2025 BLZ Price Prediction: Expert Analysis and Market Forecast for Bluzelle Token

Introduction: Market Position and Investment Value of BLZ

Bluzelle (BLZ) is an extensible decentralized database service platform designed to provide enterprise-level database management services with low cost, fast deployment, and rapid operation. Since its inception in 2018, Bluzelle has positioned itself as a key infrastructure solution for small and medium-sized software developers. As of December 2025, BLZ has achieved a market capitalization of $7,130,000 with approximately 463.15 million tokens in circulation, currently trading at around $0.01426. This innovative decentralized database protocol continues to play an increasingly vital role in building a decentralized digital economy database network.

This article will conduct a comprehensive analysis of Bluzelle's price trajectories and market trends through 2030, integrating historical performance patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors interested in BLZ on platforms such as Gate.com.

Bluzelle (BLZ) Market Analysis Report

I. BLZ Price History Review and Current Market Status

BLZ Historical Price Evolution Trajectory

-

February 2018: BLZ reached its all-time high (ATH) of $0.783089 on February 10, 2018, marking the peak of early market enthusiasm for the decentralized database project.

-

March 2020: BLZ hit its all-time low (ATL) of $0.00654948 on March 13, 2020, reflecting the significant market correction during that period.

-

2020-2025: Extended bear market phase, with BLZ experiencing a substantial long-term decline of approximately 78.81% over the one-year period.

BLZ Current Market Situation

As of December 23, 2025, BLZ is trading at $0.01426 with a 24-hour trading volume of $12,179.91. The token demonstrates moderate short-term volatility, with a 1-hour change of +0.27% and a 24-hour change of +2.14%, indicating slight bullish momentum in the immediate timeframe. However, the broader trend remains bearish, with a 7-day decline of -5.56% and a 30-day decline of -16.07%.

BLZ's market capitalization stands at $6,604,542.90, with a fully diluted valuation of $7,130,000. The circulating supply comprises 463,151,675.78 tokens out of a total supply of 500,000,000 tokens, representing a circulation ratio of 92.63%. The maximum supply is unlimited. With a market dominance of 0.00022%, BLZ remains a micro-cap asset with 29,534 token holders.

The 24-hour price range demonstrates limited volatility, trading between $0.01391 (low) and $0.01454 (high).

Click to view current BLZ market price

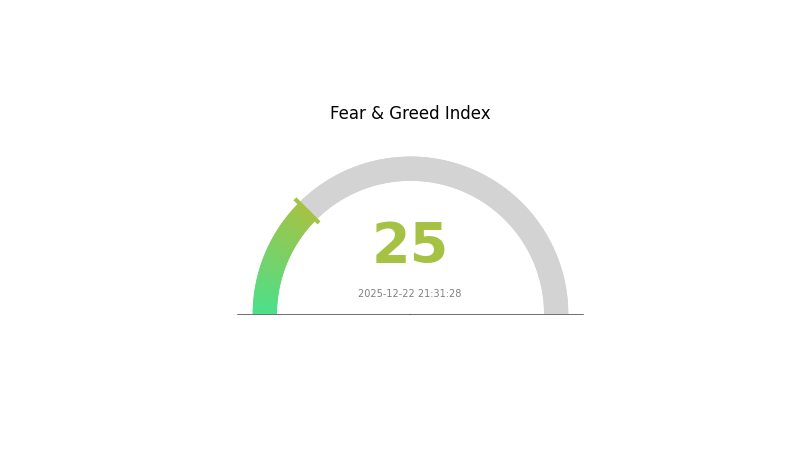

BLZ Market Sentiment Indicator

2025-12-22 Fear and Greed Index: 25 (Extreme Fear)

Click to view current Fear & Greed Index

The BLZ market is currently experiencing extreme fear, with the Fear and Greed Index hitting 25. This indicates severe market pessimism and significant selling pressure among investors. During periods of extreme fear, market volatility typically increases substantially, creating both substantial risks and potential opportunities for experienced traders. Investors should exercise caution and conduct thorough research before making trading decisions. Consider using risk management tools available on Gate.com to protect your investments during this volatile period.

