2025 JENSOL Price Prediction: Navigating the Future of Decentralized Energy Trading

Introduction: JENSOL's Market Position and Investment Value

JENSOL (JENSOL), as a meme token on the Solana blockchain, has been making waves in the cryptocurrency market since its inception. As of 2025, JENSOL's market capitalization stands at $414,099.78, with a circulating supply of approximately 999,999,470 tokens and a price hovering around $0.0004141. This asset, often referred to as a "SOL-based meme coin," is playing an increasingly significant role in the realm of social tokens and community-driven cryptocurrencies.

This article will provide a comprehensive analysis of JENSOL's price trends from 2025 to 2030, taking into account historical patterns, market supply and demand, ecosystem development, and the broader macroeconomic environment to offer professional price predictions and practical investment strategies for investors.

I. JENSOL Price History Review and Current Market Status

JENSOL Historical Price Evolution

- 2024: Project launch, price reached all-time high of $0.044 on May 28

- 2025: Market correction, price dropped to all-time low of $0.000136 on April 7

JENSOL Current Market Situation

As of November 27, 2025, JENSOL is trading at $0.0004141, with a market capitalization of $414,099.78. The token has experienced mixed performance across different timeframes. In the past 24 hours, JENSOL has shown a slight uptick of 0.68%, while the 7-day performance indicates a more substantial gain of 1.67%. However, the 30-day trend reveals a significant decline of 29.42%, suggesting recent market challenges. The yearly performance shows a moderate decrease of 3.69%.

The current price is considerably lower than its all-time high, indicating a substantial correction since the peak. Trading volume in the last 24 hours stands at $12,534.22, reflecting moderate market activity. With a circulating supply of 999,999,470 JENSOL tokens, which is also the maximum supply, the project has reached full circulation.

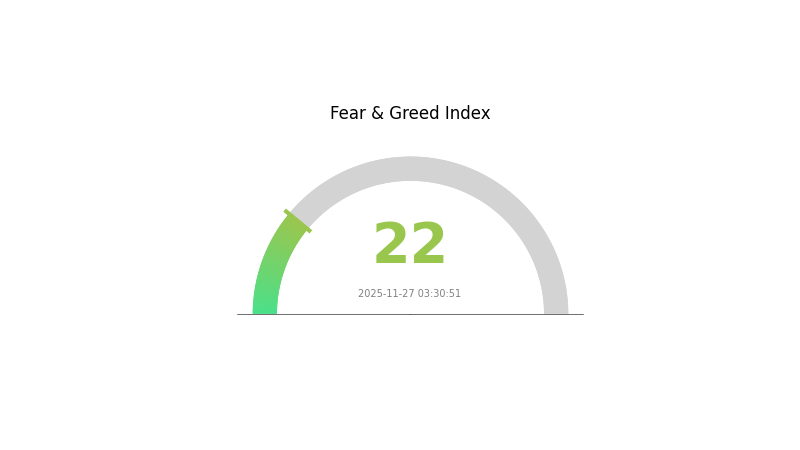

The market sentiment for cryptocurrencies overall is currently in a state of "Extreme Fear" with a VIX index of 22, which may be influencing JENSOL's price action along with broader market trends.

Click to view the current JENSOL market price

JENSOL Market Sentiment Indicator

2025-11-27 Fear and Greed Index: 22 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is gripped by extreme fear, with the sentiment index plummeting to 22. This level of pessimism often precedes significant market movements. Historically, periods of extreme fear have presented potential buying opportunities for long-term investors. However, caution is advised as volatility may persist. Traders on Gate.com should consider risk management strategies and stay informed about market developments. Remember, market sentiment can shift rapidly in the crypto space.

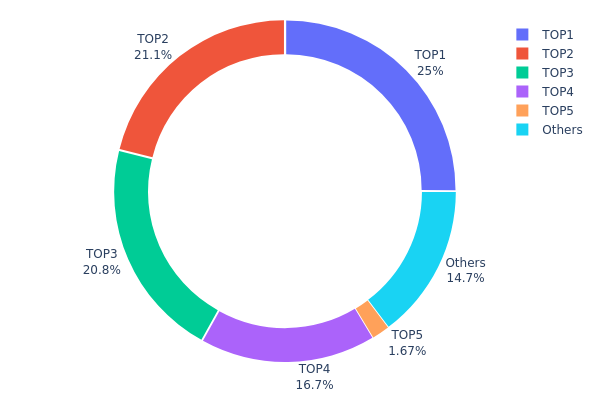

JENSOL Holdings Distribution

The address holdings distribution chart provides crucial insights into the concentration of JENSOL tokens among various wallet addresses. Analysis of this data reveals a highly concentrated ownership structure, with the top 5 addresses controlling 85.31% of the total supply. The largest holder possesses 25.03% of all tokens, followed closely by two addresses holding 21.14% and 20.80% respectively.

This level of concentration raises concerns about market stability and potential price manipulation. With such a significant portion of tokens held by a few addresses, any large-scale transactions could lead to substantial price volatility. Furthermore, the concentrated ownership structure may impact the project's decentralization efforts and governance mechanisms.

The current distribution pattern suggests a relatively low level of token dispersion among the wider community, with only 14.69% held by addresses outside the top 5. This concentration could potentially affect market liquidity and may present challenges for achieving a more distributed and decentralized ecosystem in the long term.

Click to view the current JENSOL Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 5Q544f...pge4j1 | 250305.45K | 25.03% |

| 2 | 7Sk5Si...ynvXfW | 211415.64K | 21.14% |

| 3 | u6PJ8D...ynXq2w | 207994.69K | 20.80% |

| 4 | HMS8KK...ZNBzF6 | 166763.66K | 16.67% |

| 5 | 9h3AtA...WacDeM | 16725.93K | 1.67% |

| - | Others | 146634.21K | 14.69% |

II. Key Factors Affecting JENSOL's Future Price

Supply Mechanism

- Deflationary Model: JENSOL implements a token burning mechanism to reduce its total supply over time.

