis of B2's price trajectory from 2025 through 2030, integrating historical patterns, market supply-demand dynamics, ecosystem developments, and macroeconomic factors to provide investors with professional price forecasts and actionable investment strategies.

B² Network (B2) Market Analysis Report

I. B2 Price History Review and Market Status

B2 Historical Price Evolution

Based on the available data from December 19, 2025:

- All-Time High (ATH): $2.2184, reached on October 12, 2025

- All-Time Low (ATL): $0.3154, reached on June 14, 2025

- Current Price Range: B2 has experienced a significant correction from its peak, trading approximately 71.3% below its all-time high, indicating substantial price volatility since the project's market entry

B2 Current Market Status

Price Performance:

- Current Price: $0.6367

- 24-Hour Change: +7.77% ($0.045904787974390016)

- 7-Day Change: -3.07%

- 30-Day Change: -21.5%

- 1-Year Change: +13.25%

- 24-Hour Price Range: $0.5802 - $0.6455

Market Capitalization Data:

- Market Cap: $29,856,773.1

- Fully Diluted Valuation (FDV): $133,707,000

- Market Cap/FDV Ratio: 22.33%

- Market Dominance: 0.0041%

- 24-Hour Trading Volume: $384,752.53

Supply Structure:

- Circulating Supply: 46,893,000 B2 (22.33% of total)

- Total Supply: 210,000,000 B2

- Max Supply: 210,000,000 B2

- Number of Holders: 30,079

- Listed on 20 exchanges

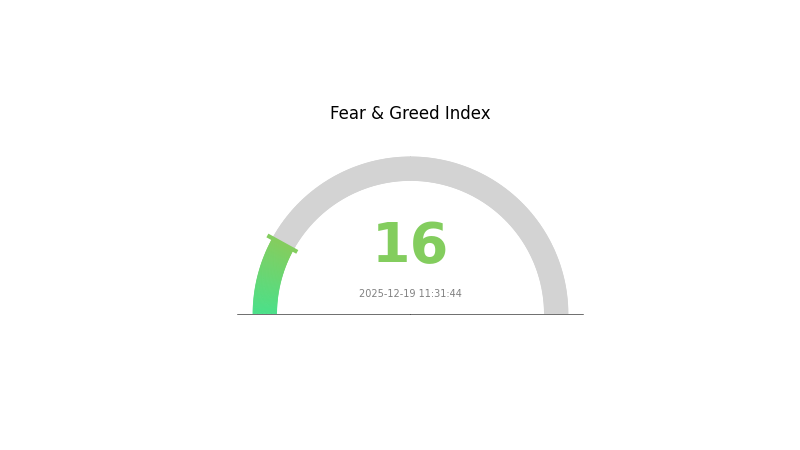

Market Sentiment: The current market displays "Extreme Fear" conditions (VIX: 16), suggesting heightened uncertainty and risk aversion among investors.

Market Position: B2 currently ranks #693 in global cryptocurrency market capitalization, reflecting its emerging status within the broader crypto ecosystem.

Visit B2 Market Price on Gate.com for real-time pricing updates

B2 Market Sentiment Indicator

2025-12-19 Fear and Greed Index: 16 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is experiencing extreme fear with an index reading of 16. This indicates strong pessimism among investors, with significant selling pressure and risk aversion dominating market sentiment. Such extreme fear levels often present contrarian opportunities for long-term investors, as historically these periods have preceded market rebounds. However, caution remains warranted as further downside cannot be ruled out. Traders should monitor key support levels and consider dollar-cost averaging strategies. The sustained extreme fear suggests capitulation may be nearing completion.

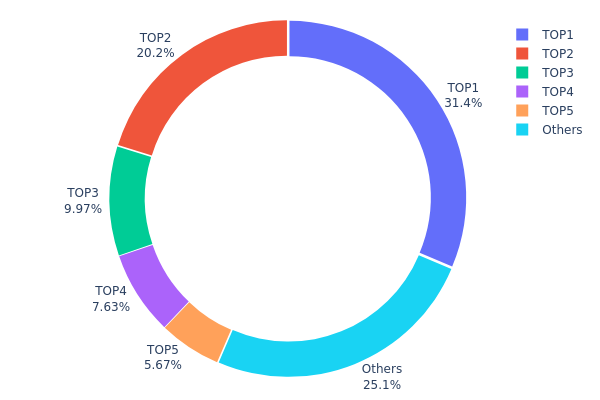

B2 Holding Distribution

The address holding distribution chart represents the concentration pattern of B2 token ownership across the blockchain network, illustrating how token holdings are allocated among different wallet addresses. This metric serves as a critical indicator for assessing the decentralization level, market structure stability, and potential risks associated with price manipulation or large-scale liquidation events.