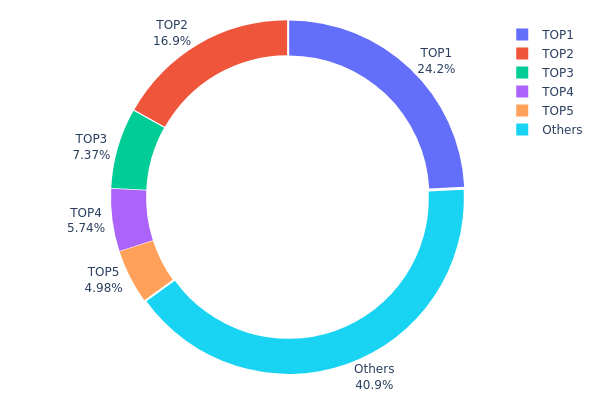

BLZ Holdings Distribution

The address holdings distribution map illustrates the concentration of BLZ tokens across the top wallet addresses on the blockchain. This metric is crucial for assessing the decentralization level and potential market manipulation risks, as it reveals how token supply is distributed among major holders. By analyzing the top addresses and their respective ownership percentages, we can evaluate the overall health and resilience of the token's network structure.

BLZ exhibits moderate concentration characteristics in its current holder distribution. The top five addresses collectively account for approximately 59.1% of the total token supply, with the largest holder commanding 24.18% of all circulating tokens. While the top address represents a significant portion, the remaining 40.9% distributed among other holders provides a degree of diversification that mitigates extreme centralization risks. Notably, no single address dominates the ecosystem to an alarming degree, suggesting that power is reasonably distributed across multiple stakeholders rather than concentrated in the hands of a few entities.

The current distribution pattern presents a balanced market structure with moderate decentralization. With nearly 41% of tokens held by addresses outside the top five, BLZ demonstrates adequate holder fragmentation that could theoretically support price stability and reduce the likelihood of coordinated manipulation events. However, investors should remain vigilant, as the substantial holdings concentrated in the top five addresses—particularly the leading position at 24.18%—indicates that major holders retain considerable influence over market dynamics. This distribution reflects a typical profile for established cryptocurrencies that have undergone initial distribution phases, balancing institutional accumulation with broader community participation.

Click to view current BLZ holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x4489...690844 | 120930.04K | 24.18% |

| 2 | 0xf98e...a22028 | 84281.76K | 16.85% |

| 3 | 0xe963...60239f | 36848.32K | 7.36% |

| 4 | 0xe25c...e0bc1e | 28700.89K | 5.74% |

| 5 | 0x8bfd...b84186 | 24891.03K | 4.97% |

| - | Others | 204347.96K | 40.9% |

II. Core Factors Affecting BLZ Future Price

Market Sentiment and Investor Confidence

-

Market Emotion Impact: BLZ token price exhibits certain volatility characteristics common to most cryptocurrencies. Price movements are significantly influenced by market sentiment, investor confidence levels, and overall blockchain technology development trends.

-

Volatility Characteristics: Like other digital assets, BLZ is susceptible to fluctuations driven by financial events, regulatory changes, and political developments that can cause rapid price movements.

-

Risk Considerations: The cryptocurrency market demonstrates high volatility, requiring cautious investment approaches. Price discovery occurs through market reassessment of related assets and associated factors.

Storage Sector Positioning

-

Sector Classification: BLZ operates within the storage sector of the blockchain ecosystem, competing alongside projects such as AR, FIL, and STORJ. This sector focuses on decentralized data storage solutions and infrastructure.

-

Market Dynamics: As a storage-focused token, BLZ's performance correlates with broader adoption trends in decentralized storage technologies and the overall health of this specific blockchain subsector.

Macroeconomic Environment

-

Regulatory and Political Factors: BLZ price movements can be affected by regulatory policy changes, financial market conditions, and geopolitical developments that impact the broader cryptocurrency market sentiment.

-

Market Cycle Dependence: Price and valuation metrics are influenced by multiple factors including overall cryptocurrency market performance, project development progress, and shifts in investor capital allocation across different digital asset categories.