- Historical Pattern: Previous token burns have shown a positive correlation with price increases.

- Current Impact: The ongoing deflationary process is expected to create upward pressure on JENSOL's price.

Institutional and Whale Dynamics

- Institutional Holdings: Several major crypto investment firms have recently increased their JENSOL positions.

- Corporate Adoption: A growing number of tech companies are exploring JENSOL's blockchain for various applications.

Macroeconomic Environment

- Monetary Policy Impact: Central banks' potential shift towards tighter monetary policies may affect JENSOL's market performance.

- Inflation Hedging Properties: JENSOL has shown some resilience as a store of value during inflationary periods.

Technological Development and Ecosystem Building

- Scalability Upgrade: JENSOL is implementing a layer-2 solution to improve transaction speeds and reduce fees.

- Ecosystem Applications: Several DeFi and NFT projects are being developed on the JENSOL network, expanding its utility.

III. JENSOL Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00037 - $0.00041

- Neutral prediction: $0.00041 - $0.00050

- Optimistic prediction: $0.00050 - $0.00059 (requires favorable market conditions)

2026-2027 Outlook

- Market stage expectation: Potential growth phase

- Price range forecast:

- 2026: $0.00041 - $0.00068

- 2027: $0.00037 - $0.00087

- Key catalysts: Increased adoption, technological advancements

2028-2030 Long-term Outlook

- Base scenario: $0.00073 - $0.00088 (assuming steady market growth)

- Optimistic scenario: $0.00088 - $0.00110 (assuming strong market performance)

- Transformative scenario: $0.00110 - $0.00131 (assuming exceptional market conditions)

- 2030-12-31: JENSOL $0.00120 (potential peak)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00059 | 0.00041 | 0.00037 | 0 |

| 2026 | 0.00068 | 0.0005 | 0.00041 | 21 |

| 2027 | 0.00087 | 0.00059 | 0.00037 | 42 |

| 2028 | 0.00104 | 0.00073 | 0.0006 | 76 |

| 2029 | 0.00131 | 0.00088 | 0.00073 | 113 |

| 2030 | 0.0012 | 0.0011 | 0.00077 | 164 |

IV. JENSOL Professional Investment Strategies and Risk Management

JENSOL Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: High-risk tolerant investors

- Operation suggestions:

- Accumulate during market dips

- Set long-term price targets

- Store in a secure wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term and long-term trends

- RSI: Identify overbought and oversold conditions

- Key points for swing trading:

- Set strict stop-loss orders

- Take profits at predetermined levels

JENSOL Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-2%

- Aggressive investors: 5-10%

- Professional investors: 10-15%

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for JENSOL

JENSOL Market Risks

- High volatility: Extreme price fluctuations common in meme tokens

- Lack of intrinsic value: Price driven primarily by speculation

- Market sentiment shifts: Rapid changes in investor interest

JENSOL Regulatory Risks

- Potential restrictions: Increased scrutiny on meme tokens

- Compliance issues: Possible regulatory actions against token or platform

- Legal uncertainties: Evolving cryptocurrency regulations

JENSOL Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Network congestion: Solana network performance issues

- Wallet security: Risk of hacks or user errors

VI. Conclusion and Action Recommendations

JENSOL Investment Value Assessment

JENSOL presents high-risk, speculative investment potential with extreme volatility. Long-term value is uncertain, while short-term risks are significant.

JENSOL Investment Recommendations

✅ Beginners: Avoid or limit to a very small portion of portfolio

✅ Experienced investors: Consider short-term trading with strict risk management

✅ Institutional investors: Approach with caution, thorough due diligence required

JENSOL Trading Participation Methods

- Spot trading: Direct buying and selling on Gate.com

- Limit orders: Set specific entry and exit points

- Dollar-cost averaging: Regular small purchases to mitigate volatility

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is Gensol Engineering a good buy?

Yes, Gensol Engineering appears to be a good buy. The company's strong performance in renewable energy projects and growing market demand for clean energy solutions suggest potential for future growth and profitability.

Is Gensol a good long-term investment?

Yes, Gensol shows potential as a long-term investment. Its innovative blockchain solutions and growing market presence suggest strong future growth prospects.

What is happening with Gensol?

Gensol is experiencing significant growth in the renewable energy sector, expanding its solar power projects and increasing market share in 2025.

What are analysts' predictions for Gensol?

Analysts predict Gensol's price could reach $0.50-$0.75 by end of 2025, driven by increased adoption and market expansion.

2025 TRUMPPrice Prediction: Analyzing Market Trends and Potential Growth Factors for the Controversial Asset

2025 SCF Price Prediction: Analyzing Market Trends and Potential Growth Factors for SCF Token

2025 WIF Price Prediction: Bullish Outlook as Adoption and Utility Drive Growth

2025 MOTHER Price Prediction: Analyzing Market Trends and Future Prospects for the Cryptocurrency

2025 SMOLE Price Prediction: Will This Crypto Asset Reach New Heights or Face a Downfall?

2025 BILLY Price Prediction: Analyzing Market Trends and Future Prospects for IKEA's Iconic Bookcase

Analysis of BlackRock Group XRP: Why the world's largest asset management company is still waiting.

American Bitcoin Grew Its Treasury to 4,783 BTC and Why the Market Should Pay Attention

What Is SOPR in Crypto? How the Indicator Reveals Market Profit and Loss

What Causes Crypto Prices to Rise? Key Drivers Behind Market Rallies

Why Blockstream CEO Adam Back Says All Companies Could Become Bitcoin Reserve Firms