The current holding distribution of B2 demonstrates pronounced concentration characteristics, with the top five addresses collectively controlling approximately 74.89% of the total token supply. The largest holder (0xa8fa...307120) commands 31.38% of all B2 tokens, while the second-largest address (0xa8ca...6fc67c) maintains 20.24% of the circulating supply. This significant concentration in the hands of a limited number of stakeholders raises concerns regarding potential market vulnerability. The remaining holders, represented by the "Others" category, account for only 25.11% of total holdings, indicating a fragmented base of smaller investors relative to the dominant positions held by major token holders.

Such extreme concentration creates asymmetrical risk dynamics within the B2 ecosystem. Large-scale token movements by top-tier addresses could trigger substantial price volatility, as coordinated selling by major holders would likely exceed typical market liquidity thresholds. This structural imbalance suggests a relatively low degree of decentralization and heightens sensitivity to whale activity. The market structure reflects characteristics commonly associated with nascent or early-stage tokens where institutional or foundational entities retain disproportionate control. Monitoring shifts in these holding patterns remains essential for assessing changes in governance stability and potential shifts in market sentiment driven by concentrated stakeholder actions.

For current B2 holding distribution data, visit Gate.com

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xa8fa...307120 | 65099.76K | 31.38% |

| 2 | 0xa8ca...6fc67c | 42000.00K | 20.24% |

| 3 | 0x1488...27c95f | 20685.00K | 9.97% |

| 4 | 0x69c2...2dc3ce | 15834.00K | 7.63% |

| 5 | 0xc882...84f071 | 11768.82K | 5.67% |

| - | Others | 52057.00K | 25.11% |

II. Core Factors Affecting B2's Future Price

Supply Mechanism

- Total Supply: B2 has a total supply of 210,000,000 tokens, which directly impacts price and investment value.

- Historical Pattern: Historical experience demonstrates that supply changes have a significant driving effect on cryptocurrency prices.

- Current Impact: Future supply adjustments will continue to influence price movements. The scarcity attribute serves as a core support for long-term investment.

Macroeconomic Environment

- Monetary Policy Impact: Federal Reserve monetary policy shifts and interest rate environments play important roles in cryptocurrency market movements.

- Geopolitical Factors: Geopolitical conflicts and international situations influence the broader market sentiment and asset allocation decisions.

Three、2025-2030 B2 Price Forecast

2025 Outlook

- Conservative Forecast: $0.51-$0.66

- Neutral Forecast: $0.66-$0.79

- Optimistic Forecast: $0.79+ (requires sustained market momentum and positive regulatory developments)

2026-2028 Mid-term Outlook

- Market Stage Expectations: Potential consolidation phase with gradual accumulation, followed by recovery and stabilization as market conditions improve

- Price Range Predictions:

- 2026: $0.64-$1.07

- 2027: $0.46-$1.10

- 2028: $0.61-$1.14

- Key Catalysts: Institutional adoption acceleration, ecosystem expansion, technology upgrades, and improved market sentiment

2029-2030 Long-term Outlook

- Base Case Scenario: $0.89-$1.21 by 2029 (assuming steady market growth and moderate adoption)

- Optimistic Scenario: $0.69-$1.54 by 2030 (with significant institutional participation and mainstream integration)

- Transformative Scenario: Above $1.54 by 2030 (under conditions of breakthrough technological innovation, major partnership announcements, or significant macroeconomic shifts favoring digital assets)

Note: These forecasts are based on historical data analysis and market trends. Investors should conduct thorough due diligence on Gate.com and other platforms before making investment decisions. Actual price movements may differ significantly from predictions due to market volatility and unforeseen circumstances.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.79032 | 0.6586 | 0.51371 | 3 |

| 2026 | 1.0722 | 0.72446 | 0.64477 | 13 |

| 2027 | 1.10495 | 0.89833 | 0.45815 | 41 |

| 2028 | 1.14187 | 1.00164 | 0.611 | 57 |

| 2029 | 1.21108 | 1.07175 | 0.88956 | 68 |

| 2030 | 1.54091 | 1.14142 | 0.69626 | 79 |

BSquared Network (B2) Professional Investment Strategy and Risk Management Report

IV. B2 Professional Investment Strategy and Risk Management

B2 Investment Methodology

(1) Long-term Holding Strategy

-

Target Investors: Bitcoin scaling enthusiasts, institutional investors seeking exposure to modular blockchain infrastructure, and long-term cryptocurrency believers

-

Operation Recommendations:

- Allocate a core position based on B2's role as a Bitcoin scaling solution with zero-knowledge proof technology

- Dollar-cost average (DCA) during price volatility to reduce timing risk, given the token's 24-hour volatility of 7.77%

- Hold through market cycles to benefit from potential adoption of B² Rollup, B² Hub, and MiningSquared protocols

-

Storage Solution:

- Utilize Gate.com Web3 Wallet for secure self-custody of B2 tokens on BSC network

- Enable two-factor authentication and backup recovery phrases in secure offline storage

- Consider hardware wallet backup for large holdings exceeding personal risk tolerance

(2) Active Trading Strategy

-

Technical Analysis Tools:

- Support and Resistance Levels: Track the 24-hour range ($0.5802 - $0.6455) and historical price pivots at $2.2184 (all-time high) and $0.3154 (all-time low) to identify breakout opportunities

- Volume Analysis: Monitor the $384,752.53 daily trading volume to assess liquidity and confirm price movements with volume confirmation

-

Wave Trading Key Points:

- Enter positions during consolidation phases near support levels with confirmed volume increases

- Set profit targets at previous resistance levels, particularly near the 30-day price decline resistance zones

- Execute stop-losses 5-10% below entry points to protect capital given the -21.5% monthly decline

B2 Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of portfolio allocation, emphasizing long-term holding with minimal trading activity

- Active Investors: 3-8% of portfolio allocation, allowing for tactical position adjustments and technical trading

- Professional Investors: 8-15% of portfolio allocation, with hedging strategies and derivatives consideration

(2) Risk Hedging Solutions

- Position Sizing Strategy: Limit individual trade size to 2-5% of total trading capital to manage downside risk from adverse price movements

- Rebalancing Schedule: Quarterly portfolio rebalancing to maintain target allocation percentages, particularly important given the -21.5% monthly decline

(3) Secure Storage Solution

- Self-Custody Approach: Gate.com Web3 Wallet offers non-custodial storage with full user control over private keys

- Multi-Signature Backup: Implement multi-signature wallets for holdings exceeding $10,000 to prevent single-point failure

- Security Notice: Never share private keys or recovery phrases; always verify smart contract addresses before token transfers on the BSC network

V. B2 Potential Risks and Challenges

B2 Market Risk

- Price Volatility: B2 experienced a -21.5% decline over 30 days and -3.07% over 7 days, indicating significant price instability that could result in substantial losses for leveraged traders

- Liquidity Constraints: With only $384,752.53 in 24-hour trading volume, large positions may face slippage and difficulty executing orders during low-volume periods

- Market Cap Concentration: At $133.7 million fully diluted valuation and only 22.33% circulating supply ratio, significant token unlocks could create selling pressure

B2 Regulatory Risk

- Jurisdictional Uncertainty: Bitcoin scaling solutions and mining pool protocols operate in evolving regulatory frameworks that could shift unexpectedly

- Classification Risk: Regulators may reclassify B2 tokens or related services (such as MiningSquared BTC yield products) as unregistered securities or derivatives

- Cross-Border Compliance: International restrictions on cryptocurrency trading or BSC network access could limit market access and token utility

B2 Technology Risk

- Smart Contract Vulnerability: As a modular Bitcoin scaling solution relying on zero-knowledge proof verification, undetected vulnerabilities could result in fund loss or protocol failure

- Bitcoin Network Dependency: B² Network's functionality depends on Bitcoin network stability; any Bitcoin consensus changes could impact the scaling solution's operability

- Competitive Displacement: Emergence of alternative Bitcoin scaling solutions or improvements to existing Layer-2 protocols could reduce B2's market relevance

VI. Conclusion and Action Recommendations

B2 Investment Value Assessment

BSquared Network represents an innovative approach to Bitcoin scaling through its modular architecture combining B² Rollup (zero-knowledge proof Bitcoin rollup), B² Hub (Bitcoin data availability layer), and MiningSquared (Bitcoin mining rewards platform). The project addresses critical Bitcoin scalability challenges. However, investors should recognize the significant market risks evidenced by recent price declines (-21.5% monthly), limited trading liquidity ($384,752.53 daily volume), and the early-stage nature of Bitcoin scaling infrastructure adoption. Long-term value depends on successful protocol adoption and Bitcoin ecosystem validation.

B2 Investment Recommendations

✅ Beginners: Start with minimal allocations (1-2%) through Gate.com's spot trading with strict stop-losses; focus on understanding Bitcoin scaling technology before increasing exposure

✅ Experienced Investors: Allocate 3-8% with tactical rebalancing strategies; utilize technical analysis tools to trade the identified support/resistance ranges; employ hedging strategies for larger positions

✅ Institutional Investors: Consider 8-15% allocations as part of Bitcoin infrastructure exposure; conduct thorough due diligence on B² Rollup and B² Hub protocol security; monitor regulatory developments across jurisdictions

B2 Trading Participation Methods

- Spot Trading on Gate.com: Purchase B2 tokens directly using fiat or cryptocurrency; optimal for long-term holders seeking simple buy-and-hold exposure

- Limit Orders: Set buy orders near identified support levels ($0.5802) to average down during volatility

- Staking Programs (if available): Explore participation in MiningSquared BTC yield products or other protocol incentive programs to generate additional returns

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make careful decisions based on their personal risk tolerance and should consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Does Bluzelle have a future?

Bluzelle has potential with its 10,000 TPS blockchain and NFT storage capabilities. However, BLZ token faces mixed predictions and market volatility. Long-term viability depends on adoption rates and broader crypto market trends.

What is the current price of B2 token and what are analyst predictions for 2024-2025?

B2 token analyst predictions indicate the price will reach $0.0001063 by end of 2025. Current market prices vary by trading volume. Historical data shows strong growth potential in the B2 ecosystem through 2025.

What factors could drive B2 token price up or down?

B2 token price rises with increased trading volume, positive market sentiment, Bitcoin L2 adoption growth, and network upgrades. Price falls due to market downturns, reduced trading activity, regulatory concerns, or project delays.

What is Bluzelle (B2) and what problem does it solve in blockchain?

Bluzelle (B2) is a decentralized data storage platform for blockchain networks. It solves critical problems of data availability, integrity, and accessibility by providing secure, efficient storage solutions that enable blockchain applications to scale reliably.

What are the main risks and challenges for B2 token investment?

B2 token faces high volatility due to recent launch and market uncertainty. Regulatory changes, competition from established platforms, and potential liquidity constraints present key challenges. Monitor market dynamics closely before investing.

2025 ZYRA Price Prediction: Analyzing Market Trends and Growth Potential for the Emerging Cryptocurrency

Nick Szabo: The Man Behind Smart Contracts

2025 ZKPrice Prediction: Analyzing Market Trends and Growth Potential for Zero-Knowledge Protocols

Can Bitcoin Wallet be Traced Back to Me?

When Are Bitcoin Fees Lowest? Best Times to Send BTC

2025 ZKCPrice Prediction: Market Analysis and Growth Potential of ZKC in the Zero-Knowledge Cryptography Ecosystem

Discover Your Wormhole Airdrop Eligibility Easily

Understanding Decentralized Lending: A Comprehensive Guide to DeFi Mechanics

Exploring Cyball: A Comprehensive Guide to Blockchain Gaming Tokens

Exploring the Advantages of Cryptocurrency Coin Burning Mechanisms

Exploring Cross the Ages: A New Era in Blockchain Gaming and Digital Ownership