III. 2025-2030 BLZ Price Forecast

2025-2026 Outlook

- Conservative Forecast: $0.00727 - $0.01594

- Neutral Forecast: $0.01426 - $0.01733

- Optimistic Forecast: $0.02039 - $0.02582 (requires sustained ecosystem development and increased adoption)

2027-2028 Medium-term Outlook

- Market Stage Expectations: Potential consolidation phase with gradual recovery trajectory as the project matures and market conditions stabilize

- Price Range Predictions:

- 2027: $0.01510 - $0.02286

- 2028: $0.01977 - $0.03266

- Key Catalysts: Expansion of platform functionality, strategic partnerships, increasing institutional interest, and positive regulatory developments

2029-2030 Long-term Outlook

- Base Case: $0.02524 - $0.03951 (assuming moderate adoption growth and steady market development)

- Optimistic Case: $0.03348 - $0.03448 (with accelerated ecosystem expansion and mainstream adoption)

- Transformative Case: $0.03951+ (contingent on revolutionary protocol upgrades, significant market share gains, and widespread enterprise adoption)

By end of 2030, BLZ is projected to potentially reach price levels representing a 134% appreciation from current levels, reflecting sustained long-term growth momentum and market maturation

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.02039 | 0.01426 | 0.00727 | 0 |

| 2026 | 0.02582 | 0.01733 | 0.01594 | 21 |

| 2027 | 0.02286 | 0.02157 | 0.0151 | 51 |

| 2028 | 0.03266 | 0.02222 | 0.01977 | 55 |

| 2029 | 0.03951 | 0.02744 | 0.02524 | 92 |

| 2030 | 0.03448 | 0.03348 | 0.01707 | 134 |

Bluzelle (BLZ) Professional Investment Strategy and Risk Management Report

IV. BLZ Professional Investment Strategy and Risk Management

BLZ Investment Methodology

(1) Long-term Holding Strategy

- Suitable Investors: Enterprise software developers, decentralized database enthusiasts, and institutional investors seeking exposure to infrastructure solutions

- Operational Recommendations:

- Accumulate BLZ tokens during market downturns, particularly when prices approach the all-time low of $0.00654948

- Hold positions through multiple market cycles to benefit from potential network adoption and ecosystem expansion

- Reinvest any staking rewards or token distributions to compound gains over time

(2) Active Trading Strategy

- Price Movement Analysis:

- Monitor 24-hour volatility: BLZ has shown 2.14% positive movement in the last 24 hours with a trading range between $0.01391 and $0.01454

- Track longer-term trends: The 7-day decline of 5.56% and 30-day decline of 16.07% indicate persistent downward pressure that should be considered in entry/exit decisions

- Wave Trading Key Points:

- Establish positions during periods of technical support around historical volatility bands

- Take profits during temporary price recoveries while maintaining core positions for long-term appreciation

BLZ Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of portfolio allocation

- Active Investors: 3-8% of portfolio allocation

- Professional Investors: 8-15% of portfolio allocation

(2) Risk Hedging Strategies

- Position Diversification: Avoid concentrated BLZ holdings by combining with other decentralized infrastructure tokens and traditional assets

- Dollar-Cost Averaging: Deploy capital gradually over months rather than lump-sum investment to mitigate timing risk

(3) Secure Storage Solutions

- Hot Wallet for Trading: Gate.com Web3 Wallet for active trading and frequent transactions

- Cold Storage for Long-term Holdings: Maintain majority of BLZ tokens in offline storage solutions for enhanced security

- Security Considerations: Enable two-factor authentication on all exchange accounts, use strong passwords, never share private keys or recovery phrases, and conduct regular security audits of wallet infrastructure

V. BLZ Potential Risks and Challenges

BLZ Market Risks

- Severe Long-term Performance Decline: The token has declined 78.81% over the past year and 95.83% from its all-time high of $0.783089 (set on February 10, 2018), indicating substantial historical losses and limited recovery trajectory

- Low Trading Volume and Liquidity: With only 12,179.91 BTC equivalent in 24-hour volume and a fully diluted market cap of just $7.13 million, BLZ exhibits minimal liquidity that could result in significant price slippage during large transactions

- Limited Market Capitalization: Ranked 1,377th by market cap with only $6.60 million in circulating market value, BLZ has minimal institutional adoption and market influence

BLZ Regulatory Risks

- Evolving Decentralized Database Regulations: As regulatory frameworks for decentralized data services mature globally, BLZ may face compliance challenges or operational restrictions

- Changing Data Protection Standards: Increasing data privacy regulations (such as GDPR and similar frameworks) may impact the operational model and token utility

