2025 CELO Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Introduction: CELO's Market Position and Investment Value

CELO (Celo) is an open platform dedicated to making financial instruments available to anyone who owns a mobile phone. Since its inception in 2020, the project has established itself as a key player in addressing financial inclusion globally. As of December 2025, CELO boasts a market capitalization of approximately $131.9 million, with a circulating supply of around 589.48 million tokens, currently trading at $0.1319 per token. This asset, designed to provide financial access to the 1.7 billion people worldwide who lack adequate financial services, continues to play an increasingly critical role in advancing the mission of mobile-first financial infrastructure.

This article will provide a comprehensive analysis of CELO's price trajectory from 2025 through 2030, integrating historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and actionable investment strategies for investors seeking exposure to this financial inclusion-focused platform.

I. CELO Price History Review and Current Market Status

CELO Historical Price Evolution

CELO achieved its all-time high (ATH) of $9.82 on August 30, 2021, during the peak of the cryptocurrency bull market. Since that pinnacle, the token has experienced a significant downtrend over the subsequent years. As of December 16, 2025, CELO reached its all-time low (ATL) of $0.128174, representing a catastrophic decline of approximately 98.7% from its historical peak.

CELO Current Market Conditions

As of December 18, 2025, CELO is trading at $0.1319, with a 24-hour trading volume of $248,369.75. The token's market capitalization stands at approximately $77.75 million, while its fully diluted valuation reaches $131.9 million. CELO ranks 393rd by market capitalization, commanding a 0.0042% market share in the broader cryptocurrency ecosystem.

Recent price performance reflects market weakness:

- 1-hour change: +0.22%

- 24-hour change: -5.78%

- 7-day change: -22.96%

- 30-day change: -30.65%

- 1-year change: -83.71%

CELO's circulating supply totals 589,481,382 tokens out of a maximum supply of 1,000,000,000 tokens, representing a circulation ratio of 58.95%. The token is held across 192,635,930 addresses, indicating broad distribution among the holder base. The current market sentiment index reads 1, reflecting "Extreme Fear" in the broader market environment.

Click to view current CELO market price

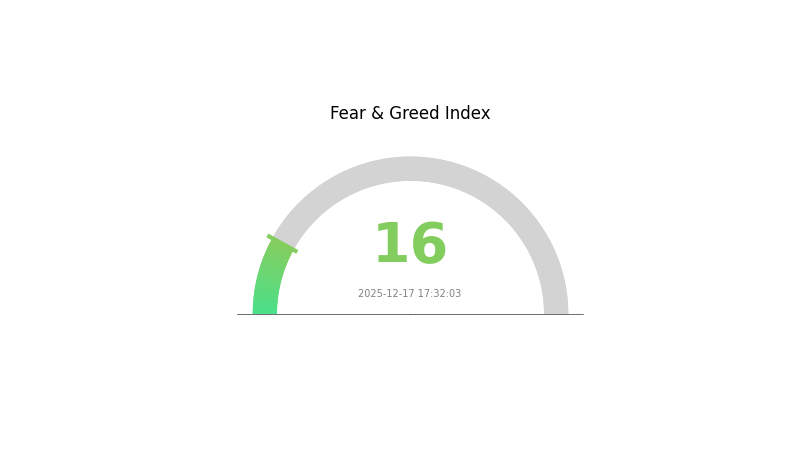

CELO Market Sentiment Indicator

2025-12-17 Fear and Greed Index: 16 (Extreme Fear)

Click to view current Fear & Greed Index

The CELO market is currently experiencing extreme fear, with the Fear and Greed Index reaching just 16 points. This exceptionally low reading indicates severe market pessimism and heightened investor anxiety. When the index enters this extreme fear territory, it often signals significant selling pressure and capitulation among market participants. However, historical patterns suggest that extreme fear episodes can present contrarian opportunities for long-term investors, as markets tend to experience mean reversion following prolonged downturns. Investors should exercise caution while remaining alert to potential entry points. Consider your risk tolerance and investment strategy before making any trading decisions during this volatile period.

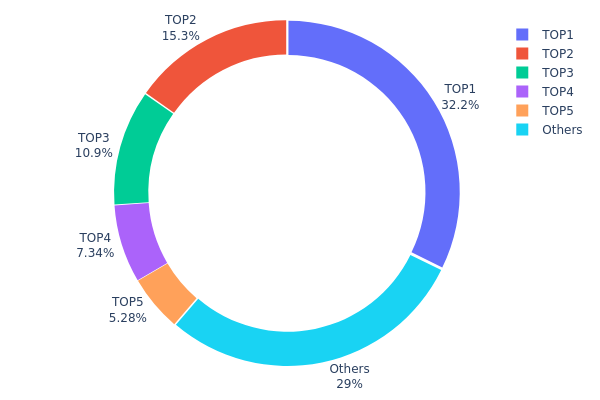

CELO Address Holdings Distribution

The address holdings distribution chart illustrates the concentration of CELO tokens across the network's top wallet addresses, providing critical insight into the token's decentralization characteristics and potential market concentration risks. This metric aggregates the largest holders and compares their combined holdings against the broader investor base, revealing the structural dynamics of CELO's on-chain ownership landscape.

Current data demonstrates moderate concentration concerns within the CELO ecosystem. The top five addresses collectively control 70.95% of tracked holdings, with the largest holder commanding 32.24% of total tokens. This concentration is particularly notable in the first address, which single-handedly maintains over one-third of the supply, suggesting potential influence over market dynamics. However, the remaining 29.05% distributed among "Others" indicates a relatively fragmented secondary tier of holders, which partially mitigates extreme centralization risks. The distribution curve shows a gradual decline from the top holder through the fifth position, suggesting some level of distributed ownership rather than extreme top-heavy concentration.

The current address distribution structure presents meaningful implications for market stability and price dynamics. While the top five holders' combined 70.95% stake indicates significant concentration, the existence of substantial holdings outside this cohort provides some resilience against coordinated market manipulation. Nevertheless, the outsized position of the primary address creates potential vulnerability to sudden liquidations or concentrated selling pressure. This structural arrangement reflects both institutional accumulation patterns and the developmental stage of CELO's market maturity, warranting continued monitoring of holder behavior for signs of consolidation or redistribution.

Click to view current CELO Address Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x7A8c...8A434f | 289473.25K | 32.24% |

| 2 | 0xA5c4...0a87fe | 137005.19K | 15.26% |

| 3 | 0x6cC0...03349E | 97415.35K | 10.85% |

| 4 | 0xef26...036Ef1 | 65853.87K | 7.33% |

| 5 | 0x9d65...50a400 | 47368.40K | 5.27% |

| - | Others | 260535.83K | 29.05% |

II. Core Factors Affecting CELO's Future Price

Macroeconomic Environment

-

Market Sentiment Impact: CELO's price is significantly influenced by market sentiment and broader trends within the cryptocurrency sector. Positive shifts in investor perception toward mobile-centric platforms, DeFi, and financial inclusion-focused cryptocurrencies could benefit CELO. Conversely, negative market sentiment can drive price declines.

-

Investor Confidence: Strong investor confidence in the market has historically pushed CELO's price upward, while periods of declining confidence have resulted in price corrections. Market sentiment remains a dynamic factor that directly impacts short-term price movements.

-

Regulatory Changes: Regulatory developments significantly influence CELO's price trajectory. As a team largely based in the United States, regulatory changes in major jurisdictions can have substantial impacts on the project's operations and market perception.

Technology Development and Ecosystem Building

-

DeFi Ecosystem Expansion: The expansion of CELO's on-chain DeFi ecosystem is crucial for future price performance. Limited growth in DeFi applications or failure to compete effectively with other public chains represents a core risk to the project's valuation and market position.

-

Mobile-Centric Platform Development: CELO's positioning as a mobile-centric cryptocurrency platform distinguishes it in the market. Continued development and adoption of mobile-first solutions strengthen the project's competitive advantage and long-term growth potential.

III. 2025-2030 CELO Price Forecast

2025 Outlook

- Conservative Forecast: $0.10009 - $0.13170

- Base Case Forecast: $0.13170

- Optimistic Forecast: $0.15277 (requires sustained ecosystem adoption and positive market sentiment)

2026-2028 Mid-term Outlook

- Market Stage Expectations: Gradual recovery and consolidation phase with incremental growth trajectory

- Price Range Forecast:

- 2026: $0.10525 - $0.17353 (7% upside potential)

- 2027: $0.14841 - $0.18156 (19% cumulative gains)

- 2028: $0.09335 - $0.17991 (28% cumulative gains)

- Key Catalysts: Expansion of Celo's mobile-first blockchain infrastructure, increased institutional adoption, development of decentralized finance applications on the platform, and enhancement of cross-chain interoperability solutions

2029-2030 Long-term Outlook

- Base Case Scenario: $0.16433 - $0.22027 (32% gains by 2029)

- Optimistic Scenario: $0.1205 - $0.2647 (49% gains by 2030 under conditions of mainstream adoption and strengthened ecosystem partnerships)

- Transformative Scenario: Breakthrough in enterprise-level adoption, integration with major payment networks, and significant expansion of the Celo ecosystem reaching institutional-grade market penetration

Note: Price forecasts represent analytical estimates based on historical patterns and market dynamics. Investors are advised to conduct independent research and consider risk management strategies when trading CELO on platforms such as Gate.com.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.15277 | 0.1317 | 0.10009 | 0 |

| 2026 | 0.17353 | 0.14224 | 0.10525 | 7 |

| 2027 | 0.18156 | 0.15788 | 0.14841 | 19 |

| 2028 | 0.17991 | 0.16972 | 0.09335 | 28 |

| 2029 | 0.22027 | 0.17481 | 0.16433 | 32 |

| 2030 | 0.2647 | 0.19754 | 0.1205 | 49 |

CELO Professional Investment Strategy and Risk Management Report

IV. CELO Professional Investment Strategy and Risk Management

CELO Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors with 2+ year investment horizons who believe in financial inclusion mission and mobile-first blockchain adoption

- Operational Recommendations:

- Dollar-cost averaging (DCA) approach to accumulate CELO during market downturns, given the asset's 83.71% yearly decline

- Hold through protocol upgrades and ecosystem development milestones

- Reinvest staking rewards to compound long-term returns

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support/Resistance Levels: Monitor the historical low of $0.128174 (ATL on December 16, 2025) as critical support and $0.1409 (24H high) as resistance

- Volume Analysis: Trade around the 24-hour volume of $248,369.75 to identify breakout opportunities

- Wave Trading Key Points:

- Entry signals when CELO bounces from support levels with increasing volume

- Exit strategy when price approaches resistance or shows weakening momentum

CELO Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of portfolio allocation

- Active Investors: 3-7% of portfolio allocation

- Professional Investors: 5-10% of portfolio allocation with hedging strategies

(2) Risk Hedging Solutions

- Portfolio Diversification: Allocate CELO within a broader cryptocurrency portfolio alongside more established assets to reduce concentration risk

- Stop-Loss Orders: Set stops at 10-15% below entry price to limit downside exposure given recent volatility

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for active trading with frequent transactions and accessibility

- Cold Storage Solution: Hardware wallet solutions for long-term holdings to ensure security against exchange hacks or cyber threats

- Security Best Practices: Enable two-factor authentication, use hardware security keys, never share private keys, verify contract addresses before transfers

V. CELO Potential Risks and Challenges

CELO Market Risk

- Severe Price Depreciation: CELO has declined 83.71% over the past year, dropping from historical high of $9.82 (August 30, 2021) to current $0.1319, indicating significant investor loss

- Low Trading Liquidity: 24-hour volume of $248,369.75 is relatively low for market cap of $77.75 million, potentially creating slippage during large trades

- Market Sentiment Deterioration: Negative 24-hour (-5.78%), 7-day (-22.96%), and 30-day (-30.65%) price changes suggest ongoing bearish market sentiment

CELO Regulatory Risk

- Financial Services Classification: Regulatory uncertainty around whether CELO's payment and mobile wallet functionalities will be classified as financial services, potentially triggering stricter compliance requirements

- Cross-Border Payment Restrictions: Different jurisdictions may impose restrictions on using CELO for cross-border payments, limiting the platform's core value proposition in certain markets

- Stablecoin Regulation: Any stablecoins built on CELO may face increased regulatory scrutiny similar to other stablecoin projects globally

CELO Technology Risk

- Blockchain Security: Risk of smart contract vulnerabilities or consensus mechanism failures that could compromise transaction security on the Celo network

- Network Scalability: Challenges in maintaining performance as user adoption grows, potentially leading to network congestion and higher transaction fees

- Mobile Wallet Dependency: Over-reliance on ultra-light client architecture for mobile wallets may expose users to phishing attacks or compromised endpoints

VI. Conclusion and Action Recommendations

CELO Investment Value Assessment

CELO operates on a compelling mission to provide financial inclusion to the 1.7 billion unbanked population globally through mobile-accessible financial tools. However, the token faces significant headwinds reflected in its 83.71% annual decline and recent volatility. The project's long-term value depends on achieving meaningful adoption of its mobile wallet and payment infrastructure. Current market conditions suggest CELO is in a consolidation phase after substantial losses, presenting both recovery opportunity and continued downside risk. Investors should carefully evaluate whether belief in the financial inclusion thesis justifies exposure to current market sentiment and execution risks.

CELO Investment Recommendations

✅ Beginners: Start with a 1-2% portfolio allocation using dollar-cost averaging through Gate.com, focusing on understanding the project's mission before committing capital. Use educational resources from Celo's official documentation at https://docs.celo.org/

✅ Experienced Investors: Employ 3-5% allocation with technical analysis-based entry points near support levels ($0.128174). Implement stop-losses at 15% below entry and consider wave trading during high-volume periods

✅ Institutional Investors: Conduct fundamental due diligence on adoption metrics, developer activity on GitHub (https://github.com/celo-org/celo-monorepo), and regulatory developments. Consider 5-10% allocation with comprehensive hedging strategies and quarterly rebalancing

CELO Trading Participation Methods

- Gate.com Spot Trading: Direct purchase of CELO tokens with fiat or cryptocurrency pairs, ideal for long-term holders and active traders

- Limit Orders Strategy: Utilize Gate.com's limit order functionality to accumulate CELO at predetermined support levels, reducing timing risk

- Portfolio Rebalancing: Regularly adjust CELO allocation on Gate.com based on performance metrics and changing risk tolerance

Cryptocurrency investments carry extreme risk. This report does not constitute investment advice. Investors should make decisions based on personal risk tolerance and are strongly advised to consult professional financial advisors. Never invest more than you can afford to lose. Past performance does not guarantee future results.

FAQ

What is the future of Celo coin?

Celo is projected to reach 70% of its total supply within five years, indicating strong growth potential. The platform's focus on mobile-first financial inclusion and expanding ecosystem adoption supports bullish long-term prospects for CELO.

Is Celo worth investing in?

Celo is worth considering if you believe in its mission for financial inclusion and mobile-first blockchain technology. Its strong ecosystem, growing adoption, and real-world use cases make it an attractive investment opportunity for long-term believers.

How much is Celo worth in 2030?

Based on technical analysis, Celo (CELO) is predicted to reach approximately $19.84 by 2030. This forecast reflects current market trends and historical data patterns.

Will Celo recover?

Celo is expected to start a cautious recovery, with analysts predicting gradual price increases in coming years. However, reaching previous all-time highs may take considerable time.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

Top Crypto ETFs to Watch in 2025: Navigating the Digital Asset Boom

5 ways to get Bitcoin for free in 2025: Newbie Guide

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

How to Copy Trade: Complete Guide to Gate Contract Copy Trading from Beginner to Pro

Solana NFT Projects Market Trends: 2025 Latest Price Analysis and Potential Opportunities

Institutions Embrace Ethereum: In-Depth Analysis of BitMine’s 48,049 ETH Accumulation

HashKey Becomes Hong Kong’s First Public Crypto Stock, but HSK Token Crashes — How Should Investors Interpret This Divergence?

Visa USDC on Solana: The Blockchain Path Transforming the U.S. Banking Settlement System