- Exchange Listing Pressures: Limited exchange availability (currently on Gate.com and select platforms) may restrict market accessibility and regulatory scrutiny

BLZ Technical Risks

- Network Adoption Uncertainty: The success of Bluzelle's decentralized database platform remains unproven at scale, with adoption rates significantly below established infrastructure projects

- Smart Contract Vulnerabilities: As an Ethereum-based token (Contract Address: 0x5732046A883704404F284Ce41FfADd5b007FD668), BLZ is exposed to potential smart contract exploits or Ethereum network risks

- Competitive Infrastructure Landscape: BLZ faces intense competition from established and emerging decentralized storage and database solutions with larger communities and development resources

VI. Conclusion and Action Recommendations

BLZ Investment Value Assessment

Bluzelle presents a high-risk, speculative investment opportunity targeting niche enterprise database applications. The project's fundamental value proposition—providing cost-effective, scalable decentralized database services to small and medium-sized software developers—remains conceptually sound but lacks demonstrated market traction. The dramatic price decline of 95.83% from its 2018 peak combined with minimal trading volume and market capitalization suggests limited institutional confidence or adoption. Investors should view BLZ as a long-tail speculative holding requiring patient capital and high risk tolerance, rather than a core portfolio position.

BLZ Investment Recommendations

✅ Beginners: Limit exposure to maximum 1% of total crypto portfolio through dollar-cost averaging over 6-12 months via Gate.com; prioritize understanding Bluzelle's whitepaper and use case before committing capital

✅ Experienced Investors: Consider 3-8% allocation within a diversified infrastructure token portfolio, utilizing technical analysis to identify accumulation zones between $0.01000 and $0.01500

✅ Institutional Investors: Conduct comprehensive due diligence on developer adoption metrics, network activity data, and competitive positioning before considering positions; evaluate whether the protocol token economics support institutional holdings

BLZ Trading Participation Methods

- Gate.com Spot Trading: Purchase and trade BLZ directly against major trading pairs with immediate settlement

- Dollar-Cost Averaging Programs: Execute systematic weekly or monthly purchases to reduce timing risk and accumulate positions methodically

- Ethereum-based Wallet Transactions: Send, receive, and hold BLZ tokens directly in Ethereum wallets at contract address 0x5732046A883704404F284Ce41FfADd5b007FD668 for ultimate custody control

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on personal risk tolerance and should consult professional financial advisors. Never invest capital you cannot afford to lose completely.

FAQ

Can Bluzelle reach 1 dollar?

Yes, Bluzelle can potentially reach $1 with significant adoption of its decentralized storage platform, technological advancements, and increased demand for Web3 solutions. Growing blockchain applications and DeFi ecosystem expansion could drive BLZ token value upward substantially.

Does Bluzelle have a future?

Yes, Bluzelle has promising potential with its high-speed blockchain(10,000 TPS), NFT storage solutions, and crypto gaming ecosystem. While BLZ token faces market volatility and mixed predictions, its innovative technology and growing adoption suggest a positive long-term outlook for the platform's development and utility expansion.

Is BLZ crypto a good investment?

BLZ shows strong potential with its high-performance blockchain, NFT storage capabilities, and gaming ecosystem. Strong transaction volume and growing adoption make it an attractive investment opportunity for long-term holders seeking exposure to innovative blockchain technology.

What's going on with Bluzelle?

Bluzelle is a decentralized database platform enabling Web3 applications to store and manage data efficiently. The project continues developing its infrastructure for blockchain-based data management solutions.

Hedera (HBAR) 2025 Price Analysis and Investment Prospects

Sui Price Market Analysis and Long-term Investment Potential in 2025

America Party: A Fundamental Analysis of Its White Paper Logic and Future Impact

Lark Davis Vs ZachXBT

2025 TIA Price Prediction: Analyzing Market Trends and Growth Potential for the Celestia Token

Elon Musk's Birthday And It's Astrology

Exploring Decentraland $MANA: A Top Metaverse Coin for Future Investment

The remarkable surge of an AI-powered cryptocurrency: Is this the beginning of a new era?

What is UOS: A Comprehensive Guide to the Unified Operating System

What is POR: A Comprehensive Guide to Plan of Record in Project Management

What is KYVE: A Decentralized Data Validation and Archiving Protocol for